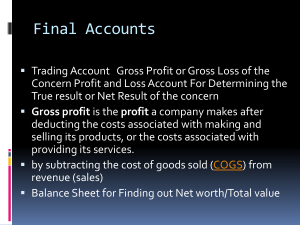

“ANALYSIS OF WORKING CAPITAL FOR COCA COLA COMPANY” 1 Define Formula Profitibility/Liquidity What is Profitability What is Liquidity What if the Profitability Ratio Increases Return on Capital Employed Gross Profit Define Formula Profitability/ Liquidity Ratio Increases Ratio Decreases 2 Net Profit Current Ratio Acid Test Ratio CONTENTS s. no. Chapters Page no. 1 Introduction to Soft drink industry 2. Research Methodology & Data analysis & interpretation Financial analysis 4.1 Liquidity Ratios 4.2 Profitability Ratios 3 Chapter – 1 4 SOFT DRINK INDUSTRY A soft drink (also referred to as soda, pop, soda pop, coke or fizzy drink) is a drink that typically contains no alcohol, though may contain small amounts (typically less than 0.5% by volume) and is usually referred to as a sugary drink. Soft drinks are often carbonated and commonly consumed while chilled or at room temperature. Some of the most common soft drinks include cola, flavoured water, sparkling water, iced tea, sweet tea, sparkling lemonade (or other lemon-lime soft drinks), squash, fruit punch, root beer, orange soda, grape soda, cream soda, and ginger ale. 5 Chapter – 2 6 RESEARCH METHODOLOGY PROJECT OBJECTIVE • The project is aimed at evaluating the financial status of Coca cola company and then doing the comparative analysis with its competitors • Studying the working capital management at Coca cola Company and estimating theworking capital requirements for 2009-2010 and then forecasting for 2010-2011 • To find out if there is any relationship between the working capital, sales and currentassets of Coca cola METHODOLOGY The methodology to be adopted for the project is explained as under: 1. The initial step of the project was studying about the company and then evaluatingthe financial position of the company on the basis of ratio analysis. 2. Comparing the firm's financial position with respect to its competitors i.e. Pepsico,DABUR and PARLE AGRO with the help of following ratios• Liquidity ratios • Profitability ratios • Investors ratios , 7 FINANCIAL ANALYSIS Liquidity vs. Profitability: Risk-Return Trade-off A large investment in current assets under certainty would mean a low rate of return on investment for the firm, as excess investment in current assets will not earn enough return. A smaller investment in current assets, on the other hand, would interrupt production and sales, because of frequent stock-outs and inability to pay creditors in time due to restrictive policy. Given a firm's technology and production policy, sales and demand conditions, operating efficiency etc., its current assets holdings will depend upon its working capital policy. These policies involve risk-return trade-offs. A conservative policy means lower return and risk, while an aggressive policy produces higher return and risk. The two important aims of the working capital management are: profitability and solvency. Solvency, used in the technical sense, refers to the firm's continuous ability to meet maturing obligations. If the firm maintains a relatively large investment in current assets, it will have no difficulty in paying claims of creditors when they become due and will be able to fill all sales orders and ensure smooth production. Thus, a liquid firm has less risk of insolvency; that is, it will hardly experience a cash shortage or a stock-out situation. However, there is a cost associated with maintaining a sound liquidity position. A considerable amount of the firm's will be tied up in current assets, and to the extent this investment is idle, the firm's profitability will suffer. To have higher profitability, the firm may sacrifice solvency and maintain a relatively low level of current assets. When the firm does so, its profitability will improve as fewer funds are tied up in idle current assets, but its solvency would be threatened and would be exposed to greater risk of cash shortage and stock-outs. 4.1 LIQUIDITY RATIOS (SHORT- TERM LIQUIDITY) Liquidity ratios measure the short term solvency, i.e., the firm's ability to pay its current dues and also indicate the efficiency with which working capital is being used. Commercial banks and short-term creditors may be basically interested in the ratios under this group. They comprise of following ratios: CURRENT RATIO OR WORKING CAPITAL RATIO Current ratio is a relationship of current assets to current liabilities. ‘current assets’ means the assets that are either in the form of cash or cash equivalents or can be converted into cash or cash equivalents in short time(say within a year) like cash, bank balances, marketable securities, sundry debtors, stock, bills receivables, prepaid expenses. ‘Current liabilities’ means liabilities repayable in as short time like sundry creditors, bills 8 payable, outstanding expenses, bank overdraft. Computation. The ratio is calculated as follows: Current ratio = Current assets Current liabilities Objective. • The ratio is mainly used to give an idea of the company's ability to pay back its shortterm liabilities with its short-term assets. • The higher the current ratio, the more capable the company is of paying its obligations. A ratio under 1 suggests that the company would be unable to pay off its obligations if they came due at that point. • While this shows the company is not in good financial health, it does not necessarily mean that it will go bankrupt - as there are many ways to access financing - but it is definitely not a good sign. • The current ratio can give a sense of the efficiency of a company's operating cycle or its ability to turn its product into cash. • An acceptable current ratio varies by industry. For most industrial companies 1.5 is an acceptable CR. A standard CR for a healthy business is close to 2. • However, a blind comparison of actual current ratio with the standard current ratio may lead to unrealistic conclusions. A very high ratio indicates idleness of funds, poor investment policies of the management and poor inventory control, while a lower ratio indicates lack of liquidity and shortage of working capital. 9 Current ratio COCA COLA PEPSICO PARLE AGRO 2009 1.1 1.0 1.3 Interpretation COCA COLA is in a better position to meet its short term obligations as can be seen by a high current ratio. This is mainly due to high proportion of Loans & Advances and a significantly low proportion of Debtors. The ratio is acceptable in case of parle agro For pepsico the ratio is high mainly due to significantly high debtors and Loans & Advances. LIQUID RATIO OR QUICK RATIO OR ACID TEST RATIO Liquid ratio is a relationship of liquid assets with current liabilities. It is fairly stringent measure of liquidity. Liquid assets are those assets which are either in the form of cash or cash equivalents or can be converted into cash within a short period. Liquid assets are computed by deducting stock and prepaid expenses from the current assets. Stock is excluded from liquid assets because it may take some time before it is converted into cash. Similarly, prepaid expenses do not provide cash at all and are thus, excluded from liquid assets. Computation. The ratio is calculated is as under: Liquid ratio= Liquid assets Current liabilities Objective. • The ratio of current assets less inventories to total current liabilities. This ratio is the most stringent measure of how well the company is covering its short-term obligations, since the ratio only considers that part of current assets which can be turned into cash immediately (thus the exclusion of inventories). • • • The ratio tells creditors how much of the company's short term debt can be met by selling all the company's liquid assets at very short notice. also called acid-test ratio. The current ratio does not indicate adequately the ability of the enterprise to discharge the current liabilities as and when they fall due. Liquid ratio is considered as a refinement of current ratio as non-liquid portion of current assets is eliminated to calculate the liquid assets. Thus it is a better indicator of liquidity. A quick ratio of 1:1 is considered standard and ideal, since for every rupee of current liabilities, there is a rupee of quick assets. A decline in the liquid ratio indicates overtrading, which, if serious, may land the company in difficulties. 10 Quick Ratio 2009 COCA COLA .9 PEPSICO 0.8 PARLE AGRO .67 Interpretation COCA COLA is better off than PARLE AGRO and PEPSICO in meeting the short –term debts by selling all the liquid assets of the company at a very short notice. May be that PARLE AGRO and PEPSICO are indulged in over-trading. The company should try to keep quickratio greater than 1. RETURN ON CAPITAL EMPLOYED (ROCE) Computation. The ratio is calculated as: Profit Before Interest & Taxes x 100 Average Capital employed Objective. ▪ ▪ ▪ It is used in finance as a measure of the returns that a company is realising from its capital employed. It is commonly used as a measure for comparing the performance between businesses and for assessing whether a business generates enough returns to pay for its cost of capital. ROCE measures the profitability of the capital employed in the business. A high ROCE indicates a better and profitable use of long-term funds of owners and creditors. As such, a high ROCE will always be preferred. Return on Employed 2009 Capital COCA COLA PEPSICO PARLE AGRO 22.9 20.9 17.6 Interpretation A high ratio in case of COCA COLA & PEPSICO indicates a better and profitable use of long term funds of ownersand creditors. In case of PARLE AGRO it is satisfactory. 11 4.2 PROFITABILITY RATIOS Profit as compared to the capital employed indicated profitability of the concern. A measure of ‘profitability' is the overall measure of efficiency. The different profitability ratios are as follows: Gross Profit is one of the most important measures to determine the profitability and the financial performance of a business. It reflects the efficiency of a business in terms of making use of its labor, raw material and other supplies. Thus, its increase or decrease over a period helps in determining the reasons causing such a fluctuation. This helps the business in taking corrective action in case there is a negative change in Gross Profit. It is one of the items appearing in the income statement of a business. So, before we head towards understanding its calculation, let’s first try to understand what is Gross Profit? What is Gross Profit? It is an item that appears in the Trading and P&L Account of a company. It is the difference between net sales revenue and cost of sales of a business. Here, the net sales revenue refers to the total revenue less the cost of sales returns, allowances and discounts. Whereas, the cost of sales refers to all the costs incurred to create a product or a service. Gross Profit Example Following are the financial highlights of Wipro as per the annual report 2018: Now, the financial highlights in the annual report show that the Gross Profit of Wipro for the year 2018 stood at Rs 159,296 million. This has increased from previous year’s gross profit that stood at Rs 158,858 million. As we can see, it is calculated by using the Gross Profit Formula. This involves subtracting cost of revenues from the total revenues. Accordingly, the Gross Profit for the year 2018 is Rs 544,871 million and for 2017 is Rs 550,402 million. Thus, it is clear that the Gross Profit for the current year has increased as compared to the previous year. Gross Profit Analysis As we can see, there is a decline in the total revenue in the current year as against the previous year. The reasons cited for such a decline have been three. First, in the Communication segment, one of the clients 12 declared bankruptcy and few large projects experienced ramp downs. Second, revenue from the Healthcare and Lifesciences verticals also declined. This was due to uncertainties around regulatory changes relating to the Affordable Care Act. Also, there was appreciation of the Indian Rupee against currencies other than US dollars that hit the revenues negatively. Last, Wipro chose to being a system integrator. This means the company chose to provide IT products as a complement to its IT services offerings rather than selling standalone IT products. All this lead to a decline in the consolidated revenue of Wipro for the year ended March 31, 2018. Furthermore, it even impacted the operating margins of the company in a negative way for the current year. Additionally, if we look at the gross margin figures, the same increased to 29.4% in 2018 as against 29.1% in 2017. Now, what is the importance of calculating these figures is something that we will discuss after a while. Why Gross Profit is an Important Measure? When analyzing the profitability and financial performance of an entity, it is important to consider Gross Profit. This is because it demonstrates the efficiency of the business in making use of its labor, raw material and other supplies. Now there are a variety of reasons that can impact the Gross Profit of your business. This change can be due to: Changes brought about in the products that lead to charging high prices Efficiency in managing the business that results in low cost sales Certain changes brought about in few of the accounting policies that lead to moving expenses from cost of sales to overheads or vice versa Purchasing raw materials at a low cost as a result of vertical integration of business Considering the example of Wipro, the year 2018 experienced a decline in total revenues and hence Gross Profit. The underlying reasons for the same were: One of the clients in the communication segment declaring bankruptcy and few large projects experiencing ramp downs. Revenues from Healthcare and Lifesciences verticals declining due to uncertainties around regulatory changes relating to the Affordable Care Act. Therefore, it is quite apparent that Gross Profit is an important measure. It helps us figure out the underlying reasons as to why there has been a change in the profitability of the business. As a result, it helps us in undertaking steps to correct the areas that impact a company’s efficiency. Important Profitability Ratios Concerning 13 Gross Profit The accounting ratios are an important tool in analyzing the financial statements of a business. The profitability ratios, also known as performance ratios, help in determining the earning capacity of your business. These ratios let you know the efficiency with which the resources of your business are utilized. The important ratios that are based on Gross Profit are Gross Profit Ratio and Gross Profit Margin. Gross Profit Ratio Gross profit ratio showcases the relationship between Gross Profit and Net Revenue of your business. It reveals the amount of Gross Profit realized as a percentage of revenue from business operations This ratio is computed as follows: Gross Profit Ratio = (Gross Profit/Net Revenue of Operations) × 100 The Gross Profit ratio indicates the amount of profit that is available to cover operating and nonoperating expenses of your business. Change in gross profit ratio reflect the changes in the selling price or cost of revenue from operations or a combination of both. If this ratio is low, it indicates unfavourable purchase and sales policy. But if the gross profit ratio is high, it is a good sign. This is because it indicates that more profit is available to cover operating and non-operating expenses of your business. Gross Profit Margin Ratio Gross Profit refers to the difference between a company’s revenues and cost of sales, or cost of goods sold. Here cost of goods sold represent the expenses related to: labor raw materials and manufacturing overhead involved in the production process. Such an expenditure is deducted from the company’s net sales/revenue, which results in a company’s gross profit. Now, gross profit margin is a ratio that shows the relationship between a company’s gross profit and its net revenue. It is used to analyze how efficiently a company is using its (1) raw materials, (2) labor and (3) manufacturing-related fixed assets to generate profits. Thus, gross profit margin is calculated as under: Gross Profit Margin = Gross Profit/Net Sales (Revenues) A higher percentage of gross profit margin indicates that the gross profits earned by the company are favorable. Such a ratio is majorly impacted by increasing or decreasing raw material costs. Retailers or service businesses that do not have a production process don’t have a cost of sales exactly. In such cases, the expenses are recorded as cost of merchandise or cost of services. With these types of companies, the gross profit margin does not carry the same weight as a producer type company. 14 NET PROFIT RATIO The Net profit ratio establishes the relationship between net profit and net sales, expressed in percentage form. Net Profit is derived by deducting administratitive and marketing expenses, finance charges and making adjustments for non-operating expenses and incomes. Computation. This ratio is calculated as follows: Net Profit ratio = Net Profit after taxes x 100 Net Sales Objective. • The net profit ratio determines the overall efficiency of the business.It indicates that proportion of sales available to the owners after the consideration of all types of expenses and costs – either operating or non-operating or normal or abnormal. • A high net profit indicates profitability of the business. Hence, higher the ratio, the better the business is. 15 Net Profit Ratio 2009 COCA COLA 22 PEPSICO 20.4 PARLE AGRO 11.38 Interpretation COCA COLA product has been able to generate a high Net profit ratio among the three. For PARLE AGRO the ratio is on a lower side so it should aim to achieve a higher ratio. 16 CONCEPTS OF WORKING CAPITAL There are two concepts of working capital – Gross and Net • Gross Working Capital refers to the firm's investment in current assets. Current assets are the assets which can be converted into cash within an accounting year and include cash, short term securities, debtors, bills receivable (accounts receivables or book debts) and stock. • Net Working Capital refers to the difference between current assets and current liabilities. Current liabilities are those claims of outsiders, which are expected to mature for payment within an accounting year, and include creditors (accounts payable), bills payable and outstanding expenses. Net working capital can be positive or negative. A positive net working capital will arise when current asset exceed current liabilities. A negative net working capital occurs when current liabilities are in excess of current assets. Focusing on management of current assets The gross working capital concept focuses attention on two aspects of current assets management: a) How to optimize investment in current assets? b) How should current assets be financed? The considerations of the level of investment in current assets should avoid two danger points- excessive or inadequate investment in current assets. Investment in current assets should be just adequate to the needs of the business firm. Excessive investment in current assets should be avoided because it impairs the firm's profitability, as idle investment earns nothing. On the other hand, inadequate amount of working capital can threaten solvency of the firm because of its inability to meet its current obligations. It should e realized that the working capital needs of the firm may be fluctuating with changing business activity. The management should be prompt to initiate an action and correct imbalances. Another aspect of the gross working capital points to the need of arranging funds to finance current assets. Whenever a need for working capital funds arises due to the increasing level of business activity or for any other reason, financing arrangement should be made quickly. Similarly, if suddenly, some surplus funds arise they should not be allowed to remain idle, but should be invested in short term securities. Thus, the financial manager should have knowledge of the sources of working capital funds as well as investment avenues where idle funds may temporarily are invested. Focusing on Liquidity management Net working capital is a qualitative concept. It indicates the liquidity position of the firm and suggests the extent to which working capital needs may be financed by permanent sources of funds. Current assets should be sufficiently in excess of current liabilities to constitute margin or buffer for maturing obligations within the ordinary operating cycle of business. In order to protect their interests, short- term creditors always like a company to maintain current assets 17 at a higher level than current liabilities. However, the quality of current assets should be considered in determining level of current assets vis-à-vis current liabilities. A weak liquidity position possesses a threat to the solvency of the company and makes it unsafe and unsound. A negative working capital means a negative liquidity, and may prove to be harmful for the company's reputation. Excessive liquidity is also bad. It may be due to mismanagement of current assets. Therefore, prompt and timely action should be taken by management to improve and correct the imbalances in the liquidity position of the firm. For every firm, there is a minimum amount of net working capital, which is permanent. Therefore, a portion of working capital should be financed with permanent sources of funds such as equity share capital, debentures, long-term debt, preference share capital or retained earnings. Management must, therefore, decide the extent to which the current assets should be financed with equity capital or borrowed capital. It may be emphasized that both gross and net concepts of working capital are equally important for the efficient management of working capital. There is no precise way to determine the exact amount of gross or net working capital of a firm. A judicious mix of long and short term finances should be invested in current assets. Since current assets involve cost of funds, they should be put to productive use. In practice, a firm may acquire resources (such as raw materials) on credit and temporarily postpone payment of certain expenses. Payables, which a firm can defer, are spontaneous sources of capital to finance investment in current assets. The creditor's deferral period is the length of time the firm is able to defer payments on various resource purchases. Net operating cycle is also referred to as cash conversion cycle. It is the net time interval between cash collections from sale of the product and cash payments for resources acquired by the firm. It also represents the time interval over which additional funds, called working capital, should be obtained in order to carry out the firm's operations. The firm has to negotiate working capital from sources such as commercial banks. The negotiated sources of working capital financing are called non-spontaneous sources. If net operating cycle of a firm increases, it means further need for negotiated working capital. There are two ways of calculations of cash conversion cycle. One is that depreciation and profit should be excluded in the computation of cash conversion cycle since the firm's concern is with cash flows associated with conversion at cost; depreciation is a non-cash item and profits re not costs. A contrary view air that a firm has to ultimately recover total costs and make profits; therefore the calculation of operating cycle should include depreciation, and even the profits. The above operating cycle concept relates to a manufacturing firm. Non-manufacturing firms such as wholesalers and retailers will not have the manufacturing phase. They will acquire stock of finished goods and convert them into debtors and debtors into cash. Further, service and financial enterprises will not have inventory of goods (cash will be their inventory). Their operating cycles will be the shortest. They need to acquire cash, then lend (create debtors) and again convert lending into cash. BALANCED WORKING CAPITAL POSITION The firm should maintain a sound working capital position. It should have adequate working capital to run its business operations. Both excessive as well as inadequate working capital positions are dangerous from the firm's point of view. 18 Excessive working capital means holding costs and idle funds, which earn no profits for the firm. The dangers of excessive working capital are as follows: • It results in unnecessary accumulation of inventories. Thus, chances of inventory mishandling, waste, theft and losses increase. • It is an indication of defective credit policy and slack collection period. Consequently, higher incidence of bad debts results, which adversely affects profits. • Excessive working capital makes management complacent which degenerates into managerial inefficiency. • Tendencies of accumulating inventories tend to make speculative profits grow. This may tend to make dividend policy liberal and difficult to cope with in future when the firm is unable to make speculative profits. Inadequate working capital is also bad as it not only impairs the firm's profitability but also results in production interrupts and in efficiencies and sales disruptions. Inadequate working has the following dangers: • It stagnates growth. It becomes difficult for the firm to undertake profitable projects for non-availability of working capital funds. • It becomes difficult to implement operating plans and achieve the firm's profit target. • Operating inefficiencies creep in when it becomes difficult even to meet day-to-day commitments. • Fixed assets are not efficiently utilized for the lack of working capital funds • Paucity of working capital funds render the firm unable to avail attractive credit opportunities etc. • The firm loses its reputation when it is not in a position to honour its short-term obligations. As a result, the firm faces tight credit terms. An enlightened management should, therefore maintain the right amount of working capital on a continuous basis. A firm's net working capital position is not only important as an index of liquidity but it is also used as a measure of the firm's risk. Risk in this regard means 19 chances of the firm's being unable to meet its obligation on due date. The lenders consider a positive net working capital as a measure of safety. All other things being equal, the more the net working capital a firm has, the less likely that it will default in meeting it current financial obligations. ISSUES IN WORKING CAPITAL MANAGEMENT Working capital management refers to the administration of all components of working capital – cash, marketable securities, debtors (receivables), and stock (inventories) and creditors (payables). The financial manager must determine levels and composition of current assets. He must see that right sources are tapped to finance current assets, and that current liabilities are paid in time. There are many aspects of working capital management which make it an important function of the financial manager. • Time. Working capital management requires much of the financial manager's time. • Investment. Working capital represents a large portion of the total investment in assets. Actions should be taken to curtail unnecessary investment in current assets. • Criticality. Working capital management has great significance for all firms but it is very critical for small firms. Small firms in India face a severe problem of collecting their dues debtors. Further, the role of current liabilities is more significant in case of small firms, as, unlike large firms, they face difficulties in raising long-term finances. • Growth. The need for working capital is directly related to the firm's growth. As sales grow, the firm needs to invest more in inventories and debtors. Continuous growth in sales may also require additional investment in fixed assets. 20 POLICIES FOR FINANCING FIXED ASSETS A firm can adopt different financing policies vis-à-vis current assets. Three types of financing may be distinguished: • Long-term Financing. The sources of long-term financing include ordinary share capital, preference share capital, debentures, long-term borrowings from financial institutions and reserves and surplus (retained earnings). • Short-Term Financing. The short-term financing is obtained for a period less than one year. It is arranged in advance from banks and other surplus of short-term finance in the money market. It includes working capital funds from banks, public deposits, commercial paper, factoring of receivables etc • Spontaneous Financing. It refers to the automatic sources of short-term funds arising in the normal course of a business. Trade (supplier's) credit and outstanding expenses are examples of spontaneous financing. INVENTORY MANAGEMENT ➢ INTRODUCTION: Inventories constitute the most significant part of current assets of a; large number majority of companies in India. On an average, inventories are approximately 60 % of current assets in public limited companies in India. Because of the large size of the inventories maintained by the firm, a considerable amount of funds is required to be committed to them. It is, therefore, absolutely imperative to manage inventories efficiently and effectively in order to avoid unnecessary investment. Inventories are stock of the product a company is manufacturing for sale and components that make up the product. The various forms in which inventories exist in a manufacturing company are: ➢ Raw materials are those basis inputs that re converted into finished product through the manufacturing process. Raw materials inventories are those units, which have been purchased and stored for future productions. ➢ Work-in-progress inventories are semi-manufactured products. They represent those products that need more work before they become finished products for sale. ➢ Finished goods inventories are those completely manufactured products, which are ready for sale. Stocks of the raw materials and work-in-process facilitate production, while stock of finished goods is required for smooth marketing operations. Thus the inventories serve as a link between the production and the consumption of goods. The levels of the three kinds of inventories for the firm depend on the nature of the business. A manufacturing firm will have substantially high level of finished goods inventories and no raw material and work-in progress inventories within manufacturing firm, there will be differences. 21 THE OPERATING CYCLE AND WORKING CAPITAL The working capital requirement of a firm depends, to a great extent up on operating cycle of the firm. The operating cycle may be defined as the time duration starting from the procurement of goods or raw material and ending with the sales realization the length and nature of the operating cycle may differ from one firm to another depending on the size and nature of the firm. The investment in working capital is influenced by four key events in the production and sales cycle form: ➢ Purchase of raw materials ➢ payment of raw materials ➢ sale of finished goods ➢ collection of cash 22