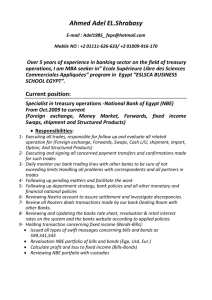

Strategic Audit of NBE National Bank of Egypt [STRATEGIC AUDIT OF NBE] Presented by: Sheta Ahmed Mahmoud Ali kuraem Hazem Mahmoud Elsadek Class # 48A National Bank Of Egypt Neveen Faried Page 1 supervised by: Dr/ Ashraf Strategic Audit of NBE Executive summary The aim of this paper is to define the NBE strategic and what we will need to ensure the successful strategy This audit analyses the strategies of the largest bank in Egypt ( NBE ) as well as its competitive positioning to get a better understanding of its strategic decisions made over the past 5 years and how effectively it should respond to changes in their business environment. The overarching predictions that guide this audit are that the banks have comparable domestic but very different international strategies, and that the banks have well-defined strategic plans, which they implement successfully with the long-term goal of profit maximization. National Bank of Egypt (NBE) was established on June 25, 1898 and is the oldest commercial bank in Egypt. NBE is the largest domestic bank in Egypt in terms of assets, branches, deposits and loans, employees and capital. Throughout its long history, NBE's functions and roles have continually adapted to the different economic and political conditions in Egypt. In the past, NBE has functioned as the central bank of Egypt and continues to perform certain quasi-governmental support activities. NBE provides direct funding to the government through its extensive holdings of government securities. The literature reviewed to conduct this audit consists of corporate strategy, strategy analysis and competitive analysis literature, which provides insight into a variety of frameworks and tools that are used to analyze the individual strategies of each bank as well as their operating environment. The basic strategic management framework utilized for this audit consists of three steps: 1) perform industry analysis, 2) conduct business strategy analysis, and 3) evaluate strategies and present conclusion. Some of the more recognized frameworks applied in this audit are Porter’s Five Forces of Competition and the SWOT analysis diagram ,BCG MATRIX,SPACE MATRIX, Balance Scorecard & QSPM matrix. National Bank Of Egypt Page 2 Strategic Audit of NBE Contents Table of Contents 1....................................................................................................... Executive summary 2...................................................................................................................... Contents 4.................................................................................................................. Bank profile 9................................................................................................................... Our vision 9................................................................................................................ Our Mission 10........................................................................................................ Board of directors 11........................................................................................... NBE's Board of Directors 11.................................................................................................... BOD Composition 12............................................................................ Responsibilities of the chairman 13........................................................................ BOD’s Duties and Responsibilities 14.............................................................................................................. Core values 15............................................................ Environmental scanning (Task environment) 15.......................................................................... Scan of the external environment 15.................................................................................................. STEEP analysis)) 16.............................................................................................. Stakeholders’ analysis 17.......................................................................................... S five forces analysis’Porter 20................................................................................................... Issue priority matrix 21.......................................................................................... Banking on Sustainability 22................................................................................................... Societal Environment 23............................................................................................................ Strategic group 23............................................................................... NBE strategic 24............................................................................................ NBE INDUSTRY MATRIX 24................................................................................................................................. 25........................................................................................................................... EFAS 26..................................................................................................... Core Competencies 28............................................................................................. A Competitive Advantage 29........................................................................................................ Business Model 34.................................................................................................... Value Chain Analysis 36..................................................................................................... Corporate Structure 37........................................................................................................ Corporate Culture 37...................................................... Our progress on strengthening corporate culture What are the corporation’s current marketing objectives, strategies, policies, and 37................................................................................................................ programs? National Bank Of Egypt Page 3 Strategic Audit of NBE 37..................................................................................................... Marketing Plan 38...................................................................................................... Target Market 38................................................................................................ Services/Products 38.................................................................................................... Pricing Strategy 39.......................................................................................... Sales/Distribution Plan 39........................................................................... Advertising and Promotions Plan 39............................................................................................................................. HR 40........................................................................................................................... IFAS 40......................................................................................................................... SWOT 41........................................................................................................................... SFAS 41................................................................................... Review of mission and objective 41.............................................................................................................. Our Mission 44....................................................................................................... Growth strategies: 44............................................................................................................. TOWS MATRIX 45............................................................................................................ SPACE MARTIX 45............................................................................................................... BCG MATRIX 46........................................................................................................................ QSPM 47....................................................................................................... Balance Scorecard 48.............................................................................. Strategy implementation problems: National Bank Of Egypt Page 4 Strategic Audit of NBE Bank profile NBE is the oldest commercial bank in Egypt. It was established on June 25, 1898 with a capital of £ 1 million. Throughout its long history, NBE's functions and roles have continually developed to square with the different economic and political stages in Egypt. During the 1950s, NBE assumed the central bank's duties. After its nationalization in the 1960s, it acted as a pure commercial bank besides carrying out the functions of the central bank in the areas where the latter had no branches. Moreover, since mid-1960s, NBE has been in charge of issuing and managing saving certificates on behalf of the government. During the FY 2013/14, NBE managed to achieve positive performance indicators. Total financial position in June 2014 recorded EGP 456.5 bn., growing 24.7% yoy. Accordingly, NBE's total assets accounted for 25.1% of the total banking system assets. Total deposits reached EGP 393.3 bn., with a growth rate of 25.8% yoy, accounting for 27.5% of the total banking system deposits. Such leap was driven by the introduction of a diversified package of saving pools in local and foreign currencies at competitively lucrative rates. Net cumulative balance of NBE's saving certificates, the largest household saving pool in Egypt, rose in June 2014 to EGP 108.4 bn., up by 6.1% yoy. NBE has further provided a set of distinguished finance schemes that meet the needs of key economic sectors. The total retail loan portfolio reached EGP 26.2 bn. as at the end of June 2014, growing 17.6%. NBE had also assumed an active role in funding key strategic economic sectors including oil, power, electricity, gas, telecommunications, air transportation, tourism and contracting. Total large corporate loan portfolio surged 3% to reach EGP 85 bn. as at June 2014. Total loans have thus risen 8.6% to reach EGP 124.6 bn. accounting for 21.2% of total banking system loans. NBE, hence, commands 25.4% of the banking market growth. Accordingly, net loans reached EGP 116.3 bn., growing 9% yoy. All such efforts resulted in achieving profit (before income taxes) of EGP 8.5 bn., increasing 18.3% yoy. Net profits rose 23.2% to record EGP 3.7 bn. National Bank Of Egypt Page 5 Strategic Audit of NBE NBE held equity participation in 182 projects, as at the end of June 2014, covering all the fields of economic activity with total capital of EGP 51.7 bn. The Bank's holdings amounted to EGP 13.8 bn. representing 27% of such projects' total capital. In line with its role in supporting state policies on an ongoing basis, NBE provided direct funding for the government by purchasing T-bills and government bonds. Average T-bill balance accounted for EGP 116.5 bn. as at June 2014 with an increase of 33.2% yoy. The Automated Clearing House (ACH) system for payments and collections was introduced by NBE as an integrated financial solution for all the payments and collections of companies/bodies to exchange and automatically settle credit and debit payment orders. ACH service, thus, saves time and effort and provides ease of use via a fully secured and safe system. Developing its services and products to provide customers with distinctive services, NBE increased the number of ATMs and improved their deployment nationwide to reach 1,735 with a growth rate of 13% yoy; thus NBE commands around one third of the market. The POS network expanded by entering into agreement with the largest and most important merchants in Egypt to amount to 11,172 machines, up by 22% yoy. Realizing the significant role played by human resources in the implementation and achievement of strategic initiatives, NBE has assigned great importance to human capital management with an eye to improving the work environment and fostering employee satisfaction. NBE further courts highly-qualified candidates and, at the same time, develops the management and leadership skills of its staff to create a new breed of managers. In July 2014 issue, The Banker ranked NBE the 259th ahead of all Egyptian banks, among the largest 1,000 banks worldwide and the 10thamong Arab banks, by total assets. NBE continued to boost its role in social responsibility by making donations in the amount of EGP 150 MM. in FY 2013/14, mainly directed to health care, education, combating poverty and slums development. Accordingly, NBE’s donations over the last five years totaled EGP 480 MM. To strengthen and boost stock investments and securities market, NBE created a distinct number of mutual funds that support the Egyptian capital market and deliver services to a distinguished segment of customers. NBE offers investment services by expanding the central depositary and trading services. National Bank Of Egypt Page 6 Strategic Audit of NBE NBE has an extensive network of 325 branches, offices and banking units nation-wide. To this may be added NBE's effective international presence through the National Bank of Egypt (UK) Limited, National Bank of Egypt (Khartoum) – Sudan, New York and Shanghai branches (in USA and China), and representative offices in Johannesburg – South Africa, Dubai – UAE and Addis Ababa – Ethiopia, plus NBE (DIFC) Limited for financial advice. This is in addition to a vast correspondent network around the globe (Europe – USA – Australia – Canada- the Far East – Africa – the Arabian Gulf). Current performance National bank of Egypt S.A.E Separate balance sheet on June 30,2014 Assets June 30, 2014 June 30, 2013 19565327 42104951 116476135 30147 477491 116349301 22501 16740213 20103269 87419012 6905 692288 106785979 57965 116855065 11138351 99205458 459026 Cash and balance with central bank Due from banks Treasury bills and governmental notes Trading financial assets Loan and advances to banks Loan and advances to customers Derivatives financial instruments Financial investments - Available for sale - Held to maturity National Bank Of Egypt Page 7 Strategic Audit of NBE Investments in subsidiaries and associates Other assets Investment property Deferred tax assets Property, plant and equipment Total assets Liabilities and shareholders’ equity Liabilities Due to banks Due to customers Derivatives financial instruments Other loans Other liabilities Current income tax liabilities Dividends payable Other provisions Pension benefits’ liabilities Total liabilities Equity Issued and paid-up capital Reserves Retained earnings Total equity Total liabilities and equity 8193660 8172313 22518640 84074 754826 1949434 456519903 23633045 198815 803453 1809447 366087188 4846303 393251561 44010 14560656 12702185 44763 4117379 1721326 431288183 6821216 312714059 47479 14468091 9541089 213374 463866 3341127 1496797 349107098 9247320 12064256 3920144 25231720 456519903 9247320 7732770 16980090 366087188 National bank of Egypt S.A.E Separate income statement for the year ended on june 30,2014 Interest and similar income Interest and similar expenses Net interest income Fees and commissions income Fees and commissions expenses Net income from fees and commissions Dividend income Net trading income Profit (loss) from financial investments Impairment (charge) National Bank Of Egypt June 30, 2014 June 30,2013 36019934 (24860116) 31813692 (20792167) 11159818 2256220 11021525 2054864 (10310) (6812) 2245910 2048052 329144 475442 733546 295870 456383 168296 (458396) (556293) Page 8 Strategic Audit of NBE release for credit loss Administrative expenses Other operating (expenses) income Earnings before income tax Income tax (expenses) Net profit of the year Earnings per share during period (5551141) (478844) (4858060) (1425713) 8455479 7150060 (4707662) 3747817 0.35 (4108431) 3041629 0.29 Critique: The Bank maintains sufficient liquidity to meet all known and likely demands which could be made upon it by its clients and ensures that such liquidity is available on a dayto-day basis in accordance with the liquidity guidelines and rules as set out Systematically most developed financial markets improved during the year and as the year progresses, confidence in emerging markets began to wane particularly. The Bank regards itself as a stand-alone entity, not relying on any related party for future liquidity support in the event of stress. Liquidity is managed by the Bank’s Treasury operation, overseen and guided by Senior Management and reporting to the Management Committee and the Board of Directors. The market risk the Bank has is kept to a minimum, with careful monitoring of our investment portfolio, and fixed rate investments are hedged with interest rate swaps. Future Developments The Directors expect the general activity to increase in the coming year. It is expected that our loan books are rebuilt, our assets and liabilities diversified to other geographic region, however, our risks continued to be controlled and monitored, and our regulatory requirements fulfilled. It is also expected that staffing levels are reviewed and resources realigned with the future needs to meet the Banks strategy and plans. It is not foreseen that the balance sheet will grow substantially, but gradually the Bank takes on more profitable assets. NBE international ratings: Foreign Currency: Local currency: Long-Term liabilities: B- Long-Term liabilities: B- Short-Term liabilities: C Short-Term liabilities: C Long-Term liabilities: B Long-Term liabilities: AA ( egy ) Standard & Poor's Ratings National Bank Of Egypt Page 9 notes extra Outlook: Stable. Standalone credit profile of NBE is b- Outlook: Stable Support Rating: 4 Viability Rating: b Support Rating Strategic Audit of NBE Floor: B Short-Term liabilities: B Fitch Ratings Short-Term liabilities: F1+ ( egy ) Senior unsecured debt: B Foreign Currency: Capital Intelligence Ratings:- Long-Term Liabilities: Caa1 Moody's Ratings Short-Term Liabilities: Not prime Long-Term liabilities: B3 Short-Term liabilities: Not Prime Financial Strength: E Outlook: Stable Long-Term Liabilities: B- Short-Term Liabilities: B Financial Strength: BB- Outlook: Stable Support Rating: 3 Senior unsecured debt: B3 Standalone credit assessment of NBE is Caa1 Critique: NBE's ratings reflect: 1. The bank's dominant franchise as the largest bank in Egypt and its stable deposit based funding structure (at 91% of non-equity funding); 2. the improvement in the bank's asset quality, which is mainly driven by the restructuring and write-offs of legacy problem loans (as of June 2014, NBE's non-performing loans (NPLs)-to-gross loans ratio declined to 5.0% from 9.0% in June 2011); and 3. Various associations’ assumption of a very high probability of government support given the bank's 100% government ownership and its systemic importance, reflecting its 27% market share in deposits. Nonetheless, the rating agencies believe asset risk remains elevated. Despite good diversification of the loan book across different sectors and improvement in the bank's risk management capabilities in the last few years, NBE's asset risk remains elevated because of the bank's high asset concentrations, and still developing risk-management tools. NBE's ratings also capture its weaker-than-peers' capital buffers, with a Tier 1 ratio of 7.0% as of June 2014 and a Moody's adjusted tangible common equity (TCE) to risk-weighted assets (RWAs) ratio of 4.6% as of June 2014. As part of its standard global adjustments to make banks' financial statements more comparable, many associations adjust the Egyptian banks RWAs by assigning a 100% risk weight to government securities, which are zero-risk-weighted in the banks' calculations. Our vision To be a trusted leader bank delivering innovative financial solutions to enhance the quality of life everywhere. Our Mission National Bank Of Egypt Page 10 Strategic Audit of NBE To be the most successful bank admired for its innovative service, people and technology both locally and in the Middle East and North Africa region. Critique: Mission statements are supposed to model what business you are in, what competition you face, and your core values. The ultimate test is that it should serve as a recruiting device leading applicants to say” That is the kind of business I want to be in and that is the kind of company I want to work for!” What remains then is to examine ways to improve the process and the product so that they are aligned and versions of each other—almost in a cause and effect partnership. Our Objectives The Bank’s approved three year strategic business plan 2015-2017 sets out the key financial objectives to restore the Bank’s historical interest income trend and improve the overall profitability and earnings. According to the approved strategy, NBE’s mission is to provide world class international banking services to Egyptian and Middle Eastern related businesses and governmental agencies and in doing so, become the first choice for Egyptian counterparties and other relationships from the Gulf region and North Africa. With our strong base of experience and market presence, we aim to grow each of our various strategic business lines in both market and product extensions. The Bank's primary business objective is to provide a range of banking services to both its Egyptian and international customers. Its strategy for doing so is as follows: • protect the Banks capital and liquidity, and within internal risk management policies, with minimal exposure to market risk; • To provide lending in trade finance to both financial institutions and large commodity corporate clients involved in trade predominantly to or from the Middle East and growing emerging markets; • Increase loans and advances including syndicated facilities and to be used as a penetrating tool for the purpose of future enhancement of trade relationships with NBEs existing counterparties and other future targeted relationships; • To provide treasury services to customers and counterparties; and • To maintain asset quality whereby the overall investment grade of the balance sheet will be around 80%. The strategy drivers are based on the strength of our parent in our home market, Egypt, combined with our historical experience in emerging markets in terms of sourcing business and accepting risk. In addition we are intent on building our funding base to be diversified, whilst maintaining liquidity and meeting all Regulatory requirements. National Bank Of Egypt Page 11 Strategic Audit of NBE Board of directors Mr. Hisham Ahmed Mahmoud Okasha Chairman National Bank Of Egypt Page 12 Strategic Audit of NBE NBE's Board of Directors BOD Composition Maintaining Balance and Independence The BOD is fully responsible for governance at NBE starting from establishing the culture of governance and approving a Code of Ethics for NBE's employees and senior management that will serve as a guide for performing their daily duties, up to taking the necessary steps to communicate the objectives and conduct that should be followed at NBE. At the same time, the best interest of shareholders and depositors should be protected. The BOD also approves the standards and values which reflect NBE's policies that should be followed by all employees, senior management and directors. This comprises NBE's strategic orientation. In addition, the BOD sets general objectives for executive officers and oversees the realization of such objectives. Furthermore, the BOD verifies the effectiveness of internal controls and risk management to ensure maintaining NBE's reputation. The chairman and directors shall be appointed by decree of the Prime Minister, after consulting the CBE's Governor, for a renewable three-year term, as shall be determined in the Executive Regulations of this Law. The two deputy chairmen shall be appointed by decree of the Prime Minister after consulting the chairman of the board of directors of the bank. The salaries, allowances, and remuneration of the chairman and his/her two deputies, the remuneration of specialized directors who are non-executive members and the board attendance allowances shall be determined by decree of the Prime Minister. The BOD meets at NBE's Head Office at least once every month, and as dictated by NBE's best interest. BOD meetings are held upon an invitation from the chairman or his/her substitute in case of his /her absence or upon a request by at least one third of the BOD. Meetings are valid if the majority of members attend, provided that the chairman, or his/her substitute in case of his/her absence, attend the meeting. BOD's decisions are passed by majority of votes of the attendees. In case of a tie, the chairman, or his/her substitute, shall have a casting vote. - NBE's chairman also undertakes the duties of the Chief Executive Officer (CEO). NBE explains the grounds for occupying this position in the annual report. NBE applies and practices governance, and ensures the presence of effective audit and budgeting functions, and forms objective opinions regarding NBE's activities and the decisions made by the BOD. This can be achieved through maintaining the balance, independence and objectivity of its BOD by dividing directors to executives and nonexecutives who shall have the skills and experience that qualify each of them to express his/her opinion during BoD's discussions independently, resulting in valid decision-making. Non-executive directors are directors who are not full-time employees at NBE, do not receive any monthly or annual salary from NBE, and do not provide any paid counseling. . The BOD discloses in its annual report the names of all non-executive directors who are deemed independent from management and do not have any kind of relationship that may prejudice their objectivity in decision making. National Bank Of Egypt Page 13 Strategic Audit of NBE Responsibilities of the chairman (Or his substitute) legally represent NBE before courts and third parties; (Or his substitute or any director delegated by the BOD for this purpose) has the authority to sign individually for the Bank; Ensure that decisions are duly taken based on a full awareness of the subject matter and that a proper mechanism is available so that decisions can be effectively and timely implemented and followed up; Encourage discussion and criticism and make sure that opposing opinions have an avenue to be voiced and discussed within the framework of the decision making process; Check that the BOD functions effectively to serve the best interests of NBE and for avoidance of any potential conflict of interest; Maintain confidence among all directors in general and between executive and non-executive directors in particular, fostering the relationship between the BOD as a whole and the senior management; Ensure the flow of adequate and accurate information on a timely basis to both directors and shareholders; Verify the effectiveness of the governance system applicable at NBE as well as the efficiency of BOD committee’s performance Ensure that all directors conduct a self-assessment which includes determining each member's compliance with the responsibilities of his/her job and the necessary requirements to boost efficiency; and Call for a BOD meeting at least once per month and set its agenda. National Bank Of Egypt Page 14 Strategic Audit of NBE BOD’s Duties and Responsibilities The Board has full powers to achieve NBE objectives and management, taking all necessary actions in this respect, except as otherwise stipulated by law or NBE's Articles of Association, with due regard to the powers assigned by law to the General Assembly. The BOD plays a vital role in internal control by: 1. Approving an organizational structure with specific responsibilities that ensures efficient internal control based on segregation of duties; 2. Avoiding any conflict of interest; 3. Adopting strategies and policies that best serve internal control; and 4. Following up the execution of the set strategic objectives, the most significant of which are: The Bank's strategy, its employees and the oversight role played by the BOD with the possibility of delegating some responsibilities to one of its committees. Critique: The Bank’s performance is measured against a number of Key Performance Indicators (KPI’s): profit, cost income ratio and return on Equity. The principal measurement is profitability against a predetermined budget which is set annually. Income results for the business are distributed daily, monthly and annually and are monitored closely by the Bank’s senior management. The Directors of the bank receive profitability results at each board meeting, where a comprehensive review is undertaken. Other KPIs are also reported regularly, such as Capital Adequacy, net interest income and Liquidity. Regular stress tests (quarterly and with the capacity to increase the frequency of these tests in special circumstances, such as volatile market conditions or where requested by the regulatory body or by Senior Management and Board of Directors) are performed and reviewed on Capital positions and Liquidity by senior management. Risk and Audits reports are prepared quarterly for Audit and Risk Committee to review. All exposures are managed within risk appetite parameters and policies agreed by the Board of Directors. Day to-day exposure is monitored by Credit Control (for credit risk), and Financial Control (Capital and Liquidity) reporting any findings to the Risk Management Officer. The Board of Directors and Management continue to promote and maintain an effective corporate governance structure in compliance with the applicable regulatory requirements. Expense payments follow guidelines set out in the Expense policy, and are regularly reviewed. National Bank Of Egypt Page 15 Strategic Audit of NBE Core values Integrity : be ethical Social commitment : NBE ”the people’s bank” Transparency : leads to the top of the pyramid of trust Loyalty : one of the main elements of our bank’s safeguards Customer focus : customers are the main reason of our existence Creativity: due to our close connection with our customers they from our source of inspiration to the future. Environmental scanning (Task environment) Scan of the external environment (STEEP analysis) National Bank Of Egypt Page 16 Strategic Audit of NBE Critique: political factors: The government affects the performance of the banking sector most by legislature and framing policy, government through its budget affects the banking activities economic factors: the economic measures affects the banking sector to boost the economy by giving certain concessions or facilities if in the savings are encouraged, then more deposits will be attracted towards the bank and in turn it can lend more money therefore booming the economy There is a serious problem faced nowadays by banks concerning high interest rates and high inflation rates which needs to be procured by active legislative actions socio-cultural factors: Life style in Egypt is changing rapidly in Egypt. It is demanding high class products. People needs and wants are increasing day by day which have opened more opportunities for the banking sector to tap this change. Increasing population has emerged the need for launching more branches to face these increasing needs of new populations. Technological factors: Technology plays a very important role in the internal control process as well as services offered by them. Through the use of technology new products and services are introduced which include aspects such as R&D, automation, incentives and the rate of technological change. Legal factors: This part was discussed earlier in the BOD responsibilities and its various roles concerning compliance with different legal issues. Environmental factors: This part was discussed earlier concerning the sustainability issue. National Bank Of Egypt Page 17 Strategic Audit of NBE Stakeholders’ analysis Stakeholders are those who may be affected by or have an effect on an effort. They may also include people who have a strong interest in the effort for academic, philosophical, or political reasons, even though they and their families, friends, and associates are not directly affected by it. Primary stakeholders are the people or groups that stand to be directly affected, either positively or negatively, by an effort or the actions of an agency, institution, or organization. In some cases, there are primary stakeholders on both sides of the equation: a regulation that benefits one group may have a negative effect on another. A rent control policy, for example, benefits tenants, but may hurt landlords. Secondary stakeholders are people or groups that are indirectly affected, either positively or negatively, by an effort or the actions of an agency, institution, or organization. A program to reduce domestic violence, for instance, could have a positive effect on emergency room personnel by reducing the number of cases they see. It might require more training for police to help them handle domestic violence calls in a different way. Both of these groups would be secondary stakeholders. Key stakeholders, who might belong to either or neither of the first two groups, are those who can have a positive or negative effect on an effort, or who are important within or to an organization, agency, or institution engaged in an effort. The director of an organization might be an obvious key stakeholder, but so might the line staff – those who work directly with participants – who carry out the work of the effort. If they don’t believe in what they’re doing or don’t do it well, it might as well not have begun. Other examples of key stakeholders might be funders, elected or appointed government officials, heads of businesses, or clergy and other community figures who wield a significant amount of influence. Critique: Stakeholders’ interests can be many and varied. A few of the more common points which are not covered by bank’s strategy concerning them: Economics. An employment training program might improve economic prospects for low-income people, for example. Zoning regulations may also have economic consequences for various groups Social change. An effort to improve racial harmony could alter the social climate for members of both the racial or ethnic minority and the majority. National Bank Of Egypt Page 18 Strategic Audit of NBE Work. Involving workers in decision-making can enhance work life and make people more satisfied with their jobs. Time. Flexible work hours, relief programs for caregivers, parental leave, and other efforts that provide people with time for leisure or taking care of the business of life can relieve stress and increase productivity. Environment. Protection of open space, conservation of resources, attention to climate change, and other environmental efforts can add to everyday life. These can also be seen as harmful to business and private ownership. Physical health. Free or sliding-scale medical facilities and other similar programs provide a clear benefit for low-income people and can improve community health. Safety and security. Neighborhood watch or patrol programs, better policing in high-crime neighborhoods, work safety initiatives – all of these and many other efforts can improve safety for specific populations or for the community as a whole. Mental health. Community mental health centers and adult day care can be extremely important not only to people with mental health issues but, also to their families and to the community as a whole. S five forces analysis’Porter 1) Threat of New Entrants: With so many new banks entering the market each year the threat of new entrants should be extremely high. However, due to mergers and bank failures the average number of total banks decreases a core reason for this is, what is arguably, the biggest barrier of entry for the banking industry, trust. Because the industry deals with other people's money and financial information new banks find it difficult to start up. Due to the nature of the industry people are more willing to place their trust in big name, well known, major banks who they consider to be trustworthy. Critique: Due to the nature of the industry people are more willing to place their trust in big name, well known, major banks who they consider to be trustworthy just like NBE. National Bank Of Egypt Page 19 Strategic Audit of NBE 2) Power of Suppliers: Capital is the primary resource on any bank and there are four major suppliers (various other suppliers [like fees] contribute to a lesser degree) of capital in the industry: 1. Customer deposits. 2. Mortgages and loans. 3. mortgage-backed securities. 4. Loans from other financial institutions. By utilizing these four major suppliers, the bank can be sure that they have the necessary resources required to service their customers' borrowing needs while maintaining enough capital to meet withdrawal expectations. Critique: The power of the suppliers is largely based on the market, their power is often considered to fluctuate between medium to high. The individual doesn't pose much of a threat to the banking industry, but one major factor affecting the power of buyers is relatively high switching costs. If a person has one bank that services their banking needs, mortgage, savings, checking, etc., it can be a huge hassle for that person to switch to another bank. To try and convince customers to switch to their bank they will often times lower the price of switching, though most people still prefer to stick with their current bank? 3) Availability of Substitutes: Some of the banking industry's largest threats of substitution are not from rival banks but from non-financial competitors. The industry does not suffer any real threat of substitutes as far as deposits or withdrawals; however insurances, mutual funds, and fixed income securities are some of the many banking services that are also offered by non-banking companies. Critique: There is also the threat of payment method substitutes and loans are relatively high for the industry. For example, big name electronics, jewelers, car dealers, and more tend to offer preferred financing on "big ticket" items. Often times these non-banking companies offer a lower interest rates on payments then the consumer would otherwise get from a traditional bank loan. 4) Competitive Rivalry: National Bank Of Egypt Page 20 Strategic Audit of NBE The banking industry is considered highly competitive. The financial services industry has been around for hundreds of years and just about everyone who needs banking services already has them. Because of this, banks must attempt to lure clients away from competitor banks. They do this by offering lower financing, higher rates, investment services, and greater conveniences than their rivals. Critique: The banking competition is often a race to determine which bank can offer both the best and fastest services, but has caused banks to experience a lower ROA (Return on Assets). Given the nature of the industry it is more likely to see further consolidation in the banking industry. Major Banks tend to prefer to acquire or merge with other banks than to spend money marketing and advertising. Issue priority matrix National Bank Of Egypt Page 21 Strategic Audit of NBE Low Low Probability Of occurrence Medium High Probable impact Medium high Foreign currency Shortages. Employee Turnover. Product Differentiation . Unexpected Interest Rates fluctuations. Regulatory Compliance. Cooping With new Tech. Competing Firms. Customer Retention. Customer satisfaction. Critique: According to the above issue priority matrix we can conclude that: The most important part to give attention is to keep a high rate of customer satisfaction levels while providing the various products and services otherwise liquidity and profitability problem will occur according to customers’ shifting to another competing firm in the market. The second stage priority issue includes competition which should be taken into consideration to keep and grow current market share while compelling with the regulatory requirements. The less important part is considering foreign currency shortages and unexpected interest rates fluctuations which is done in a co-operative way with the CBE Finally in the NBE there is a moderate employee turnover rates but with low impact on its performance. Banking on Sustainability NBE is and continues to be committed to a perceptive longer term vision of the future that strikes a sound balance between the strategic goal of increased profitability as well as serving broader socioeconomic and environmental interests; the backbone of any sustainable success and National Bank Of Egypt Page 22 Strategic Audit of NBE distinction. Environmental sustainability, corporate social responsibility and corporate governance are therefore the key factors in measuring sustainability. Environmental Sustainability: NBE has achieved several milestones on the environmental sustainability front during the past eighteen months: • Reinforced our resource-efficient efforts, decreased our carbon foot print and are expanding “quick wins,” engaging staff at every level. The Bank decreased its astronomical paper consumption — which was almost the height of our great pyramid — through the practical expedient of ensuring double-sided printing and replacing personal laser printers and relying more on digital platforms such as archiving and email. NBE also planted organic rooftop gardens in several head offices and installed green walls. The Bank is developing an integrated solid waste management system and smoking restrictions continue to be more stringently enforced. • Worked diligently in the field of water conservation through the principle of “reduce for use.” This decreased water consumption by about 20%. • Enhanced energy efficiency. LED lamps are in the process of installment at all the head offices and branches. This will cut back on the Bank’s electricity bill by about 25%. NBE is concurrently moving forward on an air-conditioning initiative to maintain a cool environment, and again, reduce costs. This mega project will be completed in 2015. • Developed its first Social and Environmental Management System (SEMS), which is a risk management framework that includes a set of actions and procedures enabling us to avoid exposure to credit, compliance and other detrimental risks as well as advance durable business opportunities. • Developed its first Sustainability Report, aligned with international best practices. It is based on the Global Reporting Initiative (GRI), a globallyrecognized initiative that provides a comprehensive sustainability reporting structure that is widely used around the world. • NBE also participated in the second pollution abatement project (EPAP II). This project provides a financial package to support public and private industries to improve their environmental status. • Also on the Economic and Finance side, NBE is committed to continuously and significantly increase its facilities to a number of environmental friendly projects from the Corporate Banking side. Such projects include but are not limited to: NBE granted International Water Treatment “IWTC” facility amount of EGP 147 million. The company’s main objective is to design and implement all types of tools, machinery, equipment and specialty water treatment chemicals used in the waste water treatment process. Moreover, NBE provided facilities to power services companies such as Middle East Engineering & Telecommunication Co. Corporate Social Responsibility: We at NBE feel strongly about our country and giving back to our community is, and has always been, atop of the list of priorities and at the heart of our responsibilities. At NBE, we turn commitments into actions, with the ultimate goal of ensuring that our efforts are having a profound impact on people’s lives. Through our CSR programs, the NBE team is firmly dedicated to National Bank Of Egypt Page 23 Strategic Audit of NBE supporting Egypt; where we live and operate, and is proud of its achievements. Community Development: During the course of 2014, NBE took concrete steps towards achieving meaningful Corporate Social Responsibility (CSR) activities, and continued with its endeavors to give back to the community. At NBE, the concept of CSR has sprung up and is steadily becoming an important facet of its business’s strategy. NBE’s steadfast commitment has been clearly evidenced by adverse range of CSR accomplishments that the Bank has embarked on during the past 12 months. Societal Environment The growing importance of environmental or ecological factors in the first decade of the 21st century have given rise to green business and encouraged widespread use of an updated version of the PEST framework. Political factors regard how and to what degree a government intervenes in the economy. Specifically, political factors include areas such as tax policy, labor law, environmental law, trade restrictions, tariffs, and political stability. Political factors may also include goods and services which the government wants to provide or be provided (merit goods) and those that the government does not want to be provided (demerit goods or merit bads). Furthermore, governments have great influence on the health, education, and infrastructure of a nation. Critique: These political factors act as a severe threat on the bank’s performance as concerning the existing circumstances. Economic factors include economic growth, interest rates, exchange rates and the inflation rate. These factors have major impacts on how businesses operate and make decisions. For example, interest rates affect a firm's cost of capital and therefore to what extent a business grows and expands. Exchange rates affect the costs of exporting goods and the supply and price of imported goods in an economy. Social-cultural factors include the cultural aspects and include health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. Trends in social factors affect the demand for a company's products and how that company operates. For example, an aging population may imply a smaller and less-willing workforce (thus National Bank Of Egypt Page 24 Strategic Audit of NBE increasing the cost of labor). Furthermore, companies may change various management strategies to adapt to these social trends (such as recruiting older workers). Critique: This point is nowadays taken into consideration as there is a specialized sections located in every branch to maintain key customers’ operations and to apply a customer retention plan. Technological factors include technological aspects such as R&D activity, automation, technology incentives and the rate of technological change. They can determine barriers to entry, minimum efficient production level and influence outsourcing decisions. Furthermore, technological shifts can affect costs, quality, and lead to innovation. Critique: As technological factors have a great effect on the bank’s performance this section should have a great attention in considering future customers’ welfare solutions. Strategic group NBE strategic Critique: According to the above figure which illustrates the strategies groups according to its commitment to technological advancements we can classify the working banks in Egypt into 3 categories and the NBE stands in the middle green area with CIB & QNB (which is can be easily improved) as it takes technology as a business and should aim to reach the in which digital is a core value. NBE INDUSTRY MATRIX Key success Weight National Bank Of Egypt NBE rating Page 25 NBE’s QNB rating QNB’s Strategic Audit of NBE factors Number of branches Fees & charges Digital banking Ease of approvals Staffs’ professionalism Products breadth Total 0.2 4 weighted score 0.8 0.2 0.1 0.2 4 3 2 0.8 0.3 0.4 3 2 3 0.6 0.2 0.6 0.2 3 0.6 3 0.6 0.3 3.2 3 0.3 2.9 0.1 1 Products breadth Number of 3 branches 1 0.5 3 weighted score 0.6 Fees & charges Critique: NBE should focus on factors that have a great effect on QNB 0 factors such as low fees & customers’ loyalty and not to rely on NBE charges and the high number of branches if it intends to compete aggressively in nowadays market and in order to keep its market share. Staffs’ professionalism Digital banking Ease of approvals EFAS External Strategic Factors National Bank Of Egypt Rating Weight Page 26 Score Strategic Audit of NBE OPPORTUNITIES New products and services New acquisitions Global markets Venture capital Income level is at a constant increase Growing economy .14 3 .42 .06 .07 .08 .10 2 3 2 3 .12 .21 .16 .30 .11 3 .33 Threats Unexpected problems Increasing rates of interest Increasing costs Financial capacity Price changes .09 .10 2 4 .18 .40 .08 .08 .09 2 3 3 .16 .24 .27 TOTAL 1 2.79 Critique: NBE have a variety in its products, services, branches and the ability to expansion all over Egypt which give them the opportunities to make more profit and growth but the management should have a division responsible for research and development to be responsible about the innovation of the new products & developing the current product and also developing the processes and procedures to make it smoothly and easily which will lead to cost reduction. Core Competencies In line with NBE's support to small and medium sized enterprises (SMEs), the total SME loan portfolio reached EGP 13.5 bn., and growing 36% yoy via National Bank Of Egypt Page 27 Strategic Audit of NBE extending finance to more than 37,000 SME customers. Total finance injected to SMEs amounted to EGP 6 bn. during FY 2013/14 whether in the form of extending loans to new customers or scaling up finance to existing ones. NBE also relent an amount of EGP 1.3 bn. from the Social Fund for Development (SFD) to its customers. The number of agreements made with the SFD since its establishment in 1992 amounted to 95, totaling EGP 8.3 bn. NBE is the only bank who runs authorities estimated important accounts such as the state petroleum and electricity sector a give them loans. NBE is always keen to render up-to-date banking services and products that are perfectly developed for its esteemed customers so that the Bank can maintain their precious confidence and continue its leadership in the local banking market. The Payroll Services: NBE provides this service to companies and their employees via transferring their salaries to the Bank whereby they may benefit from NBE's diversified banking services and products (personal cash loans, auto loans, credit cards, deposits and certificates); and NBE offers state-of-the-art integrated and well-secured electronic systems to pay salaries to corporate employees via two salary payment systems which are tailored to cater for all our customers’ needs: Al Ahly Payroll Card: Al Ahly Payroll card: a card is issued for cashing the salary which is directly transferred to such card without having to open personal current accounts for employees at NBE branches; and Al Ahly Payroll Current account: a fully-fledged product is made available to companies/bodies which enter into Payroll agreements with NBE to automatically transfer their employees’ salaries to bank accounts opened with NBE branches and obtain debit cards for such customers to enjoy NBE’s distinguished and diversified services. Salary Advance Flyer A new credit facility introduced to Al Ahly Payroll Card customers and government contract employees whose salaries are regularly transferred to NBE by providing a credit limit to cards and credit limit ceiling is EGP 20,000 without opening a current account to meet customers' needs for short term periods. With Salary Advance Service: You may disburse 80% over your salary in advance; No administrative fees; No membership fees; Use the service locally and internationally for cash and purchases; 1.8% interest rate monthly. National Bank Of Egypt Page 28 Strategic Audit of NBE Al Ahly Payment & Collection Service via EG-ACH NBE offers an integr ated finan cial soluti on for all the paym ents of comp anies /bodi es to enabl e custo mer to transf er paym ents to indivi dual or corpo rate acco unts or cards with NBE or other bank s inside Egypt by the comp anies /bodi es National Bank Of Egypt Page 29 Strategic Audit of NBE them selve s, such as the paym ent of salari es and pensi ons to empl oyee s and repay ment of suppli ers' due paym ents to their bank acco unts direct ly. This servic es uses cuttin g edge fully secur ed electr onic syste ms. The Direc t Credi t Servi ce National Bank Of Egypt Page 30 Strategic Audit of NBE Direct Cr ed it en ab le s m ak in g ge ne ral pa y m en ts su ch as sa lar ie s, su pp lie r pa y m en ts, go ve rn m en t pa y m en ts an d pe ns io ns an National Bank Of Egypt Page 31 Strategic Audit of NBE d go ve rn m en t an d un io n pe ns io ns ; Paym en ts ar e m ad e int o ac co un ts of be ne fic iar ie s wi th N B E an d all th e ot he r ba nk National Bank Of Egypt Page 32 Strategic Audit of NBE s (3 8 ba nk s) in E gy pt as w ell as E gy pt P os t an d th e Pr in ci pa l B an k fo r D ev el op m en t an d A gri cu ltu ral Cr ed it; an d National Bank Of Egypt Page 33 Strategic Audit of NBE It is us ed to m ak e du e pa y m en ts to su pp lie rs de ali ng wi th th e co m pa ni es . Benef its : 1. Mini m a l o p e r a ti o n a l r i National Bank Of Egypt Page 34 Strategic Audit of NBE s k ( h a n d li n g c a s h , f o r g e d c h e q u e s , … ) ; 2. Rec u r r i n g p a y m e n t s a r e National Bank Of Egypt Page 35 Strategic Audit of NBE s e n t o n c e ; 3. Go p a p e r l e s s v i a r e p l a c i n g p a p e r t r a n s f e r s w it h e National Bank Of Egypt Page 36 Strategic Audit of NBE l e c t r o n i c o n e s ; 4. It s a v e s ti m e a n d e ff o r t a n d p r o v i d e s e a s e o f u National Bank Of Egypt Page 37 Strategic Audit of NBE s e ; 5. Pro c e s s m u lt i p l e t r a n s a c ti o n s a t o n e ti m e t h r o u g h t h e s u b m National Bank Of Egypt Page 38 Strategic Audit of NBE i s s i o n o f a s i n g l e fi l e ( B a t c h p r o c e s s i n g ) ; 6. Low c o s t f o r l o c a National Bank Of Egypt Page 39 Strategic Audit of NBE l t r a n s a c ti o n s ; 7. A s a f e a n d f u ll y s e c u r e d s y s t e m ; 8. A c o m p l e t e National Bank Of Egypt Page 40 Strategic Audit of NBE s e t o f d a il y , m o n t h l y a n d a n n u a l r e p o r t s ; 9. Syst e m u s e r s c a n b e s p National Bank Of Egypt Page 41 Strategic Audit of NBE e c if i e d a n d i d e n ti fi e d b y s e c r e t c o d e s t h a t c h a n g e e v e r y m i n u t National Bank Of Egypt Page 42 Strategic Audit of NBE e ; a n d 10. Syst e m i s e a s y t o i n t r o d u c e a n d t r a i n i n . National Bank Of Egypt Page 43 Strategic Audit of NBE A Competitive Advantage The state-owned National Bank of Egypt (NBE) has prepared a mediumterm strategy, with a period of three years starting from 2014, in order to better face the market competition, deputy chairman of the bank Sherif Elwy. The strategy involved growing the retail banking and small and medium enterprises (SMEs) sectors due to the fact that the growth rate of these sectors is faster than of the big companies’, according to Elwy. NBE added the strategy included reducing the relative weight of financing large companies from 70% of the bank’s loan portfolio to 40%, besides diversifying the remained share on financing individuals and SMEs. NBE stated that the bank’s deposits are growing with robust rates during the 2013/2014 fiscal year (FY) and are expected to reach EGP 387bn by the end of June, compared to EGP 313bn during the same period last year. This represents an EGP 74bn increase. NBE revealed that the bank is targeting the launch of 50 new branches during the coming three years, indicating that the demand on Islamic branches is the controlling standard for such a move. This will sum the bank’s branches to 417 by the end of 2017. National Bank Of Egypt Page 44 Strategic Audit of NBE The deputy chairman of NBE automated teller machines (ATMs) reached 1,750 by the end of April, adding that the bank is aiming to increase them by 500 new ones and exchange 400 old ones by the end of 2015. NBE also adopted an approach to activate the role of non-governmental organizations (NGOs) in offering microcredit services via allocating an EGP 1 bn. tranche of loans to NGOs to be relent to micro enterprises. Total facilities amounted to EGP 850 MM. and were extended to 15 NGOs and businessmen. NBE stated that the number of ATMs will reach 2,350 by 2015, an increase of 34%. Elwy pointed out that the bank relies on sophisticated and equipped machines that allow banking services, such as phone cash. NBE added that the bank will increase the Point of Sale machines (POS) to reach 15,000 machines by the end of 2015, compared to 11,000 which will be registered by the end of 2014. Business Model National Bank Of Egypt Page 45 Strategic Audit of NBE Business Model The Bank operates a number of business lines which are described below: Customer Services: The bank offers banking services in/out Egypt to Egyptian nationals, foreigners and various corporate customers operating in or outside Egypt. The Customer Services area is able to offer fixed term deposits, plus current account services. Lending: Syndicated loans are provided for general funding requirements to banks, corporates and sovereign entities. Bilateral and direct loans to customers are to support working capital financing, capital expenditure and trading activities. The bank is looking to rebuild this business in 2014/15 after the financial crisis. The Bank also offers corporate and institutional banking facilities to correspondent banks. Treasury: Treasury activity focused primarily on liquidity management, including the management of a portfolio of investments to assist with liquidity and enhance income, despite the previous difficult interest rate market conditions. The Treasury team operates a non- trading book. Foreign exchange services in all major currencies are also offered through traditional interbank channels within pre-determined risk limits. The Treasury team also manages the banks interest rate exposure, under set internal policies. Documentary Credits: These activities have continued to be expanded internationally from the traditional Egyptian markets over the last few years, and there are both corporate and financial institutions as customers. The business includes issuing, advising and confirming letters of credit and guarantees. Principal Risks and Uncertainties National Bank Of Egypt Page 46 Strategic Audit of NBE Within our simple business model, there are a number of potential risks and uncertainties that could have a severe impact on the Bank’s performance and could cause actual results to differ materially from expected and historical achievements. NBE has a responsibility to identify these risks, understand the risks through analysis and put measures in place to mitigate these risks. This is to ensure that there are processes in place to minimize its impact. The Board of Directors and Executive Management promote a responsible approach to risk, whereby the overall risk appetite is established by the Board and reviewed on a regular basis. Such appetite for risk is always governed by high quality risk assets, diverse lending portfolio, and central oversight of risk across the Bank to ensure that the full spectrum of risks NBE is exposed to are adequately identified, measured, assessed, monitored, controlled and reported. The Risk Management function is complemented by all departments, business units and Board Committees in the process and management of certain categories of risks as detailed below. The responsibility of Risk Management is fully vested in the Board of Directors, which in turn delegates this to Senior Management and the Board’s Committees. NBE’s management ensures that risk and risk management awareness is fully adhered to at all times. NBE avoids any business where associated risks cannot be objectively assessed, measured or managed. Various investment strategies and derivatives are used to mitigate the risks the Bank is exposed to and optimize investment performance. The key risks inherent in our business model are: Credit Risk: The Bank is exposed to credit risk, in that counterparty will fail to fulfill their obligations. Where the lending is unsecured, collateral is requested to minimize the risk of default by a customer. Credit risk is managed proactively by a robust Credit department and a Credit Committee comprised of senior management. Under the Capital Requirements Directive, the Company has adopted the Standardized Approach to credit risk. Credit risk is defined as the likelihood that a customer or counterparty is unable to meet the contracted financial obligations resulting in a default situation and loss event. This risk is the main category of risk NBE is exposed to. Credit risk comprises counterparty risk, settlement risk and concentration risk. These risks arise in the Bank’s normal course of business. The approach to credit risk management is based on the foundation to preserve the independence and integrity of the credit risk assessment, management and reporting processes combined with clear policies, limits and approval structure which guide the day-to-day initiation and management of the Bank’s credit risk exposures. This approach comprises credit limits which are established for all customers after a careful assessment of their credit standing. This has enabled a greater understanding of the risks involved within the existing portfolios, while making sure an in-depth analysis and review is undertaken of new and existing transactions. Conscious efforts have also been made to increase staff awareness on risk factors within transactions. National Bank Of Egypt Page 47 Strategic Audit of NBE Critique: Over the last year, NBE has focused on operating within an environment and with counterparties with which it is not only familiar, but also comfortable. The focus has been on familiarizing the business with its existing customers while continuing to gradually increase its market share within growing emerging markets - particularly for trade finance business. Market Risk Market risk is the risk of a change in the market value, earnings or future cash flows of a portfolio of financial instruments, caused by the movements in market variables such as bond equity or commodity prices, interest and exchange rates. Market risk exists for NBE where it holds securities that are affected by market fluctuations. Its investment and debt securities are held to maturity and therefore GDR’s and other securities prices are of less concern. NBE is exposed through daily currency open positions, but this is mitigated by the restrictions placed on the maximum position allowed on each currency and enforced stop-loss positions. Critique: NBE does not undertake proprietary trading activities therefore no trading book is maintained. The interest rate risk is managed as part of the daily monitoring within predetermined limits approved by the Board. The majority of our interest bearing liabilities and assets are based on floating rates, and so any interest rate mismatch is removed. Also, the majority of assets and liabilities are short dated, and therefore not subject to interest rate risk. Liquidity Risk: Liquidity risk is when NBE is unable to retain or create sufficient cash resources to meet its commitment. This happens when there is a shortfall in the amount available to NBE and the amount due to be paid out, which could either be due to a mismatch in funding versus deposits or a lack of liquid assets. Liquidity risk is covered under the Banks “Individual Liquidity Adequacy Assessment (“ILAA”) policy and regular stress tests are undertaken to ensure that we remain liquid at all times. Under the liquidity regulations the Company has fully implemented the requirements for liquidity risk management including systems and controls. During the year under review the Company’s approach to the liquidity risk management was reviewed and documented in a revised comprehensive “Individual Liquidity Adequacy Assessment (“ILAA”) document, drawn up in accordance with the regulatory requirements. This document describes the Company’s liquidity risk tolerance, including the methodologies for ensuring that risk is restricted within that tolerance. It analyses the sources of liquidity risk, and describes the assumptions and approach taken to stress testing in light of those risks. National Bank Of Egypt Page 48 Strategic Audit of NBE It also incorporates the Company’s liquidity contingency funding plans, liquid asset buffer and identifies those risks which have the potential to cause the Company to fail (reverse stress tests), as demanded by regulatory requirements Critique: Daily monitoring is undertaken to make sure there is a good mix of wholesale and retail deposits coupled with the support of a strong stock of high quality liquid assets including Liquid Asset Buffer (“LAB”) which has been a dependable source of liquidity. Operational Risk: Operational risk is defined as the “risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems, or from external events”. However, a defined operational risk management framework is effectively applied within the Bank, coupled with a high awareness of the underlying causes of operational risk at all levels within the business units, results in a control environment which is able to evolve with changing business needs, thereby ensuring operational losses within the business are kept to a minimum. Critique: NBE has placed particular emphasis on improving in this area in recent years and has put in place both the structure and personnel to ensure steady and continual movement towards meeting this objective. Operational risk is managed by all operational areas of the Bank on a day-to-day basis, but with oversight from Financial Control, Risk, and Internal Audit. Regulatory Risk: Regulatory risk is the risk to earnings, capital and reputation associated with a failure to comply with an increasing array of regulatory requirements and expectations from banking regulators. Regulatory risk governance must begin at the Board level and cascade throughout the Bank. The Bank operates in a highly regulated environment and is therefore subject to regulatory risk in that it may find it does not comply with some aspect of the regulations, or wrongly reports figures to the regulators. Changes to the regulations are made frequently, and the Banks Financial Control and Risk areas ensure that the Bank is compliant with the rules at all times. This risk is also mitigated by regular contact with the company’s auditor, membership of trade organizations and various professional bodies. Critique: NBE ensures there is governance through its compliance and audit functions, which in turn ensures there is discipline and adherence towards maintaining regulatory requirements, while also deploying the effective resources needed to achieve them. In this way regulatory risk National Bank Of Egypt Page 49 Strategic Audit of NBE is minimized whilst the objective of NBE is taken into consideration and not hindered. IT System and Control Risk: IT/Systems risk is the risk of a failure or an issue arising within a bank’s primary systems, which might hinder the functionality of the business with unforeseeable consequences and eventually lead to a loss of revenue to the business. The Bank has an established integrated Risk Management Function that clearly assigns ownership and management of specific risks to business units heads and senior management. This ensures that all of the principal risks are defined and recognized and that policies and procedures are in place to mitigate any such risk. The Company’s risks are managed taking into account several main principles including management responsibilities for the management of risk and controls, assessment and measurement of all identified risks with acceptable balance between risk versus return, and undertaking an annual review of risk policies and the control framework to ensure optimal capital allocation and utilization for relevant risks. Critique: NBE understands the risk and reputation risk addresses the issues and maintains the most up to date systems and anti-virus software to ensure a high level of IT security is sustained. The Bank has internal controls and monitoring systems in place around operations and IT related projects and enhancements. National Bank Of Egypt Page 50 Strategic Audit of NBE Value Chain Analysis Porter’s value chain describes the activities a company engages in and divides them into two broad categories: Primary activities (those involving the physical creation, sale, and service of the product), and: Support activities (those functions constituting the company’s infrastructure). When considering the NBE strategy we can find that risk management is distinctive because it interacts with and influences both primary and support activities. Risk management overlays the four support activities and spans the five primary activities, as illustrated below. The four support activities are corporate infrastructure – including finance and treasury – human resources, technology, and procurement. Each is involved in developing and defining strategic risk management. Risk management returns the favor by helping shape and defines the four support activities. Likewise, the nature of the primary activities – the inbound supply chain, operations and production, the outbound supply chain, marketing and sales, and after-sales service – help determine the risk management strategies required, while risk management shapes the execution of the activities themselves. Risk management is a strategic concern for any corporation. The influence risk management has on shaping the configuration and execution of activities defining the company’s value chain demonstrates risk management’s role in the firm’s competitive advantage. Critique: It should be evident that there is a distinct benefit to corporations ensuring that few, if any; activities are beyond the purview of risk management. This benefit accrues through the enhancements risk management provides to value creation and their competitive advantage. It is not enough to think value is created by talking about risk management in a strategic context, as some business consultancies suggest. Risk management creates value as part of the strategic context through competitive advantage and the value chain. National Bank Of Egypt Page 51 Strategic Audit of NBE A corporate risk management culture is necessary for an effective ERM. All corporate culture begins at the top of the organization, with chief officers and the board. If risk management is to fulfill its strategic role, that is to permeate all primary and support activities that define the organization and enhance its competitive advantage, the direction must come from the highest levels. It is not necessary for every company to have a chief risk officer, but someone at the top must be accountable for risk management activities throughout the organization. The Board must be educated in risk management issues pertinent to the particular industry (see Porter’s Five Forces Model), and a risk committee, composed of officers, staff, and directors, needs to write up a guiding set of risk policies and make sure they are implemented and modified as necessary. Most importantly, all employees and staff up and down the corporate structure must understand that risk management is part of their job descriptions and that they must help manage the risks they encounter as part of their work. It cannot be otherwise, since all employees, from top to bottom, have some responsibility for competitive advantage. National Bank Of Egypt Page 52 Strategic Audit of NBE Corporate Structure 1. How is the corporation structured at present? It is essential for the banking industry to restore a firm of trust with the communities we serve. That applies to National Bank Of Egypt as well as the entire industry. We have set ourselves the goal of taking on a pioneering role in the change that is indispensable in the business sector: Cultural change was therefore an essential part of our Strategy 2015+ and corporate culture remains one of the key levers in our Strategy 2020. From 2012 onwards, Senior Management initiated a comprehensive dialogue with employees and managers. One crucial step is to bring the attitudes and goals of our staff in line with the needs of our clients and the overall economy. Since 2014, we have integrated our corporate values and beliefs into people management tools such as objective setting, performance management, leadership, management assessment and people development tools. We are developing organizational metrics and systems to support the measurement and adoption of desired behaviors. This will be achieved through the use of client management information systems, client satisfaction metrics and performance measurement systems, including the creation of a scorecard with financial and nonfinancial metrics. 2. Is the structure clearly understood by everyone in the corporation? 3. Is the present structure consistent with current corporate objectives, strategies, policies, and programs, as well as with the firm’s international operations? We have embedded our values and beliefs in our recruiting, interviewing, and on-boarding processes as well as development activities. In 2014, we focused on engaging employees throughout National Bank of Egypt with what these values mean in practice. We encourage visible and measurable changes in behavior as well as in policies, processes and practices. Workshops across the bank aim to engage small groups and reinforce the need for alignment and change, while also identifying opportunities to drive business performance. In the past, we may have underestimated the potential emotional effects of change. We have therefore developed a series of measures to support leaders and employees throughout the transformation. These include: guidelines on managing change; surveys to assess how employees are processing the change both mentally and emotionally; and coaching, workshops and trainings on how to increase efficiency. National Bank Of Egypt Page 53 Strategic Audit of NBE Corporate Culture 1. Is there a well-defined or emerging culture composed of shared beliefs, expectations, and values? In 2013, our Supervisory Board intensified its oversight of ethics through the creation of an Integrity Committee. The committee advises and monitors the Management Board on its measures to ensure the economically sound, sustainable development of the company while protecting the resources of the natural environment, maintaining social responsibility and observing the principles of sound, responsible management and corporate governance. It is also concerned with the integration of these aspects into corporate culture. In particular, the committee deals with: Monitoring the Management Board’s measures to ensure the bank’s compliance with legal requirements, authorities’ regulations and the company’s own in-house policies. Regular review of the bank’s Code of Business Conduct and Ethics with a view to fostering ethical and moral conduct within and outside the bank. Precautionary monitoring and strategic analysis of the bank’s legal and reputational risks that could place the entire bank at risk or lead to material claims for damages against current or former Management Board members and regularly advising and monitoring the Management Board with a view to avoiding such risks. Our progress on strengthening corporate culture Since we launched our strategy, we have worked intensively on our corporate culture. We introduced the process of deep, longer-term cultural change and established our new corporate values. What are the corporation’s current marketing objectives, strategies, policies, and programs? Marketing Plan Our Marketing Plan includes everything we do to get your customers to buy your product or service. This is often the weakest part of a business plan so it is important we spend enough time to get all of the research we need to complete it successfully. our Marketing Plan include both our strategies for growing sales as well as the tactics we will employ to get there along with an National Bank Of Egypt Page 54 Strategic Audit of NBE overview of the competition in our market. The Marketing Plan section is made up of five subsections: Target Market Services/Products Pricing Strategy Sales/Distribution Plan Advertising and Promotions Plan Target Market We have an understanding of the size of the target market for our product and the niche we are trying to carve out for your business. Explain the type of person or business that is likely to buy y\our product or service and how large this market is. We are sure to describe our direct competition & indirect competition. our indirect competitors are the businesses that sell a product that is not the same as ours but could be used as an alternative by your customer. The Target Market section covers the following : 1. Our target market. Including demographics statistics such as their age, gender, where they live, income etc. Also the psychographics of our target market. What do they have in common? What motivates them? 2. Estimating the total size of the target market for our product or service in terms of gross sales and units of product or service sold. 3. What trends are affecting the target market for our product or service? Consider industry trends, socioeconomic trends, government policy, and demographic shifts. 4. Summarizing our competition. Include estimates of their market share, and our sense of their financial health. Comparing their product or service to ours in terms of quality, price, service, warranties, image, etc. Include both our direct competition and indirect competition. Services/Products Our marketing strategy communicates what makes our product or service unique. It is important to describe both the features and the benefits of our product or service. Features are descriptive attributes of our products. The benefits describe what good things the customer will enjoy by using your product or service (e.g. save time, save money, feel better etc.). Our Services/Products section covers the following: 1. What is the one thing above all else that makes our product or service unique? 2. What other features does our product or services have? Consider quality, price, service, etc. 3. What benefits will our customers enjoy by buying your product or service? Will they save money, feel better, be smarter, etc.? Pricing Strategy An important part of our strategy is determining how we will price our product or service. The secret here is to establish a reasonable base price that will enable us to make a fair profit. We may believe the easiest route is simply to set your prices in accordance with those of your competitors. That's not always wise. Before we set a base price, we have to look at our own objectives and special considerations. National Bank Of Egypt Page 55 Strategic Audit of NBE The Pricing Strategy section covers the following: 1. What is our base price and how did we arrive at this figure? Provide a brief summary of our fixed and variable costs. 2. How are similar products and services priced? Explain how the price of our product or service will compete with market prices. If our price is higher, why would a customer choose your product? Do we offer superior service or a higher quality product? If our price is lower, how are we able to charge less - is the quality different, is our production process more efficient, do you sell in large volumes? 3. What do our costs include? 4. What kind of a return are we looking for in our investment and how soon are you anticipating recouping our investment? Sales/Distribution Plan Our Sales/Distribution Plan details how the transaction between us and our customer will take place. It includes a discussion about how our plan on selling our product or service and it outlines all of the different people and companies involved in getting our product into the hands of our customer. We explain in detail what type of distribution channels are available to us (account representatives, sales people, Internet, delivery services, other companies that will carry our product) what benefits we will have by choosing them and the length of time it will take to get our product to our customer. Advertising and Promotions Plan Our Advertising and Promotions Plan details how we are going to communicate to our customers and prospects. There are many ways our business may communicate including advertising, public relations, brochures, a Website, trade shows, etc. HR The HR function in NBE is primarily concerned with the “staffing” component of the five management processes, namely, planning, organizing, staffing, leading, and controlling. The key elements of staffing include: • Job analysis • Planning labor needs • Recruiting • Orienting and training new employees • Compensation, incentives and benefits • Performance appraisal • Communicating • Training and development, and • Employee commitment In addition, HR is responsible for compliance laws, safety, and handling grievances and labor relations. So,,,, the “people” or personnel aspects of management jobs involve conducting job analyses; planning labor needs and recruiting job candidates; selecting job candidates; orienting and training new employees; managing wages and salaries; providing incentives and benefits; appraising performance; communicating; training and developing managers; building employee commitment; being knowledgeable about equal opportunity, affirmative action, and employee health and safety; and handling grievances and labor relations. National Bank Of Egypt Page 56 Strategic Audit of NBE IFAS Internal Strategic Factors Strengths High Growth Rate Reduced Labor Costs Monetary Assistance Provide High Profitability and Revenue Domestic Market Weight Rating Score .15 .10 .10 .15 .10 4 3 3 4 3 .6 .3 .3 .6 .3 .05 .10 .10 .10 .05 1 3 4 4 2 2 .15 .4 .4 .2 .1 3.35 Weaknesses Future Competition Competitive Market High Loan Rates Are Possible Small Business Units Costs Tax Structure TOTAL Critique: NBE has the strongest centers of power due to the centers of power that it has a source of confidence of customer and the diversity of products and services, it should to focus on the weaknesses for control of the competitors and to be that it has the ability to transform weaknesses to strengths. SWOT SWOT analysis: Strengths Opportunities high growth rate reduced labor costs monetary assistance provided high profitability and revenue domestic market new products and services new acquisitions global markets venture capital income level is at a constant increase growing economy growing demand Weaknesses Threats National Bank Of Egypt Page 57 Strategic Audit of NBE future competition competitive market high loan rates are possible small business units costs tax structure unexpected problems increasing rates of interest rising cost of raw materials increasing costs financial capacity price changes SFAS Factors O1 - New Products & Service O4 - Venture Capital O5 - Income level is at a constant increase O6 - Growing economy T2 - Increasing Rates of Interest T5 - Price Changes S1 - High Growth Rate S2 - Reduced Labor Costs S4 - High Profitability and Revenue W3 - High Loan Rates Are Possible Total Scores Weight Rating .20 4 Weighted Score .8 .10 .15 3 3.5 .3 .525 .05 .15 2.5 3 .125 .45 .10 .05 .05 3 2.5 2.5 .3 .125 .125 .10 3 .3 .05 3 .15 1 3.2 Review of mission and objective Our Mission To be the most successful bank admired for its innovative service, people and technology both locally and in the Middle East and North Africa region. Critique: Mission statements are supposed to model what business you are in, what competition you face, and your core values. National Bank Of Egypt Page 58 Strategic Audit of NBE The ultimate test is that it should serve as a recruiting device leading applicants to say” That is the kind of business I want to be in and that is the kind of company I want to work for!” What remains then is to examine ways to improve the process and the product so that they are aligned and versions of each other—almost in a cause and effect partnership. Our Objectives The Bank’s approved three year strategic business plan 2015-2017 sets out the key financial objectives to restore the Bank’s historical interest income trend and improve the overall profitability and earnings. According to the approved strategy, NBE’s mission is to provide world class international banking services to Egyptian and Middle Eastern related businesses and governmental agencies and in doing so, become the first choice for Egyptian counterparties and other relationships from the Gulf region and North Africa. With our strong base of experience and market presence, we aim to grow each of our various strategic business lines in both market and product extensions. The Bank's primary business objective is to provide a range of banking services to both its Egyptian and international customers. Its strategy for doing so is as follows: • protect the Banks capital and liquidity, and within internal risk management policies, with minimal exposure to market risk; • To provide lending in trade finance to both financial institutions and large commodity corporate clients involved in trade predominantly to or from the Middle East and growing emerging markets; • Increase loans and advances including syndicated facilities and to be used as a penetrating tool for the purpose of future enhancement of trade relationships with NBEs existing counterparties and other future targeted relationships; • To provide treasury services to customers and counterparties; and • To maintain asset quality whereby the overall investment grade of the balance sheet will be around 80%. The strategy drivers are based on the strength of our parent in our home market, Egypt, combined with our historical experience in emerging markets in terms of sourcing business and accepting risk. In addition we are intent on building our funding base to be diversified, whilst maintaining liquidity and meeting all Regulatory requirements. National Bank Of Egypt Page 59 Strategic Audit of NBE And we need to add this objective to the NBE: Our purpose is to be where the growth is, connecting customers to opportunities. We enable businesses to thrive and economies to prosper, helping people fulfill their hopes and dreams and realize their ambitions. We have developed a two-part strategy that reflects our purpose and competitive advantages: A network of businesses connecting the world: NBE is well positioned to capture the growing international trade and capital flows. Our global reach and range of services place us in a strong position to serve clients as they grow from small enterprises into large multinationals Wealth management and retail with local scale: we aim to capture opportunities arising from social mobility and wealth creation in our priority growth markets, through our Premier proposition and Global Banking business. We will invest in full scale retail businesses only in markets where we can achieve profitable scale The world economy is becoming ever more connected, with growth in world trade and cross-border capital flows continuing to outstrip growth in average gross domestic product. Over the next decade we expect 35 markets to generate 85 per cent of world trade growth with a similar degree of concentration in cross-border capital flows. Of the world’s top 30 economies, we expect those in Asia, the Middle East and North Africa to increase in size approximately four-fold by 2050, benefiting from demographics and urbanization. By this time they will be larger than those of Europe and North America combined. We expect Asia to contribute nearly 50 per cent of global GDP growth between now and 2050. NBE is one of the few truly international banks. We have an unrivalled global presence with access to more than 85 per cent of global trade and capital flows. Our network connects faster-growing and developed markets. We have a diversified universal banking model that provides stable funding, liquidity and a low risk profile. Strong capital generation supports our ability to pay industry-leading dividends and helps us to meet capital requirements. These are distinct competitive advantages. Since 2011, we have materially transformed our business in line with our strategy. At our Investor Update in June 2015, we outlined plans to further reshape our business. We will redeploy resources to capture expected future growth opportunities and adapt to structural changes in the operating environment. We have set out a series of actions to be completed by 2017: Reduce risk-weighted assets across the Group by 25 per cent or more and reinvest the capital in higher-performing businesses. Reducing risk-weighted assets will help our Global Banking and Markets business reach profitability targets National Bank Of Egypt Page 60 Strategic Audit of NBE Continue to optimize our global network and reduce complexity through the ongoing application of the six-filter process that guides our decisions on where we do business. Set up a UK ring-fenced bank Deliver revenue growth above GDP growth from our international network Capture growth opportunities in Asia including in China’s Pearl River Delta, in the Association of Southeast Asian Nations (ASEAN), and in our Asset Management and Insurance businesses Grow business from our global leadership position in the internationalization of the Chinese currency, the RMB Complete the implementation of Global Standards, our globally consistent and rigorous financial crime controls. Targets We aim to achieve a return on equity of more than 10 per cent by 2017, with momentum for higher returns in the future. We aim to grow business revenues faster than operating expenses on an adjusted basis. We are also committed to delivering a progressive dividend. The progression of our dividend should be consistent with the growth of the overall profitability of the Group and is predicated on our ability to meet regulatory capital requirements in a timely manner. Delivering these priorities will create value for our customers and shareholders and contribute to the long-term sustainability of NBE. In the process, we shall maintain a robust, resilient and environmentally sustainable business in which our customers can have confidence, our employees can take pride and our communities can trust. Acquisition: Growth strategies: In 2004 NBE had followed growth strategy based on more vertical expansion through the full acquisition of 2 other banks (The engineering and the commercial bank). TOWS MATRIX National Bank Of Egypt Page 61 Strategic Audit of NBE SPACE MARTIX Internal strategic position Competitive advantage (CA) (-6 worst, -1 best) Product quality Market share Brand & image Customer service AVERAGE Financial strength (FS) (+1 worst, +6 best) ROA Liquidity Cash flow Leverage AVERAGE National Bank Of Egypt -1 -1 -3 -2 1.75- +5 +6 +5 +4 5+ External strategic position Industry stability (IS) (+1 worst, +6 best) Barriers to entry Growth potential Access to financing Industry profit AVERAGE Total 3 Environmental stability (ES) (-6 worst, -1 best) Inflation Technology Demand elasticity Taxation AVERAGE Total 2.75 Page 62 +6 +4 +4 +5 4.75+ -2 -1 -2 -4 2.25- Strategic Audit of NBE BCG MATRIX STAR QUESTIAN MARK Certificates Savings Current accounts Loans CASH COW DOG Credit cards Expatriates transfers Debit cards Prepaid cards QSPM STRATEGIC ALTERNATIVES Key internal factors Internal strengths Market share acquisition Financial position Marketing & advertisement Information systems Retail department Training &development Employee capital Internal weaknesses Operating expenses Low profit per share Old design branches Old staff unfamiliar to IT Market development Market penetration 0.15 0.10 0.15 0.15 0.05 0.05 0.05 AS 2 3 3 2 3 4 2 TAS 0.30 0.30 0.45 0.30 0.15 0.20 0.10 AS 3 3 4 2 4 3 3 TAS 0.45 0.30 0.60 0.30 0.20 0.15 0.15 0.10 0.05 0.10 0.05 1 --1 0.10 --0.05 2 --2 0.20 --0.10 Weight 1.00 Key external factors OPPORTUNITIES Globalization Penetration Deregulation Upstream/downstream integration 0.05 0.25 0.10 0.15 2 -2 3 0.10 -0.20 0.45 3 4 2 4 0.15 1.00 0.20 0.60 THREATS Strong competition Product substitution Induction of new players Government policies 0.20 0.10 0.05 0.10 3 3 3 1 0.60 0.30 0.15 0.10 2 2 1 1 0.40 0.20 0.05 0.10 3.85 < 4.7 Total National Bank Of Egypt Page 63 Strategic Audit of NBE Critique: According to the above analytical methods we can conclude that using the NBE resources and capabilities in order to make the best use of its strengths and to avoid weaknesses this can be done through new markets penetration as there is a huge gap in the market which is needed to be covered ( especially in the SME’s market ) Balance Scorecard Strategic Prioritie s Financial Perspectiv e Customer Perspectiv e Internal Perspectiv e Objectives Targets Initiatives Net income Cash flow Volume growth Cost reduction 10 % increase 20 % increase Increase number of branches Implement CRM Assets disposition program Personalized quality service Competitive products Attract & retain more customers # of new customers # of customer complaints Level of customer satisfaction Revenue from existing customers Increase No. of Branches & ATMs Implement Quality system Mystery Shopper Program Increase Customer Value Operational Excellence Create Innovation Products Cross-Sell Products Share of Market Revenue from new products Cross-Sell ratio Level of customer satisfaction Brand Quality measure Increase customer loyalty Low fees using bank's services No time limitation for the use of Bank's services Efficient Operations From 3 to 4 New product & Services Minimize No. of complaints Reduce the time of the transactions Increase profit Grow revenues Asset growth Efficiency ratio Measures National Bank Of Egypt Page 64 Create Market intelligence knowledgeba se Cycle time optimization program Strategic Audit of NBE Learning & Growth Train the staf Empowering Employees Incentives & Participation Employee Turnover Employee Satisfaction Hours of employee training Training Programs to all the employees Implement an appraisal and compensatio n system Develop succession plans Encourage staf training/cer tification Develop communica tions plan Essential job knowledge manual Critique: The BSC measure contains multi‐dimensional indicators that examine four perspectives of organizational performance; financial perspective, customer perspective, internal process perspective and learning and growth perspective. From our point of view NBE management has to work in developing the learning & growth perspective and customer perspective to serve the future of the oldest organization in Egypt. Strategy implementation problems: Organizational structure Organizational design Culture Strategy implementation can pose a number of challenges. The challenges arise from sources that are internal and external to the organization. The particular challenges that will face strategy implementation will depend on the type of strategy, type of organization and prevailing circumstances. Many challenges in strategy implementation can be avoided if strategy development is coupled with implementation. Involving key people especially those who will play a role in implementation in the development stage is important so that critical implementation issues are not left out of consideration during development or formulation. Challenges to strategy implementation that can arise from sources that are internal to the organization may include; behavioral challenges such as resistance to change that can be reduced through effective communication, effective reward system, good leadership and a participatory strategy development process. Proper change management approach can also drastically reduce resistance to change. Another internal source of strategy implementation challenge is inadequate resources such as funds, equipment and facilities, human resource skills and experience. This can be reduced through proper and appropriate policies and adoption of proper control system National Bank Of Egypt Page 65 Strategic Audit of NBE during strategy development. Also inappropriate systems of structure, culture, leadership, policies, support and reward can be a source of internal challenges to strategy implementation. Proper planning and control systems can be useful in reducing problems of inappropriate systems. Challenges to strategy implementation can also arise from sources that are external to the organization. The forces can be macro-environmental forces. Such forces include; economic forces, political-legal forces, socio-cultural forces, technological and ecological forces. Thorough understanding of these forces and good planning can help reduce challenges associated with the macro-environmental forces. Another external source of challenge to strategy implementation is industry forces. Here effort to implement strategy can be greatly impaired by challenges arising from, powerful buyers and suppliers and stiff competition from rivals. Thorough understanding of these forces and good planning is important and also effective communication with buyers and suppliers. The last external source is operative environmental forces. Pressure arising from stakeholders such as creditors, suppliers, customers, government, shareholders and the local community can impose challenges to strategy development. Stakeholder’s challenges can be introduced though, understanding the forces and planning for them, effective communication with stakeholders and involving key stakeholders during formulation phase. Once strategies have been developed they need to be implemented. Strategy implementation happens to be a more challenging and delicate task than that of strategy formulation. Unlike strategy formulation, here strategists cannot afford to be abstract or desk work oriented. Delicate and sensitive issues are involved in strategy implementation such as resource mobilization, restructuring, culture changes, technological changes, process changes, policy and leadership changes. If implementation is not effectively managed, the strategic plan may amount to being a mere white elephant and nothing more. A strategy may be good, but if its implementation is poor, the strategic objective for which it was intended may not be achieved. Critique: While implementation of strategy is such an important activity, is not easy. Strategy should be effectively operationalized in the organization for effective implementation. Operationalization of strategy is concerned with working out the strategy by ensuring that the organizations daily activities, work efforts and resources are directed as much as possible toward implementing the strategy. Operationalizing strategy involves developing operational plans and tactics though which otherwise abstract strategy will be implemented. The plans and tactics are developed at operational and functional level of strategic management. It is more specific, concrete and short term in nature. National Bank Of Egypt Page 66