Fireside Chat #1 Notes

Agent: acting on someone else's behalf

Principal: acting on your own behalf

o Buy low & Sell High

o Deals in markets like:

• Financial, Debt, Stock, Derivatives

• Physical (natural gas, crude oil, etc)

Finance in General

Market Agent: the author is selling research to others to use

o Research & Analysis

Market Principal: consuming/buying research to form investment decisions they're

making

o Hedge Fund

o Mutual Fund

o Anything dealing with buy low, sell high

Corporation Agent

o Management Consultant

Corporation Principal

o Respect to financial *finish sentence*

o Venture Capital

Owns part of company in hopes to sell it

o Private Equity

Buy private companies in hopes to sell

Business Line of Investment Bank & Broker/Dealer Structure

Market Agent: transacting in financial markets on behalf of clients

o Prime Brokerage

Companies you can go to & be able to transact in markets as a retail

investor

o Block Trading

o Institutional Sales

o Research

Corporation Agent

o Investment banking (operations of company, deals w/ financing)

• provide advice to people on how to finance business

Market Principal

o Prop Trading

Corporation Principal

o Merchant Banking: Investment banking firm purchasing entire business & runs it

Ch 1: Why study Financial Markets

Helpful for economy

o

Channel funds from savers (people with capital) to investors (people who need

capital for usages), promoting economic efficiency

• Opportunity costs

•

Time is scarce (exogenous)

•

Cost is higher for the person that's better

•

What else you could do with your money? Question relating this

to Finance

o Market efficiency affects: personal wealth business & welfare

• Is it improving lives or not?

• There has to be benefits

Exogenous: given or assumption or input

-

Endogenous: something happening through a process or outcome

Available capital is a limiting principal

•

There is only so much available to use

•

This endogenously causes interest rates

Debt Markets

Allow governments, corporations, individuals to borrow from savers who want a return

o Investor can be used for both sides, company raises capital & invests, so they can

get revenue

Borrowers issue debt offering interest & principal

Interest rates (Endogenous}

Cost of borrowing or a debt

o Driven by supplier & their need for a return

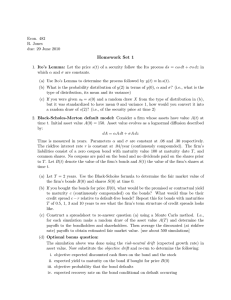

Figure 1.1 (Interest Rates on Selected Bonds Graph}

Corporate bonds have a higher interest rate & yield compared to U.S government bonds

Time Series: over time how are things moving

Cross-section: at a given time what's the difference between 2 variables

Term Spread: short term vs long term difference

Longer the term, higher the yield

The Stock Market

Sell it to raise capital

Initially sold by companies to raise money, then traded among investors

Ch 2: Overview of Financial System

Why they Exist

Positive Analysis: The world is the way it is and lets understand why it exists

Normative Analysis: management consultant

Financial Markets Funds Transferees

Lender- Savers (Suppliers)

- Borrower-Spenders (Consumers)

o

o

o

o

Households

Businesses

Governments

Foreigners

•-•-------•

Businesses

Government

Households

Foreigners

Structure & Classifications of Financial Markets

1. Asset Type

a. Debt Markets

i. Short term

ii. Long term

iii. Intermediate term (maturity in between)

b. Equity Markets

i. Residual claimant: who gets what's left over; proven to be successful

model

ii. Ownership claim in in the firm

2. Primary {IPO} V Secondary (trading w each other}

a. Primary: new securities

i. Investment banks underwriting offerings

b. Secondary: previously issued; brokers, dealers, broker-dealers

i. Exchanges or Over the Counter

ii. Performance indicators of management

1. Equity IPO or Seasoned IPO

111. Compensation

3. Maturity (how far out until you get paid back)

a. Money market (short term): less than a year

b. Capital market (long term} : more than 1 year plus equities

Development of International Financial Markets

Why?

0

0

0

0

New Technology in Foreign Exchanges

Ex: Electric vehicles

Increase risk of lawsuit in U.S

Possible avoid in foreign country

Sarbanes-Oxley increased cost of being a U.S listed public company

Disclosure, relates to helping decrease in lawsuits

Foreign Competition

Allowing opportunity

Function of Financial Intermediaries: indirect

1ntermediaries

o

o

o

Finds savers & obtains funds, then makes loans/ investments with borrowers

• Why do they exist?

Primary means from intermediation

Needed due to frictions

• Transactions costs

•

•

0

Checks/ Online Bill Pay/ Cards

Paying Convenience Yield

o Earning interest on checking/saving, with ability to pay

instantly

• Risk Aversion/sharing

• Asset Transformation: process of making risky assts into safer

assets for investors or shifting to risk to investors that are more

willing/able to take them

o Offer suppliers of capital liquid accounts

o Liquidity: have access money to the$$, right now

o Maturity:

• Asymmetric Info: one person has more info than the other that's lacking

crucial info, impacting decision making

• Adverse Selection (Hidden Type)

o Problematic & nonoptimal

o Prior to transaction occurring

o Potential borrowers most likely to produce adverse

outcome are most likely to seek loan

• Morale Hazard (Hidden Action)

o After transaction occurs

o Borrower has incentives to engage in undesirable activities

making default more likely

Only if they're insured

o Conflict of Interest/ Principle Agent Problem

Ex: Will drive vehicle safer if you bought the car

compared to if your dad bought it

Help individuals & businesses diversify portfolio

• Buying range of assets

• Pooling them

• Selling rights to the pool to individuals

Types of Financial Intermediaries

Depository Institutions (Banks):accept deposits & make loans, they includes

Commercial Banks: raise funds primarily by issuing checkable, savings, time

0

deposits used to make loans (commercial, consumer, & mortgage)

• Largest financial intermediary with most diversified asset portfolio

Thrifts:

S&L's, mutual savings bank, credit unions

0

Issue deposits as shares & owned collectively

Investment Banks: act as dealers & advise companies on securities to issue, underwrite

security offerings, offer M&A assistance

o

Mostly about issuance

Finance Companies (Shadow Bank): sell commercial paper (short term debt) & issue

bonds & stock to raise funds to lend to consumers to buy durable goods

o Non depository institution

o Non-regulated

Mutual Funds: acquire funds by selling shares to individual investors (many held in

retirement accounts) & use proceeds to purchase large, diversified portfolios

o Multiple people's money piled together

o Regulated

o Money Market Mutual Fund: buy highly liquid short term money market

instrument; look like cash but aren't cash

• Short term treasuries

• Repo

o Money Market Account exist because banks are insured up to 400K, if you have

more & still want liquidity services for very large companies

• Uninsured

Hedge Fund: require large investments {100K or more) with long holding periods,

subject to fewer regulations

o Invest across almost all asset classes

o Strategies

o Cannot access money to obtain it

Insurance & Pensions

Insurance: charge premiums & use cash to invest in securities w/ actuaries who try to

predict pay outs

o If things go wrong, we expect a payout afterwards

Pension & Gov Retirement Funds: hosted by corporations & governments

Collect employee & employer contributions to invest in various securities

0

o Provide retirement income via deferred annuities

• Private Sector: Not as common

• Public Sector: Very prevalent

Economies of Scale & Conflicts of Interest

Provide multiple services may increase efficiency but also lead to Conflict of Interest

o Economies of Scope connected to Morale Hazard & Conflict of Interest and are

introduced to financial institutions

Regulation of Financial Markets

Investor Protection: ensure individual investors & investing institutions are adequately

protected so they're willing to invest

o Info

Prosecution: go after those who are misleading or inaccurate

0

o

-

Can investors lose money?

• Savings Account: No, it's Insured

• Mutual Fund: Yes, it's insured

Stability: Prevent problems in finance by causing problems in other markets (other

Broker

Dealer

Trader

Real Estate Agent

Car Dealers

Makes Bets

Never

actually own any stock

Have inventory

Proprietary Trade (Prop)

- Make money based on

- Trades their own

selling to someone

firm's money

Have inventory

- Make money based on

bets

companies & individuals)

o Ensure the Soundness of Financial Intermediaries (prevent runs & fire sales)

Ch 3: What do Interest Rates Mean & What's their

role in Valuation

PV Intro

o

Different Debt Instruments (Fixed Income/Cash Flows)

• Payments to the holder

• Person who needs capital gets$$$, sell a bond, someone else will hold

•

asset/debt (as holder they receive payments)

Evaluated based on amount & timing of each cash flow

•

Leads to its yield to maturity/interest rate

PV

o

o

Represents a series of cash flows or single cash flow

Based on idea that a dollar in future is less valuable than it is today

• WHY?? Opportunity Cost of Capital

PV Applications: Debt will either be a bond (direct) or loan (indirect)

o

Simple Loan

• Principal: funds the lender provides to borrower

• Maturity Date: date the loan must be repaid

• Loan Term: time from initiation to maturity

• Interest Payment: cash amount borrower must pay lender for the use of

the loan principal (borrow-> lender)

•

o

PV of Future 1$= 1$/(1

+ i)n

Fixed Payment Loan

• Principal & interest repaid in several payments (often monthly, equal

dollar amounts over loan term)

iii>

• Installment loans like auto loans & home mortgages

LV=...!!_+ FP

FP

+...

FP

(l+i)

o

(l+i)"2

(1+i)"3

(l+i)"n

Coupon Bond (lenders are bond investors like insurance companies,

pension/hedge funds); lending to governments

• Models corporate bond & defined by coupon rate

• Written in to figure out the cash payments

o

Discount Bond (lenders are bond investors like insurance companies, pension or

hedge funds); lending to governments

Amortize: at the end of the loan it's paid off; part payment goes to interest, part goes to

principal

Yield to Maturity: interest rate that equates todays value w/ present value of all future

payments

o Bonds: PV= FV/ (l+i)

Distinction between Real & Nominal interest Rates

o Real (What we care about)

• Equals the nominal rate - inflation or CPI

• Reflects the true cost of borrowing

• Ex Ante: Treasury Inflation Protected Securities aka TIPS (adjusted for

expected level of inflation or CPI)

• Ex Post: real rate based on consumer price index (observation of inflation

level)

o Nominal (What we see)

• Equals the real rate + inflation

Why you would have negative rates

o Deflationary environment

o Flight to Safety

• Terrified of losing A LOT of money

o Convenience Yield

• Something about asset people are willing lose in order to hold

Distinction between Interest Rates & Returns

o Rate of Return= CI Pt+ (Pt+1- Pt)/Pt

= Current Yield +Capital Gain Yield

= What you pay + What you got

Maturity & Volatility of Bond Returns

o Prices & returns more volatile for long term bonds because they have higher rate

risk

o No rate risk for any bond whose maturity equals holding period

Reinvestment Risk

o Occurs if investor holds a series of short bonds over long holding period

o i @ which reinvest uncertain

Gain from i increase, lose when i decreases

0

Duration (Cash Flow Weighted Maturity)

o

Often confused with maturity

o Cash flow is happening as bond goes along; an understanding of when you' re

o

o

getting cash flow

• Which years are the most important? PV evaluating the years

Weighting the years by how their contributing to the PV

• If interest rates go up, duration will go down because when rates goes up

later cash flows will be worth less, small (earlier) cash flows contribute

more to PV than larger cash flows

• Higher the coupon rate, shorter the duration of the bond

Matters to bond traders because

• Set of cash flows in a portfolio, gives relationship

• Interest rate risk

• Capital gain percentage

• Bond return

%Change in price= -duration* (change in interest/(1+i)

Ch 4: Why Do interest Rates Change?

Determinants of Asset Demand

-

Asset is property that stores value; when deciding to buy/hold, individuals consider

• Personal Characteristics

• Wealth: all assets owned by individual

•

•

Age

• Risk Tolerance: depends on person

Asset Characteristics (Both relative: how does it compare to other assets

& absolute: what is that asset going to do for me)

• Expected Return: return expected over next period, change in

wealth

• Risk: degree of uncertainty associated w/ the expected return;

how uncertain you are about what returns you expect to happen

• Liquidity: ease & speed with which the asset can be turned into

cash; could dry up, all of sudden you can't turn it into cash

Variable (All else Equal)

Change in Variable

Change in Quantity Demanded

(Ceteris Paribus)

Wealth

Increase

Increase

Expected Return relative to other

Increase

Increase

Risk relative to other assets

Increase

Decrease

Liquidity relative to other assets

Increase

Increase

assets

-

The Demand Curve for a Bond

Return entirely determined by its price & is the bond's yield to maturity

Rates & prices inversely related

Summary of Forces that Increase Bond Supply

Expected Profitability of Investment Opportunity: times are good, there's more supply

of bonds; in recession, lower supply of bonds

Expected Inflation: An increase in expected causes supply of bonds because people who

would supply a bond will be more willing to do it

Government Activities: Spending more than their taking in; higher gov deficits increase

the supply, conversely surpluses decrease the supply of bonds

-

Shifts in Demand Curve

Shifts outward (to the right); meaning demand has increased

o Increase in wealth

o Expected Return

o Expected Interest Rate

• If increases, demand decreases (graph will shift inward, to the left)

o Expected Inflation

o Riskiness of bonds relative to other assets

o Liquidity of bonds relative to other assets

Shift in Supply Curve

Shifts outward, meaning supply has increased

o Profitability of Investment Opportunities

o Expected Inflation

• Very good for borrowers, since payments are fixed in nominal terms

o Government Deficit

**If prices drop, interest rates are going to rise **

/

Ch. 5: How Do Risk & Term Structure Affect Interest Rates?

-

Risk Structure of Interest Rates:

O Affected by: Risk of Default, Liquidity, & Income Tax Consideration

-

Term Structure of Interest Rates:

Default Risk Factor

-

Issuer of bond us unable/unwilling to make interest payments when promised; bonds w

this should always have + risk premium

O Risk Premium: additional interest people must earn in order to be willing to hold

a risky bond

0

Default-free bonds: no default risk

•

Ex: U.S Treasury Bonds because fed gov can increase taxes to pay off their

obligations

Liquidity Risk Factor

can be converted to cash cheaply; asset is more desirable, the more liquid it is

0

Corp Bonds: Price decrease, interest increases, Demand shifts left

0 Treasury Bond Market: relatively more liquid, demand increases, prices increase,

interest decreases

Corporate Bonds: Junk Bonds

0

Debt rated below BBB

0

Often, trusts & insurance companies aren't permitted to invest in junk debt

0 Are they bad investments?

•

Is the risk premium high enough to compensate you for the risk your

taking?

Indenture: Contract specifying the bond terms

Restrictive Covenants: mitigates conflicts w/ shareholder interests; rules lender puts on

borrower

0

Ex: may restrict new debt you can issue, pay dividends

Call Provision (prepayment option): as a borrower, they can call the bond; they have the ability

to pay earlier

0 Higher yield required

O Reinvestment Risk

Convertible Bonds: some debt can be converted from debt to equity

0 WHY?

O Option for investor (either have no value or positive value)

~h 7: Why do Financial Institutions Exist?

Asymmetric Info

takes on multiple forms & Is complicated

o Adverse Selection:

\

• One party In transaction has better Info than the (Iother party

• Before transaction occurs

• Potential borrower more likely to produce adverse outcome a,re more

likely to seek loan & be selected

·

o Moral Hazard: Conflict of Interest

• Hidden action or Temptation to exploit

• After the fact/after the transaction has o·ccurred .;,.

• Whether or not borrower will follow through, they'IJ act in .ttiei~ own oest

interest

.

··· ·

• As the principal you don't know how to tell ~hethe·r you're getting a

good deal or not

.: · ... '.

· · .

• If incentives are aligned, there's no problem/w~ aon't care

·.~

Solving Adverse Selection

. . 11. ··

Solving Moral Hazard

.

How Moral Hazard affects choice between debt & Equity contracts , ..: . ,

The Principal-Agent Problem: result of separation of ownership by .

stockholders(principals) from control by managers (agents) '.~j'\~

o mangers will act in own rather than stockholders' interest ·

Ways to help solve problem

o Monitoring

.

• Clocking In/Out, seeing when they're actually there

o Government Regulation to lnctease Information

o Financial Intermediation (Venture Capital)

· o Debt(loans) instead of Equity

• You get your portion, but you're guaranteed your portion

• Aligns incentives

Moral Hazard in Debt Markets

,

- Too much debt may create Incentive to take on very risky projects or pass on good

projects

. ·

'il:< ..

. . ····\

Debt overhang: problems that are created by lots of already Issued debt (a lot of debt & :· ·

its above your head)

·

·

"· ,"

o Won't Undertake a + NPV Project

• Possibility of losing $$$

o Cut Corners to make Interest payments .

• Debt Is collaterallzed with your physical assets

• Struggling to stay afloat

o Special Dividend?

Asset Substitutions (Go for broke/underwater)

Conflicts of Interest

a

...