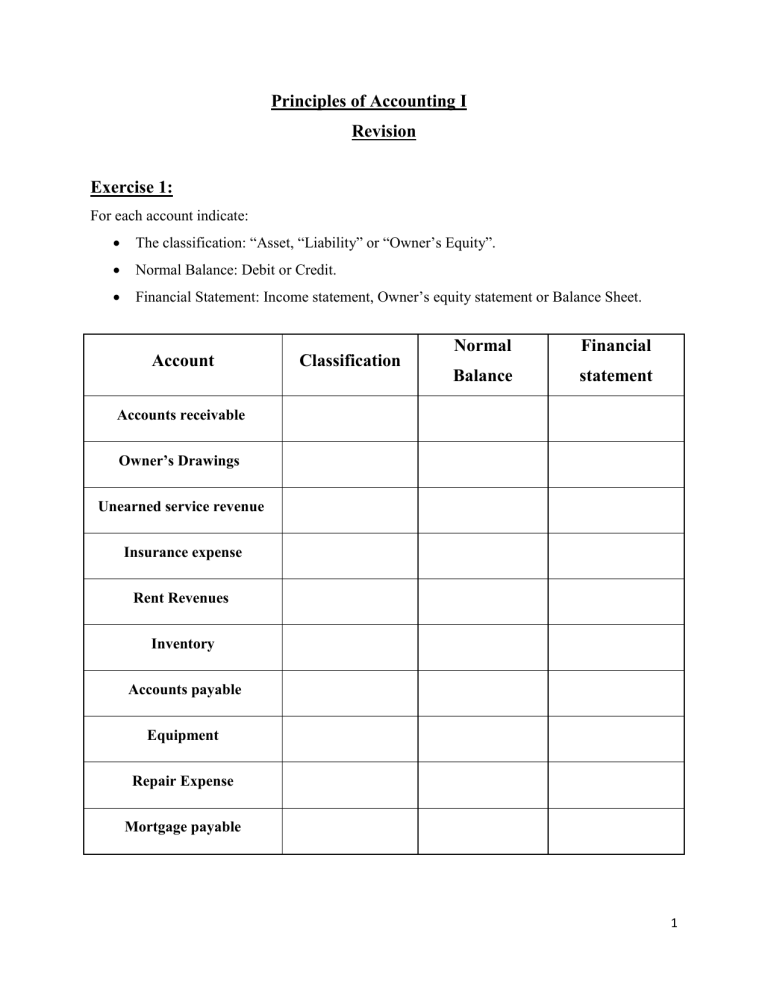

Principles of Accounting I Revision Exercise 1: For each account indicate: The classification: “Asset, “Liability” or “Owner’s Equity”. Normal Balance: Debit or Credit. Financial Statement: Income statement, Owner’s equity statement or Balance Sheet. Account Classification Normal Financial Balance statement Accounts receivable Owner’s Drawings Unearned service revenue Insurance expense Rent Revenues Inventory Accounts payable Equipment Repair Expense Mortgage payable 1 Exercise 2: Ronaldo opened a veterinary business on July 1. During August the following transactions occurred. August 2: Purchased equipment from “BioVete Company” for $5,000, paying $1,800 in cash and the balance on account. August 5: Ronaldo withdrew $1,000 cash for personal use. August 6: Paid $400 cash for August office rent. August 10: Paid $800 cash for a 1-year insurance policy. August 13: Earned revenue of $4,000 from customer, of which $2,500 is received in cash and the balance is due in 2 weeks. August 15: Paid decoration expense for $1,200 and repair expense for $600 in cash. August 20: Purchased supplies worth $1,700 with a $700 down payment. The remainder is due in 20 days. August 24: Received a $1,000 payment from customer for its due balance on August 13. August 28: Paid the salary of $1,100$ for the secretary-receptionist. Required: a- Prepare the journal entries to record each transaction. General Journal Date Account Title and Explanation Ref. Debit Credit 2 3 b. Post the “Owner’s drawing” and “Accounts payable” accounts using the three- column form of general ledger. Owner’s Drawings Date Explanation Ref Debit Credit Balance Credit Balance Accounts payable Date Explanation Ref Debit 4 Exercise 3: The below are information related to Fast company on December 31, 2015: Account receivable $3,000 Cash 7,000 Equipment 10,000 Owner’s capital Jan 1 20,000 Owner’s Drawings 1,200 Note payable 2,700 Prepaid Rent 4,700 Salaries Expense 2,200 Service Revenue 10,000 Supplies 4,000 Supplies Expense 400 Utilities Expense 200 Instructions: a) Prepare an Income Statement for the year ended December 31, 2015. b) Prepare an Owner's Equity Statement; given the Net Income for the Year 2015 is equal to $7,200. c) Prepare a Classified Balance Sheet on December 31, 2015; given the owner's capital on December, 31, 2015 is equal to $26,000. 5 6 7 Exercise 4: Given below is a list of account for Rino Company as of December 31, 2016. Each account shows a normal balance. Account Account Building 9,500 Cash 5,500 Accounts payable 2,000 Tax expense 2,000 Mr. Rino’s Capital 20,000 Service Revenue 9,000 Owner’s drawing 4,000 Utilities expense 1,000 Notes payable 1,500 Equipment 10,500 Instructions: Prepare a trial balance for December 31, 2016. 8