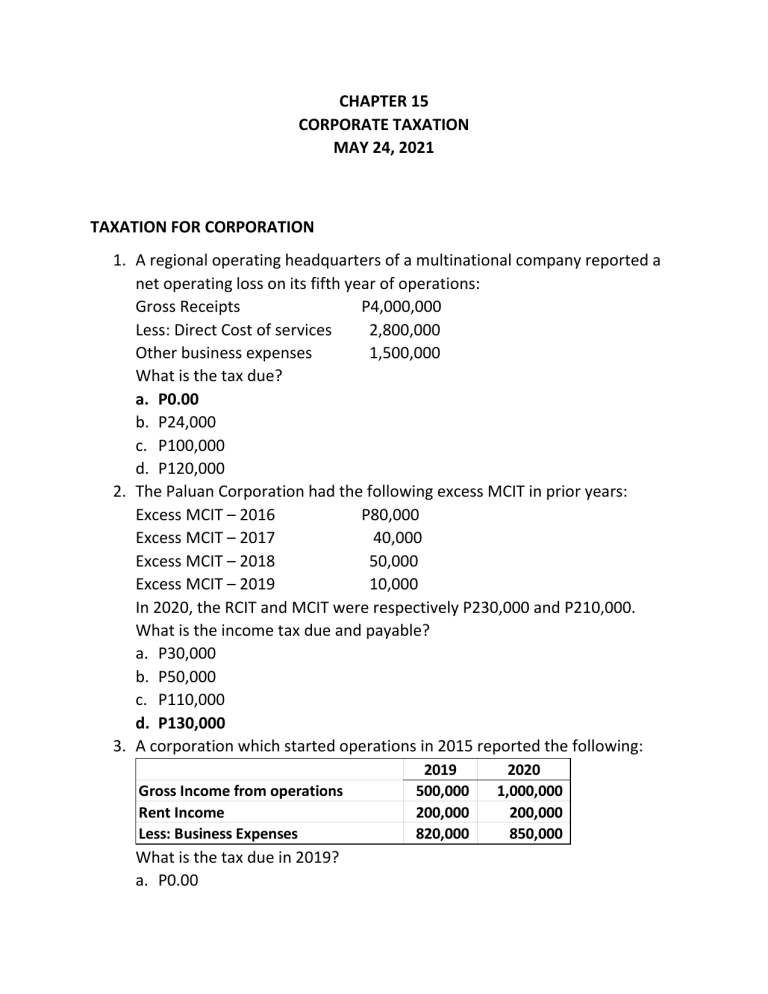

CHAPTER 15 CORPORATE TAXATION MAY 24, 2021 TAXATION FOR CORPORATION 1. A regional operating headquarters of a multinational company reported a net operating loss on its fifth year of operations: Gross Receipts P4,000,000 Less: Direct Cost of services 2,800,000 Other business expenses 1,500,000 What is the tax due? a. P0.00 b. P24,000 c. P100,000 d. P120,000 2. The Paluan Corporation had the following excess MCIT in prior years: Excess MCIT – 2016 P80,000 Excess MCIT – 2017 40,000 Excess MCIT – 2018 50,000 Excess MCIT – 2019 10,000 In 2020, the RCIT and MCIT were respectively P230,000 and P210,000. What is the income tax due and payable? a. P30,000 b. P50,000 c. P110,000 d. P130,000 3. A corporation which started operations in 2015 reported the following: Gross Income from operations Rent Income Less: Business Expenses What is the tax due in 2019? a. P0.00 2019 500,000 200,000 820,000 2020 1,000,000 200,000 850,000 b. P10,000 c. P14,000 d. P55,000 4. A corporation which started operations in 2015 reported the following: What is the tax due and payable in 2020? a. P105,000 b. P 95,000 c. P 69,000 d. P 55,000 5. In the quarterly income tax return, excess MCIT prior year is deductible only when a. The MCIT exceeds the RCIT for that quarter b. The RCIT exceeds the MCIT for the quarter c. The cumulative MCIT exceeds the cumulative RCIT as of the end of that quarter d. The cumulative RCIT exceeds the cumulative MCIT as of the end of that quarter Chapter 15-A Theory 1 page 649 1. A non-resident foreign corporation is taxable on a. World taxable income b. World gross income c. Philippine taxable income d. Philippine gross income 2. The resident and non-resident classifications do not apply to a. Domestic corporation b. Foreign corporation c. Both domestic and foreign corporation d. Neither domestic and foreign corporation 3. Which of these is a special corporate taxpayer? 4. 5. 6. 7. 8. 9. a. A private school b. A private hospital c. A business partnership d. A trading corporation As a rule, non-profit, non-stock corporations are exempt from income tac. Which of these non-profit entities is subject to income tax? a. Association b. School c. Farmer’s cooperative d. Hospital The exemption of non-profit corporations specifically pertains to income from a. Related activities b. Unrelated activities c. Disoriented activities d. Both related and unrelated activities A domestic corporation is taxable on a. World taxable income b. World gross income c. Philippine taxable income d. Philippine gross income A resident foreign corporation is taxable on a. World taxable income b. World gross income c. Philippine taxable income d. Philippine gross income Benguet State University, a public educational institution, is a. Subject to income tax at preferential rate b. Subject to income tax at the regular rate c. Subject to both regular and preferential income tax d. Exempt from corporate income tax Generally, government-owned and controlled corporation are a. Subject to preferential income tax b. Subject to regular income tax c. Subject to both regular and preferential income tax d. Exempt from income tax 10. Generally, private proprietary educational institution are a. Subject to preferential income tax b. Subject to regular income tax c. Subject to both regular and preferential income tax d. Exempt from income tax 11. Which is not exempt corporation? a. Social Security System b. Philippine Health Insurance System c. GOCC d. Home Development Mutual Fund 12. Which of these foreign corporations is subject to the 30% regular corporate tax? a. Offshore banking units b. International carrier c. Regional operating headquarters of a multinational company d. Call center 13. A non-resident foreign corporation is a. Subject to 30% tax on taxable income b. Subject to 25% tax on gross income c. Not subject to 30% tax on gross income d. Never subject to 30% tax on gross income abroad 14. A resident foreign corporation is? a. Subject to 10% tax on global taxable income b. Subject to 10% tax on Philippine taxable income c. Not subject to 30% ta on foreign income d. Not subject to 30% tax on Philippine taxable income 15. A domestic corporation is not subject to the 30% regular income tax on? a. Foreign income b. Global income c. Philippine income d. Gross income THEORY PART 2 PAGE 651 1. An allocation of common expense between related and unrelated activities is made to properly reflect taxable income. This procedure is required only of a. Domestic corporation b. Resident foreign corporation c. Exempt corporation d. Non-profit hospitals 2. What percentage of profit will shareholders ultimately receive from the corporate earnings? a. 70% of taxable income b. 70% of gross income c. 63% of taxable income d. 63% of gross income 3. Which of these concepts is not relevant to corporations? a. Exclusion b. Gross income c. Deduction d. Personal exemptions 4. The preferential tax rate of 10% on taxable income applies to a. Proprietary hospital b. Proprietary school c. Non-profit school d. Non-profit associations 5. When applicable, the 10% preferential tax rate applies to income from a. Related activities b. Unrelated activities c. Both related and unrelated activities d. Neither related nor unrelated activities 6. Exempt corporations are nevertheless subject to 30% tax on income from a. Related interests b. Unrelated interests c. Both related and unrelated interests d. Neither related nor unrelated interest 7. Which is not taxable on unrelated activities? a. Government agencies b. Non-profit corporations c. GOCC d. None of these 8. The income from properties of exempt corporations is considered income from a. Related activities b. Unrelated activities c. Either related or unrelated activities at the discretion of the examiner d. Either related or unrelated activities depending on the nature of the properties concerned. 9. The classification rule is not relevant to a a. Cooperatives b. Farmer’s association c. Government school d. Profit-oriented agricultural organization 10. Which is subject to corporate income tax? a. Joint venture engaged in construction b. Joint venture engaged in oil exploration. c. PCSO d. A charitable medical hospital. 11. International carriers are taxable on their gross income or receipt from a. Incoming shipment or flight b. Outgoing shipment or flight c. Both incoming and outgoing flight d. Any sources 12. A domestic carrier is subject to tax on a. Philippine gross income b. World gross income c. Philippine taxable income d. World taxable income 13. A non-resident lessor of vessels chartered by Filipino nationals is subject to a. 25% tax on its gross rentals from Filipino nationals. b. 25% tax on its worldwide rentals. c. 4.5% tax on its gross rentals from Filipino nationals. d. 7.5% tax on its gross rentals from Filipino nationals. 14. A domestic cinematographic film owner, distributor or lessor is subject to a. 25% tax on Philippine gross income b. 30% tax on global taxable income c. 25% tax on global taxable income d. 30% tax on Philippine gross income 15. A non-resident film owner, distributor or lessor is subject to a. 25% tax on Philippine gross income b. 30% tax on global taxable income c. 25% tax on global taxable income d. 30% tax on Philippine gross income 16. A non-resident lessor of aircraft is subject to a. 7.5% tax on Philippine gross income b. 4.5% tax on global taxable income c. 25% tax on global taxable income d. 30% tax on Philippine gross income 17. A domestic lessor of aircraft and other equipment is subject to a. 4.5% tax on Philippine gross income’ b. 30% tax on global taxable income c. 7.5% tax on global taxable income d. 30% tax on Philippine gross income 18. An exempt corporation with no taxable income is delinquent in filing its tax return. Which penalty is it liable to? a. Surcharge b. Interest c. Compromise d. All of these END