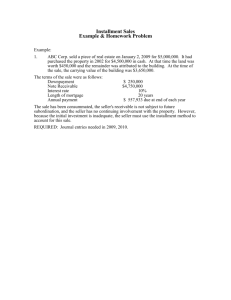

Installment Method Under this method, income is recognized only when collections are made. Problems requiring the use of the installment method of recognizing income have appeared quite regularly in the CPA exam. The following are the typical problems often encountered in the CPA exam: 1. 2. 3. 4. Computation of Gross Profit Rate for each year of sales. Computation of Realized Gross Profit for each year of sales. Computation of Deferred Gross Account balance at the end of year. Computation of Gain or Loss on repossessions. Computation of Gross Profit Rate To compute the realized gross profit in proportion to the collections made, it is necessary to determine the gross profit rate for each year’s operations. The following are the formulas in computing gross profit rate: Gross Profit Current year sales: Gross Profit Rate = Installment Sales Prior year sales: Gross Profit Rate = Deferred Gross Profit (Beg.) – Prior Year Sales Installment Accounts Receivable (Beg.) – Prior Year Sales Computation of Realized Gross Profit Once the gross profit rates are known, it is possible to compute the realized gross profit based on cash collections. The formula to be used is: Realized Gross Profit = Collections (excluding interest) x Gross Profit Rate (based on sale) Missing Factors. In as much as the realized gross profit under the installment method depends upon cash collections of receivables, it is important that the amounts collected must be known. However, in some problems, the collections are not specifically stated. Such collections must be reconstructed from related information available from the data given. The candidate should remember the following format in computing the collections: Current Prior Year Year Installment accounts receivable – beginning Installment accounts receivable – end Total credits Credit for repossessions (unpaid balance) Credit for installment A/C written off Credit representing collections Computation of Deferred Gross Profit, End Sales xx (xx) xx (xx) (xx) xx Sales xx (xx) xx (xx) (xx) xx To compute the balance of Deferred Gross profit at the end of the year, the following formula may be used: Installment Account Receivable – End x GPR = Deferred Gross Profit – End Or Deferred Gross Profit – before adjustment Less: Realized gross profit Deferred Gross Profit - End xx xx xx Computation of Gain or Loss on Repossession If a customer does not make an installment payment at the specified time, it is necessary to repossess the merchandise in order for the seller to minimize his loss. The gain or loss on repossession is computed as follows: Fair value of repossessed merchandise Less: Unrecovered cost Unpaid balance Less: deferred gross profit (unpaid balance x GP rate) Gain (loss) on repossession xx xx xx The fair value of repossessed merchandise at the time of repossession should be before reconditioning cost and before adding a normal gross profit from sale of repossessed merchandise. xx xx Trade In This type of installment sales used by car dealers, whereby an old car is received as down payment from the buyer for sale of the new car. Usually the old car traded-in is overvalued to induce the trade-in. for problem solving purposes the overvaluation is computed using a formula below: Trade-in value allowed on the old car Pxx Less: Actual value Estimated selling price Pxx Less: Normal gross profit from the sale of used car Pxx Reconditioning costs xx xx xx Overallowance on the old car Pxx The overallowance is treated as a deduction from the selling price of the new car. When there is overallowance on the old car traded-in, the gross profit rate is computed as follows: Gross profit ÷ Net Sales (net of overallowance) The realized gross profit is also computed as follows: Collections (cash + actual value of old car) x GPR PROBLEMS 1. Oro Company began operations on January 1, 2019 and appropriately uses the installment sales method of accounting. The following data are available for 2019 and 2020: Installment sales Gross profit on sales Cash collections from: 2019 sales 2020 sales 2019 2020 P1,500,000 P1,800,000 30% 40% 500,000 - 600,000 700,000 The realized gross profit for 2020 is: a. b. c. d. P720,000 520,000 460,000 280,000 2. Roco Corp., which began business on January 1, 2020, appropriately uses the installment sales method of accounting for income tax reporting purposes. The following data are available for 2020: Installment accounts receivable, 12/31/2020 Installment sales for 2020 Gross profit on sales P200,000 350,000 40% Under the installment method, what would be Roco’s deferred gross profit at December 31, 2020? a. b. c. d. P20,000 90,000 80,000 60,000 3. Gray Co., which began operations on January 1, 2020, appropriately uses the installment method of accounting. The following information pertains to Gray operations for the 2020: Installment sales Regular sales Cost of installment sales P500,000 300,000 250,000 Cost of regular sales General and administrative expenses Collections on installment sales 150,000 50,000 100,000 In its December 31, 2020 statement of financial position, what amount should Gray report as deferred gross profit? a. b. c. d. P250,000 200,000 160,000 75,000 4. Filstate Co. is a real estate developer that began operations on January 2, 2020. Filstate appropriately uses the installment method of revenue recognition. Filstate sales are made on the basis of a 10% downpayment, with the balance payable over 30 years. Filstate gross profit percentage is 40%. Relevant information for Filstate first year of operations is as follows: Sales P16,000,000 Cash collections 2,020,000 The realized gross profit and deferred gross profit at December 31, 2020 are: a. b. c. d. P808,000 and P5,592,000 5,040,000 and 808,000 5,600,000 and 808,000 808,000 and 6,400,000 5. Long Co., which began operations on January 1, 2020, appropriately uses the installment method of accounting. The following information pertains to Long’s operations for the year 2020: Installment sales Regular sales Cost of installment sales Cost of regular sales General and administrative expenses Collections on installment sales What is the total comprehensive income on December 31, 2020? a. b. c. d. P400,000 200,000 300,000 100,000 P1,000,000 600,000 500,000 300,000 100,000 200,0000 6. Kiko Co. began operations on January 1, 2020 and appropriately uses the installment method of accounting. The following information pertains to Kiko’s operations for 2020: Installment sales Cost of installment sales General and administrative expenses Collections on installment sales P800,000 480,000 80,000 300,000 The balance in the deferred gross profit account at December 31, 2020 should be: a. b. c. d. P120,000 150,000 200,000 320,000 7. Tayag Corp., which began operations in 2020, accounts for revenues using the installment method. Tayag’s sales and collections for the year were P60,000 and P35,000, respectively. Uncollectible accounts receivable of P5,000 were written off during 2020. Tayag’s gross profit rate is 30%. On December 31, 2020, what amount should Tayag report as deferred revenue? a. b. c. d. P10,500 9,000 7,500 6,000 8. Laya Corp., which began operations on January 2, 2020, appropriately uses the installment sales method of accounting. The following information is available for 2020: Installment accounts receivable, December 31, 2020 Deferred gross profit, December 31, 2020 (before recognition of realized gross profit for 2020) Gross profit on sales P800,000 560,000 40% For the year ended December 31, 2020, realized gross profit on sales should be: a. b. c. d. P320,000 340,000 320,000 240,000 9. Dulce Co., which began operations on January 1, 2019, appropriately uses the installment method of accounting to record revenues. The following information is available for the years ended December 31, 2019 and 2020: Installment sales Gross profit realized on sales made in: 2019 2020 Gross profit percentages 2019 2020 P1,000,000 P1,800,000 150,000 30% 90,000 200,000 40% What amount of installment accounts receivable should Dulce report in its December 31, 2020, statement of financial position? a. b. c. d. P1,225,000 1,300,000 1,700,000 1,775,000 10. On January 2, 2019, Black Co. sold a used machine to White, Inc. for P900,000, resulting in a gain of P270,000. On that date, White paid P150,000 cash and signed a P750,000 note bearing interest at 10%. The note was payable in three annual installments of P250,000 beginning January 2, 2020. Black appropriately accounted for the sale under the installment method. White made a timely payment of the first installment on January 2, 2020, of P325,000, which included accrued interest of P75,000. What amount of deferred gross profit should Black report at December 31, 2020? a. b. c. d. P150,000 172,500 180,000 225,000 11. White Plains, Inc. sells residential lots on installment basis. The following data was taken from the accounting records of the company as at December 31, 2020: Installment accounts receivable, January 1 Installment accounts receivable, December 31 Deferred gross profit, January 1 Installment sales P755,000 840,000 339,750 950,000 Complete (1) the realized gross profit on December 31, 2020 and (2) the balance of the Deferred Gross Profit account on December 31, 2020. a. b. c. d. (1) P389,250; and (2) P378,000 (1) 427,500; and (2) 389,250 (1) 330,750; and (2) 427,000 (1) 378,000; and (2) 339,750 12. In August, 2019, Mega World Inc. sold condominium units costing P1,440,000 for P2,400,000 receiving P350,000 cash and a mortgage note for the balance payable in monthly installments. Installment received in 2017 reduced the principal of the note to a balance of P2,000,000. The buyer defaulted on the note at the beginning of 2020, and the property was repossessed. The property had a fair market value of P1,150,000 at the time of repossession. Compute the gain (loss) on repossession if (1) profit is recognized at the point of sale and (2) gross profit is recognized in proportion to collections. a. b. c. d. (1) P(850,000); and (2) P(50,000) (1) (850,000); and (2) (450,000) (1) 850,000; and (2) (450,000) (1) (50,000); and (2) 50,000 13. Sarao Motors sells locally manufactured jeeps on installment basis. Data presented below related to the company’s operations for the last three calendar years: cost of installment sales Gross profit rates on sales Installment accounts receivable, 12/31: From 2020 sales From 2019 sales From 2018 sales 2020 2019 2018 P8,765,625 P7,700,000 P4,950,000 32% 30% 38% 9,728,125 3,025,000 8,387,500 1,512,500 4,812,500 On December 31, 2020 how much is the (1) total realized gross profit and (2) deferred gross profit? a. b. c. d. (1) P3,044,250; and (2) P4,020,500 (1) 3,044,250; and (2) 4,125,000 (1) 3,733,750; and (2) 4,020,500 (1) 6,993,250; and (2) 4,020,500 14. Polo Company appropriately uses the installment sales method of recognizing revenue. On December 31, 2020, the accounting records show unadjusted balances of the following: Installment accounts receivable – 2018 Installment accounts receivable – 2019 Installment accounts receivable – 2020 Deferred gross profit – 2018 P12,000 40,000 130,000 10,500 Deferred gross profit – 2019 Deferred gross profit – 2020 Gross profit rates: 2018 2019 2020 28,900 96,000 35% 34% 32% For the year ended December 31, 2020, compute (1) total realized gross profit and (2) the total cash collections in 2020: a. b. c. d. (1) P182,000; and (2) P135,400 (1) 76,000; and (2) 233,000 (1) 158,000; and (2) 368,400 (1) 106,000; and (2) 97,600 15. Bally Company, which began operations on January 2, 2020 appropriately, uses the installment method of revenue recognition. The following data pertains to the company’s operations for the 2020: Installment sales Cost of installment sales Collections on installment sales Installment accounts receivable written off P1,000,000 500,000 150,000 50,000 What is the balance of Deferred Gross Profit account – 2020 on December 31, 2020? a. b. c. d. P500,000 150,000 400,000 320,000 16. Nike Company, which began operations on January 5, 2019, appropriately uses the installment method of revenue recognition. The following information pertains to the company’s operations for 2019 and 2020: Sales Collections from: 2019 sales 2020 sales Accounts written off from 2019 sales 2020 sales Gross profit rates 2019 2020 P300,000 P450,000 100,000 -0- 50,000 150,000 25,000 -030% 75,000 150,000 40% What amount should Nike Company report as deferred gross profit in its December 31, 2020 statement of financial position? a. b. c. d. P75,000 80,000 112,000 125,000 17. The following accounts appeared in the accounting records of Adidas Sales Company as of December 31, 2020: Installment accounts receivable – 2019 Installment accounts receivable – 2020 Inventory, December 31, 2019 Purchases P15,000 200,000 70,000 555,000 Repossessions Installment sales Regular sales Deferred gross profit - 2019 P3,000 425,000 385,000 54,000 Additional information: Installment accounts receivable – 2019, January 1, 2020 Inventory of new and repossessed merchandise, December 31, 2020 Gross profit rate on regular sales P120,00 95,000 30% Repossession was made during the year, 2020. It was a 2019 sale and the corresponding uncollected balance at the time of repossession was P7,200. Compute (1) the total realized gross profit for 2020 and the (2) loss on repossession: a. b. c. d. (1) P129,510; and (2) P960 (1) 129,510; and (2) 1,464 (1) 245,000; and (2) 960 (1) 85,500; and (2) 1,464 18. Mango Company, which sells appliances started operations on January 10,2020 operates on a calendar year basis, and uses the installment method of revenue recognition. The following data were taken from the 2017 and 2018 accounting records: 2019 2020 Installment sales P480,000 P620,000 Gross profit rates based on cost 25% 20% Cash collection on 2019 sales 130,000 240,000 Cash collection on 2020 sales 160,000 What is the amount of realized gross profit to be recognized on December 31,2020? a. P124,500 b. P100,000 c. P92,000 d. P74,667 19. Lacoste Corporation has been using the cash method of revenue recognition. All sales are made on account with notes receivable given by the customers. The income statement for 2020 presented the following data: Revenues – collection on principal P32,000 Revenues – interes 3,600 Cost of goods purchases (includes 45,200 inventory of goods on hand P2,000) The balances due on the notes on December 31 were as follows: Notes receivable P62,000 Unearned interest income 7,167 Assuming the use of the installment method of revenue recognition, what is the realized gross profit on December 31,2020? a. P16,080 b. P25,586 c. P18,060 d. P43,633 20. Sta. Lucia Realty Corporation sells residential subdivision lots on installment basis. The following data were taken from the company’s accounting records as of December 31,2020. The company uses a uniform gross profit rate: Installment accounts receivable: January 1,2020 P1,510,000 December 31,2020 1,680,000 Unrealized gross profit – January 1,2020 679,500 Installment sales – 2019 1,180,000 Installment sales - 2020 1,900,000 How much is the gross profit realized during the year 2020? a. P778,500 b. P679,500 c. P756,500 d. P630,500 21. The following information pertains to a sale of real estate by RR Co. to SS Co. on December 31,2019: Carrying amount P2,000,000 Sales price: Cash P300,000 Purchase money mortgage 2,700,000 3,000,000 The mortgage is payable in nine annual installments of P300,000 beginning December 31,2020 plus interest of 10%. The December 31,2020 installment was paid as scheduled, together with interest of P270,000. RR uses the cost recovery method to account for the sale. What amount of income should RR recognize in 2020 from the real estate sale and its financing? a. P570,000 b. P370,000 c. P270,000 d. P0 22. Action Inc. sold a fitness equipment on installment basis on October 1,2020. The unit cost to the company was P60,000 but the installment selling price was set at P85,000. Terms of payment included the acceptance of a used equipment with a trade-in value of P30,000. Cash of P5,000 was paid in addition to the traded-in equipment with the balance to be paid in ten monthly installments due at the end of each month commencing the month of sale. It would require P1,250 to recondition the used equipment so that it could be resold for P25,000. A 15% gross profit was usual from sale of used equipment. The realized gross profit from the 2020 collections amounted to a. P4,000 b. P34,000 c. P10,000 d. P8,000 23. M & J Corp. which sells goods on installment basis, recognizes at year end gross profit on collections which is consisted of cost and gross profit. It reported the following: January 1 December 31 Installment receivables 2018 P120,100 0 2019 1,722,300 P337,200 2020 0 2,050,450 Sales and cost of sales for the three years are as follows: 2018 2019 2020 Sales P1,900,000 P2,610,000 P3,010,0000 Cost of sales 1,235,000 1,425,000 1,896,300 In 2020 the company repossessed merchandise with resale value of P8,500 from customers who defaulted in payments. The sales were made in 2019 for P27,000 on which P16,000 was collected prior to default. As collections are made, the company debits cash and credits installment receivable. For default and repossessions, the company debits installment receivable. The amount of adjustment on the inventory of repossessed merchandise to the extent of the unrealized gross profit was a. Zero b. A decrease of P6,240 c. A decrease of P2,500 d. A decrease of P3,740 24. On October 2020, Haybol Realty Co. sold to Mae Balay a property for P500,000 which is carried in its books for P250,000. The company received P100,000 on the date of the sale and a mortgage note for P400,000 payable in twenty (20) semiannual installments of P20,000 plus interest on the unpaid principal at 16% per annum. The realized profit to be recognized by Haybol Realty Corp. in 2020 if gross profit is recognized periodically in proportion to collections would be a. P50,000 b. P100,000 c. P60,000 d. P250,000 25. Quincy Enterprises uses the installment method of accounting and has the following data at year-end: Gross margin on cost 66 2/3% Unrealized gross profit P192,000 Cash collection including down payments 360,000 What was the total amount of sale on installment basis? a. P480,000 b. P648,000 c. P552,000 d. P840,000 26. The Brownout, Inc. began operating at the start of the calendar year 2020 uses the installment method of accounting: Installment sales P400,000 Gross margin based on cost 66 2/3% Inventory, Dec. 31,2020 80,000 General and administrative expenses 40,000 Accounts receivable, Dec. 31,2020 320,000 The balance of the deferred gross profit account at December 31,2020 should be: a. P192,000 b. P96,000 c. P128,000 d. P80,000 27. Tear Drops Corp. started operations on 1 January 2019 selling home appliances and furniture on installment basis. For 2019 and 2020 the following represented operational details. In thousand Pesos 2019 2020 Installment sales P1,200 P1,500 Cost of installment sales 720 1,050 Collections on installment sales 2019 630 450 2020 0 900 On 7 January 2020, an installment sale account in 2017 defaulted and the merchandise with a market value of P15,000 was repossessed. The related installment receivable balance as of date of default and repossession was P24,000. The balance of the unrealized gross profit as of the end of 2020 wa a. P218,400 b. P192,000 c. P360,000 d. P275,000 28. Four J Co. sold goods on installment. For the year just ended the following were reported: Installment sales P3,000,000 Cost of installment sales 2,025,000 Collections on installment sales 1,800,000 Repossessed accounts 200,000 Fair market value of repossessions 120,000 The gain(loss) on repossession is: a. (P15,000) b. P15,000 c. (P80,000) d. P5,000 29. A refrigerator was sold to Fernandina Castro for P16,000, which included a 40% markup on selling price. She made a down payment of 20%, payment of four of the remaining 16 equal payment and defaulted on further payments. The refrigerator was repossessed, at which time the fair value was determined to be P6,800. The repossession resulted to the following (loss) gain: a. P(1,040) b. P1,040 c. P4,056 d. P2,960 30. The Company uses the installment method of accounting to recognize income, Pertinent data are as follows: 2018 2019 2020 Installment sales P300,000 P375,000 P360,000 Cost of sales 225,000 285,000 252,000 Balances of Deferred Gross Profit at Year end 2018 P52,500 P15,000 P2019 54,000 9,000 2019 72,000 The total balance of the Installment Accounts Receivable on December 31,2020 is: a. P270,000 b. P277,500 c. P279,500 d. P300,000 31. In its first year of operations, Guijo Company’s sales were as follows: Sales basis Mark-up on cost Sales Cash 25% P250,000 Charge 33-1/3% 400,000 installment 50% 600,000 The cost of goods sold for the year was P900,000. No. 31 – Continued If collections on installment sales during the year amounted to P240,000, how much was the total gross profit realized at the end of the year? a. P50,000 b. P60,000 c. P80,000 d. P230,000 32. A sale on installment basis was made in 2020 for P8,000 at a gross profit of P2,800. At the end of 2020, when the installment account receivable had a balance of P3,500, it was ascertained that the customer would be unable to make further payments. The merchandise was then repossessed and was appraised at a value of P1,500. The loss on repossession was: a. P3,500 b. P2,000 c. P775 d. P1,775 33. On January 1,2019 Blim Company commenced its sales of gas stoves. Separate accounts were set up for installment and cash sales, but perpetual inventory record was not kept. On the installment sales of a down payment of 1/3 was required, with the balance payable in 18 equal monthly installments. The transactions of the Blim Company are as follows: 2019 2020 Sales: New gas stoves for cash P27,000 P37,000 New gas stoves on installment (including the 1/3 cash down payment) 235,000 Purchases 193,000 Physical inventories at December 31: New gas stoves at cost 45,500 Cash collections on installment contracts, exclusive of down payments: 2019 sales 54,000 77,000 2020 sales 70,000 No. 33 – Continued 330,000 215,000 60,000 The realized gross profit for the year 2020 that would be reported on the income statement amounted to: a. P131,530 b. P140,000 c. P123,350 d. P131,500 34. The data below are taken from the records of Jess Appliance Co., which sells appliances exclusively on the installment basis. 2018 2019 2020 Installment sales P365,500 P417,800 P610,750 Gross profit 36% 39% 40% The balance in the Installment Accounts Receivable controlling accounts at the beginning and end of 2020 were: 2020 From sales made in: January 1 December 31 2018 P17,400 P2019 205,400 25,800 2020 305,520 There was one repossession recorded during 2020, it related to a 2019 sale. The repossessed appliance was sold at its fair value of P200, which equaled the uncollected balance in the customer’s installment accounts receivable. The total realized gross profit on prior year sales on December 31, 2020 and the gain (loss) from the sale of the repossesses appliance are: a. P76,230 and P(78) b. P76,230 and P78 c. P69,966 and P78 d. P75,230 and P78 35. Mr. Matias Manuel is a dealer in appliance who sells on an installment basis. A refrigerator which originally cost P924 was sold by him for P1,650 to Jose Santos who made a down payment of P220, but defaulted in subsequent payments. No. 35 – Continued Mr. Manuel repossessed the refrigerator at an appraised value of P460. To improve its salability, he expended P60 for reconditioning. He was able to sell the refrigerator to Pedro Reyes for P1,000 at a down payment of the first installment of P250. The realized gross profit from the first installment sale (to Jose Santos) and from the second installment sale (to Pedro Reyes) are: a. P96.80 and P100 b. P26.40 and P120 c. P96.80 and P120 d. P26.40 and P100 36. The Bengal Furniture Company appropriately used the installment sales method in accounting for the following installment sale. During 2020 Bengal sold furniture to an individual of P3,000 at a gross profit of P1,200. On June 1 2020, this installment account receivable had a balance of P2,200 and it was determined that no further collections would be made. Bengal therefore repossessed the merchandise. When reacquired, the merchandise was appraised as being worth only P1,000. In order to improve its salability, Bengal incurred costs P100 for reconditioning. What should be the loss on repossessions attributable to this merchandise? a. P220 b. P320 c. P880 d. P1,100 37. Standard Sales Corporation accounts for sales on the installment basis. The balances of control accounts for Installment Contracts Receivable at the beginning and end of 2020 were: Installment contract receivable - 2018 Installment contract receivable – 2019 Installment contract receivable – 2020 No. 37 – continued Jan. 1,2020 P24,020 344,460 - Dec. 31,2020 P67,440 410,090 During 2020, the company repossessed a refrigerator which had been sold in 2019 for P5,400 and P3,200 had been collected prior to default. The company sales and cost of sales figures are summarized below: Net sales Cost of sales 2018 P380,000 247,000 2019 P432,000 285,120 2020 P602,000 379,260 The resale price of the repossessed merchandise is P2,000 after reconditioning cost of P200 and a normal gross profit of 35%. The total realized gross profit on December 31,2020 and the gain (loss) on repossession are: a. b. c. d. P172,892.5 and P(381) P172,852.5 and P(452) P142,500 and P(452) P142,500 and P452 38. The 680 Appliance Company reports gross profit on the installment basis. The following data are available: Installment sales Cost of goods – installment sales Gross profit Collections: 2018 installment contracts 2019 installment contracts 2020 installment contracts Defaults: Unpaid balance of 2018 Installment contracts Value assigned to repossessed Merchandise Unpaid balance of 2019 Installment contracts Value assigned to repossessed Merchandise 2018 P240,000 180,000 60,000 P45,000 2019 P250,000 181,250 68,750 2020 P300,000 216,000 84,000 P75,000 47,500 P72,500 80,000 62,500 P12,500 P15,000 6,500 6,000 16,000 9,000 No. 38 - Continued The total realized gross profit after loss on repossession for 2020 is: a. P49,775 b. P57,625 c. P48,975 d. P56,625 39. Partial trial balance of Lakan Appliance Corporation as of the end of the fiscal year September 30,2020 follows: Debit Credit Deferred gross profit – 2019 P50,000 Installment account receivable - 2019 Installment account receivable – 2020 Installment sales Inventory, September 30,2019 Loss on repossession Purchases Repossessions sales P12,500 150,000 375,000 62,500 3,750 435,000 2,500 312,500 The post closing trial balance on September 30,2019 shows the following balances of certain accounts: Installment contract receivable - 2019 P100,000 Deferred gross profit – 2019 50,000 The gross profit rate on regular sales during the year was 30% The inventory of new and repossessed merchandise on September 30,2020 amounted to P75,000. Unpaid balance on repossessed merchandise sale of 2019 is P6,250. The total realized gross profit on December 31,2020 is: a. P141,875 b. P101,250 c. P40,625 d. P140,875 40. Carlos Labung Appliance Co., sold a stove, costing P1,000 for P1,600 on September 2019. The down payment was P160, and the same amount was to be paid at the end of each succeeding month. Interest was charged on the unpaid balance of the contract at ½ of 1% a month, payments being considered as applying first to accrued interest and the balance to principal. After paying a total of P640, the customer defaulted. The stove was repossessed in February 2020. It was estimated that the stove had a value of P560 on a depreciated cost basis. The realized gross profit and the gain (loss) on repossession on December 31,2020 are: a. P232.76 and P(52.07) b. P240.00 and P(52.07) c. P232.76 and P(40.00) d. P240.00 and P(40.00) 41. The Julia Appliance company makes all sales on installment contracts and accordingly reports income on the installment basis. Installment contracts receivables are accounted for by years. Defaulted contracts are recorded by debiting Loss on Repossession account and crediting the appropriate Installment Contract Receivable account for the unpaid balance at the time of default. All repossessions and trade-ins are recorded at realizable values. The following data relate to the transactions during 2019 and 2020 2019 P150,000 2020 P198,500 Installment sales Installment contract receivable, Dec. 31: 2019 sales 80,000 25,000 2020 sales 95,000 Purchases 100,000 120,000 New merchandise inventory, Dec. 31 at cost 10,000 26,000 Loss on repossessions 6,000 The company auditor disclosed that the inventory taken on December 31,2020 did not include certain merchandise received as a trade-in on December 2,2020 for which an allowance was given. The realizable value of the merchandise is P1,500 which was also the allowance on the trade-in. No entry was made to record this merchandise on the books at the time it was received. In 2020, a 2019 contract was defaulted and the merchandise was repossessed. At the time of default, the repossessed merchandise had a fair value of P2,500. The repossessed merchandise was neither recorded nor included in the physical inventory on December 31,2020. The total realized gross profit at December 31,2020 and the adjusted gain (loss) on repossession are: Realized Gross profit Gain(Loss) on repossesion a. P70,000 P1,100 b. P70,000 (P1,100) c. P50,400 P1,100 d. P50,400 (P1,100) 42. Kanlaon Corporation started operations on January 1,2019, selling home appliances and furniture sets both under cash and under installment basis. Data on the installment sales operations for the two years ended December 31, 2019 and 2020 are as follows: 2019 P400,000 240,000 Installment sales Cost of installment sales Cash collections on: 2019 installment contracts 210,000 2020 installment contracts The balance of the Deferred Gross profit account on December 31,2020 is: a. P130,000 b. P160,000 c. P190,000 d. P76,000 2020 P500,000 350,000 150,000 300,000 43. United Trading accounts for sales under the installment method. On January 1,2020 its ledger accounts included the following balances: Installment Receivable, 2018 P38,500 Installment Receivable, 2019 Deferred Gross Profit, 2018 Deferred Gross Profit, 2019 155,000 11,550 62,000 Installment sales in 2020 were made at a 42% gross profit rate. December 31,2020 account balances before adjustments were as follows: Installment Receivable, 2018 Installment Receivable, 2019 Installment Receivable, 2020 Deferred Gross Profit, 2018 Deferred Gross Profit, 2019 Deferred Gross Profit, 2020 The total realized gross profit on December 31,2020 is: a. P90,350 b. P97,510 c. P98,910 d. P97,350 P-042,000 100,500 11,550 62,000 75,810 44. Presented below is the unadjusted trial balance, as of December 31,2020 of Moslim Products Corporation: Cash P5,000 Installment Accounts Receivable - 2019 40,000 Installment Accounts Receivable - 2020 140,000 Inventory, December 31,2020 200,000 Other Assets 497,000 Trade Accounts Payable P50,000 Unrealized Gross Profit - 2018 10,000 Unrealized Gross Profit – 2019 86,000 Unrealized Gross Profit – 2020 100,000 Capital stock 600,000 Retained Earnings 80,000 Repossession Gain 6,000 Operating expenses 50,000 P932,000 P932,000 The cost of goods sold had been uniform over the years at 60% of sales, and the company adopts perpetual inventory procedures. On the installment sales, the company charges installment accounts receivable and credits inventory and unrealized gross profit accounts. Repossessions of merchandise have been made during 2020 due to some customers’ failure to pay maturing installments. The analysis of these transactions have been summarized as follows: Inventory P7,500 Unrealized gross profit - 2018 800 Unrealized gross profit – 2019 2,400 Installment accounts receivable - 2018 2,000 Installment accounts receivable – 2019 Repossession gain 6,000 2,700 The repossessed merchandise were unsold at December 31,2020 and it was ascertained that these were booked, upon repossession, at their original cost. A fair valuation would be a sales price of P10,000 after recorditioning cost of P1,000 and a normal gross profit. The realized gross profit from 2020 sales and the gain (loss) on repossession on December 31,2020 are: a. P44,000 and (P200) b. P44,000 and P200 c. P56,000 and P300 d. P56,000 and P200 45. The following selected accounts appeared in the trial balance of Union Sales as of December 31,2020 Debit Credit Installment Accounts Receivable, 2019 sales P15,000 Installment Accounts Receivable, 2020 sales 200,000 Inventory, December 31,2019 70,000 Purchases 555,000 Repossessions 3,000 Regular Sales P385,000 Installment sales 425,000 Unrealized Gross Profit, 2019 54,000 Additional information: Installment Accounts Receivable, 2019 sales, As of December 31,2019 Inventory of new and repossessed Merchandise, December 31,2020 Gross profit rate on regular sales during the year P120,000 95,000 30% Repossession was made during the year on a 2019 sale and the corresponding uncollected amount at the time of repossession was P7,750. The total realized gross profit on December 31,2020 and the (loss) on repossession are: a. P85,5000 and P(1,262.5) b. P129,262.5 and P(1,262.5) c. P43,762.5 and P1,262.5 d. P119,622.5 and P1,262.5 46. The books of Paiyakan Company show the following account balances on December 31,2020: Accounts receivable P313,750 Deferred gross profit (before adjustment) 38,000 Analysis of the accounts receivable reveals the following: Regular accounts P207,500 2019 installment accounts receivable 16,250 2020 installment accounts receivable 90,000 Sales on installment basis in 2019 were made at 30% above cost, and in 2020 at 33-1/3% above cost. Expenses paid relating to installment sales were P1,500. How much is the total comprehensive income on installment sales? a. P10,000 b. P10,250 c. P11,000 d. P11,500 47. The Famcor Sales Company employs the perpetual inventory basis in the accounting for new cars. On August 15,2019, a new car costing P165,000 and with a list price of P220,000 was sold to Rose Castro. The company granted Ms. Castro an allowance of P85,000 on the trade-in of her old car, the current value if which was estimated to be P81,700; the balance of P135,000 was payable as follows: P35,000 cash at the time of purchase and twenty monthly payments of P5,000 starting September 1, 2019. On April 1,2020, Ms. Castro defaulted in the payment of the March 1,2020, installment. The new car sold was repossessed, and its value to the seller was P40,000. The total realized gross profit and the gain (loss) on repossession on December 31,2020 are: a. P32,616.62 and P(13,298) b. P32,616.62 and P13,298 c. P37,388.62 and P15,810.62 d. P27,844.62 and P(15,810.62) 48. The Jade Appliances Company started business on January 1,2020. Separate accounts were established for installment and cash sales. On installment sales, the price was 106% of the cash sales price. A standard installment contract was used whereby a down-payment of ¼ of the installment price was required, with the balance payable in 15 equal monthly installment. (the interest charge per month is 1% of the unpaid cash sale price equivalent at each installment.) Installment receivable and installment sales were recorded at the contact price. When contracts were defaulted, the unpaid balances were charged to Bad Debts Expense. The following data are available: Sales: Cash sales Installment sales Repossessed sales Inventory, January 1,2020: Merchandise inventory Purchases, 2020 New merchandise Inventories, physical, December 31,2020 New merchandise Repossessed inventory P126,000 265,000 230 58,060 209,300 33,300 180 Cash collections on installment contract 2020: Down payments 66,250 Subsequent installments (including interest of P9,252.84 on all contracts except on defaulted contracts) 79,341 Five contracts totaling P1,060 were defaulted, in each case after 3 monthly installments were paid. Interest should be recognized in the period earned. The total realized gross profit on December 31,2020 is: a. P99,024.85 b. P99,084.87 c. P99,184.85 d. P95,024.85 49. The following data were taken from the records of Camille Appliance Company before its accounts were closed for the year 2020. The company sells exclusively on the installment basis and its uses the installment method of recognizing profit: 2016 2017 2018 Installment sales P400,000 P440,000 P420,000 Cost of installment sales 240,000 272,800 256,200 Operating expenses 100,000 94,000 96,000 Balances as of December 31: Inst. Contracts Receivable -2018 220,000 110,000 28,000 Inst. Contracts Receivable -2019 250,000 92,000 Inst. Contracts Receivable -2020 238,000 During 2020, because some customers can no longer be located, the company wrote off P9,000 of the 2018 installment accounts and P2,800 of the 2019 installment accounts as uncollectible. Also during 2020, a customer defaulted and the company repossessed merchandise appraised at P2,400 after costs reconditioning estimated at P400. The merchandise had been purchased in 2018 by a customer who still owed P5,000 at the date of the repossession. The total comprehensive income on December 31,2020 is: a. P157,156 b. P61,000 c. P60,156 d. P59,156 50. Jing Trading Company, which started operations on January 2,2019, sells video equipment on installment terms. Whenever a contract is in default, Jing repossesses the merchandise and writes this off to a Loss on Defaulted Contracts account. Information regarding the repossessed goods are not recorded in the books but are kept on a memo basis. Proceeds from the sale of these goods are credited to the Loss on Defaulted Contracts account. The following information are taken from the books of Jing: December 31 2020 2019 Installment contracts receivable, 2019 P2,000 P31,500 Installment contracts receivable, 2020 40,000 Sales 125,000 75,000 Loss on defaulted contracts 4,275 250 Allowance for defaulted contracts 2,250 2,250 Additional information: a. No repossessed video equipment was sold in 2019 or 2020 for more than the unpaid balance of the original contract. A further analysis of the Loss on Defaulted Contracts accounts showed the following breakdown: 2019 2020 Contracts Contracts Contracts written off P3,750 P1,500 Less: sales of repossessed goods 800 175 Loss a defaulted contracts P2,950 P1,325 The repossessed goods on hand on December 31,2020, all of which were repossessed from 2019 contracts, are valued at P200. b. The P2,000 balance of the Installment Contracts Receivable 2019 account is currently due and collectible. c. The gross profit rates on installment sales were 40% in 2019 and 42% in 2020. d. The rate of bad debts loss for 2020 is estimated to be the same as the 2019 experiences rate based on sales: The required balance of the allowance for Defaulted Contracts account and the realized gross profit on December 31,2020 from 2019 sales are: a. P3,675 and P10,300 b. P3,675 and P9,300 c. P3,675 and P10,300 d. P4,675 and P9,300 ANSWERS 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. C C B A C C D D C A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. A A A B C A A D A A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. D D D A D C A A B B 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. D C A B C B B A A A 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. B D A B B B A A C A SOLUTIONS AND EXPLANATIONS 1. The answer can be computed by using the basic formula, collections x gross profit rate. 2019 sales 2020 sales Collections during 2020 P600,000 P700,000 Gross profit rate 30% 40% Realized gross profit P180,000 P280,000 Total realized gross profit (P180,000 + P280,000) 460,000 2. Installment account receivable, 12/31/13 Gross profit rate Deferred gross profit, December 31,2020 P200,000 40% P80,000 3. Installment sales Collections Installment accounts receivable, 12/31/13 Gross profit rate (P250,000/P500,000) Deferred gross profit, 12/31/13 Or Deferred gross profit(P500,000 – P250,000) Realized gross profit, 12/31/13 (P100,000x50%) P500,000 100,000 400,000 50% P200,000 250,000 50,000 Deferred gross profit, 12/31/13 P200,000 4. Realized gross profit (P2,020,000 x 40%) Deferred gross profit, 12/31/13: Installment accounts receivable, 12/31/13 (P16,000,000 - P2,020,000) Gross profit rate Deferred gross profit, 12/31/13 P808,000 5. Regular sales cost of regular sales Gross profit on regular sales Realized gross profit on installment sales: Collections Gross profit rate (P500,000/P1,000,000) Total realized gross profit General and administrative expense Total comprehensive income P600,00 300,000 P300,000 P13,980,000 40% P5,592,000 P200,000 50% 100,000 400,000 100,000 P300,000 6. Installment sales Cost of installment sales Deferred gross profit Realized gross profit (P300,000 x 40%*) Deferred gross profit, 12/31/13 *Gross Profit Rate (P320,000/P800,000) = 40% P800,000 480,000 320,000 120,000 P200,000 7. Installment sales Less: Collections Accounts written off Installment accounts receivable, 12/31/13 Gross profit rate Deferred gross profit, 12/31/13 P60,000 P35,000 5,000 8. Installment sales (P560,000/40%) Less: installment accounts receivable, 12/31/13 Collections Gross profit rate Realized gross profit 40,000 20,000 30% P6,000 P1,400,000 800,000 P600,000 40% P240,000 9. 2019 Sales 2020 Sales Total Installment sales Collections (RGP/GPR) During 2017 (P150,000/P30%) During 2018: 2017 sales (P90,000/30%) 2018 sales (P200,000/40%) Installment accounts receivable 12/31/13 P1,000,000 P2,000,000 (500,000) P500,000 10. Deferred gross profit (gain) Realized gross profit: Down payment Installment collections excluding interest: (P325,000 – P75,000) Total collections Gross profit rate (P270,000/P900,000) Deferred gross profit, 12/31/13 (300,000) (500,000) P1,200,000 P1,700,000 P270,000 P150,000 250,000 400,000 30% 11. Installment accounts receivable, January 1 Installment sales Total Less: Installment accounts receivable, Dec. 31 Collections Gross profit rate (P339,750/P755,000) Realized gross profit Installment accounts receivable, December 31 Gross profit rate Deferred gross profit, December 31 120,000 P150,000 P755,000 950,000 P1,705,000 840,000 865,000 45% 389,250 P840,000 45% P378,000 12. (1) Profit is recognized at the point of sale Fair value of repossessed property Less: Unrecovered cost (unpaid balance) Loss on repossession P1,150,000 2,000,000 P(850,000) (2) Profit is recognized in proportion to collections Fair value of repossessed property Less: Unrecovered cost Unpaid balance Deferred gross profit (P2,000,000 x 40%) Loss on repossession P1,150,000 P2,000,000 800,000 1,200,000 P(50,000) 13. (1) total realized gross profit Installment accounts receivable, 1/1/13 Installment accounts receivable, 12/31/13 Collections during 2020 Gross profit rates Realized gross profit, 12/31/13 (Total, P3,044,250) 2020 P12,890,625 9,728,125 P3,162,500 32% P1,012,000 2019 P8,387,500 3,025,000 P5,362,500 30% P1,608,750 2018 P1,512,500 -0P1,512,500 28% P423,500 (2) deferred gross profit, December 31,2020: Installment accounts receivable, 12/31/13 Gross profit rates Deferred gross profit, 12/31/13 2020 P9,728,125 32% P3,113,000 2019 P3,025,000 30% P907,500 2018 P-028% P-0- 14. (1) Total realized gross profit Deferred gross profit before adjustment Deferred gross profit, end: 2018 sales (P12,000 x 35%) 2019 sales (P40,000 x 34%) 2018 sales (P130,000 x 32%) Realized gross profit, 12/31/13 Total (P76,000) 2018 P10,500 2019 P28,900 2020 P96,000 4,200 13,600 P6,300 P15,300 41,600 P54,400 2018 2019 2020 (2) Total collections in 2020 Installment accounts receivable, beg 2018 sales (P10,500/35%) 2019 sales (P28,900/34%) 2018 sales (P96,000/32%) Installment accounts receivable, end Collections during 2020 Total (P233,000) P30,000 85,000 12,000 P18,000 40,000 P45,000 P300,000 130,000 P170,000 15. Installment sales Collections Accounts written off Installment accounts receivable, 12/31/13 Gross profit rate (P500,000/P1,000,000) Deferred gross profit, 12/31/13 P1,000,000 (150,000) (50,000) 800,000 50% P400,000 16. The balance of Deferred Gross Profit Account on December 31,2020 is computed follows: 2019 P300,000 (150,000) (100,000) P50,000 30% P15,000 Sales Collections Accounts written off Installment accounts receivable, 12/31/13 Gross profit rates Deferred gross profit, 12/31/13 Total (P75,000) 17. (1) Realized gross profit, December 31,2020 Regular Sales Cost of regular sales (70%) Gross profit on regular sales (30%) Realized gross profit on installment sales (Sched 1) Total realized gross profit 2020 P450,000 (150,000) (150,000) P150,000 40% P60,000 P385,000 269,500 115,500 128,510 P245,010 Schedule 1: Installment accounts receivable, 1/1/13 Installment accounts receivable, 12/31/13 Total credit Less: credit for repossession (unpaid balance) Collections Gross profit rates: 2019 sales (P54,000/P120,000) 2020 sales (Schedule 2) Realized gross profit, 12/31/13 Total (P129,510) Schedule 2: Installment sales Cost of installment sales: Inventory, January 1,2020 Purchases Inventory, December 31,2020 (New) Cost of sales Cost of regular sales Gross profit on installment sales Gross profit rate (P161,500/P425,000) 2019 P120,000 15,000 105,000 7,200 P97,800 2020 P425,000 200,000 225,000 -0P225,000 45% P44,010 38% P85,500 P425,000 P70,000 555,000 (92,000) 533,000 269,500 263,500 P161,500 38% (2) loss on repossession Repossession merchandise Unrecovered cost: Unpaid balance P3,000 P7,200 Deferred gross profit (P7,200 x 45%) Loss on repossession 3,240 3,960 P(960) 18. Total realized gross profit on December 31,2020 is computed below: 2019 Collections during 2020 P240,000 Gross profit rates on sales 25%/125% Realized gross profit P48,000 Total (P74,667) 2020 P160,000 20%/120% P26,667 19. Collections during 2020 Gross profit rate: Installment sales: Notes receivable (P32,000 + P62,000 + P3,600) Unearned interest income (P7,167 + P3,600) Installment sales Cost of installment sales (P45,200 – P2,000) Gross profit Gross profit rate (P46,633/ P86,833) Realized gross profit P32,000 P97,600 (10,767) P86,833 43,200 P43,633 20. Collections during 2020 (P1,510,000 + P1,900,000 – P1,680,000) Gross profit rate (P679,500/ P1,510,000) Realized gross profit, 2020 21 50.25% P16,080 P1,730,000 45% P778,500 Zero, because the total cost of P2,000,000 is not yet fully recovered. The total collections applying to principal as of December 31, 2020 is only P330,000 (P300,000 + P30,000), so no income is yet to be recognized. 22. First the over- allowance on the equipment traded- in should be computed as follows: Trade- in value P30,000 Actual value: Estimated sales price 25,000 Less: Reconditioning Cost 1,250 Gross profit(25,000 x 15%) 3,750 5,000 20,000 Over allowance P10,000 The over allowance is treated as a deduction from the selling price of new equipment. The realized gross profit can now be computed as show below: Collections Downpayment: Cash 5,000 Actual value of Trade- in 20,000 25,000 Installment collection (3 mos. X 5,000) 15,000 Total 40,000 Gross Profit Rate – (15,000/ 75,000) Realized gross profit, 12/31/2020 20% 8,000 23. the unrealized gross profit relating to the unpaid balance of P11,000 (P27,000-P16,000) is 3,740 (11,000x34%). The inventory of repossessed merchandise is to be decreased by this amount. 24. Collection during 2020 Gross profit rate (250,000/500,000) REALIZED GORSS PROFIT 25. Installment accounts receivable-end: Unrealized gross profit-end Divide by GPR on sales (66-2/3% / 116-2/3%) ADD: Collections Installment Sales 100,000 50% 50,000 192,000 40% 26. Installment accounts receivable Gross Profit Rate on Sales (66- 2/3% / 166-2/3%) 480,000 360,000 P840,000 P320,000 40% Deferred gross profit, 12/31/2020 P128,000 27. In Thousand Pesos 2019 Sales Installment sales 2020 Sales P1,200 P1,500 Collection: During 2019 (630) During 2020 (450) (900) (24) - 96 600 40% 30% P38.4 P180 Repossession (unpaid balance) Installment accounts receivable, 12/31/2020 Gross Profit rate (GP/IS) Deferred Gross Profit, 12/31/2020 Total balance is P218,400 (P38,400 + 180,000) 28. Fair market value of repossessed merchandise Less: Unrecovered cost Unpaid balance Loss on repossession P120,000 200,000 65,000 135,000 P(15,000) 29. Fair value of repossessed merchandise P6,800 Unrecovered Cost: Unpaid balance: Sales 16,000 Collections: Downpayment 3,200 Installment 3,200 6,400 9,600 Deferred gross profit (9,600 x 40%) 3,840 5,760 Gain on repossession P1,040 30. 2019 Sales Deferred gross profit – Dec.31,2020 Divide by GPR (GP/IS) Installment accounts receivable, Dec.31,2020 2020 Sales P9,000 P72,000 24% 30% P37,500 P240,000 Total balance of receivable on Dec. 31,2020 is (P37,500 + 240,000) P277,500 31. Gross profit rate based on sales: Cash (25%/125%) 20% Charge (33-1/3% / 133-1/3%) 25% Installment (50% - 150%) 33.33% Total realized gross profit: Cash sales (250,000 x 20%) P50,000 Charge sales (400,000 x 25%) 100,000 Installment Sales (240,000 x 33.33%) 80,000 Total P230,000 32. Appraised value of repossessed merchandise P1,500 Less: Unrecovered cost: Unpaid balance 3,500 Less: Deferred gross profit (3,500 x 35% *) 1,225 Loss on repossession 2,275 P775 *Gross profit rate (P2,800 / 8,000) 35% 33. 2019 2020 Sales Sales Collections: Downpayment (1/3 of sales) - P110,000 Collection of installment receivables 77,000 70,000 Total 77,000 180,000 44% 45% 33,880 81,000 - 16,650 P33,880 97,650 2020 2019 Sales Sales 37,000 27,000 330,000 235,000 367,000 262,000 45,500 - Purchases 215,000 193,000 Total 260,500 193,000 60,000 45,500 200,500 147,500 P166,500 P114,500 45% 44% Gross Profit rate (schedule 1) Realized gross profit on Installment Sales Realized gross profit on Cash Sales 2020 (P37,000 x 45%) Realized Gross Profit (P131,530) Schedule 1 Sales: Cash Installment Total Cost of Sales: Inventories, 1/1 Inventories 12/31 Cost of sales Gross Profit Gross profit rate (GP/IS) 34. P76,230 represents the total realized gross profit based on 2020 collections of Installment Accounts Receivable of 2018 and 2019 sales. 2018 2019 Sales Sales P17,400 P205,400 Collections: Installment accounts receivable, 1/1/13 Installment accounts receivable, - 25,800 17,400 179,600 12/31/13 Total credits Less: credit for repossession Collections during 2020 200 17,400 179,400 Gross profit rate 36% 39% Realized gross proft, 12/31/13 P6,264 P69,966 Total realized gross profit: (P6,264 + P69,966) P76,230 A P78 gain is realized from the sale of the repossessed merchandise as computed below: Sales price P200 Unrecovered cost: Unpaid balance P200 Less: deferred gross profit (P200 x 39%) 78 Gain on repossession 122 P78 35. on the first installment, a profit of P96.80 is realized which is computed as follows: Installment sales P1,650 Cost of sales 924 Gross profit P726 Gross profit rate 44% Realized gross profit Collections P220 Gross profit rate 44% Realized gross profit P96.8 On the second installment, a profit of P120 is realized as shown below: Sales P1,000 Cost of repossessed merchandise: Appraised value P460 Add: reconditioning cost 60 520 gross profit P480 Gross profit rate (P480/P1,000) 48% Realized gross profit: P250 Collections: Gross profit rate 48% Realized gross profit P120 P1,000 36. Appraised value of repossessed merchandise Unrecovered cost: Unpaid balance Less: deferred gross profit (P2,200 x 40%) Loss on repossession Gross profit rate (P1,200 + P3,000 ) =40% P2,200 880 1,320 (P320) 37. The realized gross profit is computed as follows: 2018 P24,020 24,020 Installment contract receivable, 1/1/13 Installment contract receivable, 12/31/13 Total credit Credit for repossession Collections Gross profit rate: 2018: 133,000/380,000 2019:146,880/432,000 2020:22,740/602,000 Realized gross profit 24,020 Year of sales 2019 P344,460 67,440 277,020 2,200 274,820 191,910 35% 34% P8,407 P93,438.8 Total realized gross profit, 12/31/13: 2018 2019 2020 Total 37% P71,006.7 P8.407 93,438.80 71,006.70 P172,852.5 The loss on repossession is computed as follows: Actual value of repossession merchandise: Resale price Less: Reconditioning cost Gross profit (P2,000 x 35%) 2020 P602,000 410,090 191,910 P2,000 P300 700 Unrecovered cost Unpaid balance (P5,400-P3,200) Less deferred gross profit (P2,200 x 34%) Loss on repossession 1,000 P2,200 748 P1,000 1,452 P(452) 38. This is computed by deducting the loss on repossession from the total realized gross profit: Year of Sales 2018 2019 2020 Collections P72,500 P80,000 P62,500 Gross profit rate 2018:P60,000/P240,000 25% 2019:P68,750/P250,000 27.5% 2020:P84,000/P300,000 28% Realized gross profit Loss on repossession Value of repossessed merchandise Unrecovered cost: Unpaid balance Less: deferred gross profit 2018:P15,000x25% 2019:P16,000x27% P18,125 P22,000 P6,000 P9,000 15,000 16,000 P17,500 Total 57,625 3,750 Unrecovered cost 11,250 Loss on repossession (P5,250) Total realized gross profit after loss on repossession 39. The computation is as follows: 4,400 11,600 (P2,600) (7,850) P49,775 Year of sales 2019 P100,000 (12,500) 87,500 (6,250) 81,250 50% P40,625 Installment contract receivable, 1/1/13 Installment contract receivable, 12/31/13 Total credit Credit for repossession Collections Gross profit rate (schedule ) Realized gross profit (P141,875) Schedule 1 : gross profit rate 2019 sales: Gross = Deferred gross profit – 2019, 9/30/2019 Inst. Contract rec’ble – 2019, 9/30/2019 profit rate P50,000 100,000 2020 P375,000 (150,000) 225,000 225,000 45% P101,250 = 50% 2020 sales: Installment sales Less: cost of installment salesCost of goods sold: Inventories, 9/30/12 Purchases Cost of goods available Less: inventories, 9/30/12 (P75,000-P2,500) Cost of goods sold P375,000 P62,500 435,000 497,500 72,500 425,000 Less: cost of regular sales (70% x P312,500) Gross profit on installment sales Gross profit rate: (P168,750/P375,000) 218,750 206,250 P168,750 45% 40. The realized gross profit is computed as follows: Collections applying to principal (Sch. 1) Gross profit rate (P600/P1,600) Realized gross profit rate P620.69 37.5% P232.76 The loss on repossession is computed below: Fair value of repossessed merchandise Less: unrecovered cost Unpaid balance (sch. 1) Less: deferred gross profit (P979.31 x 37.5%) Loss on repossession Schedule 1: Date Sept. 30 Sept. 30 Oct. 31 Nov. 30 Dec. 31 (1) Total payment P560 P979.31 367.24 (2) Applying to Interest 005 x (4) P160 160 160 160 640 612.07 (P52.07) (3) Applying to principal (1) – (2) 7.20 6.44 5.67 P19.31 P160 152.8 153.56 154.33 P620.69 (4) Balance of principal (4) – (3) P1,600 1,440 1287.20 1,133.64 979.31 41. P70,000 is the sum of the realized gross profit in 2019 and 2020 which are computed as follows: 2019 2020 Installment contract receivable, P80,000 P200,000 beg. (1/1/13) Installment contract receivable, 25,000 95,000 beg. (1/1/13) 55,000 105,000 Total credits Less: credit for repossession 6,000 Collections 49,000 105,000 Gross profit rate (schedule 1) 40% 48% Realized gross profit 12/31/13 (P70,000) P19,600 P50,400 The P1,100 adjusted loss is determined as follows: Value of repossessed merchandise Unrecovered cost: Unpaid balance Less: deferred gross profit (P6,000 x 40%) Adjusted loss on repossession P2,500 6,000 2,400 3,600 (P1,100) Schedule 1 – gross profit rates: 2019 Sales: Installment sales Cost sales: Purchases Merchandise inventory, 12/31 Gross profit Gross profit rate (P60,000/P150,000) P150,000 P100,000 10,000 90,000 P60,000 40% 2020 Sales: Adjusted installment sales (P198,500 + P1,500, Trade-in) Cost of sales: Merchandise inventory, 1/1 Purchases Goods available for sale Merchandise inventory, 12/31 Gross profit Gross profit rate (P96,000/P200,000) P200,000 P10,000 120,000 130,000 26,000 104,000 P96,000 48% 42. The balance of deferred gross profit on Dec. 31,2020 is computed as follows: Installment sales Collections in 2019 Collections in 2020 Installment contract receivable, 12/31/13 Gross profit rate (GP/IS) Deferred gross profit, 12/31/13 (P76,000) 2019 Sales P400,000 (210,000) (150,000) 40,000 40% P16,000 2020 Sales P500,000 (300,000) 200,000 30% P60,000 43. Deferred gross profit before adjustment: 2018 sales 2019 sales 2020 sales Total Less: deferred gross profit, end (IAR end X GPR) 2018 sales 2019 sales (P42,000 x 40%) 2020 sales(P100,500 x 42%) Total realized gross profit, 12/31/13 2019 GPR: P62,000/P155,000 = 40% 44. The total realized gross profit is computed below: P11,550 62,000 75,810 149,360 P16,810 42,210 59,010 P90,350 2020 Installment sales: Unrealized gross profit, 2020 Divided by GPR on sales Less: Installment receivable – 2020,12/31/13 Collection from 2020 sales Gross profit rate Realized gross profit on 2020 sales P100,000 ÷ 40% P250,000 140,000 110,000 40% P44,000 The gain (loss) on repossession is computed as follows: Actual value of repossessed merchandise: Sales price Less: reconditioning cost P1,000 Gross profit (P10,000 x 40%) 4,000 Less: unrecovered cost Unpaid balance: 2018 accounts P2,000 2019 accounts 6,000 Deferred gross profit: 2018 account(P2,000 x 40%) 800 2019 account(6,000 x 40%) 2,400 Gain on repossession 45. Total realized gross profit is computed below: Installment receivable, 1/1/13 Installment receivable, 12/31/13 Defaulted balance Collections Gross profit rates Realized gross profit, 12/31/13 Total (P129,562.50) Gross profit rate: 2019 sales (P54,000/P120,000) 2020 sales Installment sales Cost of installment sale: Inventory, 1/1 Purchases Inventory, 12/31 Repossession Total Cost of regular sale (70% x P385,000) Gross profit P10,000 5,000 P5,000 8,000 3,200 2019 Sales P120,000 (15,000) (7,750) 97,250 45% P43,762.50 4,800 P200 Year of sales 2020 Sales P425,000 (200,000) 225,000 38% P85,500 45% P425,000 70,000 555,000 (95,000) 3,000 533,000 269,500 263,500 161,500 GPR(P161,500/P425,000) The loss on repossession is computed as follows: Value of repossessed merchandise Less: unrecovered cost: Unpaid balance Deferred gross profit (7,750 x 45%) Loss on repossession 38% P3,000 P7,750 3,487.50 46. Deferred gross profit, before adjustment Less: deferred gross profit applicable to Uncollected installment accounts: 2019: P16,250 x 30%/130% 2020:P90,000 x 25% Realized gross profit Less: Expenses Net income on installment sales P38,000 P3,750 22,500 47. The computation of the realized gross profit is shown below: List price P220,000 Less: trade-in overallowance P85,000-P81,700 3,300 Adjusted selling price P216,700 Less: cost of sales 165,000 Gross profit 51,700 Value of old car trade-in Cash received at time of sale Installment collected: P5,000 x4 Total collections in 2020 Multiply by gross profit rate Realized gross profit as of December 31,2020 Gain (loss) on repossession is computed as follows: Adjusted selling price Less: collections In 2019 (No.47) In 2020: P5,000 x 2 Defaulted balance Multiply by cost rate Unrecovered cost Value of repossessed car Less: unrecovered cost Repossession gain (loss) 48. Cash sales Installment sales collected Downpayment (P265,000 x ¼) 4,262.50 P1,262.50 26,250 P11,750 1,500 P10,250 100% 76.14% 23.86% P 81,700 35,000 20,000 136,700 .2386 P32,616.62 P216,700 P136,700 10,000 146,700 P70,000 .7614 P53,298 P40,000 53,298 P(13,298) P126,000 P66,250 Subsequent installments Less: interest Interest on defaulted contracts (sch.1) Total collection Gross profit rate (sch.2) Realized gross profit, 12/31/13 P79,341 (9,252.84) (20.67) 70,067.49 136,317.49 P262,317.49 37.75% P99,024.85 Schedule 1 – interest on defaulted contracts: The total interest is determined through the use of the following table: Installment (1) Equivalent (2) Contact (3) Interest number cash sales 1sales income1% (4-3) price2-4 x1 First month Second month Third month Fourth month Total interest earned Schedule 2 – gross profit rate: P1,000 735 689.35 689.35 P1,060 795 742 689 7.35 6.89 6.43 20.67 The 37.75% gross profit rate is determined as follows: Sales: Cash sales Installment sales at cash sales price (P265,000/106%) Total sales at cash sales price CostMerchandise of sales: inventory, January 1 Purchases Goods available for sale Less: merchandise inventory, Dec. 31 Gross profit Gross profit rate (P141,940/P376,000) (4) Cash collection 265 53 53 53 P126,000 250,000 376,000 P58,060 209,300 267,360 33,300 234,060 141,940 37.75% 49. Total realized gross profit (Sch.1) Loss on repossession (Sch.2) Total realized gross profit loss on repossession Operating expenses Net income, Dec. 31,2020 P157,156 (1,000) 156,156 96,000 P60,156 Schedule 1 – realized gross profit Inst. Contract receivable, 1/1/13 2018 Sales P110,000 2019 Sales P250,000 2020 Sales P420,000 Inst. Contract receivable, 21/31/13 Accounts written off Defaulted accounts Collections Gross profit rate (GP/IS) Realized gross profit (P157,156) (28,000) (9,000) (5,000) 68,000 40% P27,200 (92,000) (2,800) 155,200 38% P58,976 (238,000) 182,000 39% P70,980 Schedule 2 - loss o repossession: Appraised value of repossessed merchandise Less: reconditioning cots Actual value at time of repossession Less: unrecovered cost Unpaid balance Deferred gross profit (P5,000 x 40%) Loss on repossession P2,400 400 2,000 5,000 2,000 3,000 P(1,000) 51. The computation of the required balance of the allowance for defaulted contracts account is shown below: 2020 Bad debts rate Loss on defaulted contracts P250 Contracts written off 3,750 Sales of repossessed goods (800) Value of repossessed goods (200) Total 3,000 Divided by 2019 sales ÷75,000 Rate of bad debt loss 4% Estimated loss from 2020 sales (125,000 x 4%) Less: loss on defaulted contract – 2020 sales Required balance of allowance, Dec. 31,2020 The realized gross profit on Dec. 31,2020 from 2019 Sales is computed below: Installment contract receivable – 2019, 1/1/13 Installment contract receivable – 2019, 12/31/13 Installment contract, receivable written off – 2019 sales Collections during 2020 Gross profit rate – 2019 Realized gross profit from 2019 sales, 12/31/13 P5,000 1,325 P3,675 P31,500 (2,000) (3,750) 25,750 40% P10,300