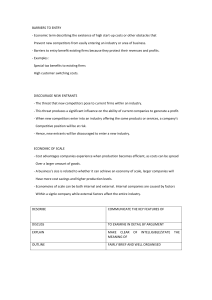

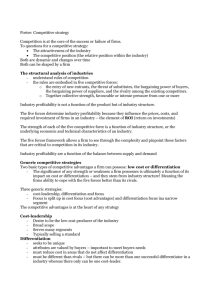

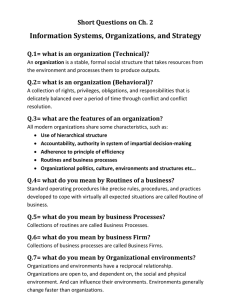

MANAGEMENT BACK TO BASICS What’s a Firm? It is a commercial enterprise. A company which buys and sells products/services to consumers with the aim of making a profit. From a transaction point of view - B2B: Transaction between businesses, such as one involving a manufacturer and wholesaler, or a wholesaler and a retailer. - B2C: Transactions conducted directly between a company and consumers who are the endusers of its products or services. - B2G: Transactions are conducted between a business which sells products, services or information to governments or government agencies. The Firm System - Autopoietic: no distinction between producer and product - Open: it exchanges resources with the external environment - Closed: it is required to maintain stable its organizational structure - Genetic heritage: entrepreneurial drive, resources, networks - Strategic project: mission, vision, and value proposition, competitive advantage, business models and resource picking Basic Principles: Costs and Total Costs Cost: is a monetary evaluation of effort, material, that has to be paid by the firm. Revenue: is the income that a firm has from the sale of its good and service. The total revenues indicates how the firm’s sales revenues vary as a function of how much product it sells. TR (Q)= P(Q)*Q Profit = Revenues – Costs Long-run total cost curve (increasing): it represents the relationship between firm’s total costs and the total amount of output it produces in a given period. This efficient relationship indicates the lowest level of TC the firm would incur to produce a level of ouput, given the technological capabilities and the prices of productions factors (labor and capital). Variable costs (VAC): costs that increase as output increases (ex: raw materials) Fixed costs (FC): those costs that remain constant as output increases (ex: property taxes, administrative expenses) Average Cost (AC): indicates how the firm’s per unit-of-output costs vary with the amount of output it produces. AC (Q) = TC(Q)/Q Marginal costs: it refers to the rate of change of total cost with respect to the output. They can be thought of as the incremental cost of producing exactly one more unit of product. MC(Q) = ΔTC(Q)/ΔQ where Δ indicates an incremental change of unit Average costs and marginal costs are different. The unique exception is when total costs vary in direct proportion to output. When MC > AC AC increases When MC < AC AC decreases The quantity over which average costs start increasing (minimum of the average cost function) is also named minimum efficient scale and its where the AC function intercepts the MC function. Economies of Scale Economies of scale are drivers of firm’s efficiency. The principle of economies of scale is based on the fact that fixed costs can be spread over larger volumes, and variable costs fall too as there is increased purchasing power and most processes are more efficient at scale. A company can increase its profits by making its production processes more efficient, rather than by increasing the price of a product. Economies of scale refers to spreading the costs of production over the number of units produced. The cost of a product per unit declines as the absolute volume per period increases. The presence of economies of scale can deter entry by forcing the entrant: - To come in at a large scale and risk strong reaction from existing firms - To come in at a small scale and accept a cost disadvantage Economies of Scope Economies of scope exist if the firm achieves savings as it increases the variety of goods and services. TC (Qx; Qy) < TC (Qx; 0)+ TC (0; Qy) Profitability Ratios These ratios compare income statement accounts and categories to show a company’s ability to generate profits from its operations. These ratios basically show how well companies can achieve profits from their operations. The profitability ratios can be used to judge whether companies are making enough operational profit from their assets. - ROE: The return on equity ratio measures the ability of a firm to generate profits from its shareholders investments in the company. The return on equity ratio shows how much profit each dollar of common stockholders’ equity generates. ROE = Net Income/Total Equity ROE is also and indicator of how effective management is at using equity financing to fund operations and grow the company (competitive advantage) - Profit margin ratio: The profit margin ratio directly measures what percentage of sales is made up of net income. In other words, it measures how much profits are produced at a certain level of sales. This ratio also indirectly measures how well a company manages its expenses relative to its net sales. That is why companies strive to achieve higher ratios. They can do this by either generating more revenues while keeping expenses constant or keep revenues constant and lower expenses. Profit Margin = Net Income/Sales (Profit/Revenues) - ROA: It measures the net income produced by total assets during a period by comparing net income to the average total assets. In other words, the return on assets ratio or ROA measures how efficiently a company can manage its assets to produce profits during a period. ROA = Net Income/Total Assets The difference between ROE and ROA is all about liabilities. The big factor that separates ROE and ROA is financial leverage, or alternatively debt. The balance sheet's fundamental equation shows how this is true. Assets = Liabilities + Shareholders’ Equity This equation tells us that if a company carries no debt, its shareholders’ equity and its total assets will be the same. It follows then that their ROE and ROA would also be the same. - ROI: Measures the gain or loss generated on an investment relative to the amount of money invested. ROI is usually expressed as a percentage and is typically used for personal financial decisions, to compare a company’s profitability or to compare the efficiency of different investments. ROI = Net Income/Investments THE STRATEGY CONCEPT Two Perspectives of Leadership - Romantic view: leadership is the key force in the organization’s success - External control perspective: external forces determine the organization’s success Leaders Can Make a Difference - Must be proactive (anticipate change) - Continually refine strategies - Be aware of external opportunities and threats - Thoroughly understand their firm’s resources and capabilities - Make strategic management both a process and a way of thinking throughout the organization Major anticipated developments can often have very negative consequences for businesses regardless of how well formulated their strategies are. However, successful executives are often able to navigate around the difficult circumstances that they face by: - Anticipating structural changes in the industry - Staying aware of changes in the external environment - Acknowledging the need to make tough strategic choices Defining Strategic Management Strategic management involves: - Analysis o Strategic goals (vision, mission, strategic objectives) o Internal and external environment - Decisions o What industries should we compete in? o How should we compete in those industries? - Actions o Allocate necessary resources o Design the organization to bring intended strategies to reality How should we compete in order to create competitive advantages in the marketplace? How can we create competitive advantages in the marketplace that are unique, valuable, and difficult for rivals to copy or substitute? Operational effectiveness (performing similar activities better than rivals) is not enough to sustain a competitive advantage. Strategic Management Key attributes of strategic management: - Directs the organization toward overall goals and objectives - Includes multiple stakeholders in decision making - Needs to incorporate short-term and long-term perspectives - Recognizes trade-offs between efficiency and effectiveness o Efficiency: achieving goals at the lowest cost respect to a benchmark o Effectiveness: tailoring actions to the needs of an organization rather than wasting effort, or “doing the right thing” Strategic Management Trade-offs Managers need to be ambidextrous: focusing on short-term efficiency while also aligning resources to take advantage of existing product markets. Focusing on long-term effectiveness while also expanding product-market scope by proactively exploring new opportunities. Strategic Management Process Strategy Analysis Strategy Formulation Strategy Implementation 1) Strategy analysis - Starting point in the strategic management process - Involves careful analysis of the goals of the organization - Requires a thorough analysis of the organization’s external and internal environment, and their fit with organizational vision and goals 2) Strategy formulation - Based on strategy analysis - Developed at several levels - Involves decisions that can create and sustain competitive advantage: o Investment decisions o Commitment of resources o Operational synergies o Recognizing viable opportunities What businesses to compete in? How to manage these businesses in order to achieve synergy? How can they create more value by working together than by operating as stand-alone businesses? 3) Strategy implementation - Implements the formulated strategy - Ensures proper strategic control systems - Establishes an appropriate organizational design (coordinates and integrates activities within the firm) - Coordinates activities with suppliers, customers, alliance partners - Leadership ensures organizational commitment to excellence and ethical behavior - Promotes learning and continuous improvement - Acts entrepreneurially in creating new opportunities It takes in considerations actions made by firms that carry out the formulated strategy including strategic controls, organizational design and leadership. What is Strategy? A strategy is an integrated and coordinated set of commitments and actions designed to exploit core competencies and gain a competitive advantage Example: Facebook + Instagram - Defence strategy against the threats Instagram may pose as a competitor - Rapid reaction to Instagram’s adoption of the Android technology - Talents’ acquisition - Strengthening its position in the mobile sector Organizations express priorities best through stated goals and objectives that form a hierarchy of goals. Vision evokes powerful and compelling mental images of a shared future. Mission encompasses the organization’s current purpose, basis of competition, and competitive advantage. Strategic objectives operationalize the mission statement with specific yardsticks Vision and Mission - Vision: the ideal for the organization and its future direction. It is a direction that is driven by and evokes passion. Short vision statements aimed at heart and mind. Vision should be clearly tied to external environment and internal organization of firm. - Mission: is the concrete view of the firm’s business, its customers and how it will serve them. It flows from vision. Should provide direction for strategic action. Organizational Vision The vision is an organizational goal that is “massively inspiring, overarching, and long term.” Who? Leaders must develop and implement the vision. It may succeed or may not. It depends on whether or not everything else happens according to an organization’s strategy Some reasons for which visions fail - The walk doesn’t match the talk: it happens if employees find that senior management behaviour is not consistent with the vision - Irrelevance: employees tend to reject visions that are not anchored to the reality - Not the holy grail: a vision cannot be viewed as a magic cure for an organization’s illness - Too much focus leads to missed opportunities: too much focus can be devastating for employees - An ideal future irreconciled the present: visions should be anchored to the present Mission Statements Mission is a set of organizational goals that include both the purpose of the organization, its scope of operations and the basis of its competitive advantage. A good mission statement must communicate why an organization is special and different. Mission vs… • It is more specific and focused on the means by which the company will compete • It incorporates the concept of stakeholder management, that means organizations must respond to multiple constituencies … vision • It is more broad • It is quite enduring and seldom changes. Strategic Objectives Strategic objectives are used to operationalize the mission statement. They provide guidance on how the organization can fulfill or move toward the higher goals in the goal hierarchy. They should be specific and cover a more well defined time frame. Financial: - Increase sales growth 6 percent to 8 percent and accelerate core net earnings growth form 13 percent to 15 percent per share in each of the next 5 years (P&G) - Generate internet-related revenue of $1.5 billion (AutoNation) - Increase the contribution of Banking Group earnings form investments, brokerage, and insurance from 16 percent to 25 percent (Wells Fargo) - Cut corporate overhead costs by $30 million per year (Fortune Brands) Nonfinancial: - We want a majority of our customers, when surveyed, to say they consider Wells Fargo the best financial institution in the community (Wells Fargo) - Reduce volatile emissions 15 percent by 2015 from 2010 base year, indexed to net sales (3M) - Our goal is to help save 100,000 more lives each year (Varian Medical System) - We want to be the top-ranked supplier to our customers (PPG) To be meaningful, objectives need to satisfy some criteria: - Measurable: There must be at a least one yardstick that measures progress in fulfilling the objective - Specific: They need to provide a specific message of what they want to accomplish - Appropriate: It must be consistent with the organization’s vision and mission - Realistic: It must be an achievable target given the organization’s capabilities and opportunities in the environment - Timely: There must be a time frame for achieving the objective. The Strategic Management Process: Problems - The business environment is not predictable The ability for analysis is limited - All the organizations must assess political processes The decisons are seldom based on optimal rationality An Alternative Model: Intended vs Realized Strategies - Intended Strategy: Organizational decisions are determined only by analysis. Intended strategy rarely survives in its original form. - Realized Strategy: Decisions are determined by both analysis (deliberate) and unforeseen environmental developments, unanticipated resource constraints, and/or changes in managerial preferences (emergent) Stakeholders - Stakeholders are individuals and groups (outside or inside the company) that have a stake in and can influence the organization’s performance. - They can affect and be affected by the vision and mission. - Stakeholders’ objectives can conflict, so they must be managed carefully. They include: - Stockholders dividends, capital appreciation - Employees wages, benefits, safe working environment, job security - Suppliers payment on time, assurance of continued relationship - Creditors payment of interest, repayment of principal - Customers value, warranties - Government taxes, compliance with regulations - Communities good citizenship behavior such as charities, employment, not polluting the environment Corporate Governance and Stakeholder Management Corporate Governance: the relationship among various participants in determining the direction and performance of corporations. Primary participants: - Shareholders (owners of a company) - Management (led by the Chief Executive Officer) - The Board of Directors (BOD) elected by the shareholders to represent their interests. THE EXTERNAL ENVIRONMENT Managers have to be aware of the external environment their decisions, choices, and actions should be considered and embraced after an in-depth analysis of the external environment. External dynamics, trends, and events can affect business opportunities, change the results of particular decisions, impact the profitability. Analyzing the external environment allows managers to recognize and understand the opportunities and threats that organizations have to face. Environmental analysis requires managers to continually question such issues: - A set of biases - Assumptions - Presuppositions about the structure of the relevant “industry” - How someone can make money in the industry - Who the customers are and aren’t Two types of environment: - The general environment, divided into 6 segments: o Demographic o Sociocultural - o Politica/Legal o Technological o Economic o Global The competitive environment, that can be analysed by: o Applying the Porter’s 5 forces model (industry analysis) o Identifying strategic groups How organizations can become aware of external environment: - Forecasts: o Environmental scanning: This process involves surveillance of a firm’s external environment to predict environmental changes and detect changes already underway. o Environmental monitoring: This process tracks the evolution of environmental trends, sequences of events, or streams of activities. Firms can evaluate how dramatically environmental trends may change the competitive landscape. o Competitive intelligence: This process allows a firm to collect and interpreting data on competitors, defining and understanding the industry, and identifying competitors’ strengths and weaknessess. Done properly, this process helps a company avoid surprises by anticipating competitor’s moves and decreasing response time. - Scenario analysis: It is a more in depth approach to environmental forecasting that involves experts’ detailed assessments of societal trends, economics, politics, technology or other dimensions of external environment. The General Environment The general environment is composed of factors that can have dramatic effects on firm strategy. It is generally divided into 6 segments. Demographic - Aging population - Rising affluence - Changes in ethnic composition - Geographic distribution of population - Greater disparities in income levels Sociocultural - More women in the workforce - Increase in temporary workers - Greater concern for fitness - Greater concern for environment - Delays in family formation Economic - Interest rates - Unemployment - Consumer price Index - Trends in GDP - Changes in stock market valuations Technological Political/Legal - Genetic engineering - Tort reform - Emergence of Internet - ADA (Americans with technology Disabilities Act) - Computer Aided - Repeal of Glass-Stegall Design/Computer Aided Act in 1999 (now banks Manufacturing Systems may offer brokerage - Research in man-made services) and exotic materials - Deregulation of utility - Pollution/global warming and other industries - Miniaturization of - Increases in federallycomputing technologies mandated minimum - Wireless wages communications - Taxation at local, state, federal levels - Global - Increasing global trade - Currency exchange rates - Emergence of the Indian and Chinese Economies - Trade agreements among regional blocks (e.g. NAFTA, EC, Asian) GATT Agreement (leading to decreasing tariffs) The demographic segment: Demographics are the most easily understood and quantifiable elements of the general environment. They are the root of many changes in the society. The sociocultural segment: Sociocultural forces influence the values, beliefs, and lifestyles of a society. The political/legal segment: It indicates how a society creates and exercises power including rules, laws, and taxation policies. The technological segment: It refers to innovation and state of knowledge in industrial arts, engineering applied sciences, and pure science, and their interaction with society. The economic segment: It takes in consideration the characteristics of the economy, including national income and monetary conditions. The global segment: It takes in consideration influences from foreign countries including foreign market opportunities, foreign based competition, and expanded capital markets. The Competitive Environment The competitive environment consists of factors that are particularly relevant to a firm’s strategy: - Competitors: existing or potential. Potential competitors may include a supplier considering forward integration (e.g., an automobile manufacturer, which acquires a rental car company) Customers (or buyers) Suppliers Industry is defined as a group of firms that produce similar goods or services. Porter’s Five Forces They can help a manager to: - Decide whether a firm should remain or not in the industry - Provide the rationale for increasing/decreasing the resource commitments - Assess how to improve the firm’s competitive position. Together they determine the potential profit for a particular industry The Structural Determinants of Porter’s Five Forces - Industry rivalry: o Concentration o Diversity of competitors o Product differentiation o Excess capacity and exit barriers o Cost conditions - Threat of entry: o Capital requirements o Economies of scale o Absolute cost advantage o Product differentiation o Access to distribution channels o Legal/regulatory barriers o Retaliation - Substitute products: o Buyers’ propensity to substitute o Relative prices and performance of substitutes - Buyers’ power: o Buyers’ price sensitivity: - o Cost of purchases as % of buyer’s total costs o How differentiated is the purchased item? o How important is the item to quality of the buyer’s own output? o Relative bargaining power: o Size and concentration of buyers relative to sellers o Buyers’ information o Ability to backward integrate Suppliers’ power o Suppliers price sensitivity o Relative bargaining power Industry Rivalry Rivalry between established companies occurs through: - Price decisions - Advertising battles - New product launch - Improvement of the level of service and guarantee for the customer. Structural determinants: - Product differentiation: The possibility to differentiate the products weaken’s price competition in the industry, there by increasing potential revenue, and helping the firm to establish an identity (e.g., brand image). The degree of differentiation is inversely related to competition. The oppurtunity does not always have a positive effect on the profitability. - Diversity of competitors - Levels of demand and offer: o Ratio demand and offer and different growth rates o Life cycle of an industry: Companies in growing market earn higher profit than companies in slow growing or declining. o High production capacity and high exit barriers: Barriers to exit are costs associated with capacity leaving an industry. Where resources are durable and specialized, and where employees are entitled to job protection, barriers to exit may be substantial. - Exit barriers: o Strategic interdependences o Institutions o Personal emotive barriers o Sunk costs, fixed costs, plants’ idiosyncraticity - Cost structure: o Extent of scale economies o Ratio of fixed to variable costs. - Concentration: o Absolute concentration refers to the number and size distribution of firms competing within a market o Relative concentation: the Herfindahl index, also known as Herfindahl-Hirschman Index or HHI, is a measure of the size of firms in relation to the industry and an indicator of the amount of competition among them. The higher the concentration, the lower the price competition. Herfindahl Index where si is the market share of firm i in the market, and N is the number of firms. Thus, in a market with two firms that each have 50 percent market share, the Herfindahl index equals 0.502+0.502 = 1/2. Market Share Market share refers to a company’s portion of sales within the entire market in which it operates. This metric indicates a company's size within its market. - Absolute market share: The ratio of company's sales over a specified period of time (such a year or quarter) and the total sales of that company's industry over the same period Absolute Market Share = Company’s Sales/Totale Sales of the Industry Problems: o Definition of a coherent time frame o Market definition o Choice of parameters to define the market - Relative market share: it provides key infos for a focal firm respect to the leading company Relative Market Share = Revenues’ Focal Firm/Revenues Main Competitor o If relative MKT Share > 1 the focal firm is leader o If relative MKT Share < 1 the focal firm is follower Threats to Entry Barriers to entry are factors or conditions in the competitive environment of an industry that make it difficult for new businesses to begin operating in that market. - - Institutional barriers: o Depends on exogenous factors (i.e., energy industry) Structural barriers: o Economies of scale/scope o Capital requirement (the capital cost of getting established in an industry can be so large as to discourage all but the largest companies) o Access to channels of distribution Strategic barriers: o Absolute cost advantage o Product differentiation (overcoming existing customer’s loyalty is difficult) The presence of economies of scale can deter entry by forcing the entrant: - To come in at a large scale and risk strong reaction from existing firms; - To come in at a small scale and accept a cost disadvantage. Threat of new entry is high if: - Profitability does not require economies of scale - Products are undifferentiated - Brand names are not well-known - Initial capital investment is low - Consumer switching costs are low - Accessing distribution channels is easy - Location is not an issue Proprietary technology is not an issue Proprietary materials is not an issue Government policy is not an issue Expected retaliation of existing firms is not an issue Threat of new entry is low if: - Profitability requires economies of scale - Products are differentiated - Brand names are well-known - Initial capital investment is high - Consumer switching costs are high - Accessing distribution channels is difficult - Location is an issue - Proprietary technology is an issue - Proprietary materials is an issue - Government policy is an issue - Expected retaliation of existing firms is an issue Threats of Substitutes A substitute product is a product from another industry that offers similar benefits to the consumer as the product produced by the firms within the industry. Extent of competitive pressure from producers of substitutes depends upon: - Customers’ propensity to substitute - The price-performance characteristics of substitutes The threat of substitutes is high when: - Consumer switching costs are low - Substitute product is cheaper than industry product - Substitute product quality is equal or superior to industry product quality - Substitute performance is equal or superior to industry product performance The threat of substitutes is low when: - Consumer switching costs are high - Substitute product is more expensive than industry product - Substitute product quality is inferior to industry product quality - Substitute performance is inferior to industry product performance - No substitute product is available Complements: products or services that have an impact on the value of a firm’s products or services. Bargaining Power of End Users/Buyers Buyers threaten an industry: - Forcing down prices - Bargaining for higher quality or more services - Playing competitors against each other Buyer power is high if: - Buyers are more concentrated (few but bigger) than sellers - Buyer switching costs are low - Threat of backward integration is high - Buyer is price sensitive - Buyer is well-educated regarding the product - Buyer purchases product in high volume - Buyer purchases comprise large portion of seller sales - Product is undifferentiated Buyer power is low if: - Buyers are less concentrated than sellers - Buyer switching costs are high - Threat of backward integration is low - Buyer is not price sensitive - Buyer is uneducated regarding the product - Buyer purchases product in low volume - Buyer purchases comprise small portion of seller sales - Product is highly differentiated - Substitutes are unavailable Bargaining Power of Suppliers Analysis of supplier bargaining power is precisely analogous to analysis of the relationship between producers and their buyers. Suppliers can exert their bargaining power by threatening to: - Raise prices - Reduce the quality of purchased goods and services. Supplier groups are powerful when: - Only a few firms (concentrated) dominate the industry - No competition from substitute products - Suppliers sell to several industries - Buyer quality is affected by industry product - Products are differentiated and have switching costs - Forward integration is possible Relative Bargaining Power - Size and concentration of buyers relative to suppliers: the smaller the number of buyers and the bigger their purchases, the greater the cost of losing one. - Buyer’s information: a well informed buyer (about suppliers, their prices and costs) has higher bargaining power. - Ability to integrate vertically Governments / Institutions Government operates at multiple levels and through many different policies, each of which will affect structure in different ways: - Patents raise barriers to entry, boosting industry profit potential - Favoring unions may raise supplier power and diminish profit potential - Bankruptcy rules that allow failing companies to reorganize rather than exit can lead to excess capacity and intense rivalry Using Industry Analysis: A Few Tips - Managers must not always avoid low profit industries — these can still yield high returns for players who pursue sound strategies. - Five forces analysis implicitly assumes a zero-sum game — yet mutually beneficial relationships can still be established with buyers and suppliers - Five forces analysis is essentially a static analysis – yet external forces can still change the structure of all industries The Value Net Vertical dimension = suppliers and customers Horizontal dimension = substitutes and complements Doing a Good Industry Analysis Good industry analysis looks rigorously at the structural underpinnings and root causes of profitability - Must choose the appropriate time frame: o Consider the industry business life cycle o Average profitability over 3-5 years or longer - Must consider quantitative factors as well as qualitative: o Get numbers to quantify five forces factors (percentages of total cost or sales accounted for by the industry, actual switching costs) Strategic Groups Two unassailable assumptions in industry analysis: - No two firms are totally different - No two firms are exactly the same Strategic groups: clusters of firms that share similar strategies Dimensions to apply: - Breadth of product and geographic scope - Price/quality - Degree of vertical integration (totally integrated, near integrated) - Type of distribution (dealers, mass, merchandisers, private labels) Strategic groups as an analytical tool helps to: - Identify barriers to mobility that protect a group from attacks by other groups - Identify groups whose competitive position may be marginal or tenuous - Chart the future direction of firms’ strategies - Think through the implications of each industry trend for the strategic group as a whole Example: Automobile Industry THE INTERNAL EVIRONMENT OF THE FIRM The Tripod - Industry based view: What strategies can firms adopt to change industry structure in order to lessen competitive pressure in an industry and improve industry profitability? How can a firm position itself within an industry in order to shelter form the forces of competition? - Institutional based view: How do institutions determine the arrows available for a firm in its quiver? How can a firm protect its institutional advantage by enacting institutional-base strategies? - Resource based view: How can the firm develop core capabilities, as unique strengths that differentiate from other firm? How can a firm protect its value creating strategy by making it inimitable by current or potential competitors? SWOT Analysis SWOT analyses is a cross-departmental managerial tool which can be used: - At organizational level to evaluate how closely a business is aligned with its growth trajectories and success benchmark At project level (such as an online advertising campaign) to evaluate its performing according to initial projections. SWOT analysis is a basic technique for analyzing firm and industry conditions: - Firm or internal conditions: strengths and weaknesses where the firm excels or where it may be lacking - Environmental or external conditions: opportunities and threats developments that exist in the general environment and activities among firms competing for the same customers STRENGHTS WEEKNESSES - Things your company does well - Things your company lacks - Qualities that separate your company - Things competitors do better than you from the competitors - Resource limitations - Internal resources as skilled - Unclear unique selling propositions knowledgable workers - Tangible assets such as intellectual properties OPPORTUNITIES THREATS - Undeserved market for specific products - Emerging competitors - Few competitors are in your area - Changing regulatory environment - Emerging needs for your products and - Negative press media coverage services - Press media coverage of your company Implications: - Forces managers to consider both internal and external factors simultaneously - Makes firms act proactively - Raises awareness about role of strategy - A firm’s strategy must build on its strengths - Remedy the weaknesses or work around them - Take advantage of the opportunities presented by the environment - Protect the firm from the threats Strenghts - What do your customers love about your company or product(s)? - What does your company do better than other companies in your industry? - What are your most positive brand attributes? - What’s your unique selling proposition? - What resources do you have at your disposal that your competitors do not? By answering these questions, you’ll be in great shape to start identifying and listing your organization’s strengths. Weaknesses - What do your customers dislike about your company or product(s)? - What problems or complaints are often mentioned in your negative reviews? - Why do your customers cancel or churn? - What could your company do better? - What are your most negative brand attributes? - What are the biggest obstacles/challenges in your current sales funnel? What resources do your competitors have that you do not? Opportunities and Threats Identifying opportunities and threats may require you to conduct in-depth competitive intelligence research about what your competitors are up to, or the examination of wider economic or business trends that could have an impact on your company. - How can we improve our sales/customer onboarding/customer support processes? - What kind of messaging resonates with our customers? - How can we further engage our most vocal brand advocates? - Are we allocating departmental resources effectively? - Is there budget, tools, or other resources that we’re not leveraging to full capacity? - Which advertising channels exceeded our expectations and why? Limitations: It is considered a tried and true tool of strategy analysis. Top managers adopt it to stimulate selfreflection and group discussion about how to improve their firm and position for success. - It is a starting point for the discussion - It does not provide any information on how to achieve the competitive advantage - By adopting it, top managers do not have a “formula” to enact strategic change - Strenghts may not lead to an advantage - SWOT gives a one-shot view of a moving target - SWOTS’s focus on the external environment is too narrow - SWOT emphasizes a single dimension of strategy An Application: Starbucks STRENGHTS - Strong brand recognition - Customers love the atmoshere in Starbucks (use laptop, working) - Starbucks presents overall the world - Superb supply chain WEAKNESSES - Product is not customized to local tastes. - It is not affordable for countries. - High employees’ turnover OPPORTUNITIES - Easy access to new countries - Agreements with movie producers THREATHS - Saturation of the US Market - Healthier lifestyle trends Value Chain Analysis Value chain analysis looks at the sequential process of value-creating activities. It is a useful approach to understand the building blocks of competitive advantage. Value is the amount buyers are willing to pay for what a firm provides. A company is profitable when the value it receives, exceeds the total costs involved in creating its products or services. Example: Streamlining the Value Chain IBM and SAP have teamed up to help firms reduce value chain inefficiencies and improve operational effectiveness. Benefits of value chain streamlining: - Commonality between parts and suppliers - Integration of sales forecasting and inventory management Lowered transaction, infrastructure and operating costs Deliver products to market faster Value Chain Analysis: Key Elements (PORTER, 1981) Primary activities contribute to the physical creation of the product or service, the sale and transfer to the buyer, and service after the sale: - Inbound logistics - Operations - Outbound logistics - Marketing and sales - Service Support activities either add value by themselves or add value through important relationships with both primary activities and other support activities: - Procurement - Technology development - Human resource management - General administration Primary Activities Inbound logistics: this activity is primarily associated with receiving, storing, and distributing inputs to the product. It includes: - Material handling - Warehousing - Inventory control - Vehicle scheduling - Returns to supply Just in time: this system allows that part deliveries arrive at the assembly plants only hours before they are needed. Operations: operations include all activities associated with transforming inputs into final product form, such as: - Machining - Packaging - Assembly - Testing Printing Facility operations Outbound logistics: outbound logistics is associate with collecting, storing, and distributing the product or service to buyers. They include: - Finished goods - Warehousing - Material handling - Delivery vehicle operation - Order processing - Scheduling Marketing and sales: these activities are associated with purchases of products and services by end users and the inducements used to get them to make purchases. - Advertising - Promotion - Sales - Force - Quoting - Channel selection - Pricing Service: this activity includes all actions associated with providing service to enhance or maintain the value of the product, such as: - Installation - Repair - Training - Parts supply - Product adjustment Support Activities Procurement: it refers to the function of purchasing inputs used in the firm’s value chain, not to the purchased inputs themselves. Purchased inputs include: - Raw materials - Suppliers - Other consumable items - Assets (i.e., machinery, laboratory, equipment, office equipment, building) Technology development: it includes all activities associated with the development of new knowledge that is applied to the firm’s operations. Human resources management: it include activities involved in the recruiting, hiring, training, development and compensation of all types of personnel. General administration: it consists of a number of activities, including general management, planning, finance, accounting, legal and government affairs, quality management, and information systems. It involves: - Effective planning systems to attain overall goals and objectives - Excellent relations with diverse stakeholder groups - Effective information technology to coordinate and integrate value-creating activities across the value chain Ability of top management to anticipate and act on key environmental trends and events, create strong values, culture and reputation Retail: primary value-chain activities Partnering with vendors Purchasing goods stores Marketing and selling Managing and distributing inventory Operating The value is created by developing expertise in the procurement of finished goods and by displaying them in their stores in a way that enhances sales. The procurement is a primary rather than a support activity. Engineering services: primary value-chain activities R&D Engineering Designs and solutions Marketing and sales Service R&D provides inputs. The transformation process is the engineering itself. Innovative designs and practical solutions are the outputs Interrelations Among Value Chain Activities Managers must not ignore the importance of interrelationships among value-chain activities - Interrelationships among activities within the firm - Relationships among activities within the firm and with other stakeholders such as customers and suppliers - Expand the value chain by exchanging resources The Prosumer Concept: Integrating Customers into the Value Chain Including customers in the actual production process can create greater satisfaction among them. Advantages: - Significant cost savings - Generating innovative ideas for customers, that can be transferred to the customer in terms of lower prices and higher quality products and services THE RESOURCE BASED VIEW The resource-based view of the firm (Barney, 1991) combines the external analysis of the industry with an internal analysis of phenomena within a company. Resources can lead to a competitive advantage if they are valuable, rare, hard to duplicate and when tangible resources, intangible resources, and organizational capabilities are combined. Assumptions: - The company as a configuration of heterogeneous resources - Achieving revenues higher than competitors comes from superior resources and/or its increased efficiency in resources combination - The key to profitability is not the imitation of competitors but the exploitation of differences among businesses - Competitive advantage is obtained through strategies that recognize and develop distinct and specific characteristics of the enterprise Resources Resources include all the assets, capabilities, organizational processes, firm attributes, information and knowledge. Resources’ value depends on the value of services that comes from the use of these resources. Better use of resources can produce higher value services for the firm. The life cycle of the firm is based on its competence to generate new resources from those of its property. Tangible resources are assets that are relatively easy to identify: - Physical assets: plant and facilities, location, machinery and equipment - Financial assets: cash and cash equivalents, borrowing capacity, capacity to raise equity - Technological resources: trade secrets, patents, copyrights, trademarks, innovative production processes - Organizational resources: effective planning processes and control systems Intangible resources are difficult for competitors to account for or imitate. They are embedded in unique routines and practices: - Human resources: trust, experience and capabilities of employees, managerial skills and effectiveness of work teams - Innovation resources: technical and scientific expertise, ideas, innovation capabilities - Reputation resources: brand names, reputation for fairness with suppliers, reliability and product quality with customers Organizational capabilities are competencies or skills that a firm employs to transform inputs into outputs, the capacity to combine tangible and intangible resources to attain desired ends. - Outstanding customer service - Excellent product development capabilities - Superb innovation processes and flexibility in manufacturing processes - Ability to hire, motivate, and retain human capital Firm Resources and Sustainable Competitive Advantages In the RBV, the competitive advantage is achieved by a firm when it is implementing a value-creating strategy not simultaneously implemented by any current or potential competitor. In the RBV, the sustained competitive advantage does not depend upon the period of calendar time during which a firm enjoys the competitive advantage. The sustained competitive advantage refers to the possibility of competitive duplication. VRIN Framework Strategic resources have four attributes - Valuable in formulating and implementing strategies to improve efficiency or effectiveness - Rare or uncommon, difficult to exploit - Difficult to imitate (inimitability) or copy due to: o Physical uniqueness by definition is hard to imitate (e.g., a beautiful location, mineral rights) o Path dependency which looks at a characteristic of resources that is developed and accumulated through unique series of events (QWERTY keyboard layout) o Causal ambiguity: competitors cannot imitate because they’re not able to disentangle the causes that have determined the born of resource or they do not be able to isolate the resource (3M’s innovation process) o Social complexity - Difficult to substitute (non-substitutability) with strategically equivalent resources or capabilities Groupon case American worldwide e-commerce company that offers online coupons for bargains, by offering activities, travel, goods and services at advantageous prices. Born in 2008 in Chicago, It is now placed in 15 countries worldwide. On April 2010, the company was valued at $1.35 billion. On September 2015, Groupon announced they would be eliminating approximately 1,100 positions, primarily in their sales and customer service operations. What’s the problem? - It offers no lasting «first mover» advantage - Not patentable - Its business model was easy to imitate 3M innovation process Headquartered in Minneapolis. In the 70’s, 3M researchers found a bonding agent, but they decided it was worthless because it did not stick papers very tightly to the surface. The unsuccess was transformed into a success when a researcher decided to use the binding agent to create the Post-it. From VRIN to the VRIO Framework Rotthaermel’s 2013 introduced a new question: “Is a company organized to exploit the resources?” VRIO framework: - Value - Rarity - Imitability - Organization If one firm has valuable resources and others don’t and if other firms can’t imitate these resources without facing high costs, the firm possessing the valuable resources will likely gain a sustained competitve advantage. - Not valuable competitive disadvantage Valuable, not rare competitive parity Valuable, rare, not inimitable temporary competitive advantage Valuable, rare, inimitable, not organized unused competitive advantage Valuable, rare, inimitable, organized sustainable competitive advantage From Resources to Capabilities - Most resources assume significant value when they operate within a complementary group and create synergistic effects. - The company is interested in developing skills that allow to perform a particular task in the best way of competition (distinctive competence). - Should not analyze only current capabilities but also future or potential ones. - Obtaining a sustainable competitive advantage, which is essential for the achievement of higher revenues over time, is based on the development of distinctive capabilities. Distintive capabilities are the combination of: o Unique value resources o Additional resources o Organizational ability or capabilities Capabilities: Some Examples Distinctive Capabilities (Kay, 1993) To obtain a competitive advantage a firm has to possess not only skills but also distinctive capabilities through which it can differentiate itself from its competitors. There are three ways through which it can be achieved: - Architecture: a structure of relational contacts - Innovation: a strong capability to (repeatedly) generate technological innovations - Reputation: a strong corporate reputation Core Competencies (Prahalad and Hamel, 1993) A harmonized combination of multiple resources and skills that distinguish a firm in the marketplace. Core competencies fulfil three criteria: - Provide potential access to a wide variety of markets - Should make a significant contribution to the perceived customer benefits of the end product - Difficult to imitate by competitors Core competencies emerge over time through an organizational process of accumulating and learning how to deploy different resources and capabilities. Example: The core competencies to produce a camera are: - Mechanics - Fine optics Micro-electronics components But also the same to produce scanners, printers. - Examples of Core Competencies BUSINESS STRATEGIES The viability of a firm’s success is driven by both the internal operations of the firm and the desires and preferences of the market. Firms that succeed have the appropriate resources and cost structure to meet the needs of the environment. They also have a strategy. Business is defined as the strategic business area in which the firm operates. Every firm can be defined on the basis of the business in which it operates. The easiest way to conceptualise a firm on the basis of its business is to analyse the markets in which it operates and the products it offers. Abell Matrix (1965) Product: the phisical appeareance of the application of a certain technology to the development of a specific use function of a defined group of customers Market: made of homogeneous groups of customers, set in a certain geographical area, with a specific need (use function) to be satisfied. To obtain a better description of the situation and of the competitive context we consider the following variables used to define Abell’s matrix: - Technology - Customer functions - Groups of customers Identification of “significant matches” among the three dimensions allows to define a business. Customer groups, customer functions and technologies are the three dimensions that can be used to define the industry and the business of a company. Abell’s matrix allows to: - Segment the sectors and identify the strategic business areas - Analyse the available diversification alternatives - Control coherence Groups of customers - Who has to be served? They identify the categories of customers served by the firm. The groups of customers can be selected on the basis of: - Geographical areas - Demographic characteristics - Socio-economic categories - Lifestyles and personal characteristics; Customer functions - What do our customer need? They represent the customer needs that have to be satisfied. They can be divided into: - Complementary fuctions: one function means the action of a second one and viceversa - Similar functions: with similar characteristics but with different technolgies or groups of customers - Independent functions: they satisfy different needs among the same group of customers They don’t have to be confused with: - The way the customer function is developed (technology) - Benefits and attributes perceived by the customer as important for the choice of the product/service Example Customer function teeth brushing Way of serving usual toothpaste, fluoride toothpaste, whitening toothpaste, etc. Attributes/benefits taste, freshness, price, etc. Customer function transport Way of serving taxi, bus, tram, train, etc. Attributes/Benefits comfort, price, speed, etc. Technologies - How do I satisfy my customers? They represent the different alternatives to satisfy a certain need. So, they are not only software and hardware technologies as we consider today. Refering to each of the three dimensions, the business can further be defined by: - Width: it refers to the number and so the industry “cubes” in which the firm operates - Differentiation: o Refering to the segments, it indicates how a certain producer behaves differently on each activity. o Refering to competitors, it indicates the difference among the offer of different producers on the same segment. Abell’s matrix application Business Strategies The purpose of a business stratey is to create differences between the firm’s position in an industry and those of its competitors. Using the value chain’s primary and support activities to create unique value. Business-level strategies require a choice: How to overcome the five forces and achieve competitive advantage? Sources of competitive advantage: - Cost leadership: similar products for reduced costs - Differentiation advantage: higher prices for unique items Business strategies define how a firm should operate in order to gain a competitive advantage. When two or more firms compete within the same market, one firm possesses a competitive advantage over its rivals when it earns (or has the potential to earn) a persistently higher rate of profit. Outcome of a strategy Competitive position Higher profitability Three Generic Strategies Companies that do not identify themselves with any type of advantage are «stuck in the middle». Firms that are stuck in the middle generally perform poorly because they lack a clear market or competitive pricing. Porter (1996) suggests that “a firm’s business-level strategy should not involve trying to serve the varied needs of different segment of customers in an industry. No firm could possibly pull this off.” Doing everything means doing nothing well Overall cost leadership is based on: - Creating a low-cost position relative to a firm’s peers - Managing relationships throughout the entire value chain to lower costs - McDonalds, Wal-Mart, Zara, Ikea Differentiation implies: - Products and/or services that are unique and valuable - Emphasis on non price attributes for which customers will gladly pay a premium - Target, Harley Davison A focus strategy requires: - Narrow product lines, buyer segments, or targeted geographic markets - Advantages obtained either through differentiation or cost leadership - Rolex, Lamborghini, Ferrari Overall Cost Leadership This strategy involves: - Aggressive construction of efficient scale facilities - Vigorous pursuit of cost reductions from experience - Tight cost and overhead control - Avoidance of marginal customer accounts - Cost minimization in all activities in the firm’s value chain, such as R&D, service, sales force, and advertising Cost leadership requires: - Learning to lower costs through experience o The experience curve: they refer to how business “learns” to lower costs as it gains experience with production processes o With experience, unit costs of production processes decline as output increases in most industries - Competitive parity: o o Being “on par” with competitors with respect to low-cost, differentiation, or other strategic product characteristics Permits cost leaders to translate cost advantages directly into higher profits (i.e., above-average returns) Advantages: - Protects a firm against rivalry from competitors - Protects a firm against powerful buyers - Provides more flexibility to cope with demands from powerful suppliers for input cost increases - Provides substantial entry barriers from economies of scale and cost advantages - Puts the firm in a favorable position with respect to substitute products Disadvantages: - Too much focus on one or few value chain activities - Increase in the cost of the inputs on which the advantage is based - A lack of parity on differentiation - Reduced flexibility - Obsolescence of the basis of a cost advantage Primary Activities - Inbound logistics o Effective layout of receiving dock operations - Operations o Effective use of quality control inspectors to minimize rework - Outbound logistics o Effective utilization of delivery fleets - Marketing and sales o Purchase of media in large blocks o Sales force utilization is maximized by territory management - Service o Thorough service repair guidelines to minimize repeat maintenance calls o Use of single type of vehicle to minimize repair costs Support Activities - Firm infrastructure o Few management layers to reduce overhead costs o Standardized accounting practices to minimize personnel required - HR Management o Minimize costs associated with employee turnover through effective policies o Effective orientation and training programs to maximize employee productivity - Technology development o Effective use of automated technology to reduce scrappage rates o Expertise in process engineering to reduce manufacturing costs - Procurement o Effective policy guidelines to ensure low-cost raw materials (with acceptable quality levels) o Shared purchasing operations with other business units Wal-Mart Wal-Mart Stores Inc. has been successful using its strategy of everyday low prices to attract customers. The idea of everyday low prices is to offer products at a cheaper rate than competitors on a consistent basis, rather than relying on sales. Wal-Mart is able to achieve this due to its large scale and efficient supply chain. They source products from cheap domestic suppliers and from lowwage foreign markets. This allows the company to sell their items at low prices and to profit off thin margins at a high volume. Southwest Airlines The airline industry has typically been an industry where profits are hard to come by without charging high ticket prices. Southwest Airlines challenged this concept by marketing itself as a cost leader. Southwest attempts to offer the lowest prices possible by being more efficient than traditional airlines. They minimize the time that their planes spend on the tarmac in order to keep them flying and to keep profits up. They also offer little in the way of additional thrills to customers, but pass the cost savings on to them. Differentiation It consists of creating differences in the firm’s product or service offering by creating something that is perceived industrywide as unique and valued by customers. A differentiation strategy can take many forms: - Prestige or brand image - Technology - Innovation - Features - Customer service - Dealer network Differentiation requires: - A level of cost parity relative to competitors - Integration of multiple points along the value chain: o Superior material handling operations to minimize damage o Accurate and responsive order processing o Personal relationships with key customers o Rapid response to customer service requests - Differentiation along several different dimensions at once Disadvantages: - Uniqueness that is not valuable - Too much differentiation - Too high a price premium - Differentiation that is easily imitated - Diffusion of brand identification through product-line extensions - Perceptions of differentiation may vary between buyers and sellers Creating Customer Loyalty A differentiation advantage can be driven by a customer service strategy, but this may be hard to do: - Can management require employees to behave positively towards customers? - Can management use control systems to reward positive employee-customer interactions? o What happens when extrinsic motivators are used? People have a need for genuine self-expression and authentic functioning. Requiring employees to obey rules may cause them to become “numb” to their real feelings. - Scripted responses to customer complaints leave no opportunity for authentic response - Resulting coping behaviors may distance employees from customers, creating dissatisfaction on both sides So how to create customer loyalty through genuine behaviors? - Business leaders should model a positive disposition toward customers o o Encourage employees to understand the company’s message or product o Strong identification with company message will lead employees to spontaneously express natural emotions, leading to authentic responses to customer issues Allow employees to have a strong personal association with customers o Reward being completely honest with customers o Reward going above and beyond company expectations Focus Focus is based on the choice of a narrow competitive scope within an industry. - Firm selects a segment or group of segments (niche) and tailors its strategy to serve them. - Firm achieves competitive advantages by dedicating itself to these segments exclusively. A focus strategy has two variants: - Cost focus: it creates a cost advantage in its target segment and exploits differences in cost behavior - Differentiation focus: it differentiates itself in its target market and exploits the special needs of buyers Advantages: - Creates higher entry barriers due to cost leadership or differentiation or both - Can provide higher margins that enable the firm to deal with supplier power - Reduces buyer power because the firm provides specialized products or services - Focused niches are less vulnerable to substitutes Disadvantages: - Erosion of cost advantages within the narrow segment - Focused products and services still subject to competition from new entrants and from imitation - Focusers can become too focused to satisfy buyer needs Combination Strategies: Integrating Low-Cost and Differentiation Integration of low-cost and differentiation strategies makes it difficult for competitors to duplicate or imitate strategy. The goal of a combination strategy is to provide unique value in an efficient manner. Combination strategies can take several forms: - Automated and flexible manufacturing systems allow for mass customization - Exploitation of the profit pool concept creates a competitive advantage - Using information technology, firms can integrate activities throughout the extended value chain Advantages: - Creates higher entry barriers due to both cost leadership and differentiation - Can provide higher margins that enable the firm to deal with supplier power - Reduces buyer power because of fewer competitors - An overall value proposition reduces threat from substitutes Disadvantages: - Firms that fail to attain both overall low-cost and differentiation strategies may end up with neither and become “stuck in the middle” - Firms can also underestimate the challenges and expenses associated with coordinating value-creating activities in the extended value chain - Firms can also miscalculate sources of revenue and profit pools in the firm’s industry BUSINESS MODEL AND BUSINESS MODEL CANVAS External environment Porter’s Five Forces (1981) Internal environment Barney RBV (1991); Hamel & Prahald Core Competences (1996) Business strategies Porter’s Value Chain (1981); Abell Matrix (1965); Porter (1981, 1996) Business model Osterwalder & Pigneur (2010) A business model describes the rationale of how an organization creates, delivers, and captures “value” The Business Model View - First, the business model is, explicitly or implicitly, considered as a new unit of analysis which spans or bridges traditional levels of analysis, such as product, firm, industry, or network. - Second, business model researchers generalIy adopt a holistic and systemic perspective (as opposed to particularistic and functional), not just on what businesses do (e.g., what products and services they produce to serve needs in addressable market spaces), but also on how they do it (e.g., how they bridge factor and product markets in serving the needs of customers). - Third, many scholars include organizational activities, performed either by a focal firm, or by any of its suppliers, partners or customers, as part of their conceptualizations. - Fourth, insight business model scholars have shifted emphasis from value capture to value creation, highlighting the latter without ignoring the former Business Model’s Building Blocks A business model can best be described through nine basic building blocks that show the logic of how a company intends to make money. The nine blocks cover the four main areas of a business: - Customer Segments - Value Proposition - Channels - Customer Relationships - Key Resources - Key Activities - Key Partnerships - Cost Structure - Revenue Streams Customer segments Customer segments defines the different groups of people or organizations an enterprise aims to reach and serve. Customer groups represent separate segments if: - Their needs require and justify a distinct offer - They are reached through different distribution channels - They require different types of relationships - They have substantially different profitabilities - They are willing to pay for different aspects of the offer For whom are we creating value? Who are our most important customers? Value proposition The value propositions building block describes the bundle of products and services that create value for a specific customer segment. - The value proposition is the reason why customers turn to one company over another. - It solves a customer problem or satisfies a customer need. - Each value proposition consists of a selected bundle of products and/or services that caters to the requirements of a specific customer segment. In this sense, the value proposition is an aggregation, or bundle, of benefits that a company offers customers. Elements contributing to customer value creation: - Newness - Performance - Customization - Design - Brand status - Price - Convenience/usability What value do we deliver to the customer? Which one of our customer’s problems are we helping to solve? Which customer needs are we satisfying? What bundles of products and services are we offering to each customer segment? Channels The channels describes how a company communicates with and reaches its customer segments to deliver a value proposition. Communication, distribution, and sales channels comprise a company’s interface with customers. Channels are customer touch points that play an important role in the customer experience. Channels serve several functions, including: - Raising awareness among customers about a company’s products and services - Helping customers evaluate a company’s value proposition - Allowing customers to purchase specific products and services - Delivering a value proposition to customers - Providing post-purchase customer support Through which channels do our customer segments want to be reached? How are we reaching them now? How are our channels integrated? Which ones work best? Which ones are most cost- efficient? How are we integrating them with customer routines? Customer relationships The customer relationships describes the types of relationships a company establishes with specific customer segments. A company should clarify the type of relationship it wants to establish with each customer segment. Relationships can range from personal to automated. Customer relationships may be driven by the following motivations: - Customer acquisition - Customer retention - Boosting sales (upselling) We can distinguish between several categories of customer relationships, which may co-exist: - Personal assistance - Dedicate personal assistance - Self-service - Automated service - Communities - Co-creation What type of relationship does each of our customer segments expect us to establish and maintain with them? Which ones have we established? How costly are they? How are they integrated with the rest of our business model? Key resources The key resources describes the most important assets required to make a business model work. These resources allow an enterprise to create and offer a value proposition, reach markets, maintain relationships with customer segments, and earn revenues. Different key resources are needed depending on the type of business model: a microchip manufacturer requires capital-intensive production facilities, whereas a microchip designer focuses more on human resources. Key resources can be: - Phisical - Financial - Intellectual - Human Key resources can be owned or leased by the company or acquired from key partners. What key resources do our value propositions require? Our distribution channels? Customer relationships? revenue streams? Key activities These are the most important actions a company must take to operate successfully. Like key resources, they are required to create and offer a value proposition, reach markets, maintain customer relationships, and earn revenues. Key activities differ depending on business model type: for software maker Microsoft, software development. For PC manufacturer Dell, supply chain management. For consultancy McKinsey, problem solving. Key activities can be categorized: - Production: related to designing, making, and delivering a product in substantial quantities and/or of superior quality - Problem solving: related to coming up with new solutions to individual customer problems - Platform/network: business models designed with a platform as a key resource are dominated by platform or network-related key activities. Networks, matchmaking platforms, software, and even brands can function as a platform. What key activities do our value propositions require? Our distribution channels? Customer relationships? revenue streams? Key partnerships The key partnerships describes the network of suppliers and partners that make the business model work. Partnerships are becoming a cornerstone of many business models. We can distinguish between four different types of partnerships: - Strategic alliances between non-competitors - Coopetition: strategic partnerships between competitors - Joint ventures to develop new businesses - Buyer-supplier relationships to assure reliable supplies It can be useful to distinguish between three motivations for creating partnerships: - Optimization and economy of scale: The most basic form of partnership or buyer-supplier relationship is designed to optimize the allocation of resources and activities. It is illogical for a company to own all resources or perform every activity by itself. Optimization and economy of scale partnerships are usually formed to reduce costs, and often involve outsourcing or sharing infrastructure. - Reduction of risk and uncertainty: Partnerships can help reduce risk in a competitive environment characterized by uncertainty. It is not unusual for competitors to form a strategic alliance in one area while competing in another. - Acquisition of particular resources and activities: Companies extend their own capabilities by relying on other firms to furnish particular resources or perform certain activities. Such partnerships can be motivated by needs to acquire knowledge, licenses, or access to customers. Who are our key partners? Who are our key suppliers? Which key resources are we acquiring from partners? Which key activities do partners perform? Cost structure Creating and delivering value, maintaining customer relationships, and generating revenue all incur costs. Such costs can be calculated relatively easily after defining key resources, key activities, and key partnerships. Some business models, though, are more cost-driven than others. It can be useful to distinguish between two broad classes of business model cost structures: - Cost-driven business models focus on minimizing costs wherever possible. This approach aims at creating and maintaining the leanest possible cost structure, using low-price value propositions, maximum automation, and extensive outsourcing. No frills airlines, such as Southwest, easyJet, and Ryanair typify cost-driven business models. - Value-driven: some companies are less concerned with the cost implications of a particular business model design, and instead focus on value creation. Premium value propositions and a high degree of personalized service usually characterize value-driven business models. Luxury hotels, with their lavish facilities and exclusive services, fall into this category. Cost structures can have the following characteristics: - Fixed costs: which remain the same despite the volume of goods or services produced. Examples include salaries, rents, and physical manufacturing facilities. Some businesses, such as manufacturing companies, are characterized by a high proportion of fixed costs. - Variable costs, whiich vary proportionally with the volume of goods or services produced. Some businesses, such as music festivals, are characterized by a high proportion of variable costs. - - Economies of scale: cost advantages that a business enjoys as its output expands. Larger companies, for instance, benefit from lower bulk purchase rates. This and other factors cause average cost per unit to fall as output rises. Economies of scope: cost advantages that a business enjoys due to a larger scope of operations. In a large enterprise, for example, the same marketing activities or Distribution Channels may support multiple products. What are the most important costs inherent in our business model? Which key resources are most expensive? Which key activities are most expensive? How Can Managers Deal With Business Model Generation? - First constructing maps of business models, in order to clarify the process underlying them. The maps then become a source of experiments to consider alternative combinations of the processes. - Second, conferring authority (within the organizational hierarchy) for experimentation. Nevertheless the process should not only consider the structural aspects of the formaI organization (typieally activity sets), but should also focus on the relational dynamics at the level of informaI organization, enphasazing the importance of the behavioral aspects involved in the business model generation. - Finally, companies can foster business model renewal by engaging in experimentation. Experimentation is conceptualized as a process of discovery aimed at gaining cumulative learning from (perhaps) a series of failures before discovering a viable alternative to the business model. The Business Model Canvas This tool resembles a painter’s canvas which allows you to paint pictures of new or existing business models. The business model canvas works best when printed out on a large surface so groups of people can jointly start sketching and discussing business model elements with Post-it® notes or board markers. It is a hands-on tool that fosters understanding, discussion, creativity, and analysis. The efficiency (the left brain - the logic): Key Partners, Key Activities, Key Resources, Cost Structure, and Value Proposition. The value (the right brain - the emotion): Customer Relationships, Customer Segments, Channels, Revenue Streams, and Value Propositions. CORPORATE STRATEGIES Corporate strategies are concerned with where a firms competes. Corporate strategies are concened primarly with the decisions over the scope of the firms’ activities, including: - Product scope: how specialized should the firm be in terms of products it supplies? - Geographical scope: what is the optimal geographical spread of activities for the firm? - Vertical scope: What range of vertically linked activities should the firm encompass? VERTICAL INTEGRATION The market economy comprises two forms of economic organization: - Market mechanism: Individuals and firms make independent decisions and they are guided by market prices. It does not require conscious planning (the invisible hand, Smith) - Administrative mechanism: Decisions over production, supply, and the purchases of inputs are made by managers and imposed by hierarchies. It requires active planning (the visible handle, Chandler), The Transaction Cost Theory The integration’s decision is based on the transaction costs. Transaction costs are the costs related to the non operation of the market prices mechanism. Transaction costs are all that costs incurred in making an economic exchange (before, during and after a transaction). - Need to make exchanges, because of work specialization - Need to cooperate among different actors - Quest for efficiency Examples: - Search costs - Negotiating costs - Contract costs - Monitoring costs - Enforcement costs - Need for transaction specific investments - Administrative costs To avoid transactions costs, it is necessary to internalize activities. The factors that determine the transaction costs: Transaction cost process - Ex ante: o Research o Selection o Negotiation - During the transaction: o Renegotiation o Monitoring - Ex post: o Management of the transaction consequences o Control of the transaction The cost conditions can be synthetized into the following formula Cp + Ca ≤ ≥ P + Ct Where: Cp : Production costs Ca: Administrative costs P: Market price Ct: Transaction costs Vertical Integration Using the words vertical integration, we refer to the internalization of a bunch of vertically correlated activities. The stronger control and property of a company phases of the economic-productive chain, the higher the level of vertical integration. To integrate or not to integrate? - Define the borders of the total activity of the company - Define the relationships between the company and third firms - Recognize the circumstances that could involve some modifications to the boundaries of the activity of the company Direction: - Backward integration: the company sets up subsidiaries that produce some of the inputs used in the production of its products (acquisition of a supplier) - Forward integration: the company gets the control or the propriety of some of his consumers Degree: The degree indicates the involvement of the company for each input – output important for the firm. - Total integration: totally integrated companies own 100% the activities of the value chain of an input/output - Near integration: nearly integrated companies don’t own all the activities of the value chain of an input/output - Conic integration: companies adopting a conic section integration, become dependant from external sources for the supply of a part of a determined input or for the delivery of a part of a determined output - No integration: non integrated companies decide to depend totally from external sources for the needs Width and extension : - Width: the measure of dependance of the company from his own internal sources for all the important input/output - Extension: the length of the internalized value chain and indicates the number of phases of the productive process Agency Theory Principal-Agent: agent acts in the principal’s interest Probelms: - Adverse selection: agent may lie or provide incomplete information concerning its competences Moral hazard: agent pursues his interest, eventually against the principal. Control is costly, so the agent may not be correctly monitored Agency costs: - Costs of monitoring and incentivate - Obbligation costs: to ensure that the principal will not damage the agent (insurance costs) - Opportunity costs: differences between real behaviour and a behaviour that would maximize utility for the principal - Vertical Integration The selection of the activities realized internally (make or buy decision of vertical integration) in a company is based on: - An economical criteria of costs comparison in different mechanisms of coordination o Market (price mechanism) vs. Hierarchy (hierarchy mechanism) - Contractual power - Appropriation risk - Diffusion risk - Deterioration risk The comparison can be made considering each single activity of the value chain. Outsourcing: strategic choice to externalize certain activities to external companies. Organizations enter into a contractual agreement involving an exchange of services and payments. - Firms does not own specific competences - Firms can not exploit certain production economies Advantages: - Cost reduction: o Internalization of economies of scale o Internalization of economies of scope o Elimination of transaction costs - Offensive market power: o Possibility to attack forward or backward businesses o Possibility to apply a successful differentiation o Higher informative and operative knowledge o Acquisition of market share - Defensive market power: o Elimination of the risk of know-how’s transfer o Exclusive rights o Higher quality control o Increase of entry and mobility barriers - Administrative managerial advantages: o Higher control of each phase of the process o Higher level of sharing of information with the external society o Administrative and legal semplification allowed by the lesser number of relations with external subjects Disadvantages: - Cost increase: o Growth of operative leverage caused by higher fixed costs o Higher level of investements Possible growth of general and structural expenditure Loss of flexibility: o Lesser diversification flexibility o Elevation of exit barriers o Higher difficulties to eliminate obsolete or not economical processes Problems of balance: o Necessity to maintain a given level of balance between each phase of the value chain (e.g., dimensioning of the productive systems in relation to the demand level) Managerial problems: o Higher heterogeneity and complexity o Higher costs for the managment of the structure o - - - PRODUCT DIVERSIFICATION Diversification is the process of firms expanding their operations by entering new businesses. Diversification initiatives must create value for shareholders through: - Diversification from outside: o Mergers and acquisitions o Strategic alliances o Joint ventures o Licensing / franchising - Internal development Diversification should create synergy between Business 1 and Business 2. Synergy is the reason why companies make diversification strategies A firm may diversify into related businesses: - Benefits derive from horizontal relationships: sharing intangible resources such as core competencies in marketing. Sharing tangible resources such as production facilities, distribution channels via vertical integration. A firm may diversify into unrelated businesses: - Benefits derive from hierarchical relationships: value creation derived from the corporate office. Leveraging support activities in the value chain. Related Diversification Related diversification enables a firm to benefit from horizontal relationships across different businesses Economies of scope allow businesses to: - Leverage core competencies: core competencies reflect the collective learning in organizations. Can lead to the creation of value and synergy if: o They create superior customer value o The value chain elements in separate businesses require similar skills o They are difficult for competitors to imitate or find substitutes for - Sharing related activities: Corporations can also achieve synergy by sharing activities across their business units. Sharing tangible and value-creating activities can provide payoffs: o o o Cost savings through elimination of jobs, facilities and related expenses, or economies of scale Revenue enhancements through increased differentiation and sales growth Increase the effectiveness of differentiation strategies Related businesses gain market power by: - Pooled negotiating power - Vertical integration Sharing core competencies is one of the primary potential advantages of diversification. In order for diversification to be most successful, it is important that the similarity required for sharing core competencies must be in the value chain, not in the product. Diversification Reasons for diversification: - Growth: the desire to escape stagnant or declining industries powerful motives for diversification (e.g., tobacco, oil, newspapers). o But, growth satisfies manager not shareholders. Growth strategies (esp. by acquisition) tend to destroy shareholder value. - Risk reduction: diversification reduces variance of profit flows. o But, doesn't’t create value for shareholders, they can hold diversified portfolios of securities. o Capital Asset Pricing Model shows that diversification lowers unsystematic risk not systematic risk (Beta) CAPM: Ke =rf +β*(Rm –Rf) Beta is a measure of a stockis volatility in relation to the market. It essentially measures the relative risk exposure of holding a particular stock or sector in relation to the market. - Profit: for diversification to create shareholder value, then bringing together of different businesses under common ownership and must somehow increase their profitability. Diversification and Shareholder Value: Porter’s Three Essential Tests If diversification is to create shareholder value, it must meet three tests: - The attractiveness test: diversification must be directed towards attractive industries (or have the potential to become attractive) - The cost of entry test: the cost of entry must not capitalize all future profits - The better-off test: either the new unit must gain competitive advantage from its link with the company, or vice-versa (e.g., some form of “synergy” must be present) Determinants of Diversification - External factors: o Market opportunity o Demand decrease in original business o High transaction costs o Public policies - Internal factors: o Economies of scale and scope o Financial resources o Risk minimization o Growth objectives (managerial view) o Synergies between tangible and intangible resources o Business captive: a captive unit is a business unit of a company functioning offshore as an entity of its own while retaining the work and close operational tie ups within the parent company. Economies of scope - Sharing tangible resources (research labs, distribution systems) across multiple businesses - Sharing intangible resources (brands, technology) across multiple businesses (i.e., Philip Morris’ Seven Up and Miller Acquisitions) - Transferring functional capabilities (marketing, product development) across businesses - Applying general management capabilities to multiple businesses Competitive advantage from diversification - Economies of scope not a sufficient basis for diversification, must be supported by transaction costs - Diversification firm can avoid transaction costs by operating internal capital and labor markets - Key advantage of diversified firm over external markets (superior access to information) Mergers and Acquisitions - Mergers involve a combination or consolidation of two firms to form a new legal entity. They are relatively rare. The two firms are on a relatively equal basis. - Acquisitions involve one firm buying another either through stock purchase, cash, or the issuance of debt. Motives: - In high-technology and knowledge-intensive industries, speed is critical: acquiring is faster than building - M&A allows a firm to obtain valuable resources that help it expand its product offerings and services - M&A helps a firm develop synergy: o Leveraging core competencies o Sharing activities o Building market power - M&A can lead to consolidation within an industry, forcing other players to merge - Corporations can also enter new market segments by way of acquisitions. Limitations: - Takeover premiums for acquisitions are typically very high - Competing firms can imitate advantages - Competing firms can copy synergies - Cultural issues may doom the intended benefits Using an acquisiton strategy successfully Kenexa, a subsidiary of IBM, provides workforce management and recruitment service solutions. Starting in 1987, expanded into new product and geographic markets, now a company with over 2,600 employees, with clients in over 20 countries. It used organic growth, strategic alliances, and acquisitions to expand. It acquired 7 companies outside the U.S. and formed a joint venture in China. The acquisition allowed Kenexa to get access to local market knowledge and delivery capabilities. - Human capital is the most valuable asset they seek to acquire as it provides a source of growth, innovation, thought leadership - - Challenge is to make sure cultures don’t compete o Firm need to get to know the acquired company’s senior leadership team, don’t depend on CEO o Allow key employees to self-select out Drivers of acquisition success: o Make sure acquisition target is tightly aligned with the firm’s overall strategy. Does the target fit the business unit’s needs? o Get the acquisition price right, understand how quickly the target must contribute to firm growth. What is the length of the payback period? o Conduct a full due diligence to avoid surprises. Do the original reasons survive diligence? o Start planning for integration early on. What performance indicators will become future financial and strategic targets? Divestment Divestment objectives include: - Cutting the financial losses of a failed acquisition - Redirecting focus on the firm’s core businesses - Freeing up resources to spend on more attractive alternatives - Raising cash to help fund existing businesses Successful divestiture involves: - Removing emotion from the decision - Knowing the value of the business you’re selling - Timing the deal right - Maintaining a sizable pool of potential buyers - Telling a story about the deal - Running divestitures systematically through a project office - Communicating clearly and frequently Strategic Alliances and Joint Ventures Motives: - Ability to enter new markets through greater financial resources and greater marketing expertise - Ability to reduce manufacturing or other costs in the value chain - Ability to develop and diffuse new technologies Limitations: - Need for the proper partner: o Partners should have complementary strengths and partner’s strengths o Partner’ strengths should be unique. Uniqueness should create synergies and synergies should be easily sustained and defended. o Partners must be compatible and willing to trust each other Internal Development (Corporate Entrepreneurship) Motives: - No need to share the wealth with alliance partners - No need to face difficulties associated with combining activities across the value chains - No need to merge diverse corporate cultures Limitations: - Time-consuming - Need to continually develop new capabilities Managerial Motives Managers may act in their own self interest, eroding rather than enhancing value creation through: - Growth for growth’s sake: top managers gain more prestige, higher rankings, greater incomes, more job security - Excessive egotism - Use of antitakeover tactics Advantages and Disadvantages of Diversification Advantages: - Firm growth - Financial synergies - Company and profits stability - Economies of scale and scope - Technology acquisition and high profile management - Competences transfer - Facing competition - Opportunity to exploit excess in resources - Management objectives Disadvantages: - Wrong objectives: underestimated risks - Unreachable synergies - High costs: coordination intensity and complexity Value wipeout INTERNATIONAL STRATEGY An internationalized firm intentionally assumes an orientation towards development in different geographical areas. Competitive advantage is created across markets. The global marketplace provides many opportunities for firms to increase their revenue base and their profitability. However, managers face many opportunities and risks when they diversify abroad. What should a firm do in order to create value and attain a competitive advantage in this global marketplace? Globalization has to do with the rise of market capitalization around the world: - International exchanges have increased trade in goods and services, exchange of money, information, and ideas - Laws, rules, norms, values, and ideas are growing more similar across countries Challenges include balancing between emerging markets and developed markets. How to meet the needs of customers at very different income levels. Factors Affecting a Nation’s Competitiveness Michael Porter’s diamond of national advantage explains why some nations and their industries outperform others: - Factor endowments: o Land, capital, labor o Factors of production must be industry and firm specific. They must be rare, valuable, difficult to imitate, and rapidly and efficiently deployed - Demand conditions: refer to the demands that consumers place on an industry. Demanding consumers drive firms in that country to: - - o Meet high standards o Upgrade existing products and services o Create innovative products and services o Better anticipate future global demand o Proactively respond to product and service requirements Related and supporting industries: enable firms to manage inputs more effectively. o A competitive supplier base reduces manufacturing costs o Close working relationships with suppliers allow for joint research and development o Development of related industries forces existing firms to practice cost control, product innovation, better distribution methods Firm strategy, structure, and rivalry: o Strong consumer demand o Strong supplier base o High new entrant potential from related industries Domestic rivalry leads to a search for new markets. Rivalry is a strong indicator of global competitive success. India’s diamond in software International Expansion: Becoming a Multinational Firm Motivations: - Increase size of potential markets and attain economies of scale - Take advantage of arbitrage opportunities at every stage of the value chain - Enhance a product’s growth potential reinvigorating the product life cycle - Optimize the location of value chain activity: o To enhance performance o To reduce cost o To reduce risk - Take advantage of learning opportunities - Explore reverse innovation: o Design and manufacture products locally o Export no-frills products to developed markets Risks: - Political risk due to social unrest, military turmoil, demonstrations, terrorism, absence of the rule of law can lead to o Destruction of property o Disruption of operations o Non-payment for goods and services o Arbitrary government decisions - Economic risk due to piracy and counterfeiting - Currency risk due to fluctuations in the local currency’s exchange rate. o It affects cost of production or net profit - Management risk due to culture, customs, language, income level, customer preferences, distribution systems. o Could lead to the need for local adaptation of apparently standard products International Expansion: Managing Risks Managing economic risk through global dispersion of value chains. Various activities of the firm’s value chain are spread across several countries and continents via: - Outsourcing - Offshoring Offshoring may be costly. Common savings from offshoring include: - Lower wages, benefits, energy costs, regulatory costs, taxes Hidden costs from offshoring include: - Higher total wage and indirect costs, wage inflation - Increased inventory due to longer lead time - Reduced market responsiveness - Increased coordination costs - Cost of protecting intellectual property Human resource challenges in international operations include: - Difficulty standardizing job descriptions, establishing common pay grades and incentives - Job titles don’t transfer across regions - Technical certifications and cross-training opportunities are difficult to manage, consistency in knowledge acquisition is key, but hard to do - Unemployment rates differ and affect cost of doing business, HR leadership strategy must be aligned across regions International Strategies: Opposing Pressures Cost reduction or adaptation to local markets? Strategies that favor global products and brands should do the following: - Standardize all products for all markets - Reduce overall costs by spreading investments over a larger market Assumptions: - Homogenous customer needs and interests - People prefer lower prices at high quality - Global markets produce economies of scale Assumptions may be incorrect: - Product markets do vary widely between nations, local adaptations work - There is a growing interest in multiple product features, product quality, and service - Technology permits flexible production, cost of production may not be critical to product cost and a firm’s strategy should not be solely product driven “One size fits all” does not generally apply. International Strategy An international strategy requires diffusion and adaptation of the parent company’s knowledge and expertise to foreign markets. The primary goal is worldwide exploitation of the parent firm’s knowledge and capabilities. - All sources of core competencies are centralized. - Pressure for both local adaptation and low costs are rather low. Strengths: - Leverage and diffusion of a parent firm’s knowledge and core competencies - Lower costs because of less need to tailor products and services Limitations: - Limited ability to adapt to local markets - Inability to take advantage of new ideas and innovations Global Strategy A global strategy implies a firm is interested in lowering costs - Competitive strategy is centralized and controlled by the corporate office - Products are standardized, operations centralized, producing economies of scale - Worldwide volume supports R&D - There’s a standard level of quality worldwide. - Pressure for reducing cost is high, pressure for adaptation to local markets is weak Advantages: - Strong integration across various businesses - Standardization leads to higher economies of scale, which lower costs - Helps create uniform standards of quality throughout the world Disadvantages: - Limited ability to adapt to local markets - Concentration of activities may increase dependence on a single facility - Single locations may lead to higher tariffs and transportation costs Multidomestic Strategy A multidomestic strategy puts emphasis on differentiating products and services to adapt to local markets. - Decisions are decentralized - Products and services are tailored to local use. Consider language, culture, income levels, customer preferences, distribution systems - Markets can expand rapidly - Prices are differentiated by market - Pressure for local adaptation is high, pressure for lowering costs is low Advantages: - Ability to adapt products and services to local market conditions - Ability to detect potential opportunities for attractive niches in a given market, enhancing revenues Disadvantages: - Decreased ability to realize cost savings through scale economies - Greater difficulty in transferring knowledge across countries - May lead to overadaptation as conditions change Transnational Strategy A transnational strategy seeks global competitiveness via trade-offs: - Efficiency versus local adaptation versus organizational learning - Assets and capabilities are disbursed according to the most beneficial location for a specific activity, some value chain activities are centralized, some are decentralized (economies of scale, increased knowledge flows) - Pressures for both local adaptation and lowering costs are high Strengths: - Ability to attain economies of scale - Ability to adapt to local markets - Ability to locate activities in optimal locations - Ability to increase knowledge flows and learning Limitations: - Unique challenges in determining optimal locations of activities to ensure cost and quality - Unique managerial challenges in fostering knowledge transfer International Strategies: Global or Regional? It may be unwise for companies to rush into full-scale globalization. Regionalization may be more reasonable: - Distance still matters - Commonalities of language, culture, economics, legal and political systems, and infrastructure all make a difference - Trading blocks and free trade zones ease trade restrictions, taxes, and tariffs Components of an Internationalized Company - Managerial component: nature of foreign activity - Organizational component: width and coherence of international organization - Structural component: diversity of normative environment and political-economical institutions - Strategic component: being abroad as a strategic choice Phases Entrance Establishment Development Rationalization Entrance - Area selection - Objective definition - How to enter the market? Entrance alternatives Indirect export Direct sales Foreign market integration Multinational-Global Firm 1) Indirect export: Firm uses intermediaries to sell products abroad and leave market penetration to the initiative of other organizations - Domestic market is more important than foreign market - o National marketing mix policies o Export of excess production Production remains in domestic market Low risk – low cost The country-of-origin effect (COE), is a psychological effect describing how consumers’ attitudes, perceptions and purchasing is influenced by products’ country of origin labeling, which may refer to where: - A brand is based - A product is designed or manufactured - Other forms of value-creation aligned to a country Consumer perception of the product (differentiation) - Supply-side Made-in effect - Demand-side Country-of-origin effect Indirect export – How to? Subjects that manage a channel between producers and buyes in different countries: Buyer Trading companies Export consortiums Broker Export management companies - - - - - Buyer: o Lives in a foreign country, represents potential investors o “Letter of intent” o Commission is payed by foreign buyers represented by him Trading companies: o Specialized in selling a country products in other nations o Strongly diversified, operate in different countries o Usually big sized companies Export consortiums: o Used by SMEs: they aggregate a number of firms to reach “critical dimension” o May be focused on single industry or reach multulple industries Broker: o Connects buyers and sellers, helps during the transactions o Usually specialized in certain products, often commodities (oil, metal) o May be buyer’s or seller’s agent EMC (export management company): o Commercial firm o Integrates operations of different firms 2) Direct selling: Production still mainly localized in the country of origin but simultaneous search of stronger presence in the foreign market (direct contact with buyers and intermediaries). Higher costs and risks but also higher control on the operations, better knowledge of the local clientele and better customer service: - Long term sales perspective - Higher market information - Offensive/defensive chances 3) Integration with the foreign market: - Production contracts: part of the production process is moved to a specific foreign market (direct investment in plants and production facilities or alliances/licensing agreements with local partners) - Assembly contracts Direct distribution of goods, franchising, JVs. Immediate presence into the foreing market and relatively low investment needed, partial loss of control on the product and sharing of revenues with licensors Foreing direct investment - Greenfield: parent companies start a new venture in a foreign country by constructing new operational facilities from the ground up - Brownfield: parent companies purchase of a previously constructed factory or other facility in order to use it for its activities Subsidiaries may be: - Commercial - Productive - R&D FDI are essential in the internationalization process of a firm. Firms may want to: - Get closer to the end market - Reduce production costs - Acquire new resources - Rationalize international production structure Value Creation Trough Global Expansion - Global model: Need to reduce production costs and place products/services at a lower price with respect to local competitors. o Companies do not transfer activities to local subsidiaries o Strongly centralized o Develop a dymanic network of relations to offer lower prices - Transnational model: Integration of the multinational and global model. o Respects local adaptation and global intregration o Transfer of activities in those markets where subsidiaries can exploit local advantages and development of a value network to drive competences and skills sharing and enhance core competences - Multidomestic model: Localizing core activities in foreing countries allows flexibility to environmental changes. o Strategic elasticity o Divisions can combine core competences with local competences (e.g., differentiation or access to strategic resources). PORTFOLIO MATRIX BCG Matrix CATEGORY OF BUSINESS MARKET SHARE BUSINESS INVESTMENTS PROFITABILITY REQUIRED NET CASH FLOWS STARS Maintaining/increasing High High Zero or proximal to zero CASH COWS Maintaining QUESTION MARKS Increasing/harvesting High Negative Low High DOGS Low or negative Divest Harvesting strategy Positive Negative Zero or proximal to zero McKinsey – G.E. Matrix The McKinsey matrix was born as a criticism to the BCG matrix. It doesn’t represent simple variables (as the BCG does), but aggregate variables (an elements’ complex that represent the industry attractiveness and the company competitive position). It can be used to analyse the present and the future company’s situations. DIMENSIONS BUSINESS COMPETITIVE CAPABILITY INDUSTRY ATTRACTIVENESS Industry attractiveness – external factors: - Market dimension - Market growth rate - Competitive structure - Industry profitability - Technology - Legislation - Political and social aspects Business competitive capability – internal factors: - Market share - Marketing - R&D Production Financial resources Human resource Brand and reputation Products range Quality Formulation of strategies Alternative BCG Matrix The pure BCG matrix gives information about strategies to implement in order to get high market shares by costs reduction. With the multiplying number of segments’ specialists and with the attainment of high economies of scale by competitors, the way to compete must be more differentiated and articulated. Companies in the best positioning are those firms that were able to forecast market evolutions and to create unique and defendable advantages. (Lockridge, 1981, BCG) DIMENSIONS COMPETITIVE ADVANTAGE EXTENSION POSSIBLE WAYS TO GET THE COMPETITIVE ADVANTAGE Subjective evaluations of the opportunities for differentiation inside the industry and the scale to get it. - Fragmented: many ways of achieving competitive advantage but the advantage is minimal. The profitability of businesses in this sector is not correlated with market share. Poor performers can be large or small and good performers are also independent of size. They differ in the large number of ways they choose to achieve a competitive advantage. - Stalemate: there are a few ways to obtain advantage and the size of the advantage is small for businesses in the Stalemate quadrant. Profitability in this quadrant is low for all competitors regardless of size. There is a small difference between the most profitable and least profitable firms. - Specialized: in this quadrant there are many ways to obtain an advantage and once it is obtained, it is large. The largest profitability is enjoyed by small businesses able to distinguish themselves among their competitors by following a focused strategy. - Volume: in a Volume business, there are only a few ways to obtain an advantage but if obtained, high volume is generated because of the size of the advantage is large. In this category, market share and profitability are closely associated. Shell Matrix DIMENSIONS INDUSTRY’S EXPECTED PROFITABILITY COMPANY’ COMPETITIVE ABILITIES IN THE BUSINESS Similar to the McKinsey – G.E. matrix. The biggest difference is in the use of simple variables, instead of aggregate variables. Evaluations about the different businesses’ insertion in the matrix are of qualitative nature. In the McKinsey matrix, coordinates are the result of a quantitative values’ weighted average. Industry – external factors: - Growth rate - Market’s quality - Environmental features - Supplying SBU – internal factors: - Market share - Production capacity - R&D investments ORGANIZATIONAL MANAGEMENT To implement strategy successfully, firms must have appropriate organizational designs. Organizational structure refers to formalized patterns of interactions linking tasks, technologies and people. Structure provides a balance between the need for division of tasks into meaningful groupings and the need to integrate these groupings for maximum efficiency and effectiveness Generally speaking, discussions of the relationship between strategy and structure strongly imply that structure follows strategy. Simple Structure The simple organizational structure is the oldest and most common organizational form, where: - The organization is small, with a single or very narrow product line - The owner-manager makes most of the decisions - The staff serves as an extension of the top executive Advantages: - Highly informal - Coordination of tasks by direct supervision - Centralized decision-making - Little specialization of tasks - Few rules and regulations, informal reward systems Disadvantages: - Employees may not understand their responsibilities - Employees may take advantage of lack of regulations, act in their own self-interest - Limited opportunities for upward mobility Functional Structure The functional organizational structure is where the major functions of the firm are grouped internally: - The organization is small, with a single or closely related product or service, high production volume, perhaps some vertical integration - The owner-manager needs specialists in various functional areas - The chief executive has responsibility for coordination and integration of the functional areas Advantages: - Enhanced coordination and control - Centralized decision-making - Enhanced organizational-level perspective - More efficient use of managerial and technical talent - Facilitated career paths in specialized areas Disadvantages: - Impeded communication and coordination due differences in values and orientations (silos) - May lead to short-term thinking - Difficult to establish uniform performance standards Divisional Structure The divisional organizational structure is where products, projects, or product markets are grouped internally: - Divisions are relatively autonomous, consisting of products and services that are different from those of other divisions - Although governed by a central corporate office, each division includes its own functional specialists - Division executives help determine product-market and financial objectives, decision making is delegated to lower-level managers Advantages: - Separation of strategic and operating control - Quicker response to changes in the market environment - Fewer problems sharing resources across functions - Development of general management talent is enhanced Disadvantages: - Duplication of functions can be very expensive - Can lead to dysfunctional competition among divisions - Differences in image and quality may occur across divisions - Can focus too much on short-term performance SBU Structure The strategic business unit structure is where similar products or markets are grouped into units to achieve synergy: - Variation on the divisional structure - Similar divisions are grouped into homogeneous units - Each of the SBUs operates as a profit center Advantages: - Planning and control done by the corporate office - Decentralization of authority - Quicker response to changes in the market environment - Synergies through related diversification, leveraging core competencies, sharing infrastructures, using market power Disadvantages: - Can be difficult to achieve synergies - Increased personnel and overhead expenses - Corporate office further removed from the divisions - Corporate unaware of key changes in market conditions Challenges of an SBU divisional structure Hewlett-Packard (HP) multiple divisions, multiple markets: personal computers, enterprise servers, storage devices, printers. - - 1999/2001: CEO Carly Fiorino created four major operating groups: services, imaging and printing, access devices, information technology infrastructure. From this created a sales and marketing division, and an R&D and manufacturing division. Although there were synergies, this lead to difficult strategic decision making, incompatibility among products, customer confusion. 2014: CEO Meg Whitman created the Printing and Personal Services Group and the HP Enterprise Group, then announced they would spin-off into separate companies, regardless of the “dis-synergies.” Holding Company Structure The holding company structure is where businesses in a corporation’s portfolio are the result of unrelated diversification: - Variation on the divisional structure - Similarities are few, so synergies are limited - Operating divisions have autonomy - Corporate staffs are small and have limited involvement, relying on financial controls and incentive programs to obtain performance Advantages: - Cost savings due to fewer personnel and lower overhead - Divisional autonomy increases motivation level of divisional executives - Quicker response to changes in the market environment Disadvantages: - Potential for synergies is very limited - Corporate office has little control - Difficult to replace key divisional executives if they leave - Turn around maybe difficult due to limited corporate staff support Matrix Structure The matrix organizational structure is where functional departments are combined with product groups on a project basis: - Functional departments, product groups and geographical units can be combined - Individuals have two managers: project managers and functional managers share responsibility. o Product managers handle development, manufacturing and distribution of their own line. o Geographic managers are responsible for profitability of the business in their regions Advantages: - Increases market responsiveness, collaboration and synergies - Allows more efficient utilization of resources - Improves flexibility, coordination and communication - Increases professional development Disadvantages: - Dual reporting relationships lead to uncertainty regarding accountability - Can lead to power struggles and conflict - Relationships are complicated, need teamwork - Decision-making takes longer International Operations Firms with international operations must consider a structure based on the following: - The type of strategy that is driving the firm’s foreign operations - The degree of product diversity - The extent to which a firm is dependent on foreign sales Multidomestic strategies use: - International division structure - Geographic-area division structure - Worldwide matrix structure Global strategies use: - Worldwide functional structure - Worldwide product division structure - Worldwide holding company structure A global start-up: - Uses inputs from around the world - Sells its products and services to customers around the world - Has communication and coordination challenges - Has fewer resources than well-established corporations - Must use less costly administrative mechanisms - Frequently chooses a boundaryless organizational design Boundaryless Designs: Barrier-Free, Modular, Virtual A boundaryless organizational design makes these boundaries more permeable: - Vertical boundaries between organizational levels - Horizontal boundaries between functional areas - External boundaries between the firm and its customers, suppliers, and regulators - Geographic boundaries between locations, cultures, and markets Boundaryless designs include barrier-free, modular, and virtual organizations A barrier-free organization has permeable internal and external boundaries and requires: - Higher level of trust and shared interests - Shift in philosophy from executive development to organizational development - Greater use of teams - Flexible, porous organizational boundaries - Communication flows and mutually beneficial relationships with both internal and external constituencies Advantages: - Leverages the talents of all employees - Enhances cooperation, coordination, and information sharing among functions, divisions, SBUs, and external constituencies - Enables a quicker response to market changes through a single-goal focus - Can lead to coordinated win-win initiatives with key suppliers, customers, and alliance partners Disadvantages: - Difficult to overcome political and authority boundaries inside and outside the organization - Lacks strong leadership and common vision, which can lead to coordination problems - Time-consuming and difficult-to-manage democratic processes - Lacks high levels of trust, which can impede performance What advantages does outsourcing provide an organization? 1. Access to the best-in-class goods and services 2. The ability to expand rapidly with a relatively low capital investment 3. The opportunity to focus scarce resources on existing core competencies 4. All of the above A modular organization requires seamless relationships with external organizations: - Outsources nonvital functions or non-core activities to outsiders - Activates knowledge and expertise of “best in class” suppliers but retains strategic control - Focuses scarce resources on key areas - Accelerates organizational learning - Decreases overall costs, leverages capital Advantages: - Directs a firm’s managerial and technical talent to the most critical activities - Maintains full strategic control over most critical activities / core competencies - Achieves best-in-class performance at each link in the value chain - Leverages core competencies by outsourcing with smaller capital commitment - Encourages information sharing and accelerates organizational learning Disadvantages: - Inhibits common vision through reliance on outsiders - Diminishes future competitive advantages if critical technologies or other competencies are outsourced - Increases the difficulty of bringing back into the firm activities that now add value due to market shifts - Leads to an erosion of cross-functional skills - Decreases operational control and potential loss of control over a supplier A virtual organization requires forming alliances with multiple external partners: - Continually evolving network of independent companies - Linked together to share skills, costs, and access to one another’s markets - Coping with uncertainty through cooperative efforts - Each gains from resulting individual and organizational learning - May not be permanent Advantages: - Enables the sharing of costs and skills - Enhances access to global markets - Increases market responsiveness - Creates a best-of-everything organization since each partner brings core competencies to the alliance - Encourages both individual and organizational knowledge sharing and accelerates organizational learning Disadvantages: - Harder to determine where one company ends and another begins, due to close interdependencies among players - Leads to potential loss of operational control among partners - Results in loss of strategic control over emerging technology - Requires new and difficult-to-acquire managerial skills Example This textbook is published by McGraw-Hill Education. Putting the textbook and supplemental material together is done by a virtual team: - The authors live in Texas, Michigan, and New York - The editors work in Illinois, with outsourced support - The text compositors are in India - The PowerPoint and Case Teaching Notes author works out of her home in Connecticut - Deadlines are coordinated by the MH editors in Illinois and New York, to pull the book together and arrange for distribution Leading virtual teams Virtual teams’ members are in different locations, so traditional leadership styles are less effective: - No face-to-face interaction means formal leaders can’t use personal influence or mentoring - A single leader may lack information to effectively monitor behaviors - Coordination and communication is increasingly done via electronic means, requiring technological acumen What works instead? - Shared leadership, substitute leadership, empowerment - Structural supports such as a fair performance appraisal system, clear information about tasks, clear goals and rewards - Good technological support A virtual boundaryless organization requires: - Mechanisms to ensure effective coordination and integration o Common culture and shared values o Horizontal organizational structures o Horizontal systems and processes o Communications and information technologies o Human resource practices - Awareness of the benefits and costs of developing lasting internal and external relationships Advantages: - Agency costs are reduced through the use of relational systems - Transaction costs between the firm and its suppliers are reduced - Individual participants are less likely to perceive a conflict of interest Disadvantages: - Relationships between individuals become more important than profits - Conflicts are resolved through ad hoc negotiations and processes - Relationships are driven more by social connections than by needed competencies Ambidextrous Designs Ambidextrous organizational designs address two contradictory challenges: - How to maintain adaptability - How to achieve alignment Ambidextrous organizations are: - Aligned and efficient while they pursue modest, incremental innovations - Flexible enough to adapt to changes in the external environment and create dramatic, breakthrough innovations Ambidextrous organizational designs: - Effectively integrate and coordinate existing operations - Establish project teams that are structurally independent units - Pay attention to each unit’s processes, structures, and cultures - Effectively integrate each unit into the existing management hierarchy According to a study by O’Reilly and Tushman, effective ambidextrous structures had all of the following attributes except 1. A clear and compelling vision. 2. Managerial efforts that were highly focused on revenue enhancement. 3. Cross-fertilization among business units. 4. Established units that were shielded from the distractions of launching new businesses. INNOVATION MANAGEMENT To remain competitive, established firms must continually seek out opportunities for growth and develop new methods for strategically renewing their performance. Innovation allows for: - Transformation of organizational processes - Creation of new and commercially viable products and services Innovation requires new knowledge from: - The latest technology - The results of experiments - Creative insights - Competitive information Whereas _______ are often associated with the low-cost leader strategy, ________ are frequently an important aspect of the differentiation strategy. A. process innovations; product innovations B. product innovations; service innovations C. radical innovations; instrumental innovations D. marketing innovations; incremental innovations Types of innovation include - Product innovation: o Creates new product designs o Applies technology to develop new products for end-users o Common during early stages of an industry’s life cycle o Associated with a differentiation strategy - Process innovation: o Improves the efficiency of an organizational process - - - - o Improves materials utilization, shortens cycle time, increases quality o Common during later stages of an industry’s lifecycle o Associated with overall cost leadership strategies Radical innovation: o A major departure from existing practices o Usually as a result of technological change o Can be highly disruptive o Can transform or revolutionize a whole industry Incremental innovation; o Can enhance existing practices o Make small improvements in products and processes o Can create evolutionary applications of earlier innovations, provide new capabilities Sustaining innovations: o Extend sales in an existing market o Enable new products or services to be sold at higher margins (via the Internet) Disruptive innovations: o Overturn markets with a new approach to meeting customer needs o Are technologically simpler and less sophisticated o Appeal to less demanding customers o Take time to take effect Managing Innovation: Challenges Innovation challenges/dilemmas: - Seeds versus weeds o Which project should we pursue? o Seeds are likely to bear fruit, weeds should be cast aside. o Projects may require considerable investment before merit can be determined - Experience versus initiative o Who should lead an innovation project? o Senior managers have experience and credibility, but tend to be more risk averse o Mid-level employees may be the innovators themselves and have more enthusiasm - Internal versus external staffing o Where do we get competent staff? o Insiders may have greater social capital, know the firm’s culture and routines, but not be able to think outside the box o Outsiders are costly to recruit, hire, and train, may have difficulty building relationships - - Building capabilities versus collaborating o How do we find needed skills? o Capabilities may come from internal departments o Collaborators may come from other companies o Dependencies may inhibit internal skills development or create conflict Incremental versus preemptive launch o An incremental launch is less risky, requires fewer resources, serves as a market test o An incremental launch can undermine the project’s credibility if it is too tentative o An incremental launch can open the door for a competitive response o A large-scale launch requires more resources o A large-scale launch can effectively preempt a competitive response Managing Innovation: Improving the Process 1) Cultivating innovation skills: - Discovery skills allow leaders to see the potential in innovations - Creative intelligence allows individuals to develop more creative, higher potential innovations by means of: o Associating patterns, information and insights o Questioning common wisdom o Observing behavior o Experimenting with new possibilities o Networking with a diverse set of individuals 2) Defining the scope of innovation - Defining the strategic envelope: o Focus on a common technology? o Focus on a market theme? - Evaluating results: o How much will the innovation initiative cost? o How likely is it to actually become commercially viable? o How much value will it add, what will it be worth if it works? o What will be learned if it does not pan out? 3) Managing the pace of innovation: - Incremental innovation: o May take six months or two years o May use a milestone approach, goals and deadlines - Radical innovations: o May take 10 years or more o May involve open ended experimentation and time-consuming mistakes - “Time pacing” allows for control of the innovation process Example: Amazon Amazon is well-known for innovative ideas, but what about selling groceries online? Webvan and others have failed. Amazon is using its acquisition of Kiva robotics and former Webvan executives to grow AmazonFresh slowly. - Limit delivery to areas with a high concentration of potential customers - Focus relentlessly on warehouse efficiency through technology 4) Staffing to capture value from innovation Effective human resource management practices for innovation projects include: - Use experienced players from diverse areas - Require employees serve in the new venture group as part of career development - Once people have new venture experience, transfer them to mainstream management positions to revitalize core businesses - Separate individual performance from innovation performance so failure is not a stigma Hiring the right employees If you want creativity, who you hire matters: - Employees with a promotion focus are motivated by opportunities for career advancement and growth, are more creative than those motivated by personal security and obligations - Engaging employees, allowing them to participate in decision making and intellectually stimulating activities, will further enhance creativity - Creative employees will come up with new ideas, new products, more innovation 5) Collaborating with innovation partners Partners such as research universities and the government provide new skills and insights so innovation projects succeed. - Needed capabilities include market and technology expertise, social capital contacts with key players - Issues include how to share rewards and intellectual property The Value of Unsuccessful Innovation - Even unsuccessful innovation efforts bear fruit - Value is in learning and experience gained from failure - Don’t overcommit or despair, pivot quickly and transfer knowledge. Instead, rethink the details, engage in continuous incremental innovation Corporate Entrepreneurship - Pursuit of new venture opportunities - Strategic renewal via “intrapreneuring” How to pursue entrepreneurial projects? - Consider corporate culture and leadership - Consider supportive structures and systems - Consider using teams - Consider whether the company is product or service oriented, high-tech or low-tech - Is innovation aimed at product or process improvements? The Profitability of Innovation Depends on: - The value of the innovation - Innovator’s ability to appropriate the value of the innovation To be obtained through: - Legal protection - Complementary resources - Imitability of the technology - Lead time First Mover Advantages The advantage is originated by the capability to anticipate competitor’s moves through activities that allow the firm to enter the market first. - Reputation - Positioning - Substitution costs - Distribution channels - Exclusive learning curve - Better access to scarce resources - Definition of the standard Sustainability of the advantage: - Competitors can’t imitate the technology o Property-rights o Specificity o Complementarity o Casual ambiguity: the more the casual ambiguity is multidimensional the more difficult for a competitor to understand the reasons for success - Speed of innovation is equal or superior to competitors o Durability of resources o Strategical factors of the industry First mover disadvantages: - Pioneering costs: o Authorities o Client education o Infrastructure development o Development of specific inputs o Cost of inputs o Complimentary products development - Risks: o Demand uncertainty o Change in customer needs o Specificity of initial investments o Technological discontituities o Low-cost imitation The Emergence of Standards A standard is a format, an interface or a system that allows interoperability. - Public: safety standards for children’s toys - Private: Windows by Microsoft Quality standards: All the choices and the solutions required to satisfy the customer needs (EX: ISO standard) Uniformity Standards: Specific areas of attention to the technological development. - Integration standards: How different components should be integrated ex: browser internet - Product standards: Reduce variety of products Legal Protection of Intellectual Property Patents: It is a document given by the government who gives the owner exclusive rights to a new and useful product, process, substance or design. It excludes others from producing the same product or process. Obtaining a patent requires that the invention is: - Novel - Not excessively obvious - Industrial applicability (usefulness) Patent law vary from country to country. In Italy a patent is valid for 20 years. Strategic use of patents: - First mover advantage - Dominant position on a certain technology - Bargaining power - Licensing and cross-licensing Some numbers: - IMach3 from Gillette is protectd by 35patents - GD, an italian firm specialized in packaging manages a portfolio of 2000 patents Copyright: Exclusive rights on intellectual creation: artistic, dramatic, and musical works. It is given since the moment of the creation of the work. It gives the owner the exclusive right to reproduce, modify, distribute and commercialize the work. It is given both on published or unpublished works. In Italy, it gives 70 years of protection (50 on softwares). Photocopies, electronic publishing and internet have made copyright difficult to enforce. Trademark: A new word, image or sign that distinguish the firm products exclusive rights to words. Trademarks are registered with the Patent Office. The protection lasts 10 years (Italy) but it can be renewed. Counterfeating is defined by the ability to generate confusion in the final consmer. Trade Secret: A trade secret is in information (chemical formulas, recipes, industrial processes) that give economic value to the firm by: - Not being knew by competitors - Not being easily understood - Is driven by the effort of keeping it secret There is no time limit for trade secrets, as they are only revealed by discovery or publishing. The trade secret can be licensed with an obligation for the licensee to mainitain the secrecy. Also, private contracts between firms and between a firm and its employees can restrict the transfer of technology and know how. OPERATION MANAGEMENT - Accounting Engineering Management Information systems Human resources Finance Information flow at the core of operation management. It is a system of integrated applications to manage the business and automate many back office functions related to technology, services and human resources. At the center of the transformation process is the technical core. - The management of inputs to produce products and services (output) - Drive value to customers Operations management pertains to the day-to-day management of the technical core. - Managing the physical production of goods or services Objectives: - Achieving superior customer responsiveness - Achieving superior innovation with speed and flexibility - Achieving superior quality - Achieving superior efficiency Supply Chain Management - Efficient and reliable system for procuring raw materials and distributing finished products - Managing the sequence of suppliers and purchasers - Use of Internet technologies Purchasing Process Spend analysis supplier assessment supplier identification sourcing contract management procurement order fulfillment invoicing, reconciliation, and payment Integrated supply chain: the case of DELL Dell is an American multinational computer technology company based in Round Rock, Texas, United States, IT develops, sells, repairs, and supports computers and related products and services. It counts 145,000 people worldwide. The Kraljic Matrix The Kraljic Matrix is one of the most effective ways to deliver accurate supplier segmentation. Its purpose is to help purchasers maximize supply security and reduce costs. The matrix involves four steps: - Purchase classification - Market analysis - Strategic positioning - Action planning 1) Purchase classification Classifying all of the commodities, components, products, and services that you buy according to the supply risk and potential profit impact of each. - Supply risk relates to: o The likelihood for an unexpected event in the supply chain to disrupt operations (e.g., tire suppliers for an automotive) o The supplier suffers from a range of risks depending on its geographic location, business model and supply chain length - Profitability describes the impact of a supply item upon the bottom line Strategic items (high supply risk – high profit impact): These items deserve the most attention from purchasing managers. Options include developing long-term supply relationships, analyzing and managing risks regularly, planning for contingencies, and considering making the item in-house rather than buying it, if appropriate. - Development of long-term relationships - Collaboration and innovation - Natural scarcity Leverage items (low supply risk – high profit impact): Purchasing approaches to consider here include using your full purchasing power, substituting products or suppliers, and placing high-volume orders. - Exploitation of full purchasing power - Targeted pricing strategies/negotiations - Abundant supply Non-critical items (low supply risk – low profit impact): Purchasing approaches for these items include using standardized products, monitoring and/or optimizing order volume, and optimizing inventory levels. - Product standardization - Process efficiency (automated purchasing e.g., catalogues, e-tendering) - Abundant supply Bottleneck items (high supply risk – low profit impact): Useful approaches here include overordering when the item is available (lack of reliable availability is one of the most common reasons that supply is unreliable) and looking for ways to control vendors. - Low control of suppliers - Innovation and product substitution and replacement - Production-based scarcity 2) Market Analysis In this step, you should investigate how much power your suppliers have, and how much buying power you have as their customer. It can be helpfull use Porter’s Five Forces 3) Strategic Positioning Classify the products or materials you identified as “strategic” in Step 1 according to the supplier and buyer power analysis you did in Step 2. To do this, simply enter each item in the purchasing portfolio matrix. 4) Action Plan Finally, develop action plans for each of the products and materials you need on a regular basis according to where those items are placed in the matrix. Designing Operations Management Systems Design for Manufacture and Assembly (DFMA®) often requires restructuring operations, creating teams of designers, manufacturers, and assemblers to work together. DFMA encourages greater collaboration on four objectives of product design: - Productivity - Cost Quality Reliability Facilities layouts: - Process layout: similar functions are grouped together - Product layout: assembly line, tasks are arranged according to progress - Cellular layout: sequenced tasks are grouped into cells. The goal of cellular manufacturing is to move as quickly as possible, make a wide variety of similar products, while making as little waste as possible - Fixed-position layout: product remains at one location and resources are brought to it Technology automation: - Radio-frequency identification (RFID): electronic tagging to track items - Flexible manufacturing systems: production lines that can be adapted to produce different products Lean manufacturing: using highly trained employees, technology and innovative methods to cut waste and improve quality Inventory Management - Inventory is expensive to carry - Unproductive asset - Dollars not tied up in inventory can be used in other areas - High levels of inventory hide business problems Just-in-Time inventory: - Designed to reduce the level of inventory and associated costs o Stockless systems, zero inventory systems, kanban systems - Suppliers deliver inventory at the exact moment needed - Reduces raw materials inventory to zero - Matching finished-goods inventory to sales demand - Reduced inventory frees capital for other uses Lean Manufacturing Lean manufacturing is an operational strategy oriented toward achieving the shortest possible cycle time by eliminating waste. It is derived from the Toyota production system and its key is to increase the value-added work by eliminating waste and reducing incidental work. The technique often decreases the time between a customer order and shipment, and it is designed to radically improve profitability, customer satisfaction, throughout time, and employee morale. The characteristics of lean processes are: - Single-piece production - Repetitive order characteristics - Just-In-Time materials/pull scheduling - Short cycle times - Quick changeover - Continuous flow work cells - Collocated machines, equipment,tools and people - Compressed space - Multi-skilled employees - Flexible workforce - Empowered employees - High first-pass yields with major reductions in defects The Toyota method - Kaizen: kaizen literally means “changing something for the better.” The object of change usually includes the standardized work, equipment, and other procedures for carrying out daily production. The purpose is to eliminate waste in seven categories: o Overproduction o Waiting imposed by an inefficient work sequence o Handling inessential to a smooth workflow o Processing that does not add value o Inventory in excess of immediate needs o Motion that does not contribute to work o Correction necessitated by defects Kaizen requires that a process be first standardized and documented so that ideas for improvement can be evaluated objectively. - Jidoka: ji (self) do (motion) ka (-ize). A general meaning of jidoka is automation. At Toyota, however, the second character has been modified by adding the element for person. “Do” now takes on the meaning of work (motion plus person). Jidoka at Toyota thus means investing machines with humanlike intelligence. In TPS, jidoka has both mechanical and human applications. Equipment contains fail-safe features like lights or buzzers that indicate defects, and people stop production when they detect any abnormalities. Overall, by adding the “human element” to the generic meaning of jidoka, Toyota emphasizes the difference between working and moving. This distinction is crucial because merely automated operations can produce both good and defective products “efficiently.” In practice, jidoka at Toyota thereby prevents defective items from being passed on to the next station, reduces waste, and most important, enables operations to build quality into the production process itself. - Heijunka: this is Toyota’s terminology describing the idea of distributing volume and different specifications evenly over the span of production such as a day, a week, and a month. Under this practice, the plant's output should correspond to the diverse mix of model variations that the dealers sell every hour. - Andon: a Japanese word for lantern, describes the appearance of the board. This board hangs over the aisle between production lines and alerts supervisors to any problem. In assembly, the board normally indicates the line name in green at the top. When a team member pulls a cord on the line, the board lights up a number corresponding to the troubled station in yellow, which then changes to red when the line actually comes to a halt. The board also shows whether the line stop is temporary or not, and whether the line is starved (body short), blocked (body full), or stopped by internal problems. This device quickly informs a supervisor of only what he or she needs to know to take immediate actions and thereby allows a small number of supervisors to control a large area, it also prompts supervisors to develop countermeasures for recurring problems in the longer term. - Kanban: means “signboard” in Japanese. The one used for a part supplied by an outside supplier indicates the name of the supplier, the receiving area at Toyota, the use-point inside the Toyota plant, the part number, and the quantity for one container. A bar code is used to issue invoice based on actual part usage. Measuring Productivity Productivity is the organization’s output of goods and services divided by its inputs. How to improve it: - Employee Productivity: having workers produce more output at a lower cost over the same time period - Managerial Productivity: means simply that managers do a better job on running the organization Cost side Total output/Total cost Reducing total cost Output side Total output/Total cost = Potential output/Total cost x Realized output/Potential output Realized output/Potential output = a measure of efficency Productivity of total cost = latent productivity x realization ratio MARKETING MANAGEMENT Marketing is an organizational function and a set of processes for creating, communicating, and delivering superior value to customers and for managing customer relationships in ways that benefit the organization and its stakeholders. Marketing management is the art of choosing target markets and getting, keeping, and growing customers. Old view of marketing: Making a sale = telling and selling New view of marketing: Making a sale = satisfying customer needs From Needs to Wants to Demands Need is “a state of felt deprivation” including physical, social, and individual needs: - Physical: food, clothing, shelter, safety - Social: belonging, affection - Individual: learning, knowledge, self-expression Wants are the manifestation of the human need that is shaped by the individual and their culture. Wants become demands when the customer has the capacity and inclination to pay for the object or service. Type of needs: - Stated needs: a customer wants a not expensive car - Real needs: the customer want a car who operating cost, not its intial price, is low - Unstated needs: the customer expects good service from the dealer - Delight needs: the customer would like the dealer to include an onboard navigation system - Secret needs: the customer wants to be seen by friends a savvy customer Needs and wants are fulfilled through a marketing offering: - Products - Services - Experiences The Consumer Buying Process Five stages of the consumer buying process: - Need recognition - Information search - Evaluation of alternatives - Purchase decision - Post-purchase evaluation Customer Satisfaction Customer satisfaction is dependent on the product’s perceived performance relative to a buyer’s prior expectations. - If performance is lower than expectations, satisfaction is low - If performance is higher than expectations, satisfaction is high Customer satisfaction leads to customer loyalty. Common Situational Influences Five common situational influences in the consumer buying process: - Physical and spatial influences - Social and interpersonal influences - Temporal (time) influences - Purchase task or product usage influences - Consumer dispositional influences Marketing Strategy Marketing managers must consider the following to ensure a successful marketing strategy: - Who are the customers in the market? (Segmentation) - What customers will we serve? (Targeting) - How can we best serve these customers? (Positioning) STP Strategy: Segmentation Targeting Positioning Market Segmentation It is the process of dividing a market into distinct groups of buyers with different needs, characteristics, or behavior who might require separate products of marketing programs Why segment? - Meet consumer needs more precisely - Increase profits - Segment leadership - Retain customers - Focus marketing communications A market segment is a group of customers who respond in a similar way to a given set of marketing efforts. Requirements for successful segmentation: - Measurable - Accessible - Substantial - Differentiable - Sustainable Geographic segmentation: dividing the market into different geographical units such as nations, states, regions, countries, cities, or neighborhoods. Demographic segmentation: dividing the market into groups based on demographic variables such as age, gender, family size, family life cycle, income, occupation, education, religion, race, and nationality. Occasion segmentation: dividing the market into groups according to occasions when buyers get the idea to buy, actually make their purchase, or use the purchased item. Benefit segmentation: dividing the market into groups according to the different benefits that consumers seek from the product. Multi-attribute segmentation: crossing several variables to identify smaller, better defined target groups Market Targeting Involves evaluating each market segment’s attractiveness and selecting one or more segments to enter. A target market is a set of buyers sharing common needs or characteristics that the company decides to serve. In evaluating and selecting the market segments, a company must look two factors: - Attractiveness of the market (size, growth, profitability, etc.) - Company’s objectives and resources Single segment concentration (only one quadrant): The marketer prefers to go for single segment. The company may adopt this strategy if it has strong market position, greater knowledge about segment-specific needs, specified reputation and probable leadership position. EX: Allahabad Law Agency (only law books) Selective specialization (multiple dislocated quadrants): It is considered as multistage coverage because different segments are sought to be captured by the company. The company selects a number of segments each of which is attractive, potential and appropriate. There may be little or no synergy among the segments, but this strategy has the advantage of diversifying the firm’s risk. EX: Sony produced plasma TV as well as Walkman, the two different types of products served two different types of markets. Product specialization (one full raw): It occurs when a company sells certain products to several different types of potential customers. EX: Yankee candles Market specialization (one full column): A company takes up a particular market segment for supplying all relevant products to the target group. EX: Samsung can implement market specialisation strategy by producing all sorts of home appliances like TV, washing machine, refrigerator and micro oven for middle class people Full market coverage (all the quadrants): The company attempts to serve all customer groups with all the products they might need. Only very large firms can undertake a full market coverage strategy Market Positioning Arranging for a product to occupy a clear, distinctive, and desirable place relative to competing products in the minds of target consumers. A product’s position is the way the product is defined by consumers on important attributes. Perceptual positioning maps can help define a brand’s position relative to competitors. 1) Choosing a positioning strategy - Identifying and choosing the right competitive advantages - Differentiation Differentiation strategy: Differentiation is the act of designing a set of meaningful differences to distinguish the company’s offering from competitor’s offerings. A difference is worth establishing if it is: - Important - Distinctive - Communicable - Affordable - Profitable 2) Choosing the value proposition The set of benefits or values a company promises to deliver to consumers to satisfy their needs. Value propositions dictate how firms will differentiate and position their brands in the marketplace. - All advertising must make a proposition to the customer: buy this, and you will receive a specified benefit - The proposition must be unique, something competitors cannot claim, or have not chosen to emphasize in their promotions - The proposition must be so compelling that it motivates individuals to act Customer perceived value: “Customer’s evaluation of the difference between all of the benefits and all of the costs of a marketing offer relative to those of competing offers.” (Armstrong & Kotler) - Perceptions may be subjective - Consumers often do not objectively judge values and costs Customer value = Perceived benefits – Perceived sacrifice Marketing Mix Set of marketing tools that the firm uses to pursue its marketing objectives in the target market. The 4 P’s of marketing: - Product: The firm must come up with a product or service that people will want to buy. o It must fulfil some need or want o It must be (or at least seem) unique - Price: Price is the value that is put to a product or service and is the result of a complex set of calculations, research and understanding and risk taking ability. A pricing strategy takes into account segments, ability to pay, market conditions, competitor actions, trade margins and input costs, amongst others. It is targeted at the defined customers and against competitors. o The price must be one that the customer thinks is good value for money o Prices have a great psychological effect on customers - Promotion: Promotions refer to the entire set of activities, which communicate the product, brand or service to the user. The idea is to make people aware, attract and induce to buy the product, in preference over others. o Advertising o Direct marketing o Sales promotion o Public relations o Personal selling - Place: It is the distribution of the product or service. It can be defined as the means by which products and services get from producer to consumer and where they can be accessed by the consumer. Different ways to reach customers: o Physical stores o Online commerce Guerrilla Marketing It is an advertising strategy that focuses on low-cost unconventional marketing tactics that yield maximum results. - Guerrilla Marketing is about taking the consumer by surprise, make an indelible impression and create copious amounts of social buzz - Guerrilla marketing is said to make a far more valuable impression with consumers in comparison to more traditional forms of advertising and marketing. This is due to the fact that most guerrilla marketing campaigns aim to strike the consumer at a more personal and memorable level Strategic Marketing Planning The Strategic Planning Process - Situation Analysis: an in-depth analysis of the organization (internal and external environments) - Marketing Plan: a written document that provides the blueprint or outline of the organizations marketing activities, including the implementation, evaluation, and control of those activities. o Explains how the organization will achieve its goals and objectives o It serves as a road map for implementing the marketing strategy o Instructs employees as to their roles and functions o Provides specifics regarding the allocation of resources, specific marketing tasks, responsibilities of individuals, and the timing of marketing activities A good marketing plan will: o Explain both the present and future situations of the organization o Specify the outcomes that are expected o Describe the specific actions that are to take place o Identify the resources that will be needed o Permit the monitoring of each action and its results Obstacles to developing marketing plans: o Inadequate communication o Harmonizing difficulties across sites/countries o Marketing environment forces o Inadequate information o Senior managers lack business/training skills o Failure to see the whole picture o Lack of understanding of customers o Individual manager’s empire building o Monopoly market position/forces o Top-down approach to planning o Time to conduct planning activities o Poor functional involvement/team commitment o Arrogance/apparent business success o Lack of enthusiasm among non-marketers o Staff turnover or lack of staff o Resistance to change o Fit with corporate strategy o Marketing is equated with promotion o Actioning the plan o No value given to planning Maintaining Customer Focus and Balance in Strategic Planning - Changes in the focus and content of strategic plans over the last two decades: o Renewed emphasis on the customer o Advent of balanced strategic planning - Changes require a shift in focus o From products to the requirements of specific target market segments o From customer transactions to customer relationships o From competition to collaboration Customer focused strategic planning: - Puts customer needs and wants first - Focuses on long-term, value-added relationships - Focuses on understanding customers in ways that enhance sustainable competitive advantages - Instills a corporate culture that places customers at the top of the organizational hierarchy - Finds ways to cooperate with suppliers and competitors to serve customers more effectively and efficiently