e

International Financial

Financial

International

Management

Management

2/27/2022

2/27/2022

Prof.Anuj

Prof.Anuj Verma

Verma

11

Introduction:

Introduction:

International

International Financial

Financial

Management

Management

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

2

OVERVIEW:

OVERVIEW:

I.I.

II.

II.

2/27/2022

2/27/2022

The Rise

Rise of

of the

the Multinational

Multinational

The

Corporation

Corporation

The

The Internationalization

Internationalization of

of

Business

Business and

and Finance

Finance

Prof.Anuj Verma

Verma

Prof.Anuj

3

I.

The MNC:

I. The

MNC: Definition

Definition

aa company

company with

with production

production and

and

distribution

distribution facilities

facilities in

in more

more than

than

one

one country.

country.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

4

A. Forces

A.

Forces Changing

Changing Global

Global Markets

Markets

Massive

Massive deregulation

deregulation

Privatizations

Privatizations of

of state-owned

state-owned industries

industries

Revolution

Revolution in

in information

information technology

technology

Wave

Wave of

of M&A

M&A

Emergence

Emergence of

of free

free market

market policies

policies

Rise

Rise of

of Big

Big Emerging

Emerging Markets

Markets (BEMs)

(BEMs)

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

5

B.

B. Prime

Prime Transmitter

Transmitter of

of Competitive

Competitive

Forces

Forces in

in the

the Global

Global Economy:

Economy:

The MNC

The

MNC emphases

emphases group

group performance

performance such

such

as

as

Global

Global coordinated

coordinated allocation

allocation of

of resources

resources

Market

Market —– entry

entry strategy

strategy

Ownership

Ownership of

of foreign

foreign operations

operations

Production,

Production, marketing

marketing and

and financial

financial activities

activities

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

66

C.

THE MNC

C. EVOLUTION

EVOLUTION OF

OF THE

MNC

Reasons

Reasons to

to Go

Go Global:

Global:

1.

1. More

More raw

raw materials

materials

2.

2. New

New markets

markets

3.

3. Minimize

Minimize costs

costs of

of

production

production

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

7

RAW

RAW MATERIAL

MATERIAL SEEKERS

SEEKERS

exploit

exploit markets

markets in

in other

other countries

countries

historically

historically first

first to

to appear

appear

modern-day

modern-day counterparts

counterparts

British Petroleum

Petroleum

British

Exxon

Exxon

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

8

MARKET

MARKET SEEKERS

SEEKERS

produce

produce and

and sell

sell in

in foreign

foreign markets

markets

heavy

heavy foreign

foreign direct

direct investors

investors

representative

representative firms:

firms:

IBM

IBM

MacDonald’s

MacDonald’s

Nestle

Nestle

Levi

Levi Strauss

Strauss

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

9

COST

COST MINIMIZERS

MINIMIZERS

seek

seek lower-cost

lower-cost production

production abroad

abroad

motive:

motive: to

to remain

remain cost

cost competitive

competitive

Texas

Texas Instruments

Instruments

Intel

Intel

Seagate

Seagate Technology

Technology

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

10

10

D.

THE MNC:

D. THE

MNC: AA BEHAVIORAL

BEHAVIORAL

VIEW

VIEW

1. State

State of

of mind:

mind:

1.

committed to

to producing,

producing,

committed

undertaking

undertaking investment

investment

and

and marketing,

marketing, and

and

financing globally.

globally.

financing

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

11

11

E.

THE GLOBAL

E. THE

GLOBAL MANAGER

MANAGER

1.

1. Understands

Understands political

political and

and

economic

economic differences;

differences;

2.

2. Searches

Searches for

for most

most costcosteffective

effective suppliers;

suppliers;

3.

3. Evaluates

Evaluates changes

changes on

on value

value

of

of the

the firm.

firm.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

12

12

The

Internationalization of

Business

The Internationalization

of Business

and

Finance

and Finance

I. Globalization

Globalization

I.

A.

Political

A.

Political and

and Labor

Labor Union

Union

Concerns

Concerns

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

13

13

B. Consequences

Consequences of

of Global

Global

B.

Competition

Competition

Acceleration of

Acceleration

of the

the global

global economy

economy

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

14

14

Four Facets

Facets to

to Understand

Understand the

the Concept

Concept of

of International

International

Four

Financial Management

Management in

in India:

India:

Financial

Foreign Exchange

Exchange

Foreign

Foreign exchange

exchange is

is an

an additional

additional risk

risk that

that aa finance manager is

is

Foreign

required to

to cater

cater to

to in

in an

an international

international setting.

setting. Foreign

Foreign exchange

exchange

required

risk refers

refers to

to the

the risk

risk related

related to

to fluctuating

fluctuating prices

prices of

of currency

currency

risk

that

that has

has the

the potential

potential to

to convert

convert aa profitable

profitable deal

deal into

into aa losslossmaking one.

one.

making

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

15

15

Political

Political Risks

Risks

Political

Political risks

risks may

may include

include any

any change

change in

in the

the business

business economic

economic

environment

environment of

of the

the country.

country. These

These changes

changes can

can include

include Taxation

Taxation

Rules,

Rules, Contract

Contract Act,

Act, or

or any

any unforeseen

unforeseen government

government action.

action. It

It

pertains

pertains to

to the

the government

government of

of aa country

country that

that can

can change

change the

the

rules

rules of

of the

the game

game anytime,

anytime, in

in an

an unexpected

unexpected manner.

manner.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

16

16

Market

Market Imperfection

Imperfection

Due

Due to

to market and product integration,, the

the world

world economy

economy

faces

faces aa lot

lot of

of differences

differences across

across the

the countries

countries in

in terms

terms of

of

transportation

transportation cost,

cost, different

different taxation

taxation systems,

systems, etc.

etc. Imperfect

Imperfect

markets

markets force

force the

the finance

finance manager

manager to

to strive

strive for

for the

the best

best

opportunities

opportunities across

across international

international borders.

borders.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

17

17

Enhanced Opportunity

Opportunity Set

Set

Enhanced

By

By taking

taking the

the business

business across

across national

national borders,

borders,

expands its

its chances

chances of

of reaping

reaping fruits

fruits of

of aa different

different

aa business expands

taste. Not

Not only

only does

does it

it enhance

enhance the

the opportunity

opportunity for

for more

more

taste.

business

business but

but also

also diversifies

diversifies the

the overall

overall risk

risk of

of business

business to

to

various nations.

nations.

various

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

18

18

THE

DETERMINATION

THE DETERMINATION

OF

OF EXCHANGE

EXCHANGE RATES

RATES

2/27/2022

Prof.Anuj Verma

19

A Brief

Brief History

History of

of the

the International

International

A

Monetary

Monetary System:

System:

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

20

20

|

A BRIEF HISTORY OF THE

INTERNATIONAL MONETARY SYSTEM

I. THE USE OF GOLD

A. Desirable properties

2/27/2022

2/27/2022

B.

In short run:

C.

In long run:

High production costs limit

changes.

Commodity money insures

Prof.Anuj Verma

Verma

Prof.Anuj

21

21

II.

The Classical Gold Standard

(1821-1914)

A.

2/27/2022

2/27/2022

Major global currencies on gold

standard.

1.

Nations fix the exchange rate

in terms of a specific amount

of gold.

Prof.Anuj Verma

Verma

Prof.Anuj

22

22

III.

The Gold Exchange Standard

(1925-1931)

A.

Only U.S. and Britain allowed

to hold gold reserves.

Others could hold both gold, dollars

or pound reserves.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

23

23

The Bretton Woods System (1946-1971)

1.

URS

ol OUl again

valued at $1 - 1/35 oz. of

gold.

All currencies linked to that

a fixed rate system.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

price in

24

24

B.

Exchange rates allowed to fluctuate

by 1% above or below initially set

rates.

Collapse, 1971

iW

= [0IS Sos

a.

U.S. high inflation rate

b.

2/27/2022

2/27/2022

U.S.$ depreciated sharply.

Prof.Anuj Verma

Verma

Prof.Anuj

25

25

Post-Bretton Woods System (1971-Present)

A.

Smithsonian Agreement,

1971:

US$ devalued to 1/38 oz. of gold.

By 1973: World on a freely floating

exchange rate system.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

26

26

Currencies devalued in 1931

- led to trade wars.

Bretton Woods

Conference

- called in order to avoid

future protectionist and

destructive economic policies

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

27

27

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

I. SETTING

SETTING THE

EQUILIBRIUM

I.

THE EQUILIBRIUM

A. Exchange

A.

Exchange Rates

Rates

market-clearing

market-clearing prices

prices that

that

equilibrate

equilibrate the

the quantities

quantities

supplied

Supplied and

and demanded

demanded of

of

foreign currency.

currency.

foreign

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

28

28

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

B.

Americans Purchase

B. How

How Americans

Purchase

German

German Goods

Goods

1.

1. Foreign

Foreign Currency

Currency Demand

Demand

-derived

-derived from

from the

the demand

demand for

for

foreign

foreign country’s

country’s goods,

goods,

services,

services, and

and financial

financial

assets.

assets.

e.g.

The demand

e.g. The

demand for

for German

German

goods

Americans

goods by

by Americans

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

29

29

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

2.

2. Foreign

Foreign Currency

Currency Supply:

Supply:

a.

a. derived

derived from

from the

the foreign

foreign

country’s

country’s demand

demand for

for

local

local goods.

goods.

b.

They must

b. They

must convert

convert their

their

currency

currency to

to purchase.

purchase.

e.g.

e.g. German

German demand

demand for

for US

US goods

goods

means

means Germans

Germans convert

convert €€ to

to US

US

in order

order to

to buy

buy. .

$¢ in

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

30

30

MN

Dollar Price of one € (1€ =

$e)

= $e)

S

w

cz

w

=

©

e€oo

Co

©

&

2

a

D

D

Sum

S

o

a

Q

Qoo

Quantity

Quantity of

of €€

2/27/2022

2/27/2022

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

Prof.Anuj

Prof.Anuj Verma

Verma

31

31

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

3.

3. Equilibrium

Equilibrium Exchange

Exchange Rate:

Rate:

occurs

occurs when

when the

the quantity

quantity

supplied

Supplied equals

equals the

the quantity

quantity

demanded

demanded of

of a

a foreign

foreign

currency

currency at

at a

a specific

specific local

local

price.

price.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

32

32

|

Y

Jb

:

* *

|| Ne

~

-

P

a

y

|

|

|

|

Impact

Impact of

of Relative

Relative Inflation

Inflation Rate

Rate

x

s

~

~

s

s

s

s

s

s

s

S

s

s

s

s

L ¢

sy

S

&

e1

eo

¢

¢

S

S

.

¢

y

: eos

s

s

¢

¢

¢

¢

¢

¢

7

:

¢

¢

—

¢

L

S

¢

:

¢

¢

¢

:

7

¢

S

@

°

Dollar Price

Price of

of one

one €€ (€1

(€1 =

Dollar

$e)

= $e)

sy

D

Q

Qoo

Quantity

Quantity of

of €€

2/27/2022

2/27/2022

Prof.Anuj

Prof.Anuj Verma

Verma

33

33

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

C.

C. How

How Exchange

Exchange Rates

Rates Change

Change

1.

1. Increased

Increased demand

demand

as

as more

more foreign

foreign goods

goods are

are

demanded,

demanded, the

the price

price of

of the

the

foreign

foreign currency

currency in

in local

local

currency

currency increases

increases and

and vice

vice

versa.

versa.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

34

34

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

2.

2. Home

Home Currency

Currency Depreciation

Depreciation

a.

d.

b.

2/27/2022

2/27/2022

Foreign

Foreign currency

currency becomes

becomes

more

more valuable

valuable than

than the

the home

home

currency.

currency.

The

The foreign

foreign currency’s

currency’s

value

value has

has appreciated

appreciated against

against

the

the home

home currency.

currency.

Prof.Anuj Verma

Verma

Prof.Anuj

35

35

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

3.

3. Calculating

Calculating a

a Depreciation:

Depreciation:

Currency

Currency Depreciation

Depreciation

=

e0 − e1

=

e

aa1

where

where ee,0 =

= old

old currency

currency value

value

ee,1 =

= new

new currency

currency value

value

Note:

Note: Resulting

Resulting sign

sign is

Is always

always negative

negative

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

36

36

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

Currency

Appreciation

Currency Appreciation

e

e

0

1 −

€,

—

€g

=

e

Eo0

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

37

37

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

EXAMPLE: dm

dm Appreciation

EXAMPLE:

Appreciation

If the

the dollar

dollar value

value of

of the

the dm

dm goes

goes from

from

If

$0.64

$0.64 (e

(e,)0) to

to $0.68

$0.68 (e

(e,),

then the

the dm

dm

1), then

has

has appreciated

appreciated by

by

e1 − e0

=

e0

=

= (.68

(.68 -- .64)/

.64)/ .64

.64

=

= 6.25%

6.25%

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

38

38

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

EXAMPLE:

EXAMPLE: US$

US$ Depreciation

Depreciation

We

We use

use the

the first

first formula,

formula,

(e

(€)0 -- e

€,)/

e,1

1)/ e

substituting

substituting

(.64

(,64 -- .68)/

.68)/ .68

.68 =

= -- 5.88%

5.88%

which

which is

is the

the value

value of

of the

the US$

US$

depreciation.

depreciation.

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

39

39

Equilibrium

Equilibrium Exchange

Exchange Rates

Rates

D.

AFFECTING

D. FACTORS

FACTORS AFFECTING

EXCHANGE

EXCHANGE RATES:

RATES:

1.

Inflation

1.

Inflation rates

rates

2.

Interest

2.

Interest rates

rates

3.

GDP

3.

GDP growth

growth rates

rates

2/27/2022

2/27/2022

Prof.Anuj Verma

Verma

Prof.Anuj

40

40

ILLUSTRATION

Calculating the Amount of Yen Depreciation Against

the Dollar

During 1995, the yen went from $0.0125 to $0.0095238. By how much did the yen depreciate against the dollar?

By how much has the dollar apptecated

2/27/2022

2/27/2022

Prof.Anuj

Prof.Anuj Verma

Verma

against the yen?

41

4]

Sw

a

ILLUSTRATION

| ae

oe

Calculating Yugoslav Dinar Devaluation

April 1, 1998, was an ill-fated date in Yugoslavia. On that day, the government. devalued

the Yugoslav dinar, setting its new rate at 10.92 dinar to the dollar, from 6.0 dinar previously. By how much has the dinar devalued against the dollar?

By how much has the dollar appreciated against the dinar?

2/27/2022

2/27/2022

Prof.Anuj

Prof.Anuj Verma

Verma

42

42

ILLUSTRATION Calculating Dollar Appreciation Against the Thai Baht

On July 2, 1997, the Thai baht fell 17% against the U.S. dollar. By how much has the dol-

lar appreciated against the baht?

2/27/2022

2/27/2022

Prof.Anuj

Prof.Anuj Verma

Verma

43

43

PARITY

PARITY CONDITIONS

CONDITIONS

AND

AND

CURRENCY

CURRENCY

FORECASTING

FORECASTING

44

OVERVIEW

OVERVIEW

I.

I.

ARBITRAGE

ARBITRAGE AND

AND THE

THE LAW

LAW OF

OF

ONE

ONE PRICE

PRICE

II.

PURCHASING

IT.

PURCHASING POWER

POWER PARITY

PARITY

III.

ITI. THE

THE FISHER

FISHER EFFECT

EFFECT

IV.

INV. THE

THE INTERNATIONAL

INTERNATIONAL FISHER

FISHER EFFECT

EFFECT

V. INTEREST

V.

INTEREST RATE

RATE PARITY

PARITY THEORY

THEORY

VI. THE

VI.

THE RELATIONSHIP

RELATIONSHIP BETWEEN

BETWEEN

THE FORWARD

AND FUTURE

THE

FORWARD AND

FUTURE

SPOT

SPOT RATE

RATE

VII. CURRENCY

VII.

CURRENCY FORECASTING

FORECASTING

45

45

ARBITRAGE AND

AND THE

LAW OF

ARBITRAGE

THE LAW

OF ONE

ONE

PRICE

PRICE

I.

I.

THE LAW

LAW OF

OF ONE

ONE PRICE

PRICE

THE

A.

Law states:

states:

A. Law

Identical

Identical goods

goods sell

sell for

for the

the

same

Same price

price worldwide.

worldwide.

46

46

ARBITRAGE AND

AND THE

LAW OF

ARBITRAGE

THE LAW

OF ONE

ONE

PRICE

PRICE

B.

B.

Theoretical

basis:

Theoretical basis:

If

If the

the price

price after

after exchange-rate

exchange-rate

adjustment

adjustment were

were not

not equal,

equal,

arbitrage

arbitrage in

in the

the goods

goods worldwide

worldwide

ensures

ensures eventually

eventually it

it will.

will.

47

47

ARBITRAGE

THE LAW

OF ONE

ONE

ARBITRAGE AND

AND THE

LAW OF

PRICE

PRICE

Five

Five Parity

Parity Conditions

Conditions Result

Result

From

These Arbitrage

Arbitrage Activities

Activities

From These

WNP

1.

2.

3.

4.

5.

“ie

C.

C,

Purchasing

Purchasing Power

Power Parity

Parity (PPP)

(PPP)

The

The Fisher

Fisher Effect

Effect (FE)

rE)

The

The International

International Fisher

Fisher Effect

Effect

(IFE)

(IFE)

Interest

Interest Rate

Rate Parity

Parity (IRP)

(IRP)

Unbiased

Unbiased Forward

Forward Rate

Rate (UFR)

(UFR)

48

48

ARBITRAGE

ARBITRAGE AND

AND THE

THE LAW

LAW OF

OF ONE

ONE

PRICE

PRICE

D.

D. Five

Five Parity

Parity Conditions

Conditions Linked

Linked

by

by

1.

1.

The adjustment

The

adjustment of

of various

various

rates

rates and

and prices

prices to

to inflation.

inflation.

49

49

ARBITRAGE

ARBITRAGE AND

AND THE

THE LAW

LAW OF

OF ONE

ONE

PRICE

PRICE

2.

The notion

2. The

notion that

that money

money

should

should have

have no

no effect

effect on

on

real

real variables

variables (since

(since they

they

have

have been

been adjusted

adjusted for

for

price

price changes).

changes).

50

50

ARBITRAGE

ARBITRAGE AND

AND THE

THE LAW

LAW OF

OF ONE

ONE

PRICE

PRICE

E.

E.

Inflation

Inflation and

and home

home currency

currency

depreciation:

depreciation:

1.

jointly determined

1.

jointly

determined by

by the

the

growth

growth of

of domestic

domestic

money

supply;

money

supply;

2.

Relative

2.

Relative to

to the

the growth

growth of

of

domestic

domestic money

money demand.

demand.

51

51

ARBITRAGE

ARBITRAGE AND

AND THE

THE LAW

LAW OF

OF ONE

ONE

PRICE

PRICE

F.

F. THE

THE LAW

LAW OF

OF ONE

ONE PRICE

PRICE

-- enforced

enforced by

by international

international

arbitrage.

arbitrage.

52

52

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

I.THE

THEORY OF

I. THE THEORY

OF PURCHASING

PURCHASING

POWER PARITY:

PARITY:

POWER

states

States that

that spot

spot exchange

exchange rates

rates

between

between currencies

currencies will

will change

change to

to

the

the differential

differential in

in inflation

inflation rates

rates

between

between countries.

countries.

53

53

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

II.

ABSOLUTE PURCHASING

Il. ABSOLUTE

PURCHASING

POWER

POWER PARITY

PARITY

A.

Price levels

levels adjusted

adjusted for

for

A. Price

exchange

exchange rates

rates should

should be

be

equal

equal between

between countries

countries

54

54

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

II.

ABSOLUTE PURCHASING

Il. ABSOLUTE

PURCHASING

POWER

POWER PARITY

PARITY

B.

B. One

One unit

unit of

of currency

currency has

has

same

Same purchasing

purchasing power

power

globally.

globally.

55

55

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

III.

III. RELATIVE

RELATIVE PURCHASING

PURCHASING

POWER

POWER PARITY

PARITY

A. states

A.

states that

that the

the exchange

exchange

rate

rate of

of one

one currency

currency against

against

another

another will

will adjust

adjust to

to reflect

reflect

changes

changes in

in the

the price

price levels

levels

of

of the

the two

two countries.

countries.

56

56

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

1.

1.

In

In mathematical

mathematical terms:

terms:

where

where

e

|t

e

Ho0

(

1 + ih )

a+z,y

t

=

+ i

Z, )

y

(G1 +

t

f

ee,t

ee,0

ii,h

ii;f

tt

=

=

=

=

=

=

=

=

=

=

future

future spot

spot rate

rate

spot

spot rate

rate

home

home inflation

inflation

foreign

foreign inflation

inflation

the

the time

time period

period

57

57

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

2.

2.

If

If purchasing

purchasing power

power parity

parity is

is

expected

expected to

to hold,

hold, then

then the

the best

best

prediction

prediction for

for the

the one-period

one-period

spot

spot rate

rate should

should be

be

et

_

=

(G-+z,

1 + ih y)

t

t

e0

<< ~~ <0

(G+,

)

1 + i yy

f

58

58

(1 + ih )

t

et > e0

(1 + i )

t

Exports

Exports

f

(1 + ih )

t

et = e0

(1 + i )

t

Equilibrium

Equilibrium

f

(1 + ih )

t

et < e0

(1 + i )

t

Imports

Imports

f

59

59

5

4

Percentage change

change in

in Home

Home currency

currency

Percentage

3

value of

of Foreign

Foreign currency

currency

value

A

2

1

pop

5

-5

-4

4

-3

3

-2

2

!

nnnneee

B

B

|

-1

1

-1

2E

-2

Parity

Parity Line

Line

vee ey Geo

2

35

Imports

Imports

|

|

4

5

FS

Inflation differential,

differential, Home

Home country

country

Inflation

relative

relative to

to Foreign

Foreign country

country (%)

(%)

34

-3

Aut

-4

5 -5

Purchasing Power

Power Parity

Parity

Purchasing

PURCHASING

PURCHASING POWER

POWER PARITY

PARITY

3.

A more simplified

3. Amore

simplified but

but less

less precise

precise

relationship

relationship is

is

et

= ih − i f

e0

that

that is,

is, the

the percentage

percentage change

change should

should be

be

approximately

approximately equal

equal to

to the

the inflation

inflation rate

rate

differential.

differential.

61

61

THE

THE FISHER

FISHER EFFECT

EFFECT (FE)

(FE)

I. THE FISHER

FISHER EFFECT

EFFECT

I.THE

states

states that

that nominal

nominal interest

interest rates

rates

(r) are

are a

a function

function of

of the

the real

real

(r)

interest rate

rate (a)

(a) and

and aa premium

premium (i)

(i)

interest

for inflation

inflation expectations.

expectations.

for

R=atiti

R

= a + i

62

62

THE

FISHER EFFECT

EFFECT

THE FISHER

B.

B. Real

Real Rates

Rates of

of Interest

Interest

1.

1. Should

Should tend

tend toward

toward equality

equality

everywhere

everywhere through

through arbitrage.

arbitrage.

2.

2. With

With no

no government

government

interference

interference nominal

nominal rates

rates vary

vary

by

by inflation

inflation differential

differential or

or

iI,h - ilef

rTyh -- rIef =

—

63

63

5

4

Interest differential

differential in

in favor

favor of

of

Interest

home

home country

country ((%% ))

Parity

Parity Line

Line

32

2

1

-5

-4

-3

-2

-1

1

-1

C

22

33

44

55

Inflation

Inflation Differential

Differential ,, home

home country

country

relative

relative to

to foreign

foreign country(%)

country(%)

-2

Arbitrage

D

outflow from

home country

Li

ie

-3

-4

-5

The Fisher

Fisher Effect

Effect

The

rTh -> rUpf =

~ ityh -7 ilef Equlibrium

Equilibrium

rtT,h -- rVp

f >

> |,ih -— i1¢f

Inflow

Inflow of

of funds

funds from

from foreign

foreign country

country to

to home

home country

country

rTrh -- reS

f < iye

h - idyf Outflow

Outflow of

of funds

funds from

from home

home country

country to

to foreign

foreign country

country

65

65

INTEREST RATE

RATE PARITY

PARITY THEORY

INTEREST

THEORY

I.

I. INTRODUCTION

INTRODUCTION

A. The

Theory states:

A.

The Theory

states:

the

the forward

forward rate

rate (F)

(F) differs

differs

from

from the

the spot

spot rate

rate (S)

(S) at

at

equilibrium

equilibrium by

by an

an amount

amount

equal

equal to

to the

the interest

interest

differential

differential (r

(r,h -- rr.)f) between

between

two

two countries.

countries.

66

66

INTEREST

RATE PARITY

PARITY

NTEREST RATE

THEORY

THEORY

2.

2,

The forward

The

forward premium

premium or

or

discount

discount equals

equals the

the interest

interest

rate

rate differential.

differential.

(F

- S)/S =

(F-S)/S

= (r

(tyh -- rfs)f)

where

where

rr,h =

= the

the home

home rate

rate

rr;f =

= the

the foreign

foreign rate

rate

67

67

INTEREST

INTEREST RATE

RATE PARITY

PARITY

THEORY

THEORY

3.

3.

In

In equilibrium,

equilibrium, returns

returns on

on

currencies

currencies will

will be

be the

the same

same

i.i. e.

e. No

No profit

profit will

will be

be realized

realized

and

and interest

interest parity

parity exists

exists

which

which can

can be

be written

written

(1

rh) =

(1 +

+n)

= EFF

(1

rf)

S

(1 +

+ Fr)

S

68

68

INTEREST

INTEREST RATE

RATE PARITY

PARITY

THEORY

THEORY

B.

B.

Covered

Arbitrage

Covered Interest

Interest Arbitrage

1.

1. Conditions

Conditions required:

required:

interest

interest rate

rate differential

differential does

does

not

not equal

equal the

the forward

forward

premium

premium or

or discount.

discount.

2.

2. Funds

Funds will

will move

move to

to a

a country

country

with

with a

a more

more attractive

attractive rate.

rate.

69

69

5

4

Interest differential

differential in

in

Interest

favor of

of home

home country

country

favor

((%

%) )

Arbitrage

inflow to home

D

country

3

2

a

1

|

|

-5

-4

-3

-2

11

-1

-1

-2

-3

Parity

Parity Line

Line

-4

!

f

!

|

22

Arbitrage

Arbitrage

C

C outflow

outflow

'

from home

home

from

country

|

country

|

33

|

44

|

55

Forward

Forward Premium(+)

Premium(+) or

or

Discount(-)

Discount(-) on

on Foreign

Foreign

Currency

Currency

Points

C &

& DD shows

Points C

shows

covered

covered interest

interest arbitrage

arbitrage

-5

Interest

Interest Rate

Rate Parity

Parity

Point C

C :: Funds

Funds will

will flow

flow from

from Home

Home Country

Country to

to Foreign

Foreign Country

Country

Point

(1

+ r f ) f1

(+ry)f,

<

1I++r,r h

<

eCo0

Point

Point D

D :: Funds

Funds will

will flow

flow from

from Foreign

Foreign Country

Country to

to

Home Country

Country

Home

(1

+ r f ) f1

(l+r,)f,

>

1l++r,r h >

eCo0

Interest

Interest Rate

Rate Parity

Parity holds

holds when

when there

there is

1s no

no Covered

Covered

Interest Arbitrage

Arbitrage

Interest

1I+ry,

+rh

ff,1

=

1l+r,

+rf

eCo0

INTEREST

INTEREST RATE

RATE PARITY

PARITY

THEORY

THEORY

3.

3.

Market

Market pressures

pressures develop:

develop:

a.

As one currency

a. | Asone

currency is

is more

more demanded

demanded spot

spot

and

and sold

sold forward.

forward.

b.

b.

Inflow

Inflow of

of fund

fund depresses

depresses interest

interest rates.

rates.

c.

C.

Parity

Parity eventually

eventually reached.

reached.

72

72

INTEREST

INTEREST RATE

RATE PARITY

PARITY

THEORY

THEORY

C.

C.

Summary:

Summary:

Interest

Interest Rate

Rate Parity

Parity states:

states:

1.

Higher

1.

Higher interest

interest rates

rates on

on a

a

currency

currency offset

offset by

by

forward

discounts.

forward

discounts.

2.

2.

Lower

Lower interest

interest rates

rates are

are

offset

offset by

by forward

forward premiums.

premiums.

73

73

To illustrate this con-

dition, suppose an investor with $1,000,000 to invest for 90 days is trying

to decide between investing in U.S. dollars at 8% per annum (2% for 90 days)

or in euros at 6% per annum (1.5% for 90 days). The current spot rate i

€1.13110/5, and the 90-day forward rate is €1.12556/S. Exhibit 4.14 shows that

ical,

ident

be

will

rn

retu

ed

hedg

his

e,

choic

ency

curr

s

stor

inve

the

of

ss

rdle

reva

00

00,0

$1,0

yield

will

cays

90

for

rs

dolla

in

sted

inve

00

00,0

$1,0

Specifically,

a

on

s

euro

In

t

inves

to

ses

choo

stor

inve

the

if

,

vely

mati

Alte

00,

1.02 = $1,020,0

hedged basis, he will

74

74

| Convert the $1,000,000 to euros at the spot rate of €1.13110/$. This

yields €1,131,100 available for investment.

2. Invest the principal of €1,131,100 at 1.5% for 90 days. At the end of 90 |

|

days, the investor will have € 1 148,066.50.

3, Simultaneously with the other transactions, sell the €1,148,066.50 in

principal plus interest forward at a rate of €1.12556/$ for delivery in 90 days.

This transaction will yield €1,148,066.50/1.12556 = $1,020,000 in 90 days.

If the covered interest differential between two money markets is nonzero,

there is an arbitrage incentive to move money from one market to the other. This

movement of money to take advantage of a covered interest differential is known

as covered interest arbitrage.

75

75

AN

OF

EXAMPLE

INTEREST

RATE

PARITY

New York

Finish

$1,020,000

Start

$1,000,000

1. Convert $1,000,000

to euros at €1.13110/$ |

3. Simultaneously with euro investment,

sell the € 1,148,066.50 forward at a

rate of € 1.12556/$ for delivery in

for.€ 1,131,100.

90 days, and receive $1,020,000

in 90 days.

€1,148,066.50

Frankfurt: 90 days

4

€ 1,131,100

:

2 Invest €

1.131.100 at 1.5% for

Frankfurt: today

90 days, yielding € 1,148,066.50

in 90 days.

76

76

THE

RELATIONSHIP BETWEEN

BETWEEN THE

THE RELATIONSHIP

THE

FORWARD AND

AND THE

FUTURE SPOT

RATE

FORWARD

THE FUTURE

SPOT RATE

I. THE UNBIASED

UNBIASED FORWARD

FORWARD RATE

RATE

I.THE

A. States

A.

States that

that if

if the

the forward

forward rate

rate

is

is unbiased,

unbiased, then

then it

it should

should

reflect

reflect the

the expected

expected future

future

spot

spot rate.

rate.

B.

B. Stated

Stated as

as

ft = e t

77

77

5

4

Expected Change

Change in

in Home

Home

Expected

3,

Currency

Currency Value

Value of

of Foreign

Foreign

2

Currency

Currency (%)

(%)

Parity Line

1

-5

-4

-3

-2

-1

1

-1

-2

A

2

3

4

5

Forward Premium(+)

Premium(+) or

or

Forward

Discount(-) on

on Foreign

Foreign

Discount(-)

Currency

Currency

-3

Lin. e eee

B

ee eee

eee

fe

-4

-5

Relation

Relation Between

Between the

the Forward

Forward Rate

Rate and

and the

the Future

Future Spot

Spot Rate

Rate

CURRENCY

FORECASTING

CURRENCY FORECASTING

I.

I. FORECASTING

FORECASTING MODELS

MODELS

A. Created

A.

Created to

to forecast

forecast exchange

exchange rates

rates in

in

addition

addition to

to parity

parity conditions.

conditions.

B.

B. Two

Two types

types of

of forecast:

forecast:

1.

Market-based

1.

Market-based

2.

Model-based

2.

Model-based

79

79

CURRENCY

FORECASTING

CURRENCY FORECASTING

MARKET-BASED FORECASTS:

FORECASTS:

MARKET-BASED

derived

derived from

from market

market indicators.

indicators.

A. The

A.

The current

current forward

forward rate

rate contains

contains implicit

implicit

information

information about

about exchange

exchange rate

rate changes

changes

for one

one year.

year.

for

B.

B. Interest

Interest rate

rate differentials

differentials may

may be

be

used

used to

to predict

predict exchange

exchange rates

rates

beyond

beyond one

one year.

year.

80

80

CURRENCY

FORECASTING

CURRENCY FORECASTING

MODEL-BASED

MODEL-BASED FORECASTS:

FORECASTS:

include

include fundamental

fundamental and

and technical

technical

analysis.

analysis.

A. Fundamental

A.

Fundamental relies

relies on

on key

key

macroeconomic

macroeconomic variables

variables and

and

policies

policies which

which most

most like

like affect

affect

exchange

exchange rates.

rates.

B.

B. Technical

Technical relies

relies on

on use

use of

of

1.

1. Historical

Historical volume

volume and

and price

price data

data

2.

2. Charting

Charting and

and trend

trend analysis

analysis

81

81

Between 1980 and 1995, the ¥/5 exchange rate moved from ¥226,63/$ to ¥93,96 Da

his same 15-year period, the consumer prie index (CPI) in Japan rose from 91.0 to i

andthe US. Cl toe fom 82.4 to 1524

_

a. IE PPP had held over this period, what would the ¥/$ exchange rate have been in 19

82

82

a

1. From base price levels of 100 in 2000, German

and U.S. price levels in 2001 stood at 102 and

106, respectively.

a. If the 2000 $:DM exchange rate was $0.54,

what should-the exchange rate be in 2001?

83

83

2. Two countries, the United States and England,

produce only one good, wheat. Suppose the price

of wheat is $3.25 in the United States and is

£1.35 in England.

a. According to the law of one price, what should

the $:£ spot exchange rate be?

b. Suppose the price of wheat over the next year

is expected to rise to $3.50 in the United

_ States and to £1.60 in England. What should

the one-year $:£ forward rate be?

84

84

|i

r

,

i

*

i

we

‘

*

or

t

=

.

os

.

LL

|

|

geen

ae SR,

Ace

5. In July, the one-year interest rate is 12% on

British pounds and 9% on U.S. dollars.

|

a. If the current exchange rate is $1.63:£1, what is

the expected future exchange rate in one year?

b. Suppose a change in expectations regarding

_

future U.S. inflation causes the expected future

spot rate to decline to $1.52:£1. What should

happen to the U.S. interest rate?

85

85

|

a a

|

“NEP

|

|

Ne.

6. Suppose that in Japan the interest rate is 8% and

inflation is expected to be 3%. Meanwhile, the

expected inflation rate in France is 12%, and the

English interest rate is 14%. To the nearest whole

‘number, what is the best estimate of the one-year

forward exchange premium (discount) at which

the pound will be selling relative to the French

franc?

86

86

P| UL | | gee

OT

ae TT OR Re

10. Assume that the interest rate is 16% on pounds

sterling and 7% on euros. At the same time,

inflation is running at an annual rate of 3% in

Germany and 9% in England.

a. If the euro is selling at a one-year forward

premium of 10% against the pound, is there

an arbitrage

opportunity?

Explain.

b. What is the real interest rate in Germany? In —

England?

c. Suppose that during the year the exchange rate

changes from €1.8:£1 to €1.77:£1. What are

the real costs to a German company of

borrowing pounds? Contrast this cost to its

real cost of borrowing euros.

d. What are the real costs to a British firm of

borrowing euros? Contrast this cost to its real

cost of borrowing pounds.

87

87

88

88

we

12.

Suppose

>

|

the spot rates for the euro, pound

sterling, and

Swiss

franc are $0.92,

$1.13,

and

$0.38, respectively. The associated 90-day interest

rates (annualized) are 8%,

16%, and 4%; the US.

90-day rate (annualized) is 12%. What is the

90-day forward rate on an ACU (ACU 1 = €1 +

£1 + SFr 1) if interest parity holds?

89

89

PPR a

werZ

b

~

|

ly

13. Suppose that three-month interest rates

(annualized) in Japan and the United States are

7% and 9%, respectively. If the spot rate is

¥142:$1 and the 90-day forward rate is ¥139:$1,

a. Where would you invest?

b. Where would you borrow’

c. What arbitrage opportunity do these figures

present?

d. Assuming no transaction costs, what would be

your arbitrage profit per dollar or dollarequivalent borrowed?

90

90

-

\

Xe;

14.

an

eS

-_

rr EL

|

Here are some prices in the international money

markets:

Spot rate

= $0.95:€

Forward rate (one year) = $0.97:€

Interest rate (DM)

Interest rate ($)

= 7% per year

= 9% per year

a. Assuming no transaction costs or taxes exist,

do covered arbitrage profits exist in this

situation? Describe the flows.

b. Suppose now that transaction costs in the

foreign exchange market equal 0.25% per

transaction. Do unexploited covered arbitrage

profit opportunities still exist?

91

91

THE FOREIGN

THE

FOREIGN

EXCHANGE

EXCHANGE MARKET

MARKET

92

OVERVIEW

OVERVIEW

I.

I.

II.

IT.

INTRODUCTION

INTRODUCTION

ORGANIZATION

ORGANIZATION OF

OF THE

THE

FOREIGN

FOREIGN EXCHANGE

EXCHANGE

MARKET

MARKET

III.

ITT. THE

THE SPOT

SPOT MARKET

MARKET

IV.

IV. THE

THE FORWARD

FORWARD MARKET

MARKET

93

93

INTRODUCTION

INTRODUCTION

I.

I.

INTRODUCTION

INTRODUCTION

A.

The

A.

The Currency

Currency Market:

Market:

where

where money

money denominated

denominated

in

in one

one currency

currency is

is bought

bought

and

and sold

sold with

with money

money

denominated

denominated in

in another

another

currency.

currency.

94

94

INTRODUCTION

INTRODUCTION

B.

B.

International Trade

and Capital

Capital

International

Trade and

Transactions:

Transactions:

facilitated

facilitated with

with the

the ability

ability

to

to transfer

transfer purchasing

purchasing power

power

between

between countries

countries

95

95

INTRODUCTION

INTRODUCTION

C.Location

C.Location

1.

OTC-type:

1.

OTC-type: no

no specific

specific

location

location

2.

Most

2.

Most trades

trades by

by phone,

phone,

telex,

telex, or

or SWIFT

SWIFT

SWIFT:

SWIFT: Society

Society for

for Worldwide

Worldwide Interbank

Interbank Financial

Financial

Telecommunications

Telecommunications

96

96

Customer

Customer

buys $$ with

buys

with €€

}

Local bank

Local

bank

{

i

Stockbroker

Stockbroker

==>

banks

Major banks

wee Major

Foreign

Foreign

IMM,LIFFE,PSE

IMM,LIFFE,PSE

ssss

—ctj

t

interbank

market

marke

bank

inter

”™”™=

r

broke

exchange broker

exchange

Local

bank

Local bank

Stockbroker

Stockbroker

t

Customer

Customer

buys €€ with

buys

with $$

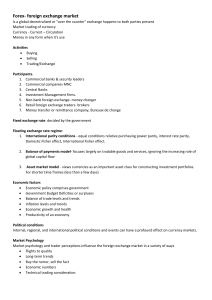

STRUCTURE OF FOREIGN EXCHANGE MARKETS

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE

EXCHANGE MARKET

MARKET

II. .

PARTICIPANTS

PARTICIPANTS IN

IN THE

THE FOREIGN

FOREIGN

EXCHANGE

EXCHANGE MARKET

MARKET

A. Participants

A.

Participants at

at 2

2 Levels

Levels

1.

Wholesale

1.

Wholesale Level

Level (95%)

(95%)

-- major

major banks

banks

2.

Retail

2.

Retail Level

Level

-- business

business customers

customers

98

98

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE MARKET

MARKET

EXCHANGE

B.

B.

Two

Types of

Two Types

of Currency

Currency Markets

Markets

1.

1. Spot

Spot Market:

Market:

-- immediate

immediate transaction

transaction

-- recorded

recorded by

by 2nd

2nd business

business day

day

99

99

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE MARKET

MARKET

EXCHANGE

2.

2.

Forward

Forward Market:

Market:

-- transactions

transactions take

take place

place at

ataa

specified

specified future

future date

date

100

100

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE MARKET

MARKET

EXCHANGE

C.

C. Participants

Participants by

by Market

Market

1.

1. Spot

Spot Market

Market

a.

a. commercial

commercial banks

banks

b.

b. brokers

brokers

c.

Cc. customers

customers of

of commercial

commercial

and

and central

central banks

banks

101

101

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE MARKET

MARKET

EXCHANGE

2.

2. Forward

Forward

a.

a.

b.

b.

c.

Cc.

Market

Market

arbitrageurs

arbitrageurs

hedgers

hedgers

speculators

speculators

102

102

ORGANIZATION

FOREIGN

ORGANIZATION OF

OF THE

THE FOREIGN

EXCHANGE MARKET

MARKET

EXCHANGE

II.

Il. CLEARING

CLEARING SYSTEMS

SYSTEMS

A. Clearing

A.

Clearing House

House Interbank

Interbank

Payments

Payments System

System

(CHIPS)

(CHIPS)

-- used

used in

in U.S.

U.S. for

for electronic

electronic

fund

fund transfers.

transfers.

103

103

THE

THE SPOT

SPOT MARKET

MARKET

I.

I.

SPOT

SPOT QUOTATIONS

QUOTATIONS

A. Sources

A.

Sources

1.

All

1.

All major

major newspapers

newspapers

2.

Major

2.

Major currencies

currencies have

have

four

four different

different quotes:

quotes:

a.

a

b.

b.

c.

C.

d.

d.

spot

Spot price

price

30-day

30-day

90-day

90-day

180-day

180-day

104

104

THE

MARKET

THE SPOT

SPOT MARKET

B.

B.

Method

Method of

of Quotation

Quotation

1.

1, For

For interbank

interbank dollar

dollar

trades:

trades:

a.

American terms

a.

American

terms

b.

b.

example:

example: $.5838/dm

$.5838/dm

European

European terms

terms

example:

example: Peso1.713/$

Pesol.713/$

105

105

THE

MARKET

THE SPOT

SPOT MARKET

C.

C.

Transactions Costs

Transactions

Costs

1.

1,

Bid-Ask

Bid-Ask Spread

Spread

used

used to

to calculate

calculate the

the fee

fee

charged by

by the

the bank

bank

charged

•

Bid

Bid =

= the

the price

price at

at which

which

the

the bank

bank is

is willing

willing to

to buy

buy

Ask =

Ask

= the

the price

price it

it will

will sell

sell

the

the currency

currency

•

106

106

THE

MARKET

THE SPOT

SPOT MARKET

4.

4.

Percent

Percent Spread

Spread Formula

Formula (PS):

(PS):

Ask − Bid

PS =

x100

Ask

107

107

THE

MARKET

THE SPOT

SPOT MARKET

D.

D.

Cross

Cross Rates

Rates

1.

1.

The exchange

The

exchange rate

rate

between

between 2

2 non

non -- US$

US$

currencies.

currencies.

108

108

THE

MARKET

THE SPOT

SPOT MARKET

2.

2,

Calculating

Calculating Cross

Cross Rates

Rates

When

When you

you want

want to

to know

know

what

what the

the dm/ff

dm/ff cross

cross rate

rate

is,

you know

is, and

and You

know dm2/US$

dm2/US$ and

and

ff.55/US$

ff.55/US$

then

then dm/ff

dm/ff =

= dm2/US$

dm2/US$ ÷

+ ff.55/US$

ff.55/US$

=

= dm3.636/

dm3.636/ ff

ff

109

109

THE

MARKET

THE SPOT

SPOT MARKET

E.

Currency

Arbitrage

E.

Currency Arbitrage

1.

1. If

If cross

cross rates

rates differ

differ from

from

one

one financial

financial center

center to

to

another,

another, and

and profit

profit

opportunities

opportunities exist.

exist.

110

110

THE

MARKET

THE SPOT

SPOT MARKET

2.

2.

Buy

Buy cheap

cheap in

in one

one int’l

int'l market,

market,

sell

sell at

at a

a higher

higher price

price in

in

another

another

3.

3.

Role

Available Information

Role of

of Available

Information

111

111

THE

MARKET

THE SPOT

SPOT MARKET

F.

F.

Settlement

Value Date:

Settlement Date

Date Value

Date:

1.

1. Date

Date monies

monies are

are due

due

2.

2. 2nd

2nd Working

Working day

day after

after date

date of

of

original

Original transaction.

transaction.

112

112

THE

MARKET

THE SPOT

SPOT MARKET

1.)

1.) Demand

Demand for

for higher

higher risk

risk

premium

premium

2.)

2.) Bankers

Bankers widen

widen bid-ask

bid-ask

spread

spread

113

113

MECHANICS OF

MECHANICS

OF SPOT

SPOT

TRANSACTIONS

TRANSACTIONS

SPOT

TRANSACTIONS: An

An Example

SPOT TRANSACTIONS:

Example

Step

Step 1.

1.

Currency

Currency transaction:

transaction:

verbal

verbal agreement,

agreement, U.S.

U.S. importer

importer specifies:

specifies:

a.

Account to

a. Account

to debit

debit (his

(his acct)

acct)

b.

b. Account

Account to

to credit

credit (exporter)

(exporter)

114

114

MECHANICS

MECHANICS OF

OF SPOT

SPOT

TRANSACTIONS

TRANSACTIONS

Step

Step 2.

2.

Bank

Bank sends

sends importer

importer

contract

contract note

note including:

including:

-- amount

amount of

of foreign

foreign

currency

currency

-- agreed

agreed exchange

exchange rate

rate

-- confirmation

confirmation of

of Step

Step 1.

1.

115

115

MECHANICS

MECHANICS OF

OF SPOT

SPOT

TRANSACTIONS

TRANSACTIONS

Step

Settlement

Step 3.

3.

Settlement

Correspondent

Correspondent bank

bank in

in Hong

Hong

Kong

Kong transfers

transfers HK$

HK$ from

from

nostro

nostro account

account to

to exporter’s.

exporter’s.

Value Date.

Value

Date.

U.S.

U.S. bank

bank debits

debits importer’s

importer’s

account.

account.

116

116

THE

FORWARD MARKET

MARKET

THE FORWARD

I.

I. INTRODUCTION

INTRODUCTION

A. Definition

A.

Definition of

of a

a Forward

Forward

Contract

Contract

an

an agreement

agreement between

between a

a bank

bank and

and a

a

customer

customer to

to deliver

deliver a

a specified

specified amount

amount of

of

currency

currency against

against another

another currency

currency at

at a

a

specified

specified future

future date

date and

and at

at a

a fixed

fixed

exchange

exchange rate.

rate.

117

117

THE

FORWARD MARKET

MARKET

THE FORWARD

2.

2. Purpose

Purpose of

of a

a Forward:

Forward:

Hedging

Hedging

the

the act

act of

of reducing

reducing exchange

exchange

rate

rate risk.

risk.

118

118

THE

FORWARD MARKET

MARKET

THE FORWARD

CALCULATING

THE FORWARD

CALCULATING THE

FORWARD

PREMIUM

PREMIUM OR

OR DISCOUNT

DISCOUNT

=

F-S xx 1212 xx 100

100

= F-S

S

nn

S

where

where

FF=_= the

the forward

forward rate

rate of

of exchange

exchange

S

S =

= the

the spot

spot rate

rate of

of exchange

exchange

nn== the

the number

number of

of months

months in

in the

the

forward

forward contract

contract

119

119

Es

ji -

|

a

»

Ree | |

ee

| ad

a

|

Suppose the pound sterling is bid at $1.5422 in New York and the euro is

ollered -at-$0.9251 in Frankfurt. At the same time, London banks are ollering

pounds sterling at €1.6650. An astute trader would sell dollars for euros in

Frankturt, use the euros to acquire pounds sterling in London, and sell the pounds

in New York.

.

Specially, if the trader begins in New York with $1 million, he could acquire

€ 1,080,964.22 for $1,000,000 in Frankfurt, sell these euros for £649 227.76. in

London, and resell the pounds in New York for $1,001.239.05, Thus, a few min-

utes’ work would yield a profit of $1,239.05, In effect, by arbitraging through

the euro, the trader would be able to acquire sterling at $1.5403 in London

(90.9251 X 1.6650) and sell it at $1.5422 in New York, This sequence of transactions, known as triangular currency arbitrage, is depicted in Exhibit 7.6

120

120

ae

TRIANGULAR

CURRENCY

ARBITRAGE

4. Net profit equals $1,239.05

New York

Finish

$1,001 ,239.05

Start

$1,000,000

2. Sell $1,000,000

in Frankfurt at €1 =

$0.9251 for

€ 1,080,964.22

oe

Multiplied by

$1.5422/2 fo

Divided by

$0.9251/€

3. Resell the pounds

sterling in New York

at £1 = $1.5422 for

$1,001,239.05

£649 ,227.76

London

"

Divided by

€ 1.6650/£

;

2. Sell these euros

in London at £1 = € 1.6650

for £649,227.76

€ 1,080,964.22

Frankfurt

121

1. The $/€ exchange rate is € 1 = $0.95, and the

€ /SFr exchange rate is SFr 1 = € 0.71. What is

the SFr/$ exchange rate?

2, Suppose the direct quote for sterling in New York

is 1.1110-5.

a. How much would £500,000 cost in New York?

b. What is the direct quote for dollars in London?

122

122

or ee

~

SE

6. Suppose Dow Chemical receives quotes of

$0.009369—71 for the yen and $0.03675-—6 for

the Taiwan dollar (NT$).

a. How many US. dollars will Dow Chemical

receive from the sale of ¥50 million?

b. What is the U.S. dollar cost to Dow Chemical

of buying ¥1 billion?

c. How many NT$ will Dow Chemical receive for

U.S:$500,0002

,

d. How many yen will Dow Chemical receive for

NT$200 million?

e. What is the yen cost to Dow Chemical of

buying NT$80 million?

123

123

7. Suppose the euro is quoted at 0.6064—80 in

London and the pound sterling is quoted at

— -1,6244-59 in Frankturt.

a. Is there a profitable arbitrage situation?

Describe it.

b. Compute the percentage bid-ask spreads on

the pound and euro.

124

124

—

te

ion

bo

a |

|

10. On checking the Telerate screen, you see the

following exchange rate and interest rate quotes:

Currency

90-Day

Interest Rates

(annualized)

Dollar

4.99% -~5.03%

Swiss franc

3.14%-—3.19%

Spot Rates

90-Day

Forward

Rates

$0.711-—22

$0.726—32

a. Can you find an arbitrage opportunity?

b. What steps must you take to capitalize on it?

c. What is the profit per $1,000,000 arbitraged?

125

125

CURRENCY

CURRENCY FUTURES

FUTURES

AND OPTIONS

AND

OPTIONS MARKETS

MARKETS

126

CHAPTER

CHAPTER OVERVIEW

OVERVIEW

I.

FUTURES

I.

FUTURES CONTRACTS

CONTRACTS

II.

IT, CURRENCY

CURRENCY OPTIONS

OPTIONS

127

PARTI.I.

PART

FUTURES CONTRACTS

FUTURES

CONTRACTS

I.CURRENCY

IT. CURRENCY FUTURES

FUTURES

A. Background

A.

Background

1.

1. 1972:

1972: Chicago

Chicago Mercantile

Mercantile

Exchange

Exchange

opens

opens International

International Monetary

Monetary

Market.

Market. (IMM)

(IMM)

128

128

FUTURES CONTRACTS

FUTURES

CONTRACTS

2.

2. IMM

IMM provides

provides

a.

d. an

an outlet

outlet for

for hedging

hedging currency

currency

risk

risk with

w ith futures

futures contracts.

contracts.

b.. Definition

Definition of

of futures

futures contracts:

contracts:

contracts

written requiring

requiring

contrac tS written

•e a

a standard

standard quantity

quantity of

of an

an available

available currency

currency

•e at

ataa fixed

fixed exchange

exchange rate

rate

•e at

ataa set

set delivery

delivery date.

date.

129

129

FUTURES CONTRACTS

FUTURES

CONTRACTS

c.

c.

Available Futures

Available

Futures Currencies:

Currencies:

1.)

1.) British

British pound

pound — 5.)

5.) Euro

Euro

2.)

2.)

3.)

3.)

4.)

4.)

Canadian

Canadian dollar

dollar 6.)

6.) Japanese

Japanese yen

yen

Deutsche

Deutsche mark

mark 7.)

7.) Australian

Australian dollar

dollar

Swiss

Swiss franc

franc

130

130

FUTURES CONTRACTS

FUTURES

CONTRACTS

d.

d. Standard

Standard Contract

Contract Sizes:

Sizes:

contract

contract sizes

sizes differ

differ for

for each

each of

of

the

the 7

7 available

available currencies.

currencies.

Examples:

Examples:

Euro

Euro =

= 125,000

125,000

British

British Pound

Pound =

= 62,500

62,500

131

131

FUTURES CONTRACTS

FUTURES

CONTRACTS

e.

e.

f.

Transaction

Transaction costs:

costs:

payment

payment of

of commission

commission to

to a

a

trader

trader

Leverage

Leverage is

is high

high

1.)

1.) Initial

Initial margin

margin required

required is

is

relatively

relatively low

low (e.g.

(e.g. less

less than

than

.02%

.02% of

of sterling

sterling contract

contract

value).

value).

132

132

FUTURES CONTRACTS

FUTURES

CONTRACTS

g.

g.

Maximum

Maximum price

price movements

movements

1.)

1.) Contracts

Contracts set

set to

to aa daily

daily

price

price limit

limit restricting

restricting

maximum

M aximum daily

daily price

price

movements.

M ovements.

133

133

FUTURES CONTRACTS

FUTURES

CONTRACTS

2.) If

If limit

limit is

is reached,

reached, a

a margin

margin

2.)

call

call may

may be

be necessary

necessary to

to

maintain a

a minimum

minimum margin.

margin.

maintain

134

134

FUTURES CONTRACTS

FUTURES

CONTRACTS

h.

h.

Global

Global futures

futures exchanges

exchanges that

that

are

are competitors

competitors to

to the

the IMM:

IMM:

1.)

1.)

Deutsche

Termin Bourse

Deutsche Termin

Bourse

2.)

2.)

L.I.F.F.E.London International

International

L.I.F.F.E.London

Financial

Financial Futures

Futures Exchange

Exchange

3.)

3.)

C.B.O.T.

Trade

C.B.0.T. Chicago

Chicago Board

Board of

of Trade

135

135

FUTURES CONTRACTS

FUTURES

CONTRACTS

4.)

4.)

S.I.M.E.X.Singapore International

International

S.I.M.E.X.Singapore

Monetary

Monetary Exchange

Exchange

5.)

5.)

H.K.F.E.

H.K.F.E. Hong

Hong Kong

Kong Futures

Futures Exchange

Exchange

136

136

FUTURES CONTRACTS

FUTURES

CONTRACTS

B.

B. Forward

Forward vs.

vs. Futures

Futures Contracts

Contracts

Basic

Basic differences:

differences:

1.

1. Trading

Trading Locations

Locations

U1

2.. Regulation

Regulation

3.. Frequency

Frequency of

of

delivery

delivery

4.. Size

Size of

of contract

contract

5.. Delivery

Delivery dates

dates

6.

6. Settlement

Settlement

Date

Date

7.

7. Quotes

Quotes

8.

Transaction

8. Transaction

costs

costs

9.

9. Margins

Margins

10.

10. Credit

Credit risk

risk

137

FUTURES CONTRACTS

FUTURES

CONTRACTS

Advantag

Advantages

es of

of futures:

futures:

1.) Smaller

1.)

Smaller

contract

contract size