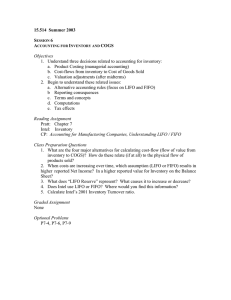

Chapter 7 Accounting Solutions: Cost of Goods Sold & Inventory

advertisement