Bank Reconciliation Statements: Teacher's Notes & Examples

advertisement

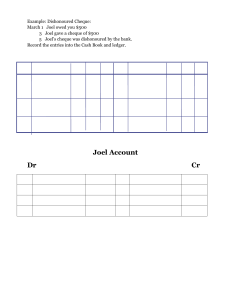

Chapter 4 Bank Reconciliation Statements Notes to teachers 1 Start with Chapter 4 of Frank Wood’s Introduction to Accounting and briefly explain to students the basic principles of recording in the cash book. 2 It is necessary to show a (real or simulated) bank statement to students as most of them would probably have no idea of what one looks like. 3 Most students have difficulty understanding why a debit bank balance appearing in the cash book represents a positive balance while a debit bank balance appearing in the bank statement represents a negative (overdraft) balance. Teachers must clarify a bank deposit from the perspectives of the business and the bank (whether it is treated as an asset or a liability). 4 Most students have the misconception that a bank reconciliation statement is used to make corrections in the cash book and/or the bank statement. Teachers must clarify that the bank reconciliation statement is simply used to show the difference between the bank balances of the cash book and the bank statement. By so doing, a bank reconciliation statement can help spot errors in the cash book or the bank statement. 5 Most students have difficulty understanding why unpresented cheques and uncredited cheques are added to and deducted from the cash book balance, respectively, in arriving at the bank statement balance. Teachers should tell them the purpose is to reconcile both balances. The calculation would be reversed if it starts with the bank statement balance and ends with the cash book balance. 6 The treatment of bank errors is the most difficult task. Teachers should spend more time demonstrating how they should be shown on the bank reconciliation statement and explaining the general principle behind this. 7 In public examinations, this topic is usually combined with other topics in a long question, most probably the correction of errors, which will be taught in Chapter 6. Q1 A bank overdraft occurs when a firm withdraws more money than it has in its bank account. As a result, the balance at the bank will become negative. Q2 A standing order is an instruction given by a bank customer to his bank to pay a fixed sum of money from his account to a named beneficiary (payee) at regular intervals. Example: A fixed amount of money is automatically transferred out of one’s bank account to pay property management fees on a fixed date each month. A direct debit is an authority given by the customer to a named payee to claim payments from the customer’s bank account and an instruction to his bank to allow the payments to go through. It does not specify the payment amount or the payment date. 50 M01_FWFA_TB_HKG_9645_C04.indd 50 2009/11/4 3:59:35 PM Example: Money is automatically transferred out of one’s bank account to pay electricity charges, but the amount and the date of each transfer is not fixed. Generally, a standing order is used when the bank customer needs to pay a fixed amount at regular intervals. When payments are made at irregular intervals or are of variable amounts, a direct debit would be used instead. Q3 The reason may be one of the following: • The drawer does not have enough money in the current account for the payment. • There is no signature on the cheque, or the signature does not match the record at the bank. • The amount in words differs from the amount in figures. • The cheque is not dated. • The cheque is a stale cheque (i.e., exceeding six months after the date of issue). • The cheque is a post-dated cheque. This means that the date on the cheque has not yet been reached. • The drawer’s account has been closed. • Alterations to the cheque have not been countersigned by the drawer. (Any two of the above) Q4 A bank reconciliation statement is prepared at the end of a period in order to show the reasons for the difference between the bank balances of the cash book and the bank statement. Q5 Yes. A bank reconciliation statement shows the reasons for the difference between the bank balances of the cash book and the bank statement. The reasons may be errors and omissions made in the cash book or the bank statement. So the preparation of a bank reconciliation statement can help to detect and correct errors. Q6 D Yuen Bank Reconciliation Statement as at 30 November 2009 $ Overdraft balance as per cash book Add Unpresented cheque Credit transfer Less Uncredited cheque Standing order Bank charges Overdraft balance as per bank statement Q7 (a) 630 1,240 1,060 770 490 $ (3,780) 1,870 (1,910) (2,320) (4,230) M Cheng Bank Reconciliation Statement as at 31 March 2010 $ Balance as per bank statement Add Bank lodgement not yet entered on bank statement Bank error — Service fee overcharged Less Unpresented cheque Adjusted balance as per cash book 11,500 1,800 $ 161,800 13,300 175,100 (16,400) 158,700 51 M01_FWFA_TB_HKG_9645_C04.indd 51 2009/11/4 3:59:36 PM (b) M Cheng Bank Reconciliation Statement as at 31 March 2010 $ Balance as per cash book Add Unpresented cheque Creditor — Stale cheque Opening balance understated Direct credit 16,400 12,000 10,000 18,600 Less Bank lodgement not yet entered on bank statement Bank error — Service fee overcharged Debtor — Dishonoured cheque Payment understated Loan interest Electricity — Direct debit Balance as per bank statement 11,500 1,800 19,000 13,000 5,000 1,400 $ 156,500 57,000 213,500 (51,700) 161,800 A2 When a firm keeps money in the bank, it is the same as the firm lending money to the bank. Therefore, the firm’s positive bank balance is treated as a liability by the bank and not an asset. A4 Adjusting entries in the drawer’s cash book: Dr Cash book (bank column) Cr Creditor’s account ASSESSMENT Short Questions 1 (a) 2009 Jun 30 " 30 Cash Book Balance b/d RS Ltd — Credit transfer (b) Union Credit — Standing order Bank charges Balance c/d $ 44 70 2,809 2,923 C Chan Bank Reconciliation Statement as at 30 June 2009 Corrected balance as per cash book Add Unpresented cheque Less Uncredited cheque Balance as per bank statement $ 2009 2,833 Jun 30 90 " 30 " 30 2,923 $ 2,809 57 2,866 (624) 2,242 52 M01_FWFA_TB_HKG_9645_C04.indd 52 2009/11/4 3:59:37 PM 2 (a) 2008 Dec 31 " 31 Cash Book K Sung — Direct credit Balance c/d (b) $ 2008 180 Dec 31 4,007 " 31 " 31 4,187 Balance b/d Mercantile Ltd — Standing order Bank charges C Hung Bank Reconciliation Statement as at 31 December 2008 $ (4,007) 84 (3,923) (211) (4,134) Corrected overdraft balance as per cash book Add Unpresented cheque Less Uncredited cheque Overdraft balance as per bank statement 3X (a) 2009 Mar 31 " 31 Cash Book K Tong — Direct credit Balance c/d (b) $ 2009 57 Mar 31 5,300 " 31 " 31 5,357 Balance b/d BKS Ltd — Direct debit Bank charges $ (5,300) 490 (4,810) (160) (4,970) Less Uncredited cheque Overdraft as per bank statement (a) 2009 May 31 " 31 $ 5,280 49 28 5,357 K Woo Bank Reconciliation Statement as at 31 March 2009 Overdraft as per corrected cash book Add Unpresented cheque 4X $ 3,922 200 65 4,187 Cash Book $ 2009 141,030 May 31 16,280 " 31 " 31 157,310 Balance b/d Dividend revenue (b) $ 4,800 820 151,690 157,310 DD Ltd Bank Reconciliation Statement as at 31 May 2009 Adjusted balance as per cash book Add Unpresented cheques ($2,790 + $16,270) Less Uncredited deposit Balance as per bank statement C Yeung — Returned cheque Bank charges Balance c/d $ 151,690 19,060 170,750 (29,140) 141,610 53 M01_FWFA_TB_HKG_9645_C04.indd 53 2009/11/4 3:59:37 PM 5 (a) Cash Book 2009 Dec 31 " 31 " 31 " 31 Balance b/d Dividend revenue (ii) HK Finance Ltd — Refund (iv) Transfer from savings a/c (v) (b) $ 4,500 720 780 4,200 10,200 2009 Dec 31 " 31 " 31 " 31 Insurance — Standing order (i) Bank charges (iii) C Ho — Dishonoured cheque (vi) Balance c/d $ 600 90 210 9,300 10,200 K Tang Bank Reconciliation Statement as at 31 December 2009 $ 9,300 1,620 10,920 (2,070) 8,850 Corrected balance as per cash book Add Unpresented cheques ($750 + $870) Less Uncredited cheque Balance as per bank statement Application Problems 6 (a) Cash Book 2010 Apr 30 " 30 " " 30 30 Balance b/d Cheque wrongly recorded on credit side ($6,200 × 2) (iv) Credit transfer (v) Dividend revenue (vii) (b) $ 2010 53,000 Apr 30 " 30 12,400 " 30 5,800 " 30 1,190 72,390 Bank charges (i) Rent — Standing order (ii) Debtor — Dishonoured cheque (iii) Balance c/d $ 150 20,000 3,560 48,680 72,390 Panda Club Bank Reconciliation Statement as at 30 April 2010 Corrected balance as per cash book Add Loan interest undercharged Unpresented cheque Balance as per bank statement or $ 48,680 2,400 700 51,780 (vi) (viii) Panda Club Bank Reconciliation Statement as at 30 April 2010 Balance as per bank statement Less Loan interest undercharged Unpresented cheque Corrected balance as per cash book $ 51,780 (2,400) (700) 48,680 (vi) (viii) (c) See text, Section 4.5 of Frank Wood’s Introduction to Accounting. 7X (a) 2009 Oct 31 " 31 " 31 Cash Book Balance b/d Dividends received (iv) Rates refund ($5,500 × 2) (v) $ 76,230 930 11,000 88,160 2009 Oct 31 " 31 " 31 " 31 Debtor — Dishonoured cheque (vi) Insurance (vii) Discounts allowed (viii) Balance c/d $ 2,720 8,250 30 77,160 88,160 54 M01_FWFA_TB_HKG_9645_C04.indd 54 2009/11/4 3:59:38 PM (b) Glory Ltd Bank Reconciliation Statement as at 31 October 2009 $ Adjusted balance as per cash book Add Unpresented cheque (ii) Less Uncredited deposits Bank error ($10,000 × 2) Balance as per bank statement (i) (iii) 5,650 20,000 $ 77,160 1,840 79,000 (25,650) 53,350 (c) The reason could be: (i) The creditor had not deposited the cheque into his bank account. (ii) The cheque had been deposited but had not yet been processed by the bank by the end of the period. 8 (a) Cash Book 2010 Mar 31 " 31 " " 31 31 Balance b/d Paul Lee — Incorrect amount entered (ii) Peter Pang — Credit transfer (v) Sales receipts omitted (viii) (b) $ 2010 93,596 Mar 31 " 31 1,080 " 31 3,256 " 31 2,504 100,436 Bank interest charges (iii) Rates — Autopay (iv) David Ho — Dishonoured cheque (vi) Balance c/d $ 184 2,688 2,080 95,484 100,436 Anne Lo Bank Reconciliation Statement as at 31 March 2010 Balance as per bank statement Add Uncredited cheque $ 91,600 8,744 100,344 (4,860) 95,484 (vii) Less Unpresented cheques Corrected balance as per cash book (i) (c)In Hong Kong, when a cheque is deposited into the bank, it takes at least one full working day for the cheque to clear. As the cheque was deposited on 31 March 2010, it would only be cashed in early April 2010. Thus, it did not appear on the bank statement for the month ended 31 March 2010. 9X (a) 2010 Dec 31 " 31 " 31 " 31 " 31 Cash Book Balance b/d Dividend revenue (ii) Mr Sin (v) Thomas Wong (v) Cheque received from Mr Ma previously recorded on the credit side ($3,360 × 2) (viii) $ 137,900 1,365 3,210 2,530 6,720 151,725 2010 Dec 31 " 31 " 31 " 31 Trade subscription (iii) Interest expenses (iv) Mr Wo — Dishonoured cheque (vi) Balance c/d $ 11,060 210 1,246 139,209 151,725 55 M01_FWFA_TB_HKG_9645_C04.indd 55 2009/11/4 3:59:38 PM (b) Bank Reconciliation Statement as at 31 December 2010 $ Corrected balance as per cash book Add Unpresented cheques: Mr Ma Mr Man $ 139,209 (i) 860 190 Less Overdraft interest wrongly charged Balance as per bank statement (vii) 1,050 140,259 (840) 139,419 or Bank Reconciliation Statement as at 31 December 2010 Balance as per bank statement Add Overdraft interest wrongly charged (vii) Less Unpresented cheques Corrected balance as per cash book 10 (a) $ 139,419 840 140,259 (1,050) 139,209 (i) Cash Book 2010 May 7 " 10 " 29 " 31 $ 1,630 10,000 555 280 Sales Capital AB Ltd Dividend revenue (ii) 2010 May 1 " 4 " 18 " 30 " 31 " 31 " 31 " 31 Balance b/d Van D Ming Ltd Wages Bank charges (i) Insurance — Standing order (iv) Sales — Dishonoured cheque (v) Balance c/d 12,465 (b) $ 3,340 5,000 237 470 110 920 75 2,313 12,465 B Mok Bank Reconciliation Statement as at 31 May 2010 Adjusted balance as per cash book Add Unpresented cheque $ 2,313 237 2,550 (555) 1,995 (vi) Less Uncredited cheque Balance as per bank statement (iii) (c) See text, Section 4.4. 11X (a) No. A bank reconciliation statement is prepared to explain the difference between the bank balances of the cash book and the bank statement. (b) (i) 2009 Mar 31 Cash Book Balance c/d (found in the bank reconciliation statement) $ 2009 24,275 Mar 31 " 31 " 31 " " 24,275 31 31 Balance b/f (balancing figure) Creditor ($5,280 + $5,016) (iii) Chung Hwa Ltd ­— Dishonoured cheque (v) Overdraft interest (vi) Electricity (vii) $ 5,894 10,296 2,484 862 4,739 24,275 56 M01_FWFA_TB_HKG_9645_C04.indd 56 2009/11/4 3:59:38 PM (ii) Bank Reconciliation Statement as at 31 March 2009 $ Adjusted bank balance as per cash book (balancing figure) Add Personal cheque wrongly deposited into bank Unpresented cheques Less Lodgement not yet entered on bank statement Overdraft balance as per bank statement (i) (ii) 1,320 11,763 (iv) $ (24,275) 13,083 (11,192) (3,180) (14,372) (iii)The bank balance to be shown in the balance sheet as at 31 March 2009 would be $24,275 (overdraft). 12 (a) Cash Book 2009 Feb 28 " 28 Balance b/d Jasper Ltd — Credit transfer (b) $ 2009 2,716 Feb 28 1,375 " 28 " 28 " 28 " 28 4,091 Bank charges Government rates — Direct debit Jacob Co — Dishonoured cheque Trade subscriptions — Standing order Balance c/d $ 562 231 350 375 2,573 4,091 Amy Ko Bank Reconciliation Statement as at 28 February 2009 $ Balance as per bank statement Add Uncredited item Unpresented cheques: Telephone (No. 4149) Wages (No. 4152) Corrected balance as per cash book $ 1,429 2,000 3,429 Less (c) 106 750 (856) 2,573 Accounts Receivable Ledger Jacob Co 2009 Feb 1 " 28 13X Balance b/d Bank — Dishonoured cheque $ 2009 719 Feb 24 350 " 28 1,069 Bank Balance c/d $ 350 719 1,069 (i) Bank receipts and payments should be recorded in the cash book on the dates that they are made. This is the time when the corresponding liability is settled. For example, a cheque payment should be recorded when the cheque is drawn and not when it is presented to the bank. Making entries on the basis of the bank statement could miss some cheques that have been drawn but have not been presented during the period. (ii) These items are usually debited or credited automatically to the bank account without prior notification. The account holder can only ascertain these items upon receiving the bank statement. (iii) Actually, these cheques or deposits were recorded in the cash book when they were drawn or made. Adjustments for such items are just for the purpose of explaining the difference between the bank balances of the cash book and the bank statement. (iv) As explained in part (i), bank receipts and payments should be recorded in the cash book when they are made. So the bank balance shown in the balance sheet should be the adjusted balance of the cash book. 57 M01_FWFA_TB_HKG_9645_C04.indd 57 2009/11/4 3:59:39 PM Past Exam Questions 14 (a) 2006 Mar 31 " 31 " 31 Cash Book $ 225,000 800 6,600 Balance b/f Trade creditors (i) Credit transfer (vii) 2006 Mar 31 " 31 " 31 " 31 232,400 (b) $ Dishonoured cheque (iii) 6,800 Payment to supplier ($2,750 × 2) (iv) 5,500 Standing order — Rent (viii) 34,000 Balance c/f 186,100 232,400 Bank Reconciliation Statement as at 31 March 2006 $ Balance as per corrected cash book Add Unpresented cheque Less Overdraft interest wrongly debited Uncredited cheque Balance as per bank statement (v) (ii) (vi) 1,000 20,150 $ 186,100 1,400 187,500 (21,150) 166,350 (c) (i) To discover any errors or irregularities, and (ii) To detect any missing transactions in the cash book. 15X (a) 2006 Dec 31 " 31 Cash Book $ 2006 186,400 Dec 31 3,900 " 31 " 31 " 31 " 31 190,300 Balance b/d Trade debtors (vii) (b) $ 7,800 2,660 19,000 6,000 154,840 190,300 Trade debtors (i) Overdraft interest (ii) Trade debtors (iv) Insurance (vi) Balance c/d Bank Reconciliation Statement as at 31 December 2006 $ Balance as per corrected cash book Add Unpresented cheques Bank errors Less Uncredited deposit Balance as per bank statement (iii) (viii) (v) 8,800 20,000 $ 154,840 28,800 (36,680) 146,960 (c) A bank reconciliation statement provides: (i) verification of firm’s records with aspects ‘not yet known’ by the bank such as uncredited deposits and unpresented cheques. (ii) verification of the amounts recorded as received and paid. (iii) a check on the time differences between when a deposit is recorded as received (or paid) and when it is banked (or withdrawn from bank). (iv) an update of the firm’s records with aspects ‘not yet known’ by the firm, that is, direct deposits such as interest received, direct withdrawals such as bank fees and dishonoured cheques. (v) a check for errors in either the firm’s records or the bank’s records (as reported in the bank statement). (Any one point) 58 M01_FWFA_TB_HKG_9645_C04.indd 58 2009/11/4 3:59:39 PM 16 (a) 2007 Mar 31 " 31 " 31 Cash Book Balance b/d Dishonoured cheque (vi) Credit side overstated (viii) $ 235,930 5,100 15,600 2007 Mar 31 " 31 " 31 " 31 Salary (iii) Machinery ($17,000 – $10,700) (iv) Bank charge (vi) Balance c/d 256,630 (b) Bank Reconciliation Statement as at 31 March 2007 $ Balance as per corrected cash book Add Unpresented cheques: Cheque drawn by Mr Chan Cheque paid to Mr Luk Less $ 33,870 6,300 100 216,360 256,630 Uncredited deposit Overdraft interest wrong charged Balance as per bank statement (i) (v) 5,650 6,320 (ii) (vii) 2,000 1,400 $ 216,360 11,970 (3,400) 224,930 (c) A bank reconciliation statement provides: (i)verification of firm’s records with aspects ‘not yet known’ by the bank such as uncredited deposits and unpresented cheques. (ii) verification of the amounts recorded as received and paid. (iii)a check on the time differences between when a deposit is recorded as received (or paid) and when it is banked (or withdrawn from bank). (iv)an update of the firm’s records with aspects ‘not yet known’ by the firm, that is, direct deposits such as interest received, direct withdrawals such as bank fees and dishonoured cheques. (v)a check for errors in either the firm’s records or the bank’s records (as reported in the bank statement). (Any two points) 59 M01_FWFA_TB_HKG_9645_C04.indd 59 2009/11/4 3:59:40 PM