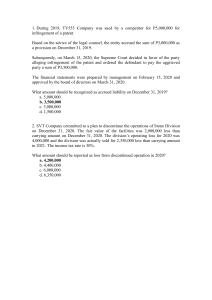

Maastricht School of Management Academic Year 2021-2022 MBA.38 Accounting for Managers The individual Assignment Name: Adnan A. Al-Eryani Student No.: 40076726 Date of Submission: 5/12/2021 Introduction. Company’s Background, Named after Brothers s Dick and Mac McDonald’s first restaurant. Their amazing idea of focusing on a limited menu that contained only burgers, fries, and beverages which was the key factor of good quality food. Ray Kroc who was one of their customers in San Bernardino, California saw the chance and he established the McDonald’s System, Inc in 1955(mcdonalds.com). Six years later, Kroc bought the exclusive rights to the McDonald’s name and operating system (mcdonalds.com). With many great ideas such as the McDonald’s principles of quality, Hamburger University, and first drive-thru, and over 36,000 restaurants in the world, operating in over 100 countries. MacDonald’s has become the biggest chain of restaurants in the world (Reiff, 2021). MacDonald’s in 2020, While it was considered one of the most difficult financial years for many companies, MacDonald’s was one the brands that made a very good performance in a very challenging market. With 20 billion in revenue and over 90 billion system sales worldwide the company had a very good financial status (McDonald’s Corporation, 2020). Like many companies that depend on online platforms for their sales, MacDonald's considered the year 2020 as a historical year in demand (McDonald's Corporation, 2020). According to their report, their active delivery system has proven to be both efficient and effective, and their digital sales were almost 20 percent systemwide on their six top markets (McDonald’s Corporation, 2020). Throughout 2020, MacDonald’s started to pay attention to the change in consumer habits, increasing the delivery staff, depending on the Drive Thru, and improving the digital system, the company adapted to the market changes in a very short amount of time; furthermore, it was able to fulfill the consumers demand without any noticeable shortage (McDonald’s Corporation, 2020). In this assignment I will be performing a horizontal then a vertical analysis on the balance sheet and income statement of the food chain restaurants in the years 2019- 2020, and I will compare the results to have an overview of the financial areas of improvement and to identify the main issues the company is facing, After that, I will be calculating the ratios of Liquidity and Activity to see the areas of improvement and to point out to the places of investment and financing according to my calculation. Balance sheet for the years 2019/2020 Consolidated Balance Sheet December 31, 2020 ASSETS Current assets Cash and equivalents $ 3,449.1 Accounts and notes receivable 2,110.3 Inventories, at cost, not in excess of market 51.1 Prepaid expenses and other current assets 632.7 Total current assets 6,243.2 Other assets Investments in and advances to affiliates 1,297.2 Goodwill 2,773.1 Miscellaneous 3,527.4 Total other assets 7,597.7 Lease right-of-use asset, net 13,827.7 Property and equipment Property and equipment, at cost 41,476.5 Accumulated depreciation and amortization (16,518.3) Net property and equipment 24,958.2 Total assets $ 52,626.8 LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities Accounts payable $ 741.3 Lease liability 701.5 Income taxes 741.1 Other taxes 227.0 Accrued interest 388.4 Accrued payroll and other liabilities 1,138.3 Current maturities of long-term debt 2,243.6 Total current liabilities 6,181.2 Long-term debt 35,196.8 Long-term lease liability 13,321.3 Long-term income taxes 1,970.7 Deferred revenues - initial franchise fees 702.0 Other long-term liabilities 1,054.1 Deferred income taxes 2,025.6 Shareholders’ equity (deficit) — Preferred stock, no par value; authorized – 165.0 million shares; issued – none Common stock, $.01 par value; authorized – 3.5 billion shares; issued – 1,660.6 million shares 16.6 Additional paid-in capital 7,903.6 Retained earnings 53,908.1 Accumulated other comprehensive income (loss) (2,586.8) Common stock in treasury, at cost; 915.2 and 914.3 million shares (67,066.4) Total shareholders’ equity (deficit) (7,824.9) Total liabilities and shareholders’ equity (deficit) $ 52,626.8 2019 In millions, except per share data Source (McDonald's Corporation 2020 Annual Report). $ 898.5 2,224.2 50.2 385.0 3,557.9 1,270.3 2,677.4 2,584.0 6,531.7 13,261.2 39,050.9 (14,890.9) 24,160.0 $ 47,510.8 $ 988.2 621.0 331.7 247.5 337.8 1,035.7 59.1 3,621.0 34,118.1 12,757.8 2,265.9 660.6 979.6 1,318.1 — 16.6 7,653.9 52,930.5 (2,482.7) (66,328.6) (8,210.3) $ 47,510.8 Horizontal Analysis of the Balance Sheet In this analysis, I will be comparing the performance of the year 2020 to the performance of 2019. First, I will be taking the difference between the two years to find out about the change percentage of the two years. Assets, *Numbers are in millions ASSETS Current assets Other assets Lease right-of-use asset, net Net property and equipment Total assets 2020 2019 6,243.20 7,597.70 13,827.70 24,958.20 52,626.80 3,557.90 6,531.70 13,261.20 24,160.00 47,510.80 Change in USD 2,685.30 1,066.00 566.50 798.20 5,116.00 Change Percentage 75% 16% 4% 3% 11% LIABILITIES AND SHAREHOLDERS’ EQUITY, *Numbers are in millions LIABILITIES AND SHAREHOLDERS’ 2020 2019 EQUITY 741.3 988.2 Current liabilities 35,196.80 34,118.10 Long-term debt 13,321.30 12,757.80 Long-term lease liability 1,970.70 2,265.90 Long-term income taxes 702 660.6 Deferred revenues - initial franchise fees 1,054.10 979.6 Other long-term liabilities 2,025.60 1,318.10 Shareholders’ equity (deficit) 7,824.90 -8,210.30 Total shareholders’ equity (deficit) Total liabilities and shareholders’ equity (deficit) 52,626.80 47510.8 Change in USD Change Percentage -246.9 1078.7 563.5 -295.2 41.4 74.5 707.5 16035.2 5116 -25% 3% 4% -13% 6% 8% 54% -195% 11% I got the percentage of the change by first calculating the change in USD which is the (current year-base year). Then, I calculated the percentage using the (base year/ change in USD). Let’s look at the assets, all the values show that there is an increase in the total assets from 2019 to 2020 which means that Macdonald's not only succeeded in keeping its assets but made an increase. Current assets the company has made a significant increase by 75 percent, the other assets which can be in a form of different investments did not do bad either in an increase by 16 percent. The lease right-of-use asset, net, and the net property and equipment got a small increase of 7 percent combined which might have accrued because of the market change in 2020. The liabilities have seen different changes and while the current liabilities have decreased by 25 percent long term debt has witnessed an increase by 3 percent which might show much the company will have to lose of its assets to cover that debt. The balance between lease right-of-use asset, net and long-term lease liability by 4 percent shows that the company has a strategy for the effective use of its facilities to the amounts it pays to keep them. The long-term investments and other factors made a noticeable reduction in the long-term income taxes by 13 percent. The increase in the deferred revenues - initial franchise fees might have occurred because of the increasing number of restaurants opened in 2020. Other long-term liabilities were increased but not by a big percentage in it cannot be considered as a problem depending on the current numbers the company is making. While Macdonald's has made an increase shareholders’ equity by 54 percent, it has also reduced the total shareholders’ equity by -195 percent showing that the company still stands on the solid ground regardless of the increase in 2020. Vertical Analysis of the Balance Sheet In this analysis, I will be stating each item as a percentage of total assets and total liabilities and shareholders’ equity (deficit) for the years 2019 and 2020. To calculate the percentage, I need to Assets, *Numbers are in millions Percentage of total Assets-2020 6,243.20 3,557.90 11.86% Current assets 7,597.70 6,531.70 14.44% Other assets 26.28% Lease right-of-use asset, net 13,827.70 13,261.20 24,160.00 47.42% Net property and equipment 24,958.20 52,626.80 47,510.80 100.00% Total assets - LIABILITIES AND SHAREHOLDERS’ EQUITY, ASSETS 2020 2019 Percentage of total Assets-2019 7.5% 13.7% 27.9% 50.9% 100.0% *Numbers are in millions LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities Long-term debt Long-term lease liability Long-term income taxes Deferred revenues - initial franchise fees Other long-term liabilities Shareholders’ equity (deficit) 2020 2019 741.3 35,196.80 13,321.30 1,970.70 702 1,054.10 2,025.60 988.2 34,118.10 12,757.80 2,265.90 660.6 979.6 1,318.10 Percentage of total liabilities and shareholders’ equity-2020 1.4% 66.9% 25.3% 3.7% 1.3% 2.0% 3.8% Percentage of total liabilities and shareholders’ equity-2019 2.08% 71.81% 26.85% 4.77% 1.39% 2.06% 2.77% Total shareholders’ equity (deficit) Total liabilities and shareholders’ equity (deficit) 7,824.90 52,626.80 -8,210.30 47510.8 14.9% 100.0% -17.28% 100.00% Looking at the percentage we can see that change between the two years is very low. MacDonald's has a clear strategy of increasing assets and decreasing debts, and while the company is decreasing the current liabilities and increasing current assets it has the biggest percentage in the long-term debt it has experienced some reduction by 4.91 percent. Most of the company’s investment goes to the net property and equipment and the lease right-of-use asset, net, and both were reduced in 2020 in comparison to 2019, as a result of the reduction in longterm debt. The other long-term liabilities were also decreased, and the investments in current assets increased by 0.74 percent which is considered somehow small but can be understood due to the reeducation in liabilities and market changes in 2020. That changed in the market in 2020 was the reason MacDonald's has decided to increase the investment on net property and equipment in order to level up to the increasing demand and the consumer’s changing dining habits (McDonald’s Corporation, 2020). Income Statement Consolidated Statement of Income In millions, except per share data Years ended December 31, 2020 REVENUES Sales by Company-operated restaurants Revenues from franchised restaurants Other revenues Total revenues OPERATING COSTS AND EXPENSES Company-operated restaurant expenses Food & paper Payroll & employee benefits Occupancy & other operating expenses Franchised restaurants-occupancy expenses Other restaurant expenses Selling, general & administrative expenses Depreciation and amortization Other Other operating (income) expense, net Total operating costs and expenses Operating income Interest expense-net of capitalized interest of $6.0, $7.4, and $5.6 Nonoperating (income) expense, net Income before provision for income taxes Provision for income taxes Net income Earnings per common share–basic Earnings per common share–diluted Dividends declared per common share Weighted-average shares outstanding–basic $ $ $ $ $ 2019 2018 9,420.8 11,655.7 287.9 21,364.4 $ 10,012.7 11,012.5 232.7 21,257.9 2,564.2 2,416.4 2,000.6 2,207.5 267.0 2,980.3 2,704.4 2,075.9 2,200.6 223.8 3,153.8 2,937.9 2,174.2 1,973.3 186.1 300.6 2,245.0 (117.5) 11,883.8 7,324.0 1,218.1 (34.8) 6,140.7 1,410.2 4,730.5 6.35 6.31 5.04 744.6 262.5 1,966.9 (119.8) 12,294.6 9,069.8 1,121.9 (70.2) 8,018.1 1,992.7 6,025.4 7.95 7.88 4.73 758.1 214.8 1,985.4 (190.2) 12,435.3 8,822.6 981.2 25.3 7,816.1 1,891.8 5,924.3 7.61 7.54 4.19 778.2 8,139.2 10,726.1 342.5 19,207.8 $ $ $ $ $ $ $ $ $ Weighted-average shares outstanding–diluted 750.1 764.9 785.6 Source (McDonald's Corporation 2020 Annual Report). Horizontal Analysis of Income statement As I did with the balance sheet, I will start the analysis by calculating the change parentage by first finding the change in USD using (current year-base year) than by using the formula (change Change in USD REVENUES 19,207.80 21,364.40 -2,156.60 OPERATING COSTS AND EXPENSES 11,883.80 12,294.60 -410.80 Operating income 7,324.00 9,069.80 -1,745.80 Income before provision for income taxes 6,140.70 8,018.10 -1,877.40 Net income 4,730.50 6,025.40 -1,294.90 Earnings per common share–basic 6.35 7.95 -1.60 Earnings per common share–diluted 6.31 7.88 -1.57 Dividends declared per common share 5.04 4.73 0.31 Weighted-average shares outstanding–basic 744.6 758.1 -13.50 Weighted-average shares outstanding–diluted 750.1 764.9 -14.80 in USD/base year). *In millions, except per share data 2020 2019 Change Percent -10.09% -3.34% -19.25% -23.41% -21.49% -20.13% -19.92% 6.55% -1.78% -1.93% Vertical analysis of income statement. Beginning the analysis, I will start by calculating the percentage of each year in order to compare the two years. The formula needed to find the percentage is (Item/ Revenue “sales”). Then I will compare the performance of the two years based on them. After that, I will try to identify the issues that the company needs to pay attention to. Percentage Percentage of 2020 of 2019 REVENUES 19,207.80 21,364.40 100.0% 100.00% OPERATING COSTS AND EXPENSES 11,883.80 12,294.60 61.9% 57.55% Operating income 7,324.00 9,069.80 38.1% 42.45% Income before provision for income taxes 6,140.70 8,018.10 32.0% 37.53% Net income 4,730.50 6,025.40 24.6% 28.20% Earnings per common share–basic 6.35 7.95 0.0% 0.04% Earnings per common share–diluted 6.31 7.88 0.0% 0.04% Dividends declared per common share 5.04 4.73 0.0% 0.02% Weighted-average shares outstanding–basic 744.6 758.1 3.9% 3.55% Weighted-average shares outstanding–diluted 750.1 764.9 3.9% 3.58% *In millions, except per share data 2020 2019 Comparison between 2019 and 2020 and overview of the main issues, Looking at the numbers and percentages between 2019 and 2020, it was clear that Macdonald's has a strategy of increasing investments and decreasing debts. While the balance sheet clearly shows the increase in investment and decrease in the debts between the two years, the income statement shows a reduction in sales in 2020 if compared to 2019, but why is that? First, let's have a look at the sales in 2019, the food chain managed to make 21,364.40 million in 2019; however, this amount was reduced to 19,207.80 million in 2020. This reduction in sales also resulted in a reduction in expenses by 4.35 percent between the two years. The company states that most of its sales come from two sources. One is the restaurants managed directly by them. The other is the fees provided by the name holders around the world (McDonald’s Corporation, 2020). fees contain a percentage of the minimum sales and any other amounts like name franchise (McDonald’s Corporation, 2020). In 2020, the restaurants' chain witnessed the highest growth in its history in the US, and the Australian market performed great for the seventh year in raw, the reduction however was a result of the performance in other markets which were more challenging (McDonald’s Corporation, 2020). The company still sees the reduction as a manageable challenge due to its growing investments and its solid managing system. The management even said that it was able to support many of its franchisees with about one billion dollars to face the market challenges and to support their operations (McDonald’s Corporation, 2020). The reduction in 2020, was a general aspect of the company throughout the year, and due to the reduction of sales not only did the expenses and taxes decreased but also the company has lowered the dividends from 5.04 to 4.73 per common share. This decrease in the dividends was not a big problem for the shareholders anyway because the company has reported a growth of 13 percent over the last five years regardless of the overall performance in 2020 (Kalinic, 2021). Macdonald's has an impressive performance of 45 years of distributing dividends (Kalinic, 2021). This relatively low percentage of dividends is consistent unlike many other big companies like Alibaba and Airbus which do not pay any dividend (Haqqi, 2021). The impressive performance of the company could point out that it could be a good place to invest, however, from the analysis I made some issues need to be looked into. First, the decrease in the long-term debt is good, the increase in the investment cannot cover all the liabilities (short and long-term). Second, the performance of the franchisees could be causing a problem to the company in the long run if the sales do not increase in the coming years. Third, for shareholders seems that Macdonald's is depending more on debt than equity which cannot be a good indicator for investors especially if they are looking to influence the management and increase their share. The management however seems to favor depending on debt since it has huge free cash flow at 97.8 % to keep reducing it (McDonald’s Corporation, 2020), and it has a low dividend rate for common shareholders. To Sum up, the financial status of MacDonald’s is considered stable and the management system they have is pretty efficient and solid, and like any other corporation in the market it depends on debt and equity even though equity share is decreasing, but if looked at as a longterm investment that does not depend on the dividend it is defiantly a good place to invest money despite the issues it is facing which can be managed and solved overtime. Financial Ratios to Identify the improvements (or deterioration) of the company 1. Quick ratio: I will start with ratio to determine the liquidity between 2019 and 2020, the company’s ability to cover the debts depending on the existing assets according to the formula: (Current Assets – Inventory) / Current Liabilities). (GoCardless) - 2019 * Amounts are in millions, Current assets are 3,557.9 Inventories, at cost, not in excess of the market are 50.2 Current Liabilities are 3,621.0 The Ratio for 2019 is 0.9687. - 2020 *Amounts are in millions, Current assets are 6,243.2 Inventories, at cost, not in excess of the market are 51.1 Current Liabilities are 6,181.2 The Ratio for 2020 is 1.0017. The ratio shows an increase between 2019 and 2020, as a result of the increase in investment. The ratio in 2019 was a little lower than 1 which put the question of the company’s available liquidity and its ability to cover the short-term debt. This issue was resolved in the year 2020 when the ratio increased to 1, and that means that the company is in a good position. Comparing the ratio of MacDonald's with Yum brands in 2019 and 2020 we can see that the ratio for Yum brands in 2019 (Yum! Corporation, 2020), *Amounts are in millions, Current assets are 1,527 Inventories, at cost, not in excess of the market are 338 Current Liabilities are 1,675 Ratio is 0.709850746 In 2020 (Yum! Corporation, 2020), *Amounts are in millions, Current assets are 1,689 Inventories, at cost, not in excess of the market are 425 Current Liabilities are 1,675 The ratio is 0.754626866. Comparing both years it is clearly seen that Macdonald's has more liquidity than Yum! Brands and that its ability to cover the short-term debts is better. 2. Debt to equity ratio This ratio will measure how MacDonald's is depending on debt, and I got from the analysis above that the company depends more on debt than equity, and this ratio will how to what degree that is. I will compare the ratio for MacDonald's in the years 2019 and 2020. Then, I will compare it to another company from the industry which is Yum! Brands. This ratio is calculated by the formula (total liabilities/shareholders’ equity). (GoCardless). MacDonald’s 2019 Vs 2020, 2019 *Amounts are in millions, The total liabilities are 37,739 Shareholder’s equity is (8,210.3) Ratio is 4.596 2020 *Amounts are in millions, The total liabilities are 41,377.8 Shareholder’s equity is (7,824.9) Ratio is 5.879 The ratio shows that MacDonald’s was depending on debt in 2020 more than in 2019, but it also shows that the depending on debt is very big for both years and the change in 2020 was very small. MacDonald’s s vs Yum! 2019 and 2020 Yum! 2019 *Amounts are in millions, The total liabilities are 13,247 Shareholder’s equity is (8,016) Ratio is 1.65256986 - 2020 *Amounts are in millions, The total liabilities are 13,743 Shareholder’s equity is (7,891) Ratio is 1.741604359 Compering with Yum! Brands a company in the same industry shows that it depends on debt less than MacDonald’s does. It also shows that Yum! Bands are holding more debt. 3. Working capital ratio This ratio compares the company’s ability to pay off current debts depending not only on the liquid assets available but all current assets including inventories. Using this ratio, I will first compare between 2019 and 2020 than between MacDonald’s and Yum! Brands in the same period. The Formula to calculate this ratio is (Current Assets / Current Liabilities). (GoCardless) MacDonald’s 2019 vs 2020 - 2019 *Amounts are in millions, Current Assets is 3,557.9 Current Liabilities is 3,621.0 Ratio is 0.982 - 2020 *Amounts are in millions, Current Assets is 6,243.2 Current Liabilities is 6,181.2 Ratio is 1.01 Just as it appeared in the quick ratio it shows that MacDonald's ability to cover debts using existing assets has increased from 2019 to 2020 due to the increase in current assets and the decrease in the liabilities. MacDonald’s vs Yum! Yum! - 2019 *Amounts are in millions, Current Assets is 1,527 Current Liabilities is 1,541 Ratio is 0.9909 - 2020 *Amounts are in millions, Current Assets is 1,689 Current Liabilities is 1,675 Ratio is 1 Comparing the two companies together it appears that both can cover the current liabilities using the assets and that there was an increase in 2020. MacDonald’s has a better ability to cover the debts than Yum!. 4. Price to earnings ratio This ratio calculates the price for earnings. As with other ratios, I will start by comparing 2019 to 2020 then I will compare MacDonald's to another company from the same industry which is Yum! Bards. The formula to calculate this ratio is (Share Price / Earnings per Share) (GoCardless). MacDonald’s 2019 vs 2020 - 2019 The share price is 197.61 Earnings per Share are 7.95 Ratio is 24.85666 -2020 The share price is 214.58 Earnings per Share are 6.35 Ratio is 33.792 MacDonald’s vs Yum! Yum! - 2019 Share Price is 100.73 Earnings per Share are 4.23 Ratio is 23.813 -2020 Share Price is 108.56 Earnings per Share are 2.99 Ratio is 36.307 Comparing the ratios together is clear that in 2019 both companies were on average the stocks in both companies cannot be considered cheap considering what they earn, but the increase in the ratio in 2020 to above 30 in both companies shows that their shares got more expensive and riskier. Looking at MacDonald’s the Company has been in an impressive run by 45 years of growth (Kalinic, 2021). From the analysis I made and the ratios above it were clear that the company’s performance was quite good in 2020 considering the market challenges in that year; however, when compared to 2019 we can see that performance has decreased even if we look at the fact that they still managed to increase the assets in 2020. The problem in the performance was according to the management was because of the unstable markets which they had to support to keep the operations running (McDonald's Corporation,2020). The financial situation of the company is stable and they are not facing any major issues, but they need to pay attention to their long-term debt. MacDonald's has a very good place in the market compared to other corporations in the industry. Their dependence on equity is lower than debt and they have a quite expensive stoke price if compared to the earnings it makes which is not a good indicator for short-term investors; therefore, MacDonald's is not the best option for investors who are looking after the high dividend. The Cash flows the company has a good and the liquidity it has was quite good for a year like 2020, and if we compare the cashflows between 2020 and other years we can see that the cash flow in 2020 is lower than 2019 and 2018, but it is still considered good of compered to other competitors in the food industry. Free Cash Flows Dollars in millions Cash provided by operations Less: Capital expenditures Free cash flow Divided by: Net income Free cash flow conversion rate Years ended December 31, 2020 2019 2018 $ 6,265.2 $ 8,122.1 $ 6,966.7 1,640.8 2,393.7 2,741.7 $ 4,624.4 $ 5,728.4 $ 4,225.0 4,730.5 6,025.4 5,924.3 97.8 % 95.1 % Source (McDonald's Corporation 2020 Annual Report). To Sum up, just like any other industry, the food sector faced a lot of challenges from the close down to the changes in people's dining habits. MacDonald's as one of the largest brands in the world were able to face the challenge due to their investment in improving the delivery system and drive thru or their flexible management system which was able to follow up with the changes in a short amount of time, but like any other cooperation there are still some issues that they have to look after such as the debt issue, and their low depend on equity which can worry investors to buy any shares. Whether we look at the company as investors or consumers we need to think not only of the financial status but the benefits we got get from investing in this company. MacDonald's is a famous brand, but they have an expensive price per share and their dividend is low if compared to the earnings, but the long-term investment could be a smart option because the company is expanding its assets and long-term investment and it could cover its liabilities just from available assets. 71.3 % References - Our history: Ray kroc & the McDonald's Brothers | McDonald's. (n.d.). Retrieved December 2, 2021, from https://www.mcdonalds.com/us/en-us/about-us/our-history.html. - Reiff, N. (2021, July 28). 10 biggest restaurant companies. Investopedia. Retrieved December 2, 2021, from https://www.investopedia.com/articles/markets/012516/worldstop-10-restaurant-companies-mcdsbux.asp. - McDonald's Corporation. (2020). 2020 annual report, Retrieved December 2, 2021, from https://corporate.mcdonalds.com/content/dam/gwscorp/assets/investors/financialinformation/annual-reports/2020%20Annual%20Report.pdf. - Kalinic, S. (2021, October 30). The dividend of McDonald's (NYSE: MCD) - why we are lovin' it. Yahoo! Finance. Retrieved December 4, 2021, from https://finance.yahoo.com/news/dividend-mcdonalds-nyse-mcd-why-150250424.html. - Haqqi, T. (2021, January 20). 15 biggest companies that don't pay dividends. Yahoo! Finance. Retrieved December 4, 2021, from https://finance.yahoo.com/news/15-biggestcompanies-don-t-184200134.html. - Yum! Corporation. (2020). 2020 annual report, Retrieved December 4, 2021, from https://s2.q4cdn.com/890585342/files/doc_financials/2020/ar/2020-annual-report.pdf. - GoCardless. (n.d.). 7 important financial ratios. GoCardless. Retrieved December 5, 2021, from https://gocardless.com/guides/posts/top-7-financial-ratios/#5-earnings-pershare.