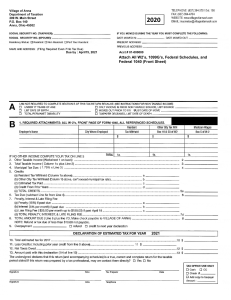

September 14, 2021 The Commissioner Inland Revenue, Corporate Tax Office, Lahore. TAXPAYER: ABC (PRIVATE) LIMITED NTN # xxxxxxxx-2 Respected sir, SUBJECT: APPLICATION FOR APPROVAL & ISSUANCE OF EXEMPTION CERTIFICATE ON EXPORT OF IT SERVICES UNDER SECTION 154A OF THE INCOME TAX ORDINANCE, 2001 With respect to the captioned subject, our company was registered in SECP & FBR as Software Export Services provider business in Pakistan on July 01, 2020. We are only doing export of IT Services business till date against which our regular remittances are being received in our business bank account. With the introduction of Section 154A and Section 65F in the Income Tax Ordinance 2001, through Finance Act 2021, banks have started to deduct 1% withholding Income Tax against all remittances we are receiving against our export of IT Services. To save this withholding Tax, bank demand Withholding Tax Exemption Certificate under section 154A of Income Tax Ordinance 2001. In this regard, we wish to convey you that kindly issue the Withholding Tax Exemption Certificate under section 154A as we meet the requirements under section 65F of the Income Tax Ordinance 2001. As per requirements of the law, following documents are attached Income Tax Return Tax Year 2020 Tax Year 2021 PRA Sales Tax Returns Bank Statement Tax Year 2021 Tax Year 2021 Withholding Tax Returns Export Details (Tax Year 2021) Form V-13 PSEB Certificate Memorandum of Association FBR Registration Certificate It is requested your honor is to approve the application so that we may continue our business activities of more actively and efficiently Thanking you. Regards, ___________________________ For and on behalf of M/s ABC (PRIVATE) LIMITED