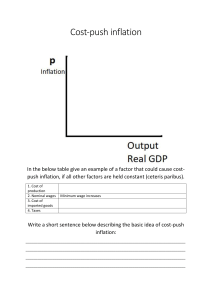

© VAN SCHAIK PUBLISHERS Chapter 20: Inflation Learning outcomes Once you have studied this chapter, you should be able to • define inflation • distinguish between different measures of inflation • Calculate CPI • explain why inflation is regarded as a problem • Explain, using diagrams, the difference between demand-pull and cost-push inflation; • Identify the factors that give rise to demand-pull and cost-push inflation • Explain “inflation targeting” as a policy measure that can be used to combat inflation © VAN SCHAIK PUBLISHERS Definition of inflation Continuous and considerable rise in prices in general. • Four important aspects • • Neutral definition (does not mention causes) • does not attempt to define inflation in terms of specific causes. • Causal in nature eg. To much money circulating. Continuous rise in prices – process • Inflation refers to a process of prices increasing annually. © VAN SCHAIK PUBLISHERS Definition of inflation Continuous and considerable rise in prices in general. • Four important aspects • • Considerable increase in prices • 1% / 2% considerable? May product’s quality cause this rise or inflation? General price level increase • Not item specific but general prices of most goods and services © VAN SCHAIK PUBLISHERS Measurement of inflation • CPI- most common indicator of the general price level • index of price of basket of G & S, not a rate • percentage change in the CPI from one period to the next = inflation rate. • therefore calculate the rate of change in CPI • Month on same month of previous year (CPI current period - CPI last period) X CPI last period 100 • Year on year (annual average on annual average) © VAN SCHAIK PUBLISHERS The measurement of inflation • The consumer price index – Month on the same month during the previous year (CPI current period - CPI last period) X CPI last period 100 Table 20-1 The consumer price index and inflation in South Africa 2012–2013 (Textbook page 383) © VAN SCHAIK PUBLISHERS The measurement of inflation • The consumer price index – Annual average on annual average (CPI annual average current period - CPI annual average last period) X CPI annual average last period 100 Table 20-1 The consumer price index and inflation in South Africa 2012–2013 (Textbook page 383) © VAN SCHAIK PUBLISHERS The measurement of inflation • The producer price index Table 20-2 Main differences between the CPI and PPI (Textbook page 383) © VAN SCHAIK PUBLISHERS The measurement of inflation The producer price index Table 20-3 Annual rates of increase in CPI and PPI, 2013 (Textbook page 384) • The implicit GDP deflator © VAN SCHAIK PUBLISHERS The effects of inflation • Distribution effects • some individuals or groups lose while others benefit • who lose and who win? • debtors tend to gain at the expense of creditors • young tend to gain at the expense of elderly • government tends to gain at expense of private sector • Economic effects • impact on employment and growth • productive activity neglected • saving discouraged • exports may suffer • imports may be stimulated © VAN SCHAIK PUBLISHERS The effects of inflation • Social and political effects • • people unhappy social and political unrest may ensue Box 20-1 The destructive power of inflation (Textbook page 386) Box 20-2 Falling prices: a consumer’s heaven? (Textbook page 387) • Expected inflation • • • inflation may result in the expectation of further inflation self-fulfilling prophesy may give rise to hyperinflation Box 20-3 Hyperinflation (Textbook page 387) © VAN SCHAIK PUBLISHERS The causes of inflation • Demand-pull and cost-push inflation – Demand-pull inflation • Prices “pulled up” by increase in aggregate demand • Could be the result of any or combination of components AD- C, I, G, X • usually accompanied by increase in M (money stock) • Price level P increases • Production and income (Y) also increases (up to full employment) • MP may be used to min inflation Figure 20-1 Demand-pull inflation (Textbook page 389) © VAN SCHAIK PUBLISHERS The causes of inflation • Demand-pull and cost-push inflation – Cost-push inflation • Prices pushed up by increase in costs to producers • Price level P increases • Production and income (Y) also Decreases (stagflation) • Sources of cost push • • • • • increased wages and salaries increased cost of imported capital and intermediate goods increased profit margins decreased productivity natural disasters Figure 20-2 Cost-push inflation (Textbook page 390) © VAN SCHAIK PUBLISHERS The causes of inflation • The structuralist approach to inflation inflation process is the result of the interaction between: – Underlying factors – Background (root) against which the inflation process occurs – Initiating factors – which trigger or intensify a particular inflation process – Propagating factors – which transmit the initiating impulse(s) through the economy and over time – To explain inflation, all three sets of factors have to be taken into account AND have to be present. © VAN SCHAIK PUBLISHERS The causes of inflation • The structuralist approach to inflation – Table 20-4 Underlying, initiating and propagating factors in the inflation process (Textbook page 391) © VAN SCHAIK PUBLISHERS The causes of inflation • The conflict approach to inflation Figure 20-3 A simplified view of the conflict approach (Textbook page 394) © VAN SCHAIK PUBLISHERS Anti-inflation policy • The costs of anti-inflation policy • Depends on the type of inflation being experienced • Demand-pull inflation VS Cost-push inflation • Demand-pull inflation • use restrictive monetary and fiscal policy • P decreases but Y also decreases • trade-off situation © VAN SCHAIK PUBLISHERS Anti-inflation policy • The costs of anti-inflation policy • Depends on the type of inflation being experienced • Demand-pull inflation VS Cost-push inflation • Cost-push inflation • cannot use restrictive monetary and fiscal policy • restrictive policy would increase unemployment further • ideal is to increase supply • difficult in practice • cannot use restrictive monetary and fiscal policy © VAN SCHAIK PUBLISHERS Anti-inflation policy • Indexation • means that prices, wages, pensions and so on are linked to price indices (for example, the CPI) to eliminate the distribution effects of inflation. • Trade-off in that todays prices serves as a basis for tomorrows price increases. • Should be used only in emergency conditions. © VAN SCHAIK PUBLISHERS Anti-inflation policy • Inflation targeting – The key features are thus: • the announcement of quantitative targets • primacy of price stability as the objective of monetary policy • a broad-based, pragmatic approach to the analysis of inflation • transparency • accountability © VAN SCHAIK PUBLISHERS Important concepts • • • • • • • • • • • • Inflation Consumer price index Headline inflation Producer price index GDP deflator Distribution effects Real interest rate Bracket creep Fiscal dividend Economic effects Social and political effects Hyperinflation • • • • • • • • • • • • Deflation Demand-pull inflation Cost-push inflation Stagflation Incomes policy Underlying factors Initiating factors Propagating factors Conflict approach Effective claims Indexation Inflation targeting © VAN SCHAIK PUBLISHERS