CMA Part 1 Essay: Financial Reporting & Internal Controls

advertisement

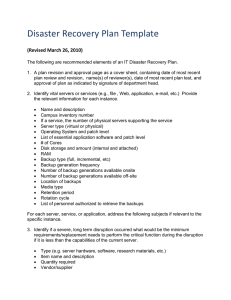

Essay CMA Part 1 Section A Essay Questions. 1. Question ID: HRC (Topic: CMA Part 1 - Section A - External Financial Reporting) HRC Inc., Financial Reporting HRC Inc. is a large publicly-held corporation. List ed below are six selected expenditures made by the company during the year ended December 31, 20X5. The proper accounting treatment of these transactions must be determined to ensure that HRS’s annual financial statements are prepared in accorda nce with generally accepted accounting principles. 1. HRC Inc. spent $2,000,000 on a program designed to improve relations with its dealers. This project was favorably received by the dealers and HRC’s management believes that significant future benefit s should be received from this program. The program was conducted during the fourt h quarter of 20X5. 2. A pilot plant was constructed during 20X5 at a c ost of $4,000,000 to test a new production process. The plant will be operated for approximately five years. At that time, the company will make a decision regarding th e economic value of the process. The pilot plant is too small for commercia l production, so it will be dismantled when the test is over. 3. A new product will be introduced next year. The company spent $3,000,000 during the current year for design of tools, jigs, molds, and dies for this product. 4. HRC Inc. purchased Merit Company for $5,000,000 in cash in early August 20X5. The fair market value of the identifiable assets of Merit was $4,000,000. 5. A large advertising campaign was produced during December 20X5 for use during the first quarter of 20X6 to introduce a new produc t to be released during the first quarter of 20X6. The production costs of the advert ising campaign were $2,500,000. 6. During the first six months of the year, $500,00 0 was expended for legal work in connection with a successful patent application. Th e patent became effective July 1, 20X5. The legal life of the patent is 17 years w hile the economic life of the patent is expected to be approximately 10 years. Required: For each of the six expenditures presented, determi ne and justify the amount, if any, 1. that should be capitalized and be included on HR C’s Statement of Financial Position prepared as of December 31, 20X5. 2. that should be included in HRC’s Statement of In come for the year ended December 31, 20X5. a. Standard full manufacturing costs plus a markup The selling division will be motivated to control costs because any costs over standard cannot be passed on to the buying division and will reduce the profit of the selling division. The buying division may be pleased with this transfer price if the market price is higher. However, if the market price is lower and the buying divisions are forced to take the transfer price, the managers of the buying division will be unhappy. b. Market selling price of the product being transferred This creates a fair and equal chance for the buying and selling divisions to make the most profit they can. It should promote cost control, motivate divisional management, and optimize overall company performance. Since both parties are aware of the market price, there will be no distrust between the parties, and both should be willing to enter into the transaction. c. Outlay (out-of-pocket) costs incurred to the point of transfer, plus opportunity costs per unit. This method is the same as market price when there is an established market price and the seller is at full capacity. At any level below full capacity, the transfer price is the outlay cost only (as there is no opportunity cost), which would approximate the variable costs of the goods being transferred. Both buyers and sellers should be willing to transfer under this method because the price is the best either party should be able to realize for the product under the circumstances. This method should promote overall goal congruence, motivate managers, and optimize overall company profits. 4. To better protect its programs and databases from u nauthorized use, the company should consider logical security controls. These co ntrols include e-IDs and passwords, system authentication requirements, biometrics, log s of log-on attempts, application level firewalls, antivirus and antispyware software , intrusion detection systems, encryption for data in transits, or smart cards. 5. Highly integrated accounting information systems of ten combine procedures that used to be performed by separate individuals. Consequent ly, an individual who has unlimited access to the computer, its programs, and live data also has the opportunity to execute and subsequently conceal a fraud. To reduce this ri sk, a company should design and implement effective separation of duties control pr ocedures. It is essential to divide the authority and responsibility for these two function s. The design and implementation of effective separation of duties control procedures m ake it difficult for any one employee to commit a successful fraudulent activity. 6. Accounting system duties that should be kept separa te include: The data control group should review records for ev idence of unauthorized computer access. Computer operators should not have access to progra m documentation or logic. Two operators should be in the computer room during processing of data. Maintain a processing log and review periodically f or evidence of irregularities. Rotate computer operators among jobs to avoid any s ingles operator always overseeing the same application. Require formal authorizations for program changes, submit written description of changes to a supervising manager for approval. Test changes to programs prior to implementation. A data control group should maintain registers of c omputer access codes, help acquire new accounting software, coordinate security contro ls with specific computer personal, reconcile input and output and distribute output to authorized user. This person should be independent of computer operation which inhibits unauthorized access to computer facility and contributes to more efficient data pro cessing authorizations. 6. Question ID: Hanson (Topic: Business Continuity and System Auditing) Michael Hanson, Internal Audit and Internal Control Michael Hanson is an internal auditor who has been asked to evaluate the internal controls and risks of his company, Consolidated Ent erprises Inc. He has been asked to present recommendations to senior management with r espect to Consolidated’s general operations with particular attention to the company ’s database procedures. With regard to database procedures, he was specifically directe d to focus attention on (1) transaction processing, (2) virus protection, (3) b ackup controls, and (4) disaster recovery controls. Required: 1. For each of the areas shown below, identify two controls that Hanson should review and explain why. a. Transaction processing. b. Virus protection. c. Backup controls. 2. Identify four components of a sound disaster rec overy plan. 3. During his evaluation of general operations, Han son found the following conditions. a. Daily bank deposits do not always correspond wit h cash receipts. b. Physical inventory counts sometimes differ from perpetual inventory records, and there have been alterations to physical counts and perpetual records. c. An unexplained and unexpected decrease in gross profit percentage has occurred. For each of these conditions, (1) describe a possib le cause of the condition and (2) recommend actions to be taken and/or controls t o be implemented that would correct the condition. Suggested answer 1. a. Transaction processing controls include: passwo rds to limit access to input or change data, segregation of duties to safeguard ass ets, control totals to ensure data accuracy. b. Virus protection controls include: ensuring that latest edition of anti-virus software is installed and updated, firewalls set up to deter incoming risks, limit internet access to business-related purposes to reduce chanc es of viruses. c. Backup controls include identification of vital systems to be backed up regularly, development of a disaster recovery plan, testing of backup communications and resources. 2. A sound disaster recovery plan contains the foll owing components: o Establish priorities for recovery process o Identification of software and hardware needed for critical processes Identify all data files and program files required for recovery o Store files in off-site storage o Identify who has responsibility for various activities, which activities are needed first o Set up and check arrangements for backup facilities o Test and review recovery plan 3. . Bank deposits do not always correspond with cash receipts. Possible cause: cash received after the bank deposit has been made. Action: have a separate individual reconcile incoming cash receipts to bank deposits. a. Physical inventory counts sometimes differ from perpetual inventory records, and sometimes there have been alterations to physical counts and perpetual records. Possible cause: timing differences. Actions: limit access to physical inventory, require and document specific approvals for adjustments to records. b. Unexpected and unexplained decrease in gross profit percentage has occurred. Possible cause: unauthorized discounts or credits provided to customers. Actions: establish policies for discounts and credits, document approvals. 7. Question ID: Greeting-Card (Topic: Business Cont inuity and System Auditing) Greeting Card Stores, Business Continuity The headquarters of Greeting Card Stores Inc. is lo cated near a large river that flooded after an extremely heavy rainfall. The disaster rec overy leader had recently left the company, and a new person had not yet been named, n or had the plan been tested for some time. The company has a backup location for al l systems, but it is in the same area and was subject to the same flood. The backup files were in the basement and first floor of the backup location. Some files were salva ged but do not have clear descriptions, and management is not sure if they ar e the correct files. After two days of being unable to process the store sales, management has implemented a backup system. This system allows them to process sales, b ut it does not have all of the current data, so some large sales that were in process were lost. Required: 1. Explain the objective of a disaster recovery pla n. 2. Explain the importance of backing up all program and data files regularly and storing them at a secure remote site. 3. Explain the difference between a hot backup site and a cold backup site. 4. Recommend four changes to improve the disaster r ecovery and storage control procedures at Greeting Card Stores Inc. 5. Besides disaster recovery, system security is al so an important control to the business. Identify three means by which management can protec t programs and databases from unauthorized use. Suggested answer 1. The objective of a disaster recovery plan is to ens ure that a company will be able to operate despite any interruptions such as power fai lures, system crashes, natural disasters, etc. It is a process and set of procedur es that organizations follow to resume business after a disruptive event. Important compon ents include: Disaster recovery team, including a primary leader and an alternate leader. Designation of a specific backup site to use for al ternate computer processing – i.e. hot site or cold site. Test, document and update the plan as required. Rev iew the plan continuously. Also include backups for hardware. 2. The regular backup and proper storage of program an d data files will reduce financial risk and business risk. Misstatements might arise i f data is lost due to inadequate backing up. Loss of data can also cause severe inte rruptions of business operations and loss of income. 3. A hot site is fully operational and can come online more or less immediately. A flyingstart hot site has the latest data and software, so it can switch on in only a few seconds after the main site goes down. A cold site is basically a bare facility, where hardware can be installed relatively quickly (days not minutes). A warm site is somewhere in between, with some communications and networking capabilities, but requiring some hardware / software installation. The choice of the level of backup site preparedness is based on the company’s weighing the cost of being off-line (lost sales, etc.) versus the cost of buying / maintaining the level of backup. 4. Greeting Cards can improve the disaster recovery and storage control procedures by: Ensure a disaster recovery leader is named. Test backup plan regularly to ensure that it is working. Keep backups in a location that might not be subject to the same natural disasters. Keep several sets of backups in case the most recent one can’t be used. Use better file labeling storage controls. External file labels or internal file labels. 5. Means that management can use to protect programs and databases from unauthorized use include: Facility and hardware controls: Control access to the building, locate data center away from public areas, give access to only authorized personnel, use key codes or biometrics for entrance, etc. Network controls: Use private network or use virtual private networks to secure connection to Internet, add password protection and require periodic password change, encrypt data before data transmission, ensure correct destination address by routing verification, verify message delivery via message acknowledgement, detect and defend attacks through virus protection software and firewall, alert intrusion by intrusion detection system, etc.