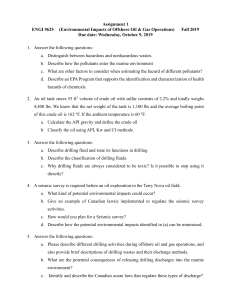

PACIFIC RIM DRILLING ready 5500 NNovember/December No ovveemb emb mber er//DDeeccem embbeer er 2007 200077 20 D R I L L I N G CONTRACTOR PACIFIC RIM DRILLING to take the world stage To meet soaring energy demands at home, China is working harder than ever to reach out to the global drilling community for new technologies, new equipment, new reserves. Here’s a glimpse into CNPC’s projects, ambitions, challenges and more. By Linda Hsieh, associate editor D R I L L I N G CONTRACTOR November/December NNo oveemb mber er//DDDec eecceemmbe ber 2007 2007 20 07 5511 PACIFIC RIM DRILLING IN THE CENTER of Daqing, a city of more than two million people in northeast China, the sprawling Iron Man Memorial Hall stands in dedication to Wang Jinxi, a 1960s oil worker who earned the nickname of “iron man” with his devotion to the development of Daqing Oilfield. He is said to have jumped into a pool of drilling mud to keep it from freezing — temperatures in Daqing can drop below -30°C in wintertime. CNPC production statistics In first half of 2007, CNPC’s oil and gas output totaled 553 million bbl of oil equivalent, a 3.7% increase from the same period in 2006. It produced 420 million bbl of crude oil, a 0.1% increase from 2006. It also produced 798 billion cu ft of marketable natural gas, a 16.5% increase from 2006. It is this “iron man” spirit that still motivates China’s petroleum workers to this day, according to the Daqing Drilling & Exploration Group of the Daqing Petroleum Administrative Bureau. The group is owned by China National Petroleum Corp (CNPC), the country’s largest oil and gas company. The Chinese petroleum industry, including industry leader CNPC, has been strongly pushing technological advances through both internal research and cooperation with foreign companies. Zheng Yi, vice chief engineer and secretary general for CNPC’s engineering technology & market department, emphasized that the company is eager to learn about new drilling techniques and equipment from around the world. CNPC knows they will be critical if they are to maximize remaining reserves on their 13 oilfields, many of which are mature. The Daqing Drilling & Exploration Group (DDEG), a massive entity within itself, owns four drilling companies and 121 drilling rigs, plus additional workover rigs, said Liu Fu, DDEG assistant president and general manager. While production at Daqing has been declining, DDEG said it is hopeful that new technologies, such as horizontal/ directional drilling and underbalanced operations, can make a difference. At the beginning of 2006, CNPC called for full deployment of horizontal drilling. By the end of the year, 522 horizontal wells had been completed. On the Daqing field alone, more than 50 horizontal wells were drilled in low-permeability, low-productivity areas. As of September 2007, the ratio of vertical to directional wells drilled had reached 1 to 0.83, Mr Liu said. More than 10,000 wells were drilled in 2006, and this year CNPC plans to drill 12,000. By September, more than 700 horizontal wells and 140 underbalanced wells had been drilled for the year — numbers that reflect CNPC mandates in 2006 to begin large-scale uses of these advanced drilling techniques to limit formation damage and improve production rates. The most active fields nowadays, in terms of rig numbers, are the Sichuan DDEG has reported average daily output from horizontal wells to be 2-5 times higher than that of vertical wells. Other improvements reported include faster drilling time, lower costs and reduced pollution risks. Underbalanced techniques have been significantly beneficial for parts of Daqing’s low-permeability formations as well, Mr Liu said. Total Footage Drilled Outside China Up 37% on average every year since 2001 1,700 1800 1600 Internal reorganization in 2007 means there is no steady number of drilling companies at CNPC at this time, Mr Zheng said. But the number of its rig fleet provides a taste for the company’s size: As of September 2007, it owned 1,035 drilling rigs, mostly land rigs with a few shallow offshore units, plus 2,000 workover rigs. Mr Zheng said 22 million meters (72.18 million ft) were drilled in 2006. Although he expects that number to stay about even for 2007, he noted that 22 million meters “is double what we drilled just five years ago, only about 11 million meters (36.1 million ft).” 1400 Footage (1000m) CNPC DRILLING November/December 2007 ‘DOUBLE CELEBRATION’ For 2006, its crude oil output was 830.7 million bbl, a 0.9% increase from 2005. Marketable natural gas output was 1.37 billion cu ft, a 22.5% increase from 2005. Total output of crude oil and natural gas was 1.06 billion bbl of oil equivalent. The discovery of Daqing Oilfield in 1959 was celebrated as step toward energy self-sufficiency at the time — Daqing signifies a “double celebration” in Chinese. However, China’s demand for oil and natural gas in recent years has soared beyond 1960s imagination. The country now stands as the world’s second-largest consumer of oil, and it understands all too well that energy is critically important to its expanding economy. 52 and Changqing fields in the Southwest and the Xinjiang field in the Northwest, Mr Zheng said. But the king of CNPC fields and the biggest-producing field in China is still Daqing, home to the “iron man” spirit. 1,275 1200 929 1000 723 800 600 400 541 355 200 0 2001 2002 2003 2004 2005 2006 Year Great Wall Drilling Company, CNPC’s international arm, has expanded rapidly outside of China since 2001. The chart above shows that GWDC’s footage drilled overseas has increased from 355,000 m in 2001 to 1.7 million m last year. D R I L L I N G CONTRACTOR PACIFIC RIM DRILLING Zou Yeh, chief engineer for Daqing Drilling, and Zhang Shurui, senior engineer for DDEG’s No. 1 Drilling Company, both cited deep gas wells as a big concern — especially since these wells are often drilled in the volcanic formations common to the area. These wells average more than 4,000 m (13,100 ft) deep, they said, with the deepest at 4,900 m (16,000 ft). About 60 of these deep wells are drilled per year, Mr Zhang said, and drilling speeds and wellbore collapses can be headaches. Underbalanced drilling has helped to a degree, but Mr Zhang and Mr Zou agreed that geosteering equipment would be extremely helpful. High costs, however, still keep things like rotary steerables out of their reach. es in onshore drilling and operates more than 180 rigs in 26 countries (including four joint ventures), ranking it among the biggest land drilling contractors in the world. Most of GWDC’s fleet were manufactured by CNPC’s own factories, said Great Wall vice president Du Jun. A big portion of them are 1,500-hp to 2,000-hp rigs with depth capabilities ranging from 2,000 m to 9,000 m (about 6,600 ft to 29,000 ft). Mr Du noted that some clients have requested 3,000-hp rigs, but GWDC determined there was not sufficient work to justify the cost of acquiring such a rig at this time. Still, GWDC has kept busy. Since a major reorganization in 2001, the company’s total footage drilled outside of China has increased by an average of 37% every year, from 355,000 m (1.16 million ft) in 2001 to 1.7 million m (5.58 million ft) in 2006. A total of 35 Great Wall rigs are working in Kazakhstan, its biggest market. Other major operating areas include Sudan and Venezuela. Case in point: In September, DRILLING CONTRACTOR toured No. 1 Drilling Company’s Rig 70163 on the Daqing Oilfield. The drilling team, which had drilled three other deep wells since 2005, was three months and 3,600 m into a 4,400-m MD/3,800-m TVD gas exploration well using downhole motors and MWD. With no top drive or rotary steerable equipment, drilling through the volcanic rock has been tough going. Average penetration stood at about 1 m (3.28 ft) per hour in September. The project would be going much faster if geosteering tools were available, Mr Zhang said. As it is, the well was expected to be completed by November 2007. GOING INTERNATIONAL Mr Liu pointed out that DDEG doesn’t serve just Daqing Oilfield; it is a comprehensive drilling engineering group that provides services on more than a dozen domestic oilfields other than Daqing. Since 1998, DDEG has also contracted for international work, providing drilling technology services in countries such as Algeria, Indonesia and Venezuela. As a relatively late entrant to the international market, Mr Liu said, DDEG is still going through the process of learning and opening new markets for itself. He emphasized that the group is keen to step up communication with other companies in the international community. GREAT WALL DRILLING Although many of CNPC’s subsidiaries, such as DDEG, work extensively around the world, the bulk of its international work is still carried out by subsidiary Great Wall Drilling Company (GWDC). Founded in 1993, the company specializ- D R I L L I N G CONTRACTOR November/December 2007 53 PACIFIC RIM DRILLING Jidong Nanpu discovery In May 2007, CNPC announced that a newly found oilfield in the tidal and shallow water area of Bohai Bay has a reserve of 1 billion tons, or about 7.35 billion bbls, the largest discovery in China in more than 40 years. The oilfield lies in the Nanpu block of CNPC’s Jidong Oilfield in north China’s Hebei province. The Nanpu block, partly offshore, covers an area of 1,300-1,500 sq km and is expected to produce light crude. It is an uncompartmentalized high-grade oilfield with average oil layer thickness of 80-100 m and major target zone depth of 1,800-2,800 m. Production testing results show that the daily output of each vertical well is between 80-100 tons and between 200-500 tons for each horizontal well. CNPC also has several onshore oilfields in the Jidong area with total reserves of more than 100 million tons. Daqing Well Control Training Center of China is equipped with a full-scale rig that can simulate a well blowout. Every year, about 3,400 well control students go through the school, which includes 13 well control instructors and five HSE training instructors. “As a subsidiary of CNPC, we try to fully utilize the advantages of CNPC’s integrated resources, such as equipment, technical expertise, financial resources and human resources,” Mr Du said. For example, Great Wall has access to technological advances at the CNPC Drilling Research Institute, established in 2006 to improve innovations and R&D in drilling technologies. Additionally, GWDC has access to the more than 1,000 rigs owned by CNPC. However, Mr Du acknowledged that, at this point, no additional CNPC rigs are available for the international market. “Just 2-3 years ago, we were actively trying to send more rigs outside of China, but it’s a very different story now.” Now, CNPC does not have enough rigs to meet its own drilling needs in China, 54 November/December 2007 both Mr Zheng and Mr Du said. So unless it’s for CNPC’s own overseas development, no more rigs will be sent outside of China. CNPC is working to amend that lack of rigs though. The company owns several drilling rig manufacturing companies, the biggest of which is Baoji Oilfield Machinery (BOMCO). The company is capable of building 9,000-m (29,500-ft) depth rigs and is targeting the building of 12,000-m (39,400-ft) rigs. Overall, CNPC is building and/or refurbishing 40-50 rigs a year on average, Mr Zheng said. “We don’t have enough rigs to meet our needs. Rig and parts manufacturers in China are very, very busy.” Liu Guanghua, president and senior engineer of CNPC’s Beijing Petroleum Machinery (BPM) factory, can attest to that. BPM produced its 100th top drive in mid-2007, and it is the largest supplier of surface-mounted BOP control systems in the world, Mr Liu said. Last year the factory produced 530 BOP control systems of up to 15,000 psi. Roughly half were exported outside China. About a third of its top drives are sold internationally as well, he noted. Mr Liu said it takes BPM three months to make one top drive and estimated that, currently, it would take them about six months to deliver a new top drive after getting the order. BPM also makes downhole motors, progressive cavity pumps and drilling jars. CHALLENGES According to CNPC’s 2006 Annual Report, its “priority areas” are increas- D R I L L I N G CONTRACTOR PACIFIC RIM DRILLING Zhang Shurui (left), senior engineer for Daqing’s No. 1 Drilling Company, monitors drilling on Rig 70163. Improving efficiency and safety on deep gas drilling is a major focus for the Daqing Drilling & Exploration Group, which owns the No. 1 Drilling Company. ing prospecting efficiency in complicated reservoirs, EOR of mature oilfields, reducing production and operation costs, improving product quality and clean operations. The report also noted that most of its major oilfields are suffering from high water cut, high percentage of low-permeability reserves and increased difficulty of heavy oil development and EOR. These were all supported in comments from Mr Zheng at CNPC’s Beijing headquarters and from Mr Liu, Mr Zou and Mr Zhang in Daqing. To address these challenges, CNPC in 2006 decided to integrate and optimize its scientific and research resources by establishing the CNPC Drilling Research Institute, which includes eight research centers and one factory (Beijing Petroleum Machinery). On the equipment side, the research institute has been focusing on improving their top drives. According to Zou Laifang, vice president of the research institute, they are also on the verge of producing geosteering tools in association with BPM. The institute has spent more than eight years researching nearbit geosteering equipment, he said, and finally research is finished and field trials are under way. The institute traditionally operates on two levels of research, Mr Zou said. The first is advanced R&D on emerging technologies; the second is direct problem-solving for CNPC oilfields. The latter can be done through real-time monitoring from the research facilities. On 18 September, the Beijing branch of the institute was monitoring three wells simultaneously, including a 7,380-m well on the Xinjiang field. Mr Zou cited several specific challenges facing the research institute and CNPC. One is drilling vertical wells in highangle formations, as often seen in northwest China such as Xinjiang, Qinghai and Gansu provinces. With formation angles in the range of 72°, sometimes drilling speeds are so slow that only 5-6 m are drilled a day. Improving drilling speeds in high-density, low-permeability and low-porosity formations is a challenge they’re facing on many oilfields. Another challenge is controlling different pressures with one formation, he said. In addition to using advanced drilling fluids to improve formation pressure capacity, they have made limited progress using corrugated pipe to expand formation pressure parameters. So far, the corrugated pipe solution has been used in lowpressure formations on 3-4 open holes and 90 cased-hole wells. The application of extended-reach drilling has been challenging on shallow offshore drilling as well, he said. In China, offshore drilling falls under the control of China National Offshore Oil Corp (CNOOC), but CNPC is allowed to drill D R I L L I N G CONTRACTOR November/December 2007 55 PACIFIC RIM DRILLING He also mentioned that cementing in sour gas formations has been problematic, especially in the Sichuan province. Finally, Mr Zou said, there’s the everpresent challenge of protecting the reservoir while drilling. He noted that improvements in drilling fluids have helped, as well as underbalanced drilling, which only recently began to see widespread use in China. One project that had significant influence on the spread of underbalanced techniques in China was done by Great Wall Drilling. According to Mr Du, air drilling is not new in China, yet due to a lack of equipment and misunderstandings about the technology, it was not popular or commonly used. This drilling project in Iran, undertaken by Great Wall Drilling Company, influenced the spread of UB techniques in China, said GWDC vice president Du Jun. Its success caught the attention of many in China’s drilling industry. Air/foam drilling has almost become standard now in some areas, he said, to improve drilling speed. An integrated drilling project in Iran in 2000 changed that. GWDC signed a contract with National Iranian Oil Company to drill 19 wells using three rigs in Tabnak, Iran’s largest onshore, sweet gas field. From the start, drilling progressed extremely slowly. The formation’s low downhole pressure made it difficult to drill with a mud system. Lost circulation, cave-ins and sloughing were encountered. Knowing that one previous contractor took 440 days to drill one 3,000-m well in this field, GWDC decided to give air drilling a shot. An air drilling program was designed and implemented, and drilling time improved significantly. From 2001-2006, 22 wells averaging 3,000 m (about 9,900 ft) were drilled with 100% success, Mr Du said. Drilling time per well was shortened from 220 days on the first well to about 80 days. Students (wearing blue hats) from China National Offshore Oil Corp (CNOOC) receive training at the Bohai Petroleum Vocational College. The school is located near Tianjin, China, by CNPC’s Huabei Oilfield. Its well control training center is WellCAP-accredited. within 5 meters offshore (see “Jidong Nanpu discovery,” page 54). In these very shallow, gentle-slope areas, CNPC must reach out from land to very shallow formations at about 1,200 m (3,900 ft). ERD applications in these situation have reached upward of 5,400 m (17,700 ft), Mr Zou said, and problems such as wellbore collapse have been common. 56 November/December 2007 Drilling in coalbed methane reservoirs using multilaterals is another area the research institute is focusing on, Mr Zou said. The production rate from these wells have not been ideal, so the center is trying to determine if multilateral technology is really a good fit for these formations. Because of the success in this project, air drilling and related underbalanced techniques caught the attention of Chinese companies, according to GWDC, especially in southern areas like Sichuan. “Air drilling or foam drilling has almost become standard drilling procedure there to speed up drilling speed. This project had great influence on the development of drilling technology in China,” Mr Du said. OPEN COMMUNICATION Other than technological challenges, Mr Zheng Yi in Beijing noted that cost increases — on everything from casing/ drill pipe to rigs and personnel — have impacted some projects. Another big obstacles for Chinese companies, especially as they try to expand in the global market, remains language, Mr Du pointed out. This problem is D R I L L I N G CONTRACTOR PACIFIC RIM DRILLING In September, No. 1 Drilling Company’s Rig 70163 on the Daqing Oilfield was drilling a 4,400-m MD deep gas exploration well. Drilling through the volcanic rock formation has been a big challenge. The team had drilled three other deep wells since 2005. especially critical for GWDC since it is CNPC’s international arm, and the company continues to work to make sure that its Chinese employees can communicate efficiently and effectively with local employees — about 75% of GWDC’s 10,000-plus employees around the world are from host countries. However, Mr Du emphasized that this problem is lessening every year as China opens up more and more. When he graduated from university in 1983, very few people in China could speak English, even college students. When he visited the Middle East in 2000, he was shocked when he was asked if China had any drilling operations or oil. “That really surprised me. How could they think we don’t have any oil?” he said. “But what that really meant was that we lacked communication.” Throughout CNPC, from Daqing to Beijing, from those in the field to those in offices, employees realize that China can benefit by learning from the international drilling community. At the same time, they’re eager to share their own knowledge, successes and “iron man” spirit with the rest of the world. China’s communication process has begun. Let’s keep pushing it forward. D R I L L I N G CONTRACTOR November/December 2007 57