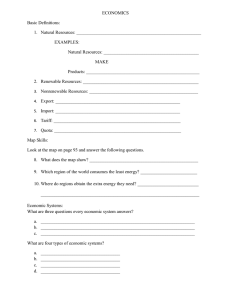

INTERNATIONAL ECONOMICS MA.Nguyen Bich Ngoc Department of International Economics School of Trade&International Economics National Economics University Email: bichngocktqt@neu.edu.vn/ bichngocktqt.neu@gmail.com/ TEL : 0936500505 GLOBAL T R A D E “the world is flat” Course descriptions SYLLABUS OF INTERNATIONAL ECONOMICS Understand the theory and principles of international economics Understand, evaluate and suggest solutions for international economics issues The course includes two parts: part 1 deals with international trade theory and policy; part 2 examines measurement of a nation’s balance of payments, exchange rate determination, open-economy macroeconomics and international monetary system. Learning resources Textbook: Dominick Salvatore (2013), International Economics, 11th edition, John Wiley & Sons, Inc Reference books: Paul R.Krugman, Maurice Obstfeld, Marc Melitz (2015), International Economics: Theory and Policy (10th Edition), Prentice Hall Thomas A. Pugel & Peter H.Lindert (2000), International Economics, eleventh edition, Irwin McGraw-Hill. Course goal Understand the basis and gains from international trade as the pattern of trade Identify obstructions to the flow of trade Identify the stages and benefits of economics integration Understand the motives and effects of international investments Interpret a nation’s balance of payment and related accounts Explain how exchange rate is determined in the short run and long run Know how to explain the effectiveness of national macroeconomic policy in open economies W1 - W2 W3 - W4 W5 - W6 W7 PART 1: International trade theory (Chapter 2 – 7) PART 2 : International Trade policy (Chapter 8,9) + Case study & Presentation Chapter 10,11: Economic integration (Case study & Presentation) Chapter 12: International Direct Investment (Quiz 1) W8 W9 W10 Lesson plan PART 3: The balance of payments (Chapter 13) Chapter 14,15: Exchange rates PART 4: Open – Economy macroeconomics (Quiz 2) Course requirement & Expectation STUDENTS 80% attendance of class section time LECTURE Attendance: 10% Quizzes: 20% Must complete 2 quizzes, group assignments and final examination Group Assignment: 20% Final exam (closed –book): 50% Rules On time, Proactive, read textbooks & do exercises before class REWARDS & PUNISHMENTS Bonus points will be assigned to students who distinguish themselves by active and productive participation in class discussions. Students will be held to the highest standards of academic honesty: No cheating of any sort will be tolerated during exams and students suspected of such behaviour will be subject to the appropriate university procedures. . CHAPTER 1 INTRODUCTION TO INTERNATIONAL ECONOMICS “WE LIVE IN A GLOBAL ECONOMY" Give some examples or evidences to prove that the statement above is right “THE RAPID GLOBALIZATION PROVIDES MANY OPPORTUNITIES AND CHALLENGES FOR NATIONS AND PEOPLE" Discuss about the statement. Which are the opportunities and challenges for nations and people? Globalization revolutions The Second Revolution The Forth Revolution • Rapid increase of international trade • World war II • Great Depression in USA in 1929 lead to the heavy trade protection 1870 - 1914 The first revolution • Industrial Revolution in Europe • Explore new lands to food and material production (America, Australia, New Zealand, South Africa) • End with the breakout of World War I in 1914 1945 – 1980 What do you know about the 4th Revolution? Since 1980 The third Revolution • The tremendous development of telecommunication • Massive international capital flows • Global financial and economic crisis (Asia in 1997, USA in 2007 affected to entire world economy) 2018 – present International flow of goods, services, labor and capital Interdependence in the world economy is reflected in the flows of goods, services, labor and capital across national boundaries The economic interdependence among nations has been increasing over the years (the more rapid growth of world trade than world production). The interdependence among nations is measured by the ratio of their import and export of goods and services to their GDP (Gross domestic product) The increase in the independence among nation lead to the effect of nations’ policies on others (and vice versa) International flow of goods and services is considered ”international trade” (ex: export, import, reexport, re-import) International flow of labor (people) include activities as migration, travelling, studying aboard, export or import labor) International flow of capital is reflected in financial or portfolio capital move to markets where interest rates are higher, foreign direct investment (FDI) The subject matter of International economics International economics deal with the economic and financial interdependence among nations. It analyzes the international flow of goods, services, labor and capital among nations, the nations’ policies to regulate these flows, and their effects on the nation’s welfare. In details, international economics deals with international trade theory, international trade policy, the balance of payment and foreign exchange markets, open-economy macroeconomics. • International trade theory analyze the basis and the gain from trade, the patterns of trade • International trade policy analyze the instruments of trade policy, the reasons and effects of trade restrictions • The balance of payments measures a nation’s total receipt from and total payments to the rest of the world • Foreign exchange markets are the institutional framework for the exchange of one national currency for others • Open-economy macroeconomics deals with the mechanisms of adjustment in balance-ofpayments disequilibria (deficits and surpluses) QUESTION FOR REVIEW 1. Groups (2 -3 participants) answer the question for review in page 18 – 19 (15min) 2. Brainstorming and discussion about “ Current international economics problems and challenges facing in the world today” (15min) 3. Choose 2 Groups for short presentation (10 min) PART 1: INTERNATIONAL TRADE THEORY CHAPTER 2: THE LAW OF COMPARATIVE ADVANTAGE Main parts Learning goals • Understand the law of comparative advantage • Understand the relationship between the opportunity costs and relative commodity prices • Explain the basis for trade and the gains from trade 1. The Mercantilists’ view on trade 2. Trade based on Absolute Advantage: Adam Smith 3. Trade based on Comparative Advantage: David Ricardo 4. Comparative advantage and Opportunity costs 5. The basis for and the gain from trade under constant costs 2.1 The Mercantilists’ views on trade An economy philosophy on international trade was known as Mercantilism during the 17th and 18th centuries The content of mercantilism: • A nation become richer and more powerful when it exports more than imports. • The export surplus is the inflow of bullion, precious metals (gold and silver). • The more gold and silver a nation had, the richer and more powerful it was. • The government have to stimulate the nation’s export and restrict its imports. • A Nation could gain in trade only in the expense of of other nations Trade was a zero-sum game Q&A • What are the differences from the views on the wealth of a nation in Mercantilism and in the world today? • Why do they say that the Mercantilists 'views on trade was a zero-sum game? • How are the Mercantilists ‘views important and appropriate in the trade policy? 2.2 Trade based on Absolute advantage: Adam Smith Assumption (1)The world has 2 nations, 2 commodities. (2) No trade restrictions : perfect mobility of factors within the nations but no international mobility, perfect competition. (3) The only element of cost of production is labor The content of theory • Trade between two nations is based on absolute advantage and benefits for both nations • Absolute advantage: When one nation is more efficient than another in the production of one commodity • When each nation specializes in the production of the commodity of its absolute advantage and exchanges part of its output for the commodity of its absolute disadvantage, both nations end up consuming more of both commodities • All nations would gain from free trade or follow a policy of ”laissez-faire” (a little government interference with the economic system) 2.2 Trade based on Absolute advantage: Adam Smith Example (Table 2.1) Which is the absolute advantage of each nations (US and UK)? - US has an absolute advantage in wheat because US produce 6 bushels of wheat more than 1 bushels of wheat of UK in a hour US can completely specialize in the production of wheat - UK has an absolute advantage in cloth because UK produce 5 yards of cloth more than 4 yards of cloth of US in a hour UK can completely specialize in the production of cloth - Both nations can gain from specialization in production and trade 2.3 Trade based on Comparative advantage: David Ricardo Assumption (1) The world has 2 nations, 2 commodities. (2) Free trade (3) Perfect mobility of labor within each nation, but immobility between two nations (4) Constant costs of production (5) No transportation costs (6) No technical change (7) The labor theory of value The content of theory: 1817 – Principles of Political Economy and Taxation • Both nations can gain by each specializing in the production and exportation of the commodity of its comparative advantage (even if one nation has an absolute disadvantage with the respect of another in the production of both commodities). There is still a basis for mutually beneficial trade. • Comparative advantage: The less efficient nation should specialize in the production and export of the commodity in which its absolute disadvantage is smaller. This is the commodity of its comparative advantage. 2.3 Trade based on Comparative advantage: David Ricardo Example (Table 2.2) Which is the comparative advantage of each nations (US and UK)? US UK Wheat 1W= 2/3C 1W = 2C Cloth 1C = 3/2W 1C = ½W Answer: US has an absolute advantage in both wheat and cloth, UK has an absolute disadvantage in both commodities BUT US’s production cost of wheat is smaller than UK’s UK’s production cost of cloth is smaller than US’s RESULT UK has comparative advantage in the production of Cloth and export cloth to US (import wheat from US) US has comparative advantage in the production of Wheat and export wheat to UK 2.3 Trade based on Comparative advantage: David Ricardo Example (Table 2.2) How does each nation gain from trade when 1Wheat exchange 1Cloth (the exchange rate is 1:1)? How the rate at which commodities are exchanged for one another is determined? 2.3 Trade based on Comparative advantage: David Ricardo Example (Table 2.2) How does each nation gain from trade when 1Wheat exchange 1Cloth (the exchange rate is 1:1)? US UK The domestically exchange rate 6 Wheat = 4Cloth 3W : 2C or 1W : 2/3C 2Cloth = 1 Wheat 2C :1W or 1C : ½ W The world exchange rate 1W : 1C 1C: 1W The gains from trade 1W = (1C - 2/3C) = 1/3C 1C = (1W – 1/2W) = 1/2W How the rate at which commodities are exchanged for one another is determined? US only trade with UK in case US gains from trade or the world exchange rate is larger than the domestically exchange rate : The world exchange rate = 1W > 2/3C (1) UK only trade with US if the world exchange rate is larger than the UK’s exchange rate in the domestic market: The world exchange rate = 1C > ½ W (2) Results as the combination (1) and (2): 2/3 C < 1W < 2C or 1/2W < 1C < 3/2W 2.4 Comparative advantage and Opportunity Cost The content of theory • The Opportunity cost theory: the cost of a commodity is the amount of a second commodity that must be given up to release enough resources to produce one additional unit of the first commodity. • The nation with the lower opportunity cost in the production of a commodity has a comparative advantage in that commodity. • Opportunity costs can be illustrated with the production possibility frontier (PPF) that shows the alternative combinations of the two commodities that a nation can produce by fully utilizing all of its resources with the best technology available to it. 2.4 Comparative advantage and Opportunity cost Example (Table 2.4) Draw the Production Possibility Frontier in both two nations based on Table 2.4 Give explanations about the opportunity cost of two nations Determine the opportunity cost and the relative price of each commodity in both nations. 2.4 Opportunity cost and the gains from trade Example (Table 2.4) Case 1: The absence of trade (a nation can consume the commodities that it produces) US may choose consume at point A (90W, 60C) UK may choose consume at point A’ (40W,40C) Case 2: Trade possible US would specialize in the production of wheat and produce at B (180W, 0C) UK would specialize in the production of Cloth and produce at B’ (120C, 0W) IF the world exchange rate 1W: 1C Assume US exchange 70W for 70C with UK US would consume at E (110W, 70C) and UK would consume at E’(50C, 70W) The consumption frontier is above the production possibility frontier (When both nations specialize in the production of the commodity of its comparative advantage, both nations would consume two commodities increasingly QUESTION FOR REVIEW 1. Groups (2 -3 participants) answer the question for review in page 52 (15min) 2. Do exercise in Problems 1 – 11 (page 52 – 53) PART 1: INTERNATIONAL TRADE THEORY CHAPTER 3: THE STANDARD THEORY OF INTERNATIONAL TRADE Main parts Learning goals • Understand how relative commodity prices and the comparative advantage of nations are determined under increasing costs • Show the basis and the gains from trade with increasing costs 1. 2. 3. 4. The Production Frontier with increasing costs Community indifference curves Equilibrium in isolation The basis for and the gain from trade with increasing costs 5. Trade based on differences in tastes 3.1 The Production Frontier with increasing costs Increasing opportunity costs: the nation must give up more and more of one commodity to release just enough resources to produce each additional unit of another commodity. Increasing opportunity costs result in a production frontier that is concave from the origin (rather than a straight line in case of constant opportunity costs in chapter 2) Example (Figure 3.1) - Concave production frontiers reflect increasing opportunity costs in each nation in the production of both commodities. - Nation 1 also faces increasing opportunity cost in the production of Y - Nation 2 also faces increasing opportunity cost in the production of X - The marginal rate of transformation (MRT) of X for Y refers to the amount of Y that a nation must give up to produce each additional unit of X. (MRT = the opportunity cost of X = the (absolute) slope of the production frontier at the point of production) 3.1 The Production Frontier with increasing costs Why do the increasing opportunities costs arise? • Resources or factors of production are not homogeneous • are not used in the same fixed proportion or intensity in the production of all commodities Why do the production frontiers of nations have different curve? • The difference in the production frontiers of two nations is due to the fact that the two nations have different factor endowments or resources at their disposal and/or use different technologies in production • As the supply or availability of factors and/or technology changes over time, a nation’s production frontier shifts. 3.2 Community indifference curves Community indifference curves: shows the various combinations of two commodities that yield equal satisfaction to the community or nation. Higher curves refer to greater satisfaction and vice versa. Community indifference curves are negatively slope and convex to the origin. Community indifference curves are different from nations to nations due to tastes, demand preferences. The Marginal rate of substitution (MRS): The marginal rate of substitution (MRS) of X for Y in consumption refers to the amount of Y that a nation could give up for one extra unit of X Example: Figure 3.2 Give an explanation with points on the figure 3.2 Give a comparison between community indifference curves in Nation 1 and Nation 2 3.3 Equilibrium in the absence of trade Equilibrium in the absence of trade: when it reaches the highest indifferent curve possible given its production frontier (or where a community indifferent curve is tangent to the nation’s production frontier) Example: Figure 3.3 1. Give an explanation with point A on the figure 3.3 2. Give a comparison between point A and B 3. Why does Nation 1 equilibrium in isolation by producing and consuming at point A? 4. Determine the comparative advantage of Nation 1 and Nation 2 3.4 The basic for and the gains from trade with increasing costs The nation with the lower relative price for a commodity has a comparative advantage in that commodity, then the nation should specialize in the production of the commodity of its comparative advantage and exchange parts of its output with the other nation for the commodity of its comparative disadvantage. As Each nation specializes in producing the commodity of its comparative advantage, its incurs increasing opportunity costs. Specialization will continue until relative commodity prices in the two nations equal at the level at which trade is in equilibrium Equilibrium-relative commodity price with trade is the common relative price in both nations with at which trade is balanced Example: Figure 3.4 Based on Figure 3.3, Nation 1 has comparative advantage in producing commodity X, Nation 2 in commodity Y Determine the gains from trade of Nation 1 and Nation 2 at the equilibrium (X:Y = 1: 1) PART 1: INTERNATIONAL TRADE THEORY CHAPTER 4: DEMAND AND SUPPLY, OFFER CURVES, AND THE TERMS OF TRADE Main parts Learning goals • • • Show how the equilibrium price at which trade takes place is determined by demand and supply Show how the equilibrium price at which trade takes place is determined with offer curves Explain the meaning of the terms of trade and how they changed over time 1. 2. 3. 4. Partial Equilibrium Analysis Offer curves General Equilibrium Analysis Relationship between Partial and General Equilibrium Analyses 5. The terms of trade 4.1 Partial Equilibrium Analysis • Curve Dx and Sx on Panel A and C refer the demand and supply curves for commodity X of Nation 1 and Nation 2 • At Panel A : In the absence of trade), Nation 1 produce and consume at point A with the relative price Px/Py = P1 If Px/Py > P1 Nation 1 produce X more than consume X surplus supply • At Panel C: In the absence of trade), Nation 2 produce and consume at point A’ with the relative price Px/Py = P3 If Px/Py <P3 Nation 2 consume X more Than consume X excess demand • With the opening of trade, Nation 1 export the surplus of supply of commodity X And Nation 2 import the deficit of demand of commodity X from Nation 1 • At the relative price P2 (the intersection of D and S at point E* in panel B) where the quantity of exports X supplied by Nation 1 (BE) equal to the quantity of Imports of X demanded by Nation 2 (B’E’). P2 is the equilibrium – relative price of commodity X 4.2 Offer Curves • Offer curves (or reciprocal demand curves) were devised by Alfred Marshall and Ysidro Edgeworth • The offer curve of a nation shows how much of its import commodity the nation demands for it to be willing to supply various amounts of its export commodity or the willingness of the nation to import and export at various relative commodity prices • Example: Derivation of the offer curve of nation 1 and 2 At the autarky, Nation 1 start to produce at point A If trade takes place at the relative price PB = 1, Nation 1 produce more X at point B ( A move to B in production) and exchange 60X= 60Y to consume at point E on its indifferent curve III. If trade takes place at the relative price PF = ½ , Nation 1 produce more X at point F ( A move to F in production) and exchange 40X= 20Y to consume at point H on its indifferent curve II. --> The offer curve of Nation 1 is generated by joining the point H and E ( The right panel in Figure 4.3) 4.3 General equilibrium analysis • The intersection of the offer curves of two nations defines the equilibrium – relative commodity prices at which trade takes place between them • Only at the equilibrium price will trade be balanced between two nations. • Example: Equilibrium – relative commodity price with trade (Figure 4.5) • The two offer curves intersect at point E with Px/Py = PB = PB’ = 1. It means Nation 1 offers 60X for 60Y and Nation 2 offers exactly 60Y for 60X Trade is in equilibrium (both nations happen to gain equally from trade) • At any other Px/Py trade would not be in equilibrium and move toward its equilibrium level • Relationship between the partial equilibrium and general equilibrium illustrate on Figure 4.6 4.4 The terms of trade • The terms of trade of a nation is the ratio of the price of its export commodity to the price of its import commodity • In the world (more than 2 nations), the terms of trade of a nation are given by the price index of its export to the price index of its import • An improvement in a nation’s terms of trade is usually regarded as beneficial to the nation in the sense that the prices that the nation receives for its exports rise relative to the prices that it pays for imports. Example: Nation1 export commodity X and import commodity Y The term of trade of nation 1 is given by Px/Py Nation 2 import commodity X and export commodity Y The term of trade of nation 2 is in the reverse of Nation1’s term of trade If the term of trade of Nation 1 rise from 100 to 120 (%) this means that the nation 1’s export prices rose 20% in relation to its import prices or the nation 2’s term of trade is deteriorated from 100 to (100/120)*100 = 83% CHAPTER 5 FACTOR ENDOWMENTS AND THE HECKSCHER - OHLIN THEORY MAIN PARTS MAIN GOALS • Explain how comparative advantage is based on differences in factor endowments across nations • Explain how trade affects relative factor prices within and across nations • Explain why trade is likely to be only a small reason for higher skilled–unskilled wage inequalities • • • Factor intensity, factor abundance and the shape of the production frontier Factor endowments and the Heckscher – Ohlin Theory Factor – Price equalization and income distribution T 5.1 Assumptions of the theory 1. There are two nations (Nation 1 and Nation 2), two commodities (commodity X and commodity Y), and two factors of production (labor and capital). 2. Both nations use the same technology in production. 3. Commodity X is labor intensive, and commodity Y is capital intensive in both nations. 4. Constant returns to scale for X and Y in both nations. 5. Incomplete specialization in production in both nations. 6. Tastes are equal in both nations. 7. Perfect competition in both commodities and factor markets in both nations. 8. There is perfect factor mobility within each nation but no international factor mobility. 9. There are no transportation costs, tariffs, or other obstructions to the free flow of international trade. 10. All resources are fully employed in both nations. 11. International trade between the two nations is balanced 5.2 Factor intensity, Factor abundance and the shape of the Production Frontier 1. Factor intensity if the capital–labor ratio (K/L) used in the production of Y is greater than K /L used in the production of X Ky/Ly > Kx/Lx Commodity Y is capital intensity 2. Factor Abundance - In term of physical units, if the ratio of the total amount of capital to the total amount of labor (TK/TL) available in Nation 2 is greater than that in Nation 1 TK2/TL2 > TK1/TL1 Nation 2 is capital abundant - In terms of relative factor prices, if the ratio of the rental price of capital to the price of labor time (PK /PL) is lower in Nation 2 than in Nation 1. PK2/PL2 < PK1/PL1 Nation 2 is capital abundant Rental price of capital is usually considered to be the interest rate (r), while the price of labor time is the wage rate (w), so Pk/PL = r/w 5.2 Factor intensity, Factor abundance and the shape of the Production Frontier 3. The shape of production frontier Since Nation 2 is the K-abundant nation and commodity Y is the K-intensive commodity, Nation 2 can produce relatively more of commodity Y than Nation 1. & Nation 1 is the L-abundant nation and commodity X is the L-intensive commodity, Nation 1 can produce relatively more of commodity X than Nation 2. Example: Figure 5.2 The production frontier of Nation 1 is flatter and wider than the production frontier of Nation 2, indicating that Nation 1 can produce relatively more of commodity X than Nation 2. The reason for this is that Nation 1 is the L-abundant nation and commodity X is the L-intensive commodity. 5.3 Factor endowments and the Heckscher-Ohlin theory 3. The Heckscher – Ohlin theory A nation will export the commodity whose production requires the intensive use of the nation’ s relatively abundant and cheap factor and import the commodity whose production requires the intensive use of the nation’s relatively scarce and expensive factor Or the relatively labor-rich nation exports the relatively labor-intensive commodity and imports the relatively capital-intensive commodity Example: Nation 1 is labor abundance and commodity X is labor intensity Nation 1 should specialize and export X Nation 2 is capital abundance and commodity Y is capital intensity Nation 2 should specialize and export Y Sum up: the H–O model is often referred to as the factor-proportions or factor-endowment theory. That is, each nation specializes in the production and export of the commodity intensive in its relatively abundant and cheap factor and imports the commodity intensive in its relatively scarce and expensive factor. Main contents International trade Balance of payment, exchange rates International factor movements and multinational enterprises International economic integration International trade policy International Trade Theory PART 2: INTERNATIONAL TRADE POLICY CHAPTER 8: TRADE RESTRICTIONS - TARIFFS MAIN GOALS • • • • Describe the effect of a tariff on consumers and producers Identify the costs and benefits of a tariff on a small and a large nation Describe an optimum tariff and retaliation Understand the meaning and importance of tariff structure MAIN PARTS 1. 2. 3. 4. 5. Partial equilibrium effects of a tariff The theory of tariff structure General equilibrium effects of a tariff in a small country General equilibrium effects of a tariff in a large country The optimum tariff What are the effects of various trade policy instruments Why do all nations impose trade restrictions? Trade Policy Which instrument is the most important in trade policy? Has it changed over the time? Who will benefit and who will lose from these trade policy instruments? 8.1 Types of tariff 1. Tariff A tariff is a tax or duty levied on the traded commodity as it crosses a national boundary. Tariff is the most important type of trade restrictions in most national trade policy. 2. Types of tariff Ad-valorem tariff A fixed percentage of the value of the traded commodity Pt = Po + Po*t = Po(1+ t) E.g.: 5% of the value of a certain import product Specific tariff A fixed sum per physical unit of the traded commodity Pt = Po + T (e.g.: 2$/kg) Compound tariff a tariff comprising an ad valorem duty to which is added or subtracted a specific duty (e.g.: 20% + $2 per kg) Ad valorem (more than 87% of all tariffs are ad valorem) and non ad valorem tariffs (which could also consist in the combination of ad valorem and non ad valorem tariffs) Ad valorem tariffs EX: Tanzanian tariff of 25% on imported avocados (080440) Mexico Price without tariff $3 Peru Price without tariff $2 Tariff paid = Price * Rate Tariff paid $0.75 Price including tariff: $3.75 Tariff paid $0.50 Price including tariff: $2.50 Specific tariffs and effects on relative prices Switzerland imports beef (02013019) from Argentina, tariff: $24 / kg Before Border $24 / kg tariff After Border $ 24 / kg $12 / kg $3 / kg Low quality beef Prime quality beef The prime beef is 4 times the price of the low-quality beef $ 27 / kg $ 36 / kg $ 24 / kg $12 / kg $3 / kg Low quality beef Prime quality beef The prime beef is now only 1.3 times the price of the low-quality beef Mixed tariffs E.g. Japanese tariff on shoes: Max. of 30% or US$36/ pair Branded shoes The maximum of 30% Ad Valorem or US$ 36/pair (US$36) Specific tariff Unbranded shoes Tariff: the maximum of 30% Ad Valorem or US$ 36/pair (US$36) US$ 30 / pair US$9 Tariff US$36 Tariff US$ 1,000 / pair US$300 Tariff US$36 Tariff 8.2 Partial equilibrium analysis of a tariff 1. Illustration of partial equilibrium analysis of a tariff DX is the demand curve and SX is the supply curve of commodity X in Nation 2 In the absence of trade: The intersection of DX and SX defines equilibrium point E , at Qx = 30X and Px = $3 With free trade at the world price of PX = $1 Nation 2 consume commodity X at point B, Dx = 70X Nation 2 produce domestically at point C, Qx = 10X Nation 2 import the remainder (BC = 70X – 10X = 60X) If Nation 2 impose a 100% ad valorem tariff on the import of commodity X Px’ = Px (1 + t) = 2$ At Px’ = 2$, Nation 2 consume at point H (Dx = 50X), produce domestically at point J (Qx = 20X) and import JH = 50X - 20X = 30X 8.2 Partial equilibrium analysis of a tariff 1. Illustration of partial equilibrium analysis of a tariff The consumption effect of a tariff decrease equal 20X (BN = 70X - 50X) The production effect of a tariff increase equal 10X (CM = 20X – 10X) The trade effect of a tariff decrease equal 30X ( = BC – JH = 60X – 30X = 30X) The revenue effect of a tariff (collected by government) = 30X (MJHN) 2. The effects of a tariff on consumer and producer surplus The increase in the price of commodity X as a result of 100% ad valorem tariff lead to: - A reduction in consumer surplus (= AGHB) - An increase in producer surplus (=AGJC) The cost and benefit of a tariff - The consumer surplus is collected by the government revenue ,the producer surplus and the deadweight loss (protection cost) AGHB = AGJC + JHNM + (JCM + HNB) The tariff redistribute income from domestic consumers to domestic producers of the commodity & from the nations’ abundant factors (exporting nations) to the nation’s scarce factors INEFFICIENCIES (or Deadweight loss or protection cost). 8.3 The theory of tariff structure The rate of effective protection In usual, a nation impose a lower import tariff or duty free on raw materials/input than the final commodity produced with the input to encourage domestic processing. The rate of effective protection exceeds the nominal tariff rate - The rate of effective protection calculate on the domestic value added or processing, while the nominal tariff rate calculate on the value of the final commodity - The formula of the rate of effective protection: Where g – the rate of effective protection to producers of the final commodity t – tariff on the final commodity ti – tariff on the input imported ai – the ratio of the cost of input imported to the price of final commodity in the absence of tariff 8.4 General equilibrium analysis of a tariff in a small country In a small country - When a small nation impose a tariff, it will not affect prices on the world market. - The domestic price of the commodity imported will rise by the full amount of the tariff for individual ( producers and consumers) in the small nation - As a result, domestic production of the importable commodity expands while domestic consumption and imports fall - However, the nation as a whole faces the unchanged world price since the nation itself collects the tariff. - If the nation impose a tariff, domestic producers can compete with imports as long as they can produce and sell commodity X at a price no higher than the price after tariff the volume of trade declines but the terms of trade remain unchanged so that the small nation’s welfare always declines 8.4 General equilibrium analysis of a tariff in a small country In a small country - Nation 2 has comparative advantage in production commodity Y, and specialize in Y - If The world price is Px/Py = 1 Nation 2 produce domestically at point B (120Y, 40X) and export 60Y to exchange for 60X Nation 2 consume at point E (60Y, 100X) - If Nation 2 impose a 100% ad valorem tariff on commodity X imported then the relative price Px/Py =2 in domestic market, but the world price unchange at Px/Py= 1 Nation 2 will increase produce domestically commodity X at point F(85Y, 65X) and export 30Y to exchange 30X Nation 2 will export 30Y to exchange 30X, but 30X redistribute 15X for consumers and 15X for tariff revenue collected by government - Since we assume that the government redistributes the tariff revenue in full to its citizens, consumption with the tariff takes place on indifference curve II’ at point H’ (30X), where the two dashed lines cross. Thus, free trade consumption and welfare (point E) are superior to consumption and welfare with the tariff (point H’). Sum up: - With the tariff, Nation 2 will specialize less than under the free trade and the gains from trade are also less than. 8.5 General equilibrium analysis of a tariff in a large country In a large country - When a large nation imposes a tariff, its offer curve shifts or rotate toward the axis measuring its importable commodity by the amount of import tariff, because any amount of the export commodity, importer want more of the import commodity to cover the tariff. - The large nation reflect to the trade partners’ offer curve having some curvature rather than being a the straight line. Sum up: - Imposition of a tariff by a large nation reduces the volume of trade but improve the nation’s terms of trade. - The reduction in the volume of trade tends to decrease the nation’s welfare, but the improvement in the nation’s terms of trade tends to increase the nation’s welfare - Whether the nation’s welfare actually rises or falls depends on the net effect of these two opposing forces. 8.5 General equilibrium analysis of a tariff in a large country In a large country - When Nation 2 impose a 100% ad-valorem tariff on the importable commodity the offer curve of Nation 2 (2) rotate to the offer curve 2’ that is at every point in 2’ twice as distant from the Y- axis as the offer curve 2 - The equilibrium at point E under free trade replaced to the new equilibrium point (E’) that is the intersection between the offer curve 2’ and the offer curve 1 (Pw = 1 to Pw = 0.8) - The terms of trade of Nation 1 deteriorated from Pw = Px/Py = 1 to Pw’ = Px/Py = 0.8 because point E ( 60X, 60Y) And point E’ (40X, 50Y) - But the terms of trade of Nation 2 improve from Pw = 1 to Pw’’ = Py/Px = 50/40 = 1.25 or = 1/Pw’ = 1/0.8 In fact, When Nation 2 impose a tariff for 50X. 25X is collected by government and only 25X directly to consumers. As a results, The relative price for consumers and producers in Nation 2 is Pd = Px/Py = 40/25 = 1.6 ( twice as much as the world price) Sum up: Thus, when large Nation 2 imposes a tariff, the volume of trade declines but its terms of trade improve. Depending on the net effect of these two opposing forces, Nation 2’s welfare can increase, decrease, or remain unchanged. CHAPTER 9: NONTARIFF TRADE BARRIERS AND THE NEW PROTECTIONISM MAIN GOALS • • • • Know the meaning and effect of quotas and other nontariff trade barriers Describe the effect of dumping and export subsidies Explain the political economy of protectionism and strategic and industrial policies Describe the effect of the Uruguay Round and the aims of the Doha Round MAIN PARTS 1. 2. Import quotas Other Nontariff barriers and the new protectionism - Voluntary export restraints - Technical, administrative and other regulations - Dumping - Export Subsidies 3. The political economy of protectionism 9.1 Non-tariff barriers 1. Import quotas - It is a direct quantitative restriction on the amount of a commodity allowed to be imported or exported. - Import quotas can be used to protect a domestic industry, to protect domestic agriculture or some infant-industry, and/or for balance-of-payments reasons 2. Voluntary export restraints - It refers to the case where an importing country induces another nation to reduce its exports of a commodity “voluntarily,” under the threat of higher all-around trade restrictions, when these exports threaten an entire domestic industry - It has all the economic effects as the same as import quotas, except that it is administered by the exporting country, and so the revenue effect or rents are captured by foreign exporters. 3. Dumping Dumping is the export of a commodity at below cost or at least the sale of a commodity at a lower price abroad than domestically. 4. Export Subsidies Export subsidies are direct payments (or the granting of tax relief and subsidized loans) to the nation’s exporters or potential exporters and/or low-interest loans to foreign buyers to stimulate the nation’s exports. 9.2 The partial equilibrium effects of an import quota DX is the demand curve and SX is the supply curve of commodity X for the nation With free trade at the world price Px = 1 The nation consumes 70X, of which 10X is produced domestically and 60X is imported If the nation impose import quota of 30X The domestic price of X increase from Px = 1 to Px’ = 2 (equivalently with the case of a 100% ad-valorem import tariff) The domestic production increase from 10X to 20X The consumption is reduced by 20X (70X to 50X) With an upward shift the demand curve from Dx to Dx’ (An increase in demand) In case of Import quota The import quota of 30X lead to the increase in the domestic price of X (Px’’ = 2.5), domestic production increase to 25X And domestic consumption increase to 55X In case of 100% of import tariff? Q&A: What are the differences between the effects of an import quotas and an import tariff? 9.2 Comparison of an import quota and an import tariff Import quota 1. An increase in demand result in: The higher domestic production The higher domestic price 2. Quotas involve the distribution of import licenses that result in monopoly profits the seeds of corruption 3. Import quotas limits imports to the specified level with certainty 4. The foreign exported cannot do this with import quotas since the quantity of imports allowed into the nation is clearly specified . Import tariff 1. An increase in demand result in: The unchanged domestic price The unchanged domestic production The higher consumption and import 2. An import tariff brings the revenue to government 3. The trade effect of an import tariff may be uncertain 4. Foreign exporters may absorb all or part of the tariff by increasing their efficiency of operation or by accepting lower profit 9.3 Voluntary Export Restraints Case study 9-2 : Voluntary Export Restraints (VERs) on Japanese Automobiles to the United States and Europe Answer these questions: 1. Why did US negotiate with Japan to limit the automobile exports to US? 2. Why did Japan agree with the negotiation? 3. What are the similarities and differences between VERs and import quotas or import tariff? 4. What are the costs and the benefits of VERs for US and Japan? 9.4 Technical, Administrative and Regulations In international trade, a very important principle governs - any product that is moved from one country to another must meet the requirements of the importing country. All requirements for the product are traditionally divided into mandatory, voluntary for the application. The composition of the mandatory requirements is established by the legislation of the country and that's why compliance with it is verified both for domestically manufactured goods and for imported. Some technical requirements or regulations: Safe regulations/health regulations or Sanitary and Phytosanitary (SPS) Labelling requirements Packing requirements Environmental requirements Q&A: 1. Why do technical requirements or regulations restrict international trade? 2. Why do nations apply technical requirements and regulations to foreign exporters? Example: Canada labeling requirement on a box of fish product Labels on fish products exported to Canada must include: A. Brand name H. Common Name B. Nutrient Content Claim I. Nutrition Facts Table C. Storage Instructions J. "Contains" Statement D. Country of Origin K. List of Ingredients E. Composition Claim L. Identity and Principal Place of F. Net Quantity G. Canada Inspected Logo Business Example of technical regulations 9.5 Export subsidies Export subsidies are direct payments (or the granting of tax relief and subsidized loans) to the nation’s exporters or potential exporters and/or low-interest loans to foreign buyers to stimulate the nation’s exports. Analysis of export subsidies - With the free trade at Px = 3.5$ Nation 2 produce at C’ (35X), consume at B’ (20X) and export 15X - If Nation 2 provides a subsidy for domestic producer 0.5$/unit X The price of commodity X increase to 4$ Nation 2 produce at J’(40X), consume at H’ (10X) and export 30X The higher price of commodity X results in the benefit for domestic producer (the area a’ + b’ + c’) and the loss for domestic consumers (the area a’ + b’) The government subsidy = the area b’ + c’ + d’ Protection cost = the area b’ + d’ 9.6 Trade Protectionism and Trade Liberalization DISCUSSION What are the arguments for and against trade restrictions or protectionism ? What are the arguments for and against trade liberalization? Which is the pivotal trends in the world economy today? CHAPTER 10: ECONOMIC INTEGRATION MAIN PARTS MAIN GOALS • • Understanding the meaning of trade creation, trade diversion and the dynamic benefit of economic integration Describe the different degree of economic integration 1. 2. 3. 4. 5. The degree of economic integration The characteristics of different degrees of economic integration Trade Creation Trade Diversion Discuss 10.1 Preferential trade agreements Preferential trade agreements or discriminatory trade agreement or regional trade liberalization PTA is a trading bloc which gives preferential access to certain products from the participating countries Preferential trade arrangements provide lower barriers on trade among participating nations than on trade with nonmember nations. It is the first stage of economic integration and is done by reducing tariffs but not abolishing them completely There are 4 degree of economic integration Free trade area Customs union Common market Economic Union 10.1 The degree of Economic Integration 1. Free trade area : is a trade bloc whose member countries have signed an agreement to eliminate internal barriers to trade but to maintain existing barriers against nonmember countries EX: EFTA (European Free Trade Area), AFTA (ASEAN Free Trade Area) Member countries of Free trade area mostly have the economical structures which are complementary 2. Custom Union: is a type of trade bloc which allows no tariffs or other barriers on trade among members (as in a free trade area), and in addition it harmonizes trade policies (such as the setting of common tariff rates) toward the rest of the world (or nonmember countries) EX: European Union (formed in 1957, with 28 member countries) Purpose for establishing a customs union normally include increasing economic efficiency and establishing closer political and cultural ties between the member countries Eliminate tariff and non-tariff barriers Setting the common tariff rate towards nonmember countries 10.1 The degree of Economic Integration 3. Common market: goes beyond a customs union by also allowing the free movement of labor and capital among member nations. EX: European common market (at the beginning of 1993) Eliminate tariff and non-tariff barriers Setting the common tariff rate towards nonmember countries Free movement of factors (labor, capital) among member nations 2. Economic Union: goes still further by harmonizing or even unifying the monetary and fiscal policies of member states. This is the most advanced type of economic integration. Eliminate tariff and non-tariff barriers Setting the common tariff rate towards nonmember countries Free movement of factors (labor, capital) among member nations Unifying the monetary and fiscal policies of member countries 10.2 Trade creation of Customs union Trade creation occurs when some domestic production in a nation that is a member of the customs union is replaced by lower-cost imports from another member nation A trade-creating customs union also increases the welfare of nonmembers because some of the increase in its real income (due to its greater specialization in production) spills over into increased imports from the rest of the world. Illustration of trade creation Assume Nation 1 produce X at Px = 1$ Nation 3 produce X at Px = 1.5$ If Nation 2 impose ad valorem tariff of 100% on X Case 1: Free trade Nation 2 will import X from Nation 1 at Px = 2$ and import 30X from Nation 1, collect 30X of tariff revenue Nation 2 will no import from Nation 3 (due to Px = 3$ from Nation 3 > Nation 1) 10.2 Trade creation of Customs union Illustration of trade creation Assume Nation 1 produce X at Px = 1$ Nation 3 produce X at Px = 1.5$ If Nation 2 impose ad valorem tariff of 100% on X Case 2: Nation 1 and 2 now form Customs Union Nation 2 will import X from Nation 1 at Px = 1$ Nation 2 will consume X at 70X, produce domestically at 10X and import 60X from Nation 1, collect no tariff revenue Consumer surplus: increase in AGHB (gain for Nation 2) Producer surplus: reduction in AGJC The net static welfare gain for Nation 2: CJM + BHN (15$) 10.3 Trade diversion of Customs union Trade diversion Trade diversion occurs when lower-cost imports from outside the customs union are replaced by higher cost imports from a union member. Trade diversion reduces welfare because it shifts production from more efficient producers outside the customs union to less efficient producers inside the union. Thus, trade diversion worsens the international allocation of resources and shifts production away from comparative advantage. A trade-diverting customs union results in both trade creation and trade diversion, and therefore can increase or reduce the welfare of union members, depending on the relative strength of these two opposing forces. 10.3 Trade diversion of Customs union Illustration of trade diversion Assume Nation 1 produce X at Px = 1$ Nation 3 produce X at Px = 1.5$ If Nation 2 impose ad valorem tariff of 100% on X Case 3: Nation 3 and 2 now form Customs Union Nation 2 will import X from Nation 3 at Px = 1.5 $ (compared to Px = 2$ from Nation 1 with tariff) Nation 2 will consume X at 60X, produce domestically at 15X and import 45X from Nation 3, collect no tariff revenue Nation 2 have now been diverted from the more efficient producers in Nation 1 to the less efficient producers in Nation 3 because the tariff discriminates against imports from Nation 1 (which is outside the union) Nation 2 also have trade –creation effects from the increase in importing X (30X before to forming Custom unions and 45X afterward 10.3 Trade diversion of Customs union Illustration of trade diversion Assume Nation 1 produce X at Px = 1$ Nation 3 produce X at Px = 1.5$ If Nation 2 impose ad valorem tariff of 100% on X Case 3: Nation 3 and 2 now form Customs Union The welfare effects on Nation 2 resulting from the formation of a customs union with Nation 3: C'JJ' and B'HH' ($3.75) is the welfare gain resulting from trade creation MNH'J' ($15) is the welfare loss from diverting the initial 30X (JH) of imports from lower cost Nation 1 to higher cost Nation 3 this trade-diverting customs union leads to a net welfare loss of $11.25 for Nation 2 CHAPTER 11: INTERNATIONAL RESOURCE MOVEMENTS AND MULTINATIONAL CORPORATIONS MAIN PARTS MAIN GOALS • • • Describe the motives for international portfolio and direct investments Describe the effects of portfolio and direct investments on investing and host countries Understanding the reason for the existence of MNCs and the effects on the home and host countries 1. 2. 3. 4. Definition and characteristics of Direct investment and Portfolio investment Motives for international capital flows Welfare effects of international capital flows Multinational corporations 12.1 Foreign direct investment Two main types of international movement of capital 1. Foreign direct investment (FDI) Capital investment that is owned and operated by a foreign entity Ex: a firm invests directly in facilities to produce or market a product or buy an existing enterprise in a foreign country 2. Portfolio investment (FPI) Capital investment financed by with foreign money but operated by domestic residents not involve obtaining a degree of control in a company (just obtaining the interest) Ex: Investment in foreign financial instruments such as bonds, stock... Q&A: List of differences between FDI and FPI? 12.1 Foreign direct investment Let's watch the video and answer these questions below https://www.youtube.com/watch?v=HSDj-apqFgQ What is the Foreign direct investment? How many types of Foreign direct investment are there in the world? What are the differences among these types? What are the main objectives of FDI? 12.1 Foreign direct investment What is the Foreign direct investment? "Direct investments are real investments in factories, capital goods, land, and inventories where both capital and management are involved and the investor retains control over use of the invested capital." or " FDI is an investment made by a resident enterprise or direct investors into the enterprise that resides in another country" Characteristics of FDI The movement of capital across national boundaries Direct investors have both the ownership and the direct management of the capital FDI involves establishing operations or acquiring tangible assets including stakes in other businesses FDI is a transfer of ownership and transfer of other factors such as technology, management, organizational skills 12.1 Foreign direct investment What is the main objectives of FDI? = PROFIT or lasting interests when do businesses in other countries Types of Foreign direct investment 1. Greenfield investment: A parent company starts a new venture in a foreign country by constructing the operational facilities from the ground up and create new long-term jobs in foreign country (ex: hiring new employees) 2. Brownfield investment: The purchasing of an existing production or business facility by companies with the purpose of new products or services (not involve the new construction of plant operation facilities) 12.1 Foreign direct investment Types of Foreign direct investment (From the strategic viewpoint) 1. Horizontal investment: Horizontal direct investment occurs when the parent company carries out the same activities abroad as at home market (Ex: assembling in the production of automobile) 2. Forward vertical Vertical direct investment occurs when the different stages of production chain are added aboard. Forward vertical FDI is when the FDI takes the firm nearer to the market. 3. Backward vertical Backward vertical FDI is when international integration moves back toward raw materials 12.2 Differences between FDI and FPI Q&A: List of differences between FDI and FPI? 1. Objectives/ Motives 2. Involvement 3. Characteristics 12.3 Welfare effects of international capital flows 1. The effects on investing and host countries - OO' – total capital stock of two countries (A and B) - OK – the capital stock of A - O'K – The capital stock of B - Va – The value of marginal product of capital curve for A - Vb – The value of marginal product of capital curve for B (The value of marginal product of capital represents the return on capital) * Country A (investing country) invest entire capital stock domestically obtain a yield OM and total product OCLK (OKLM to the owners of capital, MLC to the owners of other factors such as land and labour) * Country B (host country) invest entire capital stock domestically at a yield KH or O'N. Total product O'DHK ( O'NHK goes to the owners of capital and DHN to the other factors) 12.3 Welfare effects of international capital flows 1. The effects on investing and host countries • If free movement of capital internationally the flow of capital move from country A to country B because of higher yield or return on capital from country B than in A. - If capital movement KK1 from A to B, the return on capital in the two countries gets equalised ( EK1 = OF = O'G) + In case of Country A Total product in country A is OCEK1, added K1EJK as the total return on foreign investments ==> total national income is OCEJK, net gain for A as EJL, the total return to capital increase to OFJK, and the return to other factors decreases to CEF + In case of country B Total product rise for O'DHK to O'DEK1. K1EJK goes to foreign investors, net gain for B is EJH The total return to domestic owners of capital falls from O'NHK to O'GJK. Total return to other factors rises from DHN to DEG. 12.3 Welfare effects of international capital flows 1. The effects on investing and host countries Resource – transfer effects FDI contribute positive effects for host countries by supplying capital, technology, managerial skills or other management resources. Employment effects - Create positive employment effects for host countries (by hiring new employees in host market) it is true for greenfield FDI (not brownfield FDI) - While the investing country as a whole gains from investing abroad, there is a redistribution of domestic income from labor to capital. The host country also gains from receiving foreign investments, these investments lead to a redistribution of domestic income from capital to labor. Balance – of – payment effects - Current account surplus due to substitute for importing products and foreign enterprise promote to export goods and services to other countries Effects on competition and economic growth - Increasing the competition in the national market would help to improve innovation and drive down prices 12.4 Multinational corporations Discuss 1. How do MNCs works in the international capital flows? 2. Why do MNCs exist in world market? 3. What are the conflicts between host countries and MNCs? 4. How did the attracting FDI policy of Singapore make the greater economic growth? CHAPTER 13: BALANCE OF PAYMENTS MAIN PARTS MAIN GOALS • • • Understand what the balance of payments is and what is measures Describe the change in the Vietnam balance of payments Understand the importance of the serious deterioration of the trade balance and net international investment position of the United States in recent years 1. 2. 3. 4. Balance-of-Payments Accounting Principles The international transactions of Vietnam Accounting Balances and the Balance of Payments Multinational corporations 13.1 Definitions 1. The balance of payments is a summary statement in which, in principle, all the transactions of the residents of a nation with the residents of all other nations are recorded during a particular period of time, usually a calendar year. 2. An international transaction refers to the exchange of a good, service, or asset (for which payment is usually required) between the residents of one nation and the residents of other nations. 3. International transactions are classified as credits or debits. Credit transactions are those that involve the receipt of payments from foreigners. Credit transactions are entered with a positive sign. Ex: Export of goods and services, unilateral transfers (gifts) received from foreigners, capital inflow Debit transactions are those that involve the making of payments to foreigners and debit transactions are entered with a negative sign in the nation’s balance of payments. Ex: Import of goods and services, unilateral transfers (gifts) made to foreigners, capital outflow 4. Financial inflows can take either of two forms: an increase in foreign assets in the nation or a reduction in the nation’s assets abroad. Financial outflows can take the form of either an increase in the nation’s assets abroad or a reduction in foreign assets in the nation because both involve a payment to foreigners 13.1 Balance-of-Payments Accounting Principles 1. Double – entry bookkeeping Double – entry bookkeeping is the account procedure, It means each international transaction is recorded twice, once as a credit and once as a debit of an equal amount. Ex: Chien Thang Company export textiles with amount of 230.000 USD to Japan. Japan has paid for Vietnam Credit (+) Debit (-) Goods exports + 230.000 Financial outflow - 230.000 Financial outflow: This is an increase in VN assets abroad and a debit 13.1 Balance-of-Payments Accounting Principles 1. Double – entry bookkeeping Ex 2: Vietnamese travel to Thailand and spends 500$ on purchasing travel services from foreigners. Ex3: Vietnam government gives a balance of $100.000 to Laos Government as part of aid program. Ex4: a Vietnamese purchases a foreign stock for $400