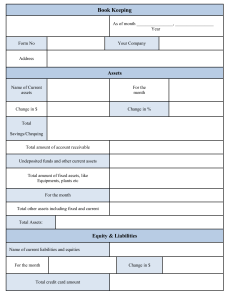

Chap 2: Basic Accounting Concepts: The Balance Sheet (AHM) What is an Asset? The economic resources of an entity are called its assets. Assets consists of, i. ii. non-monetary assets such as land, buildings and machinery whose cash value is not fixed by contract. Monetary assets such as money and marketable securities whose cash value is fixed by contract. What is Amortization? The cost of a non-monetary asset that has a long but nevertheless limited life is systematically reduced over that life by the process called amortization. The purpose of amortization is to remove systematically the cost of the asset from the asset accounts and to show it as a cost of operations. Amortization has no necessary relationship to changes in market or in real worth of the asset. The Dual Aspect Concept The economic resources of an entity are called assets. The claims of various parties against these assets are called equities. There are two types of equities: 1. Liabilities – which are the claims of creditors (i.e everyone else other than the owners of business) 2. Owner’s Equity – which are the claims of the owners of the business The fundamental equation: Assets = Liabilities + Owner’s Equity The Balance Sheet The financial position of an accounting entity as of a specified moment in time is shown by a balance sheet. Assets Assets are customarily grouped into categories, Current and Non-Current. Current Assets Cash and other assets that are expected to be realized in cash or sold or consumed during the normal operating cycle of the entity or within one year, whichever is longer are called current assets. Exception – Tobacco companies and distilleries include their inventory as current assets even though tobacco and liquor remain in inventory for an ageing process that lasts two year. Some examples of Current Assets: cash, Marketable Securities, Accounts Receivables, Inventories, Prepaid Expenses Non-Current Assets Property, Plant and Equipment → This category consists of assets that are tangible and relatively long lived. The entity has acquired these assets in order to use them to produce goods and services that will generate future cash inflows. Other Assets → Investment: Another type of assets is investments. These are securities of one company owned by another in order to control the other company or in anticipation of earning a long-term return from the investment. One difference between marketable securities and investment is that marketable securities are current asset reflecting short term use of excess cash. Intangible Assets: include goodwill, patents, copyrights, trademarks, franchises and similar valuable but non-physical things controlled by business Liabilities Liabilities are obligations to transfer assets or provide services to outside parties arising from events that have already happened. Two categories of liabilities: 1. Current Liabilities are expected to be satisfied or extinguished during the normal operating cycle or within one year or whichever is longer. Few examples, Accounts Payable, Taxes Payable, Accrued Expenses, Deferred Revenues, Current Portion of Long term debt. 2. Other Liabilities are obligations that do not meet criteria for being current liabilities. Owner’s Equities The owner’s equity of the balance sheet shows the amount the owners have invested in the entity. These have two categories: 1. Paid-In capital or contributed capital is the amount the owners have invested directly in the business by purchasing shares of stock as these shares were issued by the corporation. 2. Retained Earnings is the difference between the total earnings of the entity since its inception and the total amount of dividends paid out to its shareholders over its entire life. **There is a common misconception that there is some connection between the amount of a company’s retained earnings and the amount it holds. So now we can also write the Dual Aspect Concept Equation as, Assets = Liabilities + Paid-In Capital + Retained Earnings Current Ratio The ratio of current assets to current liabilities is called current ratio. Rule of Thumb Current Ratio = 2:1 (Satisfactory) Entity can convert its assets easily to run operations Current Ratio = 2.5 : 1 (Unsatisfactory) Entity is not utilizing its assets effectively