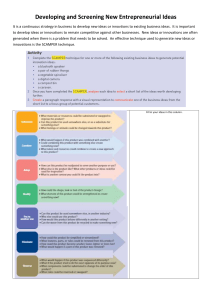

Part IV Benchmarking Mechanism and Tools Executive Summary This part details and illustrates benchmarking using FIMM. The concept, types, and processes of benchmarking are first reviewed. The key activities of benchmarking are then identified and used as a basis for designing the benchmarking of food businesses’ innovation capability. Benchmarking using FIMM and a tool for visualizing the results are illustrated for restaurant chains, food catering service providers, and food processing/manufacturing establishments. The benchmarking analysis provides a food business with insights into its current level of innovation capability, key actions for strengthening innovation capability, priorities in strengthening innovation capability, as well as examples of best practices. Page ii CONTENTS EXECUTIVE SUMMARY............................................................................................................ II WHAT IS BENCHMARKING?.................................................................................................................. 2 WHY BENCHMARKING?........................................................................................................................ 3 TYPES OF BENCHMARKING................................................................................................................... 4 Competitive Benchmarking................................................................................................................. 4 Functional Benchmarking................................................................................................................... 5 Internal Benchmarking........................................................................................................................ 6 Generic Benchmarking........................................................................................................................ 7 PROCESS OF BENCHMARKING............................................................................................................. 8 AT&T.................................................................................................................................................... 8 International Benchmarking Clearing House (lBC).............................................................................. 9 McKinsey & Co.................................................................................................................................. 10 McNair & Leibfried............................................................................................................................ 11 Vaziri’s Methodology......................................................................................................................... 12 Xerox (Robert Camp)......................................................................................................................... 13 Schmidt’s Methodology.................................................................................................................... 13 BENCHMARKING USING FOOD INNOVATION MATURITY MODEL (FIMM).....................................14 Benchmarking of Restaurant Chains Illustrated with BRC................................................................. 15 Benchmarking of Food Catering Service Provider Illustrated with SCS............................................. 23 Benchmarking of Food Processing/Manufacturing Establishments Illustrated with APM................29 SUMMARY OF THE BENCHMARKING PROCESS AND MECHANISM................................................ 35 APPENDIX A1. BRC’S MATURITY LEVEL.............................................................................................. 36 APPENDIX A2. HRC’S MATURITY LEVEL............................................................................................. 39 APPENDIX A3. LRC’S MATURITY LEVEL.............................................................................................. 42 APPENDIX A4. SRC’S MATURITY LEVEL.............................................................................................. 45 APPENDIX A5. CCS’S MATURITY LEVEL.............................................................................................. 48 APPENDIX A6. SCS’S MATURITY LEVEL.............................................................................................. 51 APPENDIX A7. TCS’S MATURITY LEVEL.............................................................................................. 54 APPENDIX A8. APM’S MATURITY LEVEL............................................................................................ 57 APPENDIX A9. IPM’S MATURITY LEVEL.............................................................................................. 60 APPENDIX A10. JPM’S MATURITY LEVEL........................................................................................... 63 APPENDIX A11. VPM’S MATURITY LEVEL.......................................................................................... 66 REFERENCES......................................................................................................................................... 69 Page 1 What is Benchmarking? Benchmarking is an organizational learning process offering a mechanism for identifying the business practices that deliver the best results and create competitive edge (Vorhies and Morgan 2005). The focus of benchmarking has evolved over time, from an initial content focus of examining the performance outcomes, strategy and content of products and services of high-performing organizations, to more recently a process focus on the core capabilities that produce these performance outcomes. Although this dichotomy between content and process is widely referred to in academic research, both issues are involved when conducting benchmarking of organizational capabilities in practice. Organizational capability benchmarking conforms to a structured learning process: 1. A discovery phase in which high-performing organizations and corresponding capability drivers are identified, 2. A gap-analysis phase that assesses the capability differences between the organization conducting the exercise and the high-performing organizations, 3. A capability improvement phase that prioritises and implements the identified improvements. Why Benchmarking? The value of benchmarking organizational capabilities in providing a sustainable competitive advantage is supported by three prevailing theoretical views. The first being resource-based view theory, which identifies heterogeneity in the levels, value, inimitability, and nonsubstitutability of organizations’ resources and capabilities as the main contributor to performance variations between organizations (Amit and Schoemaker 1993; Barney 1991; Wernerfelt 1984). A competitive advantage should arise when benchmarking is applied to enable the enhancement of the capabilities. Moreover, where benchmarking is carried out as part of continuous improvement over time, the process itself lends to the ongoing maintenance of an organization’s capabilities. Second, an organization’s ability to gather information about its market environment and subsequently determine actions, which strategy scholars have termed “market orientation”, has been identified as a key driver for business performance (e.g., Narver and Slater 1990). Benchmarking has been identified by market orientation researchers as an important tool for using resources and capabilities in a manner more appropriate to the market environment. Benchmarking serves as an operational mechanism for examining the external market environment, identifying capability improvements required for superior performance and directing resources towards these improvements. Scholars have noted the role of benchmarking in organizational learning and helping to create market-driven organizations. Third, organizational learning theory asserts that in order for marketbased learning to provide a source of competitive advantage, an organization must have more timely, accurate and alert market surveillance than its competitors (e.g., Teece et al. 1997). Benchmarking is a continuous process that can help to alleviate factors such as perpetual bias, core rigidity, and satisficing problems that impede an organization’s ability and motivation to learn from the market. It has also been posited that both imitation and experimentation lead to organizational improvement (e.g., March 1991). Benchmarking naturally lends itself to imitative learning, but introduction of external ideas into different organizational and capability contexts can lead to the creation of a stock of capabilities unique to the organization benchmarked. The adjustment of imitative capability improvements to a new operating context necessitates learning by experimentation. Page 3 Types of Benchmarking Competitive Benchmarking Competitive benchmarking provides a mechanism for comparing performance relative to direct competitors. However, it can be difficult to obtain this information. Anonymous customer feedback surveys conducted by independent consultants is one method used to counter this difficulty, but this may trigger competitors to solicit the same information and lead to no significant breakthroughs. Care is also needed to ensure that target organizations are appropriate for comparison and that relevant information can be applied to the benchmarking organization’s own context. Xerox provides an example of effective competitive benchmarking comparing its lowvolume printers time to market with companies such as Canon, Minolta and Sharp, with the clear intent to understand how a faster time to market could be achieved. At its core, benchmarking is a mechanism for understanding how better results are achieved and how improvements can be adapted to an organization’s own context to outperform the competition. Any industry, any process, anywhere Generic benchmarking Internal benchmarking Againt oneself Functional benchmarking Non competitor Direct competitor Competitive benchmarking Reactive Proactive Part of the business management process Time Figure 1. Page 4 Types of Benchmarking and Evolution Functional Benchmarking Functional Benchmarking F unctional benchmarking arose out of a deepening understanding of competitive benchmarking as a mechanism for organizational improvement and how it might be applied to a non-manufacturing environment. The objective of functional benchmarking is to compare the performance metrics of specific functions such as distribution, logistics and service with top performers in other industries. The approach has the advantage of greater ease of access to non-competitive organizations performance data as there is a lower threat and a greater potential for establishing collaborative partnerships, which can bring about higher levels of learning for those involved. Businesses tend to be very open to sharing success stories, and they are even more forthcoming when the benchmarking is focused on processes. It is encouraging how willing most organizations are to share information, especially where they are approached in a professional way and anticipate a mutually beneficial outcome. Moreover, benchmarking data from other companies can serve to challenge assumptions and drive innovation. An inherent limitation is that as the data is specific to functions it may not be applicable to other areas of the business. In addition, due to the complex nature of comparison it is important that care be taken when selecting companies to take part in benchmarking activities. Differing measurement methods and other factors such as culture and demographics can frequently contribute to weaken the credibility of findings. As an example, Rank Xerox Limited in Europe conducted a functional benchmarking activity having identified a need to significantly improve its distribution and logistics functions. It selected a highly diverse group of companies such as 3M, Ford, IBM, Sainsbury’s and Volvo, even opting to partner a supermarket chain with an office business systems company. This was considered a radical approach as benchmarking at the process and sub-process levels were not well understood at the time. After some initial resistance, the activity was successful and led to a substantial decrease in inventory levels while retaining the same level of customer service. Page 5 Internal Benchmarking Internal Benchmarking B enchmarking does not have to be against other companies and many multinationals seek to utilize available internal data before searching externally. This is part of continuous efforts to identify and implement better practice into all aspects of business operations. For example, Rank Xerox was able to compare manufacturing processes at its Lille (France), Venray (Holland) and Mitcheldean (UK) plants. This comparison can be made across any part of the operational, manufacturing or non-manufacturing dimensions. Large organizations operating in several countries need to have a way to establish where benchmarks are by business process and function across its many operations. An example of this would be examining the way in which service engineers respond to customer enquiries, and then analyzing this information to determine the best method from the customer perspective. The business might also be able to identify the business area that best handles customer complaints and seek to understand how this is achieved. Internal benchmarking is a simple concept, but it can be difficult to implement in practice. Factors such as cultural differences between countries can reduce the usefulness of comparisons. Another difficulty is that even though potential obstacles may be overcome there is a risk that targets set against internal standards may fall short of industry leading standards that may otherwise have been identified by external benchmarking. Cultural barriers can be overcome. The Malcolm Baldridge model in the US and European Foundation for Quality Management (EFQM) model offers a few pointers for overcoming these barriers. Rank Xerox successfully implemented its own model and demonstrated that comparisons across cultures are useful when there is a consistent and well-documented process underpinning the approach. Page 6 Generic Benchmarking Generic Benchmarking A s benchmarking has become more prevalent and understanding of the practice has grown, it has become apparent that more innovative results can be derived where there is a more generic approach. Generic benchmarking shares many elements with functional benchmarking but there is a greater focus on multifunctional business processes which form the core of business operations. Once these processes are identified they can be benchmarked against any organizations that has a comparable process regardless of size or industry. This is the most recent evolutionary stage of benchmarking and can be applied to any area of a business. The mindset of organizations is finding excellence wherever it is to be found and then seeking to emulate the practice in their own operating context to reap the benefits. For example, a large company making technically complex products benchmarked its “marketing to manufacture” process with a company that had a similar process but operated in a radically different market environment. Page 7 Process of Benchmarking There is no universal process for benchmarking. To identify the common activities, well-known benchmarking frameworks are reviewed in this section. AT&T This methodology arose out of strategic dilemma faced by AT&T with regards to market deregulation and as such is intended to have a focus on strategy. Process selection is centred around how processes contribute to the mission and strategic direction. The process begins with forming a specialist benchmarking team and having them work closely with process owners. Process owners have responsibility to initiate benchmarking processes independently as part of normal business activities. First things first 1. Determine who clients are (process owners and planners) 2. Advance the clients from literacy to champion stage 3. Test the environment. Identify commitment, expose barriers 4. Determine urgency. Avoid states of panic or apathy 5. Determine scope and type of benchmarking required 6. Select and prepare team. Process Page 8 7. Overlay benchmarking process onto business planning process 8. Develop benchmarking plan 9. Analyse data 10. Integrate the recommended actions 11. Take action 12. Continue improvement International Benchmarking Clearing House (lBC) The methodology consists of four phases and as many as 36 steps. These are not compulsory and only applied when appropriate. The methodology should be adapted as necessary to the requirements of the organization. • Select process • Define process inputs and outputs • Gain process owner’s participation • Document process • Select leader and team • Select CSFs to benchmark • Idetify customer expectations • Determine data collection • Analyse process flow and measures • Develop a preliminary questionnaire • Collect internal data • Solicit participation of partners • Perform secondary search • Collect preliminary data • Identify benchmarking partners • Conduct visit • Develop a survey guide • Aggregate data • Project performance to planning horizon • Normalize performance • Develop case studies of best practice • Compare current performance to data • Isolate process enablers • Identify gaps and root causes • Assess adapatability of process enablers • Set goals to close, meet and exceed gap • Commit resources • Modify enablers for implementation • Implement plan • Gain support for change • Monitor and report progress • Develop action plans • Identify opportunities for benchmarking • Communicate plan • Recalibrate the benchmark Benchmarking via this model is understood as a cyclical process which emphasizes the following: • B enchmarking stands aside from competitive analysis in that it is process focused and not constrained to the same industry. • Management buy-in and integration with strategic planning is essential. • Planning, organization and a highly nuanced understanding of internal processes is critical Page 9 McKinsey & Co. McKinsey takes a strategically focused approach and recommends that the organization consider business areas and processes therein that contribute the most value. This is not always apparent, such as in the case of a manufacturing firm using several bought in assemblies could conclude that most of the value added is coming from its supply chain management process. The methodology is heavily process focused which it states is a key advantage of benchmarking over competitive analysis. Page 10 1. Choose what process to benchmark 2. elect key measures and practices (both input and output measures on quality, timeliness, S etc.) 3. Identify comparable processes and benchmark companies 4. Assess the world-class approach 5. Develop change priorities McNair & Leibfried As with other approaches, the benchmarking process is orientated by a focus on strategy. Action, however, can only flow from a more detailed consideration of operational aspects. As benchmarking resources are inherently limited, the methodology proposes a rational selection method be used for targets. It is important to consider the organization’s critical success factors and determine the factors that have the greatest impact on shareholder value. Benchmarking activity is also driven by organizational goals and consequently an understanding of customer needs. It is also recommended that external best practice be interpreted with reference to customer satisfaction. The purpose of benchmarking can be evaluated through roles, processes or strategic issues. Focusing on how a role is performed, how a process is undertaken and why a strategic issue is defined. Identify core Internal baseline External data issures data collection collection Analysis Change Implement INPUT Issue Overview of Benchmark Compare Implementation •U nmet Customer process questionnaire and contrast plan needs benchmark data •P erfomance gap Current measure • Problem areas Potential drivers • S trategic and external advantage Issue organiztions OUTPUT Defined benchmark area Process flow External mapping company(s) Overview of key processes to benchmark Validate drivers Gap Plan to close gap Process Action to close improvements/ gap reengineering Selected performance Benchmark target Process measeurements companies analysis opportunities performance New Identify potential drivers Short-term assessment •F lows/policies/ and external organiztions operational and measures Recalibrate benchmarks procedures improvements Additional analysis/ benchmarking to Implementation Benchmark plan questionnaire Outstanding address issues issues Figure 2. McNair and Leibfried Methodology Page 11 Vaziri’s Methodology This methodology is also strategy focused and stresses the need to clearly decide the object of the benchmarking It suggests considering mission, strategic direction and the needs of customers for setting priorities. Vaziri’s methodology acknowledges benchmarking as a way of managing process innovation Needs Assessment Team Benchmarking Team Identify customers What Identify key u s to m e r e y ccustomer Id e n ti fy k need need • need nott m met et • need no by • needd met b e tt e r by t better • nee me competition on c o m p e ti ti be c o u ldbe • needdmet b u tcould tbut • nee me improved im p ro v e d te a m Problem s o lv in g team P ro b le m solving 1 Identify CSFs (what) 2 Identify competitor or best-in-class 3 Gather data 4 Analyse findings (how much, why) 5 Communication 6 Strategize (how) 7 Solve problem (action) Monitor progress/upgrade data No Figure 3: Page 12 re a c h e d ? Target Ta rg e t reached? Vaziri’s Methodology Yes Xerox (Robert Camp) Xerox lay much of the groundwork of benchmarking processes and it is befitting that their methodology is one the well known and utilized. It emphasizes both the strategic and operational components and requires the integration of benchmarking into corporate planning processes. The methodology the importance of prioritisation of benchmarking candidates which typically starts at the mission statement level before moving through subordinate processes such as customer-supplier chains and deliverables. This benchmarking methodology entails five phases: • Planning 1. Identify what is to be benchmarked. 2. Identify comparative companies. 3. Determine data collection method. • Analysis 4. Determine current performance ‘gap’. 5. Project future performance levels. • Integration 6. Communicate benchmarking findings and gain acceptance. 7. Establish functional goals. • Action 8. Develop action plans. 9. Implement specific actions and monitor progress. 10. Recalibrate benchmarks. • Maturity: Leadership position attained and practices fully integrated into processes. Schmidt’s Methodology This methodology involves the following: 1. 2. Research own company first and identify key success factors of the business. Establish scope and basis of benchmarking comparisons: strategic customer, cost versus best meets company’s improvement needs. 3. Select the group of comparators; identify and screen companies for the comparison group. 4. Develop a detailed plan for data collection and processing: sources could include customers’ trade associations, employees, joint venture partners, co-operative data exchanges, interviews or surveys. 5. Develop conclusions and establish performance targets to ensure that benchmarking is a catalyst for the future. Page 13 Benchmarking using Food Innovation Maturity Model (FIMM) As detailed in Part III, FIMM is useful for assessing the innovation capability of a food business. FIMM can also support benchmarking, which allows a food company to identify gaps in its innovation capability with respect to competitors and learn from best practices. Since innovation is typically a multi-functional endeavor, involving functional units such as strategic planning, marketing, and finance, FIMM is a type of “generic benchmarking” (see page 6). Our review of the processes of benchmarking (see page 7) indicates that the following activities are common and necessary. Accordingly, they are included in FIMM benchmarking: 1 Collect data using benchmarking questionnaire 2 Analyze data to identify gaps and visualize results 3 Prioritize actions for strengthening innovation capability 4 Analyze data to identify best practices From a food business’s perspective, benchmarking using FIMM answers the following questions: • What is our business’s current level of maturity in innovation capability? • How strong is our food innovation capability compared with the industry average? • What are the key actions for strengthening innovation capability? • Which key actions are of the highest priority? • What can we learn from the best practices of others? The process of FIMM benchmarking will be illustrated with a food company in the following lines of food business: • Restaurant Chains • Food Catering Service Provider • Food Processing/Manufacturing Establishments Page 14 1 Benchmarking of Restaurant Chains Illustrated with BRC For the purpose of illustration, data were collected from four restaurant chains for benchmarking (BRC, HRC, LRC, SRC). BRC is a franchised German casual dining restaurant conceived in 2006. It has close to 20 outlets in seven countries and focuses on providing high-quality and innovative food and beverage inspired by German roots. BRC was awarded the Singapore SME 1000 for Turnover Growth Excellence in the Hospitality/ Food & Beverage sector in 2015. BRC’s recent innovation initiatives include new menu items such as home-style recipes and vegetarian offerings, as well as events such as a German carnival of traditional flavors. HRC is an international burger bar that offers an extensive menu of gourmet burgers (e.g., vegan, beef and chicken), salads, tea, and cocktails in a casual setting. The chain believes that burgers should be enjoyed casually in a unique ambience even in a busy city. Established in 2010, RCH has since set up more than 50 outlets, in Austria, Switzerland, Italy, and Singapore. Its founders have more than 15 years of experience in running restaurant chains. LRC operates more than ten restaurants, bars, and cafés since 2005, including one in Asia’s 50 Best Restaurants 2019 list. LRC’s culture is young, vibrant and dynamic. Its recent innovation initiatives include plant-based offerings and Impossible Foods to meet the rising demands of more conscious diners. LRC has also replaced single-use plastic straws with reusable metal straws or straws made from biodegradable materials like tapioca. It has recenetly ventured into food-related technologies such as mobile ordering and payment services. SRC’s key offerings include salad, grain bowls, pastries, and all-natural fruit smoothies, with high-quality local ingredients to help reduce carbon footprint while ensuring freshness. Established in 2009, SRC is operating in ten countries. SRC joined the global cage-free movement with a commitment to use exclusively cage-free eggs in its supply chain by 2025. It also focuses on technology in its next stage of growth. SRC’s mobile app will move beyond being a loyaltypoints system to offer more personalized services such as recommendations based on personal habits and food delivery to chilled personal lockers in office buildings. Page 15 1 Collect data using benchmarking questionnaire Data were collected from BRC and other restaurant chains using the FIMM questionnaire (developed in Part II). Their innovation maturity levels are shown in Appendix A1 to A4. BRC is at innovation maturity level 2 (i.e., “Casual Innovator”). Notably, it has achieved level 3 for APM Company Name: “Strategy & Leadership”, “People & Culture”, “Innovation Process”, and “Technology”. To further APM Company Name: Processing/Manufacturing Type of Business Profiled: developType itsofinnovation maturity, BRC should focus on innovating to more proactively manage Processing/Manufacturing BusinessName: Profiled: APM Company 2 APM's Innovation Maturity Level: food hygiene and safety inLevel: “Food Production/Service”, and better collecting and managing data 2 Processing/Manufacturing APM's Type Innovation Maturity of Business Profiled: in “Operations”. 2 APM's Innovation Maturity Level: COMMITTED COMMITTED CASUAL CASUAL COORDINATED COMMITTEDCOORDINATED CASUAL COORDINATED CURIOUS CURIOUS CONNOISSEUR CONNOISSEUR CURIOUS 5 5 4 4 33 22 11 CONNOISSEUR CapabilityLevel Levelof ofEach EachKey KeyAspect Aspect Capability Capability Level of Each Key Aspect 5 4 3 2 1 Strategy & PeoplePeople & Culture Culture & LeadershipPeople & Culture StrategyStrategy & Leadership Leadership & 11 1 1. Strategic Alignment Innovation Process Innovation Process Innovation Process Technology Technology Technology Capability Level EachElement Element Capability Level ofof Each Capability Level of Each Element 22 2 3 33 FoodProduction/Service Production/Service Food Production/Service Food 4 44 Strategy & Leadership 3. Sensing of Innovations 3. 3. Sensing of Innovations 4. Innovation Partnerships People & Culture 4. 4. Innovation Partnerships 5. Training 5. Training 6. Talent Management 6. Talent Management 7. Employee Engagement 8. Learning from Failure 7. Employee 7. Engagement Innovation Process 9. Ideation 8. Learning from Failure 10. Innovation Resource 9. Ideation 11. Innovation Outcome 10. Innovation Resource 10. 12. Automation Technology 11. Innovation Outcome 11. 13. Data in Decisions 12. Automation 14. Emerging Technology 13. Data Data in in Decisions Decisions 13. 15. Access to Knowledge 14. Emerging Emerging Technology Technology 14. 16. Customer Orientation 15. Access Access to to Knowledge Knowledge 15. 17. Food Hygiene/Safety 16. Customer Customer Orientation 16. Orientation 18. Change Management 17. Food Food Hygiene/Safety 17. 19. Hygiene/Safety Operations Innovation Operations Food Food Production Production&& Operations Service Operations Service 2. Leadership Support 2. Leadership Support Food Production & Service Technology Technology Innovation Innovation Process Process People & Culture & Strategy & Leadership Leadership 1. Strategic Alignment 18. Change Change Management Management 20. Digitalization 18. 19. Operations Operations21. Innovation Data Collection 19. Innovation 20. Digitalization Digitalization 20. 21. Data Data Collection Collection 21. Figure 4. Page 16 BRC’s Food Innovation Maturity Level Operations Operations Operations 5 5 5 2 Analyze data to identify gaps and visualize results The food innovation maturity of a company can be benchmarked against the average of other restaurant chain companies. For BRC, the charts indicate that it is above the industry average for the innovation aspects of “Innovation Process” and “Technology” (see Figure 5); It is slightly below the industry average for innovation in “Food Production/Service” and “Operations”. Comparison at the more detailed element level reveals more specific gaps in the following aspects: • Innovation partnerships • Customer orientation • Innovation focus in food hygiene and safety • Change Management • Digitalization • Data collection These gaps indicate priorities for BRC in strengthening its innovation capability, as discussed next. Food Innovation Maturity Compared to Other Companies APM Other Processing/Manufacturing Companies Strategy & Leadership 5 4.5 4 3.5 Operations 3 People & Culture 2.5 2 1.5 1 Food Production/Service Innovation Process Technology Figure 5. Food Innovation Maturity of BRC vs. Other Restaurant Chains Detailed Food Innovation Maturity Level Compared to Other Companies 5 Other Processing/Manufacturing Companies 5 5 APM Page 17 Technology Detailed Food Innovation Maturity Level Compared to Other Companies 5 3.5 Strategy & Leadership People & Culture Innovation Process T e c h n o l og y 2.5 21. Data Collection 2 2.5 20. Digitalization 2 2.5 Food Production & Service 19. Operations Innovation 18. Change Management 17. Food Hygiene/Safety 16. Customer Orientation 15. Access to Knowledge 14. Emerging Technology 13. Data in Decisions 12. Automation 11. Innovation Outcome 10. Innovation Resource 9. Ideation 8. Learning from Failure 7. Employee Engagement 6. Talent Management 5. Training 2. Leadership Support 1. Strategic Alignment 2 2 2.5 3 3.5 4 3.5 3 2.5 3 3 3 3.5 4 4 3.5 4 3.5 4 3.5 4 4 3 3 3.5 4 4 4. Innovation Partnerships 4 4 4 3. Sensing of Innovations 3.5 3.5 4 5 Other Processing/Manufacturing Companies 5 APM Operations Food Innovation Aspects Better Than % Other Companies 100% 80% 60% 40% 66.7% 66.7% 20% 0% ‐20% Strategy & Leadership 33.3% 33.3% People & Culture Innovation Process Technology ‐33.3% Food Production/Service Operations ‐33.3% ‐40% ‐60% ‐80% ‐100% Figure 5. Page 18 Food Innovation Maturity of BRC vs. Other Restaurant Chains (continued) 3 Prioritize actions for strengthening innovation capability The preceding comparison indicates that BRC can progress to the next level of maturity by focusing on the innovation aspects of “Food Production/Service” and “Operations”. It is also in these aspects that BRC is slightly below the industry average. Therefore, these aspects are of the highest priority compared to the other aspects. Specific recommendations for strengthening these aspects are: •F ocus more on the total food experience in innovation initiatives • Innovate to go beyond compliance to more proactively reduce food hygiene and safety risk (e.g., using alerts, prompts, nudges) •C ommunicate to employees the importance of staying open to change and participating in innovation initiatives •D igitize more key operations data •C apture more key data immediately at the source to ensure that decisions are made on updated data Comparing BRC and other restaurant chain companies at the more detailed element level indicates a mid-to-high-priority direction for strengthening innovation capability: •C onsider establishing supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or selected consumers To develop stronger innovation capability than competitors, BRC can first focus on innovation aspects that it already excels in to get a headstart, namely “Innovation Process” and “Technology”. The following can be considered as the wow-to-medium-priority targets of improvement: •C larigy that all managers, not just senior managers, have the chance of getting resources for innovating their work • I dentify all key processes that can be automated •G o beyond diagnostic analyses and analyze data to predict the future (“what is likely to happen?”) •D evelop plan to pilot test a selected emerging technology Page 19 4 Analyze data to identify best practices Best practices for each of the six key aspects of innovation can be identified from companies that excel in managing the aspect. This is illustrated with the four restaurant chain companies included in benchmarking. Strategy and Leadership Pursue disruptive innovations that inform future strategy – BRC has assigned a senior manager to oversee innovations and dedicate more effort to breakthrough innovations. For instance, the company is looking to develop innovative solutions to existing challenges such as enhancing customer experience and marketing. The company is also considering the potential of tackling a new need or want of customers beyond its current focus. It is exploring the concept of Service 2.0 and recognizes that the initiative can lead to a new strategy. The CEO emphasized the importance of consciously remaining open minded to strategic change driven by innovation. LRC is pursuing disruptive innovations by investing in startups, including a hiring platform, cloud kitchen, and food ordering App. These initiatives are in line with the current business strategy – they are expected to improve the existing branding and the best-in-class image. They are also anticipated to lead to strategic shifts. Establish innovation partnership with unfamiliar partners – SRC has worked with local institutes of higher learning to develop packaging solutions, vending machine solutions, branding, and sustainable products. The company is also collaborating closely with local farms to improve the taste and quality of agricultural products based on customer feedback. People and Culture Invite all employees, including operations staff to participate in innovation – BRC, HRC, and LRC all make effort to include operations staff in innovation. At BRC, all employees are encouraged to innovate and participate in the planning of implementation, as the CEO explained: “Employees are 100% involved, because it’s a team effort, it’s not a top down thing. They suggest ideas a lot. They are empowered based on high-level metrics to come up with plans.” HRC ensures that feedback is gathered from employees as innovation is implemented. The CEO describes: “We will give it a try, observe, and get feedback…it’s more a team approach, where everyone would give input…Then we try, evaluate again, and then decide what’s the pros and cons, what’s the step forward.” At LRC, innovation initiatives are often carried out in teams comprising employees at different levels, such as the head of concept development, design team staff, chefs, and operations staff. Page 20 Innovation Process Assess innovation outcomes with qualitative and quantitative data from multiple sources – BRC gathers qualitative feedback for new dishes from customers by “touching tables” and observing leftovers. Concurrently, quantitative data such as sales are analyzed. When employees suggest ideas for innovation, they are also encouraged to identify qualitative and quantitative measures so that the impact can be assessed. SRC collects qualitative data from multiple sources, as the CEO describes: “We do focus groups. We get feedback through our App…We have a very engaged customer base.” The company has also hired a data analyst whose responsibilities include assessing the outcomes of innovation initiatives: “He looks at all the data that comes through and he’s constantly looking at the delivery companies if we’ve launched a new promotion there. We’ll look at those things constantly. So he’s just looking at the success of every new promotion and innovation.” Technology Pilot test emerging technologies – SRC has been actively learning about new technologies such as augmented reality and considering how they can be applied to food businesses. For instance, it has recently piloted a training system based on augmented reality. The system takes the place of a trainer and guides new hires as they prepare food for customers. It has been found to help new hires get up to speed faster. Page 21 Food Production/Service Focus on the total food experience in innovation – HRC’s CEO emphasizes the total experience when deliberating innovation initiatives: “We must satisfy customer, we must make sure we are up to the standards and all the guests are very happy with the service, food and get overall excellent experience” For instance, improving the total experience is the key driver of implementing an digital ordering system. “Customers want to their food, as soon as possible, as fresh as possible…through the app we just take an order and send…there is efficiency…so the customer will receive it much faster.” At LRC, customer feedback and data is analyzed at the dish level as well as the meal level to capture the total food experience and inform further innovation initiatives. The CEO explained: “What’s captured in our marketing is more about the experience – how do customers make decisions? How does the menu look? How does it tell a story? What are the online touch points? Offline touch points?” SRC creates a more holistic food experience for its customers through its App and other technologies: “We have innovated a lot on the consumer experience standpoint when it comes to our APP, our loyalty program, our pre-ordering platform, our mobile wallet. We have innovated in the backend – how we deal with our order management system, ...full traceability from central kitchen to the outlet. We keep adapting the product as well – we have introduced grain rolls. During the colder months we also introduce products fit the weather and rather than just cold salad….We have launched vending machines.” Page 22 Benchmarking of Food Catering Service Provider Illustrated with SCS Three catering service providers are included in benchmarking (CCS, SCS, and TCS). SCS is chosen for illustration here because it is at or exceeds the industry average in every key innovation aspect. CCS provides catering services for corporate events, sports events, social events, and weddings. Established in 1996, it has won awards such as The Distinguished Restaurant Award, Golden Peony, and Rocheston Distinguished Restaurant Awards. Recent innovation initiatives include an afternoon tea party concept during the Sakura season in Japan, and allowing guests to mix their own premium gin with tonic and more than 30 herbs, spices and other garnishes. SCS provides one-stop catering solution for corporate events, home parties, weddings, and buffets. It has more than 25 years of food catering experience and is a winner of Singapore Quality Award in 2017. SCS’s recent innovation initiatives include food trend study to create new menu items such as Japanese and Korean dishes, offerings that cater to small gatherings (less than 20 persons), and Tingkat services with door-step delivery. TCS was founded in 2009. TCS provides catering services for various private, social, and corporate events such as weddings, gatherings, product launches and meetings. TCS was a caterer for high-profiled events including the IMF Convention, as well as the Singapore F1 Grand Prix. Page 23 1 Collect data using benchmarking questionnaire The three food caterers’ food innovation maturity levels, assessed using the FIMM questionnaire, BRC Company Name: are shown in Appendix A5 to A7. SCS is at maturity level 3 (i.e., “Committed Innovator”). It is Restaurant Chain Type of Business Profiled: at maturity level 3 for all six key innovation aspects. SCS is close to achieving level 4 in its 2 BRC's Innovation Maturity Level: “Innovation Process”, with two out of three elements at level 4. COMMITTED CASUAL COORDINATED CURIOUS CONNOISSEUR Capability Level of Each Key Aspect 5 4 3 2 1 Strategy & Leadership People & Culture Innovation Process Technology Food Production/Service Operations Capability Level of Each Element 1 2 3 Innovation Process People & Culture Strategy & Leadership 1. Strategic Alignment 2. Leadership Support 3. Sensing of Innovations 4. Innovation Partnerships 5. Training 6. Talent Management 7. Employee Engagement 8. Learning from Failure 9. Ideation 10. Innovation Resource 11. Innovation Outcome Food Production & Operations Service Technology 12. Automation 13. Data in Decisions 14. Emerging Technology 15. Access to Knowledge 16. Customer Orientation 17. Food Hygiene/Safety 18. Change Management 19. Operations Innovation 20. Digitalization 21. Data Collection Figure 6. Page 24 SCS’s Food Innovation Maturity Level 4 5 2 Analyze data to identify gaps and visualize results SCS is at the industry average in the key aspect of “Innovation Process” and exceeds the industry average in all other aspects. An examination of the individual elements of the “Innovation Process” aspect reveals that SCS is slightly below the industry average for the element of “Innovation Resource”. While SCS does not face much short-term pressure to catch up with competitors, focusing first on “Innovation Process” in its development of innovation capability will help differentiate it further from competitors. This will also create some leeway for working towards the next level of innovation maturity. Food Innovation Maturity Compared to Other Companies BRC Other Restaurant Chain Companies Strategy & Leadership 5 4.5 4 3.5 Operations People & Culture 3 2.5 2 1.5 1 Food Production/Service Innovation Process Technology Food Innovation Maturity of SCS vs. Other Food Catering Companies Detailed Food Innovation Maturity Level Compared to Other Companies 5 5 Other Restaurant Chain Companies Strategy & Leadership People & Culture Innovation Process T e c h n o l og y Food Production & 2.5 2 21. Data Collection 20. Digitalization 19. Operations Innovation 2 2.5 3 2.5 3 18. Change Management 17. Food Hygiene/Safety 16. Customer Orientation 15. Access to Knowledge 14. Emerging Technology 13. Data in Decisions 12. Automation 11. Innovation Outcome 10. Innovation Resource 9. Ideation 8. Learning from Failure 7. Employee Engagement 6. Talent Management 5. Training 4. Innovation Partnerships 3. Sensing of Innovations 2. Leadership Support 1. Strategic Alignment 2 2.5 3 3 3 2.5 3 3 3 3 2.5 3.5 4 4 3.5 4 4 4 3.5 4 3 3 3 3 3.5 4 4 4 3.5 4 4.5 5 BRC 5 Figure 7. Operations Page 25 Technology Detailed Food Innovation Maturity Level Compared to Other Companies 5 5 5 Other Restaurant Chain Companies Strategy & Leadership People & Culture Innovation Process T e c h n o l og y Food Production & Service 2.5 2 21. Data Collection 20. Digitalization 19. Operations Innovation 2 2.5 3 2.5 3 18. Change Management 17. Food Hygiene/Safety 16. Customer Orientation 15. Access to Knowledge 14. Emerging Technology 13. Data in Decisions 12. Automation 11. Innovation Outcome 10. Innovation Resource 9. Ideation 8. Learning from Failure 7. Employee Engagement 6. Talent Management 5. Training 4. Innovation Partnerships 3. Sensing of Innovations 2. Leadership Support 1. Strategic Alignment 2 2.5 3 3 3 2.5 3 3 3 3 2.5 3.5 4 4 3.5 4 4 4 3.5 4 3 3 3 3 3.5 4 4 4 3.5 4 4.5 5 BRC Operations Food Innovation Aspects Better Than % Other Companies 100% 80% 60% 40% 20% 0% ‐20% ‐40% 33.3% 33.3% Strategy & Leadership People & Culture 66.7% 66.7% Innovation Process Technology Food Production/Service Operations ‐66.7% ‐66.7% ‐60% ‐80% ‐100% Figure 7. Page 26 Food Innovation Maturity of SCS vs. Other Food Catering Companies (continued) 3 Prioritize actions for strengthening innovation capability To outperform competitors on all aspects of innovation, SCS should advance its “Innovation Process” aspect first. To strengthen its overall innovation capability, it should further develop other aspects, focusing on those closer to level 4 first: Low-to-medium-priority aspect and elements • O perations • I nnovate to better forecast demand and supply for operations • Digitize more key operations data •C apture more key data immediately at the source to ensure that decisions are made based on updated data Medium-to-high-priority aspects and elements: •S trategy and Leadership •C onsider going beyond incremental innovation to undertake more breakthrough innovations that are aligned with the current strategy • I ncrease public recognition of employees participating in innovation •P eople and Culture •T rain employees more frequently to ensure that they stay abreast with technology advancement •R etain talents innovation necessary to support •E ncourage employees to consider and pursue some risky innovations • Technology • I dentify all automated key processes that can be •G o beyond diagnostic data analysis and use data to predict the future (“what is likely to happen?”) •D evelop plan to pilot test a selected emerging technology •F ood Production & Service •F ocus more on innovating to develop food safety and hygiene habits Highest-priority element: • Communicate to employees the importance of staying open to change and participating in innovation initiatives •C larify that all managers, not just senior managers, have the chance of getting resources for innovating their work Page 27 4 Analyze data to identify best practices People & Culture Invite all employees, including operations staff to participate in innovation – SCS encourages employees at all levels to participate in innovation initiatives. For instance, a process innovation in the preparation of beverages involved operations staff right from the beginning, who ideated and developed potential solutions based on their experience of preparation and serving the beverage. Technology Pilot test emerging technologies – TCS is always scanning the market for new food technologies. It was one of the earliest in Singapore to test and eventually adopt robotic cooking machines. The largest of the robots can fry 100kg of fried rice in an hour. A human chef, working at top speed, could do 30. They also save the firm money, as human chefs are expensive and it costs a lot less to hire a trainee who can operate the machines. Page 28 Benchmarking of Food Processing/ Manufacturing Establishments Illustrated with APM Four establishments are included in benchmarking (APM, IPM, JPM, VPM). The benchmarking of APM will be illustrated to show how FIMM can be useful for start-ups. APM is developing and commercializing a food technology that breaks agricultural products into compounds. The technology has a wide variety of applications, including new food products, unique dining concepts, and new packaged food. It can also help to reduce food waste, as it allows parts of agricultural products that are not traditionally consumed to be used for other nutritional purposes. IPM brands itself as a first-class purveyor of gourmet halal food products. IPM does meat and seafood canning and trading, prepared meals and manufactures meat and poultry. It has international distributors in the Middle East, Singapore, Macau, and Hong Kong. Food quality and safety is paramount in its manufacturing, which is managed with an upgraded SAP system. IPM is certified by independent bodies and government agencies and has attained the ISO 22000 Food Safety Management System, which allows full product traceability. JPM processes fresh frog meat, crocodile tail, venison flank steak, and premium Hashima free from antibiotics, hormones, or steroids. Established in 1981, JPM seeks to provide alternative food sources for people who are conscious of healthy eating and food safety. It also offers tours with live displays and demonstration. JPM’s innovation initiatives include exploring r ecirculating aquaculture systems, use of sensors and robotics to automate tasks like net cleaning, and reducing food waste by exploring ways to use other frog parts. VPM is the leading South American wine producer and one of the largest wine companies in the world. Its products range from entry level to iconic ultra-premium wines from Chile, Argentina, and California, with award winning quality and consistency. VPM has presence in more than 145 countries and is one of Drinks international’s “World’s Most Admired Wine Brands”. The company regularly conducts consumer research to inform its retail and pricing strategies. It also set up a research center to leverage digital tools and new technologies to improve winemaking practices and wine quality. For example, a new measurement system that uses drones and multispectral cameras to obtain vineyard data has been developed. The system allows the prediction of production based on artificial intelligence. Page 29 1 Collect data using benchmarking questionnaire The food innovation maturity levels of the four food processing/manufacturing companies are shown in Appendix A8 to A11. Overall, APM’s innovation capability is at maturity level 2. It is at SCS Company Name: level 2 for the aspects of “Technology” and “Operations”. It has achieved level 3 for the aspects Catering Type of Business Profiled: of “People & Culture”, “Innovation Process”, and “Food Production/Service”, and attained level 4 3 SCS's Innovation Maturity Level: for “Strategy & Leadership”. COMMITTED CASUAL COORDINATED CURIOUS CONNOISSEUR Capability Level of Each Key Aspect 5 4 3 2 1 Strategy & Leadership People & Culture Innovation Process Technology Food Production/Service Operations Capability Level of Each Element 1 2 3 Innovation Process People & Culture Strategy & Leadership 1. Strategic Alignment 2. Leadership Support 3. Sensing of Innovations 4. Innovation Partnerships 5. Training 6. Talent Management 7. Employee Engagement 8. Learning from Failure 9. Ideation 10. Innovation Resource 11. Innovation Outcome Food Production & Operations Service Technology 12. Automation 13. Data in Decisions 14. Emerging Technology 15. Access to Knowledge 16. Customer Orientation 17. Food Hygiene/Safety 18. Change Management 19. Operations Innovation 20. Digitalization 21. Data Collection Figure 8. Page 30 APM’s Food Innovation Maturity Level 4 5 2 Analyze data to identify gaps and visualize results APM is above the industry average in the innovation aspects of “Strategy & Leadership” and “Food Production & Service”. It is at the industry average for “People & Culture”. Aspects needing specific attention are “Innovation Process”, “Technology”, and “Operations”, in which APM is slightly below the industry average. A closer examination of the specific elements reveals that APM is also slightly below the industry average in the element “Talent Management”, even though APM is overall at the industry average for the corresponding “People & Culture” aspect. This indicates the importance of examining the analysis at different levels of granularity to avoid missing important information. Food Innovation Maturity Compared to Other Companies SCS Other Catering Companies Strategy & Leadership 5 4.5 4 3.5 Operations People & Culture 3 2.5 2 1.5 1 Food Production/Service Innovation Process Technology Figure 9. Food Innovation Maturity of APM vs. Other Companies Detailed Food Innovation Maturity Level Compared to Other Companies Other Catering Companies 4 4 3 2.5 3 2.5 21. Data Collection 20. Digitalization 2 9. Operations Innovation 18. Change Management 17. Food Hygiene/Safety 16. Customer Orientation 15. Access to Knowledge 14. Emerging Technology 2 13. Data in Decisions 12. Automation 11. Innovation Outcome 10. Innovation Resource 9. Ideation 8. Learning from Failure 7. Employee Engagement 3 3 3 2.5 3 3 3 3 3 3 2.5 3 3 3 2.5 2.5 3 6. Talent Management 5. Training . Innovation Partnerships 3. Sensing of Innovations 2 2.5 3 3.5 4 4 4 4 2.5 3 2. Leadership Support 1. Strategic Alignment 2 2.5 3 3.5 4 5 5 SCS Page 31 Technology Detailed Food Innovation Maturity Level Compared to Other Companies Other Catering Companies Strategy & Leadership 4 4 4 3 2.5 3 2.5 Food Production & Service 21. Data Collection 20. Digitalization 19. Operations Innovation 18. Change Management 17. Food Hygiene/Safety 16. Customer Orientation 2 T e c h n o l og y 15. Access to Knowledge 14. Emerging Technology 13. Data in Decisions 2 Innovation Process 12. Automation 11. Innovation Outcome 10. Innovation Resource 9. Ideation 8. Learning from Failure 7. Employee Engagement People & Culture 3 3 3 2.5 3 3 3 3 3 3 2.5 3 3 3 2.5 2.5 3 6. Talent Management 5. Training 4. Innovation Partnerships 3. Sensing of Innovations 2 2.5 3 3.5 4 4 4 2.5 3 2. Leadership Support 1. Strategic Alignment 2 2.5 3 3.5 4 5 5 SCS Operations Food Innovation Aspects Better Than % Other Companies 100% 80% 60% 100.0% 100.0% 100.0% 100.0% 40% 50.0% 20% 0% ‐20% Strategy & Leadership People & Culture Innovation Process 50.0% Technology Food Production/Service Operations ‐40% ‐60% ‐80% ‐100% Figure 9. Page 32 Food Innovation Maturity of APM vs. Other Companies (continued) 3 Prioritize actions for strengthening innovation capability The gap analysis indicates that innovation aspects of highest priority in APM’s development of innovation capability are “Innovation Process”, “Technology”, and “Operations”. Focusing on these aspects first as APM begins operating will bring APM closer to the industry average. An innovation element to be developed with medium-high priority is “Talent Management”. This will prevent APM from falling below the industry average in the “People & Culture” aspect. In the long term, APM should develop those innovation aspects that it already excels in to further differentiate itself from competitors in terms of innovation capability (low-to-medium priority), or work on aspects that help advance APM to the next level of maturity. Low-to-medium-priority element: •S trategy & Leadership: Consider establishing supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or selected consumers •F ood Production/Service: focus more on innovating to develop safety and hygiene habits Medium-to-high-priority element: •T alent management: Recruit and retain talents to support the key innovation initiatives Highest-priority aspects and elements: • I nnovation Process: Assess innovation outcomes with both qualitative and quantitative data when the data become available • Technology •P lan to go beyond descriptive analysis to analyze data for diagnosis (“what affects performance?”) •D evelop a plan to pilot test an emerging technology, as many others in the industry are already doing • Operations •C onsider focusing more on innovating to better analyze demand and supply for improving operations • Plan to digitize more key operations data •P lan to capture more key data immediately at the source so that data is always up to date Page 33 4 Analyze data to identify best practices Strategy & Leadership Pursue disruptive innovations that inform future strategy – APM is considering to look beyond agricultural products to lab grown food. This can potentially lead to a new strategy that focuses more on sustainability and food security, which represents a shift from its current focus of reducing food waste. Establish innovation partnership with unfamiliar partners – JPM is partnering with other food processing/manufacturing establishments in the same area to organize educational tour routes for visitors. This helps to raise brand awareness for JPM products. The tour also serves an educational purpose and is part of fulfilling corporate social responsibility. People & Culture Taking risks and preparing to learn from failure – VPM has set up a five-million-dollar research center to engage in research activities that are expected to have long-term implications. Projects at the center range from improving the taste of products to their impact on consumers’ health. The company is constantly learning from experimentations at the center. Innovation Process Employees can suggest and discuss each other’s’ ideas anytime online – VPM has set up an online platform where employees from different parts of the world can interact 24/7. The platform allows employees to share and discuss ideas and serves as a seedbed for innovation initiatives. Technology Pilot test emerging technologies – VPM has pilot-tested packaging with the near-fieldcommunication technology to see how it can improve operations as well as reach a younger demographic while also benefiting existing clients by integrating the technology with the company’s social media and marketing initiatives. Page 34 Summary of the Benchmarking Process and Mechanism To benchmark a company: 1. Collect data using FIMM questionnaire (a) Enter data into Worksheet “1” of this Excel workbook to visualize results (b) T ake note of the overall level of maturity and capability level of each key aspect of innovation 2. Analyze data to identify gaps and visualize results (a) Select the subject company in Worksheet “3” (b) Take note of all key aspects above and below industry average (c) Take note of all specific elements below the industry average 3. Prioritize actions for strengthening innovation capability (a) H ighest priority: key aspects of innovation that are below the industry average and the corresponding elements (from 2b) (b) M edium-to-high priority: specific elements that are below the industry average (from 2c) (c) L ow-to-medium priority: aspects and corresponding elements that a company excels in (that is, already above the industry average) to further distinguish the company from competitors, OR aspects and corresponding elements that should be improved to take the company to the next level of innovation maturity. 4. Analyze data to identify best practices (a) T ake note of elements that are at level 5. Analyze the interview transcript further to identify potential best practices. If necessary, contact the company for further details. Commercially sensitive details should be omitted in publications. Notes: • F IMM is a management tool for guiding the development of innovation capability, rather than a performance measurement tool. This should be emphasized when explaining the recommendations. •T he summary sent to companies should focus on providing details for companies to understand where they stand in relation to other companies. A sample of summary sent to companies is available here. •A list of Singapore 1000 and SME 500 food companies is available here. Page 35 Appendix A1. BRC’s Maturity Level Level Level 1 Key Area Strategy and Leadership Level 2 Level 3 Level 4 Level 5 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often There is no are employees trained formal training for new skills and programme yet knowledge? Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 36 Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online There is no slack resource for innovation yet There is no formal process for getting resources Only senior managers have the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome There is no formal – To what extent process is there a formal process for assessing innovation outcomes? Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding Use an ad hoc knowledge/ approach to solution yet find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? Technology Page 37 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) Page 38 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Appendix A2. HRC’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) People and Culture 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations Page 39 Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal process for getting resources Only senior managers have the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Technology Page 40 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Food hygiene/ Safety – What is the safety is not yet an innovation focus? innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have We have We have We have reorganized within reorganized within reorganized within reorganized within the past ten years the past five years the past three the past two years years 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Operations (including inventory, logistics, delivery) Page 41 Appendix A3. LRC’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be There is informal avoided as much as learning from possible failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 42 Level Level 1 Level 2 Level 3 Level 4 Level 5 Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Technology Page 43 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/ service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years 19. Operations Innovation What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Operations (including inventory, logistics, delivery) Page 44 Appendix A4. SRC’s Maturity Level Level Level 1 Key Area Strategy and Leadership Level 2 Level 3 Level 4 Level 5 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation There is no Partnerships – To formal innovation what extent is there partnership yet joint innovation with other organizations? There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 45 Level Level 1 Level 2 Level 3 Level 4 Level 5 Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation There is no formal Outcome – To process what extent is there a formal process for assessing innovation outcomes? Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? Employees are encouraged to suggest ideas during weekly meetings Technology Page 46 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/ service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Page 47 Appendix A5. CCS’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment Strategy is not yet – How are formally considered business strategy in innovations and innovation initiatives related? Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 48 Level Level 1 Level 2 Level 3 Level 4 Level 5 Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources Innovation outcomes are assessed with qualitative data Technology 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Page 49 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/ service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) Page 50 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Appendix A6. SCS’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 51 Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal process for getting resources Only senior managers have the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? Technology Page 52 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Operations (including inventory, logistics, delivery) Page 53 Appendix A7. TCS’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 54 Level Level 1 Level 2 Level 3 Level 4 Level 5 Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online Innovation Process There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? Employees are encouraged to suggest ideas during weekly meetings Innovation outcomes are assessed with qualitative data Technology 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Page 55 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – Has people and processes been reorganized to improve food production/ service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) Page 56 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Appendix A8. APM’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often There is no are employees trained formal training for new skills and programme yet knowledge? Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 57 Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online There is no slack resource for innovation yet There is no formal process for getting resources Only senior managers have the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome There is no formal – To what extent process is there a formal process for assessing innovation outcomes? Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding Use an ad hoc knowledge/ approach to solution yet find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? Technology Page 58 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Operations (including inventory, logistics, delivery) Page 59 Appendix A9. IPM’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) People and Culture Page 60 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? Employees are encouraged to suggest ideas during weekly meetings Technology Page 61 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/ service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) Page 62 19. Operations Innovation What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Appendix A10. JPM’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How There is no formal often are employees training programme trained for new skills yet and knowledge? Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 63 Level Level 1 Level 2 Level 3 Level 4 Level 5 Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal Only senior process for getting managers have resources the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding knowledge/ solution yet Use an ad hoc approach to find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Technology Page 64 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years Operations (including inventory, logistics, delivery) 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Page 65 Appendix A11. VPM’s Maturity Level Level Level 1 Level 2 Key Area Level 3 Level 4 Level 5 Strategy and Leadership 1. Strategic Alignment – How are business strategy and innovation initiatives related? Strategy is not yet formally considered in innovations Managers are aware that innovations should be aligned with strategy Focus on incremental innovations that are aligned with the current strategy Undertake breakthrough innovations that are aligned with the current strategy Pursue disruptive innovations that inform future strategy 2. Leadership Support – How much is innovation incentivized? There is no yet any incentive for employees participating in innovation There is some informal incentive for employees participating in innovation There is formal incentive for employees participating in innovation There is public recognition for employees participating in innovation Employees’ participation in innovation is tied to their job performance 3. Sensing of innovation opportunities – How do senior managers learn about the latest innovations? Encountered in news or publications (e.g., magazines) Approached by vendors of food technology Actively Search the Internet or publications (e.g. magazines) Attend trade shows/ conferences Participate in online innovation platforms 4. Innovation Partnerships – To what extent is there joint innovation with other organizations? There is no formal innovation partnership yet There is formal membership in industry associations (e.g., Restaurant association of Singapore, Singapore Food Manufacturer’s Association) There is innovation partnership with business advisors, government agencies, or universities There is supply chain innovation partnership with vendors, suppliers, distributors, marketing service providers, payment service providers, or consumers There is innovation partnership with unfamiliar partners such as non-profit organizations or competitors (e.g., to address sustainability challenges) 5. Training – How often are employees trained for new skills and knowledge? There is no formal training programme yet Employees are trained only when necessary to implement changes Employees are trained once every few years Employees are trained once a year Employees are trained several times a year 6. Talent Management – How much is the organization attracting and retaining talents to support innovation? We have not yet considered how talents support innovation. We could not find suitable talents to support our innovation. We have been able to recruit talents to support our innovation. We have been able to recruit and retain talents to support some of our innovation initiatives. We have been able to recruit and retain talents to support all of our innovation initiatives. 7. Employee Engagement – How much are employees at different levels involved in the early stages of innovation? Employees are invited to participate in the early stages of innovation on an as-needed basis All C-level managers are invited to participate in the early stages of innovation All C-level and senior managers are invited to participate All managers are invited to participate All employees, including operations staff are invited to participate 8. Learning from Failure – How much are employees encouraged to take risks and learn from failure? Failure is to be avoided as much as possible There is informal learning from failure There is formal learning from failure Employees are encouraged to pursue risky innovations Employees have been allowed to pursue some risky innovations People and Culture Page 66 Level Level 1 Level 2 Level 3 Level 4 Level 5 Innovation Process 9. Ideation – To what extent is there a channel for employees to suggest ideas for innovation? There are informal channels for employees to suggest ideas for innovation Employees are encouraged to suggest ideas during monthly meetings Employees are encouraged to suggest ideas during weekly meetings Employees can suggest ideas anytime online Employees can suggest and discuss each other’s’ ideas anytime online 10. Innovation Resource – To what extent can employees get resources (e.g., money and time) for innovating their work? There is no slack resource for innovation yet There is no formal process for getting resources Only senior managers have the chance of getting resources for innovating their work All managers have the chance of getting resources for innovating their work All employees, including operations staff have equal chance of getting resources for innovating their work 11. Innovation Outcome – To what extent is there a formal process for assessing innovation outcomes? There is no formal process Innovation outcomes are assessed based on subjective opinion Innovation outcomes are assessed with qualitative data Innovation outcomes are to be assessed with qualitative and quantitative data Innovation outcomes are to be assessed with qualitative and quantitative data from multiple sources 12. Automation – How much has automation been considered? Aware but not sure where to begin automation At least one process that can be automated has been identified Some key processes that can be automated have been identified All key processes that can be automated have been identified All processes that can be automated has been identified 13. Data in decision making – How much is data analyzed to guide decisions? Data is not yet analyzed to guide decisions Data is analyzed to describe the situation (“what are the patterns?”) Data is analyzed to diagnose problems (“what affects performance?”) Data is analyzed to predict the future (“what is likely to happen?”) Data is analyzed to prescribe decisions (“how should decisions be made?”) 14. Emerging Technology – How much is emerging technology (e.g., AI, AR, blockchain) being explored? Aware but not sure how emerging technology is useful for our business Learning about the nature of an emerging technology Discussing how an emerging technology can be applied to our business Planning to pilot test an emerging technology An emerging technology has been pilot tested. 15. Access to knowledge/ solutions – When a problem is encountered, what approach is used to find the matching knowledge/ solution? Not actively finding Use an ad hoc knowledge/ approach to solution yet find matching knowledge/ solutions inside the organization Systematically find matching knowledge/ solutions inside the organization Use an ad hoc approach to find matching knowledge/ solutions inside and outside the organization Systematically find matching knowledge/ solutions inside and outside the organization Technology Page 67 Level Level 1 Level 2 Level 3 Level 4 Level 5 Food Production/Service 16. Customer Orientation – Other than food taste and quality, how much are other aspects of food experience (e.g., visual, social) considered in innovation initiatives? Other aspects of food experience are not yet considered Other aspects of food experience have been informally considered The visual aspect of food has been formally part of an innovation initiative The social aspect has been formally part of an innovation initiative The total food experience has been formally part of an innovation initiative 17. Food Hygiene/ Safety – What is the innovation focus? Food hygiene/ safety is not yet an innovation focus Innovate to comply with regulations Innovate to proactively reduce risk (e.g., alerts, prompts, nudges) innovate to develop safety and hygiene habits Innovate to nurture safety and hygiene ownership 18. Change Management – – Has people and processes been reorganized to improve food production/service? We have not reorganized people and processes We have reorganized within the past ten years We have reorganized within the past five years We have reorganized within the past three years We have reorganized within the past two years 19. Operations Innovation - What is the innovation focus in inventory/ logistics/ delivery? Operations is not yet an innovation focus Innovate to reduce cost Innovate to better analyze current demand and supply Innovate to better forecast demand and supply Innovate to optimize demand and supply 20. Digitalization – How much is operations data digital? Less than 10% of key operations data is digital 10% to 30% of key operations data is digital 31-50% of key operations data is digital 51-70% of key operations data is digital All key operations data is digital 21. Data collection – How much is digital data captured immediately at the source? Less than 10% of data is captured immediately at the source 10% to 30% of key data is captured immediately at the source 31-50% of key data is captured immediately at the source 51-70% of key data is captured immediately at the source All key data is captured immediately at the source Operations (including inventory, logistics, delivery) Page 68 References Amit, R., and Schoemaker, P.J.H. “Strategic Assets and Organizational Rent,” Strategic Management Journal (14:1), 1993, pp. 33-46. Barney, J. “Firm Resources and Sustained Competitive Advantage,” Journal of Management (17:1), 1991, pp. 99-120. March, J. “Exploration and Exploitation in Organizational Learning,” Organization Science (2:1), 1991, pp. 71-87. Narver, J.C., and Slater, S.F. “The Effect of a Market Orientation on Business Profitability,” Journal of Marketing (54:4), 1990, pp. 20-35. Teece, D.J., Pisano, G., and Shuen, A. “Dynamic Capabilities and Strategic Management,” Strategic Management Journal (18:7), 1997, pp. 509-533. Vorhies, D.W., and Morgan, N.A. “Benchmarking Marketing Capabilities for Sustainable Competitive Advantage,” Journal of Marketing (69:1), 2005, pp. 80-94. Wernerfelt, B. “A Resource-Based View of the Firm,” Strategic Management Journal (5:2), 1984, pp. 171-180. Page 69