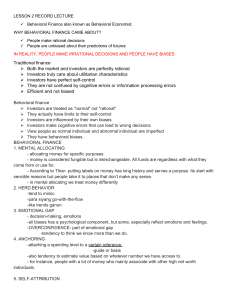

BEHAVIORAL FINANCE Topic 2. DECISION MAKING ERRORS/BIAS Introduction Psychological influences and biases affect the financial behaviors of investors and financial practitioners. Behavioral finance can be analyzed from a variety of perspectives. We can have for instance, stock market trends, or we can have psychology of people making financial choices. Questions for discussion: What about stock market trends? How about the psychology of people making financial choices? One of the key aspects of behavioral finance studies is the influence of biases. Understanding and classifying different types of behavioral finance biases is important for investigation but also for analysis. Decision-Making Errors and Biases Overview • • • Most of the manager have a tendency to take decisions based on rule of thumb. Rule of thumbs make decision-making quick and easy. However, these rules of thumb may not be reliable and may lead to error and biasness. Types of Errors in Decision Making 1. Overconfidence bias ➢ this error occurs when the decision maker believe that they know more than what they actually do. ➢ Another cause is holding too much positive views of themselves. ➢ In simple words, “I can’t go wrong” 2. Immediate Gratification ➢ Decision makers who can’t’ wait and want immediate results of their decision. ➢ They even don’t care of the cost. ➢ For them any choice that provide quick payoff is more appealing to them. 3. Anchoring effect ➢ Some decision maker has a tendency give more weightage to first piece of information. ➢ They tend to ignore the information received in the later stages. ➢ First impression their priority 4. Selective perception ➢ When decision makers selectively organize and interpret events based on their biased perception. ➢ They create a perception (which may be wrong) and take decision based on that. 5. Confirmation Bias ➢ There are decision makers who seek out information that reaffirms their past judgements and leave out information that challenges their preconceived views. 6. Framing ➢ When a decision maker highlights certain aspect of a situation while excluding others. ➢ They have a tendency to omit certain parts and end up on incorrect reference point. 7. Availability Bias ➢ When decision makers only remember events that are more recent. ➢ This distorts their judgements as they are not able to recall past events. 8. Representation bias ➢ When decision makers try to compare every new situation with the past event ➢ They have a tendency to create analogies and see identical situations where they don’t exist. 9. Randomness ➢ When decision makers have a tendency to create meaning from random events. ➢ There are so many events that happens by chance and there is no way you can predict them. 10. Sunk costs ➢ This error occurs when decision makers forget current choice can’t correct their past. ➢ They keep on investing time on their past expenditure rater that focusing on future consequences. 11. Self-Serving ➢ This occurs when decision makers are quick to take credit of their success and blame the outside factors for the failure. 12. Hindsight ➢ When decision makers say that they would have predicted the results of any event after the event outcome is already known. Remember! Behavioral finances are a part of behavioral economics, and the key idea of behavioral finance and behavioral economics, is that they are all psychological influences and biases that affect the financial behavior on investors, but also of financial practitioner. Influences and biases can be the source for explanation of a large number of market anomalies, and specifically market anomalies in the stock market. CLASSIFICATION OF BEHAVIORAL FINANCE The purpose of behavioral finance is to help understand 1. why people make certain financial choices, 2. and how these choices can affect financial markets. According to behavioral finance, economic agents are not totally rational and therefore they take investment decisions based also on psychological processes. One of the key aspects of behavioral finance studies is the influence of biases. COMPARISON BETWEEN TRADITIONAL FINANCE VERSUS BEHAVIORAL FINANCE 1. Traditional finance assumes that market and investors are fully rational, whereas behavioral finance assumes that investors are treated as normal but not rational. 2. Second, traditional finance assumes that investors truly care about the utilitarian characteristics. Whereas, according to behavioral finance investors are influenced by their own biases. 3. Also, a traditional finance assumes that investors have a perfect self-control, whereas they actually have limits to their self-control according to behavioral finance. 4. Lastly, traditional finance assumes that investors are not confused by cognitive errors or information processing errors. Whereas Behavioral Finance assumes that investors make cognitive errors that can lead to wrong decision. REMEMBER! Behavioral Finance assumes that the self-deception has an impact on heuristic simplification, social influence, emotions; all of these have an impact on financial decisions, all these elements. We will see more in details, what are those decision-making errors and biases, self-deception, heuristics, amplification, emotion, and social influences. These are basically the most relevant errors that we can have, according to Behavioral Finance. Mental accounting refers to the propensity for people to allocate money for specific purposes. We can add also cases of herd behavior, which states that people tend to mimic the financial behavior of the majority of the herd. The herding is notorious in the stock market as the cause behind dramatic rallies. Herd behaviors generate big fluctuations in stock markets. Emotional gap refers to decision-making based on extreme emotions or emotional strain, such as anxiety, anger, fear, or excitement. Sometimes, emotions are a key reason why people do not make rational choices, like the neoclassical theory states. Hankering refers to attaching and spending legal over certain reference. For instance, this may include spending consistently or rationalizing spending based on different satisfaction utilities. • A string desire to have or to do something. Self-attribution refers to a tendency to make choices based on confidence in a self-paced knowledge. Self-attribution usually stems from intrinsic confidence of a particular area. Within this category, individuals tend to rank their knowledge higher than others. Disposition bias refers to when investors sell their winners and hang to their losers. Investors thinking that they want to realize gain quickly, however, when an investment is losing money, they will hold into it because they want to get back to the initial price. Investors tend to admit they're correct about all investment quickly. However, investors are reluctant to admit that they made an investment in mistake. This is known as a disposition bias. Confirmation bias is when investor have a bias toward accepting information that confirms they already have belief in an investment. If information surfaces, investors accept it readily to confirm that they are correct about their investment decision. Even if the information is outflowed.