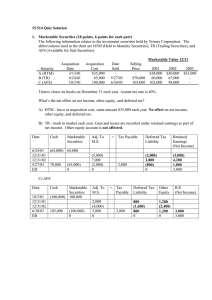

CASH AND MARKETABLE SECURITIES MANAGEMENT Chapter 18 Financial Management BSA- 2 Learning Objectives 1.Understand the concept of cash management. properly the cash flows of the firm. 2. Learn the objectives of cash management. 7. Understand the objective of marketable securities management 3. Identify the reasons for holding cash balances. 8. Realize the reason for holding marketable securities. 4. Know how to determine the target cash balance using a) Cash budget 9. Identify the factors influencing the choice of marketable securities. b) Cash Break-even Chart 10. Learn the types of marketable securities. c) Optimal Cash Balance 5. Understand the other factors that influence the target cash balance 6. Know the cash management techniques to manage 2 INTRODUCTION Managing cash is becoming even more sophisticated in the global and electronic age of the 21st century as financed managers try to squeeze the last peso of profit out of their cash management strategies. Despite whatever lifelong teachings about the virtues of having cash, the corporate financial manager actively seeks to keep this nonearning asset to a minimum. Minimizing cash balances as well as having accurate knowledge of when cash moves into and out of the company can improve overall corporate profitability. However, a business firm would not want to get caught without cash when it is needed. Cash management involves control over the receipts and payments of cash so as to minimize nonearning cash balances. 3 OBJECTIVE OF CASH MANAGEMENT The basic objective in cash management is to keep the investment in cash as low as possible while still keeping the firm operating efficiently and effectively. A financial officer can use the following strategies in monitoring cash balances: 1. Accelerate cash inflows by optimizing mechanisms for collecting cash 2. Monitor the cash disbursement needs or payments schedule 3. Minimize the amount of idle cash or funds committed to transactions and precautionary balances; and 4. Avoid misappropriation and handling losses in the normal course of business 4 To achieve the above objectives, proper planning of cash flows is needed. Effective cash management generally encompasses proper management of cash flows which entails among others the following: Improving forecasts of cash flows A. Using floats B. Synchronizing cash inflows and outflows C. Accelerating collections D. Controlling disbursements E. Obtaining additional funds when and where they are needed 5 REASONS FOR HOLDING CASH BALANCES A business enterprise may keep part of its capital tied up in cash for several reasons. These are: 1. Transaction Facilitation. This involves the use of cash to pay for planned business expenditures such as supplies, payrolls, taxes suppliers bills, interest on debts, cash dividends and acquisitions of long-term fixed assets. 2. Precautionary Motive. Although the firm expects cash to come in from day-to-day operations and other financing activities, the inflows and outflows are not usually perfectly synchronized. It will need to keep enough cash for emergency purposes. Precautionary cash balances are more likely to be important in seasonal or cyclical industries where cash inflows are more uncertain. Firms with precautionary needs usually rely on unused lines of bank credit. 6 REASONS FOR HOLDING CASH BALANCES A business enterprise may keep part of its capital tied up in cash for several reasons. These are: cont. 3. Compliance with Creditors' Covenant. Another major reason for holding cash is to be able to comply the requirement of lending institutions and other creditors of keeping a certain percentage of borrowed funds in their bank accounts (e.g., compensating balance). 4. Investment Opportunities. Having excess cash may allow the firm to take advantage of investment opportunities that would otherwise be impossible to transact. Example is when a block of raw materials is offered at discounted prices if purchased on cash basis. To determine how much cash to keep on hand, firms must know the trade-off between the opportunity costs associated with holding too much cash against the shortage costs of not having enough cash. 7 DERMINING THE TARGET CASH BALANCE the target cash balance may be derived with the use of the following approaches namely: 1.Cash Budget 2. Cash Break-even Chart 3. Optimal Cash Balance using the a) Baumol Model b) Miller-Orr Model 8 DERMINING THE TARGET CASH BALANCE the target cash balance may be derived with the use of the following approaches namely: CASH BUDGET The cash budget is the tool used to present the expected cash inflows and cash outflows. The preparation of the Cash Budget is discussed and illustrated in detail in Unit IV, Chapter 16 of this textbook. 9 DERMINING THE TARGET CASH BALANCE the target cash balance may be derived with the use of the following approaches namely: CASH BREAK-EVEN CHART (Figure 18-1) This chart shows the relationship between the company's cash needs and cash sources. It indicates the minimum amount of cash that should be maintained to enable the company to meet its obligations. To illustrate, the following data are available for XYZ Company. XYZ Company manufactures plastic which it sells to other industrial users. The monthly production capacity of the company is 1,200,000 kilos. Selling price is P2 per kilo. Its cash requirements have been determined as follows: a) Fixed monthly payments amounting to P250,000 while b) Variable cash payments are 50% of sales. 10 Fixed Monthly Payments 1. Cash break-even Point = Sales -- Variable Cost Sales Required: 1. Determine the Cash Break-even point (mathematical approach). 2. Prepare a Cash Break-even Chart to project the relationship between the company's cash needs and cash sources. = ______250, 000__ 100% -- __50%__ 100% ______250, 000__ 50% = P500, 000 or 250, 000 = 11 Cash break-even Chart. Figure18-1 12 OPTIMAL CASH BALANCE The Baumol Model In most medium or large-sized corporations, liquidity management has assumed a greater role over the past decade. Since cash is needed for both transactions and precautionary needs in all companies, it must be available in some form, (cash, marketable securities, borrowing capacity) all of the time. The liquidity managers must utilize some formal models or maintain the optimal amount at each moment in time because too much liquidity brings down the rate of return on total assets employed and too little liquidity jeopardizes the very existence of the firm itself. In managing the level of cash (currency plus demand deposits) for transaction purposes versus near cash (marketable securities), the following costs must be considered: 13 OPTIMAL CASH BALANCE The Baumol Model cont. 1. Fixed and variable brokerage fees, and 2. Opportunity costs such as interest foregone by holding cash instead of near cash. One of the models that can be used to help determine the optimal cash balance is the "Baumol model”. This model balances the opportunity cost of holding cash against the transactions costs associated with replenishing the cash account by selling off marketable securities or by borrowing. 14 OPTIMAL CASH BALANCE The Baumol Model cont. The optimal cash balance can be found by using the following variables and equations: 1. The total costs of cash balances consist of a holding (or opportunity) cost plus a transaction cost: Total Cost = Holding Cost + Transaction cost = = C (K) 2 Average cash balance. + T C Opportunity costs. (F) + Number of transactions Cost per transaction. 15 Where: C C 2 = amount of cash raised by selling marketable securities per by barrowing. = average cash balance. C* = optimal amount of cash to be raised by selling marketable securities by borrowing. make it public C* 2 = optimal average cash balance. F = fixed costs of making securities trade or obtaining a loan. T = total amount of net new cash needed for transactions during the period (usually a year). K = opportunity cost of holding cash not equal to the rate of return forgone on marketable securities or the cost of borrowing to hold cash. 16 Where: The minimum costs of cash balances are achieved when C is set equal to C*, the optimal cash transfer of optimal cash replenishment level. The formula to find C* is as follows. C* = 2 Total amount of net new cash required Fixed cost of trading securities or cost barrowing Opportunity of Holding cash or C* = ___2 (T) (F)__ K 17 Figure 18-2 Shows the Graphical approach in determining the target cash balance. Figure 18.2 Determination of the target cash balance. Cost of holding Cash 18 Illustrative Case I. Determination of optimal average cash balance for Baumol model. To illustrate, consider a business with total payments Of P10 million for one year, cost per transaction of P100, and the interest rate on the marketable securities is 8%. The optimal cash balance is calculated as follows: C* = 2(10M) (100) 8% = P 158, 114 Optimal Average Cash Balance = 158, 114 2 = 79, 057 19 Illustrative Case I. Determination of optimal average cash balance for Baumol model cont. The firm may also want to hold a safety stock of cash to reduce the probability of a cash shortage to some specified level. The Baumol model is simple in many respects. Other models have been developed to deal both with uncertainty in the cash flows and with trends. All of these models, including the Baumol models, can provide a useful starting point for establishing a target cash balance, but all of them have limitations and must be applied with judgment. 20 The Miller- Orr Model The Miller-Orr model takes a different approach to calculating the optimal cash management strategy. It assumes that the distribution of daily net cash flows is normally distributed and allows for both cash inflows and outflows. This model bases its computations where: L F = the lower control limit = the trading cost for marketable securities per transaction. 21 The Miller- Orr Model σ ί day Z* H* = the standard division in net daily cash flow. = the daily interest rate on the capital securities. = optimal cash return point. = upper control limit for cash balances. Z* = ___3F𝜎 2 __ 4 ί day To compute for H*, the following : 3Z*-2L Formula is used H* = 22 The Miller- Orr Model Note that the firm determines L and the firm can set to a non-zero number to recognize the use of safety stock. The optimal cash return point Z* is comparable to the replenishment level C* in Baumol's model but with one key difference. Since Baumol's model only allowed for cash disbursement, C was always "replenished to" from a level of zero. In the Miller-Orr model, Z* will be the replenishment level to which cash is replenished when the cash level hits L, but it will also be the return level that cash is brought back down to when cash hits H. 23 Illustrative Case II. Calculation of Optimal Return Point and Upper Limit for Miller-Orr Model Suppose that ABC Inc., would like to maintain its cash account at a minimum level of P100,000, but expects the standard deviation in net daily cash flows to be P5,000; the effective annual rate on marketable securities will be 8 percent per year, and the trading cost per sale or purchase of marketable securities will be P200 per transaction. What will be ABC's optimal cash return point and upper limit? 24 Solution The daily interest rate on marketablw securities will equal to: ί day_ = __8%___ = .00021 365 days Z* = 𝟑(𝟐𝟎𝟎)(𝟓,𝟎𝟎𝟎)𝟐 ∛ +100, 𝟒𝑿 .𝟎𝟎𝟎𝟐𝟏 = = P126,101.72 3(126,101,72)- 2 (100,000) = 378, 305.16 -200,000 = p178,305.16 H* 000 25 Illustration Case II Cont. As shown in the above computation, the firm will reduce cash to P126,101.72 by buying marketable securities when the cash balance gets up to P178,305.16, and it will increase cash to P126,101.72 by selling marketable securities when the cash balance gets down to P100,000. 26 OTHER FACTORS INFLUENCING THE TARGET CASH BALANCE 1. Option to incur short-term borrowing to meet unexpected demands for cash. If he probability of an unexpected demand for cash causing the firm to borrow in the short-term is low enough, or if the amount of interest to be earned by investing in longer-term securities is higher than that to be earned on marketable securities, then it might be worth it for the firm to risk occasionally paying a relatively high interest rate on short-term borrowing. 2. Transaction Costs and Time Element. Transaction costs as well as time associated with trading securities have fallen so dramatically low that many business firms decide to sell marketable securities as needed in order to meet any unforeseen demand for cash during the day. 27 Cont. 3. Many firms must keep certain average minimum balances in their deposit accounts as part of borrowing agreements with their bank. Some firms occasionally meet unforeseen demand for cash that causes their deposit account to temporarily fall below the minimum compensating balance. To offset this, they keep a corresponding amount of excess cash in the account in a later period. Thus enabling them to cover up the earlier deficiency and meeting the required average minimum balance. 28 CASH MANAGEMENT TECHNIQUES Although cash management activities are performed jointly by the firm and its depository bank, the financial manager is primarily responsible for the effectiveness of the cash management program. A major business enterprise may have hundreds or even thousands of bank accounts and since it is impractical to think that inflows and outflows will balance in each account, the finance department should be able to develop and implement a system where funds can be transferred from where they currently are, to where they are needed, to arrange loans, to cover net cash shortage and to invest cash surpluses without delay. 29 Effective cash management encompasses the proper management of cash inflows and outflows, which involve: 1. Synchronizing cash flows 2. Using floats 3. Accelerating cash collections 4. Getting available funds to where they are needed 5. Controlling disbursements 30 SYNCHRONIZING CASH FLOWS Synchronized cash flows is a situation in which inflows coincide with outflows thereby permitting a firm to hold low transactions balances. A thorough review of the cash flow analysis, cash conversion cycle and cash budget discussed in the previous chapters would be most helpful. By improving the forecasts of cash receipts and disbursements and arranging things so that cash receipts coincide or occur at an earlier time than the timing of required cash outflows, firms can reduce their cash balance to meet transactional requirements to a minimum. If the firm is able to reduce its cash balance, bank loans will be reduced together with the corresponding interest expense, thus boosting profits. 31 USING FLOATS Floats - is defined as the difference between the balance shown in a firm’s books and the balance on the banks record. It arises from the delays in mailing, processing and clearing checks through the banking system. Once a check is received and a deposit is made, the deposited funds are not available for use until the check has cleared the banking system ( about 3 to 6 days) and credited to the corporate bank account. This works both for checks written to pay suppliers as well as checks deposited from customers. This means float can be managed to some extent through a combination of disbursement and collection strategies. 32 Cont. Disbursement Float- represents the value of the checks the firm has written but which are still being processed and thus have not been deducted from the firm’s account balance by the bank. For example, suppose a firm writes on the average, checks amounting to P50,000 each day, and it takes 5days for these checks to clear and to be deducted from firm’s bank account. This will cause the firm’s own checkbook to show a balance of P250.000 smaller than the balance on the bank’s record’s. 33 Cont. Collections float represents the amount of checks that have been received but which have not yet been credited to the film’s account by the bank. Suppose that the film also receives checks in the amount of P50,000 but it loses four days while they are being deposited and cleared. This will result in P200,000 of collections float. 34 Cont. In total, the film’s net float, the difference between P250.000 positive disbursement float and the P200.000 negative collection float. Will be P50.000. if the net float is positive, that is, disbursement float is more than collection float, then the available bank balance exceeds the book balance. A firm with a positive net float can use it to its advantage and maintain a smaller cash balance than it would have in the absence of the float. But the firm must be able to forecast its disbursements and collections accurately in order to make much heavy use of float. Basically, the size of a firm’s net float is a function of its ability to speed up collections on checks received and to slow down collections on checks written. Efficient firms go to great lengths to speed up the processing of incoming checks the funds to work faster and they try to stretch their own payments out as long possible. 35 ACCELERATING CASH COLLECTION The finance manager should take steps for speedy recovery from debtors and for this purpose, proper internal control should be installed in the firm once the credit sales have been effected, there should be a built-in mechanism for timely recovery from the debtors such as: 1. Prompt billing and periodic statements prepared to show the outstanding bills. 2. Incentives such as trade and cash discounts offered to the customers for early/prompt payments. These should be well communicated to them. 3. Prompt deposit. Once the checks/drafts are received from costumers, no delay should occur in depositing these receipts with the bank. 36 Cont. 4. Direct deposit to firm’s bank account. Customers may also be advised to deposit their checks or cash directly into the bank account of the firm and furnish details to the firm. 5. Electronic depository transfer or payments by wire. With the developments taking place in the computer technology, the present booking system is also being switched and cash management services to their customers. The network will be linked to the different branches, banks and the transfer of funds will take place very fast that will result to substantial reduction of float. 6. Maintenance of regional collection office. The above techniques can minimize the time lag between the time the customers send the checks to the firm and the time when the firm can make use of the funds. This system of cash collection will accelerate the cash inflows of the firm. 37 SLOWING DISBURSEMENT Any action on the part of the finance officer which slows the disbursements of funds lessens the use for cash balance. This can be done by: 1. Centralized processing of payables. This permits the finance manager to evaluate the payments coming due for the entire firm and to schedule the availability of funds to meet these needs on a company-wide basis. It also result to more efficient monitoring of payables and float balances. Care however should be taken so as not to create ill will among suppliers of goods and services or raise the company’s cost if bills are not paid on time. 2. Zero balance accounts (ZBA). These are special disbursements accounts having a zero peso balance on which checks are written. As checks are presented to a ZBA for payment, funds are automatically transferred from the master account. 3. Delaying payment. If one is not going to take advantage of any offered trade discount for early payment, pay on the last day of the credit period. 38 Cont. 4. “Play the float”. This involves taking advantage of the time it takes for the company’s check to clear the banking system. 5. Less frequent payroll. Instead of paying the workers weekly, they may just be paid semi-monthly. 39 REDUCING THE NEED FOR PRECAUTIONARY BALANCE • Since the transaction and precautionary motives are the important determinants of the cash requirement, factors influencing their combined level in the firm must be analyzed. • There are techniques that are available for reducing the need for precautionary balances. These includes: 1. More accurate cash budgeting. Most critical is the accuracy of the cash budget or forecast. The closer the fit between cash inflows and outflows, the more certain the forecasts the less need for precautionary balances. 2. Lines of credit. This is a pre-arranged loan where the company can withdraw anytime within the period agreed upon. 3. Temporary investments. Investments in highly liquid securities may be maintained instead of holding idle precautionary cash balances. 40 Illustrative Case III. Acceleration of Cash Receipts Abubot Fashion Designs is evaluating a special processing system as a cash receipts acceleration device. In a typical year, this firms receives remittances totaling P7 million by check. The firm will record and process 4,000 checks over the same time period. First National Bank has informed the management of Abubot Fashion Designs that it will process checks and associated documents through the special processing system for a unit cost of P0.25 per check. Abubot Fashion Designs’ financial manager has projected that cash freed by adoption of the system can be invested in a portfolio of near-cash assets that will yield an annual before-tax return of 8 percent. Abubot Fashion Designs’ financial analysts use a 365-days year in their procedures. Required: a) What reduction in check collection is necessary for Abubot Fashion Designs to be neither better nor worse off for having adopted the proposed system? b) How would your solution to (a) be affected if Abubot Fashion Designs could invest the freed balances only at an expected annual return of 5.5 percent? c) What is the logical explanation for the differences in your answers to (a) and (b) above? 41 Solution: A. Initially, it is necessary to calculate Abubot Fashion Designs' average remittance check amount and the daily opportunity cost of carrying cash The average check size is ___P7M__ 400, 000 = P1, 750M Per Check The daily opportunity cost of carrying cash is __0.08_ =0.0002192 per day 365 Next, the days saved in the collection process can be evaluated according to the general format of added costs = added benefits or P = (D) (S) (i) P0.25 = D) (P1,750) (0.0002192) 0.6517 days = D Abubot Fashion Designs therefore will experience a financial gain if à implements the special processing system and by doing so will speed up i collection by more than 0.6517 days. 42 Solution: B. Here the daily opportunity cost of carrying cash is 0.055 The break-even cash-acceleration period of 0.9480 days is greater than the 0.6517 days found in (a). This is due to the lower yield available on near cash assets of 5.5 percent annually, versus 8.0 percent. Since the alternative rate of return on the freedup balances is lower in the second situation, more funds must be invested to cover the cost of operating the special processing system. The greater cash-acceleration period generates this increased level of required funds. =0.0001507 per day 36585rr For Abubot Fashion Designs to break-even, should it choose to install the special processing system, cash collections must be accelerated by 0.9480 days, as follows: P0.25 = (D) (P1, 750) (0.0001507) 0.9480 days = D 43 Illustration Case IV. Valuing Float Reduction Next year, Miguel Motors expects its gross revenues from sales to be P80 million. The firm’s treasurer has projected that its marketable securities portfolio will earn 6.50 percent over the coming budget year. What is the value of one day’s float reduction to the company? Miguel Motors uses a 365-day year in all of its financial analysis procedures. Solution: Value of one day’s float reduction = P80M X 6.5% 365 = P14,247 The company will earn P14, 247 per year if it is able to invest its one day sales at 6.5% 44 MARKETABLE SECURITIES MANAGEMENT OBJECTIVE MARKETABLE SECURITIES MANAGEMENT Realistically, management of cash and marketable securities cannot be separated. Management of one implies management of the other. The firm may hold excess funds in anticipation of a cash outlay. When funds are being held for other than immediate transaction purposes, they should be converted from cash into interest-earning marketable securities. Marketable securities which should be of highest investment grade usually consist of treasury bills, commercial paper, certification of time deposits from commercial banks, and money market notes. 45 REASONS FOR HOLDING MARKETABLE SECURITIES There are several basic reasons for holding marketable securities such as 1. They serve as a substitute for cash balances. Many firms prefer to hold marketable securities as a substitute for transaction balances, precautionary balances, for speculative balances or for all three. In most cases, however, the securities are held primarily for precautionary purposes or as a guard against a possible shortage of bank credit. 2. They are held as a temporary investment. Where a return is earned while funds are temporarily idle. 3. They are built up to meet known financial requirements. Such as tax payments, maturing bond issue and so on. 46 FACTORS INFLUENCING THE CHOICE OF MARKETABLE SECURITIES Among the factors that will influence the choice of marketable securities are: 1. Risks such as a.) Default risk. The risk that the issuer of the security can not pay the principal or interest at due dates. The funds invested in short-term marketable instruments should be safe and secure as regards repayment of principal and interest as and when it matures since the return on short-term investments is offered less than long-term investments, the acceptable risk level is required to be lesser commensurate with lower return. Some of the investments like commercial paper are offered with credit ratings. The government treasury bills, banker’s acceptance and certificate of deposits carry minimum default risk. b.) Interest rate risk. The risk of declines in market values of the security due to rising interest rates. c .) inflation risk. The risk that inflation will reduce the “real” value of the investment. In periods of rising prices, inflation risk is lower on investments (e.g., common stock, real estate) whose returns 47 tend to rise with inflation than on investment whose returns are fixed. Cont. d.) marketability (liquidity) risk. This refers to the risk that securities cannot be sold at close to the quoted market price and is closely associated with liquidity risk. The liquidity is the basic objective of investment in these instruments. It should offer the facility of quick sale in the market as and when need arises for cash, with low transaction cost, without loss of time and no erosion of amounts invested with fall in price of investments. e.) event risk. The probability that some event (such as merger, recapitalization or a leverage buyout) will occur and suddenly will increase a firm’s default risk. Bonds issued by regulated companies as banks or electric utilities generally have lesser event risk that bonds issued by industrial and service companies. Treasury securities usually do not carry any risk, barring national disaster. Also, long-term securities are affected more by unfavorable events than are short-term securities. 48 FACTORS INFLUENCING THE CHOICE OF MARKETABLE SECURITIES 2. Maturity. Marketable securities held should mature or can be sold at the same time cash is required. Firms generally invest in marketable securities that have relatively short maturities. The maturity periods of different investment should match with the payment obligations like dividends payments, tax payments, capital expenditure and interest payments on debt instruments. Many firms restrict their temporary investment to those maturing in less than 90 days. Short-term investments relatively carry lesser return than long-term investments, since the default risk and interest rate risk are minimized with short-term instruments. 3. Yield or returns on securities. Generally, the higher a security’s risk, the higher its required return. Corporate investors, like other investors must make a trade-off between risk and return when choosing marketable securities. Because these securities are generally held either for a specific known need or for use in emergencies, the portfolio should consist of highly liquid short-term securities issued by the government or very49 strong corporations. Treasurers should not sacrifice safety for higher rates of return. TYPES OF MARKETABLE SECURITIES 1. Money Market Instruments. These are the most suitable investment for idle funds. The money market is the market for short-term debt instruments. Money market instruments are high-grade securities characterized by a high-degree of safety of principal and maturity of one year or less. The two major types of money market instruments are: a.) Discount paper. A money market instrument which sells for less than its par or face value. The difference between the security’s purchase price and par value represents the investor’s income. At maturity, the investor receives the face value or par value of the instruments. b.) Interest-bearing securities. These are instruments which pay interest based on the par value or face value of the security and the period (days/months) of investment. 50 TYPES OF MARKETABLE SECURITIES 2. Treasury Bills. These are short-term government securities with a maturity of one year or less, issued at a discount from face value often called risk-free security. These securities are tax exempt with high degree of marketability. 3. Other Short-term Commercial Papers Issued by Finance Companies, Banks and Other Corporations. These are typically unsecured and maturities range from a few days to 270 days. Commercial paper is usually discounted but it can be interest bearing. 4. Negotiable Certificates of Deposit. Certificate of deposits are short-term loans to commercial banks with maturities ranging from a few weeks to several years. Certificate of deposits contain some default and interest rate risks but can easily be sold prior to maturity. 51 TYPES OF MARKETABLE SECURITIES 5. Repurchase Agreements (REPOS). These are sale of government securities (e.g., treasury bills) or other securities by a bank or securities dealer with an agreement to repurchase. REPOS usually involve a very short-term overnight to a few days. These are attractive to corporations because of the flexibility or maturities. These agreements have little risk because of their short maturity and the commitment of the borrower to repurchase the securities as a fixed or higher specified price. 6. Banker’s Acceptance. A time draft drawn on, and accepted by a bank usually used as a source of financing in international trade. Banker’s acceptances are sold as discount paper with maturities ranging from a few weeks to 9 months. The yields on acceptance are competitive because of low default risk owing to as many as three parties who may be liable for payment at maturity. 52 TYPES OF MARKETABLE SECURITIES 7. Money Market Mutual Fund. This is an open-ended mutual fund that invests in money-market instruments. Money market mutual funds (MMMF) sell shares to investors and then accumulate the funds to acquire money market instruments. These funds allow small investors to participate directly in high-yielding securities that are often denominated in large amounts. The MMMF shares are highly liquid because they can be sold back to the fund at any time. Returns or yields depend on the money market instruments held in the portfolio of the fund. End 53 “If you continue to think the way you’ve always thought, you’ll continue to get what you always got.” -Kevin Trudeau 54 THANK YOU! ASTURIAS BADOGAS BALBOA BSA-2