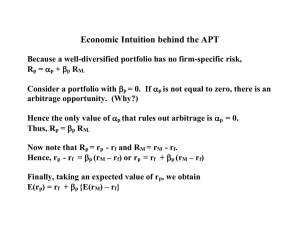

Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return Multiple Choice Questions 1. ___________ a relationship between expected return and risk. A. APT stipulates B. CAPM stipulates C. Both CAPM and APT stipulate D. Neither CAPM nor APT stipulate E. No pricing model has found 2. Consider the multifactor APT with two factors. Stock A has an expected return of 17.6%, a beta of 1.45 on factor 1 and a beta of .86 on factor 2. The risk premium on the factor 1 portfolio is 3.2%. The risk-free rate of return is 5%. What is the risk-premium on factor 2 if no arbitrage opportunities exit? A. 9.26% B. 3% C. 4% D. 7.75% E. 9.75% 3. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. factor sensitivities C. idiosyncratic risk D. factor betas E. both factor sensitivities and factor betas 4. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. firm-specific risk C. idiosyncratic risk D. factor betas E. unique risk 10-1 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 5. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. firm-specific risk C. idiosyncratic risk D. factor loadings E. unique risk 6. Which pricing model provides no guidance concerning the determination of the risk premium on factor portfolios? A. The CAPM B. The multifactor APT C. Both the CAPM and the multifactor APT D. Neither the CAPM nor the multifactor APT E. No pricing model currently exists that provides guidance concerning the determination of the risk premium on any portfolio 7. An arbitrage opportunity exists if an investor can construct a __________ investment portfolio that will yield a sure profit. A. small positive B. small negative C. zero D. large positive E. large negative 8. The APT was developed in 1976 by ____________. A. Lintner B. Modigliani and Miller C. Ross D. Sharpe E. Fama 10-2 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 9. A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor. A. factor B. market C. index D. factor and market E. factor, market, and index 10. The exploitation of security mispricing in such a way that risk-free economic profits may be earned is called ___________. A. arbitrage B. capital asset pricing C. factoring D. fundamental analysis E. technical analysis 11. In developing the APT, Ross assumed that uncertainty in asset returns was a result of A. a common macroeconomic factor. B. firm-specific factors. C. pricing error. D. neither common macroeconomic factors nor firm-specific factors. E. both common macroeconomic factors and firm-specific factors. 12. The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities. A. APT; CAPM B. APT; OPM C. CAPM; APT D. CAPM; OPM E. APT and OPM; CAPM 10-3 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 13. Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 16%. Portfolio B has a beta of 0.8 and an expected return of 12%. The risk-free rate of return is 6%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______. A. A; A B. A; B C. B; A D. B; B E. A; the riskless asset 14. Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of 13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________. A. A; A B. A; B C. B; A D. B; B E. No arbitrage opportunity exists. 15. Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the welldiversified portfolio is approximately __________. A. 3.6% B. 6.0% C. 7.3% D. 10.1% E. 8.6% 10-4 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 16. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 18%. The standard deviation on the factor portfolio is 16%. The beta of the welldiversified portfolio is approximately __________. A. 0.80 B. 1.13 C. 1.25 D. 1.56 E. 0.93 17. Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%, respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage opportunities are ruled out, stock A has a beta of __________. A. 0.67 B. 1.00 C. 1.30 D. 1.69 E. 0.75 18. Consider the multifactor APT with two factors. Stock A has an expected return of 16.4%, a beta of 1.4 on factor 1 and a beta of .8 on factor 2. The risk premium on the factor 1 portfolio is 3%. The risk-free rate of return is 6%. What is the risk-premium on factor 2 if no arbitrage opportunities exit? A. 2% B. 3% C. 4% D. 7.75% E. 6.89% 10-5 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 19. Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is __________ if no arbitrage opportunities exist. A. 13.5% B. 15.0% C. 16.5% D. 23.0% E. 18.7% 20. Consider the multifactor APT with two factors. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 6%, respectively. Stock A has a beta of 1.2 on factor 1, and a beta of 0.7 on factor 2. The expected return on stock A is 17%. If no arbitrage opportunities exist, the risk-free rate of return is ___________. A. 6.0% B. 6.5% C. 6.8% D. 7.4% E. 7.7% 21. Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on the factor. The expected returns on portfolios A and B are 11% and 17%, respectively. Assume that the risk-free rate is 6% and that arbitrage opportunities exist. Suppose you invested $100,000 in the risk-free asset, $100,000 in portfolio B, and sold short $200,000 of portfolio A. Your expected profit from this strategy would be ______________. A. −$1,000 B. $0 C. $1,000 D. $2,000 E. $1,600 10-6 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 22. Consider the one-factor APT. Assume that two portfolios, A and B, are well diversified. The betas of portfolios A and B are 1.0 and 1.5, respectively. The expected returns on portfolios A and B are 19% and 24%, respectively. Assuming no arbitrage opportunities exist, the risk-free rate of return must be ____________. A. 4.0% B. 9.0% C. 14.0% D. 16.5% E. 8.2% 23. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 3%, respectively. The risk-free rate of return is 10%. Stock A has an expected return of 19% and a beta on factor 1 of 0.8. Stock A has a beta on factor 2 of ________. A. 1.33 B. 1.50 C. 1.67 D. 2.00 E. 1.73 24. Consider the single factor APT. Portfolios A and B have expected returns of 14% and 18%, respectively. The risk-free rate of return is 7%. Portfolio A has a beta of 0.7. If arbitrage opportunities are ruled out, portfolio B must have a beta of __________. A. 0.45 B. 1.00 C. 1.10 D. 1.22 E. 1.33 10-7 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below: 25. If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate. A. 3.0% B. 14.5% C. 15.5% D. 16.0% E. 17.0% 26. If you invested in an equally weighted portfolio of stocks A and C, your portfolio return would be ____________ if economic growth was strong. A. 17.0% B. 22.5% C. 30.0% D. 30.5% E. 25.6% 27. If you invested in an equally weighted portfolio of stocks B and C, your portfolio return would be _____________ if economic growth was weak. A. −2.5% B. 0.5% C. 3.0% D. 11.0% E. 9.0% 10-8 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 28. If you wanted to take advantage of a risk-free arbitrage opportunity, you should take a short position in _________ and a long position in an equally weighted portfolio of _______. A. A; B and C B. B; A and C C. C; A and B D. A and B; C E. No arbitrage opportunity exists. Consider the multifactor APT. There are two independent economic factors, F1and F2. The risk-free rate of return is 6%. The following information is available about two welldiversified portfolios: 29. Assuming no arbitrage opportunities exist, the risk premium on the factor F1portfolio should be __________. A. 3% B. 4% C. 5% D. 6% E. 2% 30. Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be ___________. A. 3% B. 4% C. 5% D. 6% E. 2% 10-9 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 31. A zero-investment portfolio with a positive expected return arises when _________. A. an investor has downside risk only B. the law of prices is not violated C. the opportunity set is not tangent to the capital allocation line D. a risk-free arbitrage opportunity exists E. a risk-free arbitrage opportunity does not exist 32. An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________. A. a dominance argument B. the mean-variance efficiency frontier C. a risk-free arbitrage D. the capital asset pricing model E. the SML 33. The APT differs from the CAPM because the APT _________. A. places more emphasis on market risk B. minimizes the importance of diversification C. recognizes multiple unsystematic risk factors D. recognizes multiple systematic risk factors E. places more emphasis on systematic risk 34. The feature of the APT that offers the greatest potential advantage over the CAPM is the ______________. A. use of several factors instead of a single market index to explain the risk-return relationship B. identification of anticipated changes in production, inflation, and term structure as key factors in explaining the risk-return relationship C. superior measurement of the risk-free rate of return over historical time periods D. variability of coefficients of sensitivity to the APT factors for a given asset over time E. superior measurement of the risk-free rate of return over historical time periods and variability of coefficients of sensitivity to the APT factors for a given asset over time 10-10 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 35. In terms of the risk/return relationship in the APT A. only factor risk commands a risk premium in market equilibrium. B. only systematic risk is related to expected returns. C. only nonsystematic risk is related to expected returns. D. only factor risk commands a risk premium in market equilibrium and only systematic risk is related to expected returns. E. only factor risk commands a risk premium in market equilibrium and only nonsystematic risk is related to expected returns. 36. The following factors might affect stock returns: A. the business cycle. B. interest rate fluctuations. C. inflation rates. D. the business cycle, interest rate fluctuations, and inflation rates. E. the relationship between past FRED spreads. 37. Advantage(s) of the APT is(are) A. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios. B. that the model does not require a specific benchmark market portfolio. C. that risk need not be considered. D. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios and that the model does not require a specific benchmark market portfolio. E. that the model does not require a specific benchmark market portfolio and that risk need not be considered. 38. Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has expected return of 12% and standard deviation of 17%. Rational investors will A. borrow at the risk free rate and buy A. B. sell A short and buy B. C. sell B short and buy A. D. borrow at the risk free rate and buy B. E. lend at the risk free rate and buy B. 10-11 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 39. An important difference between CAPM and APT is A. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition. B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium. C. implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments. D. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition, CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium, implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments. E. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition and assumes many small changes are required to bring the market back to equilibrium. 40. A professional who searches for mispriced securities in specific areas such as mergertarget stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged in A. pure arbitrage. B. risk arbitrage. C. option arbitrage. D. equilibrium arbitrage. E. covered interest arbitrage. 41. In the context of the Arbitrage Pricing Theory, as a well-diversified portfolio becomes larger its nonsystematic risk approaches A. one. B. infinity. C. zero. D. negative one. E. None of these is correct. 10-12 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 42. A well-diversified portfolio is defined as A. one that is diversified over a large enough number of securities that the nonsystematic variance is essentially zero. B. one that contains securities from at least three different industry sectors. C. a portfolio whose factor beta equals 1.0. D. a portfolio that is equally weighted. E. a portfolio that is equally weighted and contains securities from at least three different industry sectors. 43. The APT requires a benchmark portfolio A. that is equal to the true market portfolio. B. that contains all securities in proportion to their market values. C. that need not be well-diversified. D. that is well-diversified and lies on the SML. E. that is unobservable. 44. Imposing the no-arbitrage condition on a single-factor security market implies which of the following statements? I) the expected return-beta relationship is maintained for all but a small number of welldiversified portfolios. II) the expected return-beta relationship is maintained for all well-diversified portfolios. III) the expected return-beta relationship is maintained for all but a small number of individual securities. IV) the expected return-beta relationship is maintained for all individual securities. A. I and III are correct. B. I and IV are correct. C. II and III are correct. D. II and IV are correct. E. Only I is correct. 10-13 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 45. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 9.2% D. 13.0% E. 13.2% 46. The term "arbitrage" refers to A. buying low and selling high. B. short selling high and buying low. C. earning risk-free economic profits. D. negotiating for favorable brokerage fees. E. hedging your portfolio through the use of options. 47. To take advantage of an arbitrage opportunity, an investor would I) construct a zero investment portfolio that will yield a sure profit. II) construct a zero beta investment portfolio that will yield a sure profit. III) make simultaneous trades in two markets without any net investment. IV) short sell the asset in the low-priced market and buy it in the high-priced market. A. I and IV B. I and III C. II and III D. I, III, and IV E. II, III, and IV 48. The factor F in the APT model represents A. firm-specific risk. B. the sensitivity of the firm to that factor. C. a factor that affects all security returns. D. the deviation from its expected value of a factor that affects all security returns. E. a random amount of return attributable to firm events. 10-14 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 49. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 25% and 50 securities? A. 12.5% B. 625% C. 0.5% D. 3.54% E. 14.59% 50. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 20% and 20 securities? A. 12.5% B. 625% C. 4.47% D. 3.54% E. 14.59% 51. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 20% and 40 securities? A. 12.5% B. 625% C. 0.5% D. 3.54% E. 3.16% 52. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 18% and 250 securities? A. 1.14% B. 625% C. 0.5% D. 3.54% E. 3.16% 10-15 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 53. Which of the following is true about the security market line (SML) derived from the APT? A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. The SML is not relevant for the APT. 54. Which of the following is false about the security market line (SML) derived from the APT? A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. The SML has a downward slope, the SML for the APT shows expected return in relation to portfolio standard deviation, and the SML for the APT has an intercept equal to the expected return on the market portfolio are all false. 55. If arbitrage opportunities are to be ruled out, each well-diversified portfolio's expected excess return must be A. inversely proportional to the risk-free rate. B. inversely proportional to its standard deviation. C. proportional to its weight in the market portfolio. D. proportional to its standard deviation. E. proportional to its beta coefficient. 56. Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. The portfolios have expected returns of 15% and 6%, respectively. Based on this information, what would be the expected return on well-diversified portfolio A, if A has a beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%. A. 15.2% B. 14.1% C. 13.3% D. 10.7% E. 8.4% 10-16 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 57. Which of the following is (are) true regarding the APT? I) The Security Market Line does not apply to the APT. II) More than one factor can be important in determining returns. III) Almost all individual securities satisfy the APT relationship. IV) It doesn't rely on the market portfolio that contains all assets. A. II, III, and IV B. II and IV C. II and III D. I, II, and IV E. I, II, III, and IV 58. In a factor model, the return on a stock in a particular period will be related to A. factor risk. B. non-factor risk. C. standard deviation of returns. D. both factor risk and non-factor risk. E. There is no relationship between factor risk, risk premiums, and returns. 59. Which of the following factors did Chen, Roll and Ross not include in their multifactor model? A. Change in industrial production B. Change in expected inflation C. Change in unanticipated inflation D. Excess return of long-term government bonds over T-bills E. Neither the change in industrial production, change in expected inflation, change in unanticipated inflation, nor excess return of long-term government bonds over T-bills were included in their model. 60. Which of the following factors did Chen, Roll and Ross include in their multifactor model? A. Change in industrial waste B. Change in expected inflation C. Change in unanticipated inflation D. Change in expected inflation and Change in unanticipated inflation E. All of these factors were included in their model 10-17 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 61. Which of the following factors were used by Fama and French in their multi-factor model? A. Return on the market index. B. Excess return of small stocks over large stocks. C. Excess return of high book-to-market stocks over low book-to-market stocks. D. All of these factors were included in their model. E. None of these factors were included in their model. 62. Consider the single-factor APT. Stocks A and B have expected returns of 12% and 14%, respectively. The risk-free rate of return is 5%. Stock B has a beta of 1.2. If arbitrage opportunities are ruled out, stock A has a beta of __________. A. 0.67 B. 0.93 C. 1.30 D. 1.69 E. 1.27 63. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 19%. The standard deviation on the factor portfolio is 12%. The beta of the welldiversified portfolio is approximately __________. A. 1.58 B. 1.13 C. 1.25 D. 0.76 E. 1.42 64. Black argues that past risk premiums on firm-characteristic variables, such as those described by Fama and French, are problematic because ________. A. they may result from data snooping B. they are sources of systematic risk C. they can be explained by security characteristic lines D. they are more appropriate for a single-factor model E. they are macroeconomic factors 10-18 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 65. Multifactor models seek to improve the performance of the single-index model by A. modeling the systematic component of firm returns in greater detail. B. incorporating firm-specific components into the pricing model. C. allowing for multiple economic factors to have differential effects. D. modeling the systematic component of firm returns in greater detail, incorporating firmspecific components into the pricing model, and allowing for multiple economic factors to have differential effects. E. none of these statements are true. 66. Multifactor models such as the one constructed by Chen, Roll, and Ross, can better describe assets' returns by A. expanding beyond one factor to represent sources of systematic risk. B. using variables that are easier to forecast ex ante. C. calculating beta coefficients by an alternative method. D. using only stocks with relatively stable returns. E. ignoring firm-specific risk. 67. Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5% and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio A is __________ if no arbitrage opportunities exist. A. 13.5% B. 13.4% C. 16.5% D. 23.0% E. 11.6% 68. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 6% and 4%, respectively. The risk-free rate of return is 4%. Stock A has an expected return of 16% and a beta on factor 1 of 1.3. Stock A has a beta on factor 2 of ________. A. 1.33 B. 1.05 C. 1.67 D. 2.00 E. .95 10-19 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 69. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 5%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 6%. If portfolio A has a beta of 0.6 on the first factor and 1.8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 18.2% D. 13.0% E. 13.2% 70. Consider a single factor APT. Portfolio A has a beta of 2.0 and an expected return of 22%. Portfolio B has a beta of 1.5 and an expected return of 17%. The risk-free rate of return is 4%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______. A. A; A B. A; B C. B; A D. B; B E. A; the riskless asset 71. Consider the single factor APT. Portfolio A has a beta of 0.5 and an expected return of 12%. Portfolio B has a beta of 0.4 and an expected return of 13%. The risk-free rate of return is 5%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________. A. A; A B. A; B C. B; A D. B; B E. No arbitrage opportunity exists. 10-20 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 72. Consider the one-factor APT. The variance of returns on the factor portfolio is 9%. The beta of a well-diversified portfolio on the factor is 1.25. The variance of returns on the welldiversified portfolio is approximately __________. A. 3.6% B. 6.0% C. 7.3% D. 14.1% E. 9.7% 73. Consider the one-factor APT. The variance of returns on the factor portfolio is 11%. The beta of a well-diversified portfolio on the factor is 1.45. The variance of returns on the welldiversified portfolio is approximately __________. A. 23.1% B. 6.0% C. 7.3% D. 14.1% E. 11.4% 74. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 22%. The standard deviation on the factor portfolio is 14%. The beta of the welldiversified portfolio is approximately __________. A. 0.80 B. 1.13 C. 1.25 D. 1.57 E. 67 10-21 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return Short Answer Questions 75. Discuss the advantages of arbitrage pricing theory (APT) over the capital asset pricing model (CAPM) relative to diversified portfolios. 76. Discuss the advantages of the multifactor APT over the single factor APT and the CAPM. What is one shortcoming of the multifactor APT and how does this shortcoming compare to CAPM implications? 77. Discuss arbitrage opportunities in the context of violations of the law of one price. 78. Discuss the similarities and the differences between the CAPM and the APT with regard to the following factors: capital market equilibrium, assumptions about risk aversion, riskreturn dominance, and the number of investors required to restore equilibrium. 10-22 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 79. Security A has a beta of 1.0 and an expected return of 12%. Security B has a beta of 0.75 and an expected return of 11%. The risk-free rate is 6%. Explain the arbitrage opportunity that exists; explain how an investor can take advantage of it. Give specific details about how to form the portfolio, what to buy and what to sell. 80. Name three variables that Chen, Roll, and Ross used to measure the impact of macroeconomic factors on security returns. Briefly explain the reasoning behind their model. 10-23 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return Answer Key Multiple Choice Questions 1. ___________ a relationship between expected return and risk. A. APT stipulates B. CAPM stipulates C. Both CAPM and APT stipulate D. Neither CAPM nor APT stipulate E. No pricing model has found Both models attempt to explain asset pricing based on risk/return relationships. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT and CAPM 2. Consider the multifactor APT with two factors. Stock A has an expected return of 17.6%, a beta of 1.45 on factor 1 and a beta of .86 on factor 2. The risk premium on the factor 1 portfolio is 3.2%. The risk-free rate of return is 5%. What is the risk-premium on factor 2 if no arbitrage opportunities exit? A. 9.26% B. 3% C. 4% D. 7.75% E. 9.75% 17.6% = 1.45(3.2%) + .86x + 5%; x = 9.26. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: APT 10-24 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 3. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. factor sensitivities C. idiosyncratic risk D. factor betas E. both factor sensitivities and factor betas The coefficients are called factor betas, factor sensitivities, or factor loadings. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 4. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. firm-specific risk C. idiosyncratic risk D. factor betas E. unique risk The coefficients are called factor betas, factor sensitivities, or factor loadings. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 5. In a multi-factor APT model, the coefficients on the macro factors are often called ______. A. systemic risk B. firm-specific risk C. idiosyncratic risk D. factor loadings E. unique risk The coefficients are called factor betas, factor sensitivities, or factor loadings. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-25 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 6. Which pricing model provides no guidance concerning the determination of the risk premium on factor portfolios? A. The CAPM B. The multifactor APT C. Both the CAPM and the multifactor APT D. Neither the CAPM nor the multifactor APT E. No pricing model currently exists that provides guidance concerning the determination of the risk premium on any portfolio. The multifactor APT provides no guidance as to the determination of the risk premium on the various factors. The CAPM assumes that the excess market return over the risk-free rate is the market premium in the single factor CAPM. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT and CAPM 7. An arbitrage opportunity exists if an investor can construct a __________ investment portfolio that will yield a sure profit. A. small positive B. small negative C. zero D. large positive E. large negative If the investor can construct a portfolio without the use of the investor's own funds and the portfolio yields a positive profit, arbitrage opportunities exist. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-26 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 8. The APT was developed in 1976 by ____________. A. Lintner B. Modigliani and Miller C. Ross D. Sharpe E. Fama Ross developed this model in 1976. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 9. A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor. A. factor B. market C. index D. factor and market E. factor, market, and index A factor model portfolio has a beta of 1 one factor, with zero betas on other factors. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-27 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 10. The exploitation of security mispricing in such a way that risk-free economic profits may be earned is called ___________. A. arbitrage B. capital asset pricing C. factoring D. fundamental analysis E. technical analysis Arbitrage is earning of positive profits with a zero (risk-free) investment. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 11. In developing the APT, Ross assumed that uncertainty in asset returns was a result of A. a common macroeconomic factor B. firm-specific factors C. pricing error D. neither common macroeconomic factors nor firm-specific factors. E. both common macroeconomic factors and firm-specific factors Total risk (uncertainty) is assumed to be composed of both macroeconomic and firm-specific factors. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-28 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 12. The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities. A. APT, CAPM B. APT, OPM C. CAPM, APT D. CAPM, OPM E. APT and OPM, CAPM The CAPM is an asset-pricing model based on the risk/return relationship of all assets. The APT implies that this relationship holds for all well-diversified portfolios, and for all but perhaps a few individual securities. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT and CAPM 13. Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 16%. Portfolio B has a beta of 0.8 and an expected return of 12%. The risk-free rate of return is 6%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______. A. A, A B. A, B C. B, A D. B, B E. A, the riskless asset A: 16% = 1.0F + 6%; F = 10%; B: 12% = 0.8F + 6%: F = 7.5%; thus, short B and take a long position in A. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-29 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 14. Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of 13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________. A. A, A B. A, B C. B, A D. B, B E. No arbitrage opportunity exists. A: 13% = 10% + 0.2F; F = 15%; B: 15% = 10% + 0.4F; F = 12.5%; therefore, short B and take a long position in A. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 15. Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the welldiversified portfolio is approximately __________. A. 3.6% B. 6.0% C. 7.3% D. 10.1% E. 8.6% s2P = (1.1)2(6%) = 7.26%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-30 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 16. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 18%. The standard deviation on the factor portfolio is 16%. The beta of the welldiversified portfolio is approximately __________. A. 0.80 B. 1.13 C. 1.25 D. 1.56 E. 0.93 (18%)2 = (16%)2 b2; b = 1.125. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 17. Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%, respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage opportunities are ruled out, stock A has a beta of __________. A. 0.67 B. 1.00 C. 1.30 D. 1.69 E. 0.75 A: 18% = 6% + bF; B: 8% = 6% + 1.0F; F = 12%; thus, beta of A = 9/12 = 0.75. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-31 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 18. Consider the multifactor APT with two factors. Stock A has an expected return of 16.4%, a beta of 1.4 on factor 1 and a beta of .8 on factor 2. The risk premium on the factor 1 portfolio is 3%. The risk-free rate of return is 6%. What is the risk-premium on factor 2 if no arbitrage opportunities exit? A. 2% B. 3% C. 4% D. 7.75% E. 6.89% 16.4% = 1.4(3%) + .8x + 6%; x = 7.75. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: APT 19. Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is __________ if no arbitrage opportunities exist. A. 13.5% B. 15.0% C. 16.5% D. 23.0% E. 18.7% 7% + 0.75(1%) + 1.25(7%) = 16.5%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-32 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 20. Consider the multifactor APT with two factors. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 6%, respectively. Stock A has a beta of 1.2 on factor 1, and a beta of 0.7 on factor 2. The expected return on stock A is 17%. If no arbitrage opportunities exist, the risk-free rate of return is ___________. A. 6.0% B. 6.5% C. 6.8% D. 7.4% E. 7.7% 17% = x% + 1.2(5%) + 0.7(6%); x = 6.8%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 21. Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on the factor. The expected returns on portfolios A and B are 11% and 17%, respectively. Assume that the risk-free rate is 6% and that arbitrage opportunities exist. Suppose you invested $100,000 in the risk-free asset, $100,000 in portfolio B, and sold short $200,000 of portfolio A. Your expected profit from this strategy would be ______________. A. −$1,000 B. $0 C. $1,000 D. $2,000 E. $1,600 $100,000(0.06) = $6,000 (risk-free position); $100,000(0.17) = $17,000 (portfolio B); −$200,000(0.11) = −$22,000 (short position, portfolio A); 1,000 profit. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-33 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 22. Consider the one-factor APT. Assume that two portfolios, A and B, are well diversified. The betas of portfolios A and B are 1.0 and 1.5, respectively. The expected returns on portfolios A and B are 19% and 24%, respectively. Assuming no arbitrage opportunities exist, the risk-free rate of return must be ____________. A. 4.0% B. 9.0% C. 14.0% D. 16.5% E. 8.2% A: 19% = rf + 1(F); B:24% = rf + 1.5(F); 5% = .5(F); F = 10%; 24% = rf + 1.5(10); rf = 9%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 23. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 3%, respectively. The risk-free rate of return is 10%. Stock A has an expected return of 19% and a beta on factor 1 of 0.8. Stock A has a beta on factor 2 of ________. A. 1.33 B. 1.50 C. 1.67 D. 2.00 E. 1.73 19% = 10% + 5%(0.8) + 3%(x); x = 1.67. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-34 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 24. Consider the single factor APT. Portfolios A and B have expected returns of 14% and 18%, respectively. The risk-free rate of return is 7%. Portfolio A has a beta of 0.7. If arbitrage opportunities are ruled out, portfolio B must have a beta of __________. A. 0.45 B. 1.00 C. 1.10 D. 1.22 E. 1.33 A: 14% = 7% + 0.7F; F = 10; B: 18% = 7% + 10b; b = 1.10. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below: 10-35 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 25. If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate. A. 3.0% B. 14.5% C. 15.5% D. 16.0% E. 17.0% E(Rp) = 0.5(17%) + 0.5(15%) = 16%. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: APT 26. If you invested in an equally weighted portfolio of stocks A and C, your portfolio return would be ____________ if economic growth was strong. A. 17.0% B. 22.5% C. 30.0% D. 30.5% E. 25.6% 0.5(39%) + 0.5(6%) = 22.5%. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: APT 10-36 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 27. If you invested in an equally weighted portfolio of stocks B and C, your portfolio return would be _____________ if economic growth was weak. A. −2.5% B. 0.5% C. 3.0% D. 11.0% E. 9.0% 0.5(0%) + 0.5(22%) = 11%. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: APT 28. If you wanted to take advantage of a risk-free arbitrage opportunity, you should take a short position in _________ and a long position in an equally weighted portfolio of _______. A. A, B and C B. B, A and C C. C, A and B D. A and B, C E. No arbitrage opportunity exists. E(RA) = (39% + 17% − 5%)/3 = 17%; E(RB) = (30% + 15% + 0%)/3 = 15%; E(RC) = (22% + 14% + 6%)/3 = 14%; E(RP) = −0.5(14%) + 0.5[(17% + 15%)/2]; −7.0% + 8.0% = 1.0%. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: APT Consider the multifactor APT. There are two independent economic factors, F1and F2. The risk-free rate of return is 6%. The following information is available about two welldiversified portfolios: 10-37 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 29. Assuming no arbitrage opportunities exist, the risk premium on the factor F1portfolio should be __________. A. 3% B. 4% C. 5% D. 6% E. 2% 2A: 38% = 12% + 2.0(RP1) + 4.0(RP2); B: 12% = 6% + 2.0(RP1) + 0.0(RP2); 26% = 6% + 4.0(RP2); RP2 = 5; A: 19% = 6% + RP1 + 2.0(5); RP1 = 3%. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: APT 30. Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be ___________. A. 3% B. 4% C. 5% D. 6% E. 2% 2A: 38% = 12% + 2.0(RP1) + 4.0(RP2); B: 12% = 6% + 2.0(RP1) + 0.0(RP2); 26% = 6% + 4.0(RP2); RP2 = 5; A: 19% = 6% + RP1 + 2.0(5); RP1 = 3%. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: APT 10-38 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 31. A zero-investment portfolio with a positive expected return arises when _________. A. an investor has downside risk only B. the law of prices is not violated C. the opportunity set is not tangent to the capital allocation line D. a risk-free arbitrage opportunity exists E. a risk-free arbitrage opportunity does not exist When an investor can create a zero-investment portfolio (by using none of the investor's own funds) with a possibility of a positive profit, a risk-free arbitrage opportunity exists. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 32. An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________. A. a dominance argument B. the mean-variance efficiency frontier C. a risk-free arbitrage D. the capital asset pricing model E. the SML When the equilibrium price is violated, the investor will buy the lower priced asset and simultaneously place an order to sell the higher priced asset. Such transactions result in riskfree arbitrage. The larger the positions, the greater the risk-free arbitrage profits. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-39 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 33. The APT differs from the CAPM because the APT _________. A. places more emphasis on market risk B. minimizes the importance of diversification C. recognizes multiple unsystematic risk factors D. recognizes multiple systematic risk factors E. places more emphasis on systematic risk The CAPM assumes that market returns represent systematic risk. The APT recognizes that other macroeconomic factors may be systematic risk factors. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT and CAPM 34. The feature of the APT that offers the greatest potential advantage over the CAPM is the ______________. A. use of several factors instead of a single market index to explain the risk-return relationship B. identification of anticipated changes in production, inflation, and term structure as key factors in explaining the risk-return relationship C. superior measurement of the risk-free rate of return over historical time periods D. variability of coefficients of sensitivity to the APT factors for a given asset over time E. superior measurement of the risk-free rate of return over historical time periods and variability of coefficients of sensitivity to the APT factors for a given asset over time The advantage of the APT is the use of multiple factors, rather than a single market index, to explain the risk-return relationship. However, APT does not identify the specific factors. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-40 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 35. In terms of the risk/return relationship in the APT A. only factor risk commands a risk premium in market equilibrium. B. only systematic risk is related to expected returns. C. only nonsystematic risk is related to expected returns. D. only factor risk commands a risk premium in market equilibrium and only systematic risk is related to expected returns. E. only factor risk commands a risk premium in market equilibrium and only nonsystematic risk is related to expected returns. Nonfactor risk may be diversified away; thus, only factor risk commands a risk premium in market equilibrium. Nonsystematic risk across firms cancels out in well-diversified portfolios; thus, only systematic risk is related to expected returns. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 36. The following factors might affect stock returns: A. the business cycle. B. interest rate fluctuations. C. inflation rates. D. the business cycle, interest rate fluctuations, and inflation rates. E. the relationship between past FRED spreads. The business cycle, interest rate fluctuations, and inflation rates are likely to affect stock returns. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-41 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 37. Advantage(s) of the APT is(are) A. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios. B. that the model does not require a specific benchmark market portfolio. C. that risk need not be considered. D. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios and that the model does not require a specific benchmark market portfolio. E. that the model does not require a specific benchmark market portfolio and that risk need not be considered. The APT provides no guidance concerning the determination of the risk premiums on the factor portfolios. Risk must be considered in both the CAPM and APT. A major advantage of APT over the CAPM is that a specific benchmark market portfolio is not required. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT and CAPM 38. Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has expected return of 12% and standard deviation of 17%. Rational investors will A. Borrow at the risk free rate and buy A. B. Sell A short and buy B. C. Sell B short and buy A. D. Borrow at the risk free rate and buy B. E. Lend at the risk free rate and buy B. Rational investors will arbitrage by selling A and buying B. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: APT 10-42 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 39. An important difference between CAPM and APT is A. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition. B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium. C. implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments. D. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition, CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium, implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments. E. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition and assumes many small changes are required to bring the market back to equilibrium. Under the risk-return dominance argument of CAPM, when an equilibrium price is violated many investors will make small portfolio changes, depending on their risk tolerance, until equilibrium is restored. Under the no-arbitrage argument of APT, each investor will take as large a position as possible so only a few investors must act to restore equilibrium. Implications derived from APT are much stronger than those derived from CAPM, making C an incorrect statement. AACSB: Analytic Bloom's: Remember Difficulty: Challenge Topic: APT 40. A professional who searches for mispriced securities in specific areas such as mergertarget stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged in A. pure arbitrage. B. risk arbitrage. C. option arbitrage. D. equilibrium arbitrage. E. covered interest arbitrage. Risk arbitrage involves searching for mispricings based on speculative information that may or may not materialize. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-43 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 41. In the context of the Arbitrage Pricing Theory, as a well-diversified portfolio becomes larger its nonsystematic risk approaches A. one. B. infinity. C. zero. D. negative one. E. None of these is correct. As the number of securities, n, increases, the nonsystematic risk of a well-diversified portfolio approaches zero. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 42. A well-diversified portfolio is defined as A. one that is diversified over a large enough number of securities that the nonsystematic variance is essentially zero. B. one that contains securities from at least three different industry sectors. C. a portfolio whose factor beta equals 1.0. D. a portfolio that is equally weighted. E. a portfolio that is equally weighted and contains securities from at least three different industry sectors A well-diversified portfolio is one that contains a large number of securities, each having a small (but not necessarily equal) weight, so that nonsystematic variance is negligible. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-44 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 43. The APT requires a benchmark portfolio A. that is equal to the true market portfolio. B. that contains all securities in proportion to their market values. C. that need not be well-diversified. D. that is well-diversified and lies on the SML. E. that is unobservable. Any well-diversified portfolio lying on the SML can serve as the benchmark portfolio for the APT. The true (and unobservable) market portfolio is only a requirement for the CAPM. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 44. Imposing the no-arbitrage condition on a single-factor security market implies which of the following statements? I) the expected return-beta relationship is maintained for all but a small number of welldiversified portfolios. II) the expected return-beta relationship is maintained for all well-diversified portfolios. III) the expected return-beta relationship is maintained for all but a small number of individual securities. IV) the expected return-beta relationship is maintained for all individual securities. A. I and III are correct. B. I and IV are correct. C. II and III are correct. D. II and IV are correct. E. Only I is correct. The expected return-beta relationship must hold for all well-diversified portfolios and for all but a few individual securities; otherwise arbitrage opportunities will be available. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-45 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 45. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 9.2% D. 13.0% E. 13.2% .06 + 1.2 (.04) + .8 (.03) = .132 AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 46. The term "arbitrage" refers to A. buying low and selling high. B. short selling high and buying low. C. earning risk-free economic profits. D. negotiating for favorable brokerage fees. E. hedging your portfolio through the use of options. Arbitrage is exploiting security mispricings by the simultaneous purchase and sale to gain economic profits without taking any risk. A capital market in equilibrium rules out arbitrage opportunities. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 10-46 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 47. To take advantage of an arbitrage opportunity, an investor would I) construct a zero investment portfolio that will yield a sure profit. II) construct a zero beta investment portfolio that will yield a sure profit. III) make simultaneous trades in two markets without any net investment. IV) short sell the asset in the low-priced market and buy it in the high-priced market. A. I and IV B. I and III C. II and III D. I, III, and IV E. II, III, and IV Only I and III are correct. II is incorrect because the beta of the portfolio does not need to be zero. IV is incorrect because the opposite is true. AACSB: Analytic Bloom's: Understand Difficulty: Challenge Topic: APT 48. The factor F in the APT model represents A. firm-specific risk. B. the sensitivity of the firm to that factor. C. a factor that affects all security returns. D. the deviation from its expected value of a factor that affects all security returns. E. a random amount of return attributable to firm events. F measures the unanticipated portion of a factor that is common to all security returns. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-47 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 49. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 25% and 50 securities? A. 12.5% B. 625% C. 0.5% D. 3.54% E. 14.59% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 50. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 20% and 20 securities? A. 12.5% B. 625% C. 4.47% D. 3.54% E. 14.59% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-48 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 51. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 20% and 40 securities? A. 12.5% B. 625% C. 0.5% D. 3.54% E. 3.16% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 52. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of (ei) equal to 18% and 250 securities? A. 1.14% B. 625% C. 0.5% D. 3.54% E. 3.16% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-49 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 53. Which of the following is true about the security market line (SML) derived from the APT? A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. The SML is not relevant for the APT. The benchmark portfolio does not need to be the (unobservable) market portfolio under the APT, but can be any well-diversified portfolio. The intercept still equals the risk-free rate. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 54. Which of the following is false about the security market line (SML) derived from the APT? A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. The SML has a downward slope, the SML for the APT shows expected return in relation to portfolio standard deviation, and the SML for the APT has an intercept equal to the expected return on the market portfolio are all false. The benchmark portfolio does not need to be the (unobservable) market portfolio under the APT, but can be any well-diversified portfolio. The intercept still equals the risk-free rate. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-50 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 55. If arbitrage opportunities are to be ruled out, each well-diversified portfolio's expected excess return must be A. inversely proportional to the risk-free rate. B. inversely proportional to its standard deviation. C. proportional to its weight in the market portfolio. D. proportional to its standard deviation. E. proportional to its beta coefficient. For each well-diversified portfolio (P and Q, for example), it must be true that [E(rp) − rf]/p = [E(rQ) − rf]/ Q. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 56. Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. The portfolios have expected returns of 15% and 6%, respectively. Based on this information, what would be the expected return on well-diversified portfolio A, if A has a beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%. A. 15.2% B. 14.1% C. 13.3% D. 10.7% E. 8.4% E(RA) = 3 + 0.8*(15 − 3) + 0.5*(6 − 3) = 14.1 AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-51 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 57. Which of the following is (are) true regarding the APT? I) The Security Market Line does not apply to the APT. II) More than one factor can be important in determining returns. III) Almost all individual securities satisfy the APT relationship. IV) It doesn't rely on the market portfolio that contains all assets. A. II, III, and IV B. II and IV C. II and III D. I, II, and IV E. I, II, III, and IV All except the first item are true. There is a Security Market Line associated with the APT. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 58. In a factor model, the return on a stock in a particular period will be related to A. factor risk. B. non-factor risk. C. standard deviation of returns. D. both factor risk and non-factor risk. E. There is no relationship between factor risk, risk premiums, and returns. Factor models explain firm returns based on both factor risk and non-factor risk. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-52 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 59. Which of the following factors did Chen, Roll and Ross not include in their multifactor model? A. Change in industrial production B. Change in expected inflation C. Change in unanticipated inflation D. Excess return of long-term government bonds over T-bills E. Neither the change in industrial production, change in expected inflation, change in unanticipated inflation, nor excess return of long-term government bonds over T-bills were included in their model. Chen, Roll and Ross included the four listed factors as well as the excess return of long-term corporate bonds over long-term government bonds in their model. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 60. Which of the following factors did Chen, Roll and Ross include in their multifactor model? A. Change in industrial waste B. Change in expected inflation C. Change in unanticipated inflation D. Change in expected inflation and Change in unanticipated inflation E. All of these factors were included in their model. Chen, Roll and Ross included the change in expected inflation and the change in unanticipated inflation as well as the excess return of long-term corporate bonds over longterm government bonds in their model. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-53 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 61. Which of the following factors were used by Fama and French in their multi-factor model? A. Return on the market index. B. Excess return of small stocks over large stocks. C. Excess return of high book-to-market stocks over low book-to-market stocks. D. All of these factors were included in their model. E. None of these factors were included in their model. Fama and French included all three of the factors listed. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 62. Consider the single-factor APT. Stocks A and B have expected returns of 12% and 14%, respectively. The risk-free rate of return is 5%. Stock B has a beta of 1.2. If arbitrage opportunities are ruled out, stock A has a beta of __________. A. 0.67 B. 0.93 C. 1.30 D. 1.69 E. 1.27 A: 12% = 5% + bF; B: 14% = 5% + 1.2F; F = 7.5%; Thus, beta of A = 7/7.5 = 0.93. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-54 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 63. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 19%. The standard deviation on the factor portfolio is 12%. The beta of the welldiversified portfolio is approximately __________. A. 1.58 B. 1.13 C. 1.25 D. 0.76 E. 1.42 (19%)2 = (12%)2b2; b = 1.58. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 64. Black argues that past risk premiums on firm-characteristic variables, such as those described by Fama and French, are problematic because ________. A. they may result from data snooping B. they are sources of systematic risk C. they can be explained by security characteristic lines D. they are more appropriate for a single-factor model E. they are macroeconomic factors Black argues that past risk premiums on firm-characteristic variables, such as those described by Fama and French, are problematic because they may result from data snooping. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-55 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 65. Multifactor models seek to improve the performance of the single-index model by A. modeling the systematic component of firm returns in greater detail. B. incorporating firm-specific components into the pricing model. C. allowing for multiple economic factors to have differential effects. D. modeling the systematic component of firm returns in greater detail, incorporating firmspecific components into the pricing model, and allowing for multiple economic factors to have differential effects. E. none of these statements are true. Multifactor models seek to improve the performance of the single-index model by modeling the systematic component of firm returns in greater detail, incorporating firm-specific components into the pricing model., and allowing for multiple economic factors to have differential effects. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: APT 66. Multifactor models such as the one constructed by Chen, Roll, and Ross, can better describe assets' returns by A. expanding beyond one factor to represent sources of systematic risk. B. using variables that are easier to forecast ex ante. C. calculating beta coefficients by an alternative method. D. using only stocks with relatively stable returns. E. ignoring firm-specific risk. The study used five different factors to explain security returns, allowing for several sources of risk to affect the returns. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: APT 10-56 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 67. Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5% and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio A is __________ if no arbitrage opportunities exist. A. 13.5% B. 13.4% C. 16.5% D. 23.0% E. 11.6% 3% + 0.8(3%) + 1.1(5%) + 1.25(2%) = 13.4%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 68. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 6% and 4%, respectively. The risk-free rate of return is 4%. Stock A has an expected return of 16% and a beta on factor 1 of 1.3. Stock A has a beta on factor 2 of ________. A. 1.33 B. 1.05 C. 1.67 D. 2.00 E. .95 16% = 4% + 6%(1.3) + 4%(x); x = 1.05. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-57 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 69. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 5%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 6%. If portfolio A has a beta of 0.6 on the first factor and 1.8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 18.2% D. 13.0% E. 13.2% .05 + .6 (.04) + 1.8 (.06) = .182 AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 70. Consider a single factor APT. Portfolio A has a beta of 2.0 and an expected return of 22%. Portfolio B has a beta of 1.5 and an expected return of 17%. The risk-free rate of return is 4%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______. A. A, A B. A, B C. B, A D. B, B E. A, the riskless asset A: 22% = 2.0F + 4%; F = 9%; B: 17% = 1.5F + 4%: F = 8.67%; thus, short B and take a long position in A. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-58 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 71. Consider the single factor APT. Portfolio A has a beta of 0.5 and an expected return of 12%. Portfolio B has a beta of 0.4 and an expected return of 13%. The risk-free rate of return is 5%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________. A. A, A B. A, B C. B, A D. B, B E. No arbitrage opportunity exists. A: 12% = 5% + 0.5F; F = 14%; B: 13% = 5% + 0.4F; F = 20%; therefore, short A and take a long position in B. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 72. Consider the one-factor APT. The variance of returns on the factor portfolio is 9%. The beta of a well-diversified portfolio on the factor is 1.25. The variance of returns on the welldiversified portfolio is approximately __________. A. 3.6% B. 6.0% C. 7.3% D. 14.1% E. 9.7% s2P = (1.25)2(9%) = 14.06%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-59 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 73. Consider the one-factor APT. The variance of returns on the factor portfolio is 11%. The beta of a well-diversified portfolio on the factor is 1.45. The variance of returns on the welldiversified portfolio is approximately __________. A. 23.1% B. 6.0% C. 7.3% D. 14.1% E. 11.4% s2P = (1.45)2(11%) = 23.13%. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 74. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 22%. The standard deviation on the factor portfolio is 14%. The beta of the welldiversified portfolio is approximately __________. A. 0.80 B. 1.13 C. 1.25 D. 1.57 E. 67 (22%)2 = (14%)2b2; b = 1.57. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: APT 10-60 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return Short Answer Questions 75. Discuss the advantages of arbitrage pricing theory (APT) over the capital asset pricing model (CAPM) relative to diversified portfolios. The APT does not require that the benchmark portfolio in the SML relationship be the true market portfolio. Any well-diversified portfolio lying on the SML may serve as a benchmark portfolio. Thus, the APT has more flexibility than the CAPM, as problems associated with an unobservable market portfolio are not a concern with APT. In addition, the APT provides further justification for the use of the index model for practical implementation of the SML relationship. That is, if the index portfolio is not a precise proxy for the true market portfolio, which is a cause of considerable concern in the context of the CAPM, if an index portfolio is sufficiently diversified, the SML relationship holds, according to APT. Feedback: This question is designed to determine if the student understands the basic advantages of APT over the CAPM. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Intermediate Topic: APT and CAPM 76. Discuss the advantages of the multifactor APT over the single factor APT and the CAPM. What is one shortcoming of the multifactor APT and how does this shortcoming compare to CAPM implications? The single factor APT and the CAPM assume that there is only one systematic risk factor affecting stock returns. However, several factors may affect stock returns. Some of these factors are: business cycles, interest rate fluctuations, inflation rates, oil prices, etc. A multifactor model can accommodate these multiple sources of risk. One shortcoming of the multifactor APT is that the model provides no guidance concerning the factors or risk premiums on the factor portfolios. The CAPM implies that the risk premium on the market is determined by the market's variance and the average degree of risk aversion across investors. Feedback: This question is designed to determine if the student understands the basic advantages of the multi-factor APT over the single-factor APT and CAPM. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Intermediate Topic: APT and CAPM 10-61 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 77. Discuss arbitrage opportunities in the context of violations of the law of one price. The law of one price is violated when an asset is trading at different prices in two markets. If the price differential exceeds the transactions costs, a simultaneous trade in the two markets can produce a sure profit with a zero investment. That is, the investor can sell short the asset in the high-priced market and buy the asset in the low-priced market. The investor has been able to assume these positions with a zero investment (using the proceeds of the short transaction to finance the long position). However, it should be remembered that individual investors do not have access to the proceeds of a short transaction until the position has been covered. Feedback: This question is designed to determine if the student understands the basic concept of arbitrage. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Basic Topic: APT 78. Discuss the similarities and the differences between the CAPM and the APT with regard to the following factors: capital market equilibrium, assumptions about risk aversion, riskreturn dominance, and the number of investors required to restore equilibrium. Both the CAPM and the APT are market equilibrium models, which examine the factors that affect securities' prices. In equilibrium, there are no overpriced or underpriced securities. In both models, mispriced securities can be identified and purchased or sold as appropriate to earn excess profits. The CAPM is based on the idea that there are large numbers of investors who are focused on risk-return dominance. Under the CAPM, when a mispricing occurs, many individual investors make small changes in their portfolios, guided by their degrees of risk aversion. The aggregate effect of their actions brings the market back into equilibrium. Under the APT, each investor wants an infinite arbitrage position in the mispriced asset. Therefore, it would not take many investors to identify the arbitrage opportunity and act to bring the market back to equilibrium. Feedback: The student can compare the two models by focusing on the specific items. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Challenge Topic: APT and CAPM 10-62 Chapter 10 - Arbitrage Pricing Theory and Multifactor Models of Risk and Return 79. Security A has a beta of 1.0 and an expected return of 12%. Security B has a beta of 0.75 and an expected return of 11%. The risk-free rate is 6%. Explain the arbitrage opportunity that exists; explain how an investor can take advantage of it. Give specific details about how to form the portfolio, what to buy and what to sell. An arbitrage opportunity exists because it is possible to form a portfolio of security A and the risk-free asset that has a beta of 0.75 and a different expected return than security B. The investor can accomplish this by choosing .75 as the weight in A and .25 in the risk-free asset. This portfolio would have E(rp) = 0.75(12%) + 0.25(6%) = 10.5%, which is less than B's 11% expected return. The investor should buy B and finance the purchase by short selling A and borrowing at the risk-free asset. Feedback: The student can apply arbitrage principles. AACSB: Reflective Thinking Bloom's: Apply Difficulty: Intermediate Topic: APT 80. Name three variables that Chen, Roll, and Ross used to measure the impact of macroeconomic factors on security returns. Briefly explain the reasoning behind their model. The factors they considered were IP (the % change in industrial production), EI (the % change in expected inflation), UI (the % change in unanticipated inflation), CG (excess return of long-term corporate bonds over long-term government bonds), and GB (excess return of longterm government bonds over T-bills). The rational for their model is that many different economic factors can combine to affect securities' returns. Also, by including factors that are related to the business cycle, the estimation of beta coefficients should be improved. Each beta will represent only the impact of the corresponding variable on returns. Feedback: The student has some flexibility in remembering which variables were used in the study. A general understanding of macroeconomic variables will be helpful in answering the question. The question provides an opportunity to measure the student's understanding of the types of risk that are relevant and how they can be explicitly considered in the model. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Challenge Topic: APT 10-63