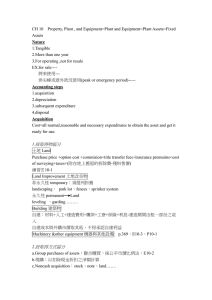

BACHELOR OF BUSINESS MANAGEMNET FIN2254 WEEK 10 PROVISION FOR DEPRECIATION Learning Objective(s) 1. To understand the types of assets that require depreciation 2. To understand the accounting concepts relating to depreciation namely matching and prudence 3. To understand the difference between capital and revenue expenditure 23/08/2021 Learning Outcome(s) 1. Students should be able to identify the types of assets that require depreciation and apply the appropriate depreciation method. 2. Students should also demonstrate their understanding and describe the accounting concepts in line with depreciation. 3. Be familiar with the difference between capital and revenue expenditure. 23/08/2021 Introduction This chapter explains the types of assets requiring depreciation. The accounting concept in relation to depreciation is explained as well. Additionally, the difference between capital and revenue expenditure is also explained. 23/08/2021 Types of asset – Plant Asset Have three characteristics: i) They have a physical substance (a definite size and shape) ii) Used in the operations of a business iii) Not intended for sale to customers Also called property, plant and equipment; or noncurrent assets. 23/08/2021 Types of asset - Land Includes all costs to acquire land and ready it for use. Costs typically include: the purchase price; closing costs, such as title and attorney’s fees; real estate brokers’ commissions; costs of grading, filling, draining, and clearing; assumption of any mortgages, or encumbrances on the property. Types of assets - Buildings Buildings are facilities used in operations, such as stores, offices, factories, and warehouses. Includes all costs related directly to purchase or construction. Construction costs: • Contract price plus payments for architects’ fees, building permits, and excavation costs. Purchase costs: • Purchase price, closing costs (attorney’s fees, title insurance, etc.) and real estate broker’s commission. • Remodeling and replacing or repairing the roof, floors, electrical wiring, and plumbing. Accounting Concepts Matching Concepts The cost of using assets to earn revenue should be matched in the Profit and Loss Account to the revenue earned Prudence If the cost of using fixed assets was not included in the Profit and Loss Account, profit would be overstated. 23/08/2021 Capital & Revenue Expenditure Capital expenditure is expenditure which results in the acquisition of non-current assets, or an improvement in their earning capacity. Revenue expenditure is expenditure which is incurred for the purpose of the trade of the business or to maintain the existing earning capacity of non-current assets. 23/08/2021 Conclusion/Summary All assets that have a finite useful life should be depreciated. Provision for depreciation is made to comply with the concept of Matching and Prudence. Since revenue items and capital items are accounted for in different ways, the correct calculation of profit for any accounting period depends on the correct classification of items as revenue or capital. 23/08/2021 References 1. F. Wood (2015). Business Accounting. Pitman Publishing 13th Edition. ISBN9781292084664 F3 FINANCIAL ACCOUNTING (FA) Apr 16, 2018 by Kaplan Publishing. ISBN9781787400801 F7 FINANCIAL REPORTING (FR) Apr 16, 2018by KaplanPublishing.ISBN9781787400856 •SEGi University & Colleges. All rights reserved. Key Terms: Term Capital expenditure Revenue expenditure Definition When a business spends money to buy or add value to a fixed asset. Expenses needed for the day-to-day running of the business Prudence is the concept that specifies, in situations where Prudence concept there is uncertainty, appropriate caution is exercised in recognizing transactions in financial records. Matching concept is also known as Accruals Concept. This Matching concept concept states that, in computing profit, amounts are included in the accounts in the period when they are earned or incurred, not received or paid. A resource with economic value that an individual, Assets corporation or country owns or controls with the expectation that it will provide future benefit 23/08/2021