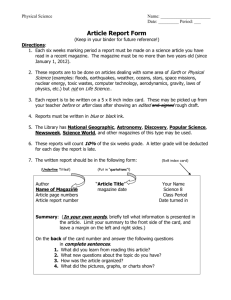

BUSINESS PLAN O Our Lifestyle Magazine BUSINESS PLAN This business plan has been prepared to present to potential government grant and loan programs, financial institutions and private investors to raise the capital necessary to assist the company in implementing its strategic business model. TABLE OF CONTENTS Business Plan ................................................................................................................................................................ 1 Table of Contents .......................................................................................................................................................... 2 STATEMENT OF NONDISCLOSURE AND CONFIDENTIALITY .......................................................................................... 4 EXECUTIVE SUMMARY .................................................................................................................................................. 5 Use of Startup Funds ..................................................................................................................................................... 6 Investor Charts .............................................................................................................................................................. 7 BUSINESS DESCRIPTION ................................................................................................................................................ 7 History of the Business ................................................................................................................................................. 7 Vision and Mission Statement ...................................................................................................................................... 8 BUSINESS GOALS ........................................................................................................................................................... 8 BUSINESS MANAGEMENT ............................................................................................................................................. 8 LOCATION AND FACILITIES OF THE BUSINESS ............................................................................................................. 12 Our Lifestyle Magazine ............................................................................................................................................... 12 DESCRIPTION OF THE PRODUCT ................................................................................................................................. 12 COMPETITIVE ADVANTAGES ....................................................................................................................................... 13 Competitive Landscape ............................................................................................................................................... 14 Unique Features .......................................................................................................................................................... 15 iNDUSTRY OVERVIEW ................................................................................................................................................. 15 OVERALL MARKET SIZE ............................................................................................................................................... 16 marekt Size summary: ................................................................................................................................................ 18 MARKETING ................................................................................................................................................................ 18 Immediate Marketing Strategy ................................................................................................................................... 19 2 PRICE ........................................................................................................................................................................... 19 SWOT ANALYSIS .......................................................................................................................................................... 20 Strengths ............................................................................................................................................................... 20 Weaknesses .......................................................................................................................................................... 20 Opportunities ........................................................................................................................................................ 21 Threats .................................................................................................................................................................. 21 IMPLEMENTATION PLAN ............................................................................................................................................ 21 FINANCIAL PLAN ......................................................................................................................................................... 22 Financial Narrative ...................................................................................................................................................... 22 Financial Assumptions ................................................................................................................................................ 23 Projected Monthly and Annual Sales Revenue ........................................................................................................... 24 Financial Highlights ..................................................................................................................................................... 24 Financial Projections ................................................................................................................................................... 25 Breakeven Analyssis .................................................................................................................................................... 26 Income Statement ...................................................................................................................................................... 27 Cash Flow Statement .................................................................................................................................................. 29 Balance Sheet ............................................................................................................................................................. 30 Monthly Income Statement First Year ........................................................................................................................ 31 Monthly Cash Flow Statement First Year .................................................................................................................... 32 3 STATEMENT OF NONDISCLOSURE AND CONFIDENTIALITY This document contains proprietary and confidential information. All data submitted to Lucinda Keyes is provided in reliance upon its consent not to use or disclose any information contained herein except in the context of its business dealings with Insights Marketing. The recipient of this document agrees to inform its present and future employees and partners who view or have access to the document's content of its confidential nature. The recipient agrees to instruct each employee that they must not disclose any information concerning this document to others except to the extent such matters are generally known to, and are available for use by, the public. The recipient also agrees not to duplicate or distribute or permit others to duplicate or distribute any material contained herein without Lucinda Keyes’s express written consent. Lucinda Keyes retains all title, ownership and intellectual property rights to the material and trademarks contained herein, including all supporting documentation, files, marketing material, and multimedia. BY ACCEPTANCE OF THIS DOCUMENT, THE RECIPIENT AGREES TO BE BOUND BY THE AFOREMENTIONED STATEMENT. EXECUTIVE SUMMARY Our Lifestyle Magazine is a consumer destination, online lifestyle magazine. Targeting the desirable LOHAS market, the magazine is seeking a cash investment to execute aggressive marketing strategies to dramatically increase readership and loyalty. Our Lifestyle, an exquisitely laid-­‐out online magazine, attracts its market with color-­‐infused rich content that echoes the company mantra: Social consciousness does not assume compromise of lifestyle, beauty and fashion. Topics such as beauty, fashion, design, food, lifestyle, entertaining, celebrity culture, and travel are embedded in an easily-­‐navigated website launched in spring 2010 to create the North American authority on contemporary, urban living for the fashion forward and the forward thinking. Visitors to the site can navigate via a scrolling marquee and headings to editorials, photo spreads, and articles that celebrate contemporary and stylish eco and responsible living. This content is enticing in its positive, nonthreatening approach. A new consumer has evolved, the socially conscious one, and it is introducing its spending power into the marketplace. This market is often defined as the LOHAS (lifestyles of health and sustainability) consumer and this is the one that this publication targets. The chart at right shows the potential online LOHAS readers in the target market age range in the two top markets, Toronto and Vancouver, and then the total for all provinces. Since site analytics indicate women to be the most likely readers, the 2.3 million would be considered the top tier and the 2.1 million m ale user market would constitute the second tier. Magazine sales in Canada are expected to grow from $1.3 billion in 2011 to $1.5 billion by 2017. Internet publishing, the industry in which this company will participate, is anticipated to show revenues of $889 million this year, growing from $830 million last year. Region/Area Toronto, Ontario Vancouver, BC Total All Provinces 175,050 155,368 42,985 40,417 2,109,042 1,950,960 Female Male TOTAL 2,327,077 2,146,746 Demand for this product will be driven not only by the requirements of its readers but also by the influences of the Online Publishing industry as a whole. Demand for Internet publishing and broadcasting is highly dependent on the availability of broadband Internet access and computers. The industry's ability to generate revenue is also tied to the size of online advertisers' budgets; contextual ads, banner ads and interactive ads are the sole source of revenue for many websites. Small businesses, large companies (e.g. automakers) and advertising agencies all use online advertising as a main component of their marketing strategies today. As such, Our Lifestyle Magazine is a strategic marketing avenue for these groups, targeting a growth market. This is an exciting time for company to expand its business into an established marketplace with solid growth potential; and into an industry with excellent revenue potential as digital media becomes the norm. 5 USE OF STARTUP FUNDS The efforts of many talented people have gone into making this magazine what it is currently. The primary costs associated with a business like this are labour costs and to date the staff has worked without compensation. The Company is seeking $100,000 to execute marketing and growth strategies. The current growth model is incredibly conservative, barely reflective of tapping into the lucrative LOHAS market. With investment, it is believed that Our Lifestyle Magazine will meet the immediate growth goals in record time and no doubt exceed them rapidly. The numbers in this model vs. the total number of the target LOHAS market reflect and support this assumption. Advertising is becoming content, not message; or, more specifically, the message is knit into the content. Under that scenario there is no 30-­‐second spot per se, there are simply threads of advertising-­‐ sponsored content. Creating content that people choose to watch (and share and listen to) is the job of every company that calls itself media. Our Lifestyle Magazine lends itself exceptionally well to this model and it will be pursued aggressively as one that increases the visibility of both the magazine and the advertiser. A particular and distinct section of content located on a website sponsored by a single advertiser offers a sales medium for the advertiser and a free content medium for the publisher. Our Lifestyle Magazine will ensure that any such content used conforms to its core editorial and advertising philosophies. Canadian online display advertising, of which sponsorship and advertorial content is a part, has grown 19% over the past year. While sponsorship advertising has not been measured in Canada until the past year, it was measured at $74 million in 2010. This makes the value of this sector literally one-­‐sixth of the total online display advertising expenditure. This model is particularly well suited to this company in that forming a partnership with content sponsors will benefit both sponsors and the Company to create a win-­‐win situation. The Company will not only realize the advertising revenue inherent in this model but will benefit from the increased traffic created by the sponsored content. The sponsor as well benefits from their association with a site containing content that is aligned with their product or service offering. 6 This funding will enable Our Lifestyle to aggressively and rapidly expand its presence in the target marketplace, which will in turn result in a rapid return on investment in terms of site trafficand revenue generation.This will support continued high-­‐quality editorial content. Investor Charts Revenue Stream/Month 2011 2012 2013 Product Offerings 1 1 1 Average Revenue $41,486 $88,744 $123,279 Average COGS $16,113 $37,112 $52,607 $30,668 $49,141 $49,141 Average Operating Expenses Average Tax Burden $0 $0 $0 Average Gross Profit $25,373 $51,632 $70,672 Average Net Profit ($5,295) $2,491 $21,530 BUSINESS DESCRIPTION HISTORY OF THE BUSINESS Our Lifestyle Magazine was established in 2010 by Editor-­‐In-­‐Chief Lucinda Keyes and has evolved into the online mecca for discerning eco-­‐consumers that it is today. With no marketing, Our Lifestyle Magazine has grown to almost 4,000 unique visitors per day. These visitors visit over two pages per visit. This number is intended to grow significantly in the short term with its new layout. In this new format (launching late September), feature articles and photo shoots will be divided into multiple page views. This will significantly impact the number of impressions and directly influence revenue potential with ads sales and sponsorship. Recent events, such as the sponsorship of the Live Green Toronto Festival, have resulted in a spike in numbers (subscribers increased by 7% in just 2 weeks after the July 16 event). Also in July 2011, Our Lifestyle Magazine partnered with the Toronto Festival of Beer on a month-­‐long promotional campaign for the festival. The magazine wrote articles featuring select craft brewing companies and liaised with top local chefs to suggest food pairings leading up to the event. This turned beer from a summer afterthought to a sought after, elegant beverage for entertaining. The magazine asked its readers to retweet the magazine for a chance to win free tickets to the festival. This program achieved great results for Our Lifestyle Magazine. During the 31-­‐day promotion, Our Lifestyle’s followers on Facebook and Twitter grew by 30% and unique visitors increased by 8%. This 7 program also exceeded expectations for the Toronto Festival of Beer as it raised significant awareness of the festival, generated significant buzz during the festival (2 of the top 10 Twitterers came from the Our Lifestyle Magazine contest) and the perception of beer was elevated to a desired pairing for food. VISION AND MISSION STATEMENT It is the mission of this Company to be the North American source for consumer eco information, and to provide outstanding content that inspires readers to make informed consumer choices with an eco slant. BUSINESS GOALS Short-­‐Term Goals: Target growth: 10,000 unique visitors per month; average 5 page views. The 10,000 is an important number as it is the minimum threshold for advertisers. To execute a detailed marketing campaign (see marketing section) in order to reach growth numbers. Long Term Goals: • • • • is to be a sustainable business with significant Ultimately, the goal of Our Lifestyle Magazine positive cash flows. To grow readership in cities throughout North America. Target growth of 50,000 by 2013 To capture more of the LOHAS market To have a physical office space BUSINESS MANAGEMENT This magazine is its staff: it reflects their knowledge, their backgrounds, their talents, and their commitment to excellence in producing this magazine. As such, a brief background is given below for the primary staff members. Lucinda Keyes, Editor In Chief/ Founder/ Publisher The chief editor oversees the whole content and makes sure the flow of the magazine is seamless. As a top editor, this person is responsible for making all the final decisions and is constantly getting reports from the managing editor, creative director and the executive editor. The publisher oversees all the business elements of the magazine. Fashion insider for over 10 years. 8 Background in public relations -­‐ was account manager for The Body Shop Canada, Remy Martin, Piper Heidsieck Champagne. Has been an entrepreneur since 2001 with a successful freelance writing career (select clients/ publications include: CondeNast, Freewheelin (magazine), George Brown College, Harbinger Communications and Applause Communication. Founded Green Beauty (www.greenbeauty.ca) an online eco beauty boutique. Spent two terms on the Toronto Chapter of Fashion Group International Board of Directors. Currently sits on the cabinet of the Just Beautiful Campaign for Environmental Defense. Lucinda regularly appears on the Marilyn Denis Show and has been featured in InStyle Magazine and numerous other publications (the Globe and Mail, Best Health, More, Today’s Parent, Now Magazine, National Post) and online resources (sweetspot.ca, vitamin daily, canoe.ca, chatelaine.ca). Shai Shaw, Creative Director and Art Director The creative director is in charge of every visual aspect of the magazine and is constantly communicating back and forth with the chief editor. His or her main task is in creating cover concepts and directing photo shoots. This vision is then translated into the layout by the art director, who works in conjunction with the photo editor. With over a decade of experience within fashion and lifestyle, Shai specializes in composing the artistic and graphic look of a brand. This involves her in graphic design, art direction, marketing and communication planning. She has worked with such international brands as Julien Macdonald, Michael Kors, Roberto Cavalli and Lanvin and here in Canada with NADA, Rowenta and Warner Bros. Music. Shai has designed layouts and graphic materials for such publications as Vogue, Elle, InStyle, GQ and W in Italy, Russia, China and Korea. Shai grew up with a pencil or camera in her hand at all times. She studied post-­‐secondary design and advertising where she won awards for media, copy writing and graphic design. Shai has lectured on web design for the North American Design Exchange and taught graphic design for the International Academy of Design. Stan O’Neal, Director of Content Development Director of Content Development oversees all the sponsored content of the magazine. His main task is to development key relationships that translate into revenue generating programs. Fashion industry and media insider for over 10 years. Model agent for leading Canadian agencies: Elite models. BNM models, Elmer Olsen models. Magazine (for cool event), Springboard magazine, and Gentleman's Option. Margaret Meade, Managing Editor The managing editor is in charge of enforcing deadlines, following the editorial calendar and making sure daily tasks are being accomplished by each person. 9 Director of Communications for Rio Verde Minerals, listing August 3, 2011 on the TSX. 2004 University of Manitoba Advanced Early Admission Scholarship. GrahamTuttles, Marketing Manager The marketing manager is in charge of creating value beyond the page. He or she handles the market research and reports the trends, gathers statistics and intelligence about the potential advertiser’s brand and plans events and programs. Led some of the largest student-­‐run post-­‐secondary fundraising campaigns in Canada at Western. Organized community involvement programs for business students at the Richard Ivey School of Business. Worked on a large-­‐scale research project with Facebook Canada's sales team. Graduated top 25% of class Currently volunteering with Social Venture Partners Toronto. Erin Smythe, Beauty Editor The beauty editor guides the content of the beauty department, manages the contributors and is in constant communication with the editor-­‐in-­‐chief on editorial direction. 10 years as a makeup artist and hair stylist. Graduated from Western with a Bachelor of Music and Bachelor of Arts (major English). Works exclusively with PR firms representing Alliance Atlantis, Disney, and Universal Studios for their movie press tours. Marian Staresinic, Food Editor The senior food editor guides the content of the beauty department, manages the contributors and is in constant communication with the editor-­‐in-­‐chief on editorial direction. For the past 20 years Marian has been involved in diverse culinary experiences. She talks food stories with farmers like Michael Statlander and food critics like Jeffery Steingarten. She is a graduate of Stratford Chef School and the Faculty of Education at Queens University. Media highlights include television & radio appearances on several networks across North America: FOX TV, Time Warner (Taste of New York), Canada's Food Network (Kitchen Equipped), CTV, Global, Breakfast Television and CBC Radio. She owned and operated The Cooking Studio and represented the iconic British AGA Cooker as North America's Brand Manager. She can be found currently at Provincial Fine Foods specializing in Authentic Artisan Canada Cheese (AACC). Sarah Jay, Fashion Editor The fashion editor guides the content of the beauty department, manages the contributors and is in constant communication with the editor-­‐in-­‐chief on editorial direction. 10 Stylist and fashion insider for over 15 years. Chosen as one of the faces of the 2006 Mille Femmes exhibit which recognizes "rising stars" for their professional contributions to the arts. Key Contributors Marni Weiss, Columnist Culinary Nutritionist and Founder of Delicious Knowledge. She is a Graduate of the Institute of Holistic Nutrition in Toronto, with a certificate as a Certified Nutritional Practitioner. She is also a graduate of The Natural Gourmet Culinary Institution in New York City as a certified chef. Her focus is stemmed around whole foods. Marni is dedicated to providing individuals with a balanced lifestyle through natural foods. Using passion and experience, she strives to educate individuals on how everyday eating can be simple and delicious. Krissy Janis, Lifestyle Columnist Krissy Janis is the owner of a premier agency in North America specializing in sustainable fashion and lifestyle clients. She has an unwavering commitment to the eco movement and has helped grow many grassroots eco/green companies into some of the top progressive brands shaping the future of this industry. Alexis Staminis, Columnist Alexis Staminis is a freelance journalist and producer in Vancouver. She graduated with a Master's in Journalism at the University of British Columbia, and has worked in various media including print, online, radio and documentary. She has traveled to India and Thailand for documentary film projects, but now dedicates most of her time to local and community news in the Lower Mainland. Advisors to Lucinda Keyes and Executive Team Steve Hinton, Business Advisor Steve has engaged in over CDN$2 billion in financings and merger and acquisitions deals for natural resource projects. In addition to his work with Rio Verde, Steve is on the Board of Directors of an innovative green specialty chemical company. Steve holds a BSc in Applied Science (Queens University), an International MBA (York University, Schulich School of Business) and a PEng (Ontario and British Columbia). Elise Ahmanson, Editorial Advisor Elise is noted for combining evocative prose with solid reporting. She has developed a unique tone that has earned her a place among Canada’s top journalists. Formerly the managing editor of Flare magazine, she now contributes articles to some of the country’s most notable and well-­‐read 11 publications, including Flare, Fashion, Today's Parent, the Globe & Mail and Style at Home magazine. Elise holds a journalism degree from Ryerson University and is currently completing a master's of psychology degree. LOCATION AND FACILITIES OF THE BUSINESS This digital magazine is based in Toronto, Ontario. There are no physical offices as everyone works remotely. While the majority of the contributors are in Toronto, there are others in Vancouver, Los Angeles and Scottsdale, AZ. Team meetings are held in private homes and coffee shops. Skype is used regularly to bring those not in Toronto into the fold. OUR LIFESTYLE MAGAZINE DESCRIPTION OF THE PRODUCT In the setting of a sophisticated interface, Our Lifestyle offers an array of information written and assembled by a talented staff into a visually appealing online magazine. Current information without a cause is what differentiates this magazine, which enables it to offer products and services that appeal to the senses and not to the political affiliation. Magazines are popular in Canada, a fact borne out by the statistics. Online media and Internet publishing have taken root as well, making this the ideal time to introduce a green magazine, a web-­‐based one, to the target market. 12 The magazine currently has content in many sections that are appropriately themed and written for what they contain. Beauty COMPETITIVE ADVANTAGES The Company’s main advantage is their people who, instead of being environmentalists starting a media 13 outlet, are media, food, beauty, lifestyle and fashion industry insiders running a media outlet. This key point of difference is evident in our aesthetic and content messaging. Beyond the valued LOHAS market, eco items are becoming desired by consumers motivated by high end, luxury products. In a recent article in the Globe and Mail (July 30, 2011) it was discussed the recent shift of the luxury consumer from valuing an outward expression of brands and labels to a private understanding of the value of the item. Jewelry adored on the inside, for example. This same motivation applies to eco goods. It is the private knowledge that an item is eco, as opposed to an overt display, that can motivate the buying decision. COMPETITIVE LANDSCAPE http://ecoforall.com Eco For All is the conscious culture and fashion website. Welcome to the place for modern minds with hearts on fire. We celebrate, we criticize. We cover what’s now – and what’s next – in fashion, culture, shelter, food, and sex. As the #1 website for conscious women, Eco For All is leading the way to a more holistic definition of green. We write about products that are earth-­‐friendly and socially responsible. We believe it’s important to celebrate technological development, innovation and fair trade in addition to eco-­‐friendly materials and green design. We do not accept payment for the products we recommend, although on rare occasions we may publish sponsored articles from brands aligned with our values (and when that happens, we disclose it fully). As stated above, this website considers itself to be the number one website for conscious women. While this is arguable, what is inarguable is that they are limiting their reach by both their content and by defining their market that way. http://www.ecout.com/ Ecout is a website devoted to the future of sustainable fashion design. We’re dedicated to showcasing and supporting designers who not only contemplate cut, form, and drape, but also a garment’s social and environmental impact, from the cultivation of its fibers to its use and disposal. Our ethos: To follow the evolution of the apparel industry toward a more environmentally sound future, as well as facilitate a conversation about why sustainable fashion matters. The focus of this site is almost exclusively fashion so, even if it reaches the same market, it does not fill the same need. http://www.welovetrees.com WeLoveTrees is the leading media outlet dedicated to driving sustainability mainstream. Partial to a modern aesthetic, we strive to be a one-­‐stop shop for green news, solutions, and product information. They publish an up to the minute blog, weekly and daily newsletters, weekly radio interviews, and regularly updated Twitter and Facebook pages. 14 The content of this site notwithstanding, there is no similarity between this one and Our Lifestyle. The focus is exactly as stated above and not on artistic presentation or capturing the imagination of visitors. Other Internet magazines offering competition are the non-­‐eco sights focusing on lifestyle issues. However, given Our Lifestyle Magazine’s focus, it is the ideal destination for LOHAS consumers and those seeking “the new luxury” of eco choices. There are many other sites in addition to these that could be construed as competition. None, however, constitute a major barrier to entry. The fact is that the primary barrier to entry (and key success factor in this industry) is a concept and presentation so unique that it will attract visitors and advertising revenue. UNIQUE FEATURES 1. Our Lifestyle is ahead of the curve. Conversations with Tree Media have revealed that they are in the early stages of defining an eco publication category for their advertising clients. 2. The eco landscape is still painted with a very hippie brush. Publications (print: Vitality, Green Living; online: see competition section) that lean this way still maintain an aesthetic that is described as granola, hippie, on the fringe and even inaccessible. Our Lifestyle Magazine packages this sought after information in a way that has broad appeal. This aesthetic is modern, clean, fresh and fashionable. 3. Our Lifestyle’s content is mature, informative, relevant and un-­‐inhibiting. So often eco/ green messaging/ content is cloaked in a sense of guilt (i.e. I am not doing enough; I have messed up so much already why change now?) or the content focuses on the negative (companies/people are not doing enough; the changes being made are not sufficient) or the content focuses on a simple message of: we need to be more green/eco for the planet. 4. Our Lifestyle content maintains unique messages: 1) always focus on the positive; the magazine would not write an article advocating not driving cars (though this is the most eco option). Instead it would focus on hybrid vehicles, cycling, public transit, walking, and the many ways to get where you need to go in the most eco/ responsible means possible. Similarly, they are not whistle blowers. INDUSTRY OVERVIEW 15 Right now, social and economic trends are exerting their influence on the Canadian magazine publishing market. While the table below clearly indicates that Canadians do love print magazines and are anticipated to keep this market healthy for the next five years, they are likewise becoming more accustomed to digital content. While this business could offer its content in both formats, a primary motivating factor for target market readers to understand is the fact that this conduit of social conscious information is provided in a green medium, online. OVERALL MARKET SIZE Site analytics for this website reveal that urban dwellers over 30, predominantly women, are the first-­‐tier market with Toronto and Vancouver being the two key locations for traffic. The second-­‐tier market is made up of male urban dwellers over 30 with Toronto and Vancouver being the two key locations for traffic. Arguably, the third-­‐tier of this magazine is the United States and urban dwellers in cities such as Los Angeles. This market is described both geographically and socially with LOHAS consumer demographics being factored into the equation. An alliance between the Natural Marketing Institute and Nielsen Canada yielded a demographic profile of the Canadian LOHAS consumer. 16 • • More than 90% of Canadians recycle. The vast majority believes that considering the impact of their actions on the environment is not too difficult. Close to one-­‐half of Canadian households report purchasing many green or eco-­‐friendly products with one quarter wiling to pay a premium for environmentally friendly and sustainable products. LOHAS describes an integrated, rapidly growing $209 billion market for goods and services that appeals to consumers who have a meaningful sense of environmental and social responsibility and incorporates those values into their purchase decisions. According to Natural Marketing Institute segmentation, nearly one-­‐quarter of Canadian households can be categorized as LOHAS. Additional studies conducted by the two companies reveal greening behaviours: • Potential Target Market in Canada: Estimated Number of Online LOHAS Users by Gender Females Region/Area 30-­‐34 35-­‐39 40-­‐44 45-­‐49 50-­‐54 55-­‐59 TOTALS Toronto, Ontario 33293 29608 29573 30783 27491 24303 175050 Vancouver, BC 8777 7306 7119 7099 6743 5942 42985 TOTALS 218035 Ontario 130984 132271 138216 156037 145221 127065 829795 Québec 78189 70790 73254 88213 91210 82907 484563 British Columbia 44388 42862 46924 52188 51922 47625 285907 Alberta 39922 37898 36877 40046 38949 33050 226742 Manitoba 11053 10827 11023 12749 12642 11496 69791 Nova Scotia 9469 8639 9202 11183 11359 10405 60257 Saskatchewan 8346 8464 8447 10447 10827 9822 56354 New Brunswick, Labrador, 6622 6850 7303 8764 8944 8453 46936 Newfoundland and 4547 4962 5546 6196 6188 6082 33522 Prince Edward Island 1224 1205 1332 1639 1674 1515 8588 Northwest Territories 596 412 438 486 439 347 2719 Yukon 362 386 384 468 418 357 2376 Nunavut 328 254 314 240 202 155 1493 TOTALS 2109042 Males Region/Area 30-­‐34 35-­‐39 40-­‐44 45-­‐49 50-­‐54 55-­‐59 TOTALS Toronto 28860 26300 26682 28512 24784 20230 155368 Vancouver 8265 7001 6950 6698 6039 5465 40417 TOTALS 195786 Ontario 116065 118667 126768 145255 134456 112716 753927 Québec 74996 69449 70516 84369 83784 74131 457244 Alberta 41189 39026 37207 38714 37811 31902 225848 British Columbia 40060 38786 42752 48081 46438 42049 258166 17 Manitoba 10461 10246 10352 11976 12170 10705 65910 Saskatchewan 8566 7887 7987 9686 9954 9074 53153 Nova Scotia 6711 7589 8218 10026 9978 9144 51666 New Brunswick, Labrador, 5941 6038 6483 7819 7844 7446 41571 Newfoundland 3994 4220 4875 5557 5523 5374 29544 Prince Edward Island 985 1094 1224 1535 1439 1340 7618 Northwest Territories 549 455 397 446 450 334 2631 Yukon 337 306 335 391 432 398 2199 Nunavut 278 280 270 278 224 156 1485 TOTALS 1950960 MAREKT SIZE SUMMARY: • • • Total Canadian LOHAS market is approximately 4 million Total primary market of focus for Our Lifestyle Magazine is approximately 400,000 Yet financial model only considers a mid-­‐term audience of 40,000 MARKETING The Company’s marketing plan is built on the triangular framework of Quality Content, Increased Readership, and Revenue Generation: It is Our Lifestyle Magazine’s view that quality content leads to increased readership which leads to increased revenue. The magazine has already seen readership grow as content is developed. Quality Content Increased Readership Revenue Generaqon 18 • • • Quality Content o Increased Readership o In order to increase Our Lifestyle’s exposure, and ultimately readership, we must market our high quality content in the following ways: § Our Lifestyle’s network: leverage our relationships with companies/individuals we have featured in the magazine or worked with on editorial content – cross-­‐ promotion, content exchanges, and ad space swaps can all extend Our Lifestyle’s reach into similar target audiences § Online Promotion: buy ad space or post on blogs, forums, websites that have a similar demographic to our target audience – (e.g. savvymom.com for Bambini, ecorazzi.com for Eco-­‐Celebs, ecofashiontalk.com for Fashion) Revenue Generation o Monetize Our Lifestyle by offering marketing opportunities to companies interested in engaging our unique, lucrative audience. Examples include: § Sponsored Content § Display Ads § Newsletter Advertising § Contests & Giveaways IMMEDIATE MARKETING STRATEGY With no marketing Our Lifestyle Magazine has achieved: Almost 4,000 unique visitors per month Over 3,000 subscribers With investment, Our Lifestyle will be able to: • • • Execute marketing strategy for relevant events (Green Living Shows in select markets, Eco Fashion Week in Vancouver, The Green Shows in New York City, annual LOHAS conference). This strategy involves social media components, event attendance, and attendee engagement through the Our Lifestyle Video Booth (guests are invited to declare their eco pledge on camera -­‐ select clips are posted on the Facebook page, others are used in video content). Our Lifestyle is already in discussion with Earth Day Canada, Eco Fashion Week, The Green Shows in New York City and the Green Living Show Toronto regarding sponsorship and participation at these exceedingly relevant events. PRICE 19 The Company has spent its first year of operations focusing on evolving high quality content and developing a consistent readership in the target marketplace. Our Lifestyle Magazine regularly receives accolades on its clean design, beautiful images and mature content. With funding and the expansion of its marketing efforts, the Company will also increase efforts towards revenue models that enable Our Lifestyle to be self-­‐sustaining. Sponsored content is the key opportunity. • This is where Our Lifestyle Magazine can charge premium pricing and as readership and impressions increase so does the fee for this content which means increased revenue • Large, national and international companies are beginning to sponsor eco media efforts SWOT ANALYSIS STRENGTHS WEAKNESSES S.W.O.T. OPPORTUNITIES THREATS STRENGTHS • • A primary strength of this company lies in its staff who produces the magazine, many of whom are national and international experts in their fields. The breadth of their experience spans fashion, eco beauty, lifestyle, whole foods and holistic nutrition, and all aspects of media from print to radio to TV to digital. The many accolades the staff has received in their industries serve as testimony to their contributions in these fields. WEAKNESSES 20 • Any new business begins with an unknown factor about how it will fare. With no marketing, however, Our Lifestyle Magazine has already grown to almost 4,000 unique visitors per day. These visitors visit over two pages per visit. • Internet publishers compete with other forms of entertainment (e.g. sports, television and hobbies) for the scarce leisure time of consumers. If consumers begin spending more time playing sports then, all else being equal, they will spend less time viewing Internet content. The availability of attractive content is also a major driver of industry demand. OPPORTUNITIES • • • Our Lifestyle Magazine is seizing on a unique opportunity to pioneer the look of the emerging convergence of eco-­‐interests and higher-­‐end fashion and lifestyle. Beyond the valued LOHAS market, eco items are becoming desired by consumers motivated by high end, luxury products. A recent article in the Globe and Mail discussed the recent shift of the luxury consumer, which includes a focus on eco goods. As numbers increase, Our Lifestyle Magazine can charge more for sponsored content and programs. For example, the Festival of Beer program is priced at the current readership and impressions number. As those numbers go up, so will the potential revenue of a similar program. Increased number of companies looking for sponsored content opportunities THREATS • • As North America has not yet fully emerged from the recession, we cannot predict precisely the trajectory of the economic recovery. Even with a weak recovery in process, however, Internet publishing is anticipated to show revenues of $889 million this year, growing from $830 million last year. In addition, magazine sales in Canada are expected to grow from $1.3 billion in 2011 to $1.5 billion by 2017. The flat economy would be more of a concern if the Company had chosen to also include a print version. They elected not to do so in part to minimize financial risk but also in keeping with the philosophy of enjoying the magazine as an eco-­‐friendly choice. With digital readership on the rise, this is the ideal time to introduce a green magazine, a web-­‐based one, to the target market. IMPLEMENTATION PLAN While in fact each issue is a labor of collaborative love among all members of the Our Lifestyle production team, careful planning and coordination are required nonetheless. Each season has a theme and there are five (spring, summer, fall, holiday and winter. Summer 2011’s theme, for example, was color). The theme is chosen by the executive team (Sean, Shai and Lucinda) with collaboration with the editors. 21 Once the theme is established, each editor works with their department team to decide what content will be developed and produced through Our Lifestyle shoots and articles. The specific article and Our Lifestyle Shoot topics come from a number of sources. Either Lucinda assigns a topic, the editors come up with ideas with their team, or the journalist pitch ideas. Once articles are assigned they are put into the editorial calendar and Melanie (managing editor) works with the writers to ensure everything is delivered on time. The actual publishing of the magazine is handled by the team of the creative director. The marketing activities are handled by Graham (who has deep experience in social media) and Lucinda. The team is poised to seek and secure advertisers and sponsored lead by Sean (who secured and designed the Toronto Festival of Beer program discussed previously). The magazine works 4 – 6 weeks ahead of publishing. For example, in September editors are working on content for November and December. FINANCIAL PLAN FINANCIAL NARRATIVE As it begins its second year of operations, Our Lifestyle Magazine intends to use the success achieved in its first year of operation as a springboard for a rapid and aggressive expansion of its presence in the target marketplace. Lucinda Keyes has already committed over $60,000 of her own funds for the development and operation of the business to date. The Company is seeking $100,000 to expand its presence rapidly in the marketplace. The purpose of the plan, which these financials will validate, is to establish the Company’s potential for solid growth through its unique business model punctuated by a healthy relation between continually increasing revenues and diligent cost containment. The website and an ever-­‐increasing amount of advertising revenue will be the basis for the Company’s expansion into the marketplace. The financial portion of this plan details this data at a monthly level for the first year and spotlights the revenue and profits during this period. The projections in this business plan are based on an evaluation of the potential market, the growth of the market, and the potential growth of an entity developed with the proposed business model and strategies. The most important financial indicators are bottom line and cash. The Company will constantly monitor the flow of revenue and operating profits, carefully control the expenses, and accumulate cash to repay debt. This is reflected in the cash flow charts and the income statements. 22 The breakeven analysis for this company calculates at what point the company is profitable, and what level of revenue keeps it above the breakeven level. The table and graph in the Breakeven section reflect the increasing delta between breakeven and revenue projected. This, then, is a visual indicator of the increasing profitability (delta between breakeven level and revenue) of the Company and evidences its ability to service debt and fund future growth from income from operations. The projected profit and loss statement for The Company highlights the relation between the sales forecast and the operating expenses. These figures are based on the projections of the Company and the performance forecasts for both the base metal mining and mining services industries. The projected cash flow statement for The Company represents the cash balance remaining at the end of each year after deducting the expenses from the gross profit (revenue minus direct costs) and any other uses of cash (increases in inventory or accounts receivable). Cash flow is crucial to business survival. With the investment requested, the Company is confident that it will have the resources to handle contingencies, take advantage of new opportunities, and make capital improvements as needed. The chart below compares revenues to the cash balance at the end of the next several years. The cash balance in 2013 is after the return of the principal of the anticipated loan. Key drivers for success are readership numbers (subscribers and unique visitors as discussed) and average number of impressions (or number of pages people read as discussed). The assumptions used in the financial model use very conservative numbers relative to the size of the market discussed previously (see overall market size). FINANCIAL ASSUMPTIONS Financial Assumptions INCOME STATEMENT Year 1 0 Year 2 114% Year 3 39% Sales Growth Operating Expenses Travel Depreciation Flat ASSUMPTION/J USTIFICATION Based on estimates provided by the client. Flat No assets to depreciate All other operating expenses Taxes Flat Flat Based on schedule provided by client 72% BALANCE SHEET Accounts Receivable Based on % to sales Accounts Payable Based on % to sales Salaries Flat Based on schedule provided by client 23 Notes Payable Prepaid Expenses Headcount 6.0 Based on % to sales 10.0 10 The baseline for salaries is unknown. There are currently 6 employees, with the desire to increase to 10 by the end of year 1. Year 2 and Year 3-­‐headcount growths is proportionate to sales growth. The Company believes that their long-­‐term prospects for growing a successful business are excellent. The Company will break through the startup barriers, acquire the capital needed, and develop a loyal client base in the target market arena. Under the leadership of the experienced business owner, and coupled with the business model, value proposition and the customer-­‐centric strategy, the Company expects to clearly differentiate itself from the competition and reach its growth goals. The impact of the leadership and attitude are reflected in the financial highlights below PROJECTED MONTHLY AND ANNUAL SALES REVENUE Sales Sales, Year 3 $1,479,348 Sales, Year 2 $1,064,932 Sales, Year 1 $497,836 FINANCIAL HIGHLIGHTS 24 THREE YEAR FINANCIAL HIGHLIGHTS Sales Year 1 Year 2 $497,836 $1,064,932 $1,479,348 Gross Profit $304,476 $619,585 $848,061 Gross Profit % Operating Profit 61% ($63,540) 58% $29,889 57% $258,365 Operating Profit % Profit Before Tax -­‐13% ($63,540) 3% $29,889 17% $258,365 Profit Before Tax % -­‐13% 3% 17% ($63,540) $29,889 $258,365 Net Profit Net Profit % -­‐13% Sales growth Year 3 3% 17% 114% 39% FINANCIAL PROJECTIONS Revenue Projechons $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $0 Year One Year Two Year Three Year One Year Two Year Three 25 Expense Projechons Profit and Loss Projechons Cash Flow Projechons $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 -­‐$50,000 -­‐$100,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 Year One Year Two $0 Year Three Year One -­‐$50,000 -­‐$100,000 Year Two Year Three BREAKEVEN ANALYSSIS Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 $147 $373 $10,814 $21,364 $37,791 $61,894 $81,572 $125,789 $170,326 $215,034 $259,943 $304,476 $3,923 $10,346 $14,269 $18,192 $24,455 $71,178 $120,401 $169,424 $218,447 $269,970 $318,993 $368,016 Cumulative Sales $241 $610 $17,682 $34,931 $61,790 $101,200 $133,374 $205,672 $278,493 $351,593 $425,021 $497,836 Breakeven Sales $546 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Breakeven Analysis Cumulative Gross Profit Cumulative Operating Expense 26 Our Lifestyle Magazine Breakeven Analysis $600,000 $500,000 $400,000 Cumulahve Gross Profit $300,000 Cumulahve Operahng Expense $200,000 Cumulahve Sales $100,000 $0 INCOME STATEMENT THREE YEAR INCOME STATEMENT Sales Direct Cost of Sales Gross Profit Operating Expenses General and Administrative Expenses Marketing Auto Expenses Bank Charges Photo Credits Giveaways Insurance Meetings/Catering Server/Internet/Systems Office Supplies Salaries Rent Travel Year Two $1,064,932 $445,347 $619,585 Year Three $1,479,348 $631,287 $848,061 $15,600 $2,400 $240 $1,800 $7,280 $9,996 $12,800 $4,200 $1,200 $290,500 $10,000 $7,500 27 Year One $497,836 $193,360 $304,476 $15,600 $2,400 $240 $1,800 $7,280 $9,996 $12,800 $4,200 $1,380 $498,000 $24,000 $7,500 $15,600 $2,400 $240 $1,800 $7,280 $9,996 $12,800 $4,200 $1,380 $498,000 $24,000 $7,500 Other G & A Expenses Total Operating Expenses Operating Profit (EBIT) Interest Expense Total Other Income/Expense Net Income Before Tax (EBT) Tax Net Income $4,500 $368,016 ($63,540) $0 $0 ($63,540) $0 ($63,540) Salary Headcount Total Salary Expense Average Salary Year One Year Two Year Three 6 10 10 $290,500 $498,000 $498,000 $48,417 $49,800 $49,800 28 $4,500 $589,696 $4,500 $589,696 $29,889 $0 $0 $258,365 $0 $0 $29,889 $258,365 $0 $0 $29,889 $258,365 CASH FLOW STATEMENT THREE YEAR CASH FLOW STATEMENT Year 0 Year 1 Year 2 Year 3 Cash and Cash Equivalents, Beginning of Year $1,500 $101,500 $37,960 $67,849 Change in Net Assets $0 $258,365 Items not Requiring (Providing) Cash Depreciation $0 Changes in: Prepaid Expenses $29,889 $0 $0 -­‐$75,590 $0 $0 $0 $9,070 $0 $0 $0 $0 $0 $0 Income Tax Payable $0 $0 $0 Notes Payable $0 $0 $0 Net cash flow from operations Investing Activities Accounts Receivable Accounts Payable -­‐$66,520 -­‐$63,540 $29,889 $258,365 Building and Equipment $0 $120,000 $0 $0 Net cash flow from investing activities Financing Activities Shareholders Loan $0 $120,000 $0 $0 Loan $0 $100,000 Principal Payment Net cash flow from financing activities Cash at Beginning of Period Cash at End of Period $100,000 Increase in Cash -­‐$120,000 $0 $0 $0 $0 $0 -­‐$120,000 $101,500 $37,960 $37,960 $67,849 $0 $67,849 $326,214 -­‐$63,540 $29,889 $258,365 $34,980 29 -­‐$63,540 $0 BALANCE SHEET THREE YEAR BALANCE SHEET Assets Current Assets Cash and Cash Equivalents Accounts Receivable Prepaid Expenses Total Current Assets Fixed Assets Property and Equipment Total Fixed Assets Less Accumulated Depreciation/Amortization Furniture Fixtures, Fleet, Net Total Assets Year 1 Year 3 $36,460 $0 $0 $36,460 Liabilities & Stockholders' Equity Current Liabilities Accounts Payable Notes Payable Income taxes payable Total Current Liabilities Long-­‐Term Liabilities Debenture Shareholder Loans Long term debt Total Liabilities Stockholders' Equity Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 30 Year 2 $66,349 $324,714 $0 $0 $0 $0 $66,349 $324,714 $0 $0 $0 $0 $0 $0 $0 $0 $36,460 $0 $0 $0 $0 $66,349 $324,714 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $100,000 $100,000 $0 -­‐$63,540 -­‐$63,540 $36,460 $0 $0 $100,000 $100,000 $0 -­‐$33,651 -­‐$33,651 $66,349 $0 $0 $100,000 $100,000 $0 $224,714 $224,714 $324,714 MONTHLY INCOME STATEMENT FIRST YEAR Sales Direct Cost of Sales $241 $369 $17,072 $17,249 $26,859 $39,410 $32,174 $72,298 $72,821 $73,100 $73,428 $72,815 $497,836 $94 $143 $6,631 $6,700 $10,432 $15,307 $12,496 $28,081 $28,284 $28,392 $28,519 $28,281 $193,360 $226 Gross Profit $147 $10,441 $10,549 $16,427 $24,103 $19,678 $44,217 $44,537 Operating Expenses General and Administrative Expenses Marketing Auto Expenses $44,708 $44,909 $44,534 $304,476 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $1,300 $15,600 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $2,400 Bank Charges $20 $20 $20 $20 $20 $20 $20 $20 $20 $20 $20 $20 $240 Photo Credits $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $1,800 Giveaways $520 $520 $520 $520 $1,560 $520 $520 $520 $520 $520 $520 $520 $7,280 Insurance $833 $833 $833 $833 $833 $833 $833 $833 $833 $833 $833 $833 $9,996 Meetings/Catering $200 $200 $200 $200 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $12,800 Server/Internet/Systems $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $4,200 Office Supplies $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $1,200 Salaries $0 $0 $0 $0 $0 $41,500 $41,500 $41,500 $41,500 $41,500 $41,500 $41,500 $290,500 Rent $0 $0 $0 $0 $0 $0 $0 $2,000 $2,000 $2,000 $2,000 $2,000 $10,000 Travel $0 $2,500 $0 $0 $0 $0 $2,500 $0 $0 $2,500 $0 $0 $7,500 Other G & A Expenses Total Operating Expenses Operating Profit (EBIT) $250 $250 $250 $250 $250 $250 $250 $550 $550 $550 $550 $550 $4,500 $3,923 $6,423 $3,923 $3,923 $6,263 $46,723 $49,223 $49,023 $49,023 $51,523 $49,023 $49,023 $368,016 -­‐$3,776 -­‐$6,197 $6,518 $6,626 $10,164 -­‐$22,620 -­‐$29,545 -­‐$4,806 -­‐$4,486 -­‐$6,815 -­‐$4,114 -­‐$4,489 -­‐$63,540 Other Income $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Interest Expense $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Other Income/Expense $0 Net Income Before Tax (EBT) Tax $0 -­‐$3,776 -­‐$6,197 $0 Net Income $0 $6,518 $0 -­‐$3,776 $0 $6,626 $0 -­‐$6,197 $0 $6,518 $6,626 $0 $10,164 -­‐$22,620 -­‐$29,545 $0 $0 $0 $0 $0 -­‐$4,806 $0 $10,164 -­‐$22,620 -­‐$29,545 $0 -­‐$4,486 $0 $0 -­‐$6,815 $0 -­‐$4,806 $0 -­‐$4,114 $0 -­‐$4,486 $0 -­‐$4,489 $0 -­‐$6,815 $0 -­‐$63,540 $0 -­‐$4,114 $0 -­‐$4,489 -­‐$63,540 Salary Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Total 6 6 6 6 6 6 6 6 6 6 6 6 6 Total Salary Expense $0 $0 $0 $0 $0 $41,500 $41,500 $41,500 $41,500 $41,500 $41,500 $41,500 $290,500 Average Salary $0 $0 $0 $0 $0 $6,917 $6,917 $6,917 $6,917 $6,917 $6,917 $6,917 $48,417 Headcount 31 MONTHLY CASH FLOW STATEMENT FIRST YEAR MONTHLY CASH FLOW STATEMENT Cash and Cash Equivalents, Beginning of Month Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 $0 $100,000 $96,224 $90,027 $96,545 $103,172 $0 -­‐$3,776 -­‐$6,197 $6,518 $6,626 $10,164 $113,336 $90,716 $61,171 $56,365 $51,879 $45,064 -­‐$29,545 -­‐$4,806 -­‐$4,486 -­‐$6,815 Change in Net Assets -­‐$22,620 Items not Requiring (Providing) Cash Depreciation Changes in: $0 $0 $0 $0 $0 $0 $0 $0 $0 -­‐$4,114 $0 $0 Prepaid Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Accounts Receivable $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Accounts Payable $0 $0 $0 Income Tax Payable $0 $0 $0 Notes Payable Net cash flow from operations $0 $0 $0 -­‐$3,776 $0 -­‐$6,197 $6,518 $0 -­‐$22,620 -­‐$29,545 $6,626 $10,164 Investing Activities -­‐$4,806 -­‐$4,486 -­‐$6,815 -­‐$4,114 Building and Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Principal Payment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Net cash flow from investing activities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Financing Activities Shareholders Loan $0 Loan $100,000 Principal Payment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Net cash flow from financing activities $100,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $100,000 $96,224 $90,027 $96,545 $103,172 $113,336 $90,716 $61,171 $56,365 $51,879 $45,064 Cash at Beginning of Period Cash at End of Period $100,000 Increase in Cash $100,000 $96,224 -­‐$3,776 $0 $90,027 $96,545 $103,172 $113,336 -­‐$6,197 $6,518 $6,626 32 $10,164 $90,716 $61,171 -­‐$22,620 -­‐$29,545 $56,365 $51,879 -­‐$4,806 $45,064 -­‐$4,486 $40,950 -­‐$6,815 -­‐$4,114