Financial Economics Exam: Retirement, Savings, Capital Budgeting

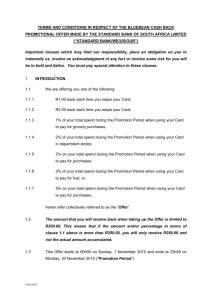

advertisement

FINANCIAL ECONOMICS (FIED26D) Summative Online Assessment November 2021 TSHWANE UNIVERSITY OF TECHNOLOGY FACULTY OF ECONOMICS AND FINANCE DEPARTMENT OF ECONOMICS Summative Online Assessment SUBJECT: FINANCIAL ECONOMICS SUBJECT CODE: FIED206D TIME ALLOWED: 4 hours TOTAL MARK: 100 SPECIAL REQUIREMENTS: CALCULATORS INTSTRUCTIONS TO CANDIDATES: ANSWER ALL THE QUESTIONS NUMBER OF PAGES: 4 NUMBER OF ANNEXURES: NONE COURSE: EXAMINER: ECONOMIC MANAGEMENT ANALYSIS Mr. Giscard Monsengwo Internal/External Moderator(s): Dr M.F. Zerihun Instruction: Read the questions carefully and write brief, but full, answers on the answer sheet provided. Write your initials, surname, and student number. 1 FINANCIAL ECONOMICS (FIED26D) Summative Online Assessment November 2021 Short Answer and Long Answer Questions [100 MARKS] Question 1: Total 45 marks 1.1. Consider the following example: You are currently 35 years old, expect to retire in 30 years at age 65, and then to live for 15 more years until age 80. Your current labour income is R250 000 per year, and you have not yet accumulated any assets. Assuming that there is no income tax collected by the government and there is zero inflation rate (real interest rate is equal to the nominal interest rate). The interest rate offers by the commercial bank on a saving account is 6% per year. Your target replacement rate of preretirement income is 75%. Let us consider how much you need to save if your goal is to spend the same amount on consumption before and after retirement. Make use of the information provided above to complete Table 1. Show all your calculations. (20 marks) Table 1: Salary, Consumption, and Saving over the life cycle Age 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Salary Consumption/Permanent Income Saving Human Capital Retirement Fund R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 2 FINANCIAL ECONOMICS (FIED26D) 59 60 61 62 63 64 65 Summative Online Assessment November 2021 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 R250 000 1.2. From Question 1.1, let us assume that 45 percent of the saving (calculated from 1.1.) must be invested in a mandatory retirement income system and 55 percent in an ordinary saving account. a. What is the total amount cumulated over 30 years of working from each one of the investments? (3 marks) b. What is the annuity payment for 15 years of retirement from each one of the investments? (3 marks) c. Let us assume that the mandatory retirement income system pays 4 percent real interest rate while the ordinary saving account pays 6 percent. Calculate the total annuity payment from both investments. (4 marks) Show all your calculations. 1.3. Consider the following example. You have got your first job in 2021 at age 25, expect to retire in 40 years at age 65, and then to live for 30 more years until age 95. Your annual labour income in the first year is R450 000. Your annual labour income will be increasing annually by 5% from 2022 until retirement. Assuming that you have not yet accumulated any assets, there is no income tax collection, and the inflation rate is zero percent per year until 2061. The interest rate offers by the commercial bank on a saving account is 3% per year. Your target replacement rate of preretirement income is 75%. Show all your calculations. a. What is your annual labour income in year 2051? (4 marks) b. What is your replacement income in year 2051? (4 marks) c. What is the amount you need to have accumulated, to sustain your annual replacement income, after retirement? (7 marks) Question 2: Total 15 marks Consider Paul who has just graduated from Tshwane University of Technology (TUT) and is deciding whether to go on for his master’s degree. Paul is currently 25 years old and plan to retire at age 55. Paul figures that if he takes a job immediately, he can earn R380 000 per year in real terms for the remainder of his working years. If he goes on for three more years of graduate study, however, he can increase his earnings to R450 000 per year. The cost of tuition is R80 000 per year in real terms. Show all your calculations. 3 FINANCIAL ECONOMICS (FIED26D) Summative Online Assessment November 2021 2.1. Is this a worthwhile investment if the real interest rate is 3.4% per year? (8 marks) 2.2. Suppose that Paul is 20 years old instead of 25. If all the other assumptions remain the same, does the investment in the graduate degree still worthwhile? (7 marks) Question 3: Total 40 marks A firm process of analyzing investment projects is called capital budgeting. Although the details regarding how businesses handle the capital budgeting process vary from firm to firm, any capital budgeting process consist of three elements: • • • coming up with proposals for investment projects. evaluating them. deciding which ones to accept and which to reject. Let us assume that you would like to start a small business company and need funding from a commercial bank. To fund your project, the bank requires a business proposal. Write a mini business proposal for your business and include the following elements (± 1 000 words): • • • Description of your business project (Background) and its objectives. Provide information which could be against these objectives (challenges). Provide market gap and possible opportunity for your business project. Note: this is a virtual proposal, and you are not obliged to provide actual information regarding the market. You can apply your imagination and knowledge. Good luck! 4