TheeffectsofequityfinancinganddebtfinancingontechnologicalinnovationEvidencefromdevelopedcountries (1)

advertisement

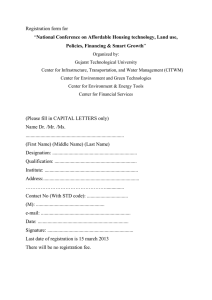

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/336646185 The effects of equity financing and debt financing on technological innovation: Evidence from developed countries Article in Baltic Journal of Management · October 2019 DOI: 10.1108/BJM-01-2019-0011 CITATIONS READS 8 526 3 authors, including: Ling Zhang Zhang Sheng Xi'an Polytechnic University Xi'an Jiaotong University 2 PUBLICATIONS 17 CITATIONS 10 PUBLICATIONS 104 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: risk tolerance View project All content following this page was uploaded by Zhang Sheng on 20 April 2020. The user has requested enhancement of the downloaded file. SEE PROFILE The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/1746-5265.htm BJM 14,4 The effects of equity financing and debt financing on technological innovation 698 Evidence from developed countries Received 8 January 2019 Revised 15 May 2019 4 August 2019 Accepted 3 September 2019 Ling Zhang School of Management, Xi’an Polytechnic University, Xi’an, China, and Sheng Zhang and Yingyuan Guo School of Public Policy and Administration, Xi’an Jiaotong University, Xi’an, China Abstract Purpose – The purpose of this paper is to compare the effects of equity financing and debt financing on technological innovation, and prove that the enhancement of a financing system’s risk tolerance for technological innovation can enhance the innovation risk preference of enterprises and thus promote innovation. Design/methodology/approach – This study is based on a transnational sample of 35 developed countries from 1996 to 2015, by using the panel econometric model to empirically examine the effects of two financing modes on innovation. Findings – The findings showed that equity financing, which has higher risk tolerance, has a more positive impact on innovation than debt financing in terms of both economic uptrend and economic downtrend, and that government efficiency plays a significant role in supporting the performance of technological innovation. Originality/value – The paper provides a research framework for examining how a financing system’s risk tolerance capacity affects the development of technological innovation through promoting risk preference among enterprises. This paper provides transnational and cross-cycle comparative evidence that equity financing with a strong risk tolerance capacity can better support technological innovation, even in periods of economic downtrend. Moreover, the importance of financing system’s risk tolerance capacity for innovation during economic crises is discussed. Keywords Innovation performance, Equity financing, Debt financing, Technological innovation, Risk tolerance Paper type Research paper Baltic Journal of Management Vol. 14 No. 4, 2019 pp. 698-715 © Emerald Publishing Limited 1746-5265 DOI 10.1108/BJM-01-2019-0011 1. Introduction Innovation is an increasingly important means by which companies can contribute to sustainable development (Mousavi and Bossink, 2017). However, technological uncertainty means the process of innovation is high-risk in terms of technological R&D and technology commercialization. A good financial system can help support innovation by tolerating and taking on the risks inherent to technological trial and error and business exploration. Whereas previous studies have shown that bank debt financing and stock market equity financing have different risk tolerance for innovation(Caggese, 2012; Nanda and Rhodes-Kropf, 2017), theoretical contributions have made little headway in exploring how a financing system’s risk tolerance capacity affects innovation. There has been a lot of academic debate about which financing system is more likely to support technological innovation – bank debt financing or stock market equity financing (Laeven et al., 2015; Rajan and Zingales, 1998). Banks’ inherent aversion to risk leads them to This work is supported by the National Natural Science Foundation of China (Grant No. 71904152). avoid investing in high-risk projects with a high probability of failure, which results in standard debt financing contracts provided by banks being unsuitable for innovation projects where the potential high returns come with a high failure probability. Moreover, the bank market itself cannot effectively overcome the information asymmetry and agency problems that exist in high-tech industries. The stock market has more advantages in terms of risk management, management incentives and multi-information review, and it is better able to supervise the company. In addition, the developed stock market provides a good price discovery mechanism, allowing innovative enterprises to provide a better stock price and thus encourage innovation. Therefore, increasing the proportion of market financing may improve the efficiency of R&D funds to promote technological innovation (Brown et al., 2009). This is particularly true of high-level technology innovations, which particularly benefits from stock market equity financing, whereas low-tech innovation generally needs bank credit financing support (Zhang et al., 2016). While some previous studies support the idea that the key factor in determining which financial system better supports innovation is the risk tolerance capacity (Beck and Levine, 2002; Levine, 2002), it is much less clear how it does and the role of risk tolerance thereof. The existing literature has emphasized that financial markets can affect innovation in at least two ways – by relieving financial constraints, and by shaping the incentives of firms to pursue novel rather than routine projects (Atanassov, 2015; Brown et al., 2013). Only a few studies emphasize difference between the effects of bank debt financing and stock market equity financing on technological innovation (Brown et al., 2017; Beck and Levine, 2004; Cornaggia et al., 2015). There is remarkably little evidence, however, about the role of risk tolerance capacity between debt financing and equity financing. More recent studies (e.g. Khan et al., 2018; Nanda and Rhodes-Kropf, 2017) have provide some evidence that financing risk has a particularly strong impact on innovation, but none of them examines why equity financing has a more positive impact on innovation than debt financing. We looked to fill that research gap by investigating whether the innovation performance is related to the risk tolerance capacity of their external financing. We further explore the effects of financing availability by examining what happens to innovation in times of economy crisis. This paper uses transnational sample data collected from 35 countries or regions from 1996 to 2015 to test the hypotheses of the study. This paper finds that equity financing with higher risk tolerance has a more positive impact on technological innovation than debt financing in terms of both economic uptrend and economic downtrend. This paper makes several contributions. First, it provides a research framework for examining how a financing system’s risk tolerance capacity affects the development of technological innovation through promoting risk preference among enterprises. Second, it contributes to our understanding of the influence of external equity and debt financing on enterprises’ decision making on innovation development, proving that equity financing with high risk tolerance can endogenously incentivize risk-averse enterprises to become riskpreference enterprises. Third, this paper provides transnational and cross-cycle comparative evidence that equity financing with a strong risk tolerance capacity can better support technological innovation, even in periods of economic downtrend. 2. Theoretical framework and research hypothesis 2.1 Theoretical framework A financial system’s risk tolerance refers to its risk-taking and risk-absorbing ability, which reflects the risk-bearing capacity of the financial system when it comes to the possibility of loss through innovation failure. Equity and credit markets could play different roles in determining financing costs and, ultimately, in influencing innovation (Khan et al., 2018). Because of their inherent risk aversion, banks need collateral to reduce the risk of corporate Equity financing and debt financing 699 BJM 14,4 700 loans (Brown et al., 2017). Due to their lack of high-value collateral, high-risk technological innovation enterprises in the seed stage and initial stage cannot easily obtain credit financing from the bank. However, in the stock market, companies without collateral can get long-term equity investments from IPO, venture capital (VC), angel investment and private equity (Drover et al., 2017). Moreover, equity investors regularly utilize risk-mitigation strategies to manage their investments. Obviously, equity financing in the stock market has a higher risk tolerance for innovation failure than bank debt financing. Firms competing on the basis of innovation always make financial slack (low leverage) a strategic priority (O’Brien, 2003). It is assumed that the risk preference value of enterprises is usually between the minimum value of risk preference (Bulls) and the maximum value of risk aversion (Bears) (Laeven et al., 2015). Comparing the critical value of enterprise risk preference between the bank debt financing and stock equity financing models, we find that because collateral is required to obtain bank credit, the minimum value of the risk preference of an enterprise using debt financing is larger than that of an enterprise with equity financing. Therefore, under the equity financing mode, enterprises tends to become risk-preferring Bulls while under the debt financing mode, they are more likely to become risk-averse Bears (Nanda and Rhodes-Kropf, 2017). In summary, based on the research of King and Zhang on the function of financial risk management, the risk tolerance of financial systems, and the trial-and-error nature of technological innovation (King and Levine, 1993; Zhang et al., 2016), this paper considers the influence of equity and debt financing risk tolerance on enterprises’ expected rates of return, and puts forward the theoretical analysis framework that the financing system affects the development of technological innovation through promoting enterprises clusters’ risk preference. The theoretical analysis model which demonstrates the effect of financing system on technological innovation is shown in Figure 1. The impact path of theoretical model is as follows: First, compared with bank debt financing, stock market equity financing maintains higher risk tolerance and can tolerate and absorb the failure loss of technological innovation, which improves the financing system’s risk tolerance and enhances the opportunity to carry out the trial-and-error practices of technology innovation, thus reducing the technological uncertainty. Second, along with the reduction of technological uncertainty, the success probability of the innovation project will be improved, thus increasing the expected return rate of financial institutions and raising the risk tolerance threshold for the financial system, which means the financing system can bear more losses associated with innovation failure and therefore be more daring, taking risks by investing in high-risk innovation projects (Nanda and Rhodes-Kropf, 2017). Third, the improvement of project success probability will also increase the expected return rate of enterprises, making the enterprises more optimistic about technological innovation, and therefore increasing the threshold of enterprises’ risk Innovation success probability Financial system risk tolerance threshold Financing system Bank debt financing Increasing risk tolerance Figure 1. Theoretical analysis model Stock market equity financing Reducing technical uncertainty Enterprises cluster Risk averse enterprise Enterprise’s expected rate of return Enterprise risk preference threshold Technological innovation Technology research Increasing risk preference Risk preference enterprise Technology commercialization preference. Finally, the improvement of the threshold value of enterprises’ risk preference will promote some risk-averse enterprises to become risk-preference enterprises, thus enhancing the risk preference of enterprises clusters on the whole, and thereby improving the development of technological research and technology commercialization. To sum up, moving from bank debt financing to equity financing enhances the risk tolerance of the financial system and thus enhances enterprises clusters’ risk appetite for technological innovation. Moreover, the accumulation of investment decisions of financial institutions and the innovation financing decisions of enterprise clusters will ultimately affect the overall level of a country’s technological innovation capacity at the macro level. 2.2 Hypothesis The financial system can provide financial support for innovative and adventurous entrepreneurs (Rajan and Zingales, 1998). In addition, compared with bank credit, stock market financing can better spread and share the risks of innovation, thus encouraging technological innovation. Stock markets enable investors to share the high returns of technological innovation by taking high risks through the mechanism of “risk-sharing and revenue-sharing,” thereby attracting more funds to invest in technological innovation (Laeven et al., 2015). For these reasons, stock markets have been said to be uniquely suited for financing technology-led growth (Brown et al., 2017; Grant and Yeo, 2018). The equity financing model is more tolerant of technological innovation failure, thus incentivizing innovation (Ferreira et al., 2014). The risk tolerance of this financial system is reflected in the market’s risk-bearing and risk-mitigation ability when it comes to the trial-and-error process of technological innovation and the failure risk associated with technological innovation (Zhang et al., 2016). Furthermore, changing from debt financing to equity financing has improved the technological innovation risk preference of enterprises, and even encouraged workers and researchers to take risks to become entrepreneurs. This encourages more social resources to invest in high-risk technological innovation activities, promoting the degree of technological innovation in society as a whole. Several studies show that well-developed stock markets (which are also pivotal to VC and other forms of private equity finance) have a positive impact on R&D and innovation, particularly high-tech industries (Brown et al., 2017; Grant and Yeo, 2018). Compared with bank debt financing, the higher risk tolerance of stock equity financing endogenously encourages risk-averse enterprises to become more risk-prone. Stock equity financing can enhance the innovation risk preference of enterprises more than bank debt financing, and is more conducive to improving the performance of technological innovation by encouraging enterprises technological innovation and business risk taking. Empirical studies have also shown that a capital-market-based financial structure supports technology innovation activity more efficiently than a bank-based financial structure does (Khan et al., 2018; Brown et al., 2009). Therefore, the following hypotheses are proposed: H1. Stock market equity financing has a significant positive impact on technological innovation. H2. Bank debt financing has a significant negative impact on technological innovation. Because enterprises are faced with different technological risks and financing needs at different stages of their development, there are differences in the impacts of different financing methods on innovation. The main sources of funds for enterprises have shown a changing trend of “government subsidy→internal financing→equity financing→government subsidy” (Hsu et al., 2014). Due to the development of financial systems throughout the world, developed countries often have developed stock market and VC markets. However, the financial system of developing countries is imperfect, as the stock markets and VC markets are not yet mature. Increased opening to the outside world and financial development will Equity financing and debt financing 701 BJM 14,4 702 significantly promotes the performance of technological innovation (Narayan and Narayan, 2013). It has also been found that there are differences in the impacts of bank credit on economic growth in different countries (Owen and Temesvary, 2014). The main reasons for the differences are bank development, stock market development and the degree of legal soundness. Both innovation and financial development promote economic growth, but the short-term effect is not obvious (Pradhan et al., 2016). Due to the development of the world’s financial systems, developed countries are generally in the innovation-driven development stage, with a more mature stock market. Also important are government support for technological innovation and entrepreneurial support (Hong et al., 2016; Rigotti and Chris, 2012). It has been found that the degree of development of the stock market and the degree of legal soundness of different countries have different effects on economic growth (Brown and Osborne, 2013; Souza et al., 2014). It has been shown that both innovation and financial development can promote economic growth (Pradhan et al., 2016), so it is necessary for governments to improve the efficiency of financial resource allocation in order to maintain the competitive advantage of their country in the scale of innovation. It is well known that public policy plays an important role in shaping a country’s national innovative capacity (Furman et al., 2002). The higher the government efficiency is, the greater the efficiency of resource allocation to the policy, legal, operational and financing aspects of technological innovation (Bertoni and Tykvová, 2015). However, the government does not need to try to choose where to innovate but only to support any innovations shown to work (Nanda and Rhodes-Kropf, 2017). Obviously, good government efficiency can improve the allocation of financial resources, promoting the development of the stock market and bank system, thus effectively supporting technological innovation. On the contrary, low government efficiency reduces the efficiency of the allocation of financial resources, resulting in the failure to support high-risk technological innovation projects, thus inhibiting technological innovation. In short, improving government efficiency can optimize the environment of innovation, and support innovation through laws and policies that regulate and coordinate innovation activities (Hong et al., 2016). Therefore, we make the following hypothesis: H3. Government efficiency has a significant positive impact on technological innovation in developed countries. In addition, considering the impact of the economic cycle on the financial markets of different countries, this paper argues that in different stages of economic development, the support for technological innovation offered by financial systems differs. In periods of economic uptrend, with the rapid growth of the real economy and a booming stock market, it is easier for enterprises to obtain financial support for innovation through external equity financing, which, of course, leads to improved technological innovation (Hsu et al., 2014). In periods of economic downtrend, the deterioration of the external business environment leads to the decline of corporate profitability, which limits the endogenous financing of technological innovation, and financial crises can lead to a severe “funding gap” in the financing of technological development and innovation (Block and Sandner, 2009). Prior research has found evidence that innovative firms have a higher demand for external capital, and that this demand seems to have increased since the financial crisis (Lee et al., 2015). However, the availability of finance for these firms worsened considerably in the crisis (Zouaghi et al., 2018). Several studies indicate that stock market financing has an anti-cyclical effect because it has greater risk tolerance for technological innovation (Tian and Wang, 2014; Zhang et al., 2016). Furthermore, stock markets in developed countries (innovation-intensive economies) offer higher returns and lower risk during crisis episodes, and investors value innovation more during difficult times (Adcock et al., 2014). And, stock markets in developed countries have the functions of risk-mitigation and risk absorption, which can play important roles as financial stabilizers in periods of economic downturn (Brown et al., 2017; Müller and Zimmermann, 2009). Thus, we argue that stock market financing can play a positive role in supporting technological innovation regardless of whether the economy is in a period of uptrend or downtrend. Building on these arguments, we make the following hypotheses: Equity financing and debt financing H4. Equity financing in developed countries’ stock markets has a significant positive impact on technological innovation in both uptrend and downtrend periods. 703 3. Model and data 3.1 Empirical model In this study, we concentrated on influence mechanism of whole financing system risk tolerance change on whole enterprises group innovation risk preference change with cross-country level evidence. The logical relationship from theoretical model to empirical model is as follows: First, there is a logical connection between the chosen financing system’s risk tolerance and enterprises’ decision making on innovation. The core aim of the theoretical model is to demonstrate that the chosen financing system’s risk tolerance capacity can affect the innovation risk appetite of enterprise clusters, which in turn affects their innovation performance. Second, there is a connection between enterprises’ decision making on innovation and macro-innovation output. There is consistency between the performance of macro-innovation output and the result of micro-mechanism of enterprise clusters’ innovation decision-making. The accumulated decisions of enterprise clusters will ultimately affect the development of technology innovation at a macro (cross-country) level. Third, there is a logical connection between the theoretical mechanism and the empirical model. The econometric model reflects the theoretical mechanism about the effect of macro-financial development on macro-innovation output. Transnational data allow the econometric model to be better measured and tested, ensuring that the applicability of the empirical research is maintained at the macro level. A large number of theoretical and empirical analyses have shown that financial development has a long-term impact on technological innovation. Based on the relevant econometric models of finance and growth (Beck, 2009; Rajan and Zingales, 1998), we put forward the following basic econometric model of stock market financing and technological innovation: Patent i;t ¼ a0 þa1 Patent i;t1 þb1 FDi;t1 þb2 Otheri;t þei;t ; (1) where Patenti,t represents the technological innovation variable of country i in the year t. We choose patent application as the index to measure the development degree of technological innovation in a country. FDi,t is the financial development index, which indicates the growth of bank private credit (domestic credits ratio GDP of private department) or stock market development index (stock market capital value ratio GDP). The other explaining variables include human capital (the number of R&D staff members), infrastructure construction (the number of internet users), trade openness (the total GDP ratio of import and export), governmental efficiency (the efficiency government provides public service) and the national dummy variable (national economic development level). αi, βi are the estimated coefficient and ei,t is the residual term. In order to better reflect the difference between equity financing and debt financing on technological innovation, the empirical study analyzes the impact of stock and bank financing systems on technological innovation respectively. In order to investigate the joint impact of the two financing methods on technological innovation, this paper puts forward a BJM 14,4 model expressing the joint impact of bank and equity financing on technological innovation. The regression model is shown as follows: Patent i;t ¼ a0 þa1 Patent i;t1 þb1 Banki;t1 þb2 Stocki;t1 þb3 Other i;t þei;t : 704 (2) Considering the lag effect of external financing on technological innovation, Stock and Bank in this model use a period-lagged index to measure the supporting effect of the former external financing in supporting technological innovation in the current period. As well, the models include the lag period for the explained variables, which may lead to a potential endogenous correlation between financing and innovation. However, when applied to equations with lagged dependent variables, the traditional fixed and random effects settings will lead to biased parameter estimates and inconsistency, potentially affecting the accuracy of the model. To address these issues of endogenous and biases, the regression models have been estimated using the generalized method of moments (GMM), developed for dynamic panel models by Arellano and Bover (1995) and Blundell and Bond (1998). 3.2 Variable measurement 3.2.1 Technological innovation. Patent application is one of the key indicators of successful technological innovation (Ernst, 2001; Cao and Zhao, 2013). Generally, the number of patent applications, the number of patent authorizations and the number of patent citations are used to measure the development of technological innovation (Picard, 2012). Therefore, our dependent variable is patent applications, which is measured as the quantity of patent applications submitted. Considering the lag effect between R&D input and R&D output, patent authorization and patent citation cannot accurately reflect the actual development level of technological innovation in current year, but the number of patent applications can better reflect the actual level of technological reserves and the technological innovation strength of a country in a given time period. Therefore, on the basis of empirical research from Hsu (Hsu et al., 2014) and Furman (Furman et al., 2002), we used patent applications to measure the development of technological innovation, with the variables used to compare whole economies. 3.2.2 Financial development. Financial development is the core explanatory variable. Previous studies have often chosen two kinds of indicators based on the financial model – bank debt financing and stock equity financing – to measure financial development (Beck et al., 2010; Pradhan et al., 2016). This paper uses the ratio of stock market capitalization value to GDP to measure the development degree of stock equity financing and to reflect the financing ability of stock market. The index measures the support of the stock market financing model for the technological innovation activities of enterprises. The calculations are as follows: Stocki;t ¼ Stock M arket Capitalizationi;t =GDP i;t : (3) Based on previous studies (Beck, 2009; Beck et al., 2016), we used the ratio of domestic credit in the private sector to GDP to measure the development of bank debt financing. The indicator reflects the direct or indirect support of bank debt financing for technological innovation. The calculations are as follows: Banki;t ¼ Bank Credit i;t =GDP i;t : (4) 3.2.3 Control variables. Based on previous literature (Ruan and Jin, 2017; Bertoni and Tykvová, 2015; Egger and Keuschnigg, 2015; Furman et al., 2002), we used six control variables in our analysis: R&D expenditure, which refers to the current expenditure and capital expenditure on innovation, including basic research, applied research and experimental development, reflecting the level of investment in technological innovation; human capital, expressed in terms of the number of R&D staff members, which reflects the level of human resources involved in technological innovation; infrastructure construction, represented by the number of internet users, which reflects the support of internet development for technological innovation in the context of the information age; trade openness, expressed by the ratio of total imports and exports of goods and services to GDP, reflecting the level of trade and the degree of openness of a country; degree of knowledge spillover, expressed by net inflow of foreign direct investment (FDI), which reflects the extent to which a country absorbs, introduces and utilizes the technological and managerial advantages from foreign capital; and government efficiency, expressed by the efficiency of the government’s delivery of public services as determined by the number of civil servants in the global governance index database, reflecting the quality of public service delivery and policy formulation and implementation by a government. The data for this are derived from the government effectiveness index in the data of the Worldwide Governance Index. In addition, the technological innovation capacity of countries is obviously affected by their level of economic development. Therefore, in order to control the differences in the stages of economic development between countries, this paper also sets up a dummy variable for the degree of national development. The definitions and data sources for each variable are shown in Table I. Equity financing and debt financing 705 3.3 Data collection In this paper, panel data are used for empirical analysis. According to the research needs and the availability of the data, we selected countries with more mature stock markets as research samples in order to test the role of stock market financing in supporting technological innovation in these countries. The sample takes transnational dynamic panel data from 35 developed (high-income) countries and territories from 1996 to 2015. These countries and time period have been carefully selected. Developed countries were selected because they have well-developed financial markets, good innovation systems and sound government governance. The World Bank defines economies as “High-income” based on their GNI per capita was high level (see World Development Indicators). The sample period is determined by the availability of financial data from Global Financial Development Database, and the economy has experienced a complete uptrend and downtrend in the studied period. The countries and territories examined are Australia, Austria, Belgium, Canada, Switzerland, Chile, the Czech Republic, Germany, Denmark, Spain, Finland, France, the UK, Greece, the Hong Kong Special Administrative region of China, Hungary, Ireland, Israel, Variables Symbol Definition Sources Technological innovation Patent Patent application (log) WDI Stock equity financing Stock Stock market capitalization value to GDP (%) GFDD Bank debt financing Bank Domestic credit in the private sector to GDP (%) GFDD R&D expenditure Research R&D expenditure to GDP (%) WDI Human capital Human Quantity of R&D staffs (log) WDI Infrastructure construction Infra Internet user (per 100 people) WDI Trade openness Trade Total imports and exports of goods and services to GDP (%) WDI Knowledge spillover degree FDI Net inflow of foreign direct investment($1bn) WDI Governmental efficiency Gov Efficiency of the government provides public service WGI Notes: WDI, World Development Indicators; GFDD, Global Financial Development Database; WGI, Worldwide Governance Indicators Table I. Research variables and definitions BJM 14,4 706 Italy, Japan, South Korea, Lithuania, Luxembourg, Latvia, the Netherlands, Norway, New Zealand, Poland, Portugal, Saudi Arabia, Singapore, Slovakia, Slovenia, Sweden and the USA. Among these, the financial development indexes are mainly established by global financial development databases (Beck et al., 2010) and the technical innovation index, while the related indicators of economic development are from the World Bank’s World Development Index database. The descriptive statistics for the related major variables are shown in Table II. The correlation between the main variables is shown in Table III. The data show that there is a very significant positive correlation between bank credit development and technology innovation, and the correlation coefficient is 0.4469. However, there is no significant positive correlation between stock market development (Stock) and technological innovation (Patent). In addition, there is a significant positive correlation between human capital, infrastructure construction and technological innovation, and a significant negative correlation between trade openness, knowledge spillover, government efficiency and technological innovation. 3.4 Methodology Because the lag term of the dependent variable would lead to problems of endogeny for the explanatory variables, the GMM is used to estimate the model (Windmeijer, 2005). The GMM is divided into difference-generalized method of moments (Diff-GMM) and systemgeneralized method of moments (SYS-GMM). As the SYS-GMM method uses more tool variables than the Diff-GMM, the standard deviation is smaller and its estimation is more accurate, so the two-step SYS-GMM will be used to test the model. In order to find the different effects of external financing on technological innovation under different financing modes, we expand our regression models into four sub-models: Model (1), original model, without considering external financing; Model (2), debt model, Table II. Variable descriptive statistics Variables Mean SD Min. Max. n Patent Stock Bank Research Human Infra Trade FDI Gov 7.402 0.846 0.926 1.728 7.862 50.965 1.050 6.246 1.369 2.126 1.193 0.449 0.962 0.677 28.737 0.807 13.712 0.591 2.708 0.0138 0.0671 0.294 5.268 0.0267 0.183 −58.323 −0.392 12.858 10.863 2.191 4.405 8.984 97.334 4.426 252.308 2.431 700 700 700 700 700 700 700 700 700 Variables Table III. Pearson correlation coefficient of major variables Patent Stock Bank Research Human Patent 1 Stock −0.073 1 Bank 0.446*** 0.403*** 1 Research 0.570*** 0.010 0.383*** 1 Human 0.032 −0.227** −0.183*** −0.211*** 1 Infra 0.211** 0.173*** 0.466*** 0.407* 0.139** Trade −0.474*** 0.546** 0.012 −0.136** −0.026 FDI −0.212** 0.324** 0.055 −0.091 −0.060 Gov 0.243** 0.321** 0.494** 0.526** −0.281** Notes: *,**,***Significant at 10, 5 and 1 percent levels, respectively Infra Trade FDI 1 0.160*** 1 0.122** 0.480** 1 0.356** 0.206** 0.152** Gov 1 only considering debt financing; Model (3), equity model, only considering equity financing; and Model (4), integral model, considering both debt financing and equity financing. The sub-models take different financing modes as their core explanatory variables, use the same control variables, and use the same sample period. This empirical strategy allows us to better compare the different effects of different financing modes on technological innovation based on the SYS-GMM. Equity financing and debt financing 707 4. Empirical analysis 4.1 Unit root test and cointegration test Using the dynamic panel data model, the stability of the panel data must be analyzed before regression to avoid “spurious regression,” ensuring the validity of the estimation results. Therefore, the unit root test is needed for the estimated parameters. In keeping with previous studies, the panel data unit root of each variable was tested by LLC, IPS and Fisher-ADF test methods (Im et al., 2003; Levin et al., 2002; Maddala and Wu, 1999), and the results are as shown in Table IV. The results of the unit root test show that the first-order difference of each variable has no unit root and is a stationary series. The purpose of the cointegration test is to examine whether there is a long-run equilibrium relationship between financing variables and technological innovation. Considering the limitation of the sample size, we proceed to test for the existence of a long-run equilibrium by using the error correction model (ECM) panel cointegration test (Westerlund, 2007). The values of the panel cointegration statistics based on 400 bootstrap replications are presented in Table V. For each cross-section of the interpretive variables Stock and Bank, the Gt statistics and Ga statistic are based on the OLS regression estimate and the Pt statistics and Pa statistics are based on the OLS residual regression estimation reject the null hypothesis, “there is no cointegration relationship,” at a 10 percent significance level. The results of the cointegration tests provide clear support for the long-run equilibrium relationships between financing variables and technological innovation. LLC Variables t-value IPS p-value W [t-bar] Patent −1.739** 0.041 −11.612*** Stock −7.965*** 0.000 −4.775*** Bank −4.623*** 0.000 −13.286*** Research −0.878 0.189 −6.824*** Human −8.475*** 0.000 −8.295*** Infra −8.877*** 0.000 −7.742*** Trade −2.672*** 0.003 −8.904*** FDI −7.271*** 0.000 −18.741*** Gov −0.936 0.174 −10.483*** Notes: **,***Significant at 5 and 1 percent levels, respectively Statistic Gt Ga Pt Pa Independent variable: stock Value z-value p-value −2.574 −14.503 −10.741 −10.191 −1.605 −2.317 −1.161 −1.225 0.054 0.010 0.000 0.000 Fisher-ADF p-value p-value χ2 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 196.015*** 200.536*** 327.211*** 141.918*** 188.102*** 271.630*** 165.516*** 324.002*** 170.575*** 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 Table IV. Unit root test results Independent variable: bank Value z-value p-value −3.289 −17.440 −17.727 −15.582 −6.872 −4.929 −6.088 −6.565 0.000 0.000 0.000 0.000 Table V. Panel cointegration test result based on error correction model BJM 14,4 708 4.2 Regression results We begin our empirical analysis by examining the impact of equity financing and debt financing on technological innovation. We use Stata 12.0 to estimate the empirical model, and the results are shown in Table VI. According to the lag term of technological innovation, the estimated results of all models are significantly positive and the coefficients are large, indicating that technological innovation itself has a greater inertia, which is consistent with the reality. Model (3) shows that there is a significant positive correlation between stock market equity financing and technological innovation at a significance level of 1 percent, which indicates that stock market equity financing in developed countries is beneficial to improving the performance of technological innovation. In the case of controlling bank debt financing, the regression coefficient of equity financing is still significantly positive. Again, there is a significant positive correlation between equity financing and technological innovation in the stock market. It is proved that equity financing has a significant positive effect on technological innovation, which supports H1. The regression results of Mdel (2) show that there is a significant negative correlation between bank debt financing and technological innovation, and the regression coefficient of debt financing in Model (4) is not significantly negative. This indicates that the contribution of bank debt financing to technological innovation is not obvious or even negative when the stock market is relatively developed; this result supports H2. These results are consistent with Hsu et al. (2014), who report a negative and quantitatively important connection between credit market development and innovation. The above empirical results show that equity financing in stock markets with high risk tolerance can have a significant positive impact on technological innovation, while bank debt financing has a negative impact on technological innovation activities. This conclusion shows that in developed countries where stock markets are relatively prosperous, equity financing is more conducive to promoting technological innovation than financing from banks. This finding is similar to that of Brown et al. (2017), who indicated that better developed stock markets support faster growth of innovative-intensive, high-tech industries. Moreover, control variables such as FDI (the degree of knowledge spillover) have a significant positive impact on technological innovation, indicating that FDI has a positive Variables Model (1) Model (2) Model (3) Model (4) L. Patent 0.967*** (43.45) 0.942*** (37.10) 0.965*** (31.49) 0.933*** (15.01) Bank −0.0806*** (−3.39) −0.00714 (−0.17) Stock 0.0185*** (4.44) 0.0303** (2.41) Research 0.0387** (2.32) 0.0398 (0.72) 0.0147 (0.37) 0.0111 (0.20) Human 0.0362 (1.45) 0.0518 (1.14) 0.0279 (0.53) 0.0501 (0.55) Infra −0.000652*** (−2.95) −0.0000506 (−0.14) −0.000249 (−0.72) −0.000371 (−0.77) Trade −0.000646 (−0.03) −0.0285 (−0.76) −0.0741*** (−2.91) −0.0563** (−2.21) FDI 0.00117*** (12.59) 0.00117*** (10.76) 0.000632*** (6.26) 0.000829*** (8.55) Gov 0.107*** (4.61) 0.0611** (2.30) 0.0388 (1.33) 0.0374 (1.25) Constant −0.203 (−0.88) 0.00344 (0.01) 0.0635 (0.16) 0.114 (0.26) Sargan test 25.473 25.585 25.085 25.608 p-values 1.000 1.000 1.000 1.000 AR(2) 1.128 1.112 1.134 1.139 p-values 0.259 0.266 0.256 0.254 Table VI. Obs 665 665 665 665 Estimate of the impact Notes: Numbers in parentheses are t-statistics. The last two rows report the Sargan test and the AR(2) test of equity financing results. Sargan test for the over-identification restrictions, AR(2) refers to second-order autocorrelation tests, and debt financing and their null hypothesis are “over-identifying restrictions are valid” and “zero autocorrelation in firston technological differenced errors.” **,***Significant at 5 and 1 percent levels, respectively innovation supporting effect on technological innovation. In addition, we have carried out an autocorrelation test on the estimated residual terms of each model. The results of the AR (2) test show that there is no second-order autocorrelation in the residual error after the first-order difference, which indicates that the dynamic panel model set used in this paper is reasonable. The results of the Sargan test also show that all the tool variables selected by the model are valid, indicating that the model setting is reasonable. Furthermore, there is a significant positive correlation between government efficiency and technological innovation, which indicates that government efficiency in developed countries have a significant supporting effect on technological innovation performance. This result supports H3. This indicates that the higher the level of government efficiency, the more technological innovation is supported. It follows that the improvement of government efficiency can promote technological innovation by providing a good business environment and entrepreneurial support. The above results are in keeping with our expectations, indicating that equity financing in mature stock markets in developed countries plays a more important role in supporting technological innovation than debt financing in banks. In fact, equity financing and debt financing can promote technological innovation to a certain extent. However, when the stock market is more developed, it has a higher risk tolerance and can better support technological trial-and-error processes and bear the risk of technological innovation failure. The stock market, especially the growth enterprise market, provides a channel to obtain long-term equity financing for high-growth, high-tech and small enterprises. The risk tolerance of the stock market not only creates technology trial-and-error space for the enterprises to engage in technology innovation, but also provides more opportunities for the commercialization, growth and maturity of enterprises’ technological developments. Finally, the stock market helps SMEs rely on technological innovation to achieve technological upgrading and sustainable development. 4.3 Robustness test There are some differences in the influence of financial development on technological innovation under different economic cycles. The American subprime mortgage crisis, which began in the summer of 2007, has had a serious negative impact on the global economy, and the support of equity financing and debt financing for the real economy and technological innovation have also been greatly affected (Block and Sandner, 2009). Therefore, it is necessary to divide the economic cycle for the period examined in our data into an uptrend period (1996–2005) and a downtrend period (2006–2015) for comparative analysis, allowing us to study the different effects of financial development on technological innovation during periods of economic boom and bust. The empirical results are shown in Table VII. Comparing the estimation results, we find that the regression results of the two subsamples are consistent with the empirical results of the whole cycle samples, which indicates that the conclusions of the study are robust. More specifically, the impact of equity financing on technological innovation during uptrend or downtrend periods are similar to the sample results for the whole cycle, as shown in Table VI. This indicates that stock market equity financing has a positive supporting effect on technological innovation, no matter whether the current period is of economic uptrend or downtrend. These results are consistent with the previous finding that a higher equity ratio is conducive to a higher R&D intensity and patenting activity (Müller and Zimmermann, 2009; Brown et al., 2017). However, the supporting effect of bank debt financing on technological innovation is not obvious, and even has a negative impact on technological innovation. This result supports H4. The reason may be that innovative firms are more likely to face absolute credit rationing during and after financial crises (Lee et al., 2015). Our findings indicate that stock market equity financing in developed countries can better support technological innovation than bank debt financing, and this positive effect Equity financing and debt financing 709 Table VII. The comparison of the regression results between periods of economic uptrend and downtrend Economic uptrend (1996–2005) Model (2) Model (3) Model (4) Model (1) Economic downtrend (2006–2015) Model (2) Model (3) Model (4) Notes: **,***Significant at 5 and 1 percent levels, respectively L. Patent 0.880*** (170.20) 0.912*** (114.58) 0.937*** (51.10) 0.973*** (48.66) 0.966*** (70.01) 0.962*** (68.68) 0.976*** (93.49) 0.973*** (82.67) Bank −0.264*** (−7.39) −0.290*** (−10.99) −0.0596*** (−3.82) −0.0790*** (−5.18) Stock 0.0848*** (5.04) 0.133*** (8.28) 0.0201*** (9.72) 0.0257*** (9.23) Research 0.0703*** (5.55) 0.0382** (2.14) −0.0147 (−0.26) −0.0214 (−0.50) 0.102*** (7.88) 0.0821*** (4.74) 0.0285 (1.04) 0.0122 (0.49) Human 0.197*** (6.80) 0.171*** (5.94) 0.154*** (2.80) 0.0957 (1.60) −0.0127 (−0.45) −0.0214 (−0.75) 0.0284 (0.66) 0.0757** (2.15) Infra −0.000967*** (−4.46) −0.0000242 (−0.10) −0.00116*** (−2.85) −0.000351 (−0.78) −0.00227*** (−3.67) −0.00182*** (−2.61) −0.000689 (−1.44) −0.000515 (−0.82) Trade −0.147*** (−7.23) −0.0814*** (−3.13) −0.0957*** (−2.74) −0.0266 (−0.59) 0.125*** (7.20) 0.117*** (5.96) −0.00914 (−1.33) −0.0211*** (−3.53) FDI −0.00159*** (−5.81) −0.00161*** (−4.48) −0.00187*** (−4.17) −0.00211*** (−6.54) 0.00119*** (15.03) 0.00121*** (14.02) 0.000704*** (7.94) 0.000777*** (11.02) Gov 0.227*** (11.35) 0.208*** (9.90) 0.0581** (2.52) 0.0311 (0.64) 0.0479 (1.29) 0.0844** (2.38) −0.0594 (−1.51) 0.00153 (0.07) Constant −0.882*** (−3.68) −0.713*** (−2.90) −0.715 (−1.57) −0.360 (−0.81) 0.156 (0.59) 0.281 (1.04) 0.0442 (0.14) −0.293 (−1.25) Sargan test 25.125 25.586 25.601 25.608 28.085 29.677 26.892 26.072 p-values 1.000 1.000 1.000 1.000 0.372 0.378 0.891 0.985 AR(2) 1.004 1.112 1.129 1.139 −0.632 −0.733 −0.658 −0.491 p-values 0.277 0.266 0.258 0.2543 0.428 0.463 0.491 0.623 Obs 315 315 315 315 315 315 315 315 Model (1) 710 Variables BJM 14,4 exists regardless of economic cyclical fluctuations. In fact, financial crises can lead to a severe “funding gap” in the financing of technological development and innovation (Block and Sandner, 2009). However, our results suggest that equity financing with powerful risk tolerance capacity is more likely to accelerate technology development and improve innovation performance, no matter what the current period is in the economic cycle. There are three main reasons why equity financing can encourage innovation during periods of economic downtrend. First, economic crises can reduce the price of capital and accelerate the optimal allocation of innovation elements. Second, economic downtrend may reduce investor income expectations and promote companies to pay more attention to long-term innovation investment (Drover et al., 2017). Third, some pioneering and promising technology enterprises may engage in talent-showing during periods of crisis, thereby accelerating the realization of technological track transitions and industrial upgrading. In addition, the influence of government efficiency on technological innovation is significantly positive in periods of both economic uptrend and downtrend, which indicates that government efficiency in developed countries have a significant supporting effect on technological innovation. It reflects that developed countries tend to have higher government performance, as well as higher degrees of policy support and business environment support for technological innovation. Furthermore, we tested the robustness of the empirical results. First, we adjusted the research samples by removing those countries with relatively weak stock markets like Greece and Chile. Then we used the selected sub-samples to re-test the empirical model. It was found that the regression results were basically consistent with the total sample regression results; the regression results are shown in Table VIII. Second, the one-step SYS-GMM was used to estimate the model again. The regression estimation coefficient of the core index showed little change, and the significance and direction were basically consistent with the above conclusions. Also, there is a significant positive correlation between government efficiency and technological innovation. This result supports H3. Therefore, the empirical results and research conclusions of this paper are robust in terms of time periods and different estimation methods. Equity financing and debt financing 711 5. Conclusions Based on the current situation of technological innovation financial support systems in various countries, this paper has compared the risk tolerance to technological innovation of stock market equity financing and bank debt financing. Based on the transnational sample Variables Model (1) Model (2) Model (3) L. Patent 0.999*** (19.65) 0.972*** (18.28) 0.926*** (12.65) Bank −0.101* (−1.91) Stock 0.00931* (1.88) Research 0.0368 (1.55) 0.0368 (1.46) 0.0277 (0.42) Human 0.0494* (1.68) 0.0747** (2.42) 0.101 (0.95) Infra −0.000923*** (−3.75) −0.000269 (−0.74) −0.000487 (−1.25) Trade 0.0428 (1.08) 0.0285 (0.63) −0.0708** (−1.98) FDI 0.00120*** (14.12) 0.00124*** (12.83) 0.000678*** (5.72) Gov 0.124*** (4.41) 0.106*** (3.71) 0.0670* (1.87) Constant −0.606 (−1.58) −0.501 (−1.37) −0.274 (−0.45) Sargan test 27.391 29.480 28.851 p-values 1.000 1.000 1.000 AR(2) 1.141 1.126 1.122 p-values 0.253 0.260 0.261 Obs 627 627 627 Notes: *,**,***Significant at 10, 5 and 1 percent levels, respectively Model (4) 0.882*** (9.25) −0.0254 (−0.51) 0.0188*** (3.17) 0.0257 (0.46) 0.0780 (1.04) −0.000196 (−0.45) −0.0506 (−1.41) 0.000716*** (6.40) 0.0766** (2.04) 0.208 (0.36) 27.392 1.000 1.102 0.270 Table VIII. 627 Regression result after adjusting samples BJM 14,4 712 data from 35 countries from 1996 to 2015, this paper has empirically analyzed the relationship between equity financing, debt financing and technological innovation by using the panel econometric model. Our findings provide one explanation for how and why equity financing can better support innovation than credit debt financing by increasing risk tolerance capacity. The results reveal that, compared with debt financing, equity financing is more tolerant of uncertainty and failure of technological innovation, and that it can enhances enterprises’ risk preference for technological innovation. This study strengthens the idea that equity financing with high risk tolerance can endogenously incentivize risk-averse enterprises to become risk-preference enterprises (e.g. Brown et al., 2017; Nanda and Rhodes-Kropf, 2017). The results also show that there is a significant negative correlation between bank debt financing and technological innovation, and a significant positive correlation between equity financing and technological innovation. Therefore, our findings reinforce the idea that stock market financing can encourage enterprises to carry out high-risk technological innovation activities (Khan et al., 2018). Although a few studies have focused on the relationship between external financing and innovation (Brown et al., 2017), it does not provide sufficient understanding from a risk tolerance perspective. This study responds to that gap in the literature by investigating why stock markets appear to be more important for innovation activity than banks. Moreover, there is a significant positive correlation between government efficiency and technological innovation, which indicates that government efficiency plays a significant role in supporting innovation performance and sustainable development in developed countries. In addition, stock market equity financing can support technological innovation better than bank debt financing in both periods of economic uptrend and downtrend. The findings reveal that equity financing with higher risk tolerance can enhance a financial system’s risk tolerance for technological innovation failure, and thus encourage enterprises to engage in more radical innovation activities (Khan et al., 2018). Thus, this paper provides a valuable contribution to understand why stock markets appear to be more important for innovation activity. Based on the above analysis and conclusions, this paper puts forward the following policy recommendations for countries to improve the sustainability of technological innovation: first, enhance the risk tolerance of the stock market and banking system, and optimize the financing structure. Actively develop the stock market to promote VC with high risk tolerance, improve the mechanism of risk compensation and risk dispersion for investors and entrepreneurs, as this can support enterprises’ technological innovations at the seed stage and initial stage. Second, improve the systems of stock issuance, encourage equity investors to invest in technology enterprises. Establish a multi-level capital market to attract and encourage angel investors, VC and private equity investors to make long-term equity investments in technology enterprises and high-tech startups. Third, improve the efficiency of government services for innovation. By building a service-oriented government and creating a good innovative business environment and policy system, governments can stimulate enthusiasm for innovation and entrepreneurship. Fourth, maintain the stability of the financial system. It is important to guard against financial risks, maintain the stability of the financial system, strengthen the risk tolerance and risk-taking capability of the financial system, and enhance the financial system’s support for the efficiency and sustainability of technological innovation. This study has several limitations. First, due to the lack of appropriate indicators that directly reflect the degree of risk tolerance among equity and debt financing methods, this paper does not empirically test the impact of financing methods’ risk tolerance on technological innovation. Second, because data on VC financing is difficult to obtain, this paper does not consider VC financing’s support for enterprises’ technological innovation. Third, this study chooses the quantity of patents as the variable measure of technological innovation, but not all patents have successfully been transformed into technological innovations, as some patents are filed but never make it to the market. Further research in this field should explore specific indicators to measure the degree of risk tolerance, construct an overall theoretical model of the impact of bank, stock market and VC financing on technological innovation, and explore the regional differences and evolution trends of the impact of financial system risk tolerance on innovation performance. References Adcock, C., Hua, X., Mazouz, K. and Yin, S. (2014), “Does the stock market reward innovation? European stock index reaction to negative news during the global financial crisis”, Journal of International Money & Finance, Vol. 49 No. 12, pp. 470-491. Arellano, M. and Bover, O. (1995), “Another look at the instrumental variable estimation of errorcomponents models”, Journal of Econometrics, Vol. 68 No. 1, pp. 29-51. Atanassov, J. (2015), “Arm’s length financing and innovation: evidence from publicly traded firms”, Management Science, Vol. 62 No. 1, pp. 128-155. Beck, T. (2009), “The econometrics of finance and growth”, Palgrave Handbook of Econometrics, Vol. 2 No. 1, pp. 1180-1212. Beck, T. and Levine, R. (2002), “Industry growth and capital allocation: does having a market-or bankbased system matter?”, Journal of Financial Economics, Vol. 64 No. 2, pp. 147-180. Beck, T. and Levine, R. (2004), “Stock markets, banks, and growth: panel evidence”, Journal of Banking & Finance, Vol. 28 No. 3, pp. 423-442. Beck, T., Chen, T., Lin, C. and Song, F.M. (2016), “Financial innovation: the bright and the dark sides”, Journal of Banking & Finance, Vol. 72 No. 2, pp. 28-51. Beck, T., Demirgüç-Kunt, A. and Levine, R. (2010), “Financial institutions and markets across countries and over time: the updated financial development and structure database”, The World Bank Economic Review, Vol. 24 No. 1, pp. 77-92. Bertoni, F. and Tykvová, T. (2015), “Does governmental venture capital spur invention and innovation? Evidence from young European biotech companies”, Research Policy, Vol. 44 No. 4, pp. 925-935. Block, J. and Sandner, P. (2009), “What is the effect of the financial crisis on venture capital financing? Empirical evidence from US internet start-ups”, Venture Capital, Vol. 11 No. 4, pp. 295-309. Blundell, R. and Bond, S. (1998), “Initial conditions and moment restrictions in dynamic panel data models”, Journal of Econometrics, Vol. 87 No. 1, pp. 115-143. Brown, J.R., Fazzari, S.M. and Petersen, B.C. (2009), “Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom”, The Journal of Finance, Vol. 64 No. 1, pp. 151-185. Brown, J.R., Martinsson, G. and Petersen, B.C. (2013), “Law, stock markets, and innovation”, The Journal of Finance, Vol. 68 No. 4, pp. 1517-1549. Brown, J.R., Martinsson, G. and Petersen, B.C. (2017), “Stock markets, credit markets, and technologyled growth”, Journal of Financial Intermediation, Vol. 32 No. 3, pp. 45-59. Brown, L. and Osborne, S.P. (2013), “Risk and innovation: towards a framework for risk governance in public services”, Public Management Review, Vol. 15 No. 2, pp. 186-208. Caggese, A. (2012), “Entrepreneurial risk, investment, and innovation”, Journal of Financial Economics, Vol. 106 No. 2, pp. 287-307. Cao, Y. and Zhao, L. (2013), “Analysis of patent management effects on technological innovation performance”, Baltic Journal of Management, Vol. 8 No. 3, pp. 286-305. Cornaggia, J., Mao, Y., Tian, X. and Wolfe, B. (2015), “Does banking competition affect innovation?”, Journal of Financial Economics, Vol. 115 No. 1, pp. 189-209. Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A. and Dushnitsky, G. (2017), “A review and road map of entrepreneurial equity financing research: venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators”, Journal of Management, Vol. 43 No. 6, pp. 1820-1853. Equity financing and debt financing 713 BJM 14,4 Egger, P. and Keuschnigg, C. (2015), “Innovation, trade, and finance”, American Economic Journal: Microeconomics, Vol. 7 No. 2, pp. 121-157. Ernst, H. (2001), “Patent applications and subsequent changes of performance: evidence from timeseries cross-section analyses on the firm level”, Research Policy, Vol. 30 No. 1, pp. 143-157. Ferreira, D., Manso, G. and Silva, A.C. (2014), “Incentives to innovate and the decision to go public or private”, Review of Financial Studies, Vol. 27 No. 1, pp. 256-300. 714 Furman, J.L., Porter, M.E. and Stern, S. (2002), “The determinants of national innovative capacity”, Research Policy, Vol. 31 No. 6, pp. 899-933. Grant, D. and Yeo, B. (2018), “A global perspective on tech investment, financing, and ICT on manufacturing and service industry performance”, International Journal of Information Management, Vol. 43 No. 6, pp. 130-145. Hong, J., Feng, B., Wu, Y. and Wang, L. (2016), “Do government grants promote innovation efficiency in China’s high-tech industries?”, Technovation, Vol. 57 No. 11, pp. 4-13. Hsu, P., Tian, X. and Xu, Y. (2014), “Financial development and innovation: cross-country evidence”, Journal of Financial Economics, Vol. 112 No. 1, pp. 116-135. Im, K.S., Pesaran, M.H. and Shin, Y. (2003), “Testing for unit roots in heterogeneous panels”, Journal of Econometrics, Vol. 115 No. 1, pp. 53-74. Khan, M.K., He, Y., Akram, U., Zulfiqar, S. and Usman, M. (2018), “Firms’ technology innovation activity: does financial structure matter?”, Asia-Pacific Journal of Financial Studies, Vol. 47 No. 2, pp. 329-353. King, R.G. and Levine, R. (1993), “Finance and growth: Schumpeter might be right”, The Quarterly Journal of Economics, Vol. 108 No. 3, pp. 717-737. Laeven, L., Levine, R. and Michalopoulos, S. (2015), “Financial innovation and endogenous growth”, Journal of Financial Intermediation, Vol. 24 No. 1, pp. 1-24. Lee, N., Sameen, H. and Cowling, M. (2015), “Access to finance for innovative SMEs since the financial crisis”, Research Policy, Vol. 44 No. 2, pp. 370-380. Levin, A., Lin, C. and Chu, C.J. (2002), “Unit root tests in panel data: asymptotic and finite-sample properties”, Journal of Econometrics, Vol. 108 No. 1, pp. 1-24. Levine, R. (2002), “Bank-based or market-based financial systems: which is better?”, Journal of Financial Intermediation, Vol. 11 No. 4, pp. 398-428. Maddala, G.S. and Wu, S. (1999), “A comparative study of unit root tests with panel data and a new simple test”, Oxford Bulletin of Economics and Statistics, Vol. 61 No. S1, pp. 631-652. Mousavi, S. and Bossink, B.A.G. (2017), “Firms’ capabilities for sustainable innovation: the case of biofuel for aviation”, Journal of Cleaner Production, Vol. 167 No. 11, pp. 1263-1275. Müller, E. and Zimmermann, V. (2009), “The importance of equity finance for R&D activity”, Small Business Economics, Vol. 33 No. 3, pp. 303-318. Nanda, R. and Rhodes-Kropf, M. (2017), “Financing risk and innovation”, Management Science, Vol. 63 No. 4, pp. 901-918. Narayan, P.K. and Narayan, S. (2013), “The short-run relationship between the financial system and economic growth: new evidence from regional panels”, International Review of Financial Analysis, Vol. 29 No. 9, pp. 70-78. O’Brien, J.P. (2003), “The capital structure implications of pursuing a strategy of innovation”, Strategic Management Journal, Vol. 24 No. 5, pp. 415-431. Owen, A.L. and Temesvary, J. (2014), “Heterogeneity in the growth and finance relationship: how does the impact of bank finance vary by country and type of lending?”, International Review of Economics & Finance, Vol. 31 No. 2, pp. 275-288. Picard, F. (2012), “Open innovation and joint patent applications: the case of greenhouse gas capture and storage technologies”, Journal of Innovation Economics, Vol. 10 No. 2, p. 107. Pradhan, R.P., Arvin, M.B., Hall, J.H. and Nair, M. (2016), “Innovation, financial development and economic growth in Eurozone countries”, Applied Economics Letters, Vol. 23 No. 16, pp. 1141-1144. Rajan, R.G. and Zingales, L. (1998), “Financial dependence and growth”, American Economic Review, Vol. 88 No. 3, pp. 559-586. Rigotti, L. and Chris, S. (2012), “Sharing risk and ambiguity”, Journal of Economic Theory, Vol. 147 No. 5, pp. 2028-2039. Ruan, A. and Jin, C. (2017), “Does formal knowledge search depth benefit Chinese firms’ innovation performance? Effects of network centrality, structural holes, and knowledge tacitness”, Asian Journal of Technology Innovation, Vol. 25 No. 4, pp. 1-19. Souza, I.D.D.S., Almeida, T.L. and Takahashi, V.P. (2014), “Will governmental incentives in developing countries support companies to innovate more?: evidences from skin care patent applications in Brazil”, Journal of Technology Management & Innovation, Vol. 9 No. 3, pp. 1-20. Tian, X. and Wang, T.Y. (2014), “Tolerance for failure and corporate innovation”, The Review of Financial Studies, Vol. 27 No. 1, pp. 211-255. Westerlund, J. (2007), “Testing for error correction in panel data”, Oxford Bulletin of Economics and Statistics, Vol. 69 No. 6, pp. 709-748. Windmeijer, F. (2005), “A finite sample correction for the variance of linear efficient two-step GMM estimators”, Journal of Econometrics, Vol. 126 No. 1, pp. 25-51. Zhang, L., Zhang, S. and Tao, N.A. (2016), “Financial system risk tolerance capacity and economic growth: evidence from a cross-country analysis”, Global Economic Review, Vol. 45 No. 2, pp. 97-115. Zouaghi, F., Sánchez, M. and Martínez, M.G. (2018), “Did the global financial crisis impact firms’ innovation performance? The role of internal and external knowledge capabilities in high and low tech industries”, Technological Forecasting and Social Change, Vol. 132 No. 3, pp. 92-104. Corresponding author Sheng Zhang can be contacted at: zhangsheng@xjtu.edu.cn For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com View publication stats Equity financing and debt financing 715