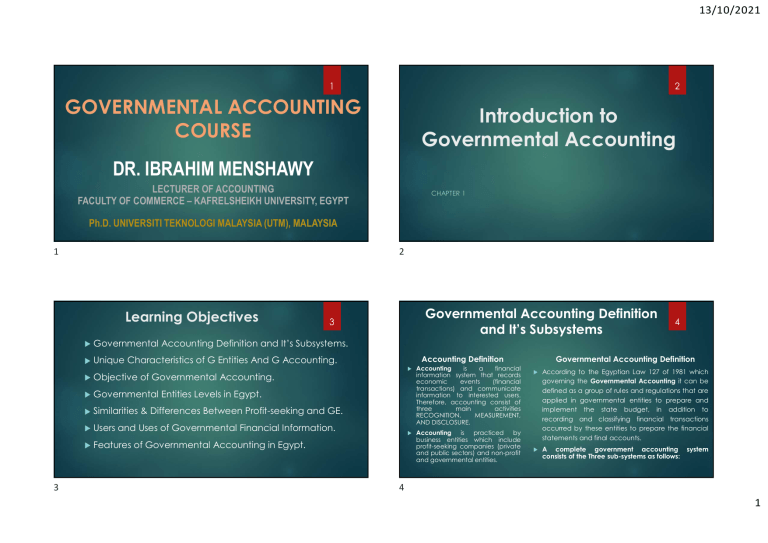

13/10/2021 1 2 GOVERNMENTAL ACCOUNTING COURSE Introduction to Governmental Accounting DR. IBRAHIM MENSHAWY LECTURER OF ACCOUNTING FACULTY OF COMMERCE – KAFRELSHEIKH UNIVERSITY, EGYPT CHAPTER 1 Ph.D. UNIVERSITI TEKNOLOGI MALAYSIA (UTM), MALAYSIA 1 2 Learning Objectives 3 Governmental Accounting Definition and It’s Subsystems 3 Governmental Accounting Definition and It’s Subsystems. Unique Characteristics of G Entities And G Accounting. Objective of Governmental Accounting. Governmental Entities Levels in Egypt. Similarities & Differences Between Profit-seeking and GE. Users and Uses of Governmental Financial Information. Features of Governmental Accounting in Egypt. Accounting Definition Accounting is a financial information system that records economic events (financial transactions) and communicate information to interested users. Therefore, accounting consist of three main activities RECOGNITION, MEASUREMENT, AND DISCLOSURE. Accounting is practiced by business entities which include profit-seeking companies (private and public sectors) and non-profit and governmental entities. 4 Governmental Accounting Definition According to the Egyptian Law 127 of 1981 which governing the Governmental Accounting it can be defined as a group of rules and regulations that are applied in governmental entities to prepare and implement the state budget, in addition to recording and classifying financial transactions occurred by these entities to prepare the financial statements and final accounts. A complete government accounting consists of the Three sub-systems as follows: system 4 1 13/10/2021 Governmental Accounting Definition and It’s Subsystems Government Accounting System Budget accounting subsystem To track the revenue collection and the use of the budgetary resources at the various stages of the spending process. Financial accounting subsystem To recognize and measure the consequences of actual transactions and events which affect the government’s finances. Cost accounting subsystem Unique characteristics of G entities and G accounting 5 Characteristics of Governmental Entities To determine the cost of producing public services. 5 Absence of profit motive but mainly concerned with providing essential services to the society. GE are mainly public ownership. Capital concept in GE is not excited and it replaced by public funds. Expenditure in GE is similar to expenses in concept but different in use. Accounting matching concept in GE is not required. Decisions made – directly or indirectly – by voters' representative. 6 Unique characteristics (continued) Objective of Governmental Accounting 7 It includes both financial control and pre- & post- internal check in order to maintain assets and resources owned by GE. There are rules for preparing and implementing the state budgeting. 8 Based on the above discussion there are several of GA are listed as follows: Characteristics of Governmental Accounting 7 6 1) to measure the results of GE activities (based on the general budget) and communicate these results to the interested users for controlling and decision making. There is no direct relationship between revenues and expenditure in GE. 2) Different governmental levels take the decisions about how much to spend, and on what to spend. To provide and communicate the necessary data and information to determine financial positions, formulating policies, and making decisions. 3) Governmental Accounting provides key information to national decision makers to manage the public expenditure and how to finance these expenditure. To Apply the financial controls and pre- & post- internal check for the GE funds or the funds they manage, whether these funds are revenue, assets or rights. 4) To Rationalize the GE expenditure. The state budget can be considered a major device of helping national decision maker to administrate each expenditure and coordinate the national activities. 5) To Monitor the GE commitments and following up on their fulfilment. 8 2 13/10/2021 Governmental Entities Levels According to the Egyptian Law 127 of 1981, the GE are divided to Three levels as follows: Central Which provides non-profit services such (General) GE ministries. Level Governmental Entities Levels Similarities to the Private Sector 9 Local GE Level Which produce some of the functions of governmental polices at the local level such as Governorates, cities, districts and villages. Public G Organizations Which provide services to the society with/without low price such as post offices, railways and public transportations ….. Etc. Besides these three levels there are several special funds and special accounts that are created under special laws and special presidential decisions. 9 10 1) Operate in the same economy and compete for same resources: financial, capital, and human 2) Acquire & convert scarce resources into goods & services 3) Provide goods and services, many of which may be similar 4) Use of accounting & other information systems 5) Need to operate economically, effectively, & efficiently 10 Differences from the Private Sector Differences from the Private Sector 11 Organizational Organizational objectives Sources of financial resources Methods of evaluating performance and operating results 11 12 objectives GE Businesses Operating Motive: maximize income from revenues and other resources Operating Motive: maximize services provided from revenues and other resources Operational Focus: report quarterly but look to the longterm as well Operational Focus: operate on annual budget, so current year is of primary importance 12 3 13/10/2021 Differences from the Private Sector (continued) Sources of Financial Resources Sources GE Businesses 2. Licenses, permits, and Fines 3. Donations 4. Appropriations and grants from other governmental entities of Financial Resources Budget – allocates resources to functions Restrictions placed by providers: typical of grantors, taxes for specific purposes, & debt proceeds Holding public officials accountable for actions 14 Differences from the Private Sector (continued) Evaluating Differences from the Private Sector (continued) 15 Evaluating Performance & Operating Results GE Businesses In business, continuing a product or service determined by the success in the marketplace. Profit not a motive and frequently cannot be measured Services not found elsewhere so there is no competition. The services and goods needed are provided to all constituents regardless of their ability to pay for these goods and services 15 14 GE Resource Allocation Mechanisms Businesses raise resources Governments raise resources from sales or debt transactions – typically no distinction from sales or from capital made in sources. stock & debt transactions – must account for different They have Unique Sources such as: sources separately. 1. Involuntary contributions – taxes! (e.g., property, sales, and income taxes) 13 Differences from the Private Sector (continued) 13 Face rules and regulations not found in private sector. 16 Performance & Operating Results Special Regulations & Controls Applied to GE Organization structure – form; board composition; number & duties of personnel Personnel policies & procedures – who has power to appoint or hire personnel; tenure; termination policies; promotion policies Sources of financial resources – types and amounts of taxes, licenses, fines or fees; procedure for setting user charges Use of financial resources – purposes, including legal restrictions; purchasing procedures; budgeting methods Accounting Financial reporting – type & frequency of reports; format; recipients Auditing – frequency; who performs; scope & type; time & place 16 4 13/10/2021 Financial Report Users and Uses Users The citizenry Comparing results with legally adopted budgets Legislative and oversight bodies Assessing financial operations Investors creditors and condition 18 Governmental Accounting in Egypt has some features such as Uses Features of Governmental Accounting in Egypt 17 and results Using the cash basis in measurement of current budget items (revenues and expenditure) while it uses the accrual basis to tracking the accounting of investment budget items which called the modified accrual basis. 2) There is no depreciation of fixed assets is computed. 3) There is no calculation is made for provision and reservation. 4) There is no preparation for balance sheet is required. of Assisting in determining compliance with financerelated laws, rules & regulations Assisting in evaluating efficiency & effectiveness 17 1) 18 19 (To be continued) 19 5