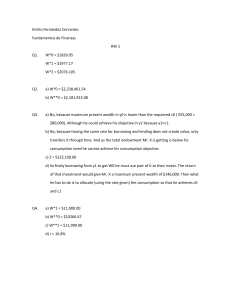

Macroeconomics I Prof. Isaac Baley and Davide Debortoli Expectations Mod.12: New Theories of Consumption and Investment The “New” Theories: A Preview Main ingredients • Permanent Income Theory of Consumption • Present value of profits and Investment decisions • Borrowing Limits “Old” Theories “New” Theories ( ) C(Y, T, r , Y e, T e, r e) ( ) I(Y, r , Y e, r e) Consumption (C) C Y ,T Investment (I) I Y ,r + + − − + − − + − + + − − − The “New” Theory of Consumption The Permanent Income Theory Main idea C = C(W ) + Households want to keep consumption constant over lifetime à each period they consume a constant fraction of their wealth (W) Changes in current income (Y) have small effects on wealth (W) à Consumption does not change much when income changes Wt = Total Wealth = Non-Human Wealth + Financial Wealth Housing Wealth Value of Stocks, Bonds, checking accounts, etc. Value of house (net of mortgages) Human Wealth Present value of expected labor income (net of taxes) Permanent Income + Borrowing Limits In practice: Young households are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current income Thus, there are two effects of an increase in current income (Yt): • it increases wealth (Wt) • it relaxes the borrowing limit Permanent Income + Borrowing Limits In practice: Young households are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current income Thus, there are two effects of an increase in current income (Yt): • it increases wealth (Wt) • it relaxes the borrowing limit Bottom line: An increase in CURRENT income have STRONGER EFFECTS on consumption than an increase in future income, because it relaxes borrowing constraints Formally: ⎛ ⎞ C ⎜Y − T ,W ⎟ ⎝ + + ⎠ Current Net Income Wealth (due to borrowing constraints) it depends on current and future income, interest rates, and taxes Permanent Income + Borrowing Limits In practice: Young households are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current income Thus, there are two effects of an increase in current income (Yt): • it increases wealth (Wt) • it relaxes the borrowing limit Bottom line: An increase in CURRENT income have STRONGER EFFECTS on consumption than an increase in future income, because it relaxes borrowing constraints Formally: C(Y, T, r , Y e, T e, r e) + − − + − − Current Net Income Wealth (due to borrowing constraints) it depends on current and future income, interest rates, and taxes The “New” Theory of Consumption Some Implications • A TEMPORARY increase in income have LITTLE effects on consumption • because wealth (Wt) does not change much • … this explains why in the data consumption does not react much to temporary change in GDP • A PERMANENT increase in income have LARGER effects on consumption • because wealth (Wt) changes substantially C(Y, T, r , Y e, T e, r e) + − − + − − Current Net Income Wealth (due to borrowing constraints) it depends on current and future income, interest rates, and taxes The “New” Theory of Investment How do Firms Make Investment Decisions? Investment (I) Resources used to increase (or replace) the stock of productive capital in the economy. it depends on: – Expected Present Discounted Value of ADDITIONAL Profits: V(Пe) – Cost of Investing V(Пe) > Cost V (Πet Invest )> COST : V(Пe) < ⎫ ⎛ ⎞ ⎪ e ⎬ ⇒ I t = I ⎜⎜V Πt ⎟⎟ e V Πt < COST : Do Not Invest ⎪⎭ ⎝ + ⎠ Cost Do Not Invest ( ) Invest ( ) Investment Decisions + Borrowing Limits In practice: Firms are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current profits Thus, there are two effects of an increase in current profits (∏t): • it increases present discounted value of investment (Vt) • it relaxes the borrowing limit Bottom line: An increase in CURRENT Profits have STRONGER EFFECTS on INVESTMENT than an increase in future profits, because it relaxes borrowing constraints Formally: ⎛ e ⎞ I t = I ⎜ Π t ,V (Π t )⎟ ⎝ + + ⎠ Current Profits Present Discounted Value (due to borrowing constraints) it depends on current and future profits and interest rates Investment Decisions + Borrowing Limits In practice: Firms are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current profits Thus, there are two effects of an increase in current profits (∏t): • it increases present discounted value of investment (Vt) • it relaxes the borrowing limit Bottom line: An increase in CURRENT Profits have STRONGER EFFECTS on INVESTMENT than an increase in future profits, because it relaxes borrowing constraints Formally: I(⇧, ⇧e , r, re ) Current Profits (due to borrowing constraints) Present Discounted Value depends on current and future profits and interest rates Investment Decisions + Borrowing Limits In practice: Firms are unlikely to be able to borrow as much as desired i.e. there are borrowing limits, which typically depend on current profits Thus, there are two effects of an increase in current profits (∏t): • it increases present discounted value of investment (Vt) • it relaxes the borrowing limit Bottom line: An increase in CURRENT Profits have STRONGER EFFECTS on INVESTMENT than an increase in future profits, because it relaxes borrowing constraints Formally: e e I(Y, Y , r, r ) income (Y) ≃ profits (∏) (when income ↑, profits ↑) The “New” Theories of Consumption and Investment Summary Consumption C(Y, T, r , Y e, T e, r e) + − − + − Wealth Current Net Income it depends on current and future (due to borrowing constraints) Investment − income, interest rates, and taxes I(Y, r , Y e, r e) + − Current Profits (due to borrowing constraints) + − Present Discounted Value depends on current and future profits and interest rates