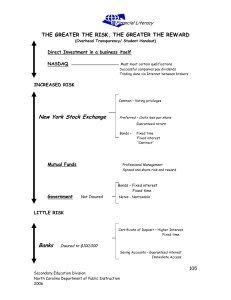

INCLUSION OF FINANCIAL LITERACY AS A PART OF CURRICULAM AMOUNGST COLLEGE STUDENTS. OBJECTIVES 1. To understand importance of financial literacy. 2. To find out the awareness of financial literacy among college students. 3. To analyse the hindrances found to include financial literacy as a part of curriculum. 4. To provide suggestive measures. INTRODUCTION Financial Literacy Financial literacy is critical because it equips us with the knowledge and skills, we need to manage money effectively. It’s one thing that will impact almost every aspect of your life, yet many people do not have the knowledge they should and even those who do often don’t share it with their children. The current pandemic is a generational event that has caused many to reflect on their financial situation and look closely at their financial habits. According to a recent poll conducted by the National Endowment for Financial Education (NEFE), 88% of Americans say the COVID-19 crisis is causing stress in their personal finances. These current obstacles create an opportunity for all of us to improve our financial literacy. The greatest generation of savers this country has ever seen was a product of the great depression. This is no coincidence. The great depression helped shape that generation’s perspective on money. It created a desire for financial security. It created a desire for financial literacy. Financial literacy is the possession of the set of skills and knowledge that allows an individual to make informed and effective decisions with all of their financial resources. Raising interest in personal finance is now a focus of state-run programs in countries including Australia, Canada, Japan, the United States, and the United Kingdom. Understanding basic financial concepts allows people to know how to navigate in the financial system. People with appropriate financial literacy training make better financial decisions and manage money better than those without such training. The Organization for Economic Co-operation and Development (OECD) started an inter-governmental project in 2003 with the objective of providing ways to improve financial education and literacy standards through the development of common financial literacy principles. In March 2008, the OECD launched the International Gateway for Financial Education, which aims to serve as a clearinghouse for financial education programs, information and research worldwide. In the UK, the alternative term "financial capability" is used by the state and its agencies: the Financial Services Authority (FSA) in the UK started a national strategy on financial capability in 2003. The US government established its Financial Literacy and Education Commission in 2003. Financial literacy is the ability to make informed judgements and effective decisions regarding the use and management of money. The pillars of financially literacy include: 1. Budgeting Budgeting is the process of creating a plan to spend your money. This spending plan is called a budget. Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. Since budgeting allows you to create a spending plan for your money, it ensures that you will always have enough money for the things you need and the things that are important to you. Following a budget or spending plan will also keep you out of debt or help you work your way out of debt if you are currently in debt. The essential features of a budget are: 1. Budget is a financial statement, but it can be statement of quantities also with or without financial figures. 2. Budget is prepared for a specific period, and it is prepared generally before the period begins. 3. Budget is a plan of the policy to be pursued during the budget period. 4. The purpose of the budget is to attain a given objective. It is a tool of management for planning its future activities including estimate of sales, expenditure production etc. It is done for indicating the expected results of the business and the possible future line of action to be followed for the attainment of such results. Expected results are projected in financial terms or in other numerical terms like units of products, man hours, machine hours etc. Budgeting or Budget making may be defined as “a forecast of programme of operations based on expected operating efficiency.” Budget should be based on estimated future requirement for a definite period of time. It should be prepared by taking the help of previous statistical data. Thus, budgeting can be defined “as forecasting and preplanning for the next period using past experience, market trends and present position”. Budget provides predetermined standard of performance for the guidance of the efforts and activities in the business. As budgets provide standards of performance, they usually become the basis for control. Control used for the execution of budgets is what is called “budgetary control”. Thus budgeting is concerned with the planning function of management, while “budgetary control” involves the function of controlling in the organisation. Budget as a Means for Planning, Coordination and Control: Since planning is looking ahead and anticipate difficulties expected and their solution. Budget plans and forecast the expenditure and performance as regards production, sales, purchases, plant utilisation etc. As coordination means weaving together the segments of the organisation so as to operate at the most efficient level and produce maximum profit. This is achieved as all the sections like sales, purchase, production, finance, personal etc. work together to achieve common goals as defined in the budget. Controlling means by systematic appraisal of results to ensure that actual and operations coincide, and remedial actions are taken if there is any deviation. The budget means, by which plans are regularly compared with actual results regarding expenses and performances. Objectives of Budget: A system of budget is necessary to plan and control the activities pertaining to production and sales. The objectives of preparing a budget are as follows: (i) To Formulate a Plan of Action: The plan of action depends upon the policy that the business decides to execute. (ii) To Facilitate Central Control: Budget is a means for the top management to control the business operations centrally. For the proper implementation of the policy and achieving the objectives, here is a need for delegation of authority and responsibility to the executives, based on the blue-print and directions required for execution. Budgets grow from below but are controlled from above. (iii) To Provide a Means of Co-Ordination: Although different budgets may be prepared for different activities, e.g., raw material budget, production budget, sale budget, etc., yet co-ordination between the different activities is provided by the master budget. Types of Budgets: The following are the different types of budgets: (i) Sale Budget: In budgetary programme, sale is a starting point, as sales factor becomes the key factor in the ordinary course in majority of cases. According to W.W. Bigg, “This is probably the most important budget, as it is usually the most difficult to forecast or attain.” This budget is prepared by the sales manager. The budget is prepared to show which finished products can be sold in what quantities and at what prices. And it may be prepared (a) product-wise, (b) territory-wise (c) customer-wise, (d) period-wise, etc. The sale budget should show the following: • Sales estimate for the period; • Area-wise analysis of estimated sales; • The methods of increasing sales if the sales are shown decreased over the past period; and • Cost of additional sales-promotion activities etc. (ii) Production Budget: It is based on sales budget, as it has to provide for the output needed to meet the requirement of the sales budget. Production budget is prepared in two parts—one showing the estimates in volume or quantities, and the other showing production costs. It helps in the best utilisation of the business resources available for production, reduction in production costs by eliminating wastage, etc. (iii) Raw Material Budget: Raw material budget is based upon production budget, as this budget provides for the materials needed for production. The budget is useful from the following points of view: (i) It helps the purchase department in planning for the purchases. (ii) It helps in fixing minimum, maximum and ordering limits of materials. (iii) It helps to keep inventory under control. (iv) Labour Budget: It is also a part of production budget like raw material budget. The labour requirement is first ascertained in terms of grades and trades of workers and their supply through the personnel department. The labour budget should be prepared both for direct and indirect labour. (v) Overhead Budget: This budget helps in the preparation of production budget. All the indirect expenses pertaining to production, office and administration, selling and distribution are shown separately under the budget and their information are collected from their concerned departments. (vi) Development and Research Budget: This budget is a long-term budget prepared to meet the expanding needs of the business and to keep in line with the latest developments and techniques of production. (vii) Cash Budget: Cash budget is based on cash forecasts or estimates which give information as to what funds would be available at what times, and whether the funds so available would meet the requirement of the time. So before preparing cash budget, a statement of cash forecast should be prepared. (viii) Master Budget: A master budget is prepared for the business as a whole, combining all the budgets for a period into this budget. In other words, a master budget is the co-ordinated and summarised budget of the entire enterprise. (ix) Fixed Budget: Fixed budget is one which remains unchanged in spite of changes in volume of output or level of capacity. This budget is prepared for a specific planned activity and it is not adjusted to activity level attained. (x) Flexible Budget: Flexible budget is one which is prepared in such a manner as to facilitate determination of the budgeted cost for any level of activities. It is also known as Variable Budget. 2. Savings Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account, a pension account, an investment fund, or as cash. Saving also involves reducing expenditures, such as recurring costs. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher; in economics more broadly, it refers to any income not used for immediate consumption. Saving does not automatically include interest. Saving differs from savings. The former refers to the act of not consuming one's assets, whereas the latter refers to either multiple opportunities to reduce costs; or one's assets in the form of cash. Saving refers to an activity occurring over time, a flow variable, whereas savings refers to something that exists at any one time, a stock variable. Importance of Saving Money: Money is something very much valuable and required for the survival. It’s not just one piece of paper but it holds some value, a value that has to be understood by every individual. If we quote it into a particular definition then money is, “A measure of value, medium of exchange and means of payment consisting of notes, coins and paperless payment systems like smart cards.” It is not about some class of people but about everyone, be it the lower class or the Richie rich. Money holds so much that we even fail to anticipate. It holds power, ability to create jealousy, manipulation, greed and what not. Need of Saving Money Money by far is the most necessary thing required after basic necessities i.e. food, shelter and clothing. It is the fundamental requisite for a middle-class person to meet his ends and for the higher class to get his luxurious demands fulfilled. The fact that shouldn’t be forgotten is that that you need to save for future crisis, for the business problems, for travel, for any sort of urgency, for fulfilling a long-cherished dream or for anything. Money is a prized possession though it’s worth is subjective but anyhow it is needed in every next step and for that you need to prioritize your needs and also understand how much savings play an important role in securing future. Importance of Saving Money The time you spend your money you may forget your limits but you got to plan first and be rational before you just give your money to something that is just as good as a scrap. This is for a generation existing right now. We argue and claim that we understand the worth of it but well we don’t. The day we start earning then maybe we might turn out to be good savers. As we say we don’t understand things until we ourselves face it. Besides this being secured by parents is great but depending on them is not happening so we need to pour senses and start saving. Saving maybe a tough task though but you can always have alternative plans like for instance this is for someone who cannot keep cash on hand for long as he’s going to spend it, then buy a piggy bank or get yourself one bank account. You can give it to your parents or let’s just presume that you’ve good self control then you start saving ten percent every month from your expenses. So this is how you manage your finances. The old school generation or the one who are not the nineties kid then they very well know the importance of saving and its perks. They have had grandfather or grandmother who would have given better techniques for that. But we as in everyone not just one particular age group; the ones who aren’t successful in saving we need to work from scratch. We should start asking prices, compare them, stop running behind brands, go for discounts and sale, use coupons, avoid spending on junk food and last but not the least try bargaining even when we fail n number of times; surely, we will master that art. So well it definitely is important to save as crisis never come with alarms. There is a crowd existing with a thought that we have one life so why think twice but well this doesn’t hold true in case of money. You always should think twice before spending it. It’s not about restricting yourself from living blissfully but prioritizing the needs. The saved money may turn out to help you some day when it’s the vital need for your life and then you would be thankful to yourselves. Obligations can help but being cautious is more helpful. 3. Investment An investment is an asset or item acquired with the goal of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time. When an individual purchases a good as an investment, the intent is not to consume the good but rather to use it in the future to create wealth. An investment always concerns the outlay of some asset today—time, money, or effort—in hopes of a greater payoff in the future than what was originally put in. Types of Investments Economic Investments Within a country or a nation, economic growth is related to investments. When companies and other entities engage in sound business investment practices, it typically results in economic growth. Investment Vehicles An investment bank provides a variety of services to individuals and businesses, including many services that are designed to assist individuals and businesses in the process of increasing their wealth. Investment banking may also refer to a specific division of banking related to the creation of capital for other companies, governments, and other entities. Investment banks underwrite new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors. Investment banks may also provide guidance to companies who are considering issuing shares publicly for the first time, such as with an initial public offering (IPO). 4. Managing Debt Everyone with even a little bit of debt has to manage their debt. If you just have a little debt, you have to keep up your payments and make sure it doesn’t get out of control. On the other hand, when you have a large amount of debt, you have to put more effort into paying off your debt while juggling payments on the debts you’re not currently paying. Ways to manage Debt 1. Know Who and How Much You Owe. 2. Pay Your Bills on Time Each Month. 3. Create a Monthly Bill Payment Calendar. 4. Make at Least the Minimum Payment. 5. Decide Which Debts to Pay off First. 6. Pay off Collections and Charge-Offs. 7. Use an Emergency Fund to Fall Back On. 8. Use a Monthly Budget to Plan Your Expenses. 9. Recognize the Signs That You Need Help. Shares Stocks are securities that represent an ownership share in a company. For companies, issuing stock is a way to raise money to grow and invest in their business. For investors, stocks are a way to grow their money and outpace inflation over time. When you own stock in a company, you are called a shareholder because you share in the company's profits. Public companies sell their stock through a stock market exchange, like the Nasdaq or the New York Stock Exchange. (Here's more about the basics of the stock market.) Investors can then buy and sell these shares among themselves through stockbrokers. The stock exchanges track the supply and demand of each company's stock, which directly affects the stock's price. Stock prices fluctuate throughout the day, but investors who own stock hope that over time, the stock will increase in value. Not every company or stock does so, however: Companies can lose value or go out of business completely. When that happens, stock investors may lose all or part of their investment. That's why it's important for investors to spread their money around, buying stock in many different companies rather than focusing on just one. If you have a 401(k), you probably already own stock, though you might not realize it. Most employer-sponsored retirement plans invest in mutual funds, which can hold a large number of company stocks pooled together. National Stock Exchange (NSE) National Stock Exchange of India Limited (NSE) is the leading stock exchange of India, located in Mumbai, Maharashtra. NSE was established in 1992 as the first dematerialized electronic exchange in the country. NSE was the first exchange in the country to provide a modern, fully automated screen-based electronic trading system which offered easy trading facilities to investors spread across the length and breadth of the country. Vikram Limaye is Managing Director & Chief Executive Officer of NSE. National Stock Exchange has a total market capitalization of more than US$2.27 trillion, making it the world's 11th-largest stock exchange as of April 2018. NSE's flagship index, the NIFTY 50, a 50 stock index is used extensively by investors in India and around the world as a barometer of the Indian capital market. The NIFTY 50 index was launched in 1996 by NSE. However, Vaidyanathan (2016) estimates that only about 4% of the Indian economy / GDP is actually derived from the stock exchanges in India. Unlike countries like the United States where nearly 70% of the country's GDP is derived from large companies in the corporate sector, the corporate sector in India accounts for only 12-14% of the national GDP (as of October 2016). Of these only 7,800 companies are listed of which only 4000 trade on the stock exchanges at BSE and NSE. Hence the stocks trading at the BSE and NSE account for only around 4% of the Indian economy, which derives most of its income-related activity from the socalled unorganized sector and household spending. Economic Times estimates that as of April 2018, 6 crore (60 million) retail investors had invested their savings in stocks in India, either through direct purchases of equities or through mutual funds. Earlier, the Bimal Jalan Committee report estimated that barely 1.3% of India's population invested in the stock market, as compared to 27% in the United States and 10% in China. Bonds Organizations may borrow funds by issuing debt securities named as bonds, having a fixed maturity period (one year or more) and pay a specified rate of interest (coupon rate) on the principal amount to the holders. Bonds have a maturity period of more than one year which differentiates it from other debt securities like commercial papers, treasury bills and other money market instruments. A bond is a debt instrument, usually tradable, that represents a debt owed by the issuer to the owner of the bond. Most commonly, bonds are promises to pay a fixed rate of interest for a number of years, and then to repay the principal upon maturity. Types of Bonds: 1. Coupon Bonds: It pays a stated coupon at periodic intervals prior to maturity. It also pays the bond’s face value at maturity. 2. Perpetual Bonds: It has no maturity date. It pays a stated coupon at periodic intervals. 3. Zero Coupon Bonds: Zero Coupon Bonds are issued at a discount to their face value and at the time of maturity, the principal/face value is repaid to the holders. No interest (coupon) is paid to the holders and hence, there are no cash inflows in zero coupon bonds. The difference between issue price (discounted price) and redeemable price (face value) itself acts as interest to holders. The issue price of Zero Coupon Bonds is inversely related to their maturity period, i.e. longer the maturity period lesser would be the issue price and vice-versa. These types of bonds are also known as Pure Discount Bond or Deep Discount Bonds. Generally speaking, deep discount bonds have a comparatively lengthy maturity period. 4. Convertible Bonds: The holder of a convertible bond has the option to convert the bond into equity (in the same value as of the bond) of the issuing firm (borrowing firm) on pre-specified terms. This results in an automatic redemption of the bond before the maturity date. The conversion ratio (number of equity of shares in lieu of a convertible bond) and the conversion price (determined at the time of conversion) are pre-specified at the time of bonds issue. Convertible bonds may be fully or partly convertible. For the part of the convertible bond which is redeemed, the investor receives equity shares and the nonconverted part remains as a bond. 5. Amortising Bonds: Amortising Bonds are those types of bonds in which the borrower (issuer) repays the principal along with the coupon over the life of the bond. The amortising schedule (repayment of principal) is prepared in such a manner that whole of the principle is repaid by the maturity date of the bond and the last payment is done on the maturity date. For example – auto loans, home loans, consumer loans, etc. Bitcoin Bitcoin is continuously increasing in popularity across the world. The crucial difference between actual cash and bitcoin is that it can be utilised without the need for internet access. It is very tough to identify the address of the users until they connect a bitcoin address to their name. The users are not tracked by bitcoin usually, although the addresses where the money is stored are continuously tracked. There are two vital parts of every address, for instance, private and public. The bitcoin address is built from the public key. It is very similar as compared to an email address, anyone can check-up and provide bitcoins. The private key is known to be identical to that of an email password since it is possible to send bitcoins with the help of remote access only. That’s why it is essential to keep the private key confidential or hidden. To send bitcoins, it is required to verify to the network that you acquire the private key of that particular address without the private key being revealed. It can be done with a specific mathematics branch referred to as public-key cryptography. Whereas the identification of the user possessing bitcoins is known as a public key. The public access and the ID number are very alike. For an individual to send you bitcoins, they require your bitcoin address. It is known to be another version of the public key that can be typed and read effortlessly. Bitcoin is also known to be a new type of cash. It is predicted to grow at a rapid pace over the years, along with its value. It is typically purchased as an investment by numerous industries and people. Mutual funds: Mutual fund is a mechanism of pooling resources by issuing units to investors and investing their funds in securities to get a good return. Out of the return received, the mutual fund keeps a margin for its costs and distributes the profits to the investors. These funds have to be invested according to the objectives provided in offer documents. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced. Unit Trust of India was the first mutual fund which was started in India. Units as a form of investment is issued by the Unit Trust of India which is a public sector financial institution. The SEBI Regulation Act of 1996 has defined a mutual fund as one, which is constituted in the form of a Trust under the Indian Trust Act, 1882. The structure of a mutual fund consists of an asset management company, sponsor and board of trustees. These are explained below. Features of Mutual Funds: Management: The professional consultants have the specialized knowledge due to expertise and training in evaluating investments. The have superiority in managing the portfolios. Small Saver: Mutual funds accommodate investors who don’t have a lot of money to invest by setting relatively low rupee value for initial purchases, subsequent monthly purchases, or both. Liquidity: Mutual fund investors can readily redeem their shares at the current NAV plus any fees and charges assessed on redemption at any time. Investments made in units give the advantage of liquidity to the investor. The investor may purchase the units and sell them at any time in an open-ended scheme. The small investor does not even have to find any other investor in the stock exchange or wait for the liquidity of his funds. The terms of payment on re-purchase are low. Diversification: Diversification reduces the risk because all stocks may not move in the same direction in the same proportion at the same time. Share prices can move up or down. The investor should be aware of these risks while making an investment decision. Even with risks, it is expected that the mutual funds are able to perform better than an individual because a careful selection of securities over a diversified portfolio covering large number of companies and industries is made and the portfolio is constantly reviewed. Spreading investments across a wide range of companies and industry sectors can help to lower risk. Analysis and Selection of Securities: Mutual funds select a large share of equities in the case of growth schemes. Although this has a greater risk and potential for capital appreciation is higher in growth schemes. Besides growth schemes, mutual funds also have income schemes. When they have income schemes, they invest in securities of a guaranteed return. They generally select a large share of fixed income securities like debentures and bonds. All growth schemes are closed-ended and income schemes are either closed ended or openended.