Financial Planning Principles & Practices in South Africa

advertisement

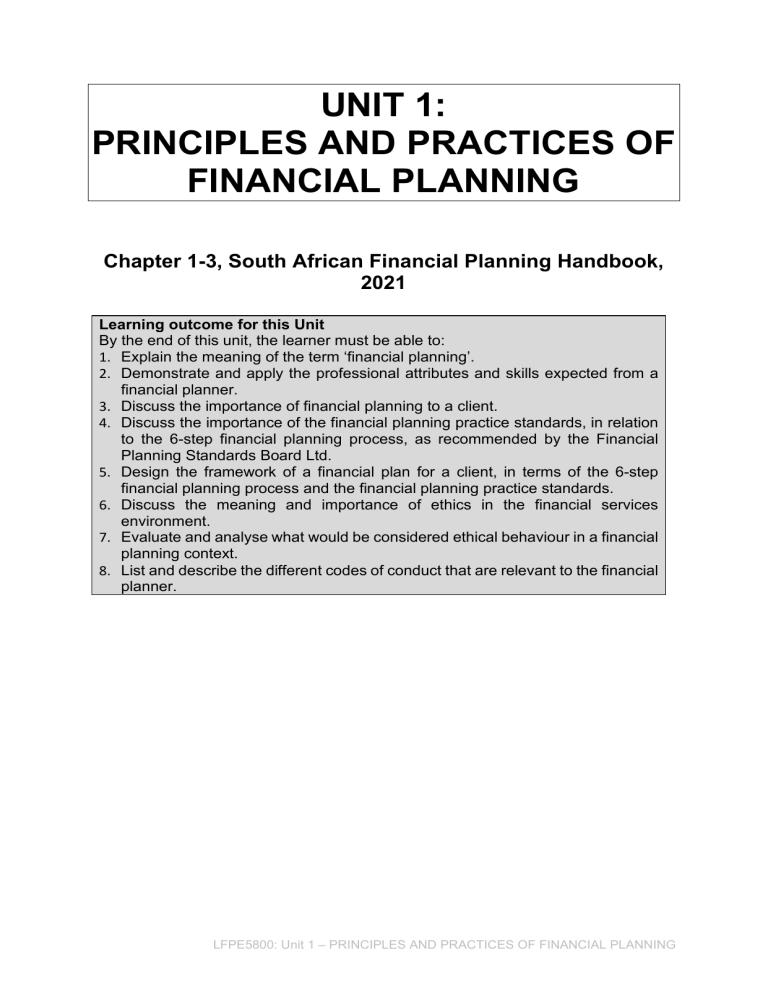

UNIT 1: PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING Chapter 1-3, South African Financial Planning Handbook, 2021 Learning outcome for this Unit By the end of this unit, the learner must be able to: 1. Explain the meaning of the term ‘financial planning’. 2. Demonstrate and apply the professional attributes and skills expected from a financial planner. 3. Discuss the importance of financial planning to a client. 4. Discuss the importance of the financial planning practice standards, in relation to the 6-step financial planning process, as recommended by the Financial Planning Standards Board Ltd. 5. Design the framework of a financial plan for a client, in terms of the 6-step financial planning process and the financial planning practice standards. 6. Discuss the meaning and importance of ethics in the financial services environment. 7. Evaluate and analyse what would be considered ethical behaviour in a financial planning context. 8. List and describe the different codes of conduct that are relevant to the financial planner. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 1 Commonly used acronyms in the financial services industry: Acronym ADR AI ASISA CISA CO CPD FAIS FIA FICA FISOS FPI FPSB FSCA FSP General Code of Conduct KI MLCO MLRO POCA POCDATARA PPR RE RDR RI TCF Full description Alternative dispute resolution Accountable Institution Association for Savings and Investment South Africa Compliance Institute Southern Africa Compliance Officer Continuous professional development Financial Advisory and Intermediary Services Act 37 of 2002 Financial Intermediaries Association Financial Intelligence Centre Act 38 of 2001 Financial Services Ombud Schemes Act 37 of 2004 Financial Planning Institute of Southern Africa Financial Planning Standards Board Financial Services Conduct Authority Financial Services Provider Board Notice 80 of 2003: General code of conduct for authorised financial services providers and their representatives Key Individual Money Laundering Control Officer Money Laundering Reporting Officer Prevention of Organised Crime Act 121 of 1998 Protection of Constitutional Democracy Against Terrorist and Related Activities Act 33 of 2004 Policyholder Protection Rules Regulatory examinations Retail Distribution Review Reporting Institution Treating Customers Fairly Introduction Most of the learning outcomes in Unit 1 are designed to give some context to what it means to be a financial planning professional, as well as the meaning of financial planning and the financial planning process. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 2 1. 1.1 Explain the meaning of the term ‘financial planning’ Summary It is important to understand the meaning of ‘financial planning’, as it defines the objectives of carrying out financial planning for clients and prevents the financial planner from doing work in areas that are not specifically related to financial planning. An explanation of the term also assists in clearly defining the various possible outcomes of financial planning. Various entities have defined financial planning. The entities with their definitions have been listed below. Entity Financial Planning Standards Board (FPSB) 1 International Organization for Standardization 2 Financial Planning Institute of Southern Africa 3 Definition The process of developing strategies to assist clients in managing their financial affairs to meet life goals. A process designed to enable a consumer to achieve his/her/their personal financial goals. Financial planning is the process of developing strategies to assist clients in managing their financial affairs to meet life and financial goals. The process of financial planning involves reviewing all the relevant aspects of the client’s current situation and comparing them with the client’s desired situation and designing a plan to assist the client on this journey of financial independence. Although the above descriptions are not identical, it represents the main elements of financial planning: • • • • • Financial planning is a process that occurs throughout the lifetime of a client; it is not a once-off event. Once the initial financial plan is in place, reviews must be conducted on a regular basis. Should the circumstances of the client change, it is possible that the financial planning goals of the client will also need to be reconsidered; Financial planning takes into account short, medium and long-term scenarios; Each of the scenarios take into account the personal circumstances, financial circumstances, risk profile and lifestyle goals of the client; The process of financial planning culminates in the drafting of a financial plan, which makes recommendations, taking into account applicable scenarios and includes supporting explanations of why these recommendations have been made; and The process includes the collection of relevant information, investigation and analysis, before making the recommendations to the client with regard to the personal financial management, asset management, risk management (including health planning), tax planning, retirement planning and estate planning. There is no definition of “financial planning” in the South African law. Many financial advisors refer to themselves as financial planners even though their services do not 1 2 3 https://www.fpsb.org/about-financial-planning/ International Organization for Standardization, Reference Number ISO 22222 2005(E). The FPI Code of Ethics and Practice Standards Incorporating the FPI Rules of Professional Conduct are available on the FPI website. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 3 meet the FPI description, they may have various types of relationships with product suppliers, or their services may or may not include a recommendation to purchase a financial product. The FSCA, in the Retail Distribution Review 2014 document 4, refers to financial planning. It is recommended that you read paragraph 2.2.2 of the document to understand the context in which the FSCA views financial planning. The document was followed with updates in December 2016 5, June 2018 6 and December 2019 7. The December 2019 update also included a Discussion Document on Categorisation of Financial Advisers and Related Matters 8 inviting comments on the proposals therein from the industry. The current FAIS regulatory framework does not recognise financial planning as an activity distinct from the giving of advice or rendering of intermediary services with regards to a financial product. Financial planning typically includes the development of a financial plan for a client, together with periodic reviews and possible adjustments of that plan, to ensure it remains suitable to the client’s financial needs and circumstances. As such, financial planning activities are conceptually independent of the product life cycle 9. Although, a lot of the proposals in the RDR document will impact financial planning and financial planners, the following proposals refer specifically to financial planning services and financial planners: Proposal A: Forms of advice (financial planning, up-front product advice, ongoing product advice) defined, with related conduct standards Original proposal: Definitions of “financial planning”, “up-front product advice” and “ongoing product advice” will be included in the regulatory framework. The definitions will be used to set conduct standards regarding the provision of each of these forms of advice, including the circumstances in which these terms may be used to describe services provided, and the way in which these services must be disclosed and explained to customers. Specific fit and proper standards will also be set for entities or individuals providing each of these forms of advice. December 2016 status update: The FSB is no longer proposing formal separate definitions of up-front & ongoing product advice, but standards will be set for the provision of ongoing advice. 4https://www.fsca.co.za/Regulatory%20Frameworks/Documents%20for%20Consultation/FSB%20Reta il%20Distribution%20Review%202014.pdf 5https://www.fsca.co.za/Regulatory%20Frameworks/Temp/FSB%20Retail%20Distribution%20Review %20Status%20as%20at%20December%202016.pdf 6https://www.fsca.co.za/Regulatory%20Frameworks/Temp/FSCA%20Retail%20Distribution%20Revie w%20Status%20Update%20June%202018%20.pdf 7https://www.fsca.co.za/Regulatory%20Frameworks/Temp/RDR%20General%20Status%20Update%2 0December%202019.pdf 8https://www.fsca.co.za/regulatory%20frameworks/temp/forms/allitems.aspx?p%252525252525255FS ortBehavior=0&p%252525252525255FYear=&p%252525252525255FRANK=&p%252525252525255 FID=904&View=%7Bde94d64b%2D0ec8%2D4bb9%2D8137%2D14ef49e65057%7D&SortField=Cate gory&SortDir=Desc 9FSCA RDR 2014 par 2.2.2 LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 4 June 2018 status update: Except for financial planning, different forms of advice will not be formally defined. Where appropriate, standards relating to advice generally will include requirements where advice is provided on an ongoing basis or up-front. December 2019 status update: Different forms of advice will not be formally defined. Where appropriate, standards relating to advice generally will include requirements where advice is provided on an ongoing basis or up-front. Exception: Financial planning will be defined (see proposals T and U). Proposal T: Criteria for financial planners Original proposal: The regulatory framework will set conduct standards for the provision of financial planning services, including: • • • Fit and proper standards for the provision of financial planning services. These will include competency standards in relation to the financial planning process as well as the types of financial planning solutions recommended through the planning process. Such standards may be set with reference to membership of, or qualifications provided by appropriate professional associations, or may vary depending on such membership or qualification, which may be recognised for these purposes. Standards on the level and extent of financial product knowledge required to provide financial planning services. Although financial planning does not necessarily entail the provision of advice relating to any particular financial product, adequate knowledge of the classes or types of financial product that are likely to underpin a proposed solution would nevertheless be important. Standards for financial planners that are also multi-tied or tied advisers – particularly with a view to ensuring that the restrictions in relation to product advice they may provide does not conflict with or compromise the quality of the financial planning service. December 2016 status update: The FSCA is considering a two-tier model of advisor categorisation. Two main categories of financial adviser are now proposed, namely: 1. Product Supplier Agents (PSAs) will not be licensed in their own right to provide financial advice. Instead, they will provide advice as agents of a financial institution that provides financial products. That product supplier will in turn be licensed to provide advice, over and above any other licence it holds to issue financial products. 2. Registered Financial Advisers (RFAs) will be licensed in their own right to provide financial advice. An RFA may be either a natural person (a sole proprietor) or a legal entity (an RFA firm). An RFA firm will in turn appoint financial advisers to provide advice on its behalf and will be responsible for the advice provided by those representatives. The RFA licensing model is therefore similar to the current Financial Services Provider licensing model under the FAIS Act, except that RFA’s will not also be product suppliers. No financial adviser may act as both a PSA and an RFA (or representative of an RFA). 10 An individual adviser (Registered Financial Advisor or Product Supplier Agent) will be permitted to use the additional designation “financial planner” if the adviser has met specific 10 Status Update: Retail Distribution Review status as at December 2016, paragraph 3.1 LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 5 standards. Accordingly, they propose that a financial adviser will be permitted to describe themselves as a “financial planner” provided the adviser meets all requirements for such designation set by a Professional Body recognised by the South African Qualifications Authority (SAQA) and is a member in good standing of such Professional Body. It follows therefore that the use of the descriptor “financial planner” will in effect be reserved for financial advisers who meet the professional competency and professional conduct standards set by the relevant Professional Body for such a designation. Currently only the Financial Planning Institute (FPI) and its Certified Financial Planner (CFP) designation meet this requirement in relation to financial planning. It is however open to other associations to apply to SAQA for the necessary approvals. Recognition of foreign equivalents will also be considered, in consultation with SAQA and relevant Professional Bodies. In the initial RDR discussion document the FSCA indicated that, in the short-term insurance sector, the activity of “risk planning” by financial advisers was a potential equivalent of “financial planning” in the long-term insurance and investments space. Their subsequent consultations and analysis have however not presented a clear case for recognising short-term insurance “risk planning” as a form of financial advice distinct from short-term insurance product advice. They have invited further input on the feasibility of formally recognising an equivalent of “financial planning” (with approved professional designations through a recognised professional body) outside the long-term insurance and investments environment. More broadly, as part of the ongoing work on refining the competency framework and enhancing professionalism for financial advice, the FSCA also intends to continue to actively work with SAQA and its structures – and relevant industry participants - as they develop frameworks for various levels of qualifications and designations in the financial sector. 11 June 2018 status update: The proposed approach is that financial planning will not be a separate adviser licence category, but rather that the descriptor / designation “financial planner” or “financial planning” will be reserved for advisers meeting prescribed professional body criteria. December 2019 status update (RDR Discussion Document on Adviser Categorisation and Related Matters) Section 5. Use of the designation “financial planner” As noted in the initial RDR paper, one of the desired outcomes of our RDR reforms is to enhance standards of professionalism in financial advice and intermediary services to build consumer confidence and trust. To this end, the FSCA confirms our intent to acknowledge the professional status of qualified financial planners by reserving the use of the designation “financial planner” for those holding a formal professional designation in this discipline. Persons designated as a CFP™ professional, who therefore meet the standards and requirements set by the Financial Planning Standards Board (FSPB), would meet this criterion. Note that this includes persons meeting the FSPB standards as adapted by organisations that have licensing and affiliation agreements in place with the FPSB to operate the CFP™ certification program in their territory. In South Africa, the relevant organisation is the Financial Planning Institute, which is also recognised by the South African Qualifications Authority as the professional body for the financial planning profession in South Africa. The point has been raised that advisers that are not formally designated as CFPs, in performing customer needs analyses and formulating financial recommendations, may 11 Status Update: Retail Distribution Review status as at December 2016, paragraph 3.1(c) and Annexure A LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 6 nevertheless follow processes and methods similar to those followed by their professionally qualified counterparts. This raises the question whether non-CFP advisers should be permitted to describe their services as “financial planning” and / or to describe their recommendations as a “financial plan”. A suggestion was made that non-CFPs should still be able to use the “financial planner / plan / planning” terminology where they perform these activities, but should be distinguished from CFPs by applying the additional term “certified” financial planner or “accredited” financial planner (or similar) in the case of CFPs. The FSCA has considered these arguments, but we believe that allowing this type of language to be used by advisers that are not professionally qualified in financial planning will undermine the effectiveness of reserving the “financial planner” designation for professionals. Our proposal therefore is that not only the designation “financial planner”, but also the terms “financial plan”, “financial planning” or other derivatives be reserved for use by qualified CFPs. Non-CFP advisers will need to use appropriate alternative terms to describe their services and recommendations. It also follows that distribution channels describing themselves as, for example, the “financial planning division” of an entity, will not be permitted to do so unless all advisers operating in that channel are in fact duly qualified. The FSCA also received a limited number of comments that the term “financial planner” was not appropriate to advisers operating in PSA / tied advice models, in view of the potential restrictions on the scope of their recommendations. We disagree. PSA advisers holding a CFP qualification are entitled to describe themselves as financial planners. There are adequate existing FAIS measures and planned RDR measures to ensure that financial customers are able to understand and make informed decisions on the type of adviser they wish to be served by. The FSCA requested stakeholders to provider their views on the proposal to disallow advisers who do not hold a professional financial planning designation (and who therefore will not be permitted to use the designation “financial planner”) from describing their services as “financial planning” and describing their recommendations as a “financial plan”. Proposal U: Status disclosures to be made by financial planners Original proposal: Conduct standards will be set requiring a financial planner to disclose the following matters to customers at appropriate times: • • That the adviser is a financial planner and an explanation (which may be standardised) of what this means, as well as details of whether or not the financial planner is a member of, or holds a qualification issued by a relevant professional organisation. Appropriate details of the scope and purpose of the financial plan, including any limitations in this regard. December 2016 status update: Disclosure standards will be introduced together with implementation of the final standards for financial planning. 12 June 2018 status update: Refer to Proposal T. 12 Status Update: Retail Distribution Review status as at December 2016, paragraph 3.1(c) and Annexure A LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 7 December 2019 status update: Refer to Proposal T. Proposal II: Standards for financial planning / risk planning fees Original proposal: Conduct standards will be set in relation to: • • • • The requirement to obtain explicit customer consent to a planning fee before any financial or risk planning is carried out, where consent must relate to the quantum of the fee, the fee calculation basis, the manner of payment and the scope of planning service to be rendered, including any ongoing financial planning services. Regulatory reporting obligations in relation to fees earned. Related disclosure obligations. Product supplier obligations to monitor planning fees charged by tied advisers and the scope and quality of the planning services provided by tied advisers. In addition, the regulator may publish benchmark guidelines in relation to planning fees, together with requirements to monitor and / or report on adherence or deviations from such guidelines and enable comparability of such fees. December 2016 status update: These standards are to be developed together with standards under Proposal T and broader standards for advice fees under Proposal JJ. These standards will be developed as the various RDR remuneration models are finalised. 13 June 2018 status update: Standards will be developed in parallel with standards for Proposal T. December 2019 status update: Standards will be developed in parallel with standards for Proposal T. Also see detail in the RDR Discussion Document on Adviser Categorisation and Related Matters, regarding use of the terms “financial planner” and “financial planning”. Note that these proposals are still under discussion and development between the industry and the FSCA, and it may be amended, as result of these discussions. Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 1 Additional reading: Please note that the following material is not prescribed reading. It has been included to provide you with additional information to assist you to understand the subject matter better and may prove to be useful in your daily activities as a financial planner. 1 Rossini L & Maree J, The business of financial advice, Juta (2015) Chapter 1 13 Status Update: Retail Distribution Review status as at December 2016, paragraph 3.1(c) and Annexure A LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 8 1.2 Tasks 1.2.1 Task 1 Discuss the benefits of financial planning Unfortunately, many clients associate the process of financial planning with the sale of products and as a result, they fail to see the benefits of the financial planning process. It is the responsibility of the financial planner to explain to the client what the potential benefits of the financial planning process are, early on in the client engagement. Other benefits for the client include: • • • • • • • Assisting the client in maximising their wealth during their lifetime; Enabling clients to reach their short, medium and long-term objectives; Providing for emergencies; Making sure everything is in order in the event of death or a life changing event; Enabling clients to manage their finances on a daily basis; Empowering the client to make the right financial choices; Building trust in the relationship with a financial planner and the financial services industry as a whole. 1.2.2 Task 2 Briefly explain the role of the financial planner The role of the financial planner is to facilitate the process of assisting clients to identify and achieve their life goals and objectives through the planning of their finances. After collecting and analysing the client’s information, the financial planner drafts a financial plan that recommends an appropriate action plan to assist the client in achieving their goals. The financial planner drafts a financial plan that recommends an appropriate course of action to achieve their goal. Although the process does not exclude the sale of a financial product, this should not be the main focus of the financial planner. The financial planner plays a vitally important public interest role. Educating clients with regard to how to manage their finances and ensuring that they provide for their retirement and other contingencies will ensure that members of our society are in a position to live independently from the state. 1.2.3 Task 3 Although the term ‘financial planning’ appears to refer only to the financial circumstances of the client, it also has a significant impact on the lifestyle aspects of a client. Discuss the importance of this statement. The degree to which a client actively manages their finances will have a significant bearing on whether the client is in a position to achieve their lifestyle goals. For example, if the client wants to go overseas on an expensive trip in two years’ time, this must be taken into account in their financial planning. If the client does not plan for these goals, they are unlikely to happen. Likewise, the lifestyle of the client will have an impact on their financial planning, as a client may choose to live a lifestyle that is inappropriate considering their financial situation. According to George Kinder, the founder of Lifestyle LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 9 Planning, the financial planning process offers clients the most comprehensive opportunity to discover and integrate a financial life plan that melds together with the meaning of money. No other profession or process assists the client in unveiling his or her most profound life goals and dreams, and then puts together a financial strategy that will assist the implementation and review of the strategy, in order to achieve those goals and dreams. 2. 2.1 Demonstrate and apply the professional attributes and skills expected from a financial planner Summary In the context of financial planning, an attribute is regarded as a characteristic quality assigned to a person, whereas a skill can be described as ability, expertise, experience and/or proficiency. This leads to the important question: what are the professional attributes and skills expected from a financial planner? There are obvious skills required, such as sufficient legal and technical knowledge, an understanding of the economy and the markets, an understanding of the products offered, effective communication and presentation skills, good research skills, effective report writing skills and being able to develop relationships with other professionals. In addition, many of the skills required are dictated by the legislation and the standards set by the various professional bodies. The less obvious question revolves more around what attributes and skills make an effective and successful financial planner. Although the skills mentioned above are essential requirements, there are certain attributes or qualities that can be expected from a financial planner. The most important attribute is a sound personal code of conduct, based on strong ethical and moral values. This creates the foundation on which the financial planner strives to put the interests of their clients first, and to make a positive difference in their lives, by building sound relationships, based on trust and integrity. Other attributes include: 14 • • • • • • • • • • • • • • Strength of character Ability to leading both a personal, as well as a business capacity Ability to communicate well and positively influence people Credibility (easy to believe and trust) Ability to offer vision and direction Excellent listening skills Ability to challenge and encourage Ability to get the best out of people by empowering them Ability to work through and overcome difficulties Ability to solve problems creatively Capacity for empathy Organizational and business skills Passion for what they do Being open to continuous learning The FPSB defines a financial planner as ‘a professional who uses the financial planning process to provide a client with integrated strategies to achieve financial and life goals and who has demonstrated the abilities, skills and knowledge outlined in the 14 M Botha et al, Fundamentals of Financial Planning, LexisNexis (2010), p2. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 10 FPSB Financial Planner Competency Profile’. The FPSB Financial Planner Competency Profile has been detailed in a document issued by the FPSB. There are three main sections to the profile, financial planning knowledge, professional skills and social competence 15. It is recommended that you read this document to understand the competencies you will need as a financial planner. Principle 5 of the FPI Code of Ethics, addresses competence and provides guidance as to the minimum requirements FPI members must meet 16. The FPI has also published a document called the Financial Advisor Competency Profile and Curriculum that describes the abilities, skills, attitudes, judgements and knowledge that a financial advisor draws on when rendering financial services and/or other professional services. 17 Although the above lists may appear daunting, both skills and attributes can be acquired over time. The most important thing is to be self-aware and to work on those areas that may need improving. Resources In order to complete this learning outcome, study the following: 1. 2. 3. 4. SAFPHB Chapter 1 FPSB Financial Planner Competency Profile (available on www.fpsb.org) FPI Code of Ethics: Principle 5 (available on www.fpi.co.za) FPI Financial Advisor Competency Profile and Curriculum (available on www.fpi.co.za) 5. FPI Continuous Professional Development (CPD) Policy (available on www.fpi.co.za) 2.2 2.2.1 Tasks Task 1 Briefly describe what you think important skills and attributes for a successful financial planner are. Comment on why you have chosen these particular skills and attributes. Ben and Sue Graham come in to see you for the first time. You have been extremely busy working on a large investment for another client and are unprepared for the appointment. Ben Graham has an intense dislike for financial planners, as he has previously had a bad experience where he lost a lot of money. As he is telling you about it, your mind is wandering to the large investment. He then tells you that he has inherited R3 million and would like advice on what to do with it. This 15https://www.fpsb.org/wp-content/uploads/2016/01/151027_doc_CompetencyProfile_FINAL-2.pdf 16 https://www.fpi.co.za/documents/Code%20of%20Ethics%20and%20Professional%20Responsibility.pd f 17 https://www.fpi.co.za/documents/Financial_Advisor_Competency_Profile_and_Curriculum.pdf LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 11 fact immediately piques your interest. Without finding out much about his personal circumstances (which include large amounts of debt), you begin to give him ideas on the best possible investment products. Briefly describe the skills and attributes you should be demonstrating in these circumstances, and comment on why they are important in building a relationship of trust with Ben and Sue Graham. There are a number of different skills and attributes any financial planner should be demonstrating in the situation described above: • • • • • • Being organised and prepared, to see new clients is essential. It is important to listen to the client and to deal empathetically with any issues the client may raise. Explain the importance of the financial planning process to the client. Explain what services the client can expect from you and your business in order to reduce unmet expectations. Pay attention and focus on the client so that you obtain sufficient information from the them. Explain to the client that you need to complete the six steps of financial planning, before being in a position to advise the client where to place his inheritance. By carrying out the above steps, you are in a stronger position to build a relationship of trust with Ben. It is important to make sure that he does not have the same experience with you that he had with a previous financial planner. You have an opportunity to do things the right way and to show him that there are many credible and skilled financial planning professionals in the industry. 3. 3.1 Discuss the importance of financial planning to a client Summary It is essential for a financial planner to have a sound understanding of why financial planning is important to the client. This understanding enables the financial planner to explain the compelling reasons for doing financial planning to the client. Even though it may be perfectly obvious to the financial planner why a client should engage with the financial planning process, many clients exhibit resistance to the process even though it may be in their best interests. A financial planner must be in a position to deal with this resistance and to show the client the benefits and importance of engaging with the financial planning process. The importance of the financial planning process (to a client) can be summarised as follows: • • • • • Increases awareness and education around financial issues. The client has an understanding of how personal financial management impacts on lifestyle goals and objectives. It enables the client to engage with, and take responsibility for, their own personal financial management and freedom. It enables the client to achieve financial and lifestyle goals. The process results in a financial plan which enables the achievement of future goals and objectives. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 12 • It minimises risks, maximises growth, and reduces the payment of taxation by appropriately structuring the assets and liabilities of the client, in accordance with their personal circumstances. Clients often do not see the importance of financial planning for a number of reasons. In many cases, clients have not been educated about the link between financial planning and achieving their own personal and financial objectives. Both bad experiences and/or negative stories in the media also contribute to a negative impression of financial planners and the financial services industry in general. Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 1 Additional reading Please note that the following material is not prescribed reading. It has been included to provide you with additional information, to assist you to understand the subject matter better and may prove to be useful in your daily activities as a financial planner. 1. Rossini L & Maree J, The business of financial advice, Juta (2015) Chapter 2 3.2 3.2.1 Tasks Task 1 List the benefits of encouraging clients to be engaged in the process of financial planning: • • • • • • • • • • • 3.2.2 Maintaining a balance of capital and income; Protection against financial risk via long- or short-term insurance; Maintaining the value and purchasing power of capital; Legitimately minimising taxation; Achieving an acceptable level of investment return in relation to the risk taken; Achieving financial independence at retirement; Achieving an appropriate structure of liabilities and debt reduction; Providing security for the family; Balancing the timing of cash outflows and inflows; Balancing a current lifestyle with a future lifestyle; and Establishing regular and clearly defined reviews of the financial plan, which should also take place after unplanned or unexpected events. Task 2 Briefly discuss the reasons why members of the public are resistant to the idea of financial planning. • Not understanding that financial planning is not only about purchasing or investing in financial products, but it is also about the development of a financial plan, which will assist them in achieving their financial and lifestyle goals; LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 13 • • • • • • 3.2.3 People are often ignorant of the reasons for the need to engage in ongoing financial planning through a process of monitoring and review; Many people are facing mounting debt, and do not think financial planning can assist them. However, this situation can be better managed by putting together a debt management plan which forms part of the financial plan; Financial planning is a low priority for many people as they do not understand the benefits it can bring; Previous negative experiences with financial planners and product suppliers; The purchase of inappropriate financial products as a result of insufficient analysis of the client’s situation, and the poor identification of needs and objectives by the financial planner; The perception of the industry being sales-driven, and not solutions- and servicedriven. Task 3 Describe the importance of educating clients about the financial planning process. It is the responsibility of the financial planner to explain their role to the client, as well as to educate them about the financial planning process. If this does not happen, the client may blame the financial planner for anything that he does not understand at a later stage. The financial planner does not necessarily have to be guilty of wrongdoing for this to happen. For example, the client may not understand how the markets work, and when the value of their investments falls because of the markets, the client may blame the financial planner for the loss. Situations such as these should be avoided by explaining the financial planning process to the client. It must be stressed to the client that the financial planner has no control over the markets. The role of the financial planner is to advise the client about structuring their investment portfolio, taking into account their risk profile, as well as their financial and personal circumstances. During the process, the financial planner must continue to educate the client about what is happening in the markets and why. 3.2.4 Task 4 Describe the negative consequences that may arise should clients and members of the public fail to plan their finances adequately. • • • • • Clients may not have sufficient capital and income on which to retire. They would have to continue working past retirement age or they may become a burden to their families. The state may become overburdened as too many people will depend on the state system at retirement. Clients will not be in a position to achieve their lifestyle goals and dreams. Levels of debt may rise to unmanageable levels. The health of clients may be affected, as they become more and more stressed because their finances are completely out of control. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 14 4. 4.1 Discuss the importance of the financial planning practice standards, in relation to the 6-step financial planning process, as recommended by the Financial Planning Standards Board Summary The FPSB established the 6-step process of financial planning for financial planners to follow in the form of the Financial Planning Practice Standards for Certified Financial Planners. Any financial planner who holds the CFP® designation is obliged to follow the 6-step process. The 6-step process provides a holistic approach to assessing where the client is financially, where they want to be and what actions must be taken to get them there. The FPI is a South African Qualifications Authority recognised professional body for financial planners in South Africa. The FPI is a non-profit professional body and founding and affiliate member of the FPSB. It is the only institution in South Africa to offer the CFP® certification. The 6-step process has also been incorporated into the FPI Code of Ethics and Practice Standards. Resources In order to complete this learning outcome, study the following: 1. 2. 3. 4. SAFPHB Chapter 1 FPSB Financial Planning Practice Standards (available on www.fpsb.org) FPSB Financial Planner Competency Profile (available on www.fpsb.org) FPI Code of Ethics and Practice Standards incorporating the FPI Rules of Professional Conduct (available on www.fpi.co.za) 5. FPI Financial Advisor Competency Profile and Curriculum (available on www.fpi.co.za) LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 15 4.2 4.2.1 Tasks Task 1 Describe the benefits of following the 6-step financial planning process. According to the FPSB, the 6-step financial planning process, together with the practice standards, defines the standard of performance expected from financial planners by: • • • • 4.2.2 Establishing the level of practice expected of a financial planning professional, engaged in the delivery of financial planning to a client; Establishing norms of professional practice, and allowing for the consistent delivery of financial planning by financial planning professionals; Clarifying the respective roles and responsibilities of financial planning professionals and their clients in financial planning engagements; and Enhancing the value of the financial planning process. Task 2 List and briefly describe the 6-step financial planning process. • • • • • • 5. 5.1 Step 1: Establish and define the professional relationship with the client. Inform the client about the financial planning process and the financial planning professional’s competencies, determine whether the financial planning professional can meet the client’s needs and define the scope of the engagement. Step 2: Collect client information. Identify the client’s personal and financial objectives, needs and priorities, collect quantitative information and documents and collect qualitative information. Step 3: Analyse and assess the client’s financial status. Analyse the client’s information and assess the client’s objectives, needs and priorities. Step 4: Develop the financial planning recommendations and present them to the client. Identify and evaluate financial planning strategies, develop the financial planning recommendations and present the financial planning recommendations to the client. Step 5: Implement the client’s financial planning recommendations. Agree on implementation responsibilities and identify and present product(s) and service(s) for implementation. Step 6: Review the client’s situation. Agree on responsibilities and terms for review of the client’s situation and review and re-evaluate the client’s situation. Design the framework of a financial plan for a client, in terms of the 6-step financial planning process and the financial planning practice standards Summary Step 3 of the financial planning process highlights an important aspect of the 6-step financial planning process. It includes the ability to take all the information gathered from the client, analyse it and make recommendations. This must be written up in a financial plan that is readable, understandable and enables the client to make an informed decision, based on the information and recommendations it contains. Although there is no standard method of drafting a comprehensive financial plan (dealing with all aspects of the client’s finances and personal circumstances), there are LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 16 guidelines that may be followed to meet the above requirements for a good financial plan: • • • • • • • • • • • • • • Title page Contents page Introduction Provide a brief summary of the personal circumstances of the client. Give a brief summary of the risk profile of the client. State the objectives of the financial plan. State any assumptions made about the recommendations and calculations included in the financial plan. Clearly outline the goals and objectives of the client (these are obtained from the client and discussed in the client meetings). Address each of the following areas in the financial plan (see the following section for detailed breakdown): Personal financial management, Investment planning, Risk management, Tax planning, Retirement planning, Estate planning, Business financial planning and Analysing existing products. Based on your analysis of the financial and personal circumstances of the client, make recommendations in each of the areas mentioned above. Depending on the recommendations made, it could be extremely useful to the client to provide them with one or two scenarios. Any recommendations made must be supported by an explanation of why you think the recommendation made is in the best interests of the client. Include an action plan, which details the actions that must be taken, who will be responsible, and where possible, a date by when each action should be completed. At the end of the financial plan, include a date for review of the financial plan. Make mention that in the event of any change in circumstances, the client must contact you as the financial plan may need to be updated. Annexures – include complex calculations as annexures rather than including them in the body of the financial plan. In addition to the drafting of a financial plan, in terms of Step 3 of the financial planning process, the General Code of Conduct, established under FAIS, requires all FSP’s and representatives to keep a Record of Advice 18, which must reflect the basis on which the advice was given, as well as other important aspects of the financial advice given. A copy of the Record of Advice must be given to the client, in writing. Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 1 2. FPSB Financial Planning Practice Standards (available on www.fpsb.org) 3. FPSB Financial Planner Competency Profile (available on www.fpsb.org) 4. FPI Code of Ethics and Practice Standards incorporating the FPI Rules of Professional Conduct (available on www.fpi.co.za) Additional reading: 1. Kinder G and Galvan S, Lighting the Torch – The Kinder Method of Life Planning, FPA Press (2006) and Kinder G, Seven Stages of Money Maturity, Delacorte Press (1999). 18 Section 9 of Board Notice 80 of 2003: General code of conduct for authorised financial services providers and their representatives LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 17 5.2 Tasks 5.2.1 Task 1 Describe the ‘Record of Advice’, as required by the General Code of Conduct. Section 9 of the General Code of Conduct states that over and above the record keeping duties of FSP’s and representatives, a record of advice must be kept. The record of advice must reflect the basis on which the advice was given and must include: • • • A brief summary of the information and material on which the advice was based. The financial product/s that were considered. The financial product/s recommended, with an explanation of why the product/s selected will most likely satisfy the client’s identified needs and objectives. Where the product/s recommended, is/are to replace an existing product/s (i.e. is a replacement product), a comparison between fees, charges, special terms and conditions, exclusions of liability, waiting periods, loadings, penalties, excesses, restrictions or circumstances in which benefits will not be provided, must be made between the terminated product and the replacement product. The record of advice must also include the reasons why the replacement product was considered to be more suitable in meeting the identified needs of the client than retaining or modifying the terminated product. The client must be provided with a copy of the record of advice, in writing. 6. 6.1 Discuss the meaning and importance of ethics in the financial services environment Summary Ethics can be defined as ‘moral principles in human conduct’. It is concerned with what is good or right in human interaction, or the conducting of an activity. According to Deon Rossouw 19, an expert on the subject of ethics, ethical behaviour results when a person does not merely consider what is only good for them, but also considers what is good for others. Therefore, the concept of ethics consists of three essential aspects, being goodness, self and others. To develop and retain an ethical culture in the financial services industry, it is essential to understand both the meaning and importance of ethics. An ethical culture and ethical conduct come about, because of the values, principles, and behaviour of the individuals (goodness, self and others) who participate in the industry. Given the intangible nature of financial products and services, as well as the low levels of financial literacy in South Africa, a strong ethical culture is the foundation of a successful financial services industry. Every unethical or dishonest action that occurs creates reputational risk for the individuals, businesses, and industry, as a whole. The topic of ethics is extremely broad, and it is up to the individual to take responsibility for their own ethical behaviour. 19 Rossouw D and van Vuuren L, Business Ethics, Oxford (2007) LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 18 Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 2 2. Ethics and Financial Planning Advice: The Final Frontier (Dr June Smith) – https://www.adviservoice.com.au/2011/01/ethics-and-financial-advice-thefinal-frontier/ Additional reading: Please note that the following material is not prescribed reading. It has been included to provide you with additional information, to assist you to understand the subject matter better and may prove to be useful in your daily activities as a financial planner. 1. Rossouw D with van Vuuren L, Business Ethics, Oxford (2007) 2. Rossini L & Maree J, The business of financial advice, Juta (2015) par 1.3 6.2 Tasks 6.2.1 Task 1 Briefly describe the similarities and differences between ethics and the law. Both ethics and the law are concerned with what is right and good in human interaction and society. However, the mechanism of how this occurs, differs significantly between the two. The law attempts to achieve what is right and good, through a public and political process. The power of the state and its various arms are used to ensure that all members of the society abide by the law. Ethics emanates from personal values, what feels is the most appropriate, good, or right manner in which to behave. It becomes obvious that ethics is based on a sense of obligation to do what is right, which is internally driven, as opposed to doing what is right, due to an external pressure exerted by the law and the fear of the consequences of not complying with that law. 6.2.2 Task 2 Unlike other products which can easily be judged on appearance or result, financial products cannot be seen or touched. In the context of this statement, discuss the reasons why it is so important to have a high standard of ethical behaviour in the financial services industry. Financial products differ from most other products and services for a number of reasons. As financial products are intangible, it makes it difficult for consumers to ascertain quality, value for money and appropriateness of the product purchased. This means that a high standard of ethical behaviour is required in the financial services industry for the following reasons: 20 • • • • 20 Financial products are not purchased frequently. Therefore, the consumer has little opportunity to learn from experience. The consumer often lacks confidence in making financial decisions. Although legislation demands transparency, there is a certain lack of transparency, making it difficult to verify the claims of the product supplier. The consumer frequently requires advice when making purchasing decisions See Bamber, Falkena, Llewellyn, Store, Financial Regulation in South Africa, SA Financial Sector Forum (2001) LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 19 • • • • • • • • 6.2.3 about financial products. A financial planner can conceal certain information (even though full disclosure is required by legislation). It is difficult to detect misrepresentation at the time of purchase. The financial product cannot be judged or tested before making the purchase. The value of purchasing the product is not always clear at the time of purchase. The consumer’s future financial well-being often depends on the performance of the financial product: a faulty product can be replaced, but a bad financial product cannot be easily surrendered or changed, other than at substantial cost. There are usually no guarantees attached to the financial product. It often takes years before consumers become aware of problems with the financial product. This limits the power of reputation as an assurance of good products. Furthermore, even if the reputation of the product supplier or financial planner is damaged by bad behaviour, in the long run, consumer wealth will have suffered. If the business becomes insolvent during the term of the financial product, the consumer will lose their investment. Task 3 Briefly discuss the different ethical levels in society. Personal or individual ethics Professional ethics Business ethics Societal ethics 6.2.4 A personal ethical code of conduct when dealing with others. Standards that outline appropriate conduct in a given profession. The values and principles that a business or an organisation has chosen that guide behaviour of people in the business or organisation and/or what stakeholders expect from the business or organisation. Principles and standards that guide members of society in day-to-day interaction with one another. Task 4 List five core personal ethical principles. Although there are numerous ethical principles or values, the following list relates directly to the financial services professional: • • • • • • • • • • • Integrity Responsibility Justice Fairness Forgiveness Generosity Compassion Self-discipline Wisdom Courage Care for all living things and the environment LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 20 6.2.5 Task 5 List five core ethical principles or values that apply specifically in the financial services industry. • • • • • • • 6.2.6 Integrity Honesty Fairness Respect for others Personal accountability Good citizenship Keeping promises Task 6 List 5 factors that contribute towards unethical behaviour in the financial services industry. • • • • • 6.2.7 Self-interest Some people do not prioritise unethical behaviour The intangible nature of financial products and services means that clients are not able to assess the products and services before making the purchase Linked to the intangible nature of financial products and services is the inherent power imbalance between the client, financial planner and product supplier. A lack of competency that manifests as inadequate knowledge or skills on the part of the financial planner can also lead to inadvertent unethical behaviour. Task 7 List 5 examples of unethical behaviour by financial advisors. • • • • • • • • 7. 7.1 Fraud Forging documents Tax evasion False insurance claims Inappropriate advice Mis-selling of products Misrepresentation of information Misuse of client funds Evaluate and analyse what would be considered ethical behaviour in a financial planning context Summary As mentioned in the previous outcome, ethical standards and culture forms the foundation of any successful financial services industry. To uphold the ethical standards and culture of the industry means that all participants in the industry must behave in an ethical manner. Although ethical behaviour can be prescribed by various LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 21 codes of conduct and enforced via legal mechanisms, in order for an ethical culture to really take hold and become embedded in the industry, individuals must behave in an ethical fashion, as well as take responsibility for their ethical behaviour. Although it is important to evaluate and analyse what values, principles, and behaviour are considered ethical at an individual level, actually deciding what makes up ethical behaviour is difficult, as what may be ethical to one person, may not be ethical to another. The best understanding is to view the ethics of financial professionals ‘as a value worth practising as a goal in itself, a necessary condition of personal and professional excellence’ (Dobson 1997). 21 When faced with a choice between an ethical versus an unethical course of action, the question ‘What should I do?’ must be embedded into the far greater question of ‘What sort of person should I be?’ (Maclagan 1998) 22. If the values and principles of the financial planner are ethical, by answering the second question, the answer to the first question is immediately apparent. In most cases, people prefer to take the ethical route in both their personal and professional lives. Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 2 2. Ethics and Financial Planning Advice: The Final Frontier (Dr June Smith) – https://www.adviservoice.com.au/2011/01/ethics-and-financial-advice-thefinal-frontier/ 7.2 Tasks 7.2.1 Task 1 Briefly describe how you make ethical decisions when faced with an ethical dilemma. There is a recognised ethical decision-making process that can be followed in the event of an ethical dilemma. If the most ethical decision is not immediately apparent, use the following model to aid you in making the correct decision: Step 1: Define the problem Step 2: Identify available alternative solutions to the problem Step 3: Evaluate the identified alternatives Step 4: Make the decision Step 5: Implement the decision Step 6: Evaluate the decision 7.2.2 Task 2 Sam Brown directs a large amount of business to a particular product supplier when making product recommendations to his clients. In return for all the business, the product supplier offers him and his wife an all-expenses paid trip overseas. He accepts the trip but does not tell his employer. Discuss the ethical issues in this scenario. 21 22 Dobson, ‘Ethics in Finance’, Financial Analysts Journal, Vol 53. Maclagan, Man and Morality: A Developmental Perspective, Sage (1998) LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 22 It would be unethical for Sam to accept the trip, as it will affect his independence and objectivity. It will be difficult for Sam to justify the recommendations made to purchase products with a particular product supplier to clients, if he is merely favouring the product supplier in order to receive gifts from them. Recommendations with regard to purchasing products from product suppliers must be made in the best interests of the clients, and not because of the potential benefits to Sam. It is also unethical of Sam not to tell his employer about the trip. Although the General Code of Conduct does deal with conflicts of interests, it is important to try to avoid, as far as possible, from being placed in a situation where the interests of the client and the financial planner are in conflict. 7.2.3 Task 3 Jim meets with one of his clients who needs to make some important decisions, with regard to the allocation of certain assets. Jim knows that these changes must be made before the end of the tax year. However, Jim does not get around to making the requested changes, as there is not likely to be any financial reward in doing the work. He does not return the client’s calls nor respond to his emails. As a result of not making the changes, the tax consequences for the client are disastrous. Discuss the ethical issues that arise from the above scenario. All financial planners are faced with work that they would rather avoid. They would want to avoid the work for a number of reasons: the work may be outside of their area of expertise, they will not be earning any money for doing the work, or they are busy with a far more lucrative case. Even if this is the case, it does not mean that the work should not be attended to timeously. By failing to carry out the work, Jim has, by omission, acted in a manner that is harmful to the best interests of the client. Jim must ensure that his business model takes into account administrative work that is not fee or commission generating. His business must also have the operational ability to deal with this type of work. His omission has resulted in a financial loss for the client, and he may be liable for the losses should the client decide to sue. 7.2.4 Task 4 Sureshnee is a partner in a financial planning business that deals primarily in the life and short-term insurance market. She assures a prospective client, who has just inherited R2 000 000, that the business can provide investment services. Given the focus of the business on the life and short-term market, none of the partners has the skills or knowledge to advise the client on how to invest this amount in a manner that is most beneficial to the client. Discuss the ethical issues that arise from this scenario. Sureshnee has been unethical by misrepresenting the services the business can perform for the client. It is important to give the prospective client the correct information with regard to the skills and knowledge available in the business, so that the client is in a position to make an informed decision about whether to use the services of the business or not. Sureshnee must limit herself to describing the services that the business can provide. She can offer to help the client to find the necessary advice and services that her business cannot provide. Is Sureshnee offering to invest the money on behalf of the client because of the commission payable? This is the type of question that will be asked, should Sureshnee invest the money in an unsuitable investment. If this is the case, it calls into question whether Sureshnee is acting in the best interests of her clients. She is also holding herself and her business out to be skilled in investing, when in fact they are not. This is unprofessional and unethical behaviour. In addition, provisions in FAIS, the General Code of Conduct, as well as the FPI Code of Ethics and Practice Standards Incorporating the FPI Rules of Professional Conduct are being contravened. LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 23 8. List and describe the different codes of conduct that are relevant to the financial planner 8.1 Summary A code of conduct can be loosely described as ‘a document or agreement that stipulates morally acceptable behaviour’. 23 There are a number of different codes of conduct within the financial services industry: • The most important of the codes are the legislated codes. The FAIS Act provides guidelines for the construction of the codes of conduct, with respect to the principles that must be included in the code for the various categories of FSP’s. The General Code of Conduct for Authorised Financial Services Providers and Representatives (FAIS Code of Conduct), is the most commonly known code of conduct. Failure to act in accordance with the prescribed standards and behaviours in a legislated code of conduct may lead to debarment, fines, penalties, and in certain circumstances, imprisonment. Most businesses or organizations have an internal code of conduct. This code clearly states what acceptable behaviour is, and what unacceptable behaviour in the work environment is. These codes also list the consequences for failing to adhere to the standards required in terms of the code. Most professional bodies have their own codes of conduct. These codes of conduct are designed to set professional standards and guidelines of behaviour which members are expected to act in accordance with. Failure to do so may result in a termination of membership from the professional body for not meeting the agreedupon standards. • • Resources In order to complete this learning outcome, study the following: 1. SAFPHB Chapter 2 2. FPI Code of Ethics and Practice Standards Incorporating the FPI Rules of Professional Conduct (available on www.fpi.co.za) 3. FPSB Financial Planner Code of Ethics and Professional Responsibility (available on www.fpsb.org) 8.2 Tasks 8.2.1 Task 1 Describe the objectives of a code of conduct. The objectives of any code of conduct are: • • • • • 23 To create a benchmark of acceptable ethical behaviour. To give the public confidence that a certain profession is committed to acting in accordance with the highest ethical standards. To assure a certain level of competency. To aim for all the members of a certain profession to connect around the same set of values and standards of behaviour, thereby creating cohesion amongst the members. To provide guidelines for the resolving of ethical dilemmas. Rossouw D with van Vuuren L, Business Ethics, Oxford (2007) LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 24 8.2.2 1. 2. 3. 4. 5. 6. 7. 8. 1. 2. 3. 4. 5. 6. 7. 8. 8.2.3 Task 2 Is the following conduct ethical? Yes No Misleading clients about the exact nature of the investment their funds are being invested into. Selling a policy to a client that they do not need. Refusing to sell products to clients that promise a higher-than-normal rate of commission for the financial planner. Telling friends, after a round of golf, about the financial circumstances of a new client. Continuously reading and attending presentations and courses, to keep up to date. Not returning phone calls and emails from the client. Only recommending products that pay the highest commission. Giving clients investment advice, when only qualified to provide advice on short and long-term insurance. Is the following conduct ethical? Yes No Misleading clients about the exact nature of the investment their funds are P2 being invested into. Selling a policy to a client that they do not need. P1 Refusing to sell products to clients that promise a higher-than-normal rate P3 of commission for the financial planner. Telling friends, after a round of golf, about the financial circumstances of a P7 new client. Continuously reading and attending presentations and courses, to keep P5 up to date. Not returning phone calls and emails from the client. P8 Only recommending products that pay the highest commission. P4 Giving clients investment advice, when only qualified to provide advice on P6 short and long-term insurance. Task 3 Read and name the principles and practice standards, as prescribed in the FPI Code of Ethics and Practice Standards Incorporating the FPI Rules of Professional Conduct. FPI Code of Ethics and Practice Standards Incorporating the FPI Rules of Professional Conduct Principle 1 – Client First Place the client’s interests first. Principle 2 – Integrity Provide professional services with integrity. Principle 3 – Objectivity Provide objective professional services. Principle 4 – Fairness Be fair and reasonable in all professional relationships. Disclose and manage conflicts of interest. Principle 5 – Competence Maintain the abilities, skills and knowledge necessary to provide competent professional services. Practice Standards 1. Client engagement 2. Collecting the client’s information 3. Analyse and assess the client’s financial status 4. Identify suitable financial planning strategies and develop the financial planning recommendations and solutions 5. Implement recommendations LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING 25 Principle 6 – Confidentiality Protect the confidentiality of all client information. Principle 7 – Diligence Provide professional services diligently. Principle 8 – Professionalism Act in a manner that demonstrates exemplary professional conduct. 6. Review the client’s situation LFPE5800: Unit 1 – PRINCIPLES AND PRACTICES OF FINANCIAL PLANNING