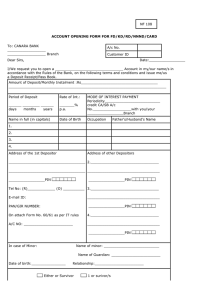

ANNEX CSP CLAIM SETTLEMENT PROCEDURE (i) The bank shall prepare a list of outstanding deposits (“claim list”) and submit the same within 45 days with effect from Cut-off date. The claim list shall be submitted in the format (Annex CSBA) duly certified by the Chief Executive Officer as required under the provisions of section 18A(2) of the Act, categorizing the eligible depositors as per the claim settlement procedure, for arriving at the deposit amount eligible for settlement of deposit insurance claim by the Corporation. (ii) The claim amount calculated shall include both the Principal and Interest accrued up to Cut-off date [provisional]. (iii) The list of outstanding deposits should show separately the amount standing to the credit of each depositor (outstanding balance plus interest accrued till the cut-off date) after aggregating/ clubbing the deposits held by each depositor in the ‘same capacity and in the same right’ and after adjusting the dues of the depositor, if any (set off), against such deposits, and shall also include details viz. complete address, full names of all joint account holders, name/s of proprietors/ partners of firms etc. Detailed guidelines for preparing the claim list is given in Annex I. Annex IA and Annex VIII may also be referred for the same. (v) It should be ensured that the name and details of depositors who have affirmed their willingness to receive the insured amount in respect of their deposit in the insured bank are duly filled-in, the declaration as to the correctness of the contents thereof along with a confirmation as to availability of the declarations signed and submitted by the depositors, and an undertaking to preserve and submit the said declarations to the Corporation, is duly signed by the chief executive officer. (vi) Claims of all depositors who have submitted willingness along with KYC documents shall be entered in Part A and those who have not submitted their willingness and KYC documents shall be entered in Part B. (vii) Before preparation of the claim list, statutory audit to the limited extent of confirming deposit liability and the liquid funds available as on cut-off date (and updated before release of claim amount) is to be carried out for arriving at the financial position of the bank and certified by the statutory auditor. (viii) The claim amount should be arrived at, based on the deposit liability as per the bank’s balance sheet as on cut-off date and the total deposit amount as per claim list should either be less than or equal to the deposit figures certified as on that date. In no case, it shall exceed the deposits certified in the audited balance sheet as on cut-off date. (ix) For operational requirements to ensure that payment is made as per section 18A of the Act, to depositors who have exercised their option/willingness, the bank shall submit (within 45 days) for verification a list of total deposits of insured depositors payable (duly certified by auditors of deposit liability) and claim the portion of depositors who have submitted willingness (as Part A) for payment by DICGC. (x) As regards those depositors who submit willingness between 46-90 days, the bank shall send to DICGC a second list on the 90th day, which will be considered for payment by DICGC subject to verification and within the overall claim admitted to be paid per depositor within 30 days of receipt of the second list. The bank must ensure that the second list does not include any depositor who should have been clubbed under same right and same capacity. (xi) DICGC would also consider the interest portion (residual) to pay off full liability as on 90 th day as fully due payable (within the overall coverage amount for all depositors of first and second list submitted by the bank). The same may be submitted duly certified by the statutory auditor, for verification and sanction. The second list and the interest payable as on 90 th day of cut off will be verified within the next 30 days. (xii) The Bank shall obtain the willingness of the depositor in the format, Annex W, and in the first instance submit a soft copy of the signed willingness to the Corporation. While the bank shall obtain the signed willingness from the depositor in writing and retain the hard copy with it for being submitted to the Corporation for verification, where it receives the willingness through email/fax, the depositor shall be notified to submit the hard copy of the signed willingness form to the bank within a reasonable period of time and the bank shall retain the hard copy and submit the same at the time of verification by the Corporation. (xiii) No claim in respect of any outstanding deposits would be accepted unless there is a signed willingness received from the depositor prior to the expiry of the period of 90 days from date on which the AID took effect either by email/fax/ hard copy, a copy of which may be scanned and submitted to DICGC along with the respective claim lists. (xiv) In case there is no list of outstanding deposits or claim received within 45 days from the date of effect of AID, it will be construed that the insured bank is not claiming from DICGC due to lack of evidence of willingness of the depositors. (xv) On payment of the insured amount to the depositors, the Corporation will stand discharged from its liability under the Act and no further payment will be payable to the depositors appertaining to the deposits in respect of which the insured amount has been paid. ***