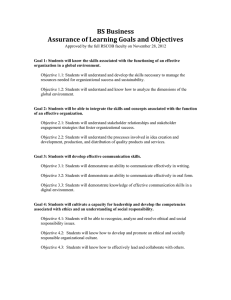

9/5/18 How To Form A Business Things to Consider when Considering Business Forms ● Ease of Formation/Maintenance ○ How easy is it to form this business? Can I start it right from my dorm room or do I need to go to the state and file a bunch of paperwork? ● Ability to Raise Money ○ Do I have money to start my business or do I need to get a lot of money right away? ● Tax Treatment ○ You want to be able to minimize taxes ● Liability Protection ○ If you start a business something could go wrong. (In a restaurant, sanitary code, etc). You do not want your personal assets to get hit with lawsuits. In some business forms there is nothing shielding you from individual liability ● Impact on Society and Environment ○ Most business want to have a positive impact on society, and you do not want your business to do any harm. You want to be able to fill social mission along with a financial mission Non-profit Business: does not generate profit for shareholders, the money generated goes back to the mission For- Profit Business Forms ● Sole Proprietorship ● General Partnership ● Limited Liability Company ● C Corporation ● S Corporation ● B Corporation ● Social Benefit Corporation Major Forms of Ownership (3 biggest forms of business entities) ● Sole Proprietorship: a business owned, and usually managed by one person (72% of businesses, 6% of total receipts or sales) ● Partnership: two or more people legally agree to become co-owners of a business (8% of businesses, 13% of total receipts or sales) ● Corporation: a legal entity with authority to act and have liability apart from its owners (20% of businesses, 81% of total receipts or sales) Major Benefits of Sole Proprietorships ● ● ● ● ● ● Ease of starting or ending your own business Being your own boss Pride of ownership Leaving a legacy (to your family) Retention (possession) of company profit No special taxes ○ You just pay the individual tax rate (whatever profit you make, you file on your individual tax return, so no entity tax) Disadvantages of Sole Proprietorship ● Unlimited Liability (any debts or damages incurred by the business are your debts, even if it means selling your home or car) - if something were to go wrong and you get sued, and you do not have enough money, you are behind bars. They can sue you and get your personal assets. You have no protection) ● Limited financial resources (no one else is contributing money to the business so it's all your money) ● Management difficulties (you can not really go on vacation because you do not have someone to manage the business while your gone) ● Overwhelming time Commitment ● Few fringe benefits ● Limit growth (no one to bounce ideas off of) ● Limited life span Advantages of General Partnerships ● More financial resources (more money pooled together) ● Shared management/complementary knowledge and skills (more minds and ideas) ● Longer survival ● No special taxes (each partner files for individual taxes, no entity taxes) Disadvantages of General Partnerships ● Unlimited liability (exposed to personal liability, if your partner makes a mistake and the whole partnership is sued, you are still responsible even though you did not make the mistake and if your company does not have enough to cover the law suit, your personal assets are at stake) ● Division of profits (resentment based on different work hours and profits) ● Disagreements among partners (Ex: someone does not show up all the time. And you can not really fire a partner, you need to negotiate) ● Difficult to terminate Advantages of LLC’s (a good way to have a business to protect yourself from liability and you can keep the business small and have a one person LLC) - if your business doesn't have enough money to protect itself from a lawsuit, no one is coming after your second house or your own assets (there are some states who do not recognize LLCs so if they do not you might have to claim yourself as a partnership, etc) LLC’s involve a lot of paperwork ● Limited liability ● Choice of taxation (you can be taxed as an individual like a sole proprietorship) ● Flexible ownership rule (distribute the profits to other members of the LLCs and flexible organization because you do not have to have a board of directors) ● Flexible distribution of profits and losses ● Operating flexibility Disadvantages of LLC’s ● No stock, therefore ownership is non-transferable (you can not sell yourself out of a business, you need to be bought out. You can not automatically enter an LLC, you need to have approval to be involved) ● Limited life span (set up for a small period of time like 5 years) ● Fewer incentives ● Paperwork (a lot of paperwork) Conventional Corporations (C- Corp) ● A state chartered legal entity with authority to act and have liability separate from their owners (stockholders) ● They have a lot of information about them they are required to reveal to the public ● How do they raise money ○ Sell Stocks and Bonds ■ Stocks: shares of ownership in the company (stockholders can be individuals or large institutions) ■ Stock Certificate: evidence of stock ownership ■ Dividends: part of the firms profits that the firm may distribute to stockholders as either cash or additional shares ○ Common Stock: the most basic form; holders have a right to vote for the board of directors and share in the profits if dividends are approved - of their are not enough dividends to go around common stockholders do not get dividends ○ Preferred Stock: owners are given preference in the payment of company dividends before common stock dividends are distributed. Preferred stockholders do not have the right to vote - whatever you invest in, you need to get paid back first before common stockholders. If you want to be a passive investor, it is better to invest in preferred stock Hierarchy in C Corp ● Shareholders (that elect the board) and Owners ● Board of Directors ● Officers (CEO) ● Managers (important employees) ● Employees Advantages of Corporations ● Limited liability (if something goes wrong, the shareholders will not be personally liable) ● Ability to raise money from shareholders who are owners of the firm and do not have to be repaid (raise unlimited capital because you can issue shares) ● Size ● Perpetual life ● Ease of ownership ● Ease of attracting talented employees (because name is big and company is profitable) ● Separation of ownership from management Disadvantages of Corporations ● Initial Cost ● Extensive paperwork ● Double taxation ● 2 tax returns (1 on the entity level, and then regular taxes) ● Size ● Difficulty of termination ● Possible conflict with stockholders and board of directors The Largest Public Companies ● Walmart ● Berkshire Hathaway ● Apple ● Exxon Mobil ● McKesson ● CVS Health S Corporations (like an LLC but it is much more rigorous to pass as an S corp) ● A unique government creation that looks like a corporation, but is taxed like sole proprietorships and partnerships ● S Corporations have shareholders, directors and employees, plus the benefit of limited liability ● Profits are taxed only as the personal income of shareholders Qualifications for S Corporations ● No more than 100 shareholders ● Shareholders must be individuals or estates (no institutions like C Corps) ● Shareholders must be citizens or permanent residents of the U.S ● Have only one class of stock B Corporations (good marketing tool) ● A term used for a non profit entity that is certified by the non profit B Lab for meeting B Lab’s rigorous standards for social and environmental impact ● The certification process occurs every 2 years and the entity must receive a score of 80/200 on the B Lab Assessment ○ The assessment looks at the transparency of the governance; treatment of workers and support to the community ● Examples: Warby Parker, Ben and Jerry's, Patagonia ● This came out at a time before Social Benefit Corps Social Benefit Corporations ● New business form recognized by 31 states ● SBC’s are corporations that want to pursue a mission to advance social and environmental causes while making a financial profit. ● SBC’s are taxed like C Corps (double taxation) - Treated like a C Corporation ● In an SBC, the mission of the company must be included in the governing documents of the company ● The Board of Directors must include a Benefits Director to oversee the corporations social and environmental mission. ● Every year the company must produce a Benefits Report, using a third party standard, to show progress on their social and environmental mission 9/10/18 Corporate Governance ● Sarbanes Oxley Act: passed to help steer companies away from bad accounting and other examples of bad corporate governance Corporate Governance ● Refers to the method by which a firm is governed, directed, administered, or controlled to the goals for which it is being governed ● It is concerned with the relative roles, rights, and accountability of stakeholder groups such as owners, board of directors, managers, employees and other stakeholders ● It is all about how a company is being managed, run or overseen. It also talks about the rights and responsibilities of the different players in corporate governance, such as shareholders and the board and executives. What are their rights and obligations with each other and the public. How is the company being controlled and governed and what are the roles and responsibilities of these individuals, to each other and public? Four Major Groups ● ● ● ● Shareholders: Own stock in the firm, giving them ultimate control (shareholder primacy model) - they have voting rights, they have bought shares with an investment, in essence they are the owners. Shareholders vote every year at a public meeting, where you vote to elect the board Board of Directors: Govern and oversee the management of the business - Board of directors can be 3 people or as many as 15 in a big company - Board members are not their day in and day out. Managers run the business day in and day out. The Board appoints the managers and CEOs and directors. Managers: The individuals hired by the board to manage the business on a day to day basis - Managers and Executives hire the lower level employees that do most of the operational work Employees: Hired to perform actual operational work Corporations Hierarchy of Authority ● State Charter (you need to file your status as a C Corp in the state with a state charter) most incorporate in Delaware because they have favorable management laws and there are tax incentives there. Texas and Nevada also have advantages of incorporating there. ● Shareholders ● Board of Directors ● Managers ● Employees Role of Shareholders ● Represent own interests as investors (care about how the company is performing because they want to see a return on their investment) ● Attend annual meetings and elect Board of Directors and terms of compensation (if they have a certain number of shares they can participate in this meeting) ● Approve executive compensation plans (the board has a committee called the compensation committee and nominating committee and they pick out the directors and their compensation and they present that to the shareholders to vote for) ● Approve external auditing firms (approve the auditing firm that the firm will use- important to pick a firm that is going to be objective and states your financials in an accurate way) ● Approve significant transactions including issuance of stock (merger, secondary stock shareholders have the right to vote for) - they do not vote for every little thing that the company does, they do not vote at an executive level because they just have an investor interest in the business ● Exert pressure to make companies more responsible through activism (if you have a lot of money and million of shares, you can exert a lot of pressure) ● Sue management for violations of duty of care and duty of loyalty (derivative lawsuitsuing managements because they violated a fundamental rule of corporate management. Any money recovered from the lawsuit goes back into the corporation) Role of Board of Directors ● Governance and oversight ● Identify risk and oversee risk management ● Hire and fire the executives ● Ensure the integrity of published financial statements (make sure the auditing firm is doing the right job to make sure the financials are accurate) ● Plan and set executive compensation ● Protect the interests of shareholders (not themselves or the executives, but the shareholders) ● Protect the company's assets and reputation ● Ensure compliance with all laws, regulations and code of conduct policies (all public companies should have) Fiduciary Duties of the Board (relationship of trust) ● Duty of Loyalty: Represent interest of owners and act without a conflict of reason protect the interest of the shareholders first, before yourself. Put your own interest aside. ● Duty of Care: Understand the company - act in good faith; make informed decisions and observe business formalities- you really care about the corporation, you show up to all the board meetings, you act in good faith for what's best for the company, making sure all of the laws are being complied with ● The Business Judgement Rule: A court of law will not hold a director personally liable for a business decision so long as the director is following the duty of loyalty and duty of care - says courts will not hold these board members individually liable as long as the directors were acting in good faith and were loyal to the shareholders and acted in good faith, even if they end up making a decision that loses the company money, they are not individually responsible Board Committees (these board members can have other jobs, they are known as outside board directors. They have a full time job somewhere else, because they only meet 10 times a year) ● Audit Committee: ensures the integrity of financial statements and assesses the adequacy of internal controls - helped to make sure that the company is doing a good job putting together the financial statements and that the external auditor is doing a good job ● Nominating Committee: ensures that competent and objective board members are selected - ensures that competent and objective board members are elected - picks out the best candidates to be on the board for election (a lot of times they nominate themselves) ● Compensation Committee: evaluates executive performance and recommends terms and conditions of employment - decides the executive compensation that the ● ● shareholders need to approve (say on pay movement - not binding). They decide how they are going to pay themselves and how to pay the CEO. They wanna be competitive with how they pay, but they also wanna see how the executives are performing, do they deserve a raise? Corporate Responsibility/ Sustainability Committee: addresses issues of diversity, equal employment opportunity, environmental affairs, consumer affairs. Board members that believed what are we doing besides making a profit to our stakeholders, what are we doing for society. What is the diversity of our board, how are we reducing waste CEO (Chief Executive Officer): Runs and manages the company day to day. Establishes strategy of the company, serves as a role model for the employees, sets financial and non financial goals, achieves results and develops leadership talent. Inside director because you are there full time, day to day management, knows what's going on all the time. They hire managers who hire employees. They ask how are we retaining talent and decide how they want to lead, they set the tone from the top. Whatever the earnings are they get attributed to the CEO. The Boards Relationship with the CEO (many people are saying this should not be allowed because this duality is conflict of interest) - Boards should oversee the executives but executives are also shareholders, so they vote for the board - they need one another to perpetuate ● Boards are responsible for monitoring CEO performance and dismissing poorly performing CEO’s ● If a CEO also serves as a chairman of the board, this duality can affect their independence. It is best to separate these roles - they need to be as objective as possible. ● Boards are also responsible for determining executive compensation. Because the CEO can be a close friend, you wanna be generous with your friends and you wanna pay them as much as they want. This makes it hard to be objective when your determining your own pay Issues Surrounding Compensation (even if the company is doing poorly, compensation can still be going up, so they can do better and perform well) ● CEO Pay-firm Performance Relationship ● Excessive CEO pay ● Executive Retirement Plans and Exit Packages ● Outside Director Compensation (traditionally they weren't paid highly, but now they are being paid more even though this is just a part time job) ● Transparency (how much are they getting paid, we need the right to know because of Dodd Frank) ; SEC Rules Excessive CEO Pay ● Say on Pay ○ ● Evolved from concerns over excessive executive compensation (shareholders vote on compensation. Shareholders have a say in the vote but its not binding, if everyone votes no and one person votes for the executive compensation package, it will go through still Clawback Provisions ○ Compensation recovery mechanisms that enable a company to recoup CEO pay, typically in the event of a financial restatement or executives misbehavior (if the CEO does something bad they can take their pay back) Executive Retirement Plans and Exit Packages ● Retirement Packages ○ Many of today's workers do not have retirement plans ○ Employment contracts already spells out how much the company pays you when you leave or when your fired. This is important after the financial crisis. If your a CEO or director when you have to step down you walk away with a lot of money, even if your leaving on bad terms Outside Director Compensation ● Paying board members is a recent idea ● If you don't pay outside directors, your not going to get the best work ○ You can get paid through stock options, this may cause them not to be objective and go with whatever the CEO wants you to do Transparency ● Executive compensation packages may include deferred pay, severance, pension benefits and other perks, that could be around $10,000, stock options ● SEC rules require disclosure of executive compensation (tells us how much money is made but how shareholders feels is still not binding on the board) ● Such disclosures may have a moderating impact prior to implementation Improving Corporate Governance- Legislative Efforts ● Sarbanes- Oxley Act of 2002 (SOX) - came out after Enron, conflict of interest with external auditor. It requires public companies to change their auditors every 5 years. Auditing firms can not provide consulting services at the same time. ○ Amends securities laws that protect investors who own public companies ○ Enhances public disclose by requiring companies to report off balance sheet transactions and loans given to executives ○ Limits what an auditor can do other than audit for a firm (other services) ○ Ilegal for accounting firms to provide services if there is a conflict of interest ○ ● The CEO and CFO are responsible for upholding the honesty of financial statements- must put their signature on every filing and financial statement, so if there is a mistake and a lie, there pay gets clawed back Dodd Frank Wall Street and Consumer Protection Act of 2010 - passed after the financial crisis of 2008. Prior to 2008 banks were regulated by the federal reserve but non bank institutions were not regulated so they were able to get away with a lot more. ○ Created the Financial Stability Oversight Council to identify and deal with risks that affect the entire financial industry - regulate the non bank institutions (hedge funds) ○ Regulates risk derivatives lie credit default swaps ○ Requires Hedge funds to register with the SEC ○ Oversees agencies that rate credit and provide credit cards, loans, and or mortgages ○ Banks are required to have capital reserve so that if they go under they are still able to give back customers money ○ Banks aren't allowed to use customer money to make bets for their own advantage - vocal rule: no more proprietary trading, can't invest peoples money to make a return for themselves. They are supposed to invest peoples money to make a return for the people, not themselves. Improving Corporate Governance ● Make changes in the board of directors ○ More board diversity ○ A greater ratio of outside board members to inside board members ● Use Board Committees to: ○ Ensure that the financials are not misleading ○ Ensure that internal controls are adequate ○ Follow-up allegations of irregularities ○ Ratify the selection of an external auditor Red Flags Signaling Corporate Governance Issues ● Company has to restate earnings (omitted something or it was not accurate) ● Poor employee morale (employees are not satisfied) ● Adverse Sarbanes-Oxley 404 opinion ● Poor customer satisfaction track record ● Management misses strategic performance goals ● Company is target of employee lawsuits ● Stock price declines (Valeant stock price went down like crazy) ● Quarterly financial results misses analysts expectations ● Low corporate governance quotient rating (3rd parties rate corporate performance and if your company is rated low for corporate governance, then a combination of these factors probably weighed into the decision and that is not a good sign) Securities and Exchange Commission (SEC) - government agency that can help us be better and protect us as investors. It looks out for the investor and requires the public companies to do the filings that we can see, in order to look up the financials of the company. Purpose is to do a lot of disclosure. The purpose is not to show the company is doing well, it just regulates how much information the companies give to investors ● A government agency that is responsible for protecting investor interest ● The SEC requires public companies to make period filings and disclosures ● The SEC is not perfect and critics believe that it favors businesses. It failed to stop the Bernard Madoff Ponzi (poster child for Ponzi scheme) - he ran a fraudulent industry, he invested billions to people and charity, then he fell on hard times and could not give people the returns he promised. Then he started taking peoples money, not investing it, putting it in bank accounts and living off of it. Then when 2008 happened and people wanted their money back he did not have it. scheme before investors lost billions, although they had been warned of the scheme almost a decade earlier. His secret to success was, anytime the regulators called him, he would never turn them away and say everything was fine. He had a secret floor he would bring the regularites, and on that floor the fraudulent activity did not take place. And because the regularities saw he was so open with them they failed to pick up on it Insider Trading - board members very susceptible to this ● The practice of buying or selling a security by an insider who has access to material, confidential information that is not available to the public ● “Material Information” is information that a reasonable investor might want to use and is likely to affect the price of a firm’s stock (information that is going to the move the price of stock, a reasonable investor would want to know this because it would affect their investment) ● A tipper provides the information ● A tippee receives the information ● Executives and anyone who works for a firm may have inside information and are forbidden to trade on it ● If an insider trades in the public stock of their own company when they are not supposed to (there are internal controls that prohibit this but if there are none) then this is a crime ○ Since they know they can get in trouble, they tip off a friend. You are on the inside and are tipping someone on the outside. Both the tipper and tippee are liable and are criminals. Even a low level employee can not trade on this information Equifax ● Equifax executives ran into this problem. They were responsible for a data breach in 2017. They are one of the three big credit rating agencies. People have to share their social security number to be rated. Someone got in to access of Americans information ● and this was a huge liability. Equifax did not disclose the breach until 2 months later and three executives sold their stocks in Equifax. Now why would they sell their stock at this time? It was to prevent themselves from losing money in Equifax shares because they assumed when this announcement went out the stock price declined. They thought they were being clever but they are being pursued for insider trading. Sudhakar Reddy Bonthu plead guilty and ended up making a profit Blackout periods: times insiders could not make changes to their investments, prior to the annual report 9/17/18 What is Accounting? ● The language of businesses ● A system for recording business transactions ● A set of rule to standardize investor information ● A source of data that managers use to make decisions ● Applied information economics What is the Point of Accounting? ● Who uses the information? ○ Financial Accounting: external parties: investors, creditors, potential employees, government agencies ○ Managerial Accounting: Internal parties: CEOs, Operations Managers, Marketing, HR Departments ● Why does it matter? ○ Financial Accounting: investors face an information symmetry problem (not all information is given to them- investors want to share enough to raise enough capital, but if you raise too much information someone will copy the technology and their will be more competition) - not giving enough information causes investors to see risk in the investment therefore not enough capital which means the company won't have money to run. You do not want people to know who your customers are. Transaction analysis is the focus of financial accounting. Financial accounting is the boss. ○ Managerial Accounting: Managers needs to make decisions. Managers need to know how to price it, they need to know where they are spending all of their money. Planning, directing and controlling are all examples of how to plan around a budget. Figure out how to make the business better tomorrow. ● What is the focus? ○ Financial Accounting: Transaction Analysis, Financial Reporting, Audit, Tax ○ Managerial Accounting: Planning, Directing and Controlling URACSI ( you are CSI) - framework that accounting drives all of these points ● ● ● Use of Resources Allocating Capital Standardizing Information Use of Resources ● What managers do (internal perspective) - Managerial Accounting - CFO is an example ○ Make investments (where should the factory go, choice of machine vs labor, strategic additional investments- invest in new location or product) ○ Manage costs (what do we need to make the product: example a tesla - material (direct material is anything that leaves as part of the car, steel tires. Indirect materials do not leave as part of the car, safety glasses for production, mop for janitor), labor (direct labor are people who build the crs. Indirect labor are people who support the building the car like HR, engineering, finance), overhead (factory rents or insurance. Put this all together and put it with data of how much you might sale based on the markets, look at competitors and see what the market will bare and set the price. If it is too high demand goes down people cannot afford it. If the price is too low, you may make a profit or you can lose money every time you sell a car. Getting the price right is very important. ○ Set pricing ○ Incentivize employees (CEO gets a bonus if you have earning of $1.50 a share he gets a million dollars in bonus. You want it to be a goal that someone can attain fi they work too hard, but not unattainable. ) ■ Compensation Contracts: ● Bonus: directly driven by accounting (if you meet a certain objective you get a million dollars) ● Stock Options: indirectly driven by accounting (if the value of the firm goes up the stock price goes up) stock options do not go down they go to zero. They are asymmetrical you can only win if they go up, not loose. A problem with how we incentive executives today is if stock goes up they get a bonus, and if stock goes to zero they only lose their job ● Senior Management: $1 million dollar bonus if you can achieve earnings of X ● Value of firm driven by earnings - financial accounting information and whether or not you hit the objective and how big the program should be is a managerial accounting objective ■ Incentives of firm tied to accounting information ● What managers do (internal perspective) ○ Make investments ○ Manage costs - war room in ford with 56 graphs everywhere. Managers would come in and it would say you bled yesterday (lost money) and you would have to say why and then you have to say later what you are going to do about it. ○ Set pricing ○ Incentivize people Allocating Capital ● What investors need to do (external perspective) ○ There are $40 trillion dollars of non US equity and $2o trillion dollars of US equity (stocks). All of this money can be invested in your firm or someone else. And if it is invested in someone else's firm your stock price will not go up. Investors need the information a company provides to make a decision where they will invest. ○ If your an investor and you want to invest you can invest in many different markets in different countries. You have to figure out how to draw interest to investors in your company. Your trying to attract capital to your company not to investors. How do you do this? ■ How do investors decide where to put money? ● What does the company have? (why investment in my company does it have something attractive to the customer) ● How has the company performed? (is it performing well) ● How risky is the investment? (look at financial statements) ■ Balance sheet has assets on one side and liabilities and equity on one side. Assets are what you have and liabilities and equity are how you pay for it. ● Assets= Liabilities + Equity ● Balance Sheet (if you have cash you have liquidity - you can use it to pay for things, but you do not get a return because you did not invest it) ○ Assets (what you have) = Liabilities + equity (how you pay for it) ■ Assets include ● Cash, accounts receivable (how much customers owe us), notes receivable, inventory ● Fixed assets ○ Land, buildings, equipment & vehicles ○ Liabilities ■ Accounts payable, short-term notes payable (total these as they are current) ■ Notes payable (long term), Bonds (mature in 10 years) Total these they are long term liabilities ■ Holding extra cash is good, pay off liquidities have more options, downside is not making a return on the money by investing it ○ Income Statement (profitability: tells us how we're doing) ■ Revenues + ● Net sales ■ Cost of Goods sold ■ Gross profit (Gross margin %) = ■ Operating expenses + ● Selling expenses (salaries, advertising) + ■ ● General expenses (insurance, rent, utilities) + Gross profit - operating expenses = Operating Income - interest expenses = net profit before taxes - income tax = Net income (profit) Standardizing Information (Auditor/CPA, internal auditor, regulator/compliance) ● Economic truth = the economic event we wish to capture (the center) ● Measurement error = some economic events are hard to measure (not systematic) - a disaster that shut down the supply chain, it was a bad year in the stock market and all the stocks are depressed, error in the measurement because something happened ● Bias is usually driven by incentives (stock prices) -numbers are too low or too highcomes from the accounting policy choices we make (aggressive or conservative choices) ● Accounting = Economic truth + Measurement error + bias (Accounting information is the source of the model, it is used to determine how much the company is worth) ● Bias and Measurement error can be minimized by governance ○ Internal Controls ■ The board of directors provides oversight, information systems (if the information always does the transaction the same way there's no chance for human error, internal auditors ( Audit committee reports back to board and checks that audit is done consistently, counting physical material and checking the financial statements) ○ External controls ■ Auditors (External auditors Deloitte, PWC. They check what our auditors do to make sure they agree), exchanges (reporting minimums or requirements, NYSE has minimum requirements for reportings), regulators (Securities and Exchange Commission - come up with the main set of rules that we use), institutional investors (when all other things fail institutional investors run big pools of money ,fidelity, jp morgan - they can sell your stock and this will increase your supply and bring your price down) Who does all of this? ● Use of Resources ○ CFO/Controller ○ Corporate Accounting ● Allocating Capital ○ Equity/credit analyst (work for banks to make loan decisions) ○ Investment banking (securitize these companies and take them public) ○ Private Equity (buy companies and run them) ● Standardizing Information ○ Auditor/CPA ○ Internal auditor ○ Regulator/compliance 9/24/18 Introduction to Marketing ● In the world of marketing we study opportunities, products, services, consumers and competitions. ● Our challenges as marketers and business people are to identify these things. What are the products and who are the consumers for our company. At some point we are going to have to ask ourselves should this idea be brought into reality as a product and be sold into the marketplace by our company. How can we find our place to differentiate such that we are able to sell products? ● Branding Map- represents the world's most valuable brands from 2018 by country. Based on the size of the country it shows you the number 1 brands in the world. Amazon is the number one brand in the world. The second largest brand is Samsung. ISBC is the industrial and commercial bank of China. It is a big company because it is the largest bank of the world because it holds the most assets. Brand Finance is the number one brand equity researchers. They make branding maps and connect the concept of brand and what is the actual value and how it translates in finances. Apple is number two according to their finances and it is less than amazon because apple is positioned as a luxury product. As you start to move overseas and in Europe we see the power of Samsung and other competitors. Amazon targets a more mass market they have a greater potential for growth. All business is global and all business is digital. It is a global world and a global competitive market place. Corporate Strategic Process and Marketing Corporate Strategic Process - strategic planning process for a corporation 1. Business Mission and objective - what is the strategic mission and objective for your company 2. Situation analysis (SWOT - strengths, weakness, opportunities, threats) - environment surrounding your company. SWOT is a framework or business tool to see how you can grow and threats that can cause you to stop growing 3. Identify opportunities (segmentation is looking at various clusters within a market because you want to reach people that have a higher probability of responding . Targeting is choosing from the clusters who you want to target and devote your resources to go after, positioning is based on the products you are offering and how does it differentiate itself from a consumer) - how do you differentiate yourself 4. Implementing marketing mix (price - what price is my consumer willing to pay, product what kind of product will my audience want , place- where can I buy it, is it easy to access, promotion- how do I promote it, know the right social media site) - look at all of my disciple areas and have managers identify how you can contribute to the corporate goals and objective of the company 5. Evaluate performance using marketing metrics - check if you are hitting your target and if you are not why? If the company is in a declining industry how can we help the decline? What is marketing? ● Marketing is a gathering of ideas and concepts, engagement with consumers and getting into their heads about what they need, connection, emotion, and psychology of business. It is about designing products and helping people to buy. The path to purchase is how do we as marketers influence and guide the consumer along the process. At the point you are the obvious choice it is because there is a comparison to competitors. Marketing is looking at an exchange between a buyer and a seller. ● Marketing is the psychology of business. Sales is one of the functions of marketing but before selling you need to get in their heads and find the need for the product and get them to buy them. ● NOTHING TO DO WITH SALES ● Consumers, Businesses, and Governments are concerned with marketing ● The marketing “problem” is finding a need in society and filling it Maslow's Hierarchy of Needs - find the needs of consumers and fill them. Ease phase level needs to be satisfied until a consumer can move up to the next level of needs Self actualization (hobbies, travel, edu) Ego Needs (cars, furniture, credit cards, stores, liquors) Belongingness (clothing, grooming products) ● ● ● ● Safety (security and protection - insurance, alarms, retirement, investments) Physiological (water, sleep, food, medicines, staple items, generics) Marketers need to find a need on this list and fill it Marketers find a need and fill it. They don’t create a need, the need is there Smell Test- how will I feel in the future. Am I going to be proud of what I did? Consumers have choices like competition and so do marketers Market Analysis ● What marketers need to know ○ Consumers - potential consumers ○ Competitors ○ Context - the environment that our company exists, this is what puts pressure on our consumers in a competitive perspective (Nike vs Adidas) ■ Nike differentiates by saying “Just do it” and more athletic products . Adidas is more fashion based Consumers - how are we going to look at our consumers who are going to have the highest probability of fulfilling the marketing mix (for footwear: everyone wears shoes) ● Market Size ● Demographics - age, income, education ● Geography - urban, hip, chic ● Psychographics - values, motives ● Useage & Frequency ● Occasion - big holiday coming up (Halloween: if your in the food business or costume business you are going to profit) ● Importance of Features - benefits derived, what does your phone help you do ● Information Sources - where do you get your information Competitors ● Number and Who - Product Line. ● Strengths and Weaknesses - strengths and weaknesses of competitor, Your strength could be their weakness ● Product Offerings - how will you fill a need and differentiate. Look at product offerings and find an empty space and fill it Context - Environmental Scan by looking at the world around us. At the heart of it is the consumer. ● Economy ● Trends ● Regulations Types of Markets ● There are various types of markets but the same general concepts apply to all markets ○ Consumers (B2C) - if a consumer buys it - Consumer buying toothpaste at CVS ○ Business to Business (B2B) - if another business buys it (Dentists or Hospitals buying toothpaste but they are reconfigured and smaller) ○ Government (B2G) - government buys toothpastes but if your in the desert it is going to melt so you must reconfigure the product ■ Follow the money - who's paying for them Strategic Questions ● I like sneakers (Adidas) ○ Industry: Footwear ○ Which segments should we consider? ■ Old ladies who need comfortable sneakers or a fashionista girl or cool guys who match their fashion to their shoes ● Old ladies do not want adidas they just want comfortable sneakers so they can walk. The fashionista does not want to wear sneakers with a dress. The guys can wear the sneakers to the gym or for fashion. Marketing Strategy ● Segmenting (what adidas would do) ○ Demographics: age, gender, disposable income, education ○ Geography: country, region, urban, suburbia ○ Psychographics: feelings, values, motives, beliefs, personality achievers, well experienced, hard workers, goal achievers ○ Usage & frequency: sporty, everyday, budget, elite, fashionista ○ Type: casual-everyday, mass, active sport, premium leather, profession ○ Lifestyle & Behavior: Benefits, gym regular users, sports lovers, athletics, image seekers, brand matters ○ Price points ■ Used on a scale (75, 129, 159, 249) use of 9 makes consumers think they are spending less ● Targeting (find your cluster and four P’s and what kind of products can you design at a price someone is willing to pay) - Athletic footwear sector ● Positioning - How do we position the product to fill this segment? ○ Find a need and fill it What is the Marketing Mix? (4 P’s - our toolbox) ● What is the Product? ● What is the Price of the product? ● Where should we Distribute the product? (Place) ● How should we Promote the product? Product Life Cycle (PLC) ● Models product life overtime - how products are born, they live, they grow, they die ○ Models impact of time on sales and profits for product overtime ○ Sales lag profits ● Introductory Phase - they are born (Electric Cars) - Tesla ● Growth- Hybrid Cars - Toyota Prius - more consumer lower the price to reach more people ● Maturity - Smartphones, Ford (number 1 selling vehicle) - as sales grow in the maturity phase we see a decrease in profits and this is because our competition is coming in and taking our market share or we are lowering our market price. ● Decline - Videocassette recorders, Cadillac Product Mix Changes Depending on PLC ● The way you manipulate your 4 P’s depends on what phase your product is in What is the Product Strategy? ● More than just features! ○ Brand Experience ○ Packaging ○ Before & After Sales Services Three Levels of a Product ● At the center is your core product benefit - benefits your products bring (Starbucks - hot cup of coffee) ● Actual Product - quality, fashion, style, does the brand mean anything (how does starbucks differentiate) ● Augmented Product - what can I offer to surround your desire to receive a cup of coffee that is delivered and if you come to starbucks you get music and wifi. You may get a loyalty card. What is the Pricing Strategy? ● What is the consumer's willingness to pay for the product? (why are you willing to pay to get your haircut on Newbury) ● What is the consumer's ability to pay? ○ Cost plus the markup - Samsung vs Apple- how much did it cost to make it and how much are you selling it for ○ Prices that are offered by competitors - competitive prices ○ The value of the product as seen from the consumer - perception of value - Apple is new and hip. ○ Dynamic pricing - when you go on Expedia, Tripadvisor, Amazon they know how many times you are searching and the more you search the more the price goes up ● Price points (price scales) ○ Scale of Possible Prices ○ $175- $129 - $159- $249 Break-Even point ● Sales cover the fixed costs of the product or service being offered ○ In the hope that you enter the land of profitability (land of gravy) ● Break even = Fixed costs / (selling price - variable costs) ○ Fixed costs are operating costs ○ Variable costs are the costs of the goods - easy because everytime you sell a item you cover the cost, But you do not cover the operating costs. ● If the fixed cost is 200k and the variable cost is 10 per item, the retail selling price (RSP) product price is 15, the company will break even at 40,000 units. This is before they can make any kind of profit What is the Distribution (Place) Strategy? ● Direct (straight to the consumer) ○ Companies website, retail website, telephones, direct mail, kiosks, mall carts, vending machines ● Indirect ○ There is a middleman (brokers, wholesalers, distributors, manufacturers representatives, retailers) - they are paid a percent of a profit but they have access to consumers that manufacturers might not have ● Multi-Channel ○ A combination of direct and indirect strategy Promotion Strategy ● Direct marketing, PR, sales promotion, personal selling, advertising, and online methods are used to communicate with the target consumer Sales Promotion ● Consumer purchases and interest with dealers are stimulated by short term activities, more sophisticated sale like selling cars or house where the consumer needs more information ○ Word of Mouth ■ Word of mouth occurs when people recommend products to their friends and family by telling them (schools restaurants, car shops, where did you get your haircut, who's taking care of your child) ○ Viral Marketing ■ Some companies pay social media celebrities to promote their product on their accounts and give positive opinions about it ■ Some consumers are paid (with company merch etc) to promote the product ○ Social Media ■ Blogging and websites ● Strategy is WHAT YOU DO NOT DO ● Conscious decision to focus on specific communication media (choose your methodology so consumers are influenced) ○ Based on target audience ○ Buying behaviors and usages Public Relations (free) ○ PR groups are responsible for building relationships with their consumers ○ They are responsible for reading public attitudes towards their products, and in turn change procedures in response to the demands of the public ○ PR executes a plan that is used to garner public understand and acceptance of their goods or services ■ They listen to the public, and must be responsive to the public's needs Publicity (cannot control the story or the publicity when people are talking) ○ Information about a company, organization, or product that is distributed to the public by media and not controlled by the seller of the company ■ Its free, reaches people that would not be looking for this product, it's more genuine to the consumer than conventional advertising, and there is no control over the story Marketing Ethics ● Upsides ○ Marketing is used to look for solutions to problems and needs ○ Makes people aware of the solutions to this problems ○ Creates a combination of features, prices to deliver benefits that satisfy the needs of the target segment (create a perfect solution to the problem in the segment) ○ Convenient access to products ● Downsides ○ Influences people to want to buy things that they don't actually need ○ Low quality and high prices (cheats us) ○ Product is promoted better than it actually is Warby Parker is and SBC corporation that is a good example of a company that markets well. They are good at hitting all four of the P’s. 1. They reshaped the eyewear industry 2. They needed to change the consumer behavior, reshaped consumer demand, and treated their customers as partners 3. Skillful execution of the marketing mix 4. They gave eye glasses to disadvantaged population 10/1/18 Operations Management ● Operations Management managing the process that brings inputs and converts them through some processes to outputs. All about getting work done - marketing, finance and accounting, organizational behavior - there is process in all of this no matter what kind of work you do What is Operations Management? ● Marketing is about understanding customer needs in order to be able to create value ● Operations is about realizing that value (making it real and implementing it) by producing the goods and services that customer purchase ○ Marketing finds out what customers want and Operations deliver what customers want ● Operations Management is the business function concerned with designing, controlling, and improving the process of producing goods and services ● What's a good? - something tangible that you can buy or sell (product) ● What’s a service? - something intangible (a haircut - you don’t walk away with a product. It not tangible but it adds value to the consumer because it meets an eed the customer has) Restaurant is a service and a good ● Pure Good (has no service associated with it) ● There is a bundle of good and service occurring - neither is particularly useful without the other (Examples: A car you buy the good but you get service from the person helping you and when you get your tires checked. A cell phone is a good but the service the provider) Operations: Creating and Delivering Value ● Good Stuff Cheap ○ Good: Effectiveness - the extent to which a product and its delivery satisfy the consumers wants and needs (meeting the needs of the customers and the states goals the organization has) ○ Stuff: Goods and Services ○ Cheap: Efficiency - the extent to which products are produced using the fewest resources necessary ■ Easy to be efficient if you don't have to be effective ■ Easy to be effective if you do not have to be efficient ● You have to be both at the same time and their is a tension between the two Operations: Creating and Delivering Value ● How are effectiveness and efficiency achieved? ○ Knowing customer needs (we do not want to deliver a good that customers do not want) ○ Understanding technology (think about how we can innovate in order to be competitive) ○ Innovation ■ Design ■ Technology ■ Process ○ Deploying and Coordinating Resources ■ Process Design ■ Process Execution (manage and oversee these processes) ● Discipline ● Consistency Process Analysis ● Process in Starbucks ○ We care about waiting time ○ Starbucks can't wait these needs if they don't think about task time and set up time, etc because this is how they get you the coffee that you want with a shorter wait that you want ● What is the Process? ○ Do you care about inventories, queuing times, cycle time, idle time, task time, setup time, throughput time and capacity when you go to Starbucks? ○ ● ● ● ● ● ● NO, you care about coffee and short waits but they need to think of all of this to get you what you want So what does one have to do with another? This shows the relationship between the different tasks done in a process, the order they are arranged and what kind of waits are involved in the process ○ Task can be a rectangle or circle in these diagrams ○ Flow is the movement from one step to the next Put these together to make a process flow diagram Task Time: Task is work performed as a station. Time required to complete a task is task time. This is what the worker at a station thinks about ○ Task Time = Run Time + Set-up Time Throughput Time: Time for a single unit (customer) to get from the beginning of the process to the end. This is what the customer thinks about. This includes waits and task times. This is from when you enter the line and when you walk out. Cycle Time: time between completion of successive units at the end of a process. If you stand there on a busy line at Starbucks and you watch how often a customer walks away with coffee. The interval between one customer is done and the next is done is cycle time. (conveyor belt - interval between each product being done is cycle time) ○ A bunch of different task in sequence and they all have different times associated with them (take different amount of times to perform). What determines the cycle time? The task that takes the most time or has the least capacity also known as the bottleneck. The bottleneck determines the cycle time because the process can only produce as fast as the slowest task will let it produce. ○ Cycle time is a process measure and Cycle Time determines what your Capacity is ■ ● ● Bottleneck time is always the same as the cycle time. Bottleneck drives the cycle time ■ Capacity: How many units can be produced (or customers can be served) in a period of time. Measured in units per period of time. Wait time has nothing to do with capacity ● Capacity = Time Available / Cycle Time ○ Cycle Time is in seconds so put your time available in seconds too Queue Time (Wait Time) ○ Time spent waiting where no value is added ○ The input is not transformed in any material way ■ The cup for your drink ■ The people Throughput Time ○ Throughput Time= Queue Time + Task Time ○ Time required for a job to go from start to finish Capacity Utilization - efficiency measure ● The percentage of capacity used. How much of your capacity you are actually using. How well we are using our capacity. What the demand was vs what we were able to produce. Tells you when it is time to hire more workers in order to achieve your effectiveness goals ● CU = capacity required / capacity available ● CU = demand / capacity ● The right capacity utilization depends ○ 911 call center - the goal is to always be available and answer the phones immediately. You have to have a low capacity utilization in order to do this (16%) ○ Emergency room- the goal is to serve the most extreme cases immediately. In order to do this you need to prioritize patients (triage). The goal is not to see all patients immediately. If you have low capacity utilization in an emergency room it would cost too much to pay the doctor. ○ Fast Food: fast and cheap. Low capacity utilization for fast and high capacity utilization for cheap. Fast food restaurants achieve fast and cheap at the same time by using machines because it costs less than labor and they can serve customers faster. They have a narrow menu and you can not customize a lot. They hire cheap labor. McDonalds is happy with 30% capacity utilization. ● What is the right capacity utilization for a process? - balance between efficiency and effectiveness ○ As high as you can make it (100% is the limit) and still meet customers requirements - like quality, fast, and or reliable delivery, or customization ○ Capacity utilization is an efficiency measure that relates directly to cost and inversely to customer service ○ ○ Queue times rise exponentially as capacity utilization passes 80% and approaches 100% If cost is the only thing that matters then a high capacity utilization is desirable. If quality, fast or reliable delivery or the ability to customize the product counts more than the price than you want a lower capacity utilization Different Areas of Supply Chain and Strategy Management ● People ○ Workforce: selection (most companies want to select people who they are going to train for years and get value from. Training and selection processes are different for this. Fast food restaurants will hire anyone. It is an initial training job.), training, retention ● Organization (organize the work of the workforce. Are they going to organize people to innovate) ○ Structure, rewards, performance measurement, culture ● Place (how many production facilities do you need, how will they be laid out, how will they be in interaction with one another) ○ Facilities: Location, layout, network ○ Capacity: (how much product do you need to be able to produce, where does it need to be able to be produced, can you have a big production facility or do you need to have a lot of smaller ones to be closer to the customer. When you add capacity, do you build entirely new facilities do you put additions on existing facilities) Growth policy, economies of sale, additions ● Partnerships ○ Supply Chain ■ Vertical Integration (all products start out being mined or harvested or collected/ refined then you can fabricate parts from them, then you can take these parts and assemble them and then you have to distribute them. If your company is responsible for all the activities in this chain then you are vertically integrated. If you only do a small part, Example Apple only does the design and marketing and distribution for iphone but they do not make any parts, they are less vertically integrated also known as vertically disintegrated), Coordination (you have to coordinate everything with partners and suppliers. You have to provide information to suppliers and give direction. Even though Apple is vertically disintegrated they still work heavily on coordination). If it not necessarily your own research and development that is creating the technology or innovation, it may be your suppliers or distributors. This is true at McDonalds, because their suppliers and franchisers are responsible for the innovation taking place at McDonalds. ● Processes ○ Technology and Innovation ■ ○ ○ Project, job shop, cell, flow, humans vs machines, product innovation, process innovation (Thinking about what technologies you want to use. In the U.S we automate more manufacturing these days; there is less labor involved. In China, there is much more labor production because they have a lot of labor available that is not skilled so there processes are more human based. You also think about product and process innovation. How are we going to use the latest technologies to make our production more efficient and effective. There is not a lot more information technology used on the products as well the processes used to make the products. There is now innovation in the manufacturing realm and the services realm.) Execution ■ Planning and Controlling, QC, Maintenance (looking at what needs to be done and planning it and having controls in place to see if it is done properly. Have preventive maintenance so you anticipate when machines are going to need fixing so you can produce consistently) Improvement (Improving processes) ■ Continuous improvement, six sigma, lean, reengineering (these are formal programs that are ways organizations that organize to push improvement through their processes) Services and Manufacturing ● The Combinations: ○ Purve Service (you only receive a service - a lawyer. You do not get any material, you only get their service) ○ Pure Good (something where you purchase something where there is no service associated with it. Usually there is a service like delivery Operations Management : The Value Chain Perspective ● Organizations Add Value By: ○ Harvesting Raw Materials ○ Producing Basic Materials ○ Fabricating Parts ○ Assembling Products ○ Distributing Products ○ Selling Products to Customers ○ Providing After-Sales Services ○ Reclaiming Materials through Recycling ● Some firms perform several of these activities - those firms are vertically integrated (Ford Motor company in the 1920’s did it all. Toyota in the 20th century only did some parts. You can have different strategies about vertical integration and how you organize the value chain and still both be successful) ● Your company is responsible for some kind of transformation, either material or work or information your company does. Supply Chain: To Make it or Not? ● Competition is becoming less about company vs company and more about supply chain vs supply chain ● Companies may have to take ethical responsibilities for the actions and errors of the supply chain (you can not get away with bad factory conditions anymore. As companies become less vertically integrated and rely on the supply chain for their production, they have to in turn take responsibility for the suppliers they are in contract with) Examples of Effective Supply Chain Management ● McDonalds ○ Effective partnership policies ■ ■ ● Loyalty to suppliers Progressive franchise policy ● Franchises profit before McDonalds receives payments ● Vital to innovation ○ Policy Effects ■ High consistency ■ High innocation levels ■ Industry leadership Walmart ○ Trailblazers in supply chain organization ■ Sharing of demand data ■ Leader in logistics and supply chain technology ■ Point of use delivery ■ Vendor managed inventory ■ The delivery dot ○ Results ■ Small, rural based competitor to industry leader and top of Fortune 500 Ethical Issues Arise from Supply Chains ● Safety ○ Union Carbide: Bhopal, India ○ Rana Plaza factory collapse in Bangladesh ○ Honda, Nissan… Takata Airbags (companies run into problems that blind side them. Takata was supposed to be a reputable company, but they allowed defective airbags to go out. This creates problems for Takaa and automobile manufacturers) ● Worker treatment - wages, hours, wellbeing ○ Nike: sweatshops ○ Apple: foxconn ● Environment ○ Chemicals ○ Steel Quality ● The ability of a product or a service to consistently meet or exceed customer expectations. Quality is about effectiveness. Can you meet your customers needs. Cost of Quality (Joseph Duran wanted to capture the attention of top management. It is not always easy to put numbers to it. Duran believes it is useful for getting attention because if you want to get a CEO’s attention, quality is abstract. The cost of quality framework puts it in terms of cost and profitability and that is something a CEO will understand. You can use this to keep score to what quality is doing to your profitability) ● Conceptual framework ● ● ● ● Not always totally quantifiable Useful for attention getting Useful for a mechanism for keeping score Consistency of measurement Four Categories of Cost ● Cost of Prevention (things that you do to make your processes more robust so they are less likely to make a defect in the first place. Examples are automation or training people how to do things and how to identify variation in the process so they could stop the process when they see the variation getting bigger) ● Cost of Appraisal (the money you spend to check the quality of the product you are creating such as paying people to do inspections or purchasing equipment to do inspections) ○ Increasing overall quality results from these 2 investments ● Cost of Internal Failure (occurs when your production process creates a defect and the problem is identified and remedied before it gets to the customer. This is easier to identify in manufactured goods before the customer receives the product but harder in services) ● Cost of External Failure (when that failure reaches the customer and is identified after the customer is in possession of the service or good) ○ Increasing overall quality results in lower incidence of these 2 categories ● The heart of the cost of quality is the notion that the money that you spend on prevention and appraisal is going to improve the quality of your output. When you improve quality internal and external costs start to come down. Eventually they reach a point where you pay more for prevention and appraisal than you get for a reduction in internal and external failure costs. If you look at the cost of quality (cost of prevention and appraisal + external and internal failure cost) that is your total cost. There is an ideal level of spending on prevention and appraisal that will minimize the cost of quality. If you spend enough on prevention and appraisal you can create a substantial decrease in failure costs. Cost of Internal Failures ● Scrap- wasted material and labor ● Rework- doing the job twice ● Retesting- checking the second time ● Downtime- capacity ● Yield Loses- goods unavailable for sale (New Balance shoes that have defects they sell for a lower price) ● Managing Defective Materials- making sure the bad one do not get out (you have to pay to throw out certain materials) Cost of External Failures (external failures are a way to lose retention) ● ● ● ● ● Customer complaint adjustment Returned materials- restocking and reshipping Warranty charges (refunds) Allowance for defective materials Lost business Cost of Appraisal ● Incoming inspection (paying people) ● In-process inspection ● Final inspection ● Testing devices ● Destructive testing (some products you have to destroy in the process of destructing them) ● Inventory safeguarding (take care of inventory so they quality does not detoritate before reaching customer) Quality of Prevention ● Quality planning (six sigma) ● Design (prototyping, field testing) ● Education and training ● Process control ● Information reporting ● Quality improvement programs, quality improvement teams (QIP and QIT) ● Supplier involvement Trade-offs ● Appraisal and Prevention (investments) ● Internal and External Failures (expenses) ● As appraisal and prevention costs increase, the level of quality improves and internal and external costs decrease MODULE 2 10/22/18 Strategy ● ● Strategy is the theme of an organization that helps drive the organization to profit maximization Wawa is a convenience store and gas station and so is Cumberland farms. Yet, people refer to Wawa as “the best place on earth”. The difference is Wawa’s strategy. At Wawa the food is fresh and the people are very friendly. It is constructed with no automatic ● ● ● ● doors so people have to hold doors. Wawa is also half employee owned so this is why they seem so happy to be working there. ○ Wawa has made a set of very clear distinctions and tradeoffs of how they want to operate and they have innovated a completely different strategic position than competitors Sports Authority strategy: No strategy because they are gone Mitchell & Ness: specialized in athletic clothing especially throwback uniforms and nostalgia. They were never are big as sports authority but this strategy enabled them to be successful Strategy involves doing something very different from your rivals and ending up receiving competitive advantage. It is about a particular plan for achieving profits. South Park: The Underpants Business Video ○ Business Plan: ■ Phase 1: Collect Underpants ■ Phase 2: ??? ■ Phase 3: Profit ○ Phase 2 is where the strategy should be. Unless they have a clear plan on how they are going to turn their product (underpants) into profit, they do not have a clear strategy Five Features that make Strategy different from other functions of Business 1. The goal of strategy is to achieve high profitability within a firm over the long term. a. Some companies main goal is not to achieve high profitability/profit maximization is not their main goal: Hersheys is owned by a charitable trust, on behalf of a school not shareholder. Hershey's is not purely for profit. 2. People in strategy see the field as the brains of the business because it helps define the sets of choices that all of the other functions (accounting, finance, marketing) ought to make. We help define the parameters within the other functions in a firm end up operating in order to profit 3. Rivals respond to your strategic choices. Northeastern is defined by the co-op experience, BU took a look at the co-op experience and decided it is not for us. But we have responded in some ways and the co-op experience that Northeastern uses is a response to things other universities have done. Your rivals are always looking at what you are doing and you are always looking at what your rivals are doing and you respond to each other in parallel. This is a long term game but when you are thinking about gaining competitive advantage you always have to ask “if we do this, how are our rivals going to respond to it?” 4. You have to look outside your firm to the external environment (what's going on in the industry and world) and then look inside the firm in order to formulate strategy and choose your strategic actions. Strategy is both an outward looking activity and inward looking activity because both are going to affect long term profits. 5. Firm strategy involves tradeoffs. This means if a firm has a clear strategy it is going to do somethings and not others. For example, Wawa is disciplined in choosing locations. It is only located in certain areas, mainly Philadelphia but many Philadelphians moved to a certain part of Florida so they opened there. It is given away the possibility to expand its business to maintain its strong and unique culture. Three Analytic Tools in Strategic ● SWOT Analysis (the most basic form of strategy analysis) ● Five Forces Analysis (a tool that helps us analyze whether a particular industry is likely to achieve high profits) ● Competitive Positioning Analysis (our first attempt to understand within industry whether one firm is likely to out compete or under compete its rivals) Five Features of Strategy ● Feature 1: Strategy is about understanding how to maximize long term firm profits. If you can figure out ways of increasing your price without increasing costs, your profits will go up, figure out ways of decreasing costs and keeping prices constant, figure out ways of increasing the number sales, these are all ways you will profit. This is the goal of strategy, in doing this you are implementing different approaches in order to find the highest profitability ● Feature 2: Strategy sees itself as the brain that coordinates the various functions of business. Strategy tells all of these functions which directions to move in. If an organization has a clear strategy, it can give correct budgets to different functions such are R&D (research and development) and marketing. If it is a company like Gillette then yes, but if it is a private label (Target brand) then no! Strategy is the one who makes the choices for the functions and tells them how they should behave. ● Feature 3: Rivals are out there and always watching us. They are going to make decisions based on the decisions we make. A strategist must focus on the fact that rivals respond. Suppose you are Coke and Pepsi. Coke comes up with a new flavor, can they gain competitive advantage? Yes, for a short time but right after coke introduces vanilla coke, pepsi will do the same in the next couple weeks. You won't gain too much advantage for coming up with a new flavor. Coke realized that men don't like saying diet coke so they changed the name to coke zero and pepsi did the same and changed the name to pepsi max. It is hard to gain competitive advantage with flavors. It is also hard to gain competitive advantage with spokespeople because as soon as Pepsi got Messi in an ad, Coke got Ronaldo. You also won't gain competitive advantage through packaging and innovation. The way that Coke and Pepsi have competitive advantage is that they are the two main soda companies, they own 75% of the market share. Anything they do, their rivals are going to respond to. In the Princess Diaries clip, we see an example of strategic thinking and knowing your rivals. ● Feature 4: Both internal factors and external factors are going to matter for firm profits. Target is more profitable than JCPenney and Sears, but Walmart outperforms Target. Walmart is successful locating in rural areas, with less competition. Pfizer (pharmaceutical industry) has a much larger profit than Walmart, because they are in ● different industries. Another examples Albertson’s who owns many supermarkets, Pfizer still has more profits, not because they are smarter but because of their industry. The University of Phoenix has larger profits than supermarkets, it is a for profit industry. It is a very high profit firm. Altria which is a tobacco firm also has a higher rate of return than supermarkets. It is because the tobacco industry has a lot less major firms than the supermarket industry. The five forces tool will explain why the tobacco industry is high profit and the supermarket industry is low profit. Some industries are high profit and some are low. Within industry, some firms have high rates of return and other have low rates of return. The jobs of strategists explain why firms profit and improve firm profitability. They also create value for people rather than shareholders. Feature 5: Tradeoffs are the essence of firm strategy which means firms are going to do some things and not do others. An example is that BU is a premium priced organization, you could have saved money at community college but you get great education at BU and great location. If BU was a profit maximizing industry, they would rent the STUVI apartments to the public for more money. BU invests more in a career center rather than a football team. You could have went to the University of Phoenix and slept during class, but they invest a lot more in online presence. They invest a lot more in IT, they are a low cost provider of education. They have made some sets of tradeoffs and have made some. The University of Phoenix is a low cost provider of higher education but they have a completely different value proposition. They have a completely different strategy, but they do have a higher profitability with their low cost strategy Three Tools of Strategy ● Swot Analysis: basic tool that does a bunch of things adequately but nothing really well ● Five Forces Analysis:a very good tool for explaining industry average profits ● Competitive Positioning Analysis: good starter tool for thinking about how firms make tradeoffs and end up being different than each other Swot Analysis ● Simplest Business Tool ● Stands for Strengths, Weaknesses, Opportunities, Threats ● It divides us the world into good and bad and then divides into things that are internal to the firm and external ● Strengths: Internal and good ● Weakness: Internal and bad ● Opportunities: Outside and good ● Threats: Outside and bad ● It is good at beginning a conversation about strategy ● It is the most widely used tool and easiest but not the most powerful ● Strengths and Weakness could be the same thing (BMW in Germany, price is high and quality is high because high pay for workers) ○ Well strength is good quality but weakness is high price Five Forces Analysis ● Michael Porter is godfather of strategy. In his 20s he began writing to help strategy work. His initial job was a PHD Economist working on industrial organization issues. Porter asked what we could do to increase industry profits relative to what the consumers get. Porter’s first ideas said you could make your industry less like perfect competition and more like an oligopoly or monopoly. This is because perfect competition has zero profit and oligopolies and monopolies have high profits. There are a couple ways to do this: you can merge all the firms in the industry to make a monopoly. This is what Rockefeller did, he bought up all the companies in the oil industry and made an oil trust. The other thing you can do is innovate, come up with better products. This will also get you away from perfect competition and be more like an oligopoly. Porter's five forces framework is an application of his incite that some firms are better than other in terms of profitability, and those firms are more like an oligopoly. The five forces analysis asks you to access where are the forces are strongest. For example if buyers are strong they will push down prices, and if they do this it will be hard for a firm to get profits. If suppliers are strong they will push up costs, if costs are high then there is a problem. It could also be that in the industry rivalry is high, the type that leads to lower prices or higher costs. An example is farmers lower prices of crops in order to sell them. Coke and Pepsi do not have price wars, they insist on high prices. Another thing that can drive down profits is if it's easy to enter the industry. It is hard to enter with another soda brand. Substitutes are also something to worry about. You can drink beer as an alternative to soda but the prices of alcohol are higher. Even free water is not a competition because people are addicted to soda. If you have an industry where none of the forces push down profits, which is typical in an oligopoly, you will have high profitability. If you have an industry where all of the forces push down profits, you will have low profitability. An example is the supermarket industry. Supermarkets have many suppliers, name brand firms are very important in supermarkets such as kellogg's and general mills. Buyers are strong. Many substitutes and rivals compete with prices. The five forces drive down supermarket profit. The five forces drive up the tobacco industry profit because it is an oligopoly. ● Five Forces: ○ Threat of Entry ○ Supplier Power ○ Industry Rivalry ○ Buyer Power ○ Threats of Substitutes Competitive Positioning Analysis ● The first of Michael Porter’s breakthroughs. He says all firms need to make two key trade offs as part of their strategy. 1. They have to decide whether they want to be a premium priced firm like BU or a low cost firm like the University of Phoenix. If you fail to make this choice it will be hard to obtain competitive advantage so it will be hard to get profits above the average. 2. You have to decide if you will serve all market segments or one or two. If you are only serving one or two you are a niche product, example Maserati. Or you can sell to everyone and have a broad product. BU is broad because you can study at multiple different schools. Bentley University is just a business school, so they are narrow. Food trucks are narrow low cost leaders, they serve a specific population and they don't have a place to sit so they lower their costs. The idea behind competitive positioning is you decide who you are and make particular tradeoffs to serve whatever approach you make. If you want to be high priced you need to choose things to convince people to pay these prices. 10/24/18 Corporate Social Responsibility ● CSR started with the idea that business did not care about society, it only cared about money. People thought business was polluting, taking advantage of the people and resources of the community without giving much bac. Over the years business wanted to respond to these allegations. This idea of CSR was first started out by asking what is the responsibility of corporations to society. CSR is how can business affect and impact all stakeholders, not just the shareholders. CSR asks what responsibility does the business have to its customers and employees, what can it do for the community at large. CSR can be also called corporate citizenship and conscience capitalism but they all mean the same thing: when the business is thinking about more than just its financial bottom line Carrol Test ● Four Part System that Corporate Social Responsibility Follows ○ Economic: to make money for the shareholders, profit and economic gain and reduce costs ○ Legal: companies are expected and required to follow the law ○ Ethical:companies are required to do more than the law, to be ethical and do what's fair and right. An example of an ethical responsibility is paying employees more than minimum wage, because minimum wage is very low. Netflix offers paid time off for men and woman expecting or adopting a baby, this is something the law does not require. This is similar to leading by example. ○ Philanthropy: ways in which the company gives back by contributing to charitable organizations. It is now a desired trait in companies. ● According to Carroll, when a company reaches all four points they are doing a good thing. We are gonna learn through Walmart that these four points can be at contention ● ● ● ● ● with one another. It is hard to make a profit and also pay your employees more than minimum wage. It is very hard for companies to be socially responsible. Economists used to say that the only responsibility of business was to make a profit (Milton Friedman). People also argued business is not equipped to handle societies problems. Another argument against CSR was that it dilutes the purpose of business and it gets in the way of business competing on the global stage. If every company was to pay employees over minimum wage, they wouldn't be able to survive. Another argument is that business cannot be competitive if it focuses on social issues. The last argument is that business already has too much power and giving them more power will make them sometimes surpass government (companies are not silent on political issues currently). By giving back and caring for employees, you are able to ensure long term success by avoiding lawsuits and creating a morale that employees actually want to work for you. You can also build brand loyalty. By being more socially responsible you can avoid government regulations, An example of this is the Dodd Frank Act of 2010 which was a response of the greedy actions of financial institutions. The whole area was not regulated and banks were trading for their own account and advantage and there was not a law in place to prevent them from doing this. The financial world was going to collapse so the act was created. If companies can be more socially responsible they can avoid have a big law that affects the industry. Business has a lot of money and the resources to make change so why shouldn't it because sometimes the government does not have the money. Being proactive is better than be reactive. As an example, Tesla, Musk created a beautiful electric car that people buy and love and he came up with it before anyone else did. Musk was a visionary and now all other companies are trying to move in the same direction. The public supports CSR and expects that companies care about society and the environment. CSR leads companies to be more innovative. CSR Greenwashing: companies that claim to be environmentally friendly but in fact their actions show the opposite. Companies are intentionally seeking to convey a message about your company that is not accurate Corporate Citizenship: we are citizens of the country and the world and have certain duties (vote, not harm, obey laws). The same should be true for corporations, if they want to be part of corporate society than they have to be a good corporate citizen. In order to get there, you have to put things into place in order to claim that you are a good corporate citizen. The ultimate goals is to be as transparent as possible. It takes place along five stages and seven dimensions. Sustainability and Triple Bottom Line ○ Bottom Line means financial profit that is the net income at the end of the day) ○ Triple Bottom Line says what about measuring the impact companies have on society and the environment. Companies should be accountable for economic, social and environmental. The goal of this is corporate sustainability. ○ To be sustainable means to use your resources in a way that preserves it for future generations ○ ● ● An example of a social benefit corporation committed to the triple bottom line is Patagonia. Patagonia is warm, fibers are recycled, they care a lot about the environment, they are sustainable, give back to society and gain profit Conscious Capitalism ○ Created by John Mackey (co founder of Whole Foods) ○ He felt the purpose of business was to impact society and solve society's problems and create value for society ○ You can be a for profit business but be conscious of what you do and have a higher purpose and engage your stakeholders. He also believed to have a conscious culture and conscious leadership (leaders that care how the business is affecting society) Creating Shared Value (CSV) ○ Michael Porter and Mark Kramer ○ We can redefine the purpose of business and create economic value in a way that also creates value for society ○ Three Ways to do this: ■ Reconceive products in the market ■ Redefine productivity in the value chain ■ Build supportive industry clusters in the area where the business is located ○ Porter wrote an article with Mark Kramer caled Creating Shared Value. He uses the example of GE (big company behind all the machines today especially light bulb) for the first one. GE brought up eco imagination and they wanted to be cleaner with all the electricity especially the light bulb and they came out with the first eco friendly light bulb and they invested a lot of money with this. In the long term this has payed off and has created $200 billion of wealth. ○ For redefining productivity in the value chain Porter says a lot of companies outsource labor of their products to other countries where labor costs are cheaper, but he said other companies also empower people in other countries so they can make a living. He uses Unilever as an example, which makes hygiene and cosmetic products. Unilever realized a big market was in India, and realized rural areas in India did not have access to their products. So they went there, where unemployment was high especially among women, who couldn't find work and needed the work. They trained woman in these rural areas about the products and to sell their products. They created jobs in rural areas as well as having people in rural areas have access to their products. They took advantage of the supply chain to empower people rather than taking advantage of low cost labor. ○ For building supportive industry clusters means when a business decides to locate somewhere new, how are they helping the other local business around them? New Balance created the big building in Allston, Brighton they wanted to attract employees and have their employees be able to commute to the location, but it was not an accessible location by the T at the time. They wanted the MTA to create a stop. They asked the MTA to create s top but they couldn't because the MTA is in financial crisis. New Balance decided to pay for the platform themselves, because it was worth while for them, because it gained favor with the state and they had a partnership with the state. The company gave back to the state because it recognizes that this is something important to do. Two ways to steer your money in the right place : ● Negative Screen: Industries that you want to avoiding putting money into because they don't have a positive impact on society. You can do a negative screen and tell your fund manager that I wanna make sure the money your investing in a whole portfolio is not going to these certain industries or companies ● Positive Screen: You and your fund manager do research into companies that are socially responsible (financially doing well, caring about the environment, investing in their employees). You want to make sure your money is being funneled into these companies ○ Goldman Sachs has a whole department on social responsible investing. If you want to start your own business and need money, you can go to these banks, and there is a pool of money that will come into you for this purpose. $7 trillion dollars are being invested in socially responsible companies. 10/31/18 Stakeholder Theory ● ● ● ● ● Society is a stakeholder, what you do for your employees, the environment is a stakeholder Stake is a legal right or a moral right or claim that an individual or organization has on a business ○ Example: Employees have a legal right to be paid ○ Shareholders have a legal right to have a return on their investment Stakeholders are any individuals who can affect or is affected by the actions, decisions, policies or goals of an organization Stakeholder is a variant of the concept stockholder (an investor/owner of a business) Stakeholder could be: ○ Primary Social ■ Employees ■ Customers ■ Suppliers ■ Vendors ■ Greater Community in which you are doing business ○ Secondary Social ■ Media ○ Primary Stakeholders are impacted day to day by your actions. Secondary stakeholders are indirect and it's more of an organizational level that they are going to impact you Social Stakeholders Primary Social Stakeholders ■ Owners ■ Managers (board) ■ Customers ■ Employees and other business partners ■ Local communities Secondary Social Stakeholders ■ Government ■ Civic Institutions (trade associations, groups for business, employees or consumers) ■ Media academic institutions (case studies) ■ Trade bodies (umbrella organizations that are usually helping industry) within the labor context there is a group called fair labor association, they are there to help companies with there labor policies. ■ Competitors Non Social Stakeholders (not people and the organizations are representing animals or intangible species, future generations or the natural environment ) Primary Non Social Stakeholder ● Natural Environment ● Future Generations ● Animals and non human species Secondary Non Social Stakeholders ● Environmental interest groups ● Animal welfare organizations ● When you think of your stakeholders, you have to think about who has legitimacy, who has power and who do we have to deal with urgently. You have to prioritize ○ Legitimacy: who has a valid claim to what's going on, the appropriateness of the claim. When Wells Fargo was cheating customers (by signing customers up for products that they didn't ask for and they were charged). And the employees were getting more bonuses. Here customers had a claim that they were dealt with unethically and illegally. For Wells Fargo to have this culture that employees had to go to this length, Wells Fargo instead of taking responsibility blamed it on a few bad employees. The employees were not going to take thus because part ○ ○ of the firm's policy was to create a benchmark that was hard to reach and sell as much as possible. The employees sued Wells Fargo. Power: The ability for you to produce an effect. The customer and employees did this at Wells Fargo, a lot of stakeholders had a lot of power in order to change the leadership and fire the CEO and turn it all around Urgency: how immediately do you have to address the concerns. If Wells Fagon was a unionized work setting and the employees did not go to work and striked, this is a huge humiliation for a company. As soon as they do this you know you need to quickly fix the problem. ● Five Questions every business should ask itself in order to interact with its different stakeholders: ○ Who are they? - make sure you are aware of the activist groups and know how to respond to their threats, how you deal with media, asses competitors, make sure you are aware of your regulations from government ○ What are the stakeholders stakes? - Tesla (Musk made announcement he wants to make the company private, the media want to know why, people think its a misrepresentation) When you make one statement numerous stakeholders will jump on you ○ What opportunities and challenges do our stakeholders present to the firm? Some are on your side and some threaten and challenge you. If you test in animals, no matter how good your product is, Pita are going to be asking you to do it in a way not to harm animals. ○ What responsibilities (legal, ethical, economic, philanthropic) does the firm have to its stakeholders? ○ What strategies or actions should the firm take to best address stakeholder challenges and opportunities? - How do you deal with them. When you are dealing with a non combative stakeholder, you need to figure out how to delicately manage it in a way that's not a bad PR stunt for you. Ignoring a non supportive stakeholder has bad consequences because they get angry and go to the media. Your stakeholders cna present opportunities and make the company prosper. It is best to build relationships with employees and stakeholders (Patagonia pays employees well, gives them time off, provides onsite childcare). Challenges (suppliers saying you are cheap and not paying them enough and they uite on you). GM had a problem with this when the suppliers of a small ignition switch got blamed for something when the ignition switch was faulty and people died. The suppliers told GM from the beginning that it wouldn't hold up but GM said to ignore it. ● You deal with stakeholders in a sit down meeting and indirectly would be over the phone. If you know that you were in the wrong and were not paying people the hourly rate, you're going to have to accommodate right away. Sometimes you are going to have to resist the stakeholder because there is nothing you can do. (Example: President Trump putting pressure on Toyota and Ford to bring manufacturing back to US. These companies need to resist if they want to make a profit and satisfy their shareholders. A lot of companies don't bring labor back to the US because they can't but they make sure the working conditions for those abroad are better). Sometimes you need to resist the wishes of your stakeholder because it would ruin your business plan. Four Stakeholder Types ● The Supportive Stakeholder ○ Always on your side, high level of cooperation and low threat level ○ Board of Directors or high level managers because they go in favor of what management says. They don't fight for compensation because they are already well compensated ● The Marginal Stakeholder ○ Low threat and low cooperation. They are the stakeholder you don't think about often, low level employees or an activist group that does not have much power or media attention. You monitor them but you do not have to be defensive ● The Non Supportive Stakeholder ○ No matter what you do they won't support it. High threat level and low cooperation level. Disgruntled employees. Employees can be in the mixed category. Pita is non supportive because it always do not support companies that test on animals and they always challenge you ● Mixed Blessing Shareholders ○ Employees that like you until something happens. Customer that liked you until you put something out they dont like. (Apple- used to like but not with all the upgrades and bad customer service) Stakeholder Engagement ● As a company if you really care about stakeholder engagement (you should care because if you dont they will make life difficult) create part of your overall strategy a way to keep them all happy, be as transparent as possible, be supportive. ○ Interaction with Stakeholder: deal with stakeholders and put a person to person meeting with a non supportive stakeholder because it shows you will hear them out and see what you can do about it. If you deny them access and ignore them it will not get any better ○ A ladder of stakeholder engagement (low to high engagement) ○ Transparency ○ Sustainability: Exxon needs to invest in renewable resource because of high fossil fuel and thy need to talk to shareholders about what strategies they are going to use. ○ Dialogue: always engage and keep the lines of communication open Strategic Steps towards global stakeholder management ● Governing Documents: Howard Schultz with starbucks focused on what value the company was going to bring to society. ● Values Statement: Create this in your values statement and live through it. ● Measurement System: Measures the value they are creating for society and the environment. This shows you are serious about it and taking it to the next level besides just rhetoric MODULE 3 11/7/18 Bias and Blind Spots: Common Causes of Unethical Behavior ● We want to understand what is causing ethical breakdowns and what is happening when people sign customers up for things they did not ask for. VW created a cheating devices in a software to pass a mission’s test Why do good people let bad things happen? ● The element of not right is ethics ● Movie Clip from Wall Street shows a businessman on Wall Street and at the time he is a corporate rater (modern day shareholder). He buys a stake in a public company and fires everyone and tries to turn it around. People do not appreciate people like this telling them what to do. He talks about how greed can lead to unethical behavior. He says he does not destroy companies he liberates them. He says greed is good and right. This shows our capitalist society, you have to work hard for something you want like love or money. It is a good thing to work hard but you have to realize there are limits to your behavior. What are Ethics? ● Once you start on a path of unethical conduct it will evidently leave to illegal conduct ● Ethics are beyond the law, what more can we do that's fair and honest. It is an unwritten code of conduct ● Unwritten rules that we have developed for our interactions with one another ● Standards of conduct generally accepted that govern society ● Virtues in action such as honesty, fairness and justice What are Unethical Decisions? ● Those that are dishonest and unfair and we want to stop businesses from making unethical decisions ● Decisions that are dishonest, unfair, and unjust and costly for you and your business ● Sometimes these decisions are unconscious Common Causes of Unethical Breakdowns ● Bias (what we have internally, our own issue. We do this consciously or unconsciously): Implicit Prejudice, In-group Favoritism, Overclaiming Credit, Conflict of Interest ● Blind Spots (we overlook the unethical actions of others and we do not stop it and we allow for it to continue because we are blinded by certain factors): Ill- Conceived Goals, Motivated Blindness, Indirect Blindness, Slippery Slope, Overvaluing Outcomes ○ Bounded Ethicality: the idea that even when we try to behave ethically, it is difficult due to a variety of organizational pressures and psychological tendencies of human nature Different Forms of Bias (behavior in ourselves that lead to unethical decisions) ● Implicit Prejudice: the tendency to have unconscious stereotypes, associations or attitudes about other individuals (as an organization you are preventing yourself from being around the best possible candidate. Ex is Faziendero having a kid and being counted out for being a mom and there is a perception that she is not as serious about her job and does not have time. No one ever asked her) ● In-Group Favoritism- the tendency to show favor to those individuals that are like ourselves in terms of race, religion, employer, alma mater, etc. Ex: white loan officers being lenient with white un-qualified loan applicants; cheating among Carnegie Mellon students (you exclude people more qualified. If your an interviewer and you see someone from your hometown and you hire them over someone more qualifiedNepotism) ● Conflict of Interest: the tendency to be partial because of a tension between self-interest and professional or public interest. Ex: lawyers advising clients to accept settlement over trials; physicians accepting money to refer patients to clinical trials (as a board member you have the duty to the corporation and your self interest. It is really important to balance personal and professional interest. You need to disclose your interest and remove yourself from decision making when you can be bias) ● Overclaiming Credit: the tendency to overrate our individual contribution to groups leading to unfair judgement of others. Ex: SM131 students overestimating contributions to team assignment on TLA (we all think very highly of ourselves and others think they are really good and we cannot all be right; if you feel like you deserve all the credit this is a disincentive to the other team members so they will not try as hard) Introduction to blind spots: video with people passing and everyone misses and is blinded to the man in the gorilla suit because you are so focused on something else Blind Spots: when we overlook or put on to someone else the unethical behavior. It is when we allow others to continue engaging and we do nothing and there is an incentive to do nothing ● Ill-Conceived Goals: setting goals and incentives to promote a desired behavior but they encourage a negative one. (If someone sets a goal that unrealistic and people have to go through extensive measures to get through the goal this will create cheating or unethical behavior. Sears had car mechanics having to repair a certain amount of cars ● ● ● per hour, and after they fixed the cars available to be fixed and they fell below this number, they began fixing things that did not need to be fixed and charging customers more. Sears goal created this effect of unethical behavior among the sales associates. Wells Fargo put a quota on their associates and no one needed the services so associates just signed customers up for things when they did not ask to be in order to meet this unrealistic quota and system. Management creates this culture.) Motivated Blindness: overlooking unethical behavior of others when it is in our best interest to remain ignorant (Bari Bonds, a baseball player who was taking illegal substances to enhance his performance, had changed because he was bigger and stronger and was batting better. Management of the team did nothing because they were benefiting from his increased aptitude to play. He was later forced to testify. Joe Paterno was the head coach of the Penn State football program which was very successful. One of his assistant coaches was molesting youth in the Penn State locker room. People came into the locker rooms and had evidence that he was doing this and they did nothing. These people must have went to Paterno but he did not fire the assistant or speak to him. The victims came forward and the man is in jail. Paterno allowed for it to continue to happen because Penn State was doing so well and if it got out it would affect his job. He died before criminal action was taken.) Indirect Blindness: holding others less accountable for unethical behavior when it is carried out through third parties (Pass off an ethical decision to another person or company for them to deal with it so we can get it off of our conscious or our plate. An example is conglomerate companies, a company as huge as Nestle, has so many brands under it. When Nestle was accused of using child labor getting it cocoa to make its chocolate from Africa, Nestle said it had no idea about this. They said this is a problem with our supplier and we are going to have to address it with them. It is their brands and companies, they should have known that they were getting a good price. They should have known their were unfair conditions, not good wages and child labor. You pass off an ethical dilemma to someone else or another entity. You get caught with a cheat sheet someone else made and get in trouble and you say you did not make it. You are passing off the unethical dilemma to someone else.) Slippery Slope: inability to detect unethical behavior of others because it develops gradually (Can be a blindspot or can also pertain to ourselves. Idea that you do something on a small level, a white lie, then after this small lie you have to keep lying. Something starts small and then snowballs out of control. We can do it with our own actions but sometimes we see other people creating their own demise but we still let it happen. Toby Growth is an example because he followed the bad actions of someone in his family and his actions spiraled out of control. Bernie Madoff was a prominent money manager. He managed money of public companies and the wealthiest people and people wanted him to invest their money. He did this legitimately for a while then we went into an economic recession. He could not promise his investor amazing returns anymore because of this. He got into a situation where times were tough and he could not give back the ten percent to his customers so he stopped investing their money and put it in a bank account for himself. The customers thought the money was being ● invested and actually making a profit. He manufactured financial statement to make people believe him. He thought not all people are going to come to me at once for their money so I’ll be good. In 2008 the financial crisis came and all investors came and asked for all their money back. Bernie could not make out everyone's money because he did not have that much. After that it was over. He started out legitimate and when he started being unethical he could not stop because it was so easy to carry on with the fraud. He went to jail and pled guilty right away. Overvaluing Outcomes: giving pass to unethical behavior if the outcome is good (Stock market is an example. Steve Cohen ran an insider trading scam. The firm was shut down by the government. When he promised his clients great returns, no one got suspicious as to why Cohen and his hedge fund were trumping the market. Hedge Fund industry is in a little trouble right now because you van just invest in a mutual fund and do just as well, because hedge funds charges fees. Cohen was involved in insider trading and he had connections with people in public companies. They were trading for their clients on this private information. No one questioned anything. The firm crosses the financial crisis of 2008 and everyone wanted their money and he did not have it. Carnegie Mellon says when you cheat and you get the positive outcome people follow in your footsteps no one brings attention to the cheating if the outcome is good. But when one person gets caught they rat everyone out.) What can you do to eliminate bias and blind spots that lead to bad decisions? ● You can not make your decisions too quickly and you need to do a thorough analysis of the biases and blind spots ● You need to make a stakeholder analysis and see who will be affected by this decision ● Be vigilant and do not rely on intuition. Our intuition can be wrong ○ System 1 Thinking: based on intuition or emotion, quick, effortless. THIS IS NOT RELIABLE ○ System 2 Thinking: slower, more conscious, logical and critical following the rational decision making model: use ethical principles and tests and watch out for bias and blind spots 11/12/18 Managerial Ethics: Ethical Principles and Tests & Creating an Ethical Culture ● Ways in ways we can evaluate our business decisions Ethics Issues Arise at Different Levels ● Personal Level ○ Situations faced in our personal lives outside the context of our employment (cheating in terms of academic conduct) ● Managerial and Organizational Levels ○ Workplace situations faced by managers and employees (we take these personal issues into the workplace. As an employee you are going to have workplace ● ● issues that are ethical dilemmas, harassment, discrimination, the way customers are being treated) Industry or Professional Level ○ A manger or organization might experience business ethics issues at the industry or professional level (insider trading, where traders take advantage of private information. When people make promises that they can not make) Societal and Global Levels ○ Managers acting in concert through their companies and industries can bring about constructive changes (Macro level - these issues affect society and how we interact with one another. The financial crisis of 2008 did do this. It caused people to be angry and to create the Dodd Frank Act) Managerial Ethics and Ethical Principles ● Principles Approach (philosophical approach) ○ A principle of business ethics is an ethical framework, guideline, or rule that assists you in taking the ethical course ● Ethical Tests Approach (tests) ○ Simple tests to help with identifying ethical issues Principle Approach to Ethics ● Major Principles of Ethics ○ Principle of Utilitarianism ○ Deontology and Kant’s Categorical Imperative ○ Principle of Rights ○ Rawl’s Principle of Justice ○ Virtue Ethics ○ The Golden Rule Deontology (Immanuel Kant) ● Articulated by Immanuel Kant ● According to Deontology, the best decisions are those motivated by a sense of duty, not by a result of the decision (an ethical belief that we should be guided by a moral sense of duty, sense of purpose regardless of what the outcome is. This is a very motive based theory) ● Kant believed that one must operate under categorical imperatives (rules that we universalize like never like or cheat); rules that you are willing to universalize so that everyone should follow them ● It says forget about what the outcome is; what is the right motive behind the decision and go with it, but it is hard to ignore outcome ● Critiques are: ○ Not concerned with consequences ○ Most struggle to follow rules strictly (sometimes you have to tell white lies to help someone, but according to Kant no matter what you have to tell the truth even if this harms someone. He is not thinking about consequences, MOTIVE ONLY) Utilitarianism ● Proponents are philosophers Jeremy Bentham and John Stuart Mill ● The utilitarian approach to ethical dilemmas is to bring the greatest good to the greatest number of people. It expresses morality from the point of view of the group ● This is the cost benefit analysis in business; you add up all the costs and add up all the benefits and if the costs outweigh the benefits then you do not go through with it. The Ford Pinto, Ford calculated the costs of making the repairs and calculated the benefit and realized the cost of repair was more so it decided to keep the tank where it was. ● This is not worried about motive but about OUTCOME ● Critiques are: ○ Fails to respect individual rights (a lot of presumption that a lot of people are going to be happy, but some may not be happy so it neglects the individual) ○ Places the same value on everyone’s happiness (it does not always have the same effect on everyone's happiness) ○ Focuses on outcomes and not motives (it ignores motive and intent and sense of duty; it is all result driven. It also places the same value of everyone's happiness) Principle of Rights ● A principle that expresses morality from the point of the individual. It says that people have both moral and legal rights that should be honored and respected ● Moral rights would be rights to life, liberty and the pursuit of happiness ● Legal rights are those found in the Constitution or federal, state or local law ● This principle is associated with the 17th century philosopher John Locke (he said we are all born with rights moral and legal) ● Consumers could evoke this principle of right (Apple was asked to decode and hack into phone and Apple said no. Apple tried to justify this because they said our consumers have privacy rights) ● This is a recognition if consumer rights Principle of Justice ● Rawls focus on fairness, equity, and justice ● Rawls reasoned that the right decision involves being ignorant of our status in life (Veil of Ignorance) ● If we are equally ignorant, what would we agree on as fundamental rights? ○ Freedom of speech ○ Assembly ○ Religion ● Social justice advocates also believe that luck, although arbitrary, plays a strong role in our lives and that it is an obligation for those who are lucky or advantaged to help the ● ● ● unlucky and disadvantaged in life (he believed those that are born into more fortune or have more fortune should share with those less fortunate) He believed the true way for us to govern ourselves and have a code that we can all feel good about is to have a Veil of Ignorance. This means that although we are born into our lives with a status (socio economic and race) it should not have an effect on how we conduct our lives. He argues what if we all assume that we are all equal in society (no one is richer than another), then we should draw out all the rights and responsibilities and obligations that we have with one another. This way it would be fair because we would all be coming from the same place. This is hard because you cannot just life with a Veil of Ignorance because once you are born into your society of a certain way it is really hard to change This says what is fair for all people and how can we balance the playing field Virtue Ethics ● The philosopher Aristotle is most closely related to Virtue Ethics. Virtue Ethics focuses on the question “What sort of person should I be or become?” ● Virtue Ethics focuses on the individual acquiring certain virtues like honesty, fairness, truthfulness, trustworthiness, benevolence, respect, and non-malfeasance ● It is an internal question to yourself. Ask how you want to live your life and with what values? ● He argued we should live out our lives and decisions following these virtues Golden Rule ● “Do unto others as you would have them do unto yourself” ● This principle is also known as the Ethic of Reciprocity ● The Golden Rule is rooted in history and religious principles and is among the oldest principles of living ● Positive attributes include: ○ It is widely accepted by most people ○ It is easy to understand ○ It acts as a compass ○ It is a win-win philosophy ● Martin Luther King is a proponent. He was deeply religious and when he led the Civil Rights Movement he used this in a lot of his preachings Ethical Tests Approach to Decision Making ● The Test of Common Sense or the Smell Test ○ Ask yourself the question “Does the action I am getting ready to take really make sense?” If your proposed course of action is stinks, then do not do it ○ When presented with an ethical dilemma use your common sense. Your common sense is good to steer you away from an ethical misstep ● The Disclosure Rule (making something public) ○ ● Warren Buffett (owner of Berkshire Hathaway) uses this when he makes decisions ○ Ask yourself “How would I feel if others knew what was going on?” and “How would I feel if I knew that my decisions or actions were going to be featured on the national evening news tonight for the entire world to see?” ○ How would your friends and family feel about you after you make this decision? If you are ashamed then you should not do it The Test of the Big Four ○ Greed (when you want too much of something), Speed (when you make the decision too fast), Laziness (do not gather all the facts), and Haziness (not accounting for your blind spots) ■ These four things most likely lead to a bad decision. Slow it down and think about everything (System 2 Thinking) ○ All of these four factors represent temptations that if succumbed to, might lead to unethical behavior Factors Affecting the Organization's Moral Climate ● Behavior of Superiors: the number one influence on moral climate (if your CEO is showing you they are getting away with things, you will think it is okay and the proper way to get ahead) ● Behavior of One’s Peers: the second influence; people do pay attention to what their peers in the firm are doing (cheating is an example because students help each other cheat. In the workplace if your peers are doing something wrong you assume it is okay and do it) ● Industry or Professional Ethical Practices: ranked in the upper half; these context factors are influential (when you see the industry is doing something unethical to get ahead, you think it is okay. If the industry is doing this, it must be something that has to be done to stay ahead and be competitive) ● Personal Financial Need: ranked last (when we do these different things we are not usually guided by the need for more money, we are just following the behavior of other people) Improving the Organization’s Ethical Culture ● The emphasis is on creating an ethical organizational culture or climate, one in which ethical behavior, values and policies are displayed, promoted, and rewarded Compliance vs. Ethics Orientation ● Compliance is following the law which is the base line. Ethics is above that. When they make it one, it is watering down the ethics component ● Ethics thinking is principles based; compliance thinking is rule-bound and legalistic. A compliance orientation can undermine ethical thinking ● Compliance can squeeze out ethics ● Managers may not consider tougher issues that a more ethics-focused approach might require Best Practices for Improving an Organization’s Ethics ● Three key elements that must exist if an ethical organizational culture is to be developed and sustained: ○ The continuous presence of Ethical Leadership reflected by the board of directors, senior executives and managers (lead by example) ○ The existence of a set of Core Ethical Values infused throughout the organization by the way of policies, processes, and practices (the firm needs to have this in writing and train everyone by it) ○ A Formal Ethics Program which includes a code of ethics, ethics training and an ethics officer (you need internal benchmarks to measure if they are achieving what they say they want to) Top Management Leadership (Moral Management) ● There are moral managers and amoral managers, who believe it is not necessary to take in consideration ethical principles when making a business decision because a business can do anything as long as they follow the law ● This premise cannot be overstated: THE MORAL TONE OF AN ORGANIZATION IS SET BY TOP MANAGEMENT ● In a poll of communication professionals, more than half believed that top management is an organization’s conscience ● Managers and employees look to their bosses at the highest levels for their cues as to what practices and policies are acceptable ● Examples of what a corporation could do to have moral management: ○ Board of directors oversight, discipline of violators, ethics programs and officers, realistic objectives, ethical decision making processes, codes of conduct, whistle-blowing mechanisms (when you realize something unethical occuring and you want to bring it to management), corporate transparency, ethics training, effective communication, and ethics audits and risk assessments 12/10/18 The Case of CVS Health ● CVS is one of the largest public companies by revenue. Who shops at CVS? ● Started in Lowell, MA in 1963 as a Consumer Value Store ● The largest pharmacy chain in the U.S ● Major Competitor: Walgreens Boot Alliance CVS Executive Leadership ● ● CEO is Larry Merlo Executive diversity (2 females and a man of color) CVS Purpose ● Their mission is to help people on the path to better health. They have a strategy to do this and values What is CVS’ business and how does it create value for the consumer? - CVS is pharmacy benefits manager ● The Retail Segment: customers are individuals ○ Prescription drugs, over the counter drugs ○ Beauty products, cosmetics, photo, seasonal merchandise, greeting cards and convenience foods ○ MinuteClinics ● The Pharmacy Services Segment: customers are employers, insurance companies, health plans, Medicare/Medicaid plans ● Corporate Segment: Executive management, legal, compliance, HR, Finance and Technology MinuteClinics ● CVS is rapidly expanding MinuteClinics. There are over 1,100 in 33 states ● MinuteClinics treat and diagnose minor illness and injuries; administer vaccines and perform health screenings and physicals ● Staffed by nurse practitioners and physician assistants ● CVS can now share patient information with hundreds of health providers What are Pharmacy Benefit Managers? (PBMs) ● CVS is the middleman in the whole supply chain is consumers get the pharmaceutical products from the drug manufacturers (Valeant, Pfizer) ○ These manufacturers do not sell directly to the consumers ● CVS contracts with health insurance companies, employers, and the government because these are the top ways we get health insurance. They work to get certain products listed on the insurance companies formularies (the list of approved drugs covered by health insurance companies) ● CVS is getting a rebate from these drug manufacturers for prescribing and including the name of the drug ○ Insurance companies also get some rebates but do we as consumers see any costs saving passed down to us ● CVS is a big part of the whole drug pricing phenomenon going on ● They are merging with Aetna so they will be an insurance company as well as pharmacy benefit managers Major Strategic Changes in CVS in the Past 5 Years ● ● ● ● In 2014, CVS stopped selling tobacco products and changed their name to CVS Health In 2015, CVS acquires Omnicare, the leading provider of pharmacy services to long-term care patients In 2015, CVS purchased all of Target’s pharmacies In 2018, CVS finalized deal to acquire Aetna Health- the third largest health insurance company Why All of These Changes? ● Strategic Driving Factors: ○ Shortage of primary care doctors ○ The Affordable Care Act - requires everyone to obtain health insurance ○ Increased prescription utilization (more people have chronic disease) ○ Epidemic of obesity and chronic illness ○ Aging population New Marketing and Branding ● Change perception “A place to buy health care and health care products” ● New name: CVS Health ● CVS has acquired brand equity and loyalty (Extra Care Card) ● Its largest asset is Goodwill ● They want you to think of CVS Health as your primary care source How Do We Deliver This? ● 4 P’s of Operation ○ Partnerships ■ Pharmaceutical companies ■ Health Insurance providers ■ Employers ■ Government How to Deliver This? ● Place: 9,800 retail pharmacies in 49 states, D.C, Puerto Rico and Brazil ○ Over 1,100 MinuteClinics ○ Over 60 million ExtraCare customers ○ They are working on same day delivery ● People: 240,000 colleagues - call their employees colleagues ○ What other company elevates the role of employees? Starbucks ● Processes: CVS makes it easier to deliver health care services in store, on the phone, and on-line ○ Apple watch integration, scan paper script, MedRemind, CVS mobile app, insurance card scan, pharmacy drive through CVS and The Triple Bottom Line 3P’s - People, Planet and Profits ● ● ● People-Social Responsibility ○ CVS donated $100 million to communities through the CVS Health Foundation in corporate grants, gifts in-kind and employee giving ○ CVS has educated more than 300,000 students about the dangers of abusing prescription drugs through its Pharmacists Teach Program ○ CVS has made a $2 million commitment to fighting the opioid abuse epidemic ○ It has invested $425 million annually to sustainable wage increases for its employees ○ It had hired as many as 17,000 youths/veterans and part time and summer positions Planet- Environmental Responsibility ○ Several CVS stores have be retrofitted with LED lighting ○ CVS had pledged to stop selling CVS brand beauty products that contain parabens and formaldehyde ○ CVS is committed to reducing emissions that contribute to climate change Profit - Economic Responsibility ○ CVS is doing so well compared to Walgreens ○ Making $184 billion Carroll Pyramid of CSR ● CVS is philanthropic ● Is CVS ethical? ● Does CVS follow the law? ● CVS is profitable Legal Issues: Opioids ● CVS sued for contributing in creating the opioid crisis ● Administering Naloxone, which reverses overdoses of opioids. Secondary recreational users were not prescribed opioids but they want it because it makes them feel good Ethical Issues: Drug Pricing ● Ethical issues become legal issues if you do not care of them ● You can bring up the price of drugs and this is legal ● This merger happening soon is going to have them be a monopoly and be vertically integrated because there is little to no competition ○ Owning more of the supply chain will reduce their costs ● They get rebates from the drug manufacturers and no one knows what it is; no transparency ● CVS is three out the five parts of the supply chain Biases and Blind Spots ● Conflict of Interest: CVS has a professional interest to help consumers on the path to better health, yet a personal interest in increasing its drug related revenues ● Indirect Blindness: CVS can point a finger at drug manufacturers to defend the higher prices of drugs (they pass off this unethical issue to drug manufacturers and not mentioning they get rebates for listing these drugs highly)