Corporate Financial Strategy Assignment - University of Nairobi

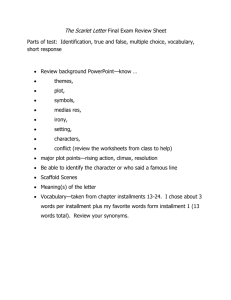

advertisement

UNIVERSITY OF NAIROBI SCHOOL OF BUSINESS Name : Zakaria Hassan Mohamed Reg no : D63/39610/2021 Department : finance and accounting (MSC PROGRAMME) Course code : DFI 512 Course Title : Corporate financial strategy Task : Lecturer : prof Mirie mwangi Individual Assignment Submission date And time : 07-jun-2021(8:00pm- 9:00pm) QUESTION ONE 1:Prepare (using a spreadsheet package) an entire duration amortization schedule as follows: Initial amount: Shs 5,000,000/=; rate of interest: 13% per annum; period: 12 years payable monthly in arrears. An additional amount of Shs 300,000/= is repaid with the 35th installment, and the monthly installment recomputed to fully pay the loan balance in the initially agreed period. The rate of interest is adjusted to 15% per annum with effect from the end of the fifth year. The monthly repayment is recomputed to fully pay the loan balance in the initially agreed period. The borrower enhances his monthly repayments by Shs 11,000/= per month from the end of month 84. The borrower is advanced an additional Shs 600,000/= at the end of month 102 and the monthly repayment is recomputed to fully pay the loan balance in 11 months less than had initially been agreed. ANSWER ONE Formulas Use:- QUESTION TWO 2: The Alpha Corporation obtains a bank loan that is disbursed as follows: Shs 320 million, Shs 240 million, Shs 160 million and Shs 80 million at the beginning of years one, two, three, and five respectively. The loan is repaid in five equal annual installments of Shs 300 million at the end of years six to ten, and a final amount at the beginning of year 13. Given a rate of inflation of 4.5% per annum during the period, and if Alpha’s real cost of the loan is 17% per annum, what should the final repayment be? ANSWER TWO Nominal rate = Inflation rate + Real rate = 3% + 14% = 17% Future value of loan at end of year 4 = (320 * (1+17%)^5) + (240 * (1+17%)^3) + (160 * (1+17%)^2) + (80 * (1+17%)^1) =701.5833 + 384.3871 + 219.024 + 93.6 = 1398.5944 million Present value of future payment = (Annual annuity payment * PVIFA(17%,5 years)) + (Final payment * PVIF(17%, 10 Years)) 1,296.655 = (300 * 3.199346) + (Final payment * 0.208037) 1,296.655 = 959.8038 + (Final payment * 0.208037) Final payment * 0.208037 = 1,296.655 - 959.8038 Final payment * 0.208037 = 336.8512 Final payment = 336.8512 / 0.208037 Final payment = 1619.189. QUESTION THREE 3:A loan of Shs 7,000,000/= disbursed today is repaid in four installments commencing at the end of year one. The second repayment is at the end of year two and is half as much again as the first installment and is 25% less than the third installment (due at the end of year four). The final installment is due at the end of year five and is 15% more than the first installment. The rate of interest is 13% per annum in years one and two; 15% per annum in years three and four; and 12% per annum in years, five and six. Compute the amount of each installment. ANSWER THREE Let the cash flow at the end of year i be denoted by Ci and interest rate for the year i be denoted by Ri C2 = C1 / 2 = 0.75 x C4 C5 = C1 x (1 + 15%) = 1.15C1 C3 = 0 Let's express all the cash flows in terms of C1 C2 = 0.5C1; C3 = 0; C4 = 0.5C1 / 0.85 = 0.6666C1; C5 = 1.15C1 R1 = R2 = 13%; R3 = R4 = 15%; R5 = 12% Loan today = PV of all the future payments Hence, 7000000 = C1/(1.13) + 0.5C1/(1.13)(1.13) + 0.6666C1/(1.13)(1.13)(1.15)(1.15) + 1.15C1/(1.13)(1.13)(1.15)(1.15)(1.12) Hence, 7,000,000 = 2.27934316996C1 Hence, C1 = 7,000,000 / 2.27934316996 = $ 3,071,060.16 C2 = 0.5C1 = $ 1,535,530.08 C4 = 0.6666C1 =$ 2,047,373.44 and C5 = 1.15C1 =$ 3,531,719.18 QUESTION FOURE 4: A firm is advanced a Shs 5 million= loan by a bank to be repaid in equal monthly installments over five years at a rate of interest of 18% per annum. After the 24th installment, the rate of interest is adjusted to 20% per annum and the monthly installment size recomputed such that the loan is fully repaid in the remaining duration of the initially agreed term. After the 36 th installment, the rate of interest is lowered by 3% per annum but the monthly installment size is not adjusted, until from the end of the 49th month when it is increased by Shs 30,000. Required: (i) Compute the initially agreed installment and the one after the interest rate adjustment to 20% per annum. (ii) (iii) At the end of which month would the loan be fully repaid? What is the total interest that the firm pays on the loan during its term? ANSWER FOUR i. Initially Agreed Installment = Loan Amount / PVAF (1.5%,60) Initially Agreed Installment = 5000000 / 39.3803 Initially Agreed Installment = Shs 126967.14 Total Payments Made till 24th Installment = Installment * 24 = 126967.14 * 24 = Shs 3047211.29 Cumulative Interest Paid till 24th Installment = "CUMIPMT(0.015,60,5000000,1,24,0)" = Shs 1559209.19 Balance after 24th Installment = Loan Amount - Total Payment made + Cumulative Interest Balance after 24th Installment = 5000000 - 3047211.29 + 1559209.19 Balance after 24th Installment = Shs 3511997.90 ii. Installment at 20% per Annum = Loan Balance / PVAF(1.67%,36) Installment at 20% per Annum = 3511997.90 / 26.91 Installment at 20% per Annum = Shs. 130518.43 iii. Loan Schedule Interest Payment = Shs. 2618272.49 Loan Term = on 57th Month the Loan is fully repaid. QUESTION FIVE 5: Suppose an investor has two assets whose standard deviation of returns are 25% and 45% respectively. The assets are perfectly negatively correlated. What asset weights will eliminate all portfolio risk? ANSWER FIVE 5: σ1 = 25% σ2 = 45% C12 (correlation) = -1 (Perfectly negatively correlated) Portfolio variance = w12σ12 + w22σ 2 2+ 2w1w2Cov1,2 Where Cov1,2 = C12 * σ1 * σ2 = -0.1125 w1 = Weight of asset 1 w2 = Weight of asset 2 = 1-w1 now, given Portfolio risk = 0 that is portfolio variance = 0 Therefore, 0 = w12 * 0.0625 + (1-w1)2 * 0.2025 - 0.225 * (1-w1) * w1 Solving the above equation w1 = 0.643 w2 = 0.357 QUESTION SIX 6: You would like to invest a certain amount today, double that amount at the end of year two and three times the initial amount at the end of year four so that you are able to receive Shs 250,000/= at the beginning of year nine and a further ten installments occurring after each additional year from the time the initial amount was received, and each of these reflecting a growth of 15% per annum from the previous one. The rates of interest are: 5% per annum during the first three years; 6.5% per annum during the next two years; 7.5% in year seven; 4% in year eight; 0% in year nine; 5% in year ten; 15% in year eleven; 9% per annum in years twelve, thirteen, fourteen and fifteen; 0% in year sixteen; 5.5% per annum in year seventeen and all subsequent years. What is the initial investment? Answer Six (Interest rate of 6th year is not given and it is assumed to be 6.5%) Let the Initial Investment be Shs. A ie. A invested today, 2*A invested at end of 2nd year and 3*A invested at end of 4 years such that Shs 250000 is received at end of 8 years (beginning of year 9) and then 10 more installments growing at 15% p.a. To achieve the same PV of Investments = PV of receipts = A + 2*A/1.05^2+3*A/(1.05^3*1.065) = 250000/(1.05^3*1.065^3*1.075*0.96)+ 250000*1.15/(1.05^3*1.065^3*1.075*0.96*1.0)+250000*1.15^2/(1.05 ^3*1.065^3 *1.075*0.96*1*1.05)+250000*1.15^3/(1.05^3*1.065^3*1.075*0.96*1*1.05*1. 15) +250000*1.15^4/(1.05^3*1.065^3*1.075*0.96*1*1.05*1.15*1.09)+250000*1.15 ^ 5/(1.05^3*1.065^3*1.075*0.96*1*1.05*1.15*1.09^2)+250000*1.15^6/(1.05^3 *1. 065^3*1.075*0.96*1*1.05*1.15*1.09^3)+250000*1.15^7/(1.05^3*1.065^3*1. 075 *0.96*1*1.05*1.15*1.09^4)+250000*1.15^8/(1.05^3*1.065^3*1.075*0.96*1* 1.05 *1.15*1.09^4*1)+250000*1.15^9/(1.05^3*1.065^3*1.075*0.96*1*1.05*1.15* 1.09 ^4*1*1.055)+250000*1.15^10/(1.05^3*1.065^3*1.075*0.96*1*1.05*1.15*1.0 9^4 *1*1.055^2)= 2.7181446*A = 2827789 A = 1040338.07 Therefore, Initial Investment must be Shs 104033