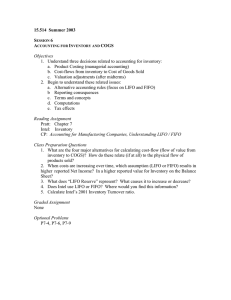

FIN 658 :: FINANCIAL STATEMENT ANALYSIS 149 | FIN 658 Chapter 6 :: Analyzing Operating Activities 150 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS • Analyze the item involved in operating activities under business activities. • Explain revenue and expense recognition and its risks for financial statement analysis. • Discuss the function of cost of sold with three inventory valuation methods (average costing, FIFO and LIFO) • Identify the role of taxation. 151 | FIN 658 Chapter 6 :: Analyzing Operating Activities OPERATING ACTIVITIES To analyze operating activities, it involved analyzing: • Revenue and gains • Cost of a good sold • Expenses • Interest Expense • Income taxes • Net income after tax Revenue and Gains Revenue recognition refers to a set of accounting rules that governs how a company accounts for its sales. Revenues must be presented at accrual basis in the income statement; and it can be identified as simple and complex. Below are the characteristics of Revenue. Aspects of Companies 1. Revenue Type Type Associated with Simple Revenue Product Type Associated with Difficult Revenue Service (architecture, legal, etc. ) construction, 2. Ownership Type Company is the owner/seller Company is an agent, distributor or franchisor (or products are sold on consignment) 3. Type of Sales Cycle Sales are made at delivery or "point of sale" Stand-alone products Sales are made via longterm service, subscription or membership contracts Bundled products and services (that is, multiple deliverable arrangements (MDAs)) 4. Degree of Product Complexity Examples of "Difficult" Revenue Extended service warranty contract is sold with consumer electronics or building highway or apartments Auction site sells airline tickets (should it report "gross" revenue or "net" fee received?) Or a restaurant boosts revenue by collecting franchise fees Fitness facility operator sells long-term gym memberships Software publisher bundles installation and technical support with product Simple revenue: • • • 152 | F I N 658 It owns its product, Gets paid fairly quickly after delivery and The product is not subject to overly complex bundling arrangements. FIN 658 :: FINANCIAL STATEMENT ANALYSIS Even the most honest companies in this business cannot avoid making revenue‐ reporting judgments and must therefore be scrutinized. Financial Accounting Standard Board (FASB) required revenue to be declared at accrual as deemed received for the particular year. Below is an example of Cash Revenue vs. Accrual JKL Industries From BALANCE SHEET: 2007 2006 Cash RM77,012 RM384,514 Receivables 6,679,907 8,982,854 2007 2006 RM204,647,364 RM200,839,393 Cost of sales 181,606,051 178,114,150 Gross profit 23,041,313 22,725,243 Assets Current assets: From INCOME STATEMENT: Sales How To Calculate “Cash Received from Customers:” (1) Net Sales (2) + Decrease (or – Increase) RM204,647,364 2,302,947 = 8,982,854 – 6,679,907 (3) + Increase In Cash Advances = Cash Received from customers N/A RM206,950,311 We add the decrease in accounts receivable because it signifies cash received to pay down receivables. 'Cash advances from customers' represents cash received for services not yet rendered; this is also known as unearned or deferred revenue and is classified as a current liability on the balance sheet. 153 | FIN 658 Chapter 6 :: Analyzing Operating Activities We calculate 'cash received from customers' to compare the growth in cash received to the growth in reported revenues. If the growth in reported revenues jumps far ahead of cash received, we need to ask why. For example, a company may induce revenue growth by offering favorable financing terms - like the advertisement you often see for consumer electronics that offer "0% financing for 18 months." A new promotion such as this will create booked revenue in the current period, but cash will not be collected until future periods. And of course, some of the customers will default and their cash will not be collected. So the initial revenue growth may or may not be good growth, in which case, we should pay careful attention to the allowance for doubtful accounts. What is Allowance for Doubtful Accounts? Allowance for Doubtful Accounts Of course, many sales are offered with credit terms: the product is sold and an accounts receivable is created. Because the product has been delivered (or service has been rendered) and payment is agreed upon, known and reasonably assured, the seller can record it as a revenue. However, the company must estimate how much of the receivables will not be collected. For example, it may book RM100 in gross receivables but, because the sales were on credit, the company might estimate that RM7 will ultimately not be collected. Therefore, a RM7 allowance is created and only RM93 is booked as revenue. As you can see, a company can report higher revenues by lowering this allowance. Therefore, it is important to check that sufficient allowances are made. If the company is growing rapidly and funding this growth with greater accounts receivables, then the allowance for doubtful accounts should be growing too. 154 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Revenue recognition is a hot topic and the subject of much post-mortem analysis in the wake of multiple high-profile restatements. We cannot directly guard against fraud; that is a job for a company's auditor and the audit committee of the board of directors. But we can do the following: • Determine the degree of accounting risk posed by the company's business model. • Compare growth in reported revenues to cash received from customers. • Parse organic growth from the other sources and be skeptical of any one-time revenue gains not tied directly to cash (quality of revenues). Scrutinize any material gains due to acquisitions. And finally, omit currency gains. Reported on the income statement, it is the sum of all direct and indirect selling expenses and all general and administrative expenses of a company. Cost of a Good Sold The direct costs attributable of the goods sold to the production by a company. This amount includes the cost of the materials used in creating the good along with the direct labor costs used to produce the good. It excludes indirect expenses such as distribution costs and sales force costs. COGS appear on the income statement and can be deducted from revenue to calculate a company's gross margin. Also referred to as "cost of sales". COGS are the costs that go into creating the products that a company sells; therefore, the only costs included in the measure are those that are directly tied to the production of the products. 155 | FIN 658 Chapter 6 :: Analyzing Operating Activities For example, the COGS for an automaker would include the material costs for the parts that go into making the car along with the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. The exact costs included in the COGS calculation will differ from one type of business to another. The costs of goods attributed to a company’s products are expensed as the company sells these goods. There are several ways to calculate COGS but one of the more basic ways is to start with: 9 The beginning inventory for the period and 9 Add the total amount of purchases made during the period then 9 Deducting the ending inventory. This calculation gives the total amount of inventory or, more specifically, the cost of this inventory, sold by the company during the period. Therefore, if a company starts with RM10 million in inventory, makes RM2 million in purchases and ends the period with RM9 million in inventory, the company's cost of goods for the period would be RM3 million (RM10 million + RM2 million - RM9 million). Current Purchase, Inventory brought forward from previous year and inventory not fully utilized until the end of the year are the measurement of COGS. Therefore part of the operating activity analysis involved monitoring purchase or materials, beginning inventory and ending inventory. The common method used to purchase and produced can be either using FIFO, LIFO or average costing methods 1. Applying Three Inventory Valuation Methods In all three case, the same beginning inventory, purchases and ending inventory will be used for a one-month accounting period in March. 156 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Three inventory purchases were made during the month: March 1 100 unit at RM10 March 15 200 unit at RM11 March 25 200 unit at RM12 The beginning inventory value was 100 items at RM9 each. Average costing Averaging costing methods is an evaluation in which the costs of inventory were averaged to determine cost per unit. Before using the average-costing inventory system, you need to calculate the average cost per unit. 100 at RM9 = RM900 (Beginning inventory) Plus purchases: 100 at RM10 = RM1,000 (March 1purchase) 200 at RM11 = RM2,200 (March 15 purchase) 200 at RM12 = RM2,400 (March 25 purchase) Cost of goods available for sale = RM6,500 Average cost per unit: RM6,500 (cost of goods available for sale) ÷ 600 (number of units) = RM10. 83 (Average cost per unit) After knowing the average cost per unit, calculate the cost of goods sold and the ending inventory value by using the average-costing inventory system: Cost of goods sold 500 at RM10.83 = RM5,415 Ending inventory 100 at RM10.83 = RM1,083 So, the value of cost of goods sold using the average-costing method is RM5,415. This is the figure as the cost of goods sold line item on the income statement. The value of the inventory left on hand, or the ending inventory is RM1,083. This is the number as the inventory item on the balance sheet. 157 | FIN 658 Chapter 6 :: Analyzing Operating Activities First In, First Out – FIFO FIFO is a valuation method in which the assets produced or acquired first are sold, used or disposed. FIFO is the most commonly used. For taxation purposes, FIFO assumes that the assets that are remaining in inventory are matched to the assets that are most recently purchased or produced. Because of this assumption, there is a number of tax minimization strategies associated with using the FIFO asset-management and valuation method. To find the costs of goods sold, add the beginning inventory to the purchases that took place during the reporting period. The remaining 100 units at RM12 are the value of ending inventory. Here’s the calculation: Beginning inventory: 100 at RM9 = RM900 March 1 purchase: 100 at RM10 = RM1,000 March 15 purchase: 200 at RM11 = RM2,200 March 25 purchase: 100 at RM12 = RM1,200 Cost of goods sold = RM5,300 = RM1,200 Ending inventory: From March 25: 100 at RM12 In this example, the cost of goods sold includes the value of the beginning inventory plus the first two purchases on March 1 and 15 and part of the purchases on March 25. Those units remaining on the shelf are from the last purchase on March 25. The cost of goods sold is RM5,300 and the value of the inventory on hand, or the ending inventory is RM1,200. Last In, First Out - LIFO LIFO is a valuation method that assumes that assets produced or acquired last are the ones that are firstly used sold or disposed. LIFO assumes that an entity sells, uses or disposes first of its newest inventory. If an asset is sold for less than it is acquired for, then the difference is considered a capital loss. If an asset is sold for more than it is acquired for, the difference is considered a capital gain. Using the LIFO method to evaluate 158 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS and manage inventory can be tax advantageous, but it may also increase tax liability. To calculate LIFO, start with the last units purchased and work backward to calculate the cost of goods sold. The first 100 units at RM9 in the beginning inventory end up being the same 100 at RM9 for the ending inventory. Here’s the calculation: March 25 purchase: 200 at RM12 = RM2,400 March 15 purchase: 200 at RM11 = RM2,200 March 1 purchase: 100 at RM10 = RM1,000 Cost of goods sold = RM5,600 = RM900 Ending inventory: From beginning inventory: 100 at RM9 So, the cost of goods sold line item on the income statement is RM5,600 and the value of the inventory line item on the balance sheet is 900. 2. Comparing inventory methods and financial statements Looking at the results of each method side by side shows the impact that the inventory valuation method has on the net income statements: Income Statement Line Item Averaging FIFO LIFO Sales RM10,000 RM10,000 RM10,000 Cost of goods sold RM5,415 RM5,300 RM5,600 Income RM4,585 RM4,700 RM4,400 LIFO gives the lowest net income figure and the highest cost of goods sold. Companies that use the LIFO system have higher costs to write off on their taxes, so they pay less in income taxes. FIFO gives companies the lowest cost of goods sold and the highest net income, so companies that use this method know their bottom lines look better to investors. 159 | FIN 658 Chapter 6 :: Analyzing Operating Activities Results for the inventory number on the balance sheet will also differ using these different methods: Ending inventory Averaging FIFO LIFO RM1,083 RM1,200 RM900 LIFO users are likely to show the lowest inventory balances because their numbers are based on the oldest purchases, which are in many industries, also the lowest cost. This situation is exactly opposite if investors are looking at an industry in which in the cost of goods is dropping in price. Then the oldest goods can be the most expensive. For example, computer companies carrying older, outdated equipment can have more expensive units sitting on the shelves if they try to use the Last In, First Out method, even though the units may not be worth anywhere near what the company paid for them. 160 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Other cost flow assumptions (rising prices) During periods of rising prices (inflation), the LIFO inventory cash flow method reports a higher cost of sales, a lower amount for ending inventory than FIFO. Therefore a change from FIFO to LIFO during this period would result in a decrease of net income and a decrease in ending inventory. As a general rule, amount-value LIFO uses a double-extension method to compute: 1. The value of the ending inventory in terms of base year prices, and 2. The value of the ending inventory at current prices. The ratio of 2 over 1 provides the specific price index for valuing any layers of inventory added in the period. This characteristic is unique to this method of inventory. None of the other inventory methods require estimate of price-level changes for specific inventories. In using LIFO, the cost of the last goods is used in pricing the costs of goods sold. In using FIFO, the costs of the last goods in are used in pricing the ending inventory. Therefore the LIFO method will result in having cost of goods sold most closely approximate current cost and the FIFO method will result in having ending inventory most closely approximate current cost. COGS LIFO = COGS FIFO + (R% x Inventory Beginning) Expenses Selling, General & Administrative Expense - SG&A Direct selling expenses are expenses that can be directly linked to the sale of a specific unit such as credit, warranty and advertising expenses. Indirect selling expenses are expenses which cannot be directly linked to the sale of a specific unit, but which are proportionally allocated to all units sold during a certain period, such as 161 | FIN 658 Chapter 6 :: Analyzing Operating Activities telephone, interest and postal charges. General and administrative expenses include salaries of non-sales personnel, rent, heat and lights. High SG&A expenses can be a serious problem for almost any business. Examining this figure as a percentage of sales or net income compared to other companies in the same industry can give some idea of: 9 Whether management is spending efficiently or 9 Wasting valuable cash flow. For example, in the television industry businesses that depend on a great deal of advertising must carefully monitor their marketing expenses. A good management team will often attempt to keep SG&A expenses under tight control and limited to a certain percentage of revenue by reducing corporate overhead (i.e. cost-cutting, employee lay-offs). Operating expense Operating expense is a category of expenditure that a business incurs as a result of performing its normal business operations. One of the typical responsibilities that management must contend with is determining how low operating expenses can be reduced without significantly affecting the firm's ability to compete with its competitors. Also known as "OPEX". For example, the payment of employees' wages and funds allocated toward research and development are operating expenses. In the absence of rising prices or finding new markets or product channels in order to raise profits, some businesses attempt to increase the bottom line purely by cutting expenses. While laying off employees and reducing product quality can initially boost earnings 162 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS and may even be necessary in cases where a company has lost its competitiveness, there are only so many operating expenses that management can cut before the quality of business operations is damaged. Non-operating expense An expense incurred by activities not relating to the core operations of the business. Accountants may remove non-operating expenses or revenues in order to examine the performance of the business, ignoring effects of financing or irrelevant issues. Non-operating expenses may take a variety of forms. The most common type relate to interest charges or other costs of borrowing. A firm may also categorize any costs incurred from restructuring or reorganizing, currency exchange, charges on obsolescence of inventory, as non-operating expenses. Expenses relating to employee benefits, such as pension contributions would also be considered as a non-operating cost. Interest Expense The amount reported by a company or individual as an expense for borrowed money. It is sometimes called "interest payable". Interest is calculated as a percentage of the amount of debt for each period of time. Points paid for a mortgage are a form of prepaid interest. Net Income Net income is a company's total earnings (or profit). Net income is calculated by: 9 Taking revenues and adjusting for the cost of doing business depreciation, interest, taxes and other expenses. This number is found on a company's income statement and is an important measure of how profitable the company is over a period of time. The measure is also used to calculate earnings per share. 163 | FIN 658 Chapter 6 :: Analyzing Operating Activities Often referred to as "the bottom line" since net income is listed at the bottom of the income statement. Net income is also known as "profit attributable to shareholders". Accounting Profit vs. Economic Profit (or Loss) The difference between the revenue received from the sale of an output and the opportunity cost of the inputs used. This can be used as another name for "economic value added" (EVA). Don't confuse this with 'accounting profit', which is what most people generally mean when they refer to profit. In calculating economic profit, opportunity costs are deducted from revenues earned. Opportunity costs are the alternative returns foregone by using the chosen inputs. As a result, you can have a significant accounting profit with little to no economic profit. For example, say you invest RM100,000 to start a business, and in that year you earn RM120,000 in profits. Your accounting profit would be RM20,000. However, say that same year you could have earned an income of RM45,000 had you been employed. Therefore, you have an economic loss of RM25,000 (120,000 - 100,000 45,000). Income Tax / Taxation Income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. By law, businesses and individuals must file an income tax return every year to determine whether they owe any taxes or are eligible for a tax refund. Income tax is a key source of funds that the government uses to fund its activities and serve the public. BASIS OF TAXATION Income tax is generally imposed on a territorial basis in that only income accruing in or derived from Malaysia is liable to tax. However, resident individuals and other noncorporate entities are also taxed on foreign-sourced income remitted into Malaysia. 164 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Foreign-sourced income received by resident companies are not subject to tax even if such income is remitted to Malaysia. Sources of Income Liable to Tax Sources of income which are liable to income tax are as follows: • Gains and profits from trade, profession and business • Salaries, remunerations, gains and profits from an employment • Dividends, interests or discounts • Rents, royalties or premiums • Pensions, annuities or other periodic payments/li> • Other gains or profits of an income nature not mentioned above. Chargeable income is arrived at after adjusting for expenses incurred wholly and exclusively in the production of the income. Specific provisions or reserves for anticipated losses or contingent liabilities are not tax deductible. No deduction for book depreciation is allowed although capital allowances are granted. Unabsorbed losses may be carried forward indefinitely to offset against future income. Corporate tax Tax rate Tax rate for a limited and unlimited company residence in Malaysia is For example in Malaysia, for year assessment 2008, with an income tax rate of 26%, for every RM100,000 that the firms makes, RM26,000 (RM100,000 x 0.26) must be paid as tax. Net Income after Tax An individual’s income after deductions, credits and taxes are factored into gross income. Deductions and credits are subtracted from gross income to arrive at taxable income, which is used to calculate income tax. Net income is income tax subtracted from taxable income. 1. Net income is calculated by starting with a company's total revenue. 165 | FIN 658 Chapter 6 :: Analyzing Operating Activities 2. From this, the cost of sales, along with any other expenses that the company incurred during the period, is removed to reach earnings before tax. 3. Tax is deducted from this amount to reach the net income number. 4. Net income, like other accounting measures, is susceptible to manipulation through such things as aggressive revenue recognition or by hiding expenses. 5. When basing an investment decision on net income numbers, it is important to review the quality of the numbers that were used to arrive at this value. For example, suppose that your gross income is RM50,000 and you have RM20,000 in deductions. This leaves you with a net income before tax (NIBT)of RM30,000. Then, your tax deductible (30,000 @ 26%) of RM7,800 will be subtracted from NIBT ; the remaining RM22,200 will be your net income after tax. Net Income after tax The amount of money that an individual or company has left over after all federal, state and withholding taxes have been deducted from taxable income. After-tax income represents the amount of disposable income that a consumer or firm has to spend on future investments or on present consumption. Also known as "income after taxes" When analyzing or forecasting personal or corporate cash flows, it is important to use an estimated after-tax net cash flow. This is a more appropriate measure because after-tax cash flows are what the entity has available for consumption. This is not to say that all investments are purchased with after tax income; some companies offer salary deferral retirement plans that deduct money on a pretax basis. The money will be taxed once the employee decides to withdraw the 166 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS amount (such as for retirement). However, because most people have less income during their retirement years compared to their prime earning years, the amount of tax paid will be less. SUMMARY Revenue is the most important source of cash for a company. To survive, a company must have its sources of revenue sustainable and grow. Thus, scrutinizing the sources of the revenue is important as it will tell us the sources of revenue growth. SELF-TEST WITH SOLUTIONS Question Sales of Kukuh Industries Sdn. Bhd are approximately RM750,000 per year. Kukuh requires a short term financing of RM150,000 to finance its working capital requirements SIM Bank is considering Kukuh,s financing request but requires certain minimum conditions be satisfied. The following information is available for Kukuh for the current year: • Beginning inventory is RM105,000 • Ending inventory is RM145,000 • Credit terms to Kukuh’s customers are 35 days • Credit terms from its suppliers are 75 days • Purchases for the years are RM450,000 • Purchase returns and allowances are 3% of purchases • Purchase discounts are 1% of purchases • Accounts payable is only current liability • Cash is 10% of accounts receivable • Sales return and allowances are 10% of sales • Sales discounts are 2% of sales You are required to compute current liabilities and current assets. 167 | FIN 658 Chapter 6 :: Analyzing Operating Activities Solution: Compute Current Liabilities (A/c Payable) Beginning inventory + Net Purchases – COGS = Ending Inventory COGS = Beginning inventory + Net Purchases - Ending Inventory = RM105,000 + (0.97 x RM450,000) – RM145,000 = RM396,500 Days’ purchase in a/c payable = (a/c payable / COGS) x 360 75 days = (a/c payable / RM396,500) x 360 A/c payable = (75 x RM396,500) / 360 = RM82,604 Compute Current Assets Current Assets Cash RM Account receivable * Inventory Total Current Assets 6,417 64,167 145,000 215,584 *ACP = A/c receivable / Sales 35 days = A/c receivable ÷ (0.88 x RM750,000) x 360 A/c receivable = (35 x RM660,000) / 360 = RM64,167 168 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Question NM and NI Corporation are involved in the same business segment; boutique and fashion. However, NM and NI are using different accounting method for their inventory costing. NM used FIFO inventory method where as NI used LIFO inventory method. i) Show the effect of FIFO and LIFO method for inventory costing during the inflationary period for NM and NI. ii) Determine which corporation would be beneficial during deflationary period. iii) Determine which method, FIFO or LIFO is preferable for analysis. Solution: i) ii) Effect NM (FIFO) NI (LIFO) Cost of materials Lower Higher Gross income Higher Lower Ending inventory Higher Lower Taxes Higher Lower In long term, as long as the costing method used is consistent, no company would be better off than another. In short period, which company would be beneficial is depending on tax environment. During deflationary period, NI should earn greater profits because the cost is expense based on recent cost which is cheaper. However, if the tax bracket is high NI needs to pay more than NM as it record higher profit for the year iii) For analysis purpose, LIFO is preferable method as its give the most recent COGS but it also leads to less recent balance sheet than often understate the inventory value. 169 | FIN 658 Chapter 6 :: Analyzing Operating Activities EXERCISES Question 1 Below is the income statement and balance sheet of PQR Corporation. From this information prepare a statement of cash flows for the year ended June 30, 2007. Income Statement for year ended June (In thousands) 2006(RM) 2007 (RM) 500,000 512,000 Cost of sales (395,000) (404,480) Gross margin 105,000 107,520 Selling and Administrative (60,000) (61,440) Income before interest and taxes 45,000 46,080 Interest expense (9,900) (12,320) Income before income taxes 35,100 33,760 Income tax (12,812) (12,322) Net income 22,288 21,438 Revenues Balance Sheet as of June (In thousands) Assets 2006 (RM) 2007 (RM) Change Cash and equivalents 10,000 10,240 240 Accounts receivable 40,000 48,640 8,640 Inventories 39,500 56,627 17,127 Prepaid expenses 10,000 11,000 1,000 Total current assets 99,500 126,507 27,007 Property, plant and equipment 390,000 411,000 21,000 (233,000) (250,000) (17,000) PPE, net 157,000 161,000 4,000 Other assets, net amortization 27,000 26,000 (1,000) Current assets Accumulated depreciation 170 | F I N 658 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Total assets 283,500 313,507 30,007 Current portion of long-term debt 12,000 13,000 1,000 Notes payable 30,000 31,000 1,000 Accounts payable 39,500 42,450 2,950 Accrued liabilities 21,569 18,000 (3,569) Income taxes payable 8,900 9,500 600 Total Current Liabilities 111,969 113,950 1,981 Long-term debt 87,000 99,000 12,000 Non-current deferred income tax 10,000 9,070 (30) Other non-current liabilities 4,340 5,000 660 Common stock – Class A 3,000 3,500 500 Capital in excess of par 21,000 26,000 5,000 Retained earnings 46,191 56,087 9,896 Total Shareholders’ Equity 70,191 85,587 15,396 Total Liabilities and Equity 283,500 313,507 30,007 Liabilities and Shareholders’ Equity Shareholders’ Equity Question 2 Briefly explain four (4) advantages for companies using FIFO as compared to LIFO inventory accounting method during period of rising prices and stable economy. 171 | FIN 658 Chapter 6 :: Analyzing Operating Activities Question 3 The Jacob Corporation has released the following year-end financial data (RM): Pretax income 60000 Net income 42000 Interest expense Sales Total Assets Common equity Based on the information above, calculate: 1. Operating profit margin 2. Asset turnover 3. Interest expense rate 4. Tax retention 5. Financial leverage 6. Return on Equity 172 | F I N 658 7200 300 000 80000 160000 FIN 658 :: FINANCIAL STATEMENT ANALYSIS Study Notes 173 | FIN 658 Chapter 6 :: Analyzing Operating Activities 174 | F I N 658