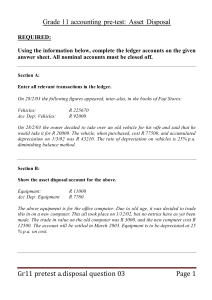

ASSET DISPOSAL Gr11 accounting Lesson 4 ASSET DISPOSAL DEFINITION Selling of business assets and the recording thereof. Two new accounts are created for this purpose: • Asset disposal account (temporary account) • Profit/Loss on sale of asset (income/expense) ASSET DISPOSAL BEGINNING OF THE YEAR When we sell an asset at the beginning of the year, all the depreciation relating to the asset has already been taken into account so we don’t need to make further depreciation entries into our books for this year. All we need to do is take the asset out of our books and record the sale. ASSET DISPOSAL NB!! STEP ENTRIES • 1: Transfer the COST PRICE of the asset. DR Asset Disposal Account. CR Vehicles A2: Calculate updated DEPRECIATION to date of sale • DR Depreciation O - CR Accumulated Depreciation [A-]+ • 3: Transfer the ACCUMULATED DEPRECIATION. DR Accumulated Depreciation [A-] CR Asset Disposal. • 4: Record SELLING PRICE Cash sale: DR Bank CR Asset Disposal, Credit sale: DR Debtors’ control CR Asset Disposal. • 5: Calculate PROFIT OR LOSS on the sale of asset: BV > SP = Loss. SP > BV = Profit ASSET DISPOSAL BEGINNING OF THE YEAR Example 1: Hugo Cash Solutions has one vehicle that it bought several years ago for R75 000 and has written depreciation off on an annual basis of 10% on cost. On 1 January 2010 Hugo sold the vehicle for R50 000 cash. Balances on 1 January 2010: Vehicles Accumulated depreciation on vehicles R75 000 R30 000 RECORDING ASSET DISPOSAL: LEDGER GENERAL LEDGER VEHICLES Jan 01 Balance bd 75 000 Jan 01 Asset Disposal GJ 75 000 bd 30 000 GJ 30 000 CRJ 50 000 ACCUMULATED DEPRECIATION ON VEHICLES Jan 01 Asset Disposal GJ 30 000 Jan 01 Balance ASSET DISPOSAL Jan 1 Vehicles GJ Profit on sale GJ 75 000 Jan 5 000 01 Acc Dep on Veh Bank 80 000 80 000 PROFIT ON SALE OF ASSET Jan 01 Asset Disposal GJ 5 000 ASSET DISPOSAL BEGINNING OF THE YEAR Example 2: Mboni Distributors has two vehicles: Mazda, bought on 1 January 2002 for R60 000, Accumulated Depreciation on 31 December 2004 is R27 000. Toyota, bought on 1 January 2001 for R40 000, Accumulated Depreciation on 31 December 2004 is R24 000. Depreciation is written off on an annual basis of 15% on cost. On 1 January 2005 Mboni sold the Toyota for R12 000 cash. Balances on 1 January 2005: Vehicles Accumulated depreciation on vehicles R100 000 R51 000 RECORDING ASSET DISPOSAL: LEDGER GENERAL LEDGER VEHICLES Jan 01 Balance bd 100 000 Jan 01 Asset Disposal GJ 40 000 bd 51 000 GJ 24 000 Bank CRJ 12 000 Loss on sale GJ 4 000 ACCUMULATED DEPRECIATION ON VEHICLES Jan 01 Asset Disposal GJ 24 000 Jan 01 Balance ASSET DISPOSAL Jan 1 Vehicles GJ 40 000 Jan 40 000 01 Acc Dep on Veh 40 000 RECORDING ASSET DISPOSAL: LEDGER GENERAL LEDGER LOSS ON SALE OF ASSET Jan 01 Asset Disposal GJ 4 000 DAY DETAILS DEBIT 1 Asset disposal 40 000 Vehicles CREDIT STEP 1 40 000 Transfer of cost price of vehicles Acc Dep on vehicles 24 000 Asset disposal 24 000 Transfer of accumulated depreciation Loss on sale of asset Asset disposal Loss made on sale of asset (NO step 2 current depreciation STEP 3 (STEP 4 done in CRJ) 4 000 4 000 STEP 5