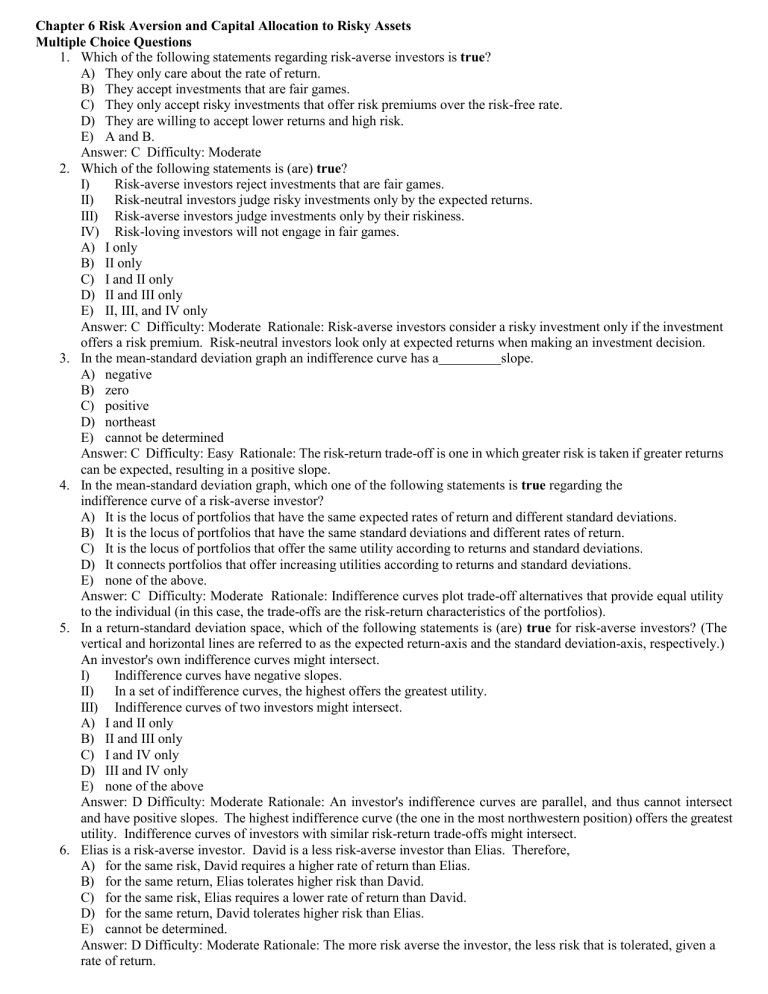

Risk Aversion & Capital Allocation: Multiple Choice Questions

advertisement