COVID-19 Impact on Philippine Business: Enterprise Survey

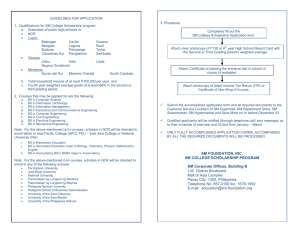

advertisement