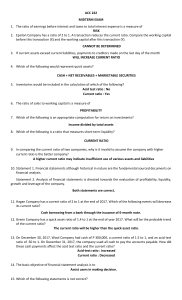

ACC 222 MIDTERM EXAM 1. The ratio of earnings before interest and taxes to total interest expense is a measure of RISK 2. Epsilon Company has a ratio of 2 to 1. A transaction reduces the current ratio. Compare the working capital before this transaction (X) and the working capital after this transaction (Y). CANNOT BE DETERMINED 3. If current assets exceed current liabilities, payments to creditors made on the last day of the month WILL INCREASE CURRENT RATIO 4. Which of the following would represent quick assets? CASH + NET RECEIVABLES + MARKETABLE SECURITIES 5. Inventories would be included in the calculation of which of the following? Acid test ratio : No Current ratio : Yes 6. The ratio of sales to working capital is a measure of PROFITABILITY 7. Which of the following is an appropriate computation for return on investments? Income divided by total assets 8. Which of the following is a ratio that measures short-term liquidity? CURRENT RATIO 9. In comparing the current ratio of two companies, why is it invalid to assume the company with higher current ratio is the better company? A higher current ratio may indicate insufficient use of various assets and liabilities 10. Statement 1. Financial statements although historical in nature are the fundamental sourced documents on financial analysis. Statement 2. Analysis of financial statements is directed towards the evaluation of profitability, liquidity, growth and leverage of the company. Both statements are correct. 11. Hagan Company has a current ratio of 2 to 1 at the end of 2017. Which of the following events will decrease its current ratio? Cash borrowing from a bank through the issuance of 6-month note. 12. Green Company has a quick asset ratio of 1.4 to 1 at the end of year 2017. What will be the probable trend of the current ratio? The current ratio will be higher than the quick asset ratio. 13. On December 30, 2017, Wool Company had cash of P 300,000, a current ratio of 1.5 to 1, and an acid test ratio of .50 to 1. On December 31, 2017, the company used all cash to pay the accounts payable. How did these cash payments affect the acid test ratio and the current ratio? Acid-test ratio : Increased Current ratio : Decreased 14. The basic objective of financial statement analysis is to Assist users in making decision. 15. Which of the following statements is not correct? The financial statements are called general-purpose financial statements because different users have common needs and objectives in analyzing financial statements. 16. Royal Company’s net Accounts Receivable were P 500,000 on December 31, 2020, and P 600,000 on December 31, 2021. Net cash sales for 2021 were P 200,000. The accounts receivable turnover for 2021 was 5. What were Royal’s net sales for 2021? 2,950,000 17. The management of Batman Company, after being informed that the selling price was 6% lower than 2020, would like to know other factors that change the gross margin as shown below: 2020 2021 Net sales 420,000 426,384 Cost of sales 243, 600 276,242.40 Gross Margin 176,400 150,141.60 Based on the following data, an analysis of changes in gross margin would show an increase (decrease) in net sales due to sales price of how much? (27,216) 18. The management of Batman Company, after being informed that the selling price was 6% lower than 2020, would like to know other factors that change the gross margin as shown below: Net sales Cost of sales Gross Margin 2020 420,000 243, 600 176,400 2021 426,384 276,242.40 150,141.60 Based on the following data, an analysis of changes in gross margin would show an increase (decrease) in cost of sales due to cost factor of how much? 13,154,000 19. The management of Batman Company, after being informed that the selling price was 6% lower than 2020, would like to know other factors that change the gross margin as shown below: 2020 2021 Net sales 420,000 426,384 Cost of sales 243, 600 276,242.40 Gross Margin 176,400 150,141.60 Based on the following data, an analysis of changes in gross margin would show an increase (decrease) in cost of sales due to volume of 19,488 20. The management of Batman Company, after being informed that the selling price was 6% lower than 2020, would like to know other factors that change the gross margin as shown below: Net sales Cost of sales Gross Margin 2020 420,000 243, 600 176,400 2021 426,384 276,242.40 150,141.60 Based on the following data, an analysis of changes in gross margin would show a percent increase (decrease in unit cost of how much? 5%, .05 21. John & Co. has a debt ratio of 0.50, a total assets turnover of .025, and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished by (1) increasing the profit margin to 14% and by (2) increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the 14% profit margin, is required to double the return on equity? .65, 65% 22. Break Company provided the following information: December 31 Net credit sales Cost of sales Trade receivables Inventory 2021 P 1,241,000 876,000 70,000 192,000 2022 P 64,000 156,000 The number of days to convert inventory to sales using 360-day year would be? 71.57 days, 71.57 23. Net sales are P6,000,000, beginning total assets are P2,800,000, and the asset turnover is 3.0. What is the ending total asset balance? 1,200,000 24. Sales for a three-year period are: Year 1, P4.0 million, Year 2, P4.6 million, and Year 3, P5.0 million. Using year 1 as the base year, the respective percentage increase in sales in year 2 and 3 are 115% and 125%, 1.15 and 1.25 25. Assume you are given the following relationships for the Bryan Company: Sales/total assets 1.5 X Return on assets (ROA) 3% Return on equity (ROE) 5% What is the Bryan Company’s debt ratio? 40%, .40 26. The following data were obtained from the records of Train, Inc.: Current ratio (at year end) Inventory turnover based on sales and ending inventory Inventory turnover based on cost of goods sold and ending inventory Gross margin for 2020 1.5 to 1 15 times 10.5 times P315,000 What was Trend, Inc.’s December 31, 2020 balance in the Inventory account? 70,000 27. Gladys expects sales for 2020 to be P2,000,000, resulting in a return on sales of 10%. The dividend payout rate is 60%. Beginning stockholders’ equity was P850,000 and current liabilities are projected to be P300,000 at the end of 2020. What are the total equities available if the ratio of long-term debt to stockholders’ equity is 60%? 1,788,000 28. The following were reflected from the records of War Freak Company: Earnings before interest and taxes Interest expense Preferred dividends Payout ratio Shares outstanding throughout 20xa Preferred Common Income tax rate Price earnings ratio The dividend yield ratio is What is the dividend ratio? P1,250,000 250,000 200,000 40 % 20,000 25,000 40% 5 times .08, 8% 29. During 20XA, Reuel Company purchased P1, 920, 000 of inventory. The cost of goods sold for 20XA was P1, 800, 000 and the ending inventory at December 31, 20XA was P360, 000. What was the inventory turn-over for 20XA? 6.0 times, 6 times, 6x, 6X 30. Selected data from Maui Company’s year-end financial statements are presented below. The difference between average and ending inventory is immaterial. Current ratio Quick ratio Current liabilities Inventory turnover (based on cost of sales) Gross profit margin 2.0 1.5 P120,000 8 times 40% What are the net sales for the year? SEMIFINALS 1. A difference between standard costs used for cost control and budgeted costs? Can exist because standard costs represent what costs should be whereas budgeted costs represent expected actual costs. 2. Zero-base budgeting requires managers to Justify all expenditures, not just increases over last years’ amount. 3. Which of the following is an advantage of the budgeting process? It communicates to employees the specific goals and objectives that may be used in evaluating their job performance. 4. A decrease in inventory order costs will Decrease the economic order quantity. 5. Companies that adopt just-in time purchasing systems often experience A reduction in the number of suppliers. 6. As a company becomes more conservative with respect to working capital policy, it would tend to have a(n) Increase in the ratio of current assets to noncurrent liabilities. 7. Wen Company follows an aggressive financing policy in its working capital management while Manong Corporation follows a conservative financing policy. Which one of the following statements is correct? When has a low current ratio while Manong has a high current ratio. 8. The Alabang Company has a daily average collection of checks of P250,000. It takes the company 4 days to convert the checks to cash. Assume a lockbox system could be employed, which would reduce the cash conversion period to 3 days. The lockbox system would have a net cost of P25,000 per year, but any additional funds made available could be invested to net 8 percent per year. Should Alabang adopt the lockbox system? No; the firm would lose P5,000 per year if the system were used. 9. It is held that the level of accounts receivable that a firm has or holds reflects both the volume of a firm’s sales on account and the firm’s credit policies. Which one of the following is not considered as part of a firm’s “credit policy”? The extent (in terms of money) to which a firm will go to collect an account. 10. Which of the following items is irrelevant for a company that is attempting to minimize the cost of the stockout? Cost of placing the order 11. When a specified level of safety stock is carried for an item in inventory, the average inventory level for that item Increases by the amount of the safety stock 12. The two most appropriate factors for budgeting manufacturing overhead expenses would be Management judgment and production volume 13. Of the following items, the one item that would not be considered in evaluating the adequacy of the budgeted annual operating income for a company is Internal rate of return 14. Which of the following is not true about a self-imposed budget? The views of the persons below middle management on budget matters are not considered by top management. 15. Which of the following sequences for performance reports can be best used in the management control process as a communication tool? Plan approval, feedforward, feedback, corrective action. 16. P1,125,000 17. Isabelle, Industries plans to sell 200,000 units of Batik products in October and anticipates growth in sales of 5 percent per month. The target ending inventory in units of the product is 80 percent of the next month’s estimated sales. There are 150,000 units in inventory as of the end of September. The production requirement in units of Batik for the quarter ending December 31 would be P665,720 18. P8,500 19. P157,000 20. Invest P200,000 21. P70,000 22. Carrying costs, P150,000, Set-up costs P25,000 23. P322,200 24. P43,000 25. 400 units 26. 300 27. P3,040,000 28. P (45,833) 29. P1,620,000 30. 31.81% 31. 29,000 uniforms 32. P986,000 33. . P520,000 34. P42,000 35. P71,400