State of States Report 2021: Fiscal Performance Analysis

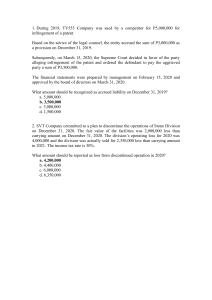

advertisement