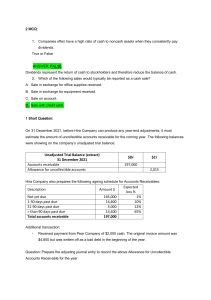

Multi-Step/Essay Practice Problems Unit 2 Revenues and Receivables Revenues Ch 6. MC: 1, 2. Q: 1. ME: 14, 15, 24, 25. E: 27, 28, 31, 33, 40. P: 47. C: 48. Legend: MC = Multiple Choice. Q = Questions. ME = Mini Exercises. E = Exercises. P = Problems. C =Cases MC 1: Which of the following best describes the condition(s) that must be present for the recognition of revenue from a contract with a customer? a. Cash payment must have been received from the customer. b. All of the performance obligations must be fulfilled. c. One of the contract's performance obligations must be fulfilled. d. There must be no uncertainty about the amount to be received from the customer. MC 2. When multiple products or services are bundled and sold for one price, the revenue should be a. recognized when the bundle of products or services is sold. b. allocated among the distinct performance obligations and recognized as each of these is fulfilled. c. deferred until all elements of the bundle are delivered to the customer. d. recognized when the customer pays cash for the bundle of products or services. Q6-1. What is the process that guides firms in the recognition of revenue? What does each of the steps mean? How does this process work for a company like Abercrombie & Fitch Co., a clothing retailer? How would it work for a construction company that builds offices under long-term contracts with developers? ME6-14. Assessing Revenue Recognition of Companies Identify and explain when each of the following companies should recognize revenue. a. The GAP Inc.: The GAP is a retailer of clothing items for all ages. b. Merck & Company Inc.: Merck engages in the development, manufacturing, and marketing of pharmaceutical products. It sells its drugs to retailers like CVS Health Corporation and Walgreens Boots Alliance, Inc. c. Deere & Company: Deere manufactures heavy equipment. It sells equipment to a network of independent distributors, who in tum sell the equipment to customers. Deere provides financing and insurance services both to distributors and customers. d. Bank of America Corporation: Bank of America is a banking institution. It lends money to individuals and corporations and invests excess funds in marketable securities. e. Johnson Controls Inc.: Johnson Controls manufactures products for the U.S. government under long-term contracts. ME6-15. Estimating Revenue Recognition with Right of Return The Unlimited Company offers an unconditional return policy for its retail clothing business. It normally expects 2% of sales at retail selling prices to be returned at some point prior to the expiration of the return period, and returned items cannot be resold. Assuming that it records total sales of $5 million for the current period, how much net revenue would it report for this period? 1 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 ME6-24. Analyzing Unearned Revenue Changes Finn Publishing Corp. produces a monthly publication aimed at competitive swimmers, with articles profiling current stars of the sport, advice from coaches, and advertising by swimwear companies, training organizations, and others. The magazine is distributed through newsstands and bookstores, and by mail to subscribers. The most common subscription is for twelve months. When Finn Publishing receives payment of an annual subscription, it records an Unearned Revenue liability that is reduced by 1112th each month as publications are provided. The table below provides four years of revenues from the income statement and unearned revenue from the balance sheet. (All amounts in $ thousands.) a. Calculate the growth in revenue from 2018 to 2019, 2019 to 2020, and from 2020 to 2021. b. Calculate the amount of customer purchases in 2019, 2020, and 2021. Customer purchases are defined as sales made at newsstands and bookstores, plus the amount paid for new or renewal subscriptions. Again, calculate the growth rates from 2019 to 2020 and from 2020 to 2021. c. Explain the differences in growth rates between parts a and b above. ME6-25. Applying Revenue Recognition Criteria Commtech, Inc., designs and sells cellular phones. The company creates the technical specifications and the software for its products, though it outsources the production of the phones to an overseas contract manufacturer. Commtech has arrangements to sell its phones to the major wireless communications companies who, in tum, sell the phones to end customers packaged with calling plans. The product life cycle for a phone model is about six months, and Commtech recognizes revenue at the time of delivery to the wireless communications company. The product team for the CD924 model has met to consider a possible modification to the phone. The software team has developed an improved global positioning application for a new phone model, and this application works in the CD924. It could be uploaded to existing phones through the wireless networks. Marketing's analysis of focus groups and customer feedback is that further sales of the CD924 would be enhanced significantly if the new application were made available. The software engineers have demonstrated that the new GPS application can be successfully sent wirelessly to the CD924. However, the finance manager points out that Commtech's financial statements have been based on the assumption that the company's phones do not involve multiple performance obligations, like upgrades. All revenue is recognized at the point of sale to the wireless communications companies. Like many communications hardware companies, Commtech has been under pressure to demonstrate its financial performance. Offering an upgrade to the CD924's navigation capabilities would probably be viewed as a significant deliverable in terms of customer value, and the finance manager says that "the accounting won't let us do it." How should the product team proceed? 2 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 E6-27. Assessing Revenue Recognition Timing L Brands, Inc. Discuss and justify when each of the following businesses should recognize revenues: a. A clothing retailer like L Brands, Inc. b. A contractor like The Boeing Company that performs work under long-term government contracts. c. An operator of grocery stores like SUPERVALU, INC. d. A residential real estate developer who constructs only speculative houses and later sells these houses to buyers. e. A banking institution like Wells Fargo & Company that lends money for home mortgages. f A manufacturer like Harley-Davidson, Inc. g. A publisher of newspapers like Gannett Co., Inc. E6-28. Contract Assets and Liabilities Haskins, Inc. has reached an agreement with a customer, Skaife Corporation, to deliver 200 units of a customized product. The standard billing price per unit is $1,000, and there are no discounts, so Skaife Corporation will pay $200,000 in total. At the time of the agreement on April 6, Skaife Corporation provides a $40,000 cash deposit to Haskins, Inc. Haskins agrees to deliver 120 units to Skaife Corporation on May 31 and at that time, Haskins can send an invoice for $50,000 to be paid by Skaife Corporation on June 15. The remaining 80 units are to be delivered on July 15, accompanied by an invoice for the remaining amount of the total $200,000 purchase price to be paid on July 31. REQUIRED Assume that Haskins, Inc. has no uncertainties about its own ability to meet the terms of the contract or about Skaife Corporation's ability and willingness to pay. Provide the journal entries to record the above events (leaving out the accounting for Haskins, Inc.'s costs). 3 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 E6-31. Accounting for Contracts with Multiple Performance Obligations Amazon.com, Inc. provides the following description of its revenue recognition policies in its second quarter of 2018 10-Q report. Revenue Revenue is measured based on the amount of consideration that we expect to receive, reduced by estimates for return allowances, promotional discounts, and rebates. Revenue also excludes any amounts collected on behalf of third parties, including sales and indirect taxes. In arrangements where we have multiple performance obligations, the transaction price is allocated to each performance obligation using the relative stand-alone selling price. We generally determine stand-alone selling prices based on the prices charged to customers or using expected cost plus a margin. A description of our principal revenue generating activities is as follows: Retail sales-We offer consumer products through our online and physical stores. Revenue is recognized when control of the goods is transferred to the customer, which generally occurs upon our delivery to the carrier or the customer. Third-party seller services-We offer programs that enable sellers to sell their products on our websites and their own branded websites, and fulfill orders through us. We are not the seller of record in these transactions. The commissions and any related fulfillment and shipping fees we earn from these arrangements are recognized as the services are rendered. Subscription services-Our subscription sales include fees associated with Amazon Prime memberships and access to content including audiobooks, ebooks, digital video, digital music, and other non-AWS subscription services. Prime memberships provide our customers with access to an evolving suite of benefits that represent a single stand-ready obligation. Subscriptions are paid for at the time of or in advance of delivering the services. Revenue from such arrangements is recognized over the subscription period. AWS-Our AWS sales arrangements include global sales of compute, storage, database, and other service offerings. Revenue is allocated to the services provided based on stand-alone selling prices and is recognized as the services are rendered. Sales commissions we pay in connection with contracts that exceed one year are capitalized and amortized over the contract term. Other-Other revenue primarily includes sales of advertising services and is recognized as the services are rendered. a. What is an "arrangement with multiple performance obligations? How are revenues recognized in such arrangements? b. Suppose that Amazon.com sells a Fire Tablet with a one-year membership in Amazon Prime. Assume that the device has a stand-alone selling price of $110, and a one-year Prime membership costs $120. Suppose the price charged for the combination is $200, and a customer buys the combination on July 1. What amount of revenue would Amazon recognize in the third calendar quarter (July through September)? How would the remaining revenues be recognized? c. Record the July 1 transaction described in part busing the financial statement effects template and in journal entry form. 4 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 E6-33. Applying Revenue Recognition Criteria Simpyl Technologies, Inc., manufactures electronic equipment used to facilitate control of production processes and tracking of assets using RFID and other technologies. Since its initial public offering in 1996, the company has shown consistent growth in revenue and earnings, and the stock price has reflected that impressive performance. Operating in a very competitive environment, Simpyl Technologies provides significant bonus incentives to its sales representatives. These representatives sell the company's products directly to end customers, to value-added resellers, and to distributers. Consider the four situations below. In each case, determine whether Simpyl Technologies can recognize revenue at this time. Describe the reasons for your judgment. a. When selling directly to the end customer, Simpyl Technologies requires a sales contract with authorized signatures from the customer company. At the end of Simpyl's fiscal year, sales representative A asks to book revenue from a customer. The customer's purchasing manager has confirmed the intention to complete the purchase, but the contract has only one of the two required signatures. The second person is traveling and will return to the office in a few days (but after the end of Simpyl's fiscal year). The inventory to fulfill the order is sitting in Simpyl's warehouse. Can Simpyl recognize revenue at this time? b. Sales representative B has an approved contract to deliver units that must be customized to meet the customer's specifications. Just prior to the end of the fiscal year, the uncustomized units are shipped to an intermediate staging area where they will be reconfigured to meet the customer's requirements. Can Simpyl recognize revenue on the basic, uncustornized units at this time? c. Sales representative Chas finalized an order from a value-added reseller who regularly purchases significant volumes of Simpyl's products. The products have been delivered to the customer at the beginning of the fiscal year, and Simpyl Technologies has no further responsibilities for the items. However, the sales representative (with the regional sales manager) is still conducting negotiations with the value-added reseller as to the volume discounts that will be offered for the current year. Can Simpyl recognize revenue on the items delivered to the customer? d. Sales representative D has finalized an order from a distributor, and the items have been delivered. However, an examination of the distributor's financial condition shows that it does not have the resources to pay Simpyl for the items it has purchased. It needs to sell those items, so the resulting proceeds can be used to pay Simpyl. Can Simpyl recognize revenue on the items delivered to the distributor? 5 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 E6-40. Analyzing Unearned Revenue Liabilities The Metropolitan Opera Association, Inc., was founded in 1883 and is widely regarded as one of the world's greatest opera companies. The Metropolitan's performances run from September to May, and the season may consist of more than two dozen different operas. Many of the opera's loyal subscribers purchase tickets for the upcoming season prior to the end of the opera's fiscal yearend at July 31. In its annual report, the Metropolitan recognizes a Deferred Revenue liability that is defined in their footnotes as follows. "Advance ticket sales, representing the receipt of payments for ticket sales for the next opera season, are reported as deferred revenue in the consolidated balance sheets." Ticket sales are recognized as box office revenue "on a specific performance basis." a. What revenue recognition principle(s) drive The Metropolitan Opera's deferral of advance ticket purchases? b. Recreate the summary journal entries to recognize ticket sales revenue (box office and tours) for The Metropolitan Opera's fiscal year 2017 and advance sales forthe fiscal year 2018 season. (Assume that advance ticket sales extend no further than the next year's opera season.) c. The Metropolitan Opera's season changes every year. At the end of each fiscal year, management of the opera can observe the revenue generated by the season just concluded and also its subscribers' enthusiasm for the upcoming season. How might that information be used in managing the organization? P6-47. Analyzing Unearned Revenue Changes Take-Two Interactive Software, Inc. (TTWO) is a developer, marketer, publisher, and distributor of video game software and content to be played on a variety of platforms. There is an increasing demand for the ability to play these games in an online environment, and TTWO has developed this capability in many of its products. In addition, TTWO maintains servers (or arranges for servers) for the online activities of its customers. TIWO considers that its products have multiple performance obligations. The first performance obligation is to provide software to the customer that enables the customer to play the game offline or online. That performance obligation is fulfilled at the point at which the software is provided to the customer. In addition, TIWO's customers benefit from "online functionality that is dependent on our online support services and/or additional free content updates." This second performance obligation is fulfilled over time, and the estimated time period for which an average user plays the software product is judged to be a faithful depiction of the fulfillment of this performance obligation. At the beginning of the first quarter of fiscal year 2018, TIWO had a deferred net revenue liability of $566,141 thousand. When that quarter ended on June 30, 2018, the deferred net revenue liability was $466,429 thousand. Revenue for the quarter was $387,982 thousand. REQUIRED a. What would cause the deferred net revenue liability to go down over the quarter? b. What was the amount of online-enabled games purchased by TTWO's customers in the first quarter ended June 30, 2018? Were the purchases greater or less than the revenue recognized in the income statement? How might that information be useful for a financial statement reader? 6 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 C6-48. Revenue Recognition and Refunds From the first quarter 2018 10-Q of Groupon, Inc., Groupon operates online local commerce marketplaces throughout the world that connect merchants to consumers by offering goods and services, generally at a discount. Consumers access those marketplaces through our websites, primarily localized groupon.com sites in many countries, and our mobile applications. Traditionally, local merchants have tried to reach consumers and generate sales through a variety of methods, including online advertising, paid telephone directories, direct mail, newspaper, radio, television and other promotions. By bringing the brick and mortar world of local commerce onto the Internet, Groupon is helping local merchants to attract customers and sell goods and services. We provide consumers with savings and help them discover what to do, eat, see, buy and where to travel. The same filing provides the following information about the company's revenue recognition policies. 10. REVENUE RECOGNITION Product and service revenue are generated from sales transactions through the Company's online marketplaces in three primary categories: Local, Goods and Travel. Product revenue is earned from direct sales of merchandise inventory to customers and includes any related shipping fees. Service revenue primarily represents the net commissions earned by the Company from selling goods and services provided by third-party merchants. Those marketplace transactions generally involve the online delivery of a voucher that can be redeemed by the purchaser with the thirdparty merchant for goods or services (or for discounts on goods or services). To a lesser extent, service revenue also includes commissions earned when customers make purchases with retailers using digital coupons accessed through the Company's websites and mobile applications. Additionally, in the United States the Company has recently been developing and testing voucherless offerings that are linked to customer credit cards. Customers claim those voucherless merchant offerings through the Company's online marketplaces and earn cash back on their credit card statements when they transact with the related merchants, who pay the Company commissions for such transactions. In connection with most of our product and service revenue transactions, we collect cash from credit card payment processors shortly after a sale occurs. For transactions in which the Company earns commissions when customers make purchases with retailers using digital coupons accessed through its websites and mobile applications, the Company generally collects payment from affiliate networks on terms ranging from 30 to 150 days. For merchant agreements with redemption payment terms, the merchant is not paid its share of the sale price for a voucher sold through one of the Company's online marketplaces until the customer redeems the related voucher. If the customer does not redeem a voucher with such merchant payment terms, the Company retains all of the gross billings for that voucher, rather than retaining only its net commission. [T]he Company estimates the variable consideration from vouchers that will not ultimately be redeemed and recognizes that amount as revenue at the time of sale, rather than when the Company's legal obligation expires. The Company estimates variable consideration from unredeemed vouchers using its historical voucher redemption experience. REQUIRED a. Assume that Groupon sells an Invicta Chronograph Watch in its Product marketplace. The price of the watch is $80, and the watch cost Groupon $40. Using journal entries, illustrate how Groupon would record the sale of the watch. b. Assume that Groupon sells a restaurant voucher in its Local marketplace. The consumer pays $80, and Groupon will pay the restaurant $40 after the consumer has redeemed the voucher at the restaurant. The consumer has 60 days to redeem the voucher. Using journal entries, illustrate how Groupon would record the sale of the voucher. Assume that the consumer will redeem the voucher with certainty. c. Refer to the facts presented in part b above. Assume that Groupon estimates that 10% of the Groupon customers will not redeem the voucher within the 60-day period. How does this change the entry in part b? 7 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 Receivables Ch 6. MC: 5-6. Q: 7, 9-11. ME: 18-23, 26. E: 34, 35, 37. P: 45. Legend: MC = Multiple Choice. Q = Questions. ME = Mini Exercises. E = Exercises. P = Problems. C =Cases MC5. If bad debts expense is determined by estimating uncollectible accounts receivable, the entry to record the write-off of a specific uncollectible account would decrease a. allowance for uncollectible accounts. b. net income. c. net book value of accounts receivable. d. bad debts expense. MC 6. If management intentionally underestimates bad debts expense, then net income is a. overstated and assets are understated. b. understated and assets are overstated. c. understated and assets are understated. d. overstated and assets are overstated. Q6-7. Why does GAAP allow management to make estimates of amounts that are included in financial statements? Does this improve the usefulness of financial statements? Explain. Q6-9. Explain how management can shift income from one period into another by its estimation of uncollectible accounts. Q6-10. During an examination of Wallace Company's financial statements, you notice that the allowance for uncollectible accounts has decreased as a percentage of accounts receivable. What are the possible explanations for this change? Q6-11. Under what circumstances would it be correct to say that a company would be better off with more uncollectible accounts? ME6-18. Reporting Uncollectible Accounts and Accounts Receivables Mohan Company estimates its uncollectible accounts by aging its accounts receivable and applying percentages to various aged categories of accounts. Mohan computes a total of $2,100 in estimated losses as of December 31, 2019. Its Accounts Receivable has a balance of $98,000, and its allowance for Uncollectible Accounts has an unused balance of $500 before adjustment at December 31, 2019. a. What is the amount of bad debts expense that Mohan will report in 2019? b. Determine the net amount of accounts receivable reported in current assets at December 31, 2019. c. Set up T-accounts for both Bad Debt Expense and for Allowance for Uncollectible Accounts. Enter any beginning balances and effects from the information above (including your results from parts a and b). Explain the numbers for each of your T-accounts. ME6-19. Explaining the Allowance Method for Accounts Receivable At a recent board of directors meeting of Ascot, Inc., one of the directors expressed concern over the allowance for uncollectible accounts appearing in the company's balance sheet. "I don't understand this account," he said. "Why don't we just show accounts receivable at the amount owed to us and get rid of that allowance?" Respond to that director 's question. Include in your response (a) an explanation of why the company has an allowance account, (b) what the balance sheet presentation of accounts receivable is intended to show, and (c) how the concept of expense recognition relates to the analysis and presentation of accounts receivable. 8 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 ME6-20. Analyzing the Allowance for Uncollectible Accounts Following is the current asset section from the Ralph Lauren Corporation balance sheet: a. Compute the gross amount of accounts receivable for both 2018 and 2017. Compute the percentage of the allowance for uncollectible accounts relative to the gross amount of accounts receivable for each of these years. b. How do you interpret the change in the percentage of the allowance for uncollectible accounts relative to total accounts receivable computed in part a? c. Ralph Lauren reported net sales of $6,182.3 million in 2018. Compute its accounts receivable turnover and average collection period. ME6-21. Analyzing Accounts Receivable Changes The comparative balance sheets of Sloan Company reveal that accounts receivable (before deducting allowances) increased by $15,000 in 2019. During the same time period, the allowance for uncollectible accounts increased by $2,100. If sales revenue was $120,000 in 2019 and bad debts expense was 2% of sales, how much cash was collected from customers during the year? ME6-22. Evaluating Accounts Receivable Turnover for Competitors The Procter & Gamble Company and Colgate-Palmolive Company report the following sales and accounts receivable balances ($ millions): a. Compute accounts receivable turnover and average collection period for both companies. b. Identify and discuss a potential explanation for the difference between these competitors' accounts receivable turnover. 9 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 ME6-23. Analyzing Accounts Receivable Changes In 2019, Grant Corporation recorded credit sales of $3,200,000 and bad debts expense of $42,000. Write-offs of uncollectible accounts totaled $39,000 and one account, worth $12,000, that had been written off in an earlier year was collected in 2019. a. Prepare journal entries to record each of these transactions. b. If net accounts receivable increased by $220,000, how much cash was collected from credit customers during the year? Prepare a journal entry to record cash collections. c. Set up T-accounts and post each of the transactions in parts a and b to them. d. Record each of the above transactions in the financial statement effects. ME6-26. Earnings Management and the Allowance for Doubtful Accounts Verdi Co. builds and sells PC computers to customers. The company sells most of its products for immediate payment but also extends credit to some customers. The industry is competitive and in the most recent year many competitors showed declines in revenue. However, Verdi Co. showed stable revenues. It is later revealed that Verdi Co. made sales and extended credit to customers previously deemed to have credit scores too low for the company to extend credit. The company did not disclose this practice in its financial statements or elsewhere. a. Explain how this practice would have enabled Verdi Co. to show stable sales. b. How should Verdi Co. have accounted for these additional sales and related receivables in its financial statements? c. How would the actions by Verdi Co. in the current period affect financial statements in future periods if the customers cannot pay for the computers they purchased on credit? E6-34. Reporting Uncollectible Accounts and Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, 2019, and arrives at the aged categories below along with the percentages that are estimated as uncollectible. At the beginning of the fourth quarter of 2019, there was a credit balance of$4,350 in the Allowance for Uncollectible Accounts. During the fourth quarter, Lafond Company wrote off $3,830 in receivables as uncollectible. a. What amount of bad debts expense will Lafond report for 2019? b. What is the balance of accounts receivable that it reports on its December 31 , 2019, balance sheet? c. Set up T-accounts for both Bad Debts Expense and for the Allowance for Uncollectible Accounts. Enter any unadjusted balances along with the dollar effects of the information described (including your results from parts a and b ). Explain the numbers in each of the T-accounts. d. Suppose Lafond wrote off $1 ,000 more in receivables in the quarter? Or, $1 ,000 less? How would that affect the bad debt expense for the fourth quarter? How does the aging of accounts deal with the inevitable differences between estimated cash collections and actual cash collections? 10 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 E6-35. Analysis of Accounts Receivable and Allowance for Doubtful Accounts Steelcase, Inc. reported the following amounts in its 2018 and 2017 10-K reports (years ended February 23, 2018, and February 24, 2017). a. Prepare the journal entry to record accounts receivable written off as uncollectible in 2018. Also prepare the entry to record the provision for doubtful accounts (bad debts expense) for 2018. What effect did these entries have on Steelcase's income for that year? b. Calculate Steelcase's gross receivables for the years given, and then determine the allowance for doubtful accounts as a percentage of the gross receivables. c. Calculate Steelcase's accounts receivable turnover for 2018. (Use Accounts receivable, net for the calculation.) d. How much cash did Steelcase receive from customers in 2018? E6-37. Estimating Bad Debts Expense and Reporting of Receivables At December 31, 2019, Sunil Company had a balance of $375,000 in its accounts receivable and an unused balance of $4,200 in its allowance for uncollectible accounts. The company then aged its accounts as follows: The company has experienced losses as follows: 1 % of current balances, 5% of balances 0--60 days past due, 15% of balances 61-180 days past due, and 40% of balances over 180 days past due. The company continues to base its provision for credit losses on this aging analysis and percentages. a. What amount of bad debts expense does Sunil report on its 2019 income statement? b. Show how accounts receivable and the allowance for uncollectible accounts are reported in its December 31 , 2019, balance sheet. c. Set up T-accounts for both Bad Debts Expense and for the Allowance for Uncollectible Accounts. Enter any unadjusted balances along with the dollar effects of the information described (including your results from parts a and b). Explain the numbers in each of the T-accounts. 11 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020 P6-45. Interpreting Accounts Receivable and Uncollectible Accounts Mattel, Inc. designs, manufactures, and markets a broad variety of toy products worldwide which are sold to its customers and directly to consumers. The company's brands include American Girl, FisherPrice, Hot Wheels, and Barbie. The following information is taken from the company's I 0-K annual report for its fiscal year ending December 31, 2017. Activity in the allowance for doubtful accounts for the past three fiscal years is as follows: Mattel's revenues were $4,881,951 thousand and $5,456,650 thousand for fiscal years 2017 and 2016, respectively. REQUIRED a. What amount did Mattel report as accounts receivable, net in its January 31, 2017, balance sheet? b. Prepare journal entries to record bad debts expense and write-offs of uncollectible accounts in fiscal 2017. (Assume that Deductions did not include recoveries or foreign currency adjustments.) Post these entries to T-accounts. Now suppose Mattel experienced a $350 thousand recovery of a previously writtenoff receivable. How should the company record this recovery? c. Compute the ratio of allowance for doubtful accounts to gross accounts receivable for fiscal 2016 and 2017. d. Compute Mattel's accounts receivable turnover and average collection period for 2017 and 2016. e. What might be the cause of the changes that you observe in parts c and d? 12 Problems taken from Chapter 6, Financial Accounting, 6th Edition, Cambridge Business Publishers, 2020