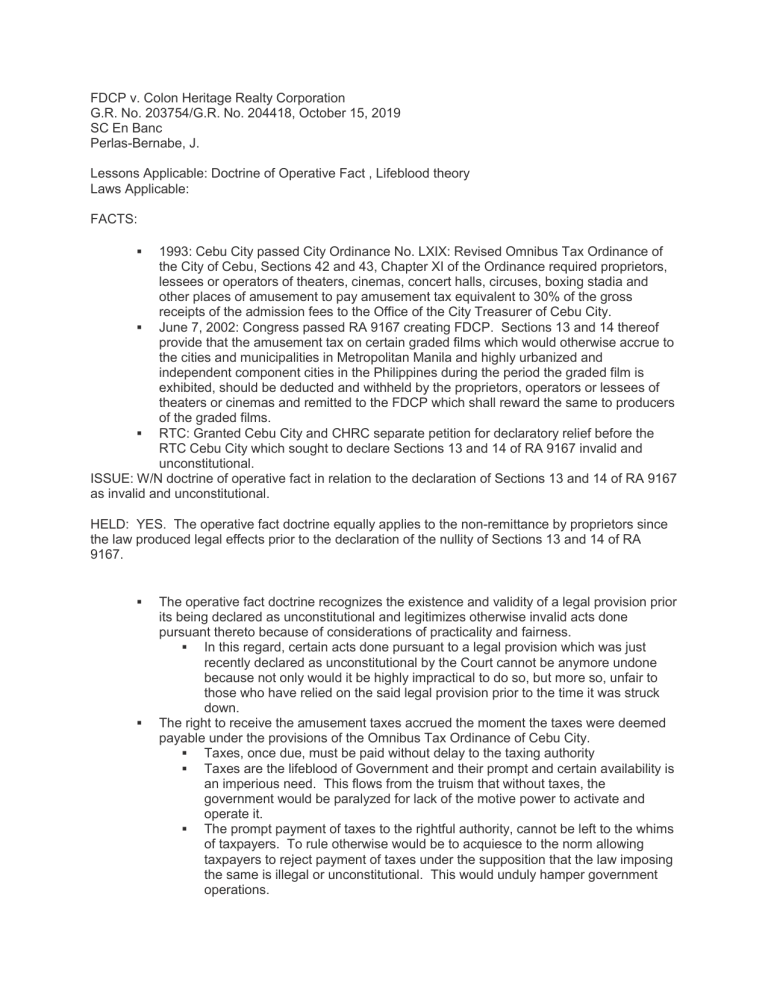

FDCP v. Colon Heritage Realty Corporation G.R. No. 203754/G.R. No. 204418, October 15, 2019 SC En Banc Perlas-Bernabe, J. Lessons Applicable: Doctrine of Operative Fact , Lifeblood theory Laws Applicable: FACTS: 1993: Cebu City passed City Ordinance No. LXIX: Revised Omnibus Tax Ordinance of the City of Cebu, Sections 42 and 43, Chapter XI of the Ordinance required proprietors, lessees or operators of theaters, cinemas, concert halls, circuses, boxing stadia and other places of amusement to pay amusement tax equivalent to 30% of the gross receipts of the admission fees to the Office of the City Treasurer of Cebu City. June 7, 2002: Congress passed RA 9167 creating FDCP. Sections 13 and 14 thereof provide that the amusement tax on certain graded films which would otherwise accrue to the cities and municipalities in Metropolitan Manila and highly urbanized and independent component cities in the Philippines during the period the graded film is exhibited, should be deducted and withheld by the proprietors, operators or lessees of theaters or cinemas and remitted to the FDCP which shall reward the same to producers of the graded films. RTC: Granted Cebu City and CHRC separate petition for declaratory relief before the RTC Cebu City which sought to declare Sections 13 and 14 of RA 9167 invalid and unconstitutional. ISSUE: W/N doctrine of operative fact in relation to the declaration of Sections 13 and 14 of RA 9167 as invalid and unconstitutional. HELD: YES. The operative fact doctrine equally applies to the non-remittance by proprietors since the law produced legal effects prior to the declaration of the nullity of Sections 13 and 14 of RA 9167. The operative fact doctrine recognizes the existence and validity of a legal provision prior its being declared as unconstitutional and legitimizes otherwise invalid acts done pursuant thereto because of considerations of practicality and fairness. In this regard, certain acts done pursuant to a legal provision which was just recently declared as unconstitutional by the Court cannot be anymore undone because not only would it be highly impractical to do so, but more so, unfair to those who have relied on the said legal provision prior to the time it was struck down. The right to receive the amusement taxes accrued the moment the taxes were deemed payable under the provisions of the Omnibus Tax Ordinance of Cebu City. Taxes, once due, must be paid without delay to the taxing authority Taxes are the lifeblood of Government and their prompt and certain availability is an imperious need. This flows from the truism that without taxes, the government would be paralyzed for lack of the motive power to activate and operate it. The prompt payment of taxes to the rightful authority, cannot be left to the whims of taxpayers. To rule otherwise would be to acquiesce to the norm allowing taxpayers to reject payment of taxes under the supposition that the law imposing the same is illegal or unconstitutional. This would unduly hamper government operations.