Muttley Marketing Campaign: BTEC Business Assessment

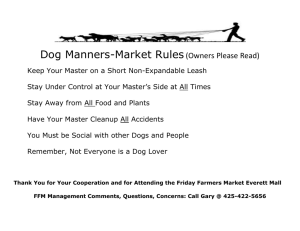

advertisement

Please note: this sample assessment resource is not approved by Pearson. BTEC NATIONAL BUSINESS UNIT 2 – DEVELOPING A MARKETING CAMPAIGN SAMPLE ASSESSMENT MATERIAL MUTTLEY PART B Set task You must complete BOTH activities. You will need to refer to the additional task information on the following pages and the notes and annotations from Part A. Activity 1 Prepare a rationale for a marketing campaign for the owners of Muttley to promote its dog food products. The rationale should include: • the marketing aims and objectives • an analysis of the research data on the market and competition • a justification for your rationale. (Total for Activity 1 = 34 marks) Activity 2 Based on your rationale from Activity 1, develop a budgeted plan with a timescale for your marketing campaign. You must produce this plan in an appropriate written format for the owners of Muttley. (Total for Activity 2 = 36 marks) TOTAL FOR PAPER = 70 MARKS Part B Set Task Information UK Dog Food Market Dogs are the most popular pet in the UK, with over 12 million households owning one or more dogs. Dog ownership has grown since the pandemic with many households adding a pet for the first time. UK households spend over £6billion on their pets each year, with just under half of that going on pet food (including treats). The growth of pet food sales is expected to reach £3.2billion in 2021 with similar growth forecast in the other market segments over the next 5 years. Households spend an average of £6.80 per week on pet food, with people aged between 50-64 years old spending the most. As pet owners soon discover, the costs of vet fees are also significant, particularly for pets that suffer from obesity, ill-health or enter their final years. Dog food is the largest segment of the UK pet food market - worth £1.2billion per year. Many different brands compete in the dog food market most notably Pedigree, Winalot and Bakers. In 2020, UK households spent £462million on dog treats – the fastest-growing segment of the dog food market. Overall, however, the UK dog food market is mature with relatively low long-term growth. Pedigree, owed by Mars, dominates the UK dog food market. Retail sales data indicates that five million households in the UK regularly buy Pedigree products, compared to 1.7 million households who buy Winalot (owned by Nestle’s Purina) and 1.3 million from Bakers. Most dog food is bought from retail outlets – i.e., supermarkets (including online shopping), convenience stores and pet shops. The leading dog food brands dominate retail distribution, supported by extensive television advertising to sustain brand awareness. However, an increasing amount of dog food is now being bought directly from smaller, specialist providers operating their own websites. Some dog food providers offer their products on a subscription service where a household is sent a pack each month. Others focus on selling directly to households using e-commerce or via veterinary practices. Many of the products sold by these specialist dog food providers are sold at a premium price, although most dog owners still value affordability and convenience as key factors in the products and brands they choose, and where they buy their dog food. The UK dog population is changing. As the number of dogs owned has increased, more households are choosing smaller dogs, and unique breeds. This is partly driven by urbanisation of the UK population, with over 60% of people expected to live in cities by 2030. Dogs are also getting “larger”. Pet obesity is the top welfare concern for vets. According to The Kennel Club, between 30% and 60% of dogs in the UK are now overweight. Dog owners are becoming more conscious of what they feed their pets and it is no surprise that the trends of human and animal health and wellness continue to blend. This can be seen in the growth of plant-based and specialist food offerings, including food with only “natural” ingredients and products designed to help dogs lose and maintain a healthy weight. Dog food packaging is a hot topic within the industry just as much as in the wider community, with customers moving away from single use plastic wherever possible. Sustainability is fast moving up on the consumer agenda, and leading dog brands are increasingly looking to use alternative materials in food production where possible, including sustainable ingredients. Dog food producers must also contend with increasingly strict legislation covering manufacturing of safe pet foods, including the use of additives. EU legislation introduced in 2018 is still applicable to all UK-based pet food manufacturers. UK brands that import dog food from overseas factories must also ensure that these standards are met. Dog food is typically sold at around £2/kg for branded products and £1/kg for supermarket own label. More specialist dog food products such as treats and food targeting particularly dog conditions sell for more. Muttley Muttley is a privately-owned, profitable business that was formed twenty years ago by two vets – Hans Mutt and Gwen Oakley. Muttley sells a range of complete dried dog food and treats under the SuperMutt brand. It uses other suppliers to make its products. These factories have a reputation for high quality and reliability, and they also produce own label dog food for several supermarket chains. The factories have the capacity to increase production for Muttley if required. Although using other businesses to make the dog food reduces the profit margin achieved by Muttley, it enables the business to focus on marketing and customer service. It mainly sells its products via veterinary surgeries and high-quality pet shops, as well as direct to customers from its website and Facebook / Instagram shop. Customers are offered free delivery if they spend more than £50 on any online order from the Muttley online store. Muttley uses a variety of promotional methods, including email marketing to its customer database and occasional sales promotions to support its veterinary practice and pet shop outlets. Muttley’s complete dog food product is offered in a variety of flavours and sells for £2.50/kg. It is popular with its loyal customer base – most of whom have owned dogs for many years. Both the complete dog food and associated range of treats use 100% natural ingredients, although they tend to have quite a high calorific content per serving. In total, Muttley sells over 2million kg of dog food each year. Hans Mutt is a well-known vet, has featured in several television documentary series, and is a skilled communicator. His views on pet ownership and treatment are widely respected. Expanding the Business A national chain of pet shops has approached Muttley about stocking existing SuperMutt products for the first time. This would be likely to significantly increase Muttley’s sales, although the profit margin made on the additional sales would be much lower than selling direct. Hans Mutt has also been approached by a social media business who are offering to help develop and launch a new YouTube channel. The channel will provide advice to new dog owners on how to keep their pet healthy as well as enable Muttley to promote its product range. The owners of Muttley want to increase sales of their dog food products and are considering two options: EITHER 1. Use an advertising campaign to build brand awareness of the SuperMutt brand and grow both retail and direct sales. OR 2. Launch a new low-calorie version of SuperMutt dog treats, targeting dog owners who want to help their pets lose weight The marketing budget for the campaign is £500,000 and the campaign should run for 6 months