7),1)LQDQFLDO$FFRXQWLQJ,,B3DUW %

)6&ROOHFWLRQV'LVEXUVHPHQWV

7),1

)LQDQFLDO$FFRXQWLQJ,,

3DUW%

SAP AG 2005

SAP AG©2006

mySAP ERP Core Component 6.0

2006/Q2

Material number 50080316

&RS\ULJKW

&RS\ULJKW6$3$*$OOULJKWVUHVHUYHG

1RSDUWRIWKLVSXEOLFDWLRQPD\EHUHSURGXFHGRUWUDQVPLWWHGLQ

DQ\IRUPRUIRUDQ\SXUSRVHZLWKRXWWKHH[SUHVVSHUPLVVLRQRI

6$3$* 7KHLQIRUPDWLRQFRQWDLQHGKHUHLQPD\EHFKDQJHG

ZLWKRXWSULRUQRWLFH

SAP AG 2006

Some software products marketed by SAP AG and its distributors contain proprietary software

components of other software vendors.

Microsoft, Windows, Outlook, and PowerPoint are registered trademarks of Microsoft Corporation.

IBM, DB2, DB2 Universal Database, OS/2, Parallel Sysplex, MVS/ESA, AIX, S/390, AS/400,

OS/390, OS/400, iSeries, pSeries, xSeries, zSeries, z/OS, AFP, Intelligent Miner, WebSphere,

Netfinity, Tivoli, and Informix are trademarks or registered trademarks of IBM Corporation in the

United States and/or other countries.

Oracle is a registered trademark of Oracle Corporation.

UNIX, X/Open, OSF/1, and Motif are registered trademarks of the Open Group.

Citrix, ICA, Program Neighborhood, MetaFrame, WinFrame, VideoFrame, and MultiWin are

trademarks or registered trademarks of Citrix Systems, Inc.

HTML, XML, XHTML and W3C are trademarks or registered trademarks of W3C®, World Wide

Web Consortium, Massachusetts Institute of Technology.

Java is a registered trademark of Sun Microsystems, Inc.

JavaScript is a registered trademark of Sun Microsystems, Inc., used under license for technology

invented and implemented by Netscape.

MaxDB is a trademark of MySQL AB, Sweden.

SAP, R/3, mySAP, mySAP.com, xApps, xApp, SAP NetWeaver and other SAP products and

services mentioned herein as well as their respective logos are trademarks or registered trademarks

of SAP AG in Germany and in several other countries all over the world. All other product and

service names mentioned are the trademarks of their respective companies. Data contained in this

document serves informational purposes only. National product specifications

may vary.

The information in this document is proprietary to SAP. No part of this document may be

reproduced, copied, or transmitted in any form or for any purpose without the express prior written

permission of SAP AG.

This document is a preliminary version and not subject to your license agreement or any other

agreement with SAP. This document contains only intended strategies, developments, and

functionalities of the SAP® product and is not intended to be binding upon SAP to any particular

course of business, product strategy, and/or development. Please note that this document is subject to

change and may be changed by SAP at any time without notice.

SAP assumes no responsibility for errors or omissions in this document. SAP does not warrant the

accuracy or completeness of the information, text, graphics, links, or other items contained within

this material. This document is provided without a warranty of any kind, either express or implied,

including but not limited to the implied warranties of merchantability, fitness for a particular

purpose, or non-infringement.

SAP shall have no liability for damages of any kind including without limitation direct, special,

indirect, or consequential damages that may result from the use

of these materials. This limitation shall not apply in cases of intent or gross negligence.

The statutory liability for personal injury and defective products is not affected. SAP has no control

over the information that you may access through the use

of hot links contained in these materials and does not endorse your use of third-party Web pages nor

provide any warranty whatsoever relating to third-party Web pages.

&RXUVH3UHUHTXLVLWHV

5HTXLUHG

z $FFRXQWLQJNQRZOHGJH

z 7),1)LQDQFLDO$FFRXQWLQJ,

z 606ROXWLRQ0DQDJHU2YHUYLHZ

SAP AG 2006

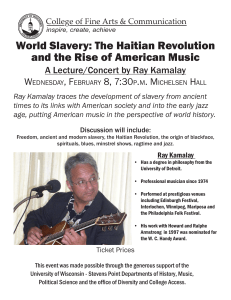

7DUJHW*URXS

3DUWLFLSDQWV

z 6ROXWLRQFRQVXOWDQWVUHVSRQVLEOHIRUWKHLPSOHPHQWDWLRQ

RI)LQDQFLDO$FFRXQWLQJZLWKP\6$3 (53)LQDQFLDOV

'XUDWLRQ

z GD\V

SAP AG 2003

&RXUVH2EMHFWLYHV

$IWHUWKHFRXUVHSDUWLFLSDQWVZLOOEHDEOHWR

XQGHUVWDQGWKHORJLFRI1HZ*HQHUDO/HGJHU

$FFRXQWLQJ

$IWHUWKHFRXUVHWKHSDUWLFLSDQWVZLOOEHDEOHWR

DFWLYDWHFRQILJXUHDQGXVH1HZ*HQHUDO/HGJHU

$FFRXQWLQJ

SAP AG 2006

These course materials are not suitable for self-learning. The information you will get from your

course instructor is essential to completing the materials.

In some cases, there may not be enough time to perform all the exercises during the course. The

exercises provide additional examples that are covered during the course. You can also go through

the exercises yourself after the course, to reinforce what you have learnt.

&RXUVH&RQWHQW

3UHIDFH

Unit 1

Unit 2

Unit 3

Unit 4

,QWURGXFWLRQ

/HGJHU'HILQLWLRQ

'RFXPHQW6SOLWWLQJ

Unit 5

Unit 6

3HULRGLF3URFHVVLQJ

5HSRUWLQJ

,QWHJUDWLRQ

([HUFLVHVDQG6ROXWLRQV

SAP AG 2003

&RXUVH2YHUYLHZ

,QWURGXFWLRQ

,QWURGXFWLRQ

3HULRGLF3URFHVVLQJ

3HULRGLF3URFHVVLQJ

/HGJHU'HILQLWLRQ

/HGJHU'HILQLWLRQ

5HSRUWLQJ

5HSRUWLQJ

'RFXPHQW6SOLWWLQJ

'RFXPHQW6SOLWWLQJ

,QWHJUDWLRQ

,QWHJUDWLRQ

SAP AG 2003

&RXUVH2YHUYLHZ,QWURGXFWLRQ

,QWURGXFWLRQ

,QWURGXFWLRQ

3HULRGLF3URFHVVLQJ

3HULRGLF3URFHVVLQJ

/HGJHU'HILQLWLRQ

/HGJHU'HILQLWLRQ

5HSRUWLQJ

5HSRUWLQJ

'RFXPHQW6SOLWWLQJ

'RFXPHQW6SOLWWLQJ

,QWHJUDWLRQ

,QWHJUDWLRQ

SAP AG 2006

© SAP AG

TFIN52

1-1

,QWURGXFWLRQ

&RQWHQWV

7KLVXQLWVXPPDUL]HVWKHPRVWLPSRUWDQWSURSHUWLHVDQG

EHQHILWVRI1HZ*HQHUDO/HGJHU$FFRXQWLQJLQDFRPSDFW

RYHUYLHZ

SAP AG 2006

© SAP AG

TFIN52

1-2

,QWURGXFWLRQ2EMHFWLYHV

$IWHUFRPSOHWLQJWKLVXQLW\RXZLOOEHDEOHWR

2XWOLQHWKHDGYDQWDJHVDQGEHQHILWVRI1HZ*HQHUDO

/HGJHU$FFRXQWLQJ

1DPHSRVVLEOHIXQFWLRQVRI1HZ*HQHUDO/HGJHU

$FFRXQWLQJ

SAP AG 2006

© SAP AG

TFIN52

1-3

3RVVLELOLWLHVZLWK1HZ*HQHUDO/HGJHU$FFRXQWLQJ

/HJDODQG

0DQDJHPHQW5HSRUWLQJ

6WDQGDUG(QKDQFHPHQW

DQG([WHQVLELOLW\

5HDO7LPH,QWHJUDWLRQ

&2 !),

6HJPHQW

5HSRUWLQJ

(with custom fields)

1HZ*HQHUDO

/HGJHU

$FFRXQWLQJ

LQP\6$3(53

7UDQVSDUHQF\DQG

&RQVLVWHQF\

$FFHOHUDWHG

3HULRG(QG&ORVLQJ

)LQDQFLDO5HSRUWLQJ

8VLQJ$Q\&KDUDFWHULVWLFV

(document splitting)

6LPSOH

5HSUHVHQWDWLRQ

RI3DUDOOHO

$FFRXQWLQJ

SAP AG 2006

© SAP AG

TFIN52

1-4

1HZ*HQHUDO/HGJHU$FFRXQWLQJ2QH&RPSRQHQW±

/RWVRI)XQFWLRQV

5(QWHUSULVH

(Legal

requirements)

COS

5HFRQFLOLDWLRQ

/HGJHU

(&

(&3&$

(Management

and Segment

Reporting)

6SHFLDO3XUSRVH/HGJHU

1H

/H Z

G J *H

HU Q H

$ UD

FF O

RX

QW

LQ

J

),&ODVVLF

P\6$3(53

(Multidimensional;

customizable)

SAP AG 2006

Prior to mySAP ERP, SAP customers have to install and operate many different components to meet

international (or industry-specific) requirements and standards as completely as possible.

In fact, the situation is worsening because more and more service providers (in the public sector,

insurance, and media sectors, for example) are demanding balance sheets based on additional criteria

- such as grant, fund, or industry.

Of course, the increasing importance of IAS/IFRS as accounting principles is also heightening the

need for improved quality and modeling of segment reporting.

Furthermore, a unified solution would undoubtedly also be a bonus for tackling issues such as )DVW

&ORVHand 6DUEDQHV2[OH\.

2YHUYLHZof the WRWDOVWDEOHV when the FODVVLFFRPSRQHQWV are used:

y Classic FI: GLT0

y Cost-of-sales ledgers: GLFUNCT

y Reconciliation ledger: COFIT

y EC-PCA / classic Profit Center Accounting: GLPCT

© SAP AG

TFIN52

1-5

%HQHILWVRI1HZ*HQHUDO/HGJHU$FFRXQWLQJ²

2YHUYLHZ

1HZ*HQHUDO/HGJHU$FFRXQWLQJLQP\6$3(53 KDVWKHIROORZLQJ

DGYDQWDJHV FRPSDUHGWRFODVVLF*HQHUDO/HGJHU$FFRXQWLQJ(such as in

5(QWHUSULVH)

1HZ*HQHUDO/HGJHU$FFRXQWLQJKDVDQH[WHQGHGGDWDVWUXFWXUH LQWKHVWDQGDUG

GHOLYHU\

&XVWRPHUILHOGVFDQDOVREHDGGHGWRWKHJHQHUDOOHGJHU

:LWK UHDOWLPH GRFXPHQWVSOLWWLQJEDODQFHVKHHWVFDQEHFUHDWHGIRUHQWLWLHV

VXFKDV6HJPHQW

<RXFDQUXQDUHDOWLPHUHFRQFLOLDWLRQRI0DQDJHPHQW$FFRXQWLQJ &2 DQG

)LQDQFLDO$FFRXQWLQJ ), WKHUHLVWKHUHDOWLPHLQWHJUDWLRQZLWK&RQWUROOLQJ

7KLVUHQGHUVWLPHFRQVXPLQJUHFRQFLOLDWLRQWDVNVREVROHWH

1HZ*HQHUDO/HGJHU$FFRXQWLQJPDNHVLWSRVVLEOHWRPDQDJH PXOWLSOHOHGJHUV

ZLWKLQ*HQHUDO/HGJHU$FFRXQWLQJ 7KLVLVRQHRIWKHSRVVLEOHZD\VRI

SRUWUD\LQJSDUDOOHODFFRXQWLQJ LQWKH6$3V\VWHP

SAP AG 2006

The subsequent units will elaborate on these benefits.

6$31RWH also provides an overview of the benefits of New General Ledger Accounting.

New General Ledger Accounting can be explained briefly as follows: New General Ledger

Accounting contains functions that combine classic General Ledger Accounting with the 6SHFLDO

3XUSRVH/HGJHU component.

Important: Despite all the new features, the "interfaces" for entering the data and making the postings

are virtually identical to the interfaces in the previous release.

© SAP AG

TFIN52

1-6

,QWURGXFWLRQ6XPPDU\

<RXVKRXOGQRZEHDEOHWR

'HVFULEHWKHIXQFWLRQVRI1HZ*HQHUDO/HGJHU

$FFRXQWLQJ

%ULHIO\GHVFULEHWKHEHQHILWVRI1HZ*HQHUDO/HGJHU

$FFRXQWLQJ

SAP AG 2006

© SAP AG

TFIN52

1-7

&RXUVH2YHUYLHZ /HGJHU'HILQLWLRQ

,QWURGXFWLRQ

,QWURGXFWLRQ

3HULRGLF3URFHVVLQJ

3HULRGLF3URFHVVLQJ

/HGJHU'HILQLWLRQ

/HGJHU'HILQLWLRQ

5HSRUWLQJ

5HSRUWLQJ

'RFXPHQW6SOLWWLQJ

'RFXPHQW6SOLWWLQJ

,QWHJUDWLRQ

,QWHJUDWLRQ

SAP AG 2003

© SAP AG

TFIN52

2-1

/HGJHU'HILQLWLRQ

&RQWHQWV

$FWLYDWLQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

*HWWLQJWRNQRZWKHQHZWRWDOVWDEOH)$*/)/(;7

$VVLJQLQJVFHQDULRVDQGWKHLULPSRUWDQFH

(QWU\YLHZDQGJHQHUDOOHGJHUYLHZIRU)LQDQFLDO

$FFRXQWLQJGRFXPHQWV

7KH6HJPHQWFKDUDFWHULVWLF

'HULYLQJWKHVHJPHQW

SAP AG 2006

© SAP AG

TFIN52

2-2

/HGJHU'HILQLWLRQ8QLW2EMHFWLYHV

$IWHUFRPSOHWLQJWKLVXQLW\RXZLOOEHDEOHWR

$FWLYDWH1HZ*HQHUDO/HGJHU$FFRXQWLQJ

1DPHWKHQHZILHOGVLQWKHWRWDOVWDEOH

'HVFULEHWKHLPSRUWDQFHRIVFHQDULRV

7HOOWKHGLIIHUHQFHEHWZHHQWKHHQWU\YLHZDQGWKH

JHQHUDOOHGJHUYLHZ

'HILQHDQGGHULYHVHJPHQWV

SAP AG 2006

© SAP AG

TFIN52

2-3

1HZ*HQHUDO/HGJHU$FFRXQWLQJ

:LWKP\6$3(53&HQWUDO&RPSRQHQWWKH6$3V\VWHPRIIHUVLQWKH

)LQDQFLDOVDUHDDQLQWHUHVWLQJDOWHUQDWLYHLQ*HQHUDO/HGJHU

$FFRXQWLQJ

1(:*(1(5$//('*(5$&&2817,1*

&UXFLDOTXHVWLRQ'RFRPSDQLHVKDYHWRXVH1HZ*HQHUDO/HGJHU

$FFRXQWLQJ?

,WZLOOEHRSWLRQDO IRUH[LVWLQJFXVWRPHUV <RXZLOOQRWEHREOLJHG

WRDFWLYDWH1HZ*HQHUDO/HGJHU$FFRXQWLQJ 'XULQJDUHOHDVH

XSJUDGH(to mySAP ERP)FODVVLF*HQHUDO/HGJHU$FFRXQWLQJ

XVLQJWRWDOVWDEOH*/7 UHPDLQVDFWLYHDWILUVW

2IFRXUVH1HZ*HQHUDO/HGJHU$FFRXQWLQJKDVPDQ\

DGYDQWDJHV

)RUQHZLQVWDOODWLRQV1HZ*HQHUDO/HGJHU$FFRXQWLQJLVDFWLYH

E\GHIDXOWLQP\6$3(53

SAP AG 2006

,QIRUPDWLRQIRUH[LVWLQJFXVWRPHUV If the advantages presented in the course AC210 are important

or even crucial for your company, you can implement New General Ledger Accounting in a separate

migration project after upgrading to P\6$3(53. For more information, see the unit of 0LJUDWLRQ at

the end of this course.

,QIRUPDWLRQIRUQHZFXVWRPHUV In the case of a new installation, see 6$31RWHon setting

up the system for New General Ledger Accounting.

© SAP AG

TFIN52

2-4

$FWLYDWLQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

'LVSOD\,0*

q?rh k g0h [ ats*uwv;W gxk

m*W1^ WT]kTWUi [(nDe;\Hop] g0h e;[

!" #%$ %& ' (&)*( +(

, , , , , , ,.-

%'/%/ '$01 ( !

'%/ '$01 ( !)2$ (3%'%$45 !

6 7%' 8509:); '$/<+!1/ /!

5 #%'=>?+(

@A@ .

9LHZ$FWLYDWH1HZ*HQHUDO/HGJHU$FFRXQWLQJ

QR !STU N $ /'O" P ' Activation of New General Ledger Accounting

V*WXZYW[W1\]1^ _5W?`6a1W6\?bdcTc e*f6[(g4h [Taji kUb&c g0h l W

BDCE FHG0CIJK LCJK M

SAP AG 2006

If existing customers want to use New General Ledger Accounting, they first need to activate it using

a Customizing transaction (=> )$*/B$&7,9$7,21).

&DXWLRQ This transaction is performed at the start of the course to enable you to explore the new

functions. In practice, executing this transaction (for existing customers) is one of the last activities

performed during the migration project leading up to the implementation of New General Ledger

Accounting.

The DFWLYDWLRQLQGLFDWRULVVHWIRUHDFKFOLHQW.

y Caution: Activating New General Ledger Accounting results in system-wide changes to

application and Customizing paths.

© SAP AG

TFIN52

2-5

1HZ0HQX3DWKV$IWHU$FWLYDWLRQ

'LVSOD\,0*

q?rh kTgh [ ats2uv;W gxk

m;W1^ WT]kTWUi [(nDe;\Ho]g0h e;[

H 1 & /!" d#%$ %& ' (&)* +(

, , , , , , ,:-

'%/ '$06/ !

'%/ '$06/ !zy 8?09O{

'%/ '$06/ !S?' 2 / %!(Oy 8T9O{

<%+!(% )*$ 3%'$/' '%> OP 6 &#'=>?+

| &

@U@

)2% '$<%+!?/ % %!dy 8T9O{

} ' % | ' '

S5% //O~ '' T$ '/ !

+ OT / !

@A@,

1/ N / 7'%3$ *'%%+>1/T( &'4='3%$ S5'%;1/ /!

6///6// ( %!

@@

5 ($ $ !

" 74> } '%'!(%>

@@

%0

SAP AG 2006

The SDWKVIRU1HZ*HQHUDO/HGJHU$FFRXQWLQJ are DGGHG to the existing Customizing paths.

To help you find your way around, the classic Financial Accounting paths will initially remain

available in their present form.

Once you have become familiar with the paths for New General Ledger Accounting, you can run

program 5)$*/B6:$3B,0*B2/' to hide the classic Financial Accounting paths.

Activating New General Ledger Accounting also makes several new nodes available in the

application and the SAP Easy Access menu.

&DXWLRQ The activation of New General Ledger Accounting not only affects the menu entries; a few

classic functions / transactions can no longer be executed either.

© SAP AG

TFIN52

2-6

/HGJHU'HILQLWLRQ

6$3SURYLGHVWKHOHDGLQJOHGJHU/ DQGWRWDOVWDEOH)$*/)/(;7 ZLWK

WKHVWDQGDUGV\VWHP.

*Wn0h [ W_TW5`6a6W1\ k:h [YW6[ W1\]1^T_TW5`1a6W6\5bdc5c e*f?[g4h [Ta

_6

_5WT`a?W1\*V*]5opW

e6gH]^ kA;]6^ W

?_

_5W ]?`*h [5a.^ W5`6a?W\

bdYA_1_1q5O

_5W ]5`*h [Ta

%0%

7KHOHDGLQJOHGJHUJHWVPDQ\RILWVFRQWUROSDUDPHWHUV(as before) IURPWKHFRPSDQ\

FRGH ± ZHWULHGWRNHHSHYHU\WKLQJDVIDPLOLDUDVSRVVLEOH ± VSHFLILFDOO\

The leading ledger manages the (additional) ORFDOFXUUHQF\ FXUUHQFLHV that is (are) assigned

to the company code.

The leading ledger uses the ILVFDO\HDUYDULDQW that is assigned to the company code.

The leading ledger uses the SRVWLQJSHULRGYDULDQW that is assigned to the company code.

6SHFLDOIHDWXUHV RIWKHOHDGLQJOHGJHU

There is H[DFWO\RQH OHDGLQJOHGJHU!

Only the YDOXHV from the leading ledger are SRVWHGWR&2in the standard system!

SAP AG 2006

You define DGGLWLRQDOFXUUHQFLHV in Customizing under )LQDQFLDO$FFRXQWLQJ 1HZ !)LQDQFLDO$FFRXQWLQJ

*OREDO6HWWLQJV 1HZ !/HGJHUV!/HGJHU!'HILQH&XUUHQFLHVRI/HDGLQJ/HGJHU.

The assignment of the ILVFDO\HDUYDULDQW and the YDULDQWRISRVWLQJSHULRGV to the leading ledger is located

in Customizing under: )LQDQFLDO$FFRXQWLQJ 1HZ !)LQDQFLDO$FFRXQWLQJ*OREDO6HWWLQJV 1HZ !/HGJHUV

!)LVFDO<HDUDQG3RVWLQJ3HULRGV

In addition to the leading ledger, you can also define other, non-leading ledgers (=> also see the unit 3DUDOOHO

$FFRXQWLQJ).

y The non-leading ledgers can then be assigned currencies and/or fiscal year variants that differ from the

leading ledger.

© SAP AG

TFIN52

2-7

7RWDOV7DEOH)$*/)/(;7

2QHORRNDWWKHGDWDEDVHWDEOHVPDNHVWKHSULPDU\VWDQGDUGH[WHQVLRQ RIWKHGDWD

VWUXFWXUHYLVLEOHLPPHGLDWHO\

1>;24>*>&2&p2&H;

&2> w>O¡> £¢p¤>¢&>¥O¦

§¨ © ¨ª«D¬ ­6®­ ¯°±°5¬ © ° ²5© ¨z¯x¬ ¨© ³5´?µ

Ç ¬ ¨T© ³

¶

¶

»6Û½ ÆÜ»

ººº

¶

¶

»6Æ&Ë>Ë;Á

¶

Ò6ÓÔ(Õ%Ö×(Ø×TÙ

¶

Ä;Å>Ñ>»§

¶

»Ë&À1Á*»

¶

É »;ËÁ;»

¢> 2>TÚ>

;>1>2ÍÏ¡;O

Ë2­?´«2½1© ¨¸¨ ®(«

Ì >ÍÏÎ&Ð

¶

»2Ä;Å*§6Æ

§2½6¾¿½À6Á

¶

¶

¶

Ì >O

Ë2­?´«ËO¨®«x¨ ¹

É ¹H­5¯Ê¬ «ËO¨®«Ê¨ ¹

¶

» Ç Æd»2½TÆ

¶

ÝÞ 0&>1ß2

ÇTÈ ®Tª«0¬ ­6®5° ©Æd¹x¨°

ÂU>;Ã:0

§¨·1¸¨®«6¯H­1¹1§;¨(·6ºT»;¨ ¼ ­1¹ «

¶

à/áxá GF4â

SAP AG 2006

The totals table of New General Ledger Accounting (=> )$*/)/(;7) updates more entities than

was possible in the classic totals table (=> */7).

Examples of the new standard fields include:

y Cost Center

y Profit Center

y Segment

Totals table )$*/)/(;7can be extended with additional fields – both predefined SAP fields and

entirely new customer fields. To add customer fields to totals table )$*/)/(;7they first have to

be added to the account assignment block (=> Function: (GLW$FFRXQW$VVLJQPHQW%ORFN).

y &DXWLRQ: Please do QRWWHVWWKLVGXULQJWKHFRXUVH, because extending the account assignment

block will lock out all other transactions (including for other course participants).

© SAP AG

TFIN52

2-8

6FHQDULRV± 'HILQLWLRQDQG$VVLJQPHQW

:KDWLVDVFHQDULRGHILQLWLRQ"

$VFHQDULRGHILQHVZKLFKILHOGVDUHXSGDWHGLQWKHOHGJHUV(in the general ledger view)

GXULQJDSRVWLQJ(from other application components)

6FHQDULRVSURYLGHGE\6$3

Ì 2ÜO;O&Î*O;D

ã

ä

(FIN_CCA)

Update of the sender cost center and receiver cost center fields

å >Î;O0/ æ0Üd;;d O1 d

ã

ä

ä

(FIN_GSBER)

Update of the sender business area and receiver business area fields

å 02æ Ü1O;Oz&Î;O

ã

ä

ä

ã

(FIN_PCA)

(FIN_SEGM)

Update of the segment, partner segment, and PC fields

Ì 2èD2æ4èx;> *Ü>/*

ä

_TWT]5`;h [Tat^ WT`1a6W1\

êH?_5ì

V2e;[5éÊ^ W5]5`;h [Ta

^ W?`6a1W6\êDV>í%ì

V2e;[5éÊ^ W5]5`;h [Ta

^ W?`6a1W6\êDV*ëì

Update of profit center and partner PC fields

Ý ;&Íç>/ d

ã

;&OO î

Update of consolidation transaction type and trading partner fields

ÂOH*1ç24

ã

(FIN_CONS)

(FIN_UKV)

Update of the sender functional area and receiver functional area fields

SAP AG 2006

The fields that are updated by the scenarios can be used to model certain business circumstances – such as

segment reporting.

To display the available VFHQDULRV, goto &XVWRPL]LQJ for )LQDQFLDO$FFRXQWLQJ 1HZ , and choose )LQDQFLDO

$FFRXQWLQJ*OREDO6HWWLQJV 1HZ !/HGJHUV!)LHOGV!'LVSOD\6FHQDULRVIRU*HQHUDO/HGJHU$FFRXQWLQJ.

You FDQQRWGHILQH\RXURZQVFHQDULRV.

The delivered VFHQDULRV DUHDVVLJQHGWRWKHOHGJHUV in Customizing for Financial Accounting (New) under

Financial Accounting Global Settings (New) -> Ledgers -> Ledger -> Assign Scenarios and Customer Fields to

Ledgers.

y ,PSRUWDQWQRWH$OHGJHU(=> the leading ledger in all cases) FDQEHDVVLJQHGRQHRUPRUHVFHQDULRVRU

HYHQDOOVL[DWRQFH

y The decision as to how many scenarios to assign depends solely on which "facts" / "business aspects" you

want to model in the General Ledger Accounting.

You do not necessarily have to define non-leading ledgers, which means scenarios do not have to be assigned

to non-leading ledgers either. ,PSRUWDQW<RXGRQRWQHHGDOHGJHUIRUHDFKVFHQDULR

Multiple/non-leading ledgers are useful for portraying accounting in accordance with different accounting

principles.

© SAP AG

TFIN52

2-9

(QWU\9LHZDQG*HQHUDO/HGJHU9LHZ

:KHQ1HZ*HQHUDO/HGJHU$FFRXQWLQJLVDFWLYHD)LQDQFLDO

$FFRXQWLQJGRFXPHQWDOZD\VKDVWZRYLHZV7KHHQWU\YLHZ DQGWKH

JHQHUDOOHGJHUYLHZ.

Besides the leading ledger, you may also see the document in other, non-leading

ledgers in the general ledger view.

'HILQLWLRQ

(QWU\9LHZ 9LHZof KRZa document also appears in the

VXEOHGJHUYLHZV / VXEOHGJHUV (AP / AR / AA / taxes)!

*HQHUDOOHGJHUYLHZ 9LHZ of KRZa document appears (only) LQ

WKHJHQHUDOOHGJHU!

SAP AG 2006

© SAP AG

TFIN52

2-10

6FHQDULRV² $VVLJQPHQWDQG)XQFWLRQV,

0RGHOHGVLWXDWLRQ(QWU\YLHZ of an FI document !WKHYLHZZKHQSRVWLQJWKH

GRFXPHQW without assignment of scenarios to a ledger.

'LVSOD\'RFXPHQW(QWU\9LHZ

YW[W1\]1^ _5W?`6a?W1\%h WX

](r6Wk

Document no. 1000000001

Doc. date: DD.MM.YYYY

$#

1000

"

!

ö

Company code:

1000

Posting date: DD.MM.YYYY

ûTú ö1ù

ù5úDú

ý þ

1I

1 40

417000

Purch. Services

50.00 EUR

2 50

100000

Petty Cash

55.00- EUR

3 40

154000

Input Tax

5.00 EUR

Fiscal Year: YYYY

Period: M

õ6ö

ø ù(öúxû ü

ú

û Aû ó(óôô

ô%÷Tô(ô

ÿô ôô

ÿ÷ ô

ö

1I

ïðñDò

SAP AG 2006

In general, you will notice that QRWKLQJKDVFKDQJHG regarding HQWU\ of the documents.

The dependencies have also remained the same. For example:

y Account 3XUFKDVHG6HUYLFHV(417000) is defined as a primary cost element in CO and therefore

requires a CO-relevant account assignment during entry.

y The CO object (such as cost center) is used to derive the profit center and functional area

y New with ERP: A segment can now be derived from the profit center.

© SAP AG

TFIN52

2-11

6FHQDULRV² $VVLJQPHQWDQG)XQFWLRQV,,

0RGHOHGVLWXDWLRQ*HQHUDOOHGJHUYLHZof an FI document, ZLWKRXW DVVLJQPHQW RI

VFHQDULRVWRWKHOHDGLQJOHGJHU/

'LVSOD\'RFXPHQW*HQHUDO/HGJHU9LHZ

1]r6Wk

q*[(g4\'&(d

% h WX

Doc. Number: 1000000001

Doc. Date: DD.MM.YYYY

_ W?`6a6W6\)56_

$#

1000

"

!

ö

Company Code: 1000

Posting Date: DD.MM.YYYY

Fiscal Year: YYYY

Period: M

2ec?f?oUW6[ g*)1íT TT6í

1h k?cT]6^,+2W]1\).--/-/-

06W1\Dh e6`)21

ö1ù

ûTú ù5úDú

ý þ

1I

1 40

417000

Purch. Services

50,00 EUR

2 50

100000

Petty Cash

55,00- EUR

3 40

154000

Input Tax

5,00 EUR

õ6ö

ø ù(öúxû ü

ú

û Aû 1I

ïðñDò

SAP AG 2006

3

,IWKHFRUUHVSRQGLQJVFHQDULRVDUHQRWDVVLJQHGQRHQWLWLHVDUHLQKHULWHGWR*HQHUDO/HGJHU

$FFRXQWLQJ (=> neither to the leading ledger nor to one or more non-leading ledgers).

y (IIHFWVRIDPLVVLQJVFHQDULRDVVLJQPHQW If you call up a balance sheet (and a profit & loss

statement), you would indeed see the amount of ¼RQWKH3XUFKDVHG6HUYLFHV account. It

would be impossible, however, to allocate the bookkeeping transaction to a business area,

functional area, profit center, or any other entity. Accordingly, if you do not assign scenarios to a

ledger (=>or to multiple ledgers, if necessary), segment balance sheets will not be possible.

© SAP AG

TFIN52

2-12

6FHQDULRV² $VVLJQPHQWDQG)XQFWLRQV,,,

0RGHOHGVLWXDWLRQ*HQHUDOOHGJHUYLHZ of an FI document, ZLWK previous DVVLJQPHQW of

VFHQDULRV $QQXDO5HSRUWDQG&RVW&HQWHU8SGDWH WRWKHOHDGLQJOHGJHU

'LVSOD\'RFXPHQW*HQHUDO/HGJHU9LHZ

1]r6Wk

q*[(g4\'&(d

% h WX

Doc. No.: 1000000001

Doc. Date: DD.MM.YYYY

_ W?`6a6W6\)56_

$#

1000

"

!

ö

Company Code: 1000

Posting Date: DD.MM.YYYY

Fiscal Year: YYYY

Period: M

2ec?f?oUW6[ g*)1íT TT6í

1h k?cT]6^,+2W]1\)+$++$+

06W1\Dh e6`)21

ö1ù

ûTú ù5úDú

ý þ

1I

1 40

417000

Purch. Services

50.00 EUR

2 50

100000

Petty Cash

55.00- EUR

3 40

154000

Input Tax

5.00 EUR

õ6ö

ó(óôô

ø ù(öúxû ü

ú

û Aû ÿô ôô

1I

ïðñDò

SAP AG 2006

3

Given that the scenarios &RVW&HQWHU8SGDWH and %XVLQHVV$UHD are assigned to the leading ledger

0L, these two entities are updated to General Ledger Accounting and displayed in the corresponding

general ledger view.

3

The 6HJPHQW field, for example, is not updated or displayed in the general ledger view, however,

because this scenario has not previously been assigned to the leading ledger.

3

Caution: Scenario assignment is not capable of effecting a "zero balance setting" for any given

entity.

y In terms of the business area (=> BA): It is not yet possible to create a correct BA balance sheet

(for BA 9900, for example), because the BA was not inherited to posting items 2 and 3.

y To use this function, document splitting must additionally be configured with active inheritance.

© SAP AG

TFIN52

2-13

8VHRIWKH(QWLW\6HJPHQW

7KH6HJPHQWILHOG LVRQHRIWKHVWDQGDUGDFFRXQWDVVLJQPHQW

REMHFWV DYDLODEOHLQP\6$3(53IRUUXQQLQJDQDO\VHVIRU

REMHFWVEHORZWKHFRPSDQ\FRGHOHYHO

7KHREMHFWLYH LVWRJLYHDGHWDLOHGORRNDWWKHYDULRXVEXVLQHVV

DFWLYLWLHV !PDUNHWVRUSURGXFWV± LQJHQHUDODFWLYLW\DUHDV DWD

EURDGEDVHG HQWHUSULVH .H\ZRUGVHJPHQWUHSRUWLQJ

$OWHUQDWLYHDFFRXQWDVVLJQPHQWVXVHGLQWKHSDVW

3URILW&HQWHU

%XVLQHVV$UHD

(Profitability segment)

SAP AG 2006

3

Segments can be used to meet the requirements of international accounting principles (=> IAS /

IFRS / U.S. GAAP) regarding "segment reporting".

y Excerpt from IAS 14:… reporting is required for a business or geographical segment when the

majority of its revenues stems from sales to external customers and segment revenues account for

at least 10% of total internal and external revenues of all segments, segment income accounts for

at least 10% of all segment income, or segment assets account for at least 10% of the assets of all

segments. A segment can be reported separately even if it does not meet these size requirements. If

the segments subject to reporting requirements account for less than 75% of total consolidated

revenues or enterprise revenues, then other segments must be reported on separately, irrespective

of the 10% limit, until at least this 75% is reached. …

3

3

The %XVLQHVV$UHD or 3URILW&HQWHU objects can be used as alternatives.

The segment is provided in addition because the business area and/or profit center were frequently

used for other purposes in the past and thereby to meet other requirements.

© SAP AG

TFIN52

2-14

'HULYLQJD6HJPHQW

&KDQJH3URILW&HQWHU

l =.?A hHI HnmVI on;Kp>@?oq;

f ?A I gI C@hji ;>I kg

:<;=.;>@?A/B$?.CD?

Profit Center

Controlling Area

EF2FF

EF.F.F

Profit Center 1000

CO Europe

G ?.HI JKB$?.CL?

Person Responsible

Department

Hierarchy Area

M$N$OQPRQSNTT*PVURW<X

_`PVa$NU*T8ObPXTdc e

Y[Z2\]^

Segment

46587*9

SAP AG 2006

The ERP system enables you to assign a segment in the master data of a profit center.

Postings are automatically made to the segment when the profit center is posted to.

y There is no "dummy segment posting", as in the profit center logic; if the profit center does not

have a segment, there is no segment account assignment either.

The default setting involves deriving the segment from the profit center, but customers can develop

their own derivation solutions through a user exit (BAdI).

y The definition name of the BAdI is: FAGL_DERIVE_SEGMENT.

© SAP AG

TFIN52

2-15

'LVSOD\LQJWKH6HJPHQW(QWLW\LQDQ),

'RFXPHQW

_qr RVats Nuwv@e(PVX$x WU8y_zWt{|VO}PVXT~tdXTU*ue[r P

Document No. 19000001538

Doc. Date: DD.MM.YYYY

#

"

1000

!

1 31

öt.6ù2

1000

Company Code: 1000

Posting Date: DD.MM.YYYY

û ú ö

(1ù ù?úDú

Vendor X

11000- EUR

10000 EUR

2 40

417000

Purch. Services

3 40

154000

Input Tax

Fiscal Year: YYYY

Period: M

V ú

1ú2 .û ûú û û. 1000

1402

SEG A

1000 EUR

ï0ð/ñDò

§¨}©¨ª«*¬2­® ­$¯ °±/²¬/­®³´³Vµ ªV©¯ ­ °³$¨¶·¸¹²$® «ª² ºV¸²®«Dª´µ'®¼»t²½¿¾(²®²$ÀD­$¯Á² ³Vº²$À$Âz¶ ¶¨V·$®«*µL®º¬2°¨V·¼Ã ­ IJK«*¨

© ²$ÀŨVÀ8¸¿«8òÆŨt¯ ¯ ¨½µ ®ºª «²$© ª Ç

B;/*I =I C*I k=

E

H J;=?>I k

HJ;=.?>I k.2q/ /

of the

The

has to be defined for the leading ledger (and for any other nonleading ledgers) – if it is not, the segment is only visible in the entry view.

B;/*I =/;

the segments.

B;>DI /;

the segments – The standard SAP system supports derivation from profit centers

I ;A gKH/CL?C.H(2? >I ?=C

I ;A g[H/CL?.C8H[>Lk.H

p ?2J/Jk =C@H

$/[2

? I =C?I =

the

of the corresponding

: The

./.

/¡2

/.nand/or

2

g;*I =.;2g

¢,¢

¢ ) must be

as an "optional entry" *

group /

I ;A gKH/CL?C.H

2k HC*I =.¤;h

? I =C?I =

the

of the corresponding

: The above statement also apples. *

?h2kC

.[2

gkJ/on;=C$g$I HA ?h

B I HA ?h

the

field using the ¦

(icon

) in the

2

2

£

2¥

field (=>

SAP AG 2006

7RPDLQWDLQWKHVFHQDULRV: In Customizing under )LQDQFLDO$FFRXQWLQJ 1HZ !)LQDQFLDO

$FFRXQWLQJ*OREDO6HWWLQJV 1HZ !/HGJHUV!/HGJHU!$VVLJQ6FHQDULRVDQG&XVWRPHU)LHOGV

WR/HGJHUV.

3

The 6HJPHQWfield (technical name: SEGMENT) appears in the standard version of the totals table in

New General Ledger Accounting (=> )$*/)/(;7) in mySAP ERP.

3

'HILQLWLRQRIWKHVHJPHQWV In Customizing under (QWHUSULVH6WUXFWXUH!'HILQLWLRQ!)LQDQFLDO

$FFRXQWLQJ!'HILQH6HJPHQW

0DLQWDLQLQJDVHJPHQWLQDSURILWFHQWHUApplication Accounting -> Controlling -> Profit Center

Accounting -> Master Data -> Profit Center -> Individual Processing -> Change

3

y Caution: If a customer does not use Profit Center Accounting, for example, a BAdI enables

alternative derivation strategies to be used.

3

3

0DLQWDLQ the ILHOGVWDWXVYDULDQW the fastest method (since Release 4.6): Transaction code )%.3 or

in Customizing under)LQDQFLDO$FFRXQWLQJ 1HZ !)LQDQFLDO$FFRXQWLQJ*OREDO6HWWLQJV 1HZ !/HGJHUV!)LHOGV!'HILQH)LHOG6WDWXV9DULDQWV

0DLQWDLQ the field status of the SRVWLQJNH\ - the fastest method (since Release 4.6): Transaction

code )%.3 or in Customizing under)LQDQFLDO$FFRXQWLQJ 1HZ !)LQDQFLDO$FFRXQWLQJ*OREDO

6HWWLQJV 1HZ !'RFXPHQW!'HILQH3RVWLQJ.H\

* If the field status is not defined as described here, postings are still made to the 6HJPHQW table field,

but this table field cannot be displayed or edited in the coding block.

© SAP AG

TFIN52

2-16

/HGJHU'HILQLWLRQ6XPPDU\

<RXVKRXOGQRZEHDEOHWR

$FWLYDWH1HZ*HQHUDO/HGJHU$FFRXQWLQJ

1DPHWKHQHZILHOGVLQWKHJHQHUDOOHGJHUWRWDOVWDEOH

([SODLQKRZVFHQDULRVDUHXVHG

'HVFULEHWKHGLIIHUHQFHEHWZHHQWKHHQWU\YLHZDQG

WKHJHQHUDOOHGJHUYLHZ

'HILQHDQGGHULYHVHJPHQWV

SAP AG 2006

© SAP AG

TFIN52

2-17

([HUFLVHV

8QLW/HGJHU'HILQLWLRQ

7RSLF&RQILJXULQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

At the conclusion of these exercises, you will be able to

• Activate and configure New General Ledger Accounting. You will

understand the scenarios of New General Ledger Accounting, how to

create and derive segments, and how to tell the difference between the

entry view and the general ledger view of a Financial Accounting

document.

2-1

([HUFLVHVIRUFRQILJXULQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

2-1-1

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Call up the DFWLYDWLRQLQGLFDWRU for New General Ledger Accounting and

make sure New General Ledger Accounting has been activated!

Which WUDQVDFWLRQFRGH can you use to call up the activation indicator?

What does the acronym “FAGL” stand for?

2-1-2

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Check the Customizing settings to find out the ,' of the OHDGLQJOHGJHU, as

well as the WRWDOVWDEOH where the values are saved.

2-1-3

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

,PSRUWDQW,QDOOIXWXUHH[HUFLVHVWKHWZRKDVKNH\V ! VWDQGIRU\RXUWZRGLJLWJURXSQXPEHU

Check the “QHZ´,0*SDWKV to find out , which ILVFDO\HDUYDULDQW your

FRPSDQ\FRGH $$uses, and ZKLFKILHOGVWDWXVYDULDQW is assigned to

your FRPSDQ\FRGH$$.

© SAP AG

TFIN52

2-18

2-1-4

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Which VFHQDULRV have been assigned (by the trainer) to the OHDGLQJOHGJHU,

/?

2-1-5 &UHDWH a new VHJPHQW with ID 6(* and name it “ Segment Group ##”.

2-1-6 Now FUHDWH a SURILWFHQWHU with ID 3&. For a WHPSODWH, please use

SURILWFHQWHU LQFRQWUROOLQJDUHD. 0DLQWDLQWKHIROORZLQJGDWD

for the profit center

$QDO\VLV7LPH)UDPH: to 1DPH: 3&*URXS

/RQJ7H[W: 3URILW&HQWHU*URXS

3HUVRQ5HVSRQVLEOH: *URXS

'HSDUWPHQW: &RXUVH

+LHUDUFK\$UHD: + (Course)

6HJPHQW: Your new 6HJPHQW6(* from the previous exercise. $FWLYDWH

the new profit center.

2-1-7 Call FRVWFHQWHU 7)$ LQFKDQJHPRGH and make sure that the cost

center is assigned to your company code $$. 5HSODFH the existing cost

center with your QHZSURILWFHQWHU 3&. Answer any warning/information

messages with “ Yes”. 6DYH your changes.

2-1-8 1RZFUHDWHYHQGRU in your company code $$ – leave the account

group blank and choose 9HQGRU in &RPSDQ\&RGH as a

WHPSODWH. )LOOLQDOOWKHUHTXLUHGILHOGV with the address data and VDYH your

data.

2-1-9

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Before the first posting, QRZFKHFNwhether the FRVWFHQWHU, the SURILW

FHQWHU, and the VHJPHQW DUHGHILQHGDV“ 2SWLRQDO´in the ILHOGVWDWXV

JURXS of DFFRXQW (Purchased Services) / FRPSDQ\FRGH$$.

2-1-10 Now create a YHQGRULQYRLFH for the services you purchased ZLWKWKH

IROORZLQJGDWD:

&RPSDQ\&RGH: $$

9HQGRU: ,QYRLFHDQGSRVWLQJGDWH: 7RGD\

$PRXQW: ¼

&DOFXODWH7D[LQGLFDWRU: 6HW

7D[&RGH: 91

7H[W 3RVWLQJ$&

*/$FFRXQW: $PRXQWLQGRFXPHQWFXUUHQF\: or just “ *”

&25HOHYDQW$FFRXQW$VVLJQPHQW: Cost center 7)$

Simulate and VDYH the posting document!

© SAP AG

TFIN52

2-19

2-1-11 'LVSOD\WKHGRFXPHQW. &KDQJHWKHOD\RXWin the entry view such that the

FRVWFHQWHU, SURILWFHQWHU, and VHJPHQW DUHGLVSOD\HG! 6DYHWKLVOD\RXW

XVHUVSHFLILFDOO\ with QDPH/. If you want, you can also save your new

layout as the default setting. If you do, layout / will be started

automatically whenever you display the document.

© SAP AG

TFIN52

2-20

6ROXWLRQV

8QLW/HGJHU'HILQLWLRQ

7RSLF&RQILJXULQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

2-1

([HUFLVHVIRUFRQILJXULQJ1HZ*HQHUDO/HGJHU$FFRXQWLQJ

2-1-1

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Call up the DFWLYDWLRQLQGLFDWRU for New General Ledger Accounting and

make sure New General Ledger Accounting has been activated!

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJ*OREDO6HWWLQJVo

$FWLYDWH1HZ*HQHUDO/HGJHU$FFRXQWLQJ

Which WUDQVDFWLRQFRGH can you use to call up the activation indicator?

7UDQVDFWLRQFRGH)$*/B$&7,9$7,21

What does the acronym “ FAGL” stand for?

)LQDQFLDO$FFRXQWLQJ*HQHUDO/HGJHU

2-1-2

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Check the Customizing settings to find out the ,' of the OHDGLQJOHGJHU, as

well as the WRWDOVWDEOH where the values are saved.

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o)LQDQFLDO$FFRXQWLQJ*OREDO

6HWWLQJV 1HZ o/HGJHUVo/HGJHUo'HILQH/HGJHUVIRU*HQHUDO/HGJHU

$FFRXQWLQJ

o7KH,'LV/

o7KHWRWDOVWDEOHQDPHLV)$*/)/(;7

© SAP AG

TFIN52

2-21

2-1-3

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

,PSRUWDQW,QDOOIXWXUHH[HUFLVHVWKHWZRKDVKNH\V ! VWDQGIRU\RXUWZRGLJLWJURXSQXPEHU

Check the “ QHZ´,0*SDWKV to find out which ILVFDO\HDUYDULDQW your

FRPSDQ\FRGH $$uses …

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o)LQDQFLDO$FFRXQWLQJ*OREDO

6HWWLQJV 1HZ o/HGJHUVo)LVFDO<HDUDQG3RVWLQJ3HULRGVo$VVLJQ

&RPSDQ\&RGHWRD)LVFDO<HDU9DULDQW

<RXUFRPSDQ\FRGH$$KDVILVFDO\HDUYDULDQW.

... and which ILHOGVWDWXVYDULDQW is assigned to your FRPSDQ\FRGH$$?

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o)LQDQFLDO$FFRXQWLQJ*OREDO

6HWWLQJV 1HZ o/HGJHUVo)LHOGVo$VVLJQ&RPSDQ\&RGHWR)LHOG6WDWXV

9DULDQWV

<RXUFRPSDQ\FRGH$$KDVILHOGVWDWXVYDULDQW

2-1-4

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Which VFHQDULRV have been assigned (by the trainer) to the OHDGLQJOHGJHU,

/?

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o)LQDQFLDO$FFRXQWLQJ*OREDO

6HWWLQJV 1HZ o/HGJHUVo/HGJHUo$VVLJQ6FHQDULRVDQG&XVWRPHU)LHOGVWR

/HGJHUV

6HOHFWOHGJHU/GRXEOHFOLFNWRVHOHFWWKH6FHQDULRVHQWU\LQWKHGLDORJ

VWUXFWXUH7KHIROORZLQJVFHQDULRVPD\EHYLVLEOH

&RVW&HQWHU8SGDWH

3UHSDUDWLRQVIRU&RQVROLGDWLRQ

%XVLQHVV$UHD

3URILW&HQWHU8SGDWH

6HJPHQWDWLRQ

&RVWRI6DOHV$FFRXQWLQJ

© SAP AG

TFIN52

2-22

2-1-5 &UHDWH a new VHJPHQW with ID 6(* and name it “ Segment Group ##” .

&XVWRPL]LQJ(QWHUSULVH6WUXFWXUHo'HILQLWLRQo)LQDQFLDO$FFRXQWLQJo

'HILQH6HJPHQW

0DLQWDLQWKHQHZHQWU\DVGHVFULEHGLQWKHH[HUFLVHWH[W

2-1-6 Now FUHDWH a SURILWFHQWHU with ID 3&. For a WHPSODWH, please use

SURILWFHQWHU LQFRQWUROOLQJDUHD. 0DLQWDLQWKHIROORZLQJGDWD

for the profit center

$QDO\VLV7LPH)UDPH: to 1DPH: 3&*URXS

/RQJ7H[W: 3URILW&HQWHU*URXS

3HUVRQ5HVSRQVLEOH: *URXS

'HSDUWPHQW: &RXUVH

+LHUDUFK\$UHD: + (Course)

6HJPHQW: Your new 6HJPHQW6(* from the previous exercise. $FWLYDWH

the new profit center.

&XVWRPL]LQJ(QWHUSULVH6WUXFWXUHo'HILQLWLRQo)LQDQFLDO$FFRXQWLQJo

'HILQH3URILW&HQWHU

,QWKHGLVSOD\HGGLDORJER[FKRRVH(&3&$&UHDWHSURILWFHQWHU

0DLQWDLQWKHQHZHQWU\ZLWKWKHUHIHUHQFHSURILWFHQWHUDVGHVFULEHGLQWKH

H[HUFLVHWH[W

2-1-7 Call FRVWFHQWHU 7)$ LQFKDQJHPRGH and make sure that the cost

center is assigned to your company code $$. …

6$3(DV\$FFHVVPHQXo$FFRXQWLQJo&RQWUROOLQJo&RVW&HQWHU$FFRXQWLQJ

o0DVWHU'DWDo&RVW&HQWHUo,QGLYLGXDO3URFHVVLQJo&KDQJH

… 5HSODFH the existing profit center with your QHZSURILWFHQWHU 3&.

Answer any warning/information messages with “ Yes” . 6DYH your changes.

2-1-8 1RZFUHDWHYHQGRU in your company code $$ – leave the account

group blank and choose 9HQGRU in &RPSDQ\&RGH as a

WHPSODWH. )LOOLQDOOWKHUHTXLUHGILHOGV with the address data and VDYH your

data.

6$3(DV\$FFHVV0HQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo9HQGRUVo

0DVWHU5HFRUGVo&UHDWH

0DLQWDLQWKHQHZHQWU\ZLWKWKHUHIHUHQFHDVGHVFULEHGLQWKHH[HUFLVHWH[W

© SAP AG

TFIN52

2-23

2-1-9

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

Before the first posting, QRZFKHFNwhether the FRVWFHQWHU, the SURILW

FHQWHU, and the VHJPHQW DUHGHILQHGDV“ 2SWLRQDO´in the ILHOGVWDWXV

JURXS of DFFRXQW (Purchased Services) / FRPSDQ\FRGH$$.

6$3(DV\$FFHVVPHQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo*HQHUDO

/HGJHUo0DVWHU5HFRUGVo*/$FFRXQWVo,QGLYLGXDO3URFHVVLQJo&HQWUDOO\

(QWHUDFFRXQWDQGFRPSDQ\FRGH$$

'RXEOHFOLFNWKHWDE&UHDWHEDQNLQWHUHVW

'RXEOHFOLFNWKHHQWU\IRUWKH)LHOGVWDWXVJURXS !* 'RXEOHFOLFNRQWKH$GGLWLRQDODFFRXQWDVVLJQPHQWVJURXS

)LQGWKHDSSURSULDWHDFFRXQWDVVLJQPHQWVLQWKHGLVSOD\HGWDEOH<RXPD\

KDYHWRVFUROOGRZQWRVHHWKHVHJPHQW

2-1-10 Now create a YHQGRULQYRLFH for the services you purchased ZLWKWKH

IROORZLQJGDWD:

&RPSDQ\&RGH: $$

9HQGRU: ,QYRLFHDQGSRVWLQJGDWH: 7RGD\

$PRXQW: ¼

&DOFXODWH7D[LQGLFDWRU: 6HW

7D[&RGH: 91

7H[W 3RVWLQJ$&

*/$FFRXQW: $PRXQWLQGRFXPHQWFXUUHQF\: or just “ *”

&25HOHYDQW$FFRXQW$VVLJQPHQW: Cost center 7)$

Simulate and VDYH the posting document!

6$3(DV\$FFHVV0HQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo9HQGRUVo

'RFXPHQW(QWU\o,QYRLFH

(QWHUWKHPLVVLQJGDWDDVGHVFULEHGLQWKHH[HUFLVHWH[W

2-1-11 'LVSOD\WKHGRFXPHQW.… 5HPDLQLQWKH(QWHU9HQGRU,QYRLFHVFUHHQDQGFKRRVHPHQXSDWK'RFXPHQWo

'LVSOD\

… &KDQJHWKHOD\RXWin the entry view such that the FRVWFHQWHU, SURILW

FHQWHU, and VHJPHQW DUHGLVSOD\HG! …

&KRRVH&KDQJH/D\RXWIURPWKHGURSGRZQOLVWXQGHUWKH6HOHFW/D\RXW

SXVKEXWWRQ'LVSOD\WKHWKUHHGHVFULEHGILHOGV

... 6DYHWKLVOD\RXWXVHUVSHFLILFDOO\ with QDPH/. If you want, you can

also save your new layout as the default setting. If you do, layout / will be

started automatically whenever you display the document.

&KRRVH6DYH/D\RXWIURPWKHGURSGRZQOLVWXQGHUWKH6HOHFW/D\RXW

SXVKEXWWRQ

© SAP AG

TFIN52

2-24

&RXUVH2YHUYLHZ 'RFXPHQW6SOLWWLQJ

,QWURGXFWLRQ

,QWURGXFWLRQ

3HULRGLF3URFHVVLQJ

3HULRGLF3URFHVVLQJ

/HGJHU'HILQLWLRQ

/HGJHU'HILQLWLRQ

5HSRUWLQJ

5HSRUWLQJ

'RFXPHQW6SOLWWLQJ

'RFXPHQW6SOLWWLQJ

,QWHJUDWLRQ

,QWHJUDWLRQ

SAP AG 2003

© SAP AG

TFIN52

3-1

'RFXPHQW6SOLWWLQJ

&RQWHQWV

z 0RWLYDWLRQIRUGRFXPHQWVSOLWWLQJ

z 'RFXPHQWVSOLWWLQJIXQFWLRQV

z $FWLYDWLQJGRFXPHQWVSOLWWLQJ

z 'HILQLQJGRFXPHQWVSOLWWLQJFKDUDFWHULVWLFV

z ,QKHULWDQFHLQGRFXPHQWVSOLWWLQJ

z ([DPSOHSRVWLQJVZLWKGRFXPHQWVSOLWWLQJ

SAP AG 2006

© SAP AG

TFIN52

3-2

'RFXPHQW6SOLWWLQJ 2EMHFWLYHV

$WWKHFRQFOXVLRQRIWKLVXQLW\RXZLOOEHDEOHWR

z ([SODLQWKHPRWLYDWLRQDQGWKHRU\EHKLQGGRFXPHQW

VSOLWWLQJ

z $FWLYDWHDQGXVHGRFXPHQWVSOLWWLQJ

z 3HUIRUPH[DPSOHSRVWLQJVZLWKGRFXPHQWVSOLWWLQJ

SAP AG 2006

© SAP AG

TFIN52

3-3

'RFXPHQW6SOLWWLQJ² 0RWLYDWLRQ

$YDLODEOH IXQFWLRQV LQWKH6$3V\VWHP(Release SAP ERP Central Component

5.0 and later) WRFUHDWHVHJPHQWILQDQFLDOVWDWHPHQWV

7KH6HJPHQW ILHOG LVDVWDQGDUGILHOGLQWKHWRWDOVWDEOHIRU

1HZ*HQHUDO/HGJHU$FFRXQWLQJ )$*/)/(;7

1HZ),GULOOGRZQUHSRUWLQJIXQFWLRQV OHW\RXFUHDWHVHJPHQW

ILQDQFLDOVWDWHPHQWV

5HTXLUHPHQW ([DPSOH3RVWLQJZGLIIVHJPHQWDVVLJQPHQW

-/.

8

56 7

2 34

01

1000

,

*+

1 31

$$)

" #$%'& (& 1000

Vendor X

!

11,000- EUR

2 40

417000

Purch. Services

4,000 EUR

SEG A

3 40

417000

Purch. Services

6,000 EUR

SEG B

4 40

154000

Input Tax

1,000 EUR

6ROXWLRQ 'RFXPHQWVSOLWWLQJRQOLQHVSOLW

SAP AG 2006

The system requirements can be even more "simple" – there do not necessarily have to be different

segment assignments in the expense lines. At the very least, the payables line (in the general ledger

view) has to have a "segment assignment" line, for example, to create balanced segment financial

statements at all.

© SAP AG

TFIN52

3-4

$VVXPSWLRQVIRU'RFXPHQW6SOLWWLQJ

$VVXPSWLRQVIRU'RFXPHQW6SOLWWLQJ

The RSHUDWLYHSURFHVV (of document entry) PXVWQRW EHGLVWXUEHG (changed) by the

online split – VSHFLILFH[DPSOH

When entering the following vendor invoice in the system ...

9;:=<?>@:?AB

N :PO-Q-FSRUTPBGR KVA

J >LK?DMAB CEDFGFIH

Vendor X

11,600- EUR

Purch. Services

4,000 EUR

SEG A

Purch. Services

6,000 EUR

SEG B

Input Tax

1,600 EUR

…. the user RQO\ZDQWVWRHQWHUWKHYHQGRURQFH

Later, of course, when segment financial statements are required (for segment A, for

example), the payables (in the general ledger) should report the corresponding share

(=> 4,640).

When a YHQGRUOLQHLWHPOLVW is called (in the FI-AP subledger), of course, there

should still RQO\EHRQHRSHQLWHP for the above invoice.

Therefore: Document splitting is only relevant for the general ledger; it does not need

to be visible from within the subledgers.

SAP AG 2006

© SAP AG

TFIN52

3-5

6WHSV,QYROYHGLQ'RFXPHQW6SOLWWLQJ

6LPSOLILHG\RXFDQGLYLGHWKHGRFXPHQWVSOLWWLQJ

SURFHVVLQWRWKUHHVWHSV

3DVVLYHVSOLW

'XULQJFOHDULQJ(during a payment, for example), WKHDFFRXQWDVVLJQPHQWV

RIWKHLWHPVWRFOHDUDUHLQKHULWHGWRWKHFOHDULQJOLQHLWHP>V@

(=> such as payables line item[s]).

7KLVVWHSFDQQRWEHFXVWRPL]HG

$FWLYH UXOHEDVHG VSOLW

7KHV\VWHPVSOLWVGRFXPHQWVRQWKHEDVLVRI(delivered or custom )

GRFXPHQWVSOLWWLQJUXOHV

'RFXPHQWVSOLWWLQJUXOHVFDQEHFRQILJXUHG

&OHDULQJOLQHV]HUREDODQFHIRUPDWLRQE\EDODQFLQJFKDU(and document)

7KHV\VWHPFUHDWHVFOHDULQJOLQHVDXWRPDWLFDOO\WRDFKLHYHDVSOLW

<RXFDQFRQWUROWKLVSURFHVVZLWKWKH]HUREDODQFHLQGLFDWRU

SAP AG 2006

In situations involving clearing, the SDVVLYHVSOLW not only ensures that the account itself is balanced,

but also the additional dimensions. See the example in the next slides.

The logic behind the rules for DFWLYHVSOLWV is explained in the following slides.

&OHDULQJOLQHV are always formed when values have to be reposted between account assignment

objects. For example: Transfer posting from profit center A to profit center B.

y The clearing lines ensure that not only the document itself is balanced internally, but also the

additional dimensions (=> such as business area, segment, or profit center).

Between steps two and three, document splitting is supported by two things: LQKHULWDQFH and GHIDXOW

DFFRXQWDVVLJQPHQW.

The system DOZD\V processes document splitting in the sequence shown in the slide.

© SAP AG

TFIN52

3-6

'RFXPHQW6SOLWWLQJ&KDUDFWHULVWLFV IURP),

<RXILUVW KDYHWRGHILQHIRUZKLFK ), FKDUDFWHULVWLFVGRFXPHQWVSOLWWLQJ

LVSHUIRUPHG

7\SLFDOGRFXPHQWVSOLWWLQJFKDUDFWHULVWLFV

• %XVLQHVVDUHD

• 3URILWFHQWHU

• 6HJPHQW

,PSRUWDQW: User-defined entities can also be split

N KWQWD=>X:WAPBWO?TWYZR B[B\RUA<]Q-^/_F`_=QB`:WFGR OBGR QOba'KMFc<:?AP:WF[_WYPY :-d-<:WFO

)LHOG

=HUR%DO

PRCTR Profit Center

0DQG)OG

«

SEGMENT Segment

e)f[gih

SAP AG 2006

You define the document splitting characteristics in &XVWRPL]LQJunder )LQDQFLDO$FFRXQWLQJ 1HZ !*HQHUDO/HGJHU$FFRXQWLQJ 1HZ !%XVLQHVV7UDQVDFWLRQV!'RFXPHQW6SOLWWLQJ!'HILQH

'RFXPHQW6SOLWWLQJ&KDUDFWHULVWLFVIRU*HQHUDO/HGJHU$FFRXQWLQJ

y The system proposes logical document splitting characteristics based on the assigned scenarios.

y If you elect to use additional document splitting characteristics, you should use these

characteristics in at least one ledger.

You should always set the =HUR%DODQFHLQGLFDWRU if you plan to use the characteristics to create

financial statements. The balance of the involved entities is then always 0 for HYHU\SRVWLQJ,

ensuring "entity balancing".

The 0DQGDWRU\ILHOG has two meanings:

y Firstly, it is an H[WHQVLRQRIWKHILHOGVWDWXV for accounts in which the characteristics cannot be

"entered" during document entry, and/or for accounts that cannot be controlled using the field

status. Example: Vendor lines should always include a profit center or a segment.

y Secondly, it is a check as to whether a business process-equivalent business transaction variant

was selected (which determines whether a splitting rule can be found).

© SAP AG

TFIN52

3-7

$FWLYDWLQJ'RFXPHQW6SOLWWLQJDQG,QKHULWDQFH

'RFXPHQWVSOLWWLQJ LVILUVW DFWLYDWHGFOLHQWZLGH LQ&XVWRPL]LQJ

,QDIXUWKHUVWHS (in the dialog structure), \RXFDQXVHWKLVWUDQVDFWLRQWR

DFWLYDWHGHDFWLYDWHGRFXPHQWVSOLWWLQJIRUHDFKFRPSDQ\FRGH

Activate Document Splitting

Splitting

Method

Level of Detail

Inheritance

Standard A/C Assignment

Splitting: Like 0000000002 ….

Constant

e)f[gih

,QKHULWDQFH PHDQVWKDWZKHQ\RXFUHDWHDFXVWRPHULQYRLFHIURPDUHYHQXH

OLQHIRUH[DPSOHWKHHQWLWLHV(such as business area or segment) DUHSURMHFWHG

LQKHULWHG WRWKHFXVWRPHUDQGWD[OLQHVLQWKHJHQHUDOOHGJHUYLHZ

7KHVWDQGDUG$&DVVLJQPHQW FDQEHXVHGWRUHSODFHDOODFFRXQWDVVLJQPHQWV

WKDWFRXOGQRWEHGHULYHGIURPWKHSRVWLQJZLWKDFRQVWDQWYDOXH

SAP AG 2006

Document splitting is activated in Customizing for New General Ledger Accounting under)LQDQFLDO

$FFRXQWLQJ 1HZ !*HQHUDO/HGJHU$FFRXQWLQJ 1HZ !%XVLQHVV7UDQVDFWLRQV!'RFXPHQW

6SOLWWLQJ!$FWLYDWH'RFXPHQW6SOLWWLQJ

y Splitting method 0000000012 is the standard splitting method provided by SAP.

There is no reason why you should not activate LQKHULWDQFH when document splitting is active.

y If you were not to use inheritance, you would have to define "rules" for the business processes to

ensure that the DFFRXQWDVVLJQPHQWVDUHSURMHFWHG, for example, to achieve a zero balance in

order to post the document.

y Activation of inheritance is practically the first step to enable documents to be posted when

document splitting is active, without any other Customizing activities.

y Inheritance is performed online and at the line item level.

To use a default account assignment, you first have to define a constant, which you do in

&XVWRPL]LQJunder)LQDQFLDO$FFRXQWLQJ 1HZ !*HQHUDO/HGJHU$FFRXQWLQJ 1HZ !%XVLQHVV

7UDQVDFWLRQV!'RFXPHQW6SOLWWLQJ!(GLW&RQVWDQWVIRU1RQDVVLJQHG3URFHVVHV

© SAP AG

TFIN52

3-8

'RFXPHQW6SOLWWLQJ² $FWLYH6SOLW

0RGHOHGEXVLQHVVWUDQVDFWLRQ

x

9HQGRULQYRLFH with PXOWLSOHH[SHQVHOLQHLWHPV and different account assignments

(ZLWKLQSXWWD[RI)

Entry view:

=.

, *=+ $$i

" t#t$%'& (t'& 1000

-

uyv

11,000.00r EUR

VN

Advertising Costs

1,000.00 EUR

VN

417000

Purch. Services

9,000.00 EUR

VN

154000

Input Tax

1,000.00 EUR

VN

wllt -

u%v

1 31

1000

Miller Inc.

2 40

477000

3 40

4 40

General ledger view / Ledger 0L:

=.

, *=+ $$i

" t#t$%& (t'& 1000

wl

1 31

160000

Vendor Payable

1,100.00r EUR

VN

2 40

477000

Advertising Costs

1,000.00 EUR

VN

4 40

154000

Input Tax

100.00 EUR

VN

1 31

160000

Vendor Payable

9,900.00r EUR

VN

3 40

417000

Purch. Services

9,000.00 EUR

VN

4 40

154000

Input Tax

900.00 EUR

VN

-

* Ptl%t

n)p%pp

n)p%pp

-jlk osniotp

nIoypiq

-jlk]m

-

n)ptpp

osnIo%p

* Ptl%t

n)ptptp

-jlk n)ptptp

n)ptptp

nIopq

nIopq

nIopq

-jlkXm

Layout sorted by segment in ascending order

SAP AG 2006

The entities defined as document splitting characteristics are inherited in non-assigned posting items.

As you can see in the slide, the individual posting components always balance to zero.

In this rule-based split, the vendor and tax lines (items 1 and 4) in the general ledger view are split in

accordance with the expense lines / base item category ([SHQVH (items 2 and 3; expense accounts

477000 and 417000).

© SAP AG

TFIN52

3-9

6LPXODWLQJWKH*HQHUDO/HGJHU9LHZ

6LPXODWH'RFXPHQW (Entry View):

zW{ |}-~ tc\{

6LPXODWH'RFXPHQW (General Ledger View):

y~lyP-{ s~ {

From the menu,

choose 'RFXPHQW!

6LPXODWH*HQHUDO

/HGJHU

SAP AG 2006

)URP5HOHDVHP\6$3(53, you can VLPXODWHnot only the entry view but also the JHQHUDO

OHGJHUYLHZ before the posting.

In this way, you can analyze early any error that would lead to a termination (=> error message) of

the posting.

You can then use the expert mode to view the detailed data of document splitting.

© SAP AG

TFIN52

3-10

'RFXPHQW6SOLWWLQJ² 6SOLW/RJLF$FWLYH6SOLW

6SOLWWLQJORJLF EDVHGRQWKHH[DPSOH RIDYHQGRULQYRLFH

_POR QB:WF[>XOTWFSRUAPB':/dLRUAXWY _/Q-EM/KMY d

=>

=> /?=% ¡ Es¢/£P¤E¥Z§¦£=¨£E© ª/¨P¦« ª­¬¥U®P°¯? ¨Z£¥ y±

9TWYZR BBGRUA=<L:BI^/KWd

P==PVt

³

DOWRZA/:PO=O

_ APO/_=QPB\RZKMA

² F` ª/¦P¶·P´=¸/©ªtµ¹ ´P

DPOWRZA/:OO

² F`_APO/ _/QBGR KMAº!_FIR _A/B

¶V[¹

M¨£ª=¦£=©`¦

N KQ-D->:WAB

² ÅWT=:

ÇÉÈ

9!TWYZR BBGRUA/<¼»DWY :?½

¾-¿]À B:->ÁQP_=B:/<?KMFIR :PO«B`KÂ:­OWTYR B

³

¶·P¸-¹

³ Pª/¦P´P©

¶Äc%=i¹

£¥Z®Ã£/¦¦/¦§_P¨O£s¢:R B`:->ÁQ_B:-<WKMF`Å

¾/¿

Æ

¶U//Pt¹

¢ycªP±lP±

Ê aa`:QB`ORZA­BS^/:§_TWTWYZR Q=_PBGR KMA

ºw:A/dWKcFcd?KQ-D->X:AB

Expense

Expense

Tax

to vendor

SAP AG 2006

(without any reference to an explicit document splitting characteristic)

(entry view):

10

90

10

110

ºw:A=d?KcFMd?KWQ-D/>]:APB?OWTYR B

Expense

Tax

to vendor

Expense

Tax

to vendor

½

(general ledger view)

½

10

1

11

90

9

99

A VSOLWWLQJPHWKRG, in brief, is the WRWDORIDOOVSOLWWLQJUXOHVRIDOOEXVLQHVVWUDQVDFWLRQV. As such,

the splitting method defines how and under which circumstances document splitting is performed. In

detail, this means that each splitting method defines how each item category is handled in the

individual business transactions - for example, whether the account assignment of a customer item is

copied from the revenue items to a customer invoice. (=> See rule-based split)

y The EXVLQHVVWUDQVDFWLRQ is a general breakdown of actual business processes that SAP provides

and that is assigned a wide variety of item categories.

y The EXVLQHVVWUDQVDFWLRQYDULDQW is a specific version of the predefined business transaction

provided by SAP and the (technical) modeling of a real business process for document splitting.

y An LWHPFDWHJRU\ is a (technical) map of the posted line items. It describes the items that appear

within a document (business transaction). They are derived from, among other things, the account

types of the G/L accounts.

- In other words: The item category is the semantic description for the document split.

y An individual VSOLWWLQJUXOH defines which item categories can/will be split (=> LWHPFDWHJRULHVWR

EHVSOLW) and at the same time defines which base can be used (=> EDVHLWHPFDWHJRULHV).

© SAP AG

TFIN52

3-11

'RFXPHQW6SOLWWLQJ6SOLWWLQJ5XOH'HWDLO9LHZ

Ë;ê=ë Ö Ì·Ì\Ö Î=ì«ø°ÚÌ\ù×-Ï

ÑlÑÑÑlÑÑlÑPÑPÒyð

Ë;ê/ë Ö ÌÌ\Ö ÎìVíî=ÖZï%Ú ÑÑÑÑÑlÑlÑPÑÑlðÙñ·ò ×ë ë ×óõô'ö=êÕP×PÔlÌ·Ô×WÎ/ë Ö ÎPÚP÷

Þ?ßtàá â%ã%à%à°äåæâàæçè'á é/â

ÑlÝÑÑlÑ

ØcÚ=ÎÏ/×Ð?ÛZÎÜP×Ö ÕlÚ

Ó ÐÍ/ÎÔPÍÕÌ[Ö ×ÎÙØVÍ=Ð[Ö Í=ÎÌ

ÑlÑÑ=Ò

ËWÌÍ=ÎÏÍ=ÐÏ

û Ô Ô-Ö ìÎÚÏbÛ ÌÚ=üþý;ÍÌÚPì/×Ð[Ö ÚÔ

Ë;ê=ë Ö ÌÌ[Ö Îì@ú;ö=ë Ú

Account Determination Zero Balance Posting

Leading Item Category

Û ÌÚPüþý;ÍÌÚì/×Ð[Ö ÚÔÌ×bÿPÚEËÉê=ë Ö Ì

000

03000

Standard Account for Zero Balance

Vendor

ÑlÝlÑlÑÑ

ØcÚ=ÎÏ/×Ð

ÑÒyÑÑ

ØcÍ=ë ölÚPô û Ï-Ï/ÚlÏ Ó Í

Splitting based on base items

Base item with VAT indicator of the item to be split

ÍsÔÚÛ ÌÚü ý ÍsÌÚlì×WÐ[Ö ÚsÔ

ÑÒ%ÑlÑÑ

Í=ë ÍÎPÕÚÙÔ/ùÚlÚlÌ/ÍPÕÕ×Wö=ÎPÌ

ðlÑÑlÑÑ

-êlÚ=ÎÔlÚ

SAP AG 2006

The view shown above is displayed when you choose the SULQWHULFRQ for an explicit splitting rule:

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ !*HQHUDO/HGJHU$FFRXQWLQJ 1HZ !%XVLQHVV

7UDQVDFWLRQV!'RFXPHQW6SOLWWLQJ!([WHQGHG'RFXPHQW6SOLWWLQJ!'HILQH6SOLWWLQJ5XOHV

y You can also call the splitting rules with WUDQVDFWLRQFRGH*63B5'

© SAP AG

TFIN52

3-12

'RFXPHQW6LPXODWLRQ² ([SHUW0RGH,

6LPXODWH'RFXPHQW (General Ledger View):

t=t'%~slsst{ s~ s{ l

The H[SHUWPRGH provides LQIRUPDWLRQRQ all essential GRFXPHQWVSOLWWLQJSDUDPHWHUV (such

as splitting method or business transaction) and GHVFULEHV KRZWKHVSOLWDPRXQWVDUH

DFKLHYHG.

([DPSOH How does the system calculate the amount of SD\DEOHV (=> AP domestic) IRU SURILW

See next

FHQWHU (=> ¼)?

slide

SAP AG 2006

© SAP AG

TFIN52

3-13

'RFXPHQW6LPXODWLRQ² ([SHUW0RGH,,

&XVWRPL]LQJ

3DUDPHWHURI

'RFXPHQW

6SOLW

ÑÑ

= Base Line 0….04 / Expenseline (=>

ÑÑÑ

) Base Line 0…. 05 / Tax out of Base Line 0….04 (=>

PÑÑ

)

SAP AG 2006

© SAP AG

TFIN52

3-14

'RFXPHQW6SOLWWLQJ² )ROORZ8S3URFHVV,

0RGHOHGEXVLQHVVWUDQVDFWLRQ

x

The YHQGRULQYRLFH (see Example Figures II) LVQRZSDLG

It is paid with a retention amount of FDVKGLVFRXQW – amount paid: .

:KDWWRZDWFKIRU

The selected GRFXPHQWVSOLWWLQJFKDUDFWHULVWLFV now have to be LQKHULWHGWRWKH

SRVWLQJOLQHVRIWKHSD\PHQWGRFXPHQW as well.

The payment document is split on the basis of GRFXPHQWVSOLWWLQJUXOHV of the

original expense posting / vendor invoice.

Entry view:

&&G , 3. $FFW

'HVFULSWLRQ

1000 1 50 113100 Bank

$PRXQW

&XUU 7[ &&WU

10,670.00 EUR

2 50 276000 Discount rec.

30.00 EUR

VN

3 50 276000 Discount rec.

270.00 EUR

VN

4 25 1000

Miller Inc.

11,000.00 EUR

5 50 154000 Input Tax

30.00 EUR

3&

6HJPHQW

6(*$

6(*%

VN

See overleaf for general ledger view

SAP AG 2006

For more information on "cash discount received" lines, see the ,QWHJUDWLRQ unit, topic 2QOLQH

'LVWULEXWLRQRI)ROORZ8S&RVWV.

© SAP AG

TFIN52

3-15

'RFXPHQW6SOLWWLQJ² )ROORZ8S3URFHVV,,

General ledger view / Ledger 0L:

&&G , 3. $FFW

'HVFULSWLRQ

1000 1 50 113100 Bank

2 50 276000 Discount rec.

4 25 160000 Vendor Payable

5 50 154000 Input Tax

$PRXQW &XUU 7[ &&WU

1,067.00 EUR

30.00 EUR

1,100.00 EUR

3.00 EUR

(85

1000 1 50 113100 Bank

3 50 276000 Discount rec.

4 25 160000 Vendor Payable

5 50 154000 Input Tax

VN

VN

(85

SEG A

VN

VN

9,900.00 EUR

27.00 EUR

6HJPHQW

6(*$

SEG B

9,603.00 EUR

270.00 EUR

3&

6(*%

Layout sorted by segment in ascending order and with segment subtotals

SAP AG 2006

In the line item display, the payment document and original invoice document appear as cleared

items, as in prior releases.

The GRFXPHQWVSOLWWLQJUXOHV for splitting the payment of a vendor invoice are provided in the

VWDQGDUG SAP system.

y The "payables lines" (=> account 160000) are created through passive document splitting.

If we assume that the invoice were not to be paid in full and a UHVLGXDOLWHP of ¼ZHUHWR

remain, this would create a new vendor line item; this residual item would in turn be split among the

original expenses in the general ledger view for invoice entry.

© SAP AG

TFIN52

3-16

'RFXPHQW6SOLWWLQJ ,QKHULWDQFH

0RGHOHGEXVLQHVVWUDQVDFWLRQ

x

*/DFFRXQWSRVWLQJV – Expense, taxes to petty cash / document type 6$

6\VWHPFRQILJXUDWLRQ

x

Scenarios 3URILW&HQWHU8SGDWH and 6HJPHQWDWLRQ are assigned

x

Document splitting activated – Doc. splitting chars 3URILW&HQWHU and 6HJPHQW are defined

Entry view:

&&G

1000

,

3. $FFW

'HVFULSWLRQ

$PRXQW

&XUU

1 40

476000

Office materials

50.00 EUR

2 50

100000

Petty Cash

58.00- EUR

3 40

154000

Input Tax

8.00 EUR

,QKHULWDQFHLQGLFDWRUQRW set!

General ledger view / Ledger 0L:

,PSRUWDQW

Missing columns

are identical to

the entry view.

$PRXQW &&WU

50.00 3&

6HJPHQW

6(*$

58.008.00

7[

3&

&&WU

VN VN

6HJPHQW

6(*$

,QKHULWDQFHLQGLFDWRUVHW

General ledger view / Ledger 0L:

,PSRUWDQW

Missing columns

are identical to

the entry view.

$PRXQW &&WU

50.00 58.008.00

3&

6HJPHQW

6(*$

6(*$

6(*$

Balancing field "Segment" is not filled in line item 002

SAP AG 2006

The ,QKHULWDQFH indicator ensures that the corresponding account assignment objects are projected to

the petty cash and tax line items, even without corresponding splitting rules.

This indicator also ensures a zero balance setting for entities selected for document splitting, without

requiring you to define any other system settings.

© SAP AG

TFIN52

3-17

'RFXPHQW6SOLWWLQJ² &UHDWLRQRI=HUR%DODQFH

0RGHOHGEXVLQHVVWUDQVDFWLRQ

x

*/DFFRXQWSRVWLQJ– Transfer posting within an account

6\VWHPFRQILJXUDWLRQ

x

Scenarios 3URILW&HQWHU8SGDWH and 6HJPHQWDWLRQ are assigned

x

Document splitting activated – Doc splitting chars 3URILW&HQWHU and 6HJPHQW are defined

Entry view:

&&G , 3. $FFW

'HVFULSWLRQ

$PRXQW

&XUU 7[ &&WU

1000 1 40 113100 Bank

10,000.00 EUR

2 50 113100 Bank

10,000.00 EUR

General ledger view / Ledger 0L:

&&G , 3. $FFW

'HVFULSWLRQ

1000 1 40 113100 Bank

$PRXQW

&XUU 7[ &&WU

10,000.00 EUR

3 50 194500 Clear. Seg.

10,000.00 EUR

2 50 113100 Bank

10,000.00 EUR

4 40 194500 Clear. Seg.

10,000.00 EUR

3&

6HJPHQW

6(*$

6(*%

3&

6HJPHQW

6(*$

6(*%

Layout sorted by segment in ascending order

SAP AG 2006

Reason for reposting: A vendor invoice was assigned to an incorrect segment and paid with this

incorrect segment.

y Both the expense and the vendor item obviously need to be corrected.

Zero balance creation is only useful and necessary if you want to create a complete balance sheet for

a specific characteristic. The above case is an example of clearing line formation.

© SAP AG

TFIN52

3-18

'RFXPHQW6SOLWWLQJ² 0RGHOLQJ

0RGHOHGEXVLQHVVWUDQVDFWLRQ

x

*/DFFRXQWSRVWLQJV – Multiple expense line items, taxes to petty cash

6\VWHPFRQILJXUDWLRQ

x

Scenarios 3URILW&HQWHU8SGDWH and 6HJPHQWDWLRQ are assigned

x

Document splitting activated – Doc. splitting chars 3URILW&HQWHU and 6HJPHQW are defined

Entry view:

&&G , 3. $FFW

'HVFULSWLRQ

1000 1 40 476000 Office materials

$PRXQW &XUU 7[ &&WU

50.00 EUR VN 2 40 476000 Office materials

100.00 EUR VN 3 50 100000 Petty Cash

165.00- EUR

4 40 154000 Input Tax

3&

6HJPHQW

6(*$

6(*%

15.00 EUR VN

Balancing field "Segment" is not filled in line item 003

FB50

7KHVWDQGDUGVSOLWWLQJUXOHVGRQRWFRYHUWKLVW\SHRIEXVLQHVVWUDQVDFWLRQ

7RSRVWWKHWUDQVDFWLRQ\RXKDYHWRHQKDQFHWKHH[LVWLQJVSOLWWLQJUXOHV

SAP AG 2006

What are the reasons for the error message during the error message?

y No base item category is assigned for item category &DVK$FFRXQW (nor for item category 9DOXH

$GGHG7D[) in the corresponding combination of business transaction and business transaction

variant that is assigned to the respective document type.

y Moreover, “inheritance" of the segment is not possible because it is not unique.

If you have to modify a rule, you should create your own splitting method and copy the assigned

rules from the standard configuration.

© SAP AG

TFIN52

3-19

'RFXPHQW6SOLWWLQJ 6XPPDU\

<RXFDQQRZ

z ([SODLQWKHPRWLYDWLRQEHKLQGGRFXPHQWVSOLWWLQJDQG

KRZLWZRUNV

z $FWLYDWHDQGXVHGRFXPHQWVSOLWWLQJ

z 3HUIRUPH[DPSOHSRVWLQJVZLWKWKHRQOLQHVSOLW

GRFXPHQWVSOLWWLQJ IXQFWLRQ

SAP AG 2006

© SAP AG

TFIN52

3-20

([HUFLVHV

8QLW'RFXPHQW6SOLWWLQJ

7RSLF3RVWLQJVZLWK2QOLQH'RFXPHQW6SOLWWLQJ

At the conclusion of these exercises, you will be able to

• Understand and configure document splitting. You will also be able to

enter and analyze split documents.

3-1

([HUFLVHVIRUFRQILJXULQJDQGGHPRQVWUDWLQJGRFXPHQWVSOLWWLQJ

3-1-1

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

3OHDVHFKHFN whether at least the 6HJPHQWVSOLWWLQJFKDUDFWHULVWLF is

defined! The =HUR%DODQFHand 0DQGDWRU\)LHOG indicators have to be set

for the segment. If this is not the case, please notify your course instructor.

3-1-2 When should you set the “zero balance” indicator for the splitting

characteristics in general ledger accounting?

3-1-3 Does it make sense to also set the “mandatory indicator” for a balancing

entity?

3-1-4 $FWLYDWHGRFXPHQWVSOLWWLQJIRUyour FRPSDQ\FRGH $$. $VDOUHDG\

FRQILJXUHG, use VSOLWWLQJPHWKRG (splitting: like 0000000002

[follow-up costs online]) for your company code, and make sure

LQKHULWDQFHLVDFWLYDWHG. You do not need to enter a constant for a default

account assignment.

3-1-5 Now create a YHQGRULQYRLFH for the VSDUHSDUWV you purchased ZLWKWKH

IROORZLQJGDWD:

&RPSDQ\&RGH: AA##

9HQGRU: ,QYRLFHDQGSRVWLQJGDWH: Today

$PRXQW: ¼

&DOFXODWHWD[LQGLFDWRU: 6HW

7D[&RGH: 91

7H[W Spare parts purchase group ##

*/$FFRXQW: $PRXQWLQGRFXPHQWFXUUHQF\: or just “*”

&25HOHYDQW$FFRXQW$VVLJQPHQW: Cost center 7)$

Simulate and VDYH the posting document!

© SAP AG

TFIN52

3-21

3-1-6 'LVSOD\WKHGRFXPHQW. You can see in the entry view that your segment

6(* was derived. Now switch to the JHQHUDOOHGJHUYLHZ: The VHJPHQW

should now be LQKHULWHG in the payables and tax line items.

,PSRUWDQW: If your instructor has (also) defined the profit center

(and/or business area) as a splitting characteristic, these entities will

also be inherited in the payables and tax line items.

3-1-7 $FWLYHVSOLW You will now HQWHUDQDGGLWLRQDOVSDUHSDUWVLQYRLFH for

YHQGRU. In contrast to the previous exercise, VRPHRIWKHVSDUHSDUWV

should now be assigned to your defined VHJPHQW6(*, ZLWKWKHUHVW

DVVLJQHGWRVHJPHQW6(*$!

3-1-7-1To make sure that the second part of the posted amount is really

assigned to segment 6(*$, FKHFNthe settings for FRVWFHQWHU 7)%

before you post: :KLFKSURILWFHQWHULVGHILQHGLQFRVWFHQWHU7)%"

3-1-7-2Which segment is defined in the corresponding profit center?

Hopefully segment 6(*$ -

The LQYRLFHWRWDOshould amount to ¼QHW. 6SOLWthe costs for the

spare parts KRZHYHU\RXOLNH, as long as you assign VRPHSDUWV to FRVW

FHQWHU7)$ DQGWKHRWKHUVto FRVWFHQWHU7)%.

You can use DFFRXQWor as the H[SHQVHDFFRXQW. Use the

data and control parameters from the previous exercise.

3-1-8 'LVSOD\WKHGRFXPHQW. You can already see in the entry view that the

expense has been split – of course in the ratio you defined yourself in the

posting. 1RZVZLWFKWRWKHJHQHUDOOHGJHUYLHZ You should now see 6

line items instead of the 4 posting line items.

3-1-9 To instantly see whether a zero balance has been reached for each segment,

FKDQJHWKHOD\RXW of the document: Sort by segment and calculate a

subtotal for the 6HJPHQW column.

3-1-10 You can VDYH this OD\RXW as user-specific layout /.

3-1-11 To demonstrate that the split is really only performed in the general ledger,

and not in the subledgers, FDOODYHQGRUOLQHLWHPOLVWfor your vendor

.

You should see 3 open items. The last recorded document is displayed as

RQH open item in the amount of EUR 11,600.00. To show the split by

segment, you have to display the document from within the Open item list.

© SAP AG

TFIN52

3-22

6SOLWWLQJ6ROXWLRQV

8QLW'RFXPHQW6SOLWWLQJ

7RSLF3RVWLQJVZLWK2QOLQH'RFXPHQW6SOLWWLQJ

3-1

([HUFLVHVIRUFRQILJXULQJDQGGHPRQVWUDWLQJGRFXPHQWVSOLWWLQJ

3-1-1

&RQWUROH[HUFLVH±3OHDVHGRQRWFKDQJHWKHV\VWHP

FRQILJXUDWLRQ

3OHDVHFKHFN whether at least the 6HJPHQWVSOLWWLQJFKDUDFWHULVWLF is

defined! The =HUR%DODQFHand 0DQGDWRU\)LHOG indicators have to be set

for the segment. If this is not the case, please notify your course instructor.

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o*HQHUDO/HGJHU$FFRXQWLQJ 1HZ o%XVLQHVV7UDQVDFWLRQVo'RFXPHQW6SOLWWLQJo'HILQH'RFXPHQW6SOLWWLQJ

&KDUDFWHULVWLFVIRU*HQHUDO/HGJHU$FFRXQWLQJ

3-1-2 When should you set the “ zero balance” indicator for the splitting

characteristics in general ledger accounting?

<RXKDYHWRVHWWKLVLQGLFDWRUZKHQHYHUWKHFKDUDFWHULVWLFLQYROYHGLVD

EDODQFLQJHQWLW\6HWWLQJWKH³]HUREDODQFH´LQGLFDWRUHQVXUHVWKDWWKH

FKDUDFWHULVWLFZLOOKDYHD]HUREDODQFHLQWKHGRFXPHQW

6SHFLILFDOO\,IWKHLQGLFDWRULVVHWWKHV\VWHPFKHFNVZKHWKHUWKHEDODQFHRI

WKHFKDUDFWHULVWLFLV]HURGXULQJSRVWLQJ,IWKLVLVQRWWKHFDVHWKHV\VWHP

FUHDWHVDGGLWLRQDOFOHDULQJOLQHLWHPVLQWKHGRFXPHQWWRDFKLHYHWKH]HUR

EDODQFH

3-1-3 Does it make sense to also set the “ mandatory indicator” for a balancing

entity?

<HVLQWKLVFDVHWKHV\VWHPQRWRQO\JHQHUDWHVWKHFOHDULQJOLQHLWHPVEXWDOVR

FKHFNVZKHWKHUDOOWKHOLQHLWHPVLQWKHSRVWLQJDUHDVVLJQHGWRWKHDSSURSULDWH

FKDUDFWHULVWLFDIWHUWKHVSOLW

3-1-4 $FWLYDWHGRFXPHQWVSOLWWLQJIRUyour FRPSDQ\FRGH $$. $VDOUHDG\

FRQILJXUHG, use VSOLWWLQJPHWKRG (splitting: like 0000000002

[follow-up costs online]) for your company code, and make sure

LQKHULWDQFHLVDFWLYDWHG. You do not need to enter a constant for a default

account assignment.

&XVWRPL]LQJ)LQDQFLDO$FFRXQWLQJ 1HZ o*HQHUDO/HGJHU$FFRXQWLQJ 1HZ o%XVLQHVV7UDQVDFWLRQVo'RFXPHQW6SOLWWLQJo$FWLYDWH'RFXPHQW6SOLWWLQJ

7KHVHWWLQJVLQWKHILUVWVFUHHQVKRXOGDOUHDG\EHFRUUHFW

6ZLWFKWR'HDFWLYDWLRQSHU&RPSDQ\&RGHLQWKHGLDORJVWUXFWXUH)LQGWKHOLQH

ZLWK\RXUFRPSDQ\FRGH$$DQGGHOHWHWKHLQDFWLYHLQGLFDWRU

© SAP AG

TFIN52

3-23

3-1-5 Now create a YHQGRULQYRLFH for the VSDUHSDUWV you purchased ZLWKWKH

IROORZLQJGDWD:

&RPSDQ\&RGH: AA##

9HQGRU: ,QYRLFHDQGSRVWLQJGDWH: 7RGD\

$PRXQW: ¼

&DOFXODWHWD[LQGLFDWRU: 6HW

7D[&RGH: 91

7H[W Spare parts purchase group ##

*/$FFRXQW: $PRXQWLQGRFXPHQWFXUUHQF\: or just “ *”

&25HOHYDQW$FFRXQW$VVLJQPHQW: Cost center 7)$

Simulate and VDYH the posting document!

6$3(DV\$FFHVV0HQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo9HQGRUVo

'RFXPHQW(QWU\o,QYRLFH

(QWHUWKHUHTXLUHGGDWDDVGHVFULEHGLQWKHH[HUFLVHWH[W

3-1-6 'LVSOD\WKHGRFXPHQW. …

5HPDLQLQWKH(QWHU9HQGRU,QYRLFHVFUHHQDQGFKRRVHPHQXSDWK'RFXPHQWo

'LVSOD\

... You can see in the entry view that your segment 6(* was derived.

Now switch to the JHQHUDOOHGJHUYLHZ: The VHJPHQW should now be

LQKHULWHG in the payables and tax line items.

,PSRUWDQW: If your instructor has (also) defined the profit center

(and/or business area) as a splitting characteristic, these entities will

also be inherited in the payables and tax line items.

3-1-7 $FWLYHVSOLW You will now HQWHUDQDGGLWLRQDOVSDUHSDUWVLQYRLFH for

YHQGRU. In contrast to the previous exercise, VRPHRIWKHVSDUHSDUWV

should now be assigned to your defined VHJPHQW6(*, ZLWKWKHUHVW

DVVLJQHGWRVHJPHQW6(*$!

3-1-7-1 To make sure that the second part of the posted amount is really

assigned to segment 6(*$, FKHFNthe settings for FRVWFHQWHU 7

)% before you post: :KLFKSURILWFHQWHULVGHILQHGLQFRVW

FHQWHU7)%"

6$3(DV\$FFHVVPHQXo$FFRXQWLQJo&RQWUROOLQJo&RVW&HQWHU$FFRXQWLQJ

o0DVWHU'DWDo&RVW&HQWHUo,QGLYLGXDO3URFHVVLQJo'LVSOD\

3URILWFHQWHULVGHILQHG

© SAP AG

TFIN52

3-24

3-1-7-2 :KLFKVHJPHQWLVGHILQHGLQWKHFRUUHVSRQGLQJSURILWFHQWHU"

Hopefully segment 6(*$ -

6$3(DV\$FFHVVPHQXo$FFRXQWLQJo&RQWUROOLQJo3URILW&HQWHU

$FFRXQWLQJo0DVWHU'DWDo3URILW&HQWHUo,QGLYLGXDO3URFHVVLQJo'LVSOD\

(QWHUSURILWFHQWHUDQGGLVSOD\WKHPDVWHUGDWD,QSXWILHOG6HJPHQW

DSSHDUVLQWKHORJLFDOILHOGJURXS%DVLF'DWD

The LQYRLFHWRWDOshould amount to ¼QHW. 6SOLWthe costs for the

spare parts KRZHYHU\RXOLNH, as long as you assign VRPHSDUWV to FRVW

FHQWHU7)$ DQGWKHRWKHUVto FRVWFHQWHU7)%.

You can use DFFRXQWor as the H[SHQVHDFFRXQW. Use the

data and control parameters from the previous exercise.

6$3(DV\$FFHVV0HQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo9HQGRUVo

'RFXPHQW(QWU\o,QYRLFH

(QWHUWKHUHTXLUHGGDWDDVGHVFULEHGLQWKHH[HUFLVHWH[W

3-1-8 'LVSOD\WKHGRFXPHQW. …

5HPDLQLQWKH(QWHU9HQGRU,QYRLFHVFUHHQDQGFKRRVHPHQXSDWK'RFXPHQWo

'LVSOD\

... You can already see in the entry view that the expense has been split – of

course in the ratio you defined yourself in the posting. 1RZVZLWFKWRWKH

JHQHUDOOHGJHUYLHZ You should now see 6 line items instead of the 4

posting line items.

3-1-9 To instantly see whether a zero balance has been reached for each segment,

FKDQJHWKHOD\RXW of the document: 6RUWE\VHJPHQWDQGFDOFXODWHD

VXEWRWDOIRUWKH6HJPHQWFROXPQ

6HOHFWWKH6HJPHQWFROXPQLQWKHGLVSOD\GRFXPHQWDQGSUHVVWKH6RUW

$VFHQGLQJEXWWRQ6HOHFWWKH$PRXQWFROXPQDQGSUHVVWKH7RWDOVEXWWRQ7KHQ

VHOHFWWKH6HJPHQWFROXPQDJDLQDQGSUHVVWKH6XEWRWDOEXWWRQ

3-1-10 You can VDYH this OD\RXW as user-specific layout /.

&KRRVH6DYH/D\RXWIURPWKHGURSGRZQOLVWXQGHUWKH6HOHFW/D\RXW

SXVKEXWWRQ

3-1-11 To demonstrate that the split is really only performed in the general ledger,

and not in the subledgers, FDOODYHQGRUOLQHLWHPOLVWfor your vendor

. …

6$3(DV\$FFHVV0HQXo$FFRXQWLQJo)LQDQFLDO$FFRXQWLQJo9HQGRUVo

$FFRXQWo'LVSOD\&KDQJH/LQH,WHPV

(QWHUYHQGRUDQGFRPSDQ\FRGH$$WKHQVWDUWWKHVHOHFWLRQRI\RXU

RSHQLWHPVRSHQDVRIWRGD\

... You should see 3 open items. The last recorded document is displayed as RQH

open item in the amount of EUR 11,600.00. To show the split by segment, you have

to display the document from within the Open item list.

'RXEOHFOLFNWKHGLVSOD\HGGRFXPHQWQXPEHU

&KRRVHPHQXSDWK*RWRo'RFXPHQW2YHUYLHZ

© SAP AG

TFIN52

3-25

&RXUVH2YHUYLHZ ,QWHJUDWLRQ

,QWURGXFWLRQ

,QWURGXFWLRQ

3HULRGLF3URFHVVLQJ

3HULRGLF3URFHVVLQJ

/HGJHU'HILQLWLRQ

/HGJHU'HILQLWLRQ

5HSRUWLQJ

5HSRUWLQJ

'RFXPHQW6SOLWWLQJ

'RFXPHQW6SOLWWLQJ

,QWHJUDWLRQ

,QWHJUDWLRQ

SAP AG 2003

© SAP AG

TFIN52

4-1

,QWHJUDWLRQ

&RQWHQWV

z ,QWHJUDWLRQZLWK),6XEOHGJHUV

z ,QWHJUDWLRQZLWK&RQWUROOLQJ

SAP AG 2003

© SAP AG

TFIN52

4-2

,QWHJUDWLRQ 2EMHFWLYHV

$IWHUFRPSOHWLQJWKLVXQLW\RXZLOOEHDEOHWR

z (QWHUSRVWLQJVLQ$FFRXQWV3D\DEOHDQG$FFRXQWV

5HFHLYDEOH

z (QWHUSRVWFDSLWDOL]DWLRQRIFDVKGLVFRXQWVIRUDVVHWV

LQUHDOWLPH

z 8QGHUVWDQGDQGFRQILJXUHWKHUHDOWLPH LQWHJUDWLRQ

IURP&2WR),

SAP AG 2003

© SAP AG

TFIN52

4-3

7KH1HZ*HQHUDO/HGJHU± ,QWHJUDWLRQ

,QWHJUDWLRQZLWKWKHIROORZLQJFRPSRQHQWVLVUHOHYDQW

,QWHJUDWLRQZLWK),6XEOHGJHUV

• ),$3 $FFRXQWV3D\DEOH

• Covered in detail in the Document Splitting unit

• ),$5 $FFRXQWV5HFHLYDEOH

• ),$$ $VVHW$FFRXQWLQJ

,QWHJUDWLRQZLWK&RQWUROOLQJ

• &2!),UHDOWLPHLQWHJUDWLRQ

SAP AG 2003

© SAP AG

TFIN52

4-4

7KH1HZ*HQHUDO/HGJHU± ,QWHJUDWLRQ

,QWHJUDWLRQZLWKWKHIROORZLQJFRPSRQHQWVLVUHOHYDQW

,QWHJUDWLRQZLWK),6XEOHGJHUV

• ),$3 $FFRXQWV3D\DEOH

• Covered in detail in the Document Splitting unit

• ),$5 $FFRXQWV5HFHLYDEOH

• ),$$ $VVHW$FFRXQWLQJ

,QWHJUDWLRQZLWK&RQWUROOLQJ

• &2!),UHDOWLPHLQWHJUDWLRQ

SAP AG 2003

© SAP AG

TFIN52

4-5

1HZ*HQHUDO/HGJHU$FFRXQWLQJ²

,QWHJUDWLRQZLWK),$5

&XVWRPHUGRFXPHQWV DUHVXEMHFWWRWKHVDPHUXOHVDVLQ

DFFRXQWVSD\DEOH

7KHDFFRXQWDVVLJQPHQWREMHFWV LQWKHUHYHQXHOLQHLWHPDUHLQKHULWHG WR

WKHFXVWRPHUDQGWD[LWHPVLQWKHLQYRLFH You can see this in the

general ledger view of the document display.

7KHFXVWRPHUDQGWD[OLQHLWHPVRIDFXVWRPHULQYRLFH ZLWKGLIIHUHQW

DFFRXQWDVVLJQPHQWREMHFWVLQWKHUHYHQXHOLQHLWHPVDUHVSOLW RQOLQH

LQSURSRUWLRQWRWKHDPRXQWVLQWKHUHYHQXHOLQHLWHPV You can also

see this in the general ledger view of the document display.

7KHFXVWRPHUOLQHLWHPOLVW VWLOORQO\RXWSXWVRQHLWHP SHUGRFXPHQW

:KHQSD\PHQWVDUHUHFHLYHGWKHEDQNDQGDQ\FDVKGLVFRXQWLWHPVDUH

VSOLW DQDORJRXVWRWKHUHYHQXHOLQHVLQWKHRULJLQDOFXVWRPHULQYRLFH ±

.H\ZRUG IROORZXSSURFHVV

SAP AG 2006

You can see the inheritance of customer items clearly in transaction )% (=> Enter Customer

Invoice).