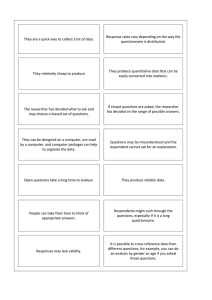

MODULE V – MARKET ANALYSIS This is the lifeblood of virtually every project study. While profitability is generally the focal point of a project study, the question of demand is the most basic issue. Obviously, there can be no discussion of profitability or of the other aspects of feasibility evaluation, if there is no demand of the product or services being considered. It is therefore imperative that the market study be given first-hand concern and sensitivity. The market study seeks to determine the following: 1. 2. 3. 4. 5. 6. The industry and competitor analyses The size, nature, and growth of the total demand for the product/services; The description and price of the product to be sold; The supply situation and the nature of the competitors; The diff. factors affecting the market of the product/services and; The appropriate marketing program for the project. a. Industry Analysis – specifies the particular market industry to where the product or services belong. (e.g. Bread – baking industry, breakfast foods, etc.) b. Competitor Analysis – specifies the direct and indirect competitors of the product or services, their distribution style, market demands, mfg. process., etc. (e.g. Cold desserts – Magnolia, Presto, Dairy Queen, Razon’s, Goldilock’s, McDonald’s, etc.) c. Market Analysis Segmentation as to: Demographic, Technological, Socio-Cultural, Global, Political/Legal and Economic issues. Marketing Aspect format A. B. C. D. E. General Assumptions Industry analysis Competitor analysis Market analysis 1. Historical demand-Supply a. Method/s of data acquisition (interview, survey questionnaire, others) b. Projections and analysis c. Market gap d. Market share Marketing strategies Industry Analysis/es This chapter referenced to the specific industry where your business will be held to. Samples of which are the following: Manufacturing Industry Food Staple Food (taken in during Breakfast, Snack, Lunch/Dinner) Drinks (Beverages, Alcohol, Processed Water, Energy Enhancers, Juices) Sweets and Desserts (cold items, hot desserts, cakes and pastries, cookies, candies) Processed Dairy Products (milk, butter, margarine) Others (Processed Meat and Produce, Exotic Meat Products) Condiments (sauces, cooking additives, taste enhancer) Machine/Aparratus/Device (Electrical & Mechanical devices and machine) Novelty Products (Gift items – metal/ceramic/plastic items) Appliances (Electrical, mechanical) Non-food (Textile & Clothing, Fibrous materials, Tools) Packaging Materials (Paper, Plastics, Rubber, Other Materials) Scientific Products (Engineering Materials) Service Industry Expert Services (Engineering Design, Legal Assistance, Patent Assistance, Hotel/Travel Booking, Ticketing, Transportation Services, Document Assistance, Event Organization, Brokerage, Food Services) Non-Expert Services (Motorized/Non-Motorized Deliveries, Mail Services, Stores and Merchandising Business). As an example, the business could be in the Food Manufacturing Industry of condiments specializing in the preparation, production and distribution of “Food Taste Enhancer” like Monosodium Glutamate (MSG). Competitor Analysis Competitors are broken down into two distinct classifications – the Direct Competitor and the Indirect Competitor. The former describes that their products/services are directly the same as to its purpose and output. If you are trying to establish a business that produces television, it is therefore vividly ascertain that your direct competitors are Sony, Sharp, Panasonic, Black and Decker, etc. However, due to the technological advancement, movies and other media coverage can now be viewed in other Hi-Tech gadgets like cellular phones and so on, these companies may be presumed as your Indirect Competitors depending on the direction and result of interviews and/or survey. This section defines the top producers/performers within the same industry where your potential business venture could be included. It may include in the text the name of the business competitor, there office/plant address, total manpower, organization type, production capacity, sales and distribution strategies and others that could be vital for the creation of your business’ marketing strategies. Market Analysis This section depicts the cautious study of the buying public. The sensitivity may vary depending on the items/services being offered, the capacity of the buyer to purchase/avail, and other factors that may affect the conditions of acceptance. Historical Market Demand/Supply We defined demand as the amount of some product that a consumer is willing and able to purchase at each price. This suggests at least two factors, in addition to price, that affect demand. “Willingness to purchase” suggests a desire to buy, and it depends on what economists call tastes and preferences. If you neither need nor want something, you won’t be willing to buy it. “Ability to purchase” suggests that income is important. Professors are usually able to afford better housing and transportation than students, because they have more income. The prices of related goods can also affect demand. If you need a new car, for example, the price of a Honda may affect your demand for a Ford. Finally, the size or composition of the population can affect demand. The more children a family has, the greater their demand for clothing. The more driving-age children a family has, the greater their demand for car insurance and the less for diapers and baby formula. These factors matter both for demand by an individual and demand by the market as a whole. Exactly how do these various factors affect demand, and how do we show the effects graphically? To answer those questions, we need the ceteris paribus assumption. In economics, the assumption of ceteris paribus, a Latin phrase meaning "with other things the same" or "other things being equal or held constant," is important in determining causation. It helps isolate multiple independent variables affecting a dependent variable. Causal relationships among economic variables are difficult to isolate in the real world since most economic variables are usually affected by more than one cause, but models often depend on an assumption of independent variables. In the real world, for instance, it would be nearly impossible to determine the causal relationship between the price of a good (dependent variable) and the number of units demanded of it (independent variable), while also taking into account other variables that affect price. For example, the price of beef may rise if more people are willing to purchase it, and producers may sell it for a lower price if fewer people want it. But prices of beef may also drop if, for instance, the price of land to raise cattle also drops, making it difficult to assume it was demand alone that caused the price change. However, if these other variables, such as prices of related goods, production costs, and labor costs are held constant under the ceteris paribus assumption, it is simpler to describe the relationship between only price and demand. However, not all that has willingness to buy will actually buy the product or avail of the services. Therefore, an analyst shall also consider some percentage for these potential buyers. Market Supply refers to the production and availability of products/services created by the existing competitors. Although it is very hard to acquire such data and information, certain methods can still be applied to estimate the availability of the same using various techniques. The information can be attained from the conduct of series of interviews, product sampling and survey questionnaires. 1. Historical Demand These are records of previous years’ data/information relevant to the specific area (products/services) that an individual would like to search. This is commonly used to generate new information for future developments, similarly sales, trends, purchases, material availability, and others. Data/Information acquired shall be explicitly described whether in descriptive analysis (describing the data garnered using mean, median, mode, frequency distribution, range, and standard deviation) or thru inferential analysis (test the validity of the hypothesis and identifies standard errors). Requirement for the course: a 3-year actual historical demand based on electronic or personally acquired data. Forecasted demand/supply & factors considered in preparing the projections This refers to the forecasting of the segmented data from the electronic surfing or personally acquired data from various credible sources like the Philippine Statistics Authority (PSA), National Economic Development Authority (NEDA), Department of Trade and Industry (DTI), Board of Investments (BOI), Local Government Units (LGUs) and other national and local government agencies. Requirement for this section is a comparative demand projection analysis of at least 3 common statistical tools and analysis of choosing the best results garnered from it. The following are sample statistical tools that can be used for projections: a. b. c. d. e. f. Straight Line method Exponential Smoothing method Semi-Log method Simple/Multiple Linear Regression analysis Seasonal Indices Others Technique Use Math Invlolved Data Needed Straight Line Moving Average Constant Growth Rate Repeated Forecasts Compare 1 independent with 1 dependent variable Compare more than 1 independent variable with 1 dependent variable Minimum Level Minimum Level Historical Data Historical Data Statistical knowledge required Sample of relevant data Statistical knowledge required Sample of relevant data Simple Linear Regression Multiple Linear Regression Brgy. 2. Trgt Mkt % to total Milagrosa 12,000 40.00% 160 San Antonio 10,000 33.33% 133 Sto Tomas 8,000 26.67% Total 30,000 100.00% 1. Slovin’s Formula = 400 (normally) 106 Convenience Sampling = 100 surveys Survey contents Microchip What are your preferences in purchasing a microchip? Storage Speed Temperature Tolerance Replacement availability Lower Price When do u usually buy michrochips? (How many times per year do u buy micros) At what price do u usually buy the micros? P500 P600 P750 P900 What brand do u usually prefer? Intel Microshift Delta Silicon Valley No preference Current and potential product/service consumers and their locations From the word itself, potential buyers are those individuals, group of individuals, business entities and government agencies who are willing and capable of purchasing the product or services being offered by the technopreneur. Location shall therefore be established (e.g. NCR, Luzon Island, Central Visayas, ARMM, etc.) and categorize specific target market of the business as to age, gender, purchasing capability/capacity, etc. Market Gap Refers to the difference between the market demand and the market supply If there is a market need of about 10M units of a certain product/service and competitors are only providing 8M units, the market gap of 2M can be considered in this business venture as potential buyers. A simple is as follows: Gap = Demand – Supply Market Share Depending on the outcome of the marketing study on Demand-Supply previously discussed, the market share can be analyzed from the remainder as potential market share of the company. However, the potential difference discussed may not be suitable to compute for various factors, Some of the factors to be considered are – production/service capacity, quality, Financial capability. Still, the most important thing to note is that your company is new in the industry and consequently not known as a true competitor. As for this reason, it is advisable to limit the percentage of the market share. This is the effect of the external factors being felt by new comers in the industry. Market Share = (Gap + other factors) X Potential Target Market Percentage Remember: Reflect your Potential Target Market in accordance with your production capacity. The market survey It is form of data acquisition for demand-supply issues. Normally, new comers are studying the market area thru survey and other means. The result of the survey can be used to further the forecasting requirements of the entity. Some of the survey measurements are survey questionnaire, interviews, sampling, etc. Marketing Program A marketing program is a coordinated, thoughtfully designed set of activities that help you achieve your marketing objectives. Your marketing objectives are strategic sales goals that fit your strengths and are a good way to stretch your business in its current situation. In order to build strong customer relationships and maximize your sales, you need to put every possible marketing tool to work for you. Marketing is a broad field, encompassing elements as diverse as advertising, brand and logo design, sales calls, Web sites, brochures, packaging, shows, conferences and other events, and so on. The more tools provided, the better results to be obtained but, the variety and complexity of choices makes getting organized and focused hard. Identifying the following to achieve better program results 1. Present marketing practices of the competitor 2. Selling organizations, Terms of sale, Channels of distribution, Location of sales outlets, Transportation and storing facilities 3. Packaging of the product 4. Promotional advertising schemes 5. Product logistics Tips for creating surveys A good survey requires good planning, good questions and thoughtful answers choices. The better your write your survey then the better your responses will be. 1. Primarily ask closed-ended questions. Depending on the size of your survey and your objectives multiple choice and closed questions are usually the best question type. This is because open text questions require the respondent/participant more thought, effort, and time to answer. Too many of these types of questions will cause your participants to abandon the survey without answering. If possible, put your open questions on in a separate group at the end of your survey/form. If the respondent/participant drops out at this point, then you still have their responses from the rest of the survey. 2. Ask neutral questions. Asking leading questions or putting opinions in your questions will influence respondents’ answers. Say you asked the question: “We think the best make of car is BMW, what do you think?” This is a leading question that would encourage people to choose BMW from the options. The question conveys an opinion! You could better write the question as “What do you think is the best car manufacturer?” then have BMW in the answers, you can also use randomization to reduce bias. 3. Keep the question answers balanced. Respondents need a way to provide a balanced and honest opinion, otherwise, the credibility of their responses is dubious. Answer choices included can be a source of bias. For example, the following answer options are used when asking respondents how good your customer service reps are: (a). Extremely helpful (b). Very helpful (c). Helpful. You’ll notice that there no choice for the participant to say that customer service is crap! We need to make the choices a more balanced set of answer options by giving the participant choices d. Unhelpful e. Very unhelpful 4. Only ask for one thing at a time. Asking for more than one thing in a question will confuse the respondent. It is likely that they will choose an answer that doesn’t reflect their opinion. A common type of “double-barreled” question is asking respondents to assess two different things at the same time. For example: “How would you rate the brand and performance of your car?” The brand and performance of your car are two separate issues. Having both options in the same question will influence the participant to either evaluate one or to skip the question. The best way forward with this is to split the question into sub-questions. 5. Don’t keep asking the same question over and over. If someone believes that you are asking the same question or similar over and over they will not engage well with the survey and the results will become skewed and they will answer your questions without putting much thought into them. You can address this in the planning stage by planning to vary questions you ask, how you ask them, changing the order of the questions that are similar. 6. Do not force participants to answer all of the questions. Some of the participants may find the answers difficult or may not have the answers. There may be some questions they can’t answer. Keep this in mind when deciding which questions require answers. And unsure make questions optional. Forcing respondents to answer questions they can’t is likely to make them abandon the survey or choose a random answer to get past the question. 7. Test, test, and test again! Sending an untested survey can be fatal. It is far simpler to correct an error in your survey prior to it being sent to participants. To assist with your testing, ask friends’ family, and colleagues to take the survey and give you feedback on it. Most importantly test it yourself several times. 8. Use logic. Don’t keep the participant answering irrelevant questions. When there may be a selection of the questions that depend upon the answer to another question, use logic to skip over these questions. 9. Use images. A picture is worth a thousand words. To get your message across better, you can use videos and images in your questions. 10. Keep the survey short. Attempt to keep your survey as short as possible by combining questions and data points. Do your questions more than meet the survey objectives? If the participant feels that you are wasting their time or the survey is going on too long, they’re likely to abandon or choose random answers for the remainder of the survey. Use logic. Don’t keep the participant. https://a1surveys.com/how-to-make-a-survey-or-questionnaire/ Survey Questionnaire Definition A questionnaire is a research tool used to conduct surveys. It includes specific questions with the goal to understand a topic from the respondents' point of view. Questionnaires typically include closed-ended, open-ended, short-form, and long-form questions. The questions should always remain as unbiased as possible. For instance, it's unwise to ask for feedback on a specific product or service that is still in the ideation phase. To complete the questionnaire, the customer would have to imagine how they might experience the product or service rather than sharing their opinion about their actual experience with it. Rather, ask broad questions about the kinds of qualities and features your customers enjoy in your products or services and incorporate that feedback into new offerings your team is developing. In-Depth Interviews vs. Questionnaire Questionnaires can be a more feasible and efficient research method than in-depth interviews. They are a lot cheaper to conduct because in-depth interviews can require you to compensate the interviewees for their time and provide accommodations and travel reimbursement. Questionnaires also save time for both parties because customers can quickly complete them on their own time and employees of your company don't have to spend time conducting the interviews. They can capture a larger audience than in-depth interviews can which makes them much more cost-effective. While it would be impossible for a large company with upwards of tens of thousands of customers to interview every single customer in person, the same company could potentially get close to receiving feedback from their entire customer base when using an online questionnaire. When considering your current products and services, as well as ideas for new products and services, it's essential to get the feedback of the existing and potential customers as they are the ones who have a say in whether or not they want to make a purchasing decision. Survey vs. Questionnaire A questionnaire is a tool that is used to conduct a survey. A survey is the process of gathering, sampling, analyzing, and interpreting data from a group of people. The confusion between these terms most likely stems from the fact that questionnaires and data analysis were treated as very separate processes before the internet became popular. Questionnaires used to be completed on paper, and data analysis occurred later as a separate process. Nowadays, these processes are typically combined since online survey tools allow questionnaire responses to be analyzed and aggregated all in one step. However, questionnaires can still be used for reasons other than data analysis. Job applications and medical history forms, among others, are examples of questionnaires that have no intention of being statistically analyzed. This is the key difference between questionnaires and surveys — they can exist together or separately. https://blog.hubspot.com/service/questionnaire 1. Define the purpose of the survey Before you even think about your survey questions, you need to define their purpose. The survey’s purpose should be a clear, attainable, and relevant goal. For example, you might want to understand why customer engagement is dropping off during the middle of the sales process. Your goal could then be something like: “I want to understand the key factors that cause engagement to dip at the middle of the sales process, including both internal and external elements.” Or maybe you want to understand customer satisfaction post-sale. If so, the goal of your survey could be: “I want to understand how customer satisfaction is influenced by customer service and support post-sale, including through online and offline channels.” The idea is to come up with a specific, measurable, and relevant goal for your survey. This way you ensure that your questions are tailored to what you want to achieve and that the data captured can be compared against your goal. SMART = specific, measurable, attainable, realistic, time-bounded 2. Make every question count You’re building your survey questionnaire to obtain important insights, so every question should play a direct role in hitting that target. Make sure each question adds value and drives survey responses that relate directly to your research goals. For example, if your participant’s precise age or home state is relevant to your results, go ahead and ask. If not, save yourself and your respondents some time and skip it. It’s best to plan your survey by first identifying the data you need to collect and then writing your questions. You can also incorporate multiple-choice questions to get a range of responses that provide more detail than a solid yes or no. It’s not always black and white. 3. Keep it short and simple Although you may be deeply committed to your survey, the chances are that your respondents... aren’t. As a survey designer, a big part of your job is keeping their attention and making sure they stay focused until the end of the survey. Respondents are less likely to complete long surveys or surveys that bounce around haphazardly from topic to topic. Make sure your survey follows a logical order and takes a reasonable amount of time to complete. Although they don’t need to know everything about your research project, it can help to let respondents know why you’re asking about a certain topic. Knowing the basics about who you are and what you’re researching means they’re more likely to keep their responses focused and in scope. 4. Ask direct questions Vaguely worded survey questions confuse respondents and make your resulting data less useful. Be as specific as possible, and strive for clear and precise language that will make your survey questions easy to answer. It can be helpful to mention a specific situation or behavior rather than a general tendency. That way you focus the respondent on the facts of their life rather than asking them to consider abstract beliefs or ideas. Different question types will also allow for a variety of clear answers that help to uncover deeper insights. Good survey design isn’t just about getting the information you need, but also encouraging respondents to think in different ways. Don’t do this! How often are you particularly averse to risky situations? Never Rarely 5. Ask one question at a time Sometimes Often All the time Although it’s important to keep your survey as short and sweet as possible, that doesn’t mean doubling up on questions. Trying to pack too much into a single question can lead to confusion and inaccuracies in the responses. Take a closer look at questions in your survey that contain the word “and” – it can be a red flag that your question has two parts. For example: “Which of these cell phone service providers has the best customer support and reliability?” This is problematic because a respondent may feel that one service is more reliable, but another has better customer support. Also, if you want to go beyond surveys and develop a multi-faceted listening approach to drive meaningful change and glean actionable insights, make sure to download our guide. 6. Avoid leading and biased questions Although you don’t intend them to, certain words and phrases can introduce bias into your questions or point the respondent in the direction of a particular answer. As a rule of thumb, when you conduct a survey it’s best to provide only as much wording as a respondent needs to give an informed answer. Keep your question wording focused on the respondent and their opinions, rather than introducing anything that could be construed as a point of view of your own. In particular, scrutinize adjectives and adverbs in your questions. If they’re not needed, take them out. 7. Speak your respondent's language This tip goes hand in hand with many others in this guide – it’s about making language only as complex or as detailed as it needs to be when conducting great surveys. Create surveys that use language and terminology that your respondents will understand. Keep the language as plain as possible, avoid technical jargon and keep sentences short. However, beware of oversimplifying a question to the point that its meaning changes. 8. Use response scales whenever possible Response scales capture the direction and intensity of attitudes, providing rich data. In contrast, categorical or binary response options, such as true/false or yes/no response options, generally produce less informative data. If you’re in the position of choosing between the two, the response scale is likely to be the better option. Avoid using scales that ask your target audience to agree or disagree with statements, however. Some people are biased toward agreeing with statements, and this can result in invalid and unreliable data. 9. Avoid using grids or matrices for responses Grids or matrices of answers demand a lot more thinking from your respondent than a scale or multiple choice questions. They need to understand and weigh up multiple items at once, and oftentimes they don’t fill in grids accurately or according to their true feelings. Another pitfall to be aware of is that grid question types aren’t mobile-friendly. It’s better to separate questions with grid responses into multiple questions in your survey with a different structure such as a response scale. 10. Rephrase yes/no questions if possible As we’ve described, yes/no questions provide less detailed data than a response scale or multiple-choice, since they only yield one of two possible answers. Many yes/no questions can be reworked by including phrases such as “How much,” “How often,” or “How likely.” Make this change whenever possible and include a response scale for richer data. By rephrasing your questions in this way, your survey results will be far more comprehensive and representative of how your respondents feel. 11. Start with the straightforward stuff Ease your respondent into the survey by asking easy questions at the start of your questionnaire, then moving on to more complex or thought-provoking elements once they’re engaged in the process. This is especially valuable if you need to cover any potentially sensitive topics in your survey. Never put sensitive questions at the start of the questionnaire where they’re more likely to feel off-putting. Your respondent will probably become more prone to fatigue and distraction towards the end of the survey, so keep your most complex or contentious questions in the middle of the survey flow rather than saving them until last. 12. Use unbalanced scales with care Unbalanced response scales and poorly worded questions can mislead respondents. For example, if you’ve asked them to rate a product or service and you provide a scale that includes “poor”, “satisfactory”, “good” and “excellent”, they could be swayed towards the “excellent” end of the scale because there are more positive options available. Make sure your response scales have a definitive, neutral midpoint (aim for odd numbers of possible responses) and that they cover the whole range of possible reactions to the question. 13. Consider adding incentives To increase the number of responses, incentives — discounts, offers, gift cards, or sweepstakes — can prove helpful. Of course, while the benefits of offering incentives sound appealing (more respondents), there’s the possibility of attracting the opinions of the wrong audiences, such as those who are only in it for the incentive. With this in mind, make sure you limit your surveys to your target population and carefully assess which incentives would be most valuable to them. 14. Take your survey for a test drive Want to know how to make a survey a potential disaster? Send it out before you pre-test. However short or straightforward your questionnaire is, it’s always a good idea to pre-test your survey before you roll it out fully so that you can catch any possible errors before they have a chance to mess up your survey results. Share your survey with at least five people, so that they can test your survey to help you catch and correct problems before you distribute it. https://www.qualtrics.com/blog/10-tips-for-buildingeffective-surveys/ Concise introduction We are 3rd year Industrial Engineering Students of the PUP Binan Branch and we would like to request a portion of your time in answering the survey questionnaire. Instruction in answering the questions General Instructions: Kindly encircle the choice of your responses. Encircle all appropriate choices for your response. Prelim stage/Stage 1 Name: Optional Age: Family Income Gender…. Stage2 Guide questions 1. How many times in a week do you eat bread? Everyday 5-6 times 3-4 times 1-2 times Never (no need for “remarks”) Salutation: Thank you remarks….