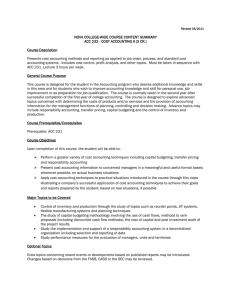

Management Accounting RAHMEE 1 Management Accounting LO1. Demonstrate an understanding of management accounting systems. P1. Explain management accounting and give the essential requirement of different types of management accounting systems. Management Accounting Management accounting, also called managerial accounting or cost accounting, is the process of analyzing business costs and operations to prepare internal financial report, records, and account to aid managers’ decision-making process in achieving business goals. In other words, it is the act of making sense of financial and costing data and translating that data into useful information for management and officers within an organization. Origin Managerial accounting has its roots in the industrial revolution of the 19th century. During this early period, most firms were tightly controlled by a few owner-managers who borrowed based on personal relationships and their personal assets. Since there were no external shareholders and little unsecured debt, there was little need for elaborate financial reports. In contrast, managerial accounting was relatively sophisticated and provided the essential information needed to manage the early large-scale production of textile, steel, and other products. After the turn of the century, financial accounting requirements burgeoned because of new pressures placed on companies by capital markets, creditors, regulatory bodies, and federal taxation of income. Johnson and Kaplan state that “many firms needed to raise funds from increasingly widespread and detached suppliers of capital. To tap these vast reservoirs of outside capital, firms’ managers had to supply audited financial reports. And because outside suppliers of capital relied on audited financial statements, independent accountants had a keen interest in establishing well defined procedures for corporate financial reporting. The inventory costing procedure adopted by public accountants after the turn of the century had a profound effect on management accounting. As a consequence, for many decades, management accountants increasingly focused their efforts on ensuring that financial accounting requirements were met and financial reports were released on time. Roles Formulate Financial Strategies Management accountants can formulate financial strategies using sales forecasts, budgets and job-costing techniques, among other managerial accounting tools. They also can incorporate data from a company’s financial statements to develop strategies that enhance gross income, net profit and earnings per share. Whether it’s formulating a plan to purchase capital equipment or reduce operating costs to ensure the continued viability of a business, management accountants serve a vital role in formulating effective financial strategies. RAHMEE 2 Management Accounting Explain Financial Consequences of Decisions If senior leaders adjust their company’s capital structure, management accountants can explain the ramifications of adding additional debt or equity financing. This is true of other decisions, such as merging with other companies, opening new operating facilities or laying off large numbers of employees. They can explain how decisions impact budgets and financial statements, illustrating how decisions change a company’s profit or loss for a given period of time. While some business decisions may sound good, it's only when digging into the numbers that a company finds whether they truly add up or not. Monitor Expenses Management accountants can create static, flexible or rolling budgets, along with other types of reports that allow senior leaders and department heads to monitor expenses. This is important, because operating expenses have a direct impact on bottom-line profit. Management accountants can select the optimal budgeting technique, given the specific needs of their stakeholders, and help their company run as cost-effectively as possible. They also can create ad-hoc reports that make it easier for their stakeholders to understand the nature of the expenses their department or organization incur. Maintain Profitability There are many tools management accountants can use to keep their businesses profitable, including performing a break-even analysis. With this type of analysis, the accountants weigh sales against variable and fixed costs to determine the point at which a company breaks even. Knowing this point will help management determine production levels, sales objectives and overhead costs, among other points impacting profitability. Also, management accountants can examine direct and indirect manufacturing costs, helping to optimize a company’s cost structure. Principles Designing and Compiling Accounting information, records, reports, statements and other evidence of past, present or future results should be designed and compiled to meet the needs of the particular business and/or specific problem. It means that management accounting system is designed in such a way presenting the relevant data. If so, a particular problem is to be solved. Moreover, accounting information can be modified and adopted to meet the requirements of management. RAHMEE 3 Management Accounting Management by Exception The principle of management by exception is followed when presenting information to management. It means that budgetary control system and standard costing techniques are followed in the management accounting system. In this way, the actual performance is compared with pre-determined one for finding the deviations. The unfavorable deviations alone are informed precisely to management as what is going wrong. If so, the management has spent less time to read and study the information and more time to take action. Absorption of Overhead Costs Overhead costs are absorbed on anyone of the predetermined basis. The overhead costs are the combination of indirect materials, indirect labour and indirect expenses. Hence, the selected method or methods for the absorption of overheads should bring about the desired results in the most equitable manner. Control at Source Accounting Costs are best controlled at the points at which they are incurred – control at source accounting. The performance of individual workers, details of materials issues and utilization and usage of services such as machine, power, repairs and maintenance, vehicles etc. are prepared in the form of quantitative and qualitative information. In this way, control can be exercised over employees, materials and service providing devices. Accounting for Inflation A profit cannot be said to be earned unless capital is maintained intact in real terms. It means that money value is not stable. Hence, it is necessary to assess the value of capital contributed by the owners of the business concern in terms of real value of money through revaluation accounting. In this way, rate of inflation is taken into account to judge the real success of the business concern. RAHMEE 4 Management Accounting Management Accounting System Financial accounting focuses on preparing information for external parties, such as stockholders, public regulators and lenders, in accordance with generally accepted accounting principles. Managerial accounting, on the other hand, takes a company's financial information and develops reports for internal and confidential use by managers for decision-making and identifying ways to run the company more efficiently. These reports are based on management's informational needs and include budgeting, breakeven charts, product cost analysis, trend charts and forecasting. Inventory management System Inventory management is a discipline primarily about specifying the shape and placement of stocked goods. It is required at different locations within a facility or within many locations of a supply network to precede the regular and planned course of production and stock of materials. Cost Accounting System A cost accounting system is used by manufacturers to record production activities using a perpetual inventory system. In other words, it’s an accounting system designed for manufacturers that tracks the flow of inventory continually through the various stages of production. Job Costing System Job cost accounting is the process of assigning the costs you incur to a specific job you or your business is involved with. This term is widely used in the construction industry and it refers to allocating costs to individual construction projects at a company. Price optimization System Price optimization is the process of finding that pricing sweet spot, or maximizing price against the customers willingness to pay. Companies up and down the supply chain, both in B2B and B2C settings, rightly dedicate a massive amount of time towards price optimization to ensure that their products will sell quickly at the right price while still making a decent profit. RAHMEE 5 Management Accounting The different between Financial Accounting and Management Accounting BASIS FOR COMPARISON FINANCIAL ACCOUNTING MANAGEMENT ACCOUNTING Meaning Financial Accounting is an accounting system that focuses on the preparation of financial statement of an organization to provide the financial information to the interested parties. The accounting system which provides relevant information to the managers to make policies, plans and strategies for running the business effectively is known as Management Accounting. Is compulsory? Yes No Information Monetary information only Monetary and non-monetary information Objective To provide financial To assist the management information to outsiders. in planning and decisionmaking process by providing detailed information on various matters. Format Specified Not Specified Time Frame Financial Statements are prepared at the end of the accounting period which is usually one year. The reports are prepared as per the need and requirements of the organization. User. User Internal and external Only internal management. parties. Reports Summarized Reports about Complete and Detailed the financial position of the reports regarding various organization. information. Publishing and auditing Required to be published Neither and audited by statutory audited auditors. auditors. RAHMEE published nor by statutory 6 Management Accounting P2. Explain different Methods used for management accounting reporting Why information should be relevant to the user, reliable, up to date and accurate. What is Information? Data that is accurate and timely, specific and organized for a purpose, presented within a context that gives it meaning and relevance, and can lead to an increase in understanding and decrease in uncertainty. Information is valuable because it can affect behavior, a decision, or an outcome. Relevance Data captured should be relevant to the purposes for which it is to be used. This will require a periodic review of requirements to reflect changing needs. We have a duty to collect and report performance information against a wide range of statutory indicators. These are set out in the context of the Government’s White Paper – Strong and Prosperous Communities. Where appropriate each service will identify reliable local performance indicators to manage performance and drive improvement. These are reviewed on an annual basis to ensure relevance. Reliable Data should reflect stable and consistent data collection processes across collection points and over time. Progress toward performance targets should reflect real changes rather than variations in data collection approaches or methods. Source data is clearly identified and readily available from manual, automated or other systems and records. Protocols exist where data is provided from a third party, such as Hertfordshire Constabulary and Hertfordshire County Council. Accuracy Data should be sufficiently accurate for the intended use and should be captured only once, although it may have multiple uses. Data should be captured at the point of activity. Data is always captured at the point of activity. Performance data is directly input into Performance Plus by the service manager or nominated data entry staff. Access to P+ for the purpose of data entry is restricted through secure password controls and limited access to appropriate data entry pages. Individual passwords can be changed by the user and which under no circumstances should be used by anyone other than that user. RAHMEE 7 Management Accounting Where appropriate, base data, i.e. denominators and numerators, will be input into the system which will then calculate the result. These have been determined in accordance with published guidance or agreed locally. This will eliminate calculation errors at this stage of the process, as well as provide contextual information for the reader. Timeliness Data should be captured as quickly as possible after the event or activity and must be available for the intended use within a reasonable time period. Data must be available quickly and frequently enough to support information needs and to influence service or management decisions. Performance data is requested to be available within one calendar month from the end of the previous quarter and is subsequently reported to the respective Policy and Scrutiny Panel on a quarterly basis. As a part of the ongoing development of Performance Plus it is intended that performance information will be exported through custom reporting and made available via the Three Rivers DC website. This will improve access to information and eliminate delays in publishing information through traditional methods. Why the way in which the information is presented must be understandable The Understandable information must be easily to get ideas when users can be read. And this information gives how to planning, how to control and also how to organize for the decision making. Understanding is a brief, complete and clear explanation for the information provided in the report. The Information relating to the relationship is essential to users in understanding financial statements. The legitimate background of business activities represents the understanding of the data the financial quality that can be understood from they people with knowledge. The main things are we consider the understandable presented information, there are: Information must be understandable by its users. Main two external users are Investors and Creditors. Users are assumed to have reasonable comprehension of, and ability to study, the accounting, business, and economic concepts needed to the underattended information. However, by understanding its fundamental problems, each of them will not fully understand the complex information. Instead of providing a system, the information must be published correctly. RAHMEE 8 Management Accounting Different types of managerial accounting reports Managerial accounting reports help small business owners and managers monitor the company's performance and are prepared frequently throughout accounting periods as needed. Depending on the type of project and the time-sensitivity of the information, an owner or manager may request reports quarterly, monthly, weekly or even daily. Budget Report Budget reports help small business owners analyze their company's performance and, if the business is big enough, managers analyze their department's performance and control costs. The estimated budget for the period is usually based on the actual expenses from prior years. If the small business as a whole or a specific department was substantially over budget in a previous year and cannot find feasible ways to trim costs, the budget for future years may need to be increased to a more accurate level. Owners and managers can also use budget reports to provide incentives to employees. In this case, some of the funds budgeted may be given out up as bonuses to employees for meeting specific financial goals. Accounts Receivable Aging Reports The accounts receivable aging report is a critical tool for managing cash flow for companies that extend credit to their customers. This report breaks down the customer balances by how long they have been owed. Most aging reports include separate columns for invoices that are 30 days late, 60 days late and 90 days late or more. A manager can use the aging report to find problems with the company's collections process. If a significant number of customers are unable to pay their balances, the company may need to tighten its credit policies. Periodically analyzing the accounts receivable aging also keeps the collections department from overlooking old debts. Job Cost Reports Job cost reports show expenses for a specific project. They are usually matched with an estimate of revenue so the company can evaluate the job's profitability. This helps identify higher-earning areas of the business so the company can focus its efforts there instead of wasting time and money on jobs with low profit margins. Job cost reports are also used to analyze expenses while the project is in progress so managers can correct areas of waste before the costs escalate. Inventory and Manufacturing Companies with physical inventory can use managerial accounting reports to make their manufacturing processes more efficient. These reports generally include items such as inventory waste, hourly labor costs or per-unit overhead costs. The manager can then compare different assembly lines within the company to see where one can improve or to offer bonuses to the bestperforming departments. RAHMEE 9 Management Accounting LO2. Apply a range of management accounting techniques P3. Calculate costs using appropriates techniques of cost analysis to prepare an income statement using marginal and absorption costs. A.Cost In business and accounting, cost is the monetary value that a company has spent in order to produce something. Cost denotes the amount of money that a company spends on the creation or production of goods or services. It does not include the markup for profit. From a seller’s point of view, cost is the amount of money that is spent to produce a good or product. If a producer were to sell his products at the production price, his costs and income would break even, meaning that he would not lose money on the sales. However, he would not make a profit. From a buyer’s point of view the cost of a product is also known as the price. This is the amount that the seller charges for a product, and it includes both the production cost and the mark-up, which is added by the seller in order to make a profit. B. Different Classification cost such as, Fixed Cost A periodic cost that remains more or less unchanged irrespective of the output level or sales revenue, While in practice, all costs vary over time and no cost is a purely fixed cost, the concept of fixed costs is necessary in short term cost accounting. Organizations with high fixed costs are significantly different from those with high variable costs. This difference affects the financial structure of the organization as well as its pricing and profits. The breakeven point in such organizations (in comparison with high variable cost organizations) is typically at a much higher level of output, and their marginal profit (rate of contribution) is also much higher. EX- insurance, interest, rent, salaries Variable Cost A variable cost is a cost that varies in relation to either production volume or services provided. If there is no production or no services are provided, then there should be no variable costs. EX- Bonus, wage cost Direct Cost A direct cost is a price that can be completely attributed to the production of specific goods or services. Some costs, such as depreciation or administrative expenses, are more difficult to assign to a specific product and therefore are considered to be indirect costs. EX-Direct material, Direct labour RAHMEE 10 Management Accounting Indirect Cost Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product). Indirect costs may be either fixed or variable, But some overhead costs can be directly attributed to a project and are direct costs. EX--Indirect material, Indirect labour Material Cost Direct materials cost the cost of direct materials which can be easily identified with the unit of production. For example, the cost of glass is a direct materials cost in light bulb manufacturing. The manufacture of products or goods required material as the prime element. Labor Cost Labor cost is wages that are incurred in order to produce specific goods or provide specific services to customers. The total amount of labor cost is much more than wages paid. It also includes the payroll taxes associated with those wages, plus the cost of company-paid medical insurance, life insurance, workers' compensation insurance, any company-matched pension contributions, and other company benefits. Inventory Cost Inventory cost includes the costs to order and hold inventory, as well as to administer the related paperwork. This cost is examined by management as part of its evaluation of how much inventory to keep on hand. This can result in changes in the order fulfillment rate for customers, as well as variations in the production process flow. C. Different Costing system such as, Marginal Costing System Marginal cost is the cost of one additional unit of output. The concept is used to determine the optimum production quantity for a company, where it costs the least amount to produce additional units. If a company operates within this "sweet spot," it can maximize its profits. The concept is also used to determine product pricing when customers request the lowest possible price for certain orders. RAHMEE 11 Management Accounting Absorption Costing System Variable costing is a methodology that only assigns variable costs to inventory. This approach means that all overhead costs are charged to expense in the period incurred, while direct materials and variable overhead costs are assigned to inventory. There are no uses for variable costing in financial reporting, since the accounting frameworks (such as GAAP and IFRS) require that overhead also be allocated to inventory. RAHMEE 12 Management Accounting Job Costing System A job costing system involves the process of accumulating information about the costs associated with a specific production or service job. This information may be required in order to submit the cost information to a customer under a contract where costs are reimbursed. The information is also useful for determining the accuracy of a company's estimating system, which should be able to quote prices that allow for a reasonable profit. The information can also be used to assign inventoriable costs to manufactured goods. Batch Costing System Batch cost is the cluster of costs incurred when a group of products or services are produced, and which cannot be identified to specific products or services within the group. For cost accounting purposes, it may be considered necessary to assign the batch cost to individual units within a batch. If so, the total batch cost is aggregated and divided by the number of units produced to arrive at a unit cost. Process Costing System A process costing system accumulates costs when a large number of identical units are being produced. In this situation, it is most efficient to accumulate costs at an aggregate level for a large batch of products and then allocate them to the individual units produced. The assumption is that the cost of each unit is the same as that of any other unit, so there is no need to track information at an individual unit level. The classic example of a process costing environment is a petroleum refinery, where it is impossible to track the cost of a specific unit of oil as it moves through the refinery. ABC Costing System Activity-based costing (ABC) is a methodology for more precisely allocating overhead to those items that actually use it. The system can be used for the targeted reduction of overhead costs. ABC works best in complex environments, where there are many machines and products, and tangled processes that are not easy to sort out. Conversely, it is of less use in a streamlined environment where production processes are abbreviated. RAHMEE 13 Management Accounting 1.Calculate the unit cost under marginal costing & absorption costing techniques. Marginal Costing Unit cost (Working 01) Direct materials 8.00 Direct labor 5.00 Variable production o/h’s 3.00 Unit cost 16.00. Value of inventory (Working 02) May June Opening FG 0 + Production [500 units x €16]= €8,000 [200 units x €16] = €3,200 [200 units x €16] = €3,200 [380 units x €16] = €6,080 [80 units x €16] = €1,280 - Closing FG 2. Prepare the income statement by using the marginal costing and absorption costing techniques. Income statement of Galway PLC (Marginal) May Sales May June 15000 June 25000 VP cost of sales Opening FG 0 3200 Production 8000 6080 Close FG (3200) (4800) (1280) (8000) Differences 10200 17000 -Other VC (750) (1250) contribution 9450 15750 -Fixed cost(4+2+4) (10000) (10000) Profit (550) 5750 RAHMEE 14 Management Accounting Absorption method Unit cost (Working 03) Direct materials 8.00 Direct labor 5.00 Variable production o/h’s 3.00 Fixed production o/h [€4,000/400 units] 10.00 Full production cost 26.00 Value of inventory (Working 04) May June Opening FG 0 + Production [[500 units x €26] = €13,000 [200 units x €26] = €5,200 [200 units x €26] = €5,200 [380 units x 26] = €9,880 [80 units x €26] = €2,080 - Closing FG RAHMEE 15 Management Accounting Income statement of Galway PLC (Absorption) May May Sales June June 15000 25000 cost of sales Opening FG 0 5200 Production 13000 9880 Close FG (5200) (7800) (2080) (13300) Gross Profit 8200 11800 -admin /selling/other expanses Net profit (6750) (7250) 1450 4550 1000 (200) 450 4350 (+/-) over/ absorption Profit under Assumption: standard and actual fixed production over heads are equal. Under/ over absorbed FPOH (Working 05) May June Actual Fixed production o/h €4,000 €4,000 Fixed o/h absorbed €5,000 [500*€10] €3,800 [380 units *€10] €1,000 (over absorbed) €200 (under absorbed) 3. Prepare the profit reconciliation statement May June Profit under absorption €1,450 €4,550 FPOH p/u (€2,000) [200 units * €10] €1,200 [120 units * €10] Profit under marginal costing (€550) €5,750 RAHMEE 16 Management Accounting LO3. Explain the use of planning tools used in management accounting. P4. Explain the advantage and disadvantage of different types of planning tools used for budgetary control. a. Budget A budget is an estimation of revenue and expenses over a specified future period of time; it is compiled and re-evaluated on a periodic basis. Budgetary control A system of management control in which actual income and spending are compared with planned income and spending, so that you can see if plans are being followed and if those plans need to be changed in order to make a profit. b. Different types of budgets Capital Budget Capital budgeting is the process in which a business determines and evaluates potential expenses or investments that are large in nature. These expenditures and investments include projects such as building a new plant or investing in a long-term venture. Often times, a prospective project's lifetime cash inflows and outflows are assessed in order to determine whether the potential returns generated meet a sufficient target benchmark, also known as "investment appraisal." Operational Budgeting A detailed projection of all estimated income and expenses based on forecasted sales revenue during a given period (usually one year). It generally consists of several subbudgets, the most important one being the sales budget, which is prepared first. Since an operating budget is a short-term budget, capital outlays are excluded because they are long-term costs. RAHMEE 17 Management Accounting Master Budget A master budget is an aggregate of a company's individual budgets designed to present a complete picture of its financial activity and health. The master budget combines factors like sales, operating expenses, assets, and income streams to allow companies to establish goals and evaluate their overall performance, as well as that of individual cost centers within the organization. Master budgets are often used in larger companies to keep all individual managers aligned. Cash Flow Budget A cash flow budget is a means of projecting how and when cash comes in and flows out of a business within a specified time period. It can be useful in helping a company determine whether it's managing its cash wisely. Cash flow budgets consider factors such as accounts payable and accounts receivable to assess whether a company has ample cash on hand to continue operating, the extent to which it is using its cash productively, and its likelihood of generating cash in the near future. A construction company, for example, might use its cash flow budget to determine whether it can start a new building project before getting paid for the work it has in progress. Financial Budget A financial budget presents a company's strategy for managing its assets, cash flow, income, and expenses. A financial budget is used to establish a picture of a company's financial health and present a comprehensive overview of its spending relative to revenues from core operations. A software company, for instance, might use its financial budget to determine its value in the context of a public stock offering or merger. RAHMEE 18 Management Accounting c. Advantage and Disadvantage of budgeting Advantage Forecasting A business budget not only helps you project annual expenses but lets you see costs as they will occur. For example, averaging your insurance premiums per month helps you set average monthly revenue goals. Budgeting the exact amount of money to pay premiums in the months they come due helps you manage your cash flow to ensure you have money on hand to pay your bills each month. Budgets also let you forecast your annual bottom line using more than one revenue scenario. Price Setting Market conditions such as your competitors’ prices aren’t the only parameters you need to set your fees, rates and prices. You must know your manufacturing and overhead costs before you set your prices. A budget lets you project your utility, health care, marketing, rent, wages, debt service and other costs so you can learn the true cost per unit of making your products or delivering your service. Once you know this, you can set your prices to make the profit you want. If this price is too high for you to be competitive in your marketplace, you can use your budget to identify areas where you can reduce your costs. Capital and Credit Procurement Few venture capitalists, banks, suppliers or other lenders will give you money or credit unless you have financial data to demonstrate you are a going concern. Unless you have assets you can use as collateral, you’ll need to show financial statements that prove you are stable. If you are a new business, or are expanding, a budget will show potential partners how their participation will affect your sales and profits. Flexibility A budget lets you track your business’ performance throughout the year, allowing you to make necessary changes to rein in costs or increase spending to take advantage of growth opportunities. If your marketing is effective, a budget will let you know if you have funds available to increase your advertising to grow your sales. If your sales are slow, a budget identifies areas where you can cut discretionary costs to make you more competitive or tide you through slow periods. RAHMEE 19 Management Accounting Disadvantage Only considers financial outcomes. The nature of the budget is numeric, so it tends to focus management attention on the quantitative aspects of a business; this usually means an intent focus on improving or maintaining profitability. In reality, customers do not care about the profits of a business – they will only buy from the company as long as they are receiving good service and well-constructed products at a fair price. Unfortunately, it is quite difficult to build these concepts into a budget, since they are qualitative in nature. Thus, the budgeting concept does not necessarily support the needs of customers. Blame for outcomes If a department does not achieve its budgeted results, the department man ager may blame any other departments that provide services to it for not having adequately supported his department. Expense allocations The budget may prescribe that certain amounts of overhead costs be allocated to various departments, and the managers of those departments may take issue with the allocation methods used. This is a particular problem when departments are not allowed to substitute services provided from within the company for lower-cost services that are available else where. Use it or lose it If a department is allowed a certain amount of expenditures and it does not appear that the department will spend all of the funds during the budget period, the department manager may authorize excessive expenditures at the last minute, on the grounds that his budget manager may authorize excessive expenditures at the last minute, on the grounds that his budget tends to make managers believe that they are entitled to a certain amount of funding each year, irrespective of their actual need for the funds. Time required It can be very time-consuming to create a budget, especially in a poorly-organized environment where many iterations of the budget may be required. The time involved is lower if there is a well-designed budgeting procedure in place, employees are accustomed to the process, and the company uses budgeting software. The work required can be more extensive if business conditions are constantly changing, which calls for repeated iterations of the budget model. RAHMEE 20 Management Accounting d. Alternative methods of budgeting Zero based budgeting In a dynamic business it often makes sense to 'start afresh' when developing a budget rather than basing ideas too much on past performance. This is appropriate to Kraft because the organization is continually seeking to innovate. Each budget is therefore constructed without much reference to previous budgets. In this way, change is built into budget thinking. Strategic budgeting This involves identifying new, emerging opportunities, and then building plans to take full advantage of them. This is closely related to zero based budgeting and helps Kraft to concentrate on gaining competitive advantage. Rolling budgets Given the speed of change and general uncertainty in the external environment, shareholders seek quick results. US companies typically report to shareholders every three months, compared with six months in the UK. Rolling budgets involve evaluating the previous twelve months' performance on an ongoing basis, and forecasting the next three months' performance. Activity based budgeting This examines individual activities and assesses the strength of their contribution to company success. They can then be ranked and prioritized, and be assigned appropriate budgets. e. Approaches budgets Zero Based Budget In ZBB the budget for any activity at the start of each year is set at zero. All expenditure must be justified on a cost/benefit basis, including justification of continuing existence. Top-Down Approach It is called top-down approach because the budgets are made by the top executed and then the money is passed down the line to various departments. This approach is applied in affordable method percentage of sales, competitive parity method and Return On Investments (ROI)method of budgeting. RAHMEE 21 Management Accounting Bottom-up Budgeting In this method promotion adjectives are set for the tasks to be performed. All the necessary activities to achieve the objectives are planned. The cost of these activities is as curtained and budgeted. The total promotion budget is then approved by top management. This is also knowing the build-up approach of budgeting. Base Budget A recurring set of funds provided to a department at the onset of each budget period. The base budget is used to keep the department functioning, and is derived from the previous year's spending and adjustments such as inflation. It is not designed to fund special projects. See also non-base budget. Incremental Budget Incremental budgeting is budgeting based on slight changes from the preceding period's budgeted results or actual results. This is a common approach in businesses where management does not intend to spend a great deal of time formulating budgets, or where it does not perceive any great need to conduct a thorough re-evaluation of the business. This mindset typically occurs when there is not a great deal of competition in an industry, so that profits tend to be perpetuated from year to year. f. Pricing The amount of money charged for product or service, or the sum of value that consumer exchange for the benefits of having or using the product or service. g. Pricing Strategy A business can use a variety of pricing strategies when selling a product or service. The price can be set to maximize profitability for each unit sold or from the market overall. It can be used to defend an existing market from new entrants, to increase market share within a market or to enter a new market. Types Price Skimming Designed to help businesses maximize sales on new products and services, price skimming involves setting rates high during the introductory phase. The company then lowers prices gradually as competitor goods appear on the market. One of the benefits of price skimming is that it allows businesses to maximize profits on early adopters before dropping prices to attract more price-sensitive consumers. Not only does price skimming help a small business recoup its development costs, but it also creates an illusion of quality and exclusivity when your item is first introduced to the marketplace. RAHMEE 22 Management Accounting Psychology Pricing With the economy still limping back to full health, price remains a major concern for American consumers. Psychology pricing refers to techniques that marketers use to encourage customers to respond on emotional levels rather than logical ones. For example, setting the price of a watch at $199 is proven to attract more consumers than setting it at $200, even though the true difference here is quite small. One explanation for this trend is that consumers tend to put more attention on the first number on a price tag than the last. The goal of psychology pricing is to increase demand by creating an illusion of enhanced value for the consumer. Penetration Pricing A few companies adopt these strategies in order to enter the market and to gain market share. Some companies either provide a few services for free or they keep a low price for their products for a limited period that is for a few months. This strategy is used by the companies only in order to set up their customer base in a particular market. For example France telecom gave away free telephone connections to consumers in order to grab or acquire maximum consumers in a given market. Similarly the Sky TV gave away their satellite dishes for free in order to set up a market for them. This gives the companies a start and a consumer base. In the similar manner there are few companies that keep their product cost low as their introductory offer that is a way of introducing themselves in the market and creating a consumer base. Similarly when the companies want to promote a premier product or service they do raise the prices of the products and services for that particular time. Value Pricing a Product Let me first be clear about what value pricing means, value pricing is reducing the price of a product due to external factors that can affect the sales of the product for example competition and recession; value pricing does not mean that the company has added something or increased the value of a product. When the company is afraid of factors such as competition or recession affecting their sales and profits the company considers value pricing. For example McDonalds the famous food chain has started value meals for their consumer since they have started facing competition with other fast food chains. They offer a meal or a combination of a few products as a lower price where the consumer feels emotionally content and continues to buy their products. RAHMEE 23 Management Accounting h. How do competitors determine their prices? Pricing Strategy Options Competitive pricing is one of four major pricing strategies. Other options include cost-plus pricing, where a set profit margin is added to the total cost of a product -- including materials, labor and overhead. Markup pricing is where a percentage is added to the wholesale cost of a product. Demand pricing is determined by establishing the optimal relationship between profit and volume; a smaller per-unit profit is acceptable if volume is increased significantly. Competitive pricing is charging a price that is comparable to other vendors selling the same item. Factors to Consider Product prices determine the revenue stream of a business. Prices must be sufficient to cover the costs of product production, company overhead and profit. Before lowering prices it's preferable to lower costs to maintain a stable profit margin and a stable cash flow into the business. Any pricing strategy must be chosen to ensure a maximum of profit. Knowing your market and customer base are key elements to choosing the right pricing strategy. About Competitive Pricing Vendors use a competitive pricing strategy when several other businesses sell the same product and there is little to distinguish one vendor from another. A market leader will generally set the price for the product and other vendors will usually have no option but to follow suit in order to remain competitive. Vendors will either match the pricing of the market leader or set prices within a comparable range. Establishing Competitive Pricing Vendors who are not market leaders can use the accepted price as a starting point. From there they can opt to charge slightly more on the basis of factors such as superior customer service or an extended warranty on a product. Retailers must be fully informed of the prices their competitors charge and also know how discerning their customers are on price alone. Once price is established, sales volume must be monitored to see if the strategy is working. Risks of Competitive Pricing For many small businesses in particular, competitive pricing results in a narrowing of profit margins. This makes the business vulnerable to a sudden rise in costs. Therefore, independent retailers competing with high-volume, big box stores may choose an alternative pricing strategy that affords them a larger cushion on their profit margin and RAHMEE 24 Management Accounting justify it on the basis of their niche advantage -- for example, being local and customerfocused. i. Supply and Demand considerations. Supply and demand, in economics, relationship between the quantity of a commodity that producers wish to sell at various prices and the quantity that consumers wish to buy. It is the main model of price determination used in economic theory. The price of a commodity is determined by the interaction of supply and demand in a market. The resulting price is referred to as the equilibrium price and represents an agreement between producers and consumers of the good. In equilibrium the quantity of a good supplied by producers equals the quantity demanded by consumers. Illustration of the relationship of price to supply (S) and demand (D) Demand Curve The quantity of a commodity demanded depends on the price of that commodity and potentially on many other factors, such as the prices of other commodities, the incomes and preferences of consumers, and seasonal effects. In basic economic analysis, all factors except the price of the commodity are often held constant; the analysis then involves examining the relationship between various price levels and the maximum quantity that would potentially be purchased by consumers at each of those prices. The price-quantity combinations may be plotted on a curve, known as a demand curve, with price represented on the vertical axis and quantity represented on the horizontal axis. A demand curve is almost always downward-sloping, reflecting the willingness of consumers to purchase more of the commodity at lower price levels. Any change in non-price factors would cause a shift in the demand curve, whereas changes in the price of the commodity can be traced along a fixed demand curve. RAHMEE 25 Management Accounting increase in demand Illustration of an increase in equilibrium price (p) and equilibrium quantity (q) due to a shift in demand (D). Supply Curve The quantity of a commodity that is supplied in the market depends not only on the price obtainable for the commodity but also on potentially many other factors, such as the prices of substitute products, the production technology, and the availability and cost of labour and other factors of production. In basic economic analysis, analyzing supply involves looking at the relationship between various prices and the quantity potentially offered by producers at each price, again holding constant all other factors that could influence the price. Those price-quantity combinations may be plotted on a curve, known as a supply curve, with price represented on the vertical axis and quantity represented on the horizontal axis. A supply curve is usually upward-sloping, reflecting the willingness of producers to sell more of the commodity they produce in a market with higher prices. Any change in non-price factors would cause a shift in the supply curve, whereas changes in the price of the commodity can be traced along a fixed supply curve. RAHMEE 26 Management Accounting decrease in supply Illustration of an increase in equilibrium price (p) and a decrease in equilibrium quantity (q) due to a shift in supply (S). Market Equilibrium It is the function of a market to equate demand and supply through the price mechanism. If buyers wish to purchase more of a good than is available at the prevailing price, they will tend to bid the price up. If they wish to purchase less than is available at the prevailing price, suppliers will bid prices down. Thus, there is a tendency to move toward the equilibrium price. That tendency is known as the market mechanism, and the resulting balance between supply and demand is called a market equilibrium. As the price rises, the quantity offered usually increases, and the willingness of consumers to buy a good normally declines, but those changes are not necessarily proportional. The measure of the responsiveness of supply and demand to changes in price is called the price elasticity of supply or demand, calculated as the ratio of the percentage change in quantity supplied or demanded to the percentage change in price. Thus, if the price of a commodity decreases by 10 percent and sales of the commodity consequently increase by 20 percent, then the price elasticity of demand for that commodity is said to be 2. The demand for products that have readily available substitutes is likely to be elastic, which means that it will be more responsive to changes in the price of the product. That is because consumers can easily replace the good with another if its price rises. The demand for a product may be inelastic if there are no close substitutes and if expenditures on the product constitute only a small part of the consumer’s income. Firms faced with relatively RAHMEE 27 Management Accounting inelastic demands for their products may increase their total revenue by raising prices; those facing elastic demands cannot. Supply-and-demand analysis may be applied to markets for final goods and services or to markets for labor, capital, and other factors of production. It can be applied at the level of the firm or the industry or at the aggregate level for the entire economy. RAHMEE 28 Management Accounting LO4. Compare ways in which organization could use management accounting to respond to financial problems. P5. Compare how in which organization are adapting management accounting systems to respond to financial problems. Benchmarking Benchmarking is a process of measuring the performance of a company’s products, services, or processes against those of another business considered to be the best in the industry, aka “best in class.” The point of benchmarking is to identify internal opportunities for improvement. By studying companies with superior performance, breaking down what makes such superior performance possible, and then comparing those processes to how your business operates, you can implement changes that will yield significant improvements. That might mean tweaking a product’s features to more closely match a competitor’s offering, or changing the scope of services you offer, or installing a new customer relationship management (CRM) system to enable more personalized communications with customers. There are two basic kinds of improvement opportunities: continuous and dramatic. Continuous improvement is incremental, involving only small adjustments to reap sizeable advances. Dramatic improvement can only come about through reengineering the whole internal work process. Key Benefits In addition to helping companies become more efficient and profitable, benchmarking has other benefits, too, such as: Improving employee understanding of cost structures and internal processes Encouraging team-building and cooperation in the interests of becoming more competitive Enhancing familiarity with key performance metrics and opportunities for improvement company-wide In essence, benchmarking helps employees understand how one small piece of a company’s processes or products can be the key to major success, just as one employee’s contributions can lead to a big win. RAHMEE 29 Management Accounting Key Performance Indicator(KPI) A performance indicator or key performance indicator (KPI) is a type of performance measurement. KPIs evaluate the success of an organization or of a particular activity (such as projects, programs, products and other initiatives) in which it engages. Often success is simply the repeated, periodic achievement of some levels of operational goal (e.g. zero defects, 10/10 customer satisfaction, etc.), and sometimes success is defined in terms of making progress toward strategic goals. Accordingly, choosing the right KPIs relies upon a good understanding of what is important to the organization. [citation needed] 'What is important' often depends on the department measuring the performance – e.g. the KPIs useful to finance will differ from the KPIs assigned to sales. Since there is a need to understand well what is important, various techniques to assess the present state of the business, and its key activities, are associated with the selection of performance indicators. These assessments often lead to the identification of potential improvements, so performance indicators are routinely associated with 'performance improvement' initiatives. A very common way to choose KPIs is to apply a management framework such as the balanced scorecard. Definitions of financial governance Financial governance NGOs exist for the benefit of their beneficiaries. The NGO’s governing body is entrusted with responsibility for overseeing the organization on behalf of the beneficiaries. For this reason, governing body members are often called ‘trustees’. They act as stewards, representing and protecting the beneficiaries’ interests. The board has ultimate legal, moral, and financial responsibility for the organization. The governing body The governing body may have different names, such as board of trustees, board of directors, executive council, executive committee, etc. The board is often organized with a series of permanent or temporary sub-committees – e.g. for Finance and Personnel matters. Advisory committees are also frequently set up to provide support to a country programme or new project. RAHMEE 30 Management Accounting The five roles of board members Board members should avoid getting too involved in day to day management of the organization, although they do need to be aware of what is happening. Their five roles are: Making sure that funds are used to help beneficiaries effectively Making sure that the organization has enough funding Making sure that the organization has effective senior management Making sure that the organization operates within the law Making sure that the board can handle its responsibilities effectively 1. Making sure funds are used to help beneficiaries effectively Ensuring the organization has practical strategies for analyzing and responding to social problems Monitoring if the organization is actually doing a good job, putting its strategy into practice and achieving value for money Approving an annual budget for expenditure, based on the cost of relevant activities Making sure that the organization has appropriate internal controls and accounting systems to ensure that funds are used properly Regularly checking that internal controls are followed in practice (e.g. carrying out or engaging internal audits) Taking an active role in internal controls as necessary (e.g. authorizing large payments) Regularly monitoring financial reports, including the income and expenditure statement and the balance sheet Monitoring whether the organization is being accountable to its beneficiaries (eg presenting financial reports to them) If there is no evidence of dialogue with beneficiaries, then your work may not be meeting their real needs. 2. Making sure the organization has enough funding Approving the income section of the annual budget Monitoring the amount of income received Actively working out how to ensure the organization will be sustainable, including approving a financing strategy Monitoring relationships with donors (e.g. if reports are submitted on time) Monitoring fund balances including general reserves If any fund balances are in negative, this could have serious implications for your credibility. RAHMEE 31 Management Accounting 3. Making sure the organization has effective senior management Recruiting a chief executive with financial management skills for their role (or supporting the Chief Executive to develop these skills) Supporting the Chief Executive to develop a culture of good financial management (e.g. leading by example and encouraging finance and programme staff to work together) Making sure that the most senior finance manager is a member of the most senior management team Encouraging an open culture that recognizes problems and aims to learn from them Holding senior managers to account for the results of the decisions that they take and the initiatives they launch Everything you want to achieve depends on the people employed to do it. Senior managers have to inspire and support other staff. 4. Making sure the organization operates within the law Understanding the NGO's legal requirements, including Labour laws, Tax laws and Health & Safety legislation. Making sure that the management team meets legal requirements (e.g. paying taxes, filing annual reports). Appointing external auditors and overseeing the audit. Approving the audited accounts and annual reports. Filing reports with government departments. 5. Making sure the board can handle its responsibilities effectively Appointing a treasurer, with specific responsibilities for financial management and the skills to carry them out. Making sure that all board members understand their financial management responsibilities and supporting them to develop appropriate skills. Making sure there are no conflicts of interest between the organization’s operations and board members' work or business interests Making time at board meetings to discuss the financial management aspect of all major decisions. Mango has a one-day training course called Financial governance in practice, which can be run as an in-house event for your board. RAHMEE 32 Management Accounting Management Accounting skill set Planning & Reporting The competencies required to envision the future, measure performance, and report financial results. Decision Making The competencies required to guide decisions, manage risk, and establish an ethical environment. Technology The competencies required to manage technology and information systems to enable effective operations. Operations The competencies required to contribute as a cross-functional business partner to transform company-wide operations. Leadership The competencies required to collaborate with others and inspire teams to achieve organizational goals. Characteristic of an effective management accountant Competence Maintain an appropriate level of professional expertise by continually developing knowledge and skills. Perform professional duties in accordance with relevant laws, regulations, and technical standards. Provide decision support information and recommendations that are accurate, clear, concise, and timely. Recognize and communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity. RAHMEE 33 Management Accounting Confidentiality Keep information confidential except when disclosure is authorized or legally required. Inform all relevant parties regarding appropriate use of confidential information. Monitor subordinates' activities to ensure compliance. Refrain from using confidential information for unethical or illegal advantage. Integrity Mitigate actual conflicts of interest; regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts. Refrain from engaging in any conduct that would prejudice carrying out duties ethically. Abstain from engaging in or supporting any activity that might discredit the profession. Credibility Communicate information fairly and objectively. Disclose all relevant information that could reasonably be expected to influence an intended user's understanding of the reports, analyses, or recommendations. Disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law. RAHMEE 34 Management Accounting How can these skills be used to prevent and/or deal with financial problems Find a Replacement for One Large Expense in Your Monthly Budget Cutting out an expense or changing a habit is easier if you replace it with something else. For instance, if you want to quit buying expensive coffee on your way to work, plan how you can replace this habit with a new one. You might buy yourself a new travel cup and purchase some coffee that you enjoy drinking (and can make at home!). Then change your routine so that you’re not tempted to stop for coffee anyways. E.g. travel a different route to work. Find one expense that’s taking a real bite out of your budget and find replacement solutions. Cutting back on coffee is just one example. What about your entertainment costs, quitting smoking or scaling back what you spend on hobbies and recreational activities? You’ll know that you’ve passed this assignment when all of your bills are paid up to date and you’ve got a little extra left in your bank account. Identify Expenses You Can Reduce Over the next month, identify areas of your budget that need some special attention. Look for ways to decrease your spending with your utilities. Do your laundry with cold water instead of hot; turn the heat down and the lights off when you’re not home. If you have a home phone as well as a cell phone, decide if you need both. Routines can be hard habits to break. Also identify products or services you no longer need but which you’re still paying for. Many people simply let their bundled services renew from month to month, even when their needs have changed. This might be because they’re too busy to look at their bills carefully, but taking the time to go through your bills line by line and calling the companies to make changes to service plans, or cancel services altogether, can find a lot of hidden cash. If you haven’t guessed it yet, your fifth assignment is to identify what expenses you can reduce and then create the plan to follow through with your changes. If you’re not sure where to start, here’s a list of our most popular money saving tips. You’ll know you’ve passed this when your bills get a little smaller. Increase Your Spending Awareness Consider what you learned about your spending habits by only using cash. Was it easier or harder to part with cash than plastic? Did you only buy things you needed, or was there also enough money to buy something that you wanted? How much did you have left at the end? Some cases have found that people spend as much as 15% more per purchase when they use plastic instead of cash. Spending more on every purchase adds up over the years, and if you want debt solutions that last for life, be aware of how you spend your money. RAHMEE 35 Management Accounting Create a Spending Plan or a Budget to Solve and Prevent Financial Problems Creating a monthly plan for your spending is one of the smartest things you can do for your finances, yet it’s the most overlooked solution to most people’s financial problems. Having a spending plan or a budget (the technical name for a monthly spending plan) makes life so much easier because you’ve given yourself a guide to decide how you want to spend your money. Ironically, it’s also one of the things that you’ll likely never learn in a class at Cambridge or Harvard. Not to pick on these universities though; most schools don’t teach students how to create a budget. So to help with this lack of training, your third assignment is to outline your budget. If you’ve never created a household budget that works, here is a personal budget workbook to get you started or you can try out this interactive budgeting resource that guides you through the whole process. A budget based on real numbers sets you up for success, so use what you learned when you tracked your spending. If there’s an expense you want to cut out of your budget, start by reducing it by half. This will tell you if you can stick it out for the long term. If you can make having a budget part of your life. RAHMEE 36 Management Accounting M1. Evaluate the benefits of Management Accounting systems and their application within an organizational context. Management accounting does not usually follow any national accounting standards. Business owners can design management accounting systems according to their company’s business operations or management’s need for business information. Management accounting has several advantages. These advantages usually coincide with the ability for companies to improve operations and overall profitability. Business owners can also create a competitive advantage by developing cost allocation processes in their management accounting function. Reduce Expenses Management accounting can help companies lower their operational expenses. Business owners often use management accounting information to review the cost of economic resources and other business operations. This information allows owners to better understand how much money it costs to run the business. Business owners can also use management accounting to conduct an analysis on the quality of economic resources used to produce goods or services. If overall product quality would not suffer by using a cheaper raw material, business owners can make this change to reduce production costs. Improve Cash Flow Budgets are a major part of management accounting. Business owners often use budgets so they have a financial road map for future business expenditures. Many budgets are based on a company's historical financial information. Management accountants will comb through this information and create a master budget for the entire company. Larger business organizations may use several smaller budgets for divisions or departments. These individual budgets usually roll up into the company's overall master budget. The main purpose of budgets is to save the company money through careful analysis of necessary and unnecessary cash expenditures. Business Decisions Management accounting often improves the business owner’s decision-making process. Rather than making business decisions based solely on qualitative analysis, business owners or managers can use management accounting information as a decision-making tool. Management accounting usually provides a quantitative analysis for various decision opportunities. Business owners can review each opportunity through the prism of quantitative analysis to assure they have a clear understanding relating to business decisions. RAHMEE 37 Management Accounting Increase Financial Returns Business owners can also use management accounting to increase their company’s financial returns. Management accountants can prepare financial forecasts relating to consumer demand, potential sales or the effects of consumer price changes in the economic marketplace. Business owners will often use this information to ensure they can produce enough goods or services to meet consumer demand at current prices. Companies also pay close attention to the amount of competition in the economic marketplace. Competition can reduce the company’s financial returns from business operations. RAHMEE 38 Management Accounting M3. Analyze the use of different planning tool and their application for preparing and forecasting budgets. (Please find the question 01 in appendix) A. Production budget for ABC Company for the next six months. Jan Feb Mar Apr May Jun Semi-annual 5,000 7,500 10,000 15,000 20,000 30,000 87,500 Closing 2,250 3,000 4,500 6,000 9,000 10,500 10,500 (3,000) (4,500) (6,000) (9,000) (1,200) 11,500 16,500 23,000 31,500 96,800 Sales unit Add: Inventory Less: Opening (1,200) (2,250) Inventory Production 6,050 8,250 Unit B. ABC Company direct material purchases budget for April Production budget (Working 01) April May Sales in unit 800 850 Add: Closing inventory 850 925 Less: Opening inventory (1,200) (850) Production Units 450 925 ABC Company DM purchase budget April May Production units 450 925 DM per Unit €5 €5 RAHMEE 39 Management Accounting Add: Closing inventory Less: Opening inventory €2,250 €4,625 €4,625 €5,000 €6,875 €9,625 €2,250 €4,625 €4,625 €5000 Question 02 Jeet’s Palace cash budget for three months Receipts Month 01 Collection from debtors(Working 45,000 Month 02 Month 03 60,000 60,000 01) Old equipment sell 1,200 45,000 61,200 60,000 Material purchase(Working 02) (15,000) (15,000) (15,000) Labor cost (15,000) (15,000) (15,000) Payments Superannuation payment (5,200) Annual rates payment (1,200) Rent (4,000) (4,000) (4,000) Lease payment (1,200) (1,200) (1,200) Energy Bills Due (3,800) 9,800 17,000 23,600 Opening cash balance 5,000 14,800 31,800 Closing cash balance 14,800 31,800 55,400 Month 02 Month 03 Collection from debtors (Working 01) Sales Month 01 Month 01 RAHMEE 40 Management Accounting 60,000*75% 45000 60,000*25% 15000 Month 02 60,000*75% 45000 60,000*25% 15000 Month 03 60,000*75% Collection from debtors 45000 45,000 60,000 60,000 Month 01 Month 02 Month 03 Production (25% sales) 15,000 15,000 15,000 Add: closing stock 2,000 2,000 2,000 Less: Opening Stock (2,000) (2,000) (2,000) DM Purchase 15,000 15,000 15,000 DM purchase budget (Working 02) Mr. Surjeet can install a new tandoor oven at a cost of $12,000 in three months’ time since he has a positive and enough cash inflow of $55,400 as per the forecasted cash budget. RAHMEE 41 Management Accounting M4. Analyze how, in responding to financial problems, management accounting can lead organizations to sustainable success. Management accounting have basic objective to serve the management for decision making purpose. In case of financial problems, management needs the information relating to increasing. Today's question is how to establish their strategies, business models, and practices to address social and environmental challenges while creating financial success and value for their shareholders. There are some of companies have the skills to meet these challenges and to compete in a sustainable economy according to the Environmental Management and Assessment Institute. The Management Report stands to show how many business entities have disappeared into valuable intelligence and analysis by failing to gain accountability capabilities. This includes the business environment for impact and analysis and reporting on the impact of environmental and social factors on business performance. Furthermore, 60% believe that the administrator is responsible for adding information and analyzes to producers to resolve responsible environmental and social factors. However, only 45% of respondents are currently present. The unnecessary defect from the decision makers, the main reason for the respondents, regardless of this information. Systems and processes that do not support data are another common obstacle. In this case, the senior responder may have information on this type of information. For example, CFOs, CEOs and directors accounted for 52% of the issues related to decision-making issues. One of the major obstacles to identification in the surveys is that by 60% of the voters, there is no need to get this kind of information from the producers. However, there are indications that it begins to change, and predicts two-thirds of the estimated predicted growth in the next two years for environmental and social data. 1. Forecasting the cash flows Cash flow forecasts can help predict upcoming cash surpluses or shortages to help you make the right decisions. It can help in tax preparation, planning new equipment purchases or identifying if you need to secure a small business loans. You can also use it to see the effect of an upcoming business change or decision. If you're considering hiring a new employee for example, you'd add the additional salary and related costs into your forecast. The new figures in your cash flow forecast will tell you whether hiring that additional employee is likely to place your business in a stronger position and help you decide whether to hire them or not. RAHMEE 42 Management Accounting ‘ Report Management accounts report in many ways the firm can guide their companies towards success: Utilizing administrative accounting tools and techniques such as natural resource gain, life cycle cost and carbon footprint, to assist in consolidating affairs in decision making process. Attach fixed business challenges to company strategy, business model, performance overview, and licensing license. Explain the impact of these stability issues in strong business terms. Develop a statement strategy that integrates sustainability issues to ensure that financial and non-financial information is revealed. An international example of international coordinated report structure created by the International Coordinated Report Council. Identify environmental and social trends that influence the company's ability to generate value over time. RAHMEE 43 Management Accounting Reference RAHMEE 44