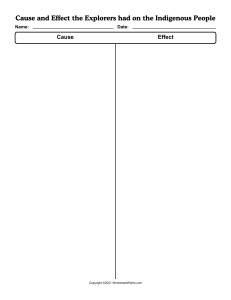

MIS 111 – Spring 2021 – Applied Business Project 1 Grading Rubric Applied Business Project Grading Guidelines Assignment: To perform a technical analysis of a publicly traded company. The deliverables included a basic history of the company, information about recent stock trading, and an analysis of two stock investment strategies. Applied Business Project Grading Guidelines 1. 2. 3. 4. 5. If a paper does not have any errors, you should include “NE” (no errors) in the error code column. Every paper you are assigned should have at least one item (“NE” or one or more error codes) in the error code column. Enter the individual numeric codes that are appropriate. If a Question was left unanswered, just enter the code for that Question (e.g.: 20) Be sure to enter applicable codes individually, do not use hyphens t (ie: if tasks 21, 22, and 23 were all left undone, put it down as 21, 22, 23 AND NOT as 21-23) Do not use any codes which are not listed If you find multiple files from a student, grade the last one submitted General Report Guidelines / Formatting Requirements (once per paper) CODE 81 82 83 84 85 86 Explanation Did not include student first and last names in the submission Report not well organized (no section headers, material out of order) Report not professionally formatted (poorly aligned, random fonts, formatting errors (e.g., number as #####), figures cutoff) Report contains multiple spelling, punctuation, capitalization, or other errors Report contains multiple sentence fragments, grammatical errors, “text speak” Student used the Wrong Company 88 E-Tegrity Statement Missing 20 90 91 No Report submitted to the OT Submission Folder File Submitted but corrupted or not a file that can be opened and graded. GRADERS: PLEASE STATE THE EXACT CAUSE IN THE NOTES TO FACULTY! Note, if any part of the paper can be graded (for example a student accidently uploaded their Excel working file so the tables are gradable), please do so, and just deduct for all missing materials. Submitted document is not a solution for this assignment (e.g., a blank template, a wrong assignment, the assignment guidelines, etc.). GRADERS: PLEASE STATE THE EXACT CAUSE IN THE NOTES TO FACULTY! Paper submitted for Partial Credit to the Partial Credit submission folder File submitted in a format different from .pdf but able to open and grade. GRADERS: if it is an OSX Pages file you can convert it to MS Word and then grade it using an online converter such as the one found here: https://cloudconvert.com/pages-to-doc Hold for instructor review – READ THIS BEFORE USING!!!!! ONLY PUT THIS CODE INTO THE NOTES SECTION! If you use this code, also put down all other applicable error codes in the error codes section, so if we clear it, the assignment is already graded. Please state EXPLICITLY exactly what the instructor 100 100 92 93 95 99 February 04, 2021 Points 2 2 2 2 2 40 100 20 10 100 MIS 111 – Spring 2021 – Applied Business Project 1 Grading Rubric should look at and why this code was used in the faculty notes section . DO NOT use this code for partial, incomplete, or incorrect assignments. Section 1 CODE 10 Task All Tasks Explanation Did Not Complete Any Part of This Question (PLEASE DO NOT enter any of the specific error codes for parts of this task if Points 20 you entered this error Code because the entire Question was unanswered) 1.1 11 1.1 Two or more items missing in the governance table 4 Company’s legal company name Company’s trading exchange and ticker symbol The URL for the company’s primary customer-facing website Location (city, state) of its corporate headquarters Name of the most key executive (typically, President or CEO) of the company and their title Calendar date (day and month) of the company’s most recent fiscal-year end The company’s number of full-time employees Company’s industry sector Company’s industry classification 1.2 12 1.2 Two or more items missing from Financial Profile: The date (on or after August 30, 2019) you select for your “financial profile” For that specific trading day, show the following: 6 Previous Close Share Price Daily volume (Volume) Average daily volume (Avg. Volume) 52 week range (high and low) 1 Year Target Estimate Current Market Capitalization on the date selected (“Market Cap”) Company PE Ratio (TTM or Twelve Trading Months) Company Earnings per Share (EPS (TTM)) Company’s “Beta” (5Y Months) Percentage of shares owned by insiders [Holdings] Percentage of shares own by institutions [Holdings] Analyst “Fair Value” assessment (e.g., Overvalued, not the numeric value “xx.xx”) Overall Analysts Recommendation Rating (i.e., Strong Buy to Sell scale) 1.3 13 1.3 14 1.3 Discussion did not provide a reasonable explanation for why they thought there was a Buy/Sell/Hold recommendation (this needs to be focused on issues). Length of discussion under 100 words (about 7 lines) February 04, 2021 6 4 MIS 111 – Spring 2021 – Applied Business Project 1 Grading Rubric Section 2 CODE 20 Task All Tasks 2.1 2.1 23 2.1 2.1 (PLEASE DO NOT enter any of the specific error codes for parts of this task if you entered this error Code because the entire Question was unanswered) One or more items “Balance Sheet” items missing from table (NA is OK) From Balance Sheet (may be in Millions or Thousands or just $) From Balance Sheet o Assets Total Assets Cash and Cash Equivalents Inventory Goodwill o Liabilities Total Liabilities Accounts Payable Current Debt Long Term Debt o Stockholder Equity o Retained Earnings One or more items “Income Statement” items missing from table, note some items may have NA, that is OK Total Revenue Gross Profit Selling General and Administrative Operating Income (or Loss) Pretax Income EBITDA or Normalized EBITDA One or more items “Cash Flow” items missing from table (NA is OK) From Cash Flow Statement 25 Points 25 NOTE: All date for 2.1 may be put in one table or may be put in multiple tables, as long as the information is present, there is no error 21 24 Explanation Did Not Complete Any Part of This Question 2.1 o 4 4 Operating Cash Flow Investing Cash Flow Financing Cash Flow End Cash Position Free Cash Flow One or more items “Historical Stock Price data” items missing from table From historical stock data o 4 3 “Adjusted Close” stock price on the closing date of the last three (3) fiscal years. This means there will be 3 columns of information, Volume (shares of stock traded) 2.2 26 2.2 27 2.2 28 2.2 Discussion does not clearly describe how an investor would be able to independently verify the press releases financial information could be verified based on the information that can be found in the financial reports, or the article was more than 12 months old Bibliographic citation not included for the article (included URL and date referenced, if the article was from an online source, see guideline examples) Length of Investor Analysis discussion under 100 words (about 7-8 lines) February 04, 2021 4 2 4 MIS 111 – Spring 2021 – Applied Business Project 1 Grading Rubric Section 3 CODE 30 Task All Tasks Explanation Did Not Complete Any Part of This Question (PLEASE DO NOT enter any of the specific error codes for parts of this task if you Points 25 entered this error Code because the entire Question was unanswered) 3.1 Stock Price Table 31 32 33 3.1 3.1 3.1 34 3.1 3.2 35 36 37 38 3.2 3.2 3.2 3.2 39 3.2 Table header missing and / or not merged into one overall header cell Closing dates not shown Two (2) companies and One (1) index (students assigned company and 1 competitor and DOW-30 or NASDAQ) are not all shown Table is missing either a caption and/or a citation Stock Price Graph index Meaningful title not included for chart Meaningful label not included for X-Axis (Dates) or both Y-Axes (price) Graph is not a line graph (see guideline example) Actual closing dates were not used for the x-axis (i.e., discrete dates, not a Continuous range typically showing all dates on the 1st of the Month) Legend identifying each company’s stock tracking line in graph not provided 3 3 3 3 2 2 3 3 3 Note, this is the example graph in the assignment, We don’t care if the colors match, but the graph does need to be professional, have 2 competitors, have x and y axis labels, have a title, and have the actual last trading days of the month in the X Axis Figure 1 – Industry Stock Price Analysis Chart (Source: https://finance.yahoo.com/ Referenced 8/25/2020) February 04, 2021 MIS 111 – Spring 2021 – Applied Business Project 1 Grading Rubric Section 4 CODE 40 Task All Tasks 4.1 41 4.1 Explanation Did Not Complete Any Part of This Question (PLEASE DO NOT enter any of the specific error codes for parts of this task if you entered this error Code because the entire Question was unanswered) Fundamental numbers needed for Financial Ratios Missing two or more of the following (some may be a 0, a dash (–) means 0 so is OK) 42 43 4.1 4.2 44 Points 30 6 Summary o Market Capitalization Financials / Balance Sheet o Total Equity (or Total Equity Gross Minority Interest) o Total Liabilities (or Total Liabilities Net Minority Interest) o Current Assets o Goodwill and Other Intangible Assets [Goodwill] o Current Liabilities [Liabilities] o Cash, Cash Equivalents, and Short-term Investments [Cash] o Ordinary Shares [Common Stock] o Accounts Receivable [A/R] o Long Term Debt and Capital Lease Obligations [Debt] o Common Stock Equity [Equity] 3 2 4.2 No Source(s) cited for table Acid Test Ratio Missing: The acid test is focused on whether a company’s shortterm assets will cover its short-term liabilities. Students just need to include the final number, not the calculations How is the company doing under 100 words (about 5-6+ lines, OK if over) 45 4.3 Working Capital Ratio Missing: 2 46 4.3 5 47 4.4 48 4.4 Write 125-175 words about the state of the company with respect to this ratio. Under 100 words (about 6+ lines, OK if over) P/B Ratio (OK if called Market to Book Ratio) Missing: The price to book ratio is widely used in financial analysis. If it is in the thousands verify the student didn’t have market Cap in Billions and Book Value in Missions (wrong if they did that) P/B Ratio = Market Capitalization / Book Value of Equity. if the number is in the Write a 125-175 word analysis of the companies P/B ratio and whether it appears low enough to be favorable in your view. Specifically discuss whether the company also has intangible assets or goodwill that may be artificially depressing the P/B ratio and making the company appear to be a better value than it actually is. Under 100 words or no citation (about 5-6+ lines, OK if over) February 04, 2021 5 2 5