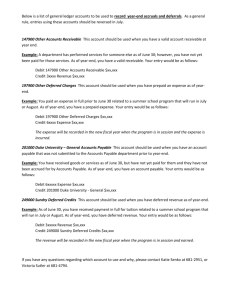

Financial Accounting & Reporting Part 1: Instructional Material

advertisement