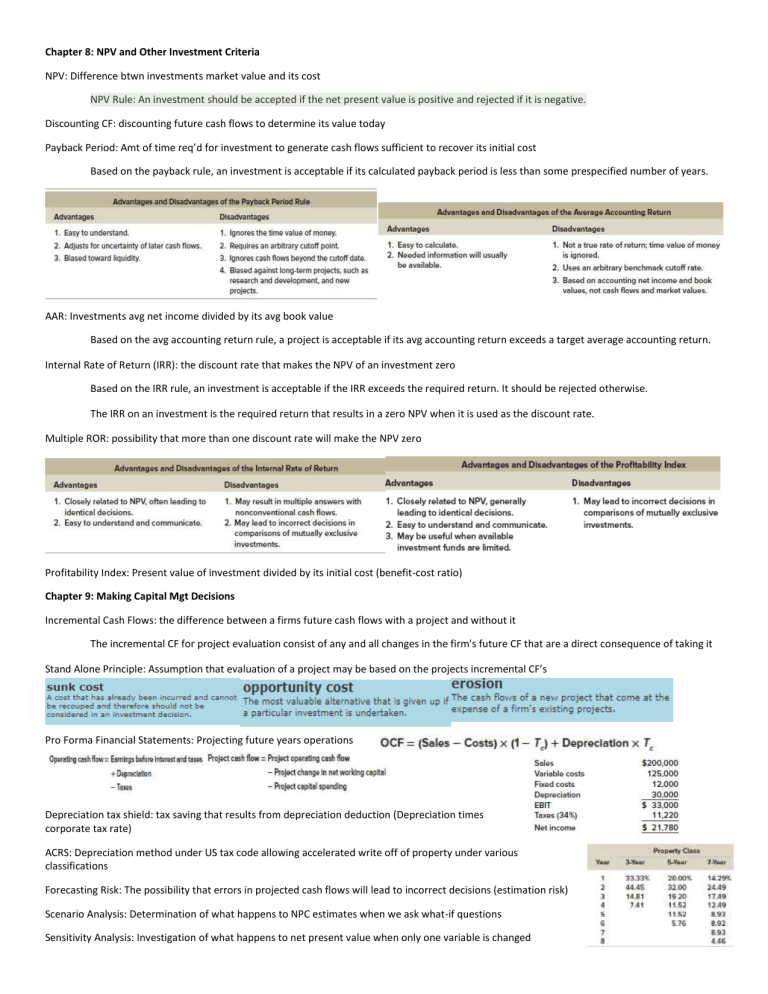

Chapter 8: NPV and Other Investment Criteria NPV: Difference btwn investments market value and its cost NPV Rule: An investment should be accepted if the net present value is positive and rejected if it is negative. Discounting CF: discounting future cash flows to determine its value today Payback Period: Amt of time req’d for investment to generate cash flows sufficient to recover its initial cost Based on the payback rule, an investment is acceptable if its calculated payback period is less than some prespecified number of years. AAR: Investments avg net income divided by its avg book value Based on the avg accounting return rule, a project is acceptable if its avg accounting return exceeds a target average accounting return. Internal Rate of Return (IRR): the discount rate that makes the NPV of an investment zero Based on the IRR rule, an investment is acceptable if the IRR exceeds the required return. It should be rejected otherwise. The IRR on an investment is the required return that results in a zero NPV when it is used as the discount rate. Multiple ROR: possibility that more than one discount rate will make the NPV zero Profitability Index: Present value of investment divided by its initial cost (benefit-cost ratio) Chapter 9: Making Capital Mgt Decisions Incremental Cash Flows: the difference between a firms future cash flows with a project and without it The incremental CF for project evaluation consist of any and all changes in the firm's future CF that are a direct consequence of taking it Stand Alone Principle: Assumption that evaluation of a project may be based on the projects incremental CF’s Pro Forma Financial Statements: Projecting future years operations Depreciation tax shield: tax saving that results from depreciation deduction (Depreciation times corporate tax rate) ACRS: Depreciation method under US tax code allowing accelerated write off of property under various classifications Forecasting Risk: The possibility that errors in projected cash flows will lead to incorrect decisions (estimation risk) Scenario Analysis: Determination of what happens to NPC estimates when we ask what-if questions Sensitivity Analysis: Investigation of what happens to net present value when only one variable is changed Managerial options; opportunities that managers can exploit if certain things happen in the future Contingency Planning: taking into account the managerial options implicit in a project (Expand, abandon, wait) Strategic options: options for future, related business products or strategies Capital Rationing: If firm has positive NPV projects but cannot obtain financing (soft: units of business are allocated a certain amount of financing for capital budgeting) (hard: Cannot raise financing for project under any circumstances) Ch 11: Risk and return Systematic risk: Market risk, influences large number of assets (m) Unsystematic: Asset specific, small number of assets (e) Principle of Diversification: spreading eliminates some, not all risk Total Risk = Systematic risk + Unsystematic Systematic Risk Principle: the expected return on an asset depends only on that assets systematic risk Beta: Amount of systematic risk present in a particular risky asset relative to that in an average risky asset Std dev measures total risk, beta- systematic risk SML: Positively sloped straight line displaying the relationship between expected return and beta Market Risk Premium: slope of SML; difference between expected return on market portfolio and Risk free rate Ch 12; cost of capital Cost of Equity: Return that equity investors require on their investment in the firm Cost of Debt: Return that lenders require on firms debt Cost of preferred stock: WACC: weighted avg cost of equity and aftertax cost of debt The WACC is the overall return the firm must earn on its existing assets to maintain the value of its stock. Ex: D/E ratio=.45, Equity = 1/1.45 = .6897, Debt= .3103 Pure play Approach: use of a WACC unique to a particular project, based on companies in similar lines of business