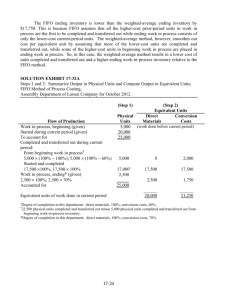

CHAPTER 7 SPECIAL PRODUCTION ISSUES: LOST UNITS AND ACCRETION MULTIPLE CHOICE 1. Shrinkage should be treated as a. b. c. d. defective units. spoiled units. miscellaneous expense. a reduction of overhead. ANSWER: 2. not be sold through normal channels of distribution. be sold through normal channels of distribution. not be reprocessed to a sufficient quality level. also be called a spoiled unit. ANSWER: b EASY A unit that is rejected at a quality control inspection point, but that can be reworked and sold, is referred to as a a. b. c. d. spoiled unit. scrap unit. abnormal unit. defective unit. ANSWER: 4. EASY Economically reworked units may a. b. c. d. 3. b d EASY Spoiled units are a. b. c. d. units that cannot be economically reworked to bring them up to standard. units that can be economically reworked to bring them up to standard. the same as defective units. considered abnormal losses. ANSWER: a EASY 7–1 7–2 5. Chapter 7 The cost of abnormal losses (net of disposal costs) should be written off as a. b. c. d. Product cost yes yes no no ANSWER: 6. Abnormal loss yes yes no no ANSWER: EASY d Normal loss yes no no yes EASY If abnormal spoilage occurs in a job order costing system, has a material dollar value, and is related to a specific job, the recovery value of the spoiled goods should be a. b. c. d. debited to a scrap inventory account the specific job in process a loss account factory overhead ANSWER: 8. c Period cost no yes yes no Which of the following would fall within the range of tolerance for a production cycle? a. b. c. d. 7. Special Production Issues: Lost Units and Accretion a credited to the specific job in process overhead the specific job in process sales MEDIUM If normal spoilage is detected at an inspection point within the process (rather than at the end), the cost of that spoilage should be a. b. c. d. included with the cost of the units sold during the period. included with the cost of the units completed in that department during the period. allocated to ending work in process units and units transferred out based on their relative values. allocated to the good units that have passed the inspection point. ANSWER: d MEDIUM Chapter 7 9. Special Production Issues: Lost Units and Accretion A continuous loss a. b. c. d. occurs unevenly throughout a process. never occurs during the production process. always occurs at the same place in a production process. occurs evenly throughout the production process. ANSWER: 10. c EASY The method of neglect handles spoilage that is a. b. c. d. discrete and abnormal. discrete and normal. continuous and abnormal. continuous and normal. ANSWER: d MEDIUM Normal spoilage is defined as unacceptable production that a. b. c. d. arises because of a special job or process. occurs in on-going operations. is caused specifically by human error. is in excess of that which is expected. ANSWER: 13. EASY adding the correct ingredients to make a bottle of ketchup putting the appropriate components together for a stereo adding the wrong components when assembling a stereo putting the appropriate pieces for a bike in the box ANSWER: 12. d Which of the following would be considered a discrete loss in a production process? a. b. c. d. 11. 7–3 b EASY When the cost of good units are increased and lost units are not included in an equivalent unit schedule, these units are considered a. b. c. d. normal and discrete. normal and continuous. abnormal and discrete. abnormal and continuous. ANSWER: b EASY 7–4 14. Chapter 7 The net cost of normal spoilage in a job order costing system in which spoilage is common to all jobs should be a. b. c. d. assigned directly to the jobs that caused the spoilage. charged to manufacturing overhead during the period of the spoilage. charged to a loss account during the period of the spoilage. allocated only to jobs that are completed during the period. ANSWER: 15. MEDIUM written off as a period cost. never shown in EUP schedules. treated as a product cost. both b and c. ANSWER: c EASY Normal spoilage units resulting from a continuous process a. b. c. d. are extended to the EUP schedule. result in a higher unit cost for the good units produced. result in a loss being incurred. cause estimated overhead to increase. ANSWER: 17. b Normal spoilage is a. b. c. d. 16. Special Production Issues: Lost Units and Accretion b EASY When normal spoilage is discovered at a discrete inspection point and the degree of completion of ending work in process has not reached the level of completion of the inspection point, normal spoilage is handled by a. b. c. d. prorating the spoilage cost between units transferred out and units in ending work in process. extending the spoiled units to the EUP schedule. assigning the normal spoilage costs to the units transferred out and those in beginning inventory. both b and c. ANSWER: d MEDIUM Chapter 7 18. Special Production Issues: Lost Units and Accretion In a job order costing system, the net cost of normal spoilage is equal to a. b. c. d. estimated disposal value plus the cost of spoiled work. the cost of spoiled work minus estimated spoilage cost. the units of spoiled work times the predetermined overhead rate. the cost of spoiled work minus the estimated disposal value. ANSWER: 19. Beginning Inventory no yes no yes ANSWER: MEDIUM b Ending Inventory yes yes no no Units Started & Completed yes yes yes no MEDIUM The cost of normal discrete losses is a. b. c. d. absorbed by all units past the inspection point on an equivalent unit basis. absorbed by all units in ending inventory. considered a period cost. written off as a loss on an equivalent unit basis. ANSWER: 21. d Taylor Co. has a production process in which the inspection point is at 65 percent of conversion. The beginning inventory for July was 35 percent complete and ending inventory was 80 percent complete. Normal spoilage costs would be assigned to which of the following groups of units, using FIFO costing? a. b. c. d. 20. 7–5 a EASY When spoilage is discovered at a discrete point in the production process, a. b. c. d. equivalent units for the spoilage are shown in the EUP schedule. its cost, if normal, should be assigned to the units transferred out. its cost, if abnormal, should be assigned to the good units produced. both a and c. ANSWER: a EASY 7–6 22. Chapter 7 When the cost of lost units must be assigned, and those same units must be included in an equivalent unit schedule, these units are considered a. b. c. d. normal and discrete. normal and continuous. abnormal and discrete. abnormal and continuous. ANSWER: 23. MEDIUM spoilage that is forecasted or planned. spoilage that is in excess of planned. accounted for as a product cost. debited to Cost of Goods Sold. ANSWER: b EASY Which of the following accounts is credited when abnormal spoilage is written off in an actual cost system? a. b. c. d. Miscellaneous Revenue Loss from Spoilage Finished Goods Work in Process ANSWER: 25. d Abnormal spoilage is a. b. c. d. 24. Special Production Issues: Lost Units and Accretion d EASY Which of the following types of spoilage cost is considered a product cost? a. b. c. d. Abnormal spoilage yes yes no no ANSWER: c EASY Normal spoilage yes no yes no Chapter 7 26. Special Production Issues: Lost Units and Accretion Abnormal spoilage can be a. b. c. d. continuous yes no yes no ANSWER: 27. good units yes no yes no ANSWER: EASY d lost units yes no no yes EASY The cost of abnormal continuous losses is a. b. c. d. considered a product cost. absorbed by all units in ending inventory and transferred out on an equivalent unit basis. written off as a loss on an equivalent unit basis. absorbed by all units past the inspection point. ANSWER: 29. c discrete no no yes yes The cost of abnormal discrete units must be assigned to a. b. c. d. 28. 7–7 c EASY Which of the following statements is false? The cost of rework on defective units, if a. b. c. d. abnormal, should be assigned to a loss account. normal and if actual costs are used, should be assigned to material, labor and overhead costs of the good production. normal and if standard costs are used, should be considered when developing the overhead application rate. abnormal, should be prorated among WIP, FG, and CGS. ANSWER: d MEDIUM 7–8 30. Chapter 7 A process that generates continuous defective units a. b. c. d. never requires a quality control point. requires a quality control point at the end of the process. requires quality control points every time new materials are added to the production process. requires quality control points at the beginning of the production process. ANSWER: 31. MEDIUM accretion. reworked units. complex procedure. undetected spoilage. ANSWER: a EASY When material added in a successor department increases the number of units, the a. b. c. d. extra units are treated like spoilage. unit cost of the transferred-in units is decreased. costs associated with the extra units are maintained separately for financial reporting purposes. unit cost of the transferred-in units is increased. ANSWER: 33. b The addition of material in a successor department that causes an increase in volume is called a. b. c. d. 32. Special Production Issues: Lost Units and Accretion b EASY Which of the following is not a question that needs to be answered in regard to quality control? a. b. c. d. What happens to the spoiled units? What is the actual cost of spoilage? How can spoilage be controlled? Why does spoilage happen? ANSWER: a MEDIUM Chapter 7 34. Special Production Issues: Lost Units and Accretion In regard to spoilage, management should be most concerned with which of the following? a. b. c. d. accounting for spoilage controlling spoilage planning for spoilage inspecting spoilage ANSWER: b EASY Use the following information for questions 35–46. The following information is available for K Co. for June: Started this month Beginning WIP (40% complete) Normal spoilage (discrete) Abnormal spoilage Ending WIP (70% complete) Transferred out Beginning Work in Process Costs: Material Conversion Current Costs: Material Conversion 80,000 units 7,500 units 1,100 units 900 units 13,000 units 72,500 units $10,400 13,800 $120,000 350,000 All materials are added at the start of production and the inspection point is at the end of the process. 35. 7–9 What are equivalent units of production for material using FIFO? a. b. c. d. 80,000 79,100 78,900 87,500 ANSWER: a MEDIUM 7–10 36. Chapter 7 What are equivalent units of production for conversion costs using FIFO? a. b. c. d. 79,700 79,500 81,100 80,600 ANSWER: 37. b EASY What are equivalent units of production for conversion costs using weighted average? a. b. c. d. 83,600 82,700 82,500 81,600 ANSWER: a EASY What is cost per equivalent unit for material using FIFO? a. b. c. d. $1.63 $1.37 $1.50 $1.56 ANSWER: 40. MEDIUM 86,600 87,500 86,400 85,500 ANSWER: 39. d What are equivalent units of production for material using weighted average? a. b. c. d. 38. Special Production Issues: Lost Units and Accretion c EASY What is cost per equivalent unit for conversion costs using FIFO? a. b. c. d. $4.00 $4.19 $4.34 $4.38 ANSWER: c EASY Chapter 7 41. Special Production Issues: Lost Units and Accretion What is cost per equivalent unit for material using weighted average? a. b. c. d. $1.49 $1.63 $1.56 $1.44 ANSWER: 42. $4.19 $4.41 $4.55 $4.35 ANSWER: EASY $75,920 $58,994 $56,420 $53,144 ANSWER: b MEDIUM What is the cost assigned to abnormal spoilage using FIFO? a. b. c. d. $1,350 $3,906 $5,256 $6,424 ANSWER: 45. d What is the cost assigned to ending inventory using FIFO? a. b. c. d. 44. EASY What is cost per equivalent unit for conversion costs using weighted average? a. b. c. d. 43. a c MEDIUM What is the cost assigned to normal spoilage and how is it classified using weighted average? a. b. c. d. $6,193 allocated between WIP and Transferred Out $6,424 assigned to units Transferred Out $6,193 assigned to loss account $6,424 assigned to units Transferred Out ANSWER: b MEDIUM 7–11 7–12 46. Chapter 7 Special Production Issues: Lost Units and Accretion What is the total cost assigned to goods transferred out using weighted average? a. b. c. d. $435,080 $429,824 $428,656 $423,400 ANSWER: b DIFFICULT Use the following for questions 47–57. The following information is available for OP Co. for the current year: Beginning Work in Process (75% complete) Started Ending Work in Process (60% complete) Abnormal spoilage Normal spoilage (continuous) Transferred out 14,500 units 75,000 units 16,000 2,500 5,000 66,000 units units units units Costs of Beginning Work in Process: Material $25,100 Conversion 50,000 Current Costs: Material $120,000 Conversion 300,000 All materials are added at the start of production. 47. Using weighted average, what are equivalent units for material? a. b. c. d. 82,000 89,500 84,500 70,000 ANSWER: 48. c EASY Using weighted average, what are equivalent units for conversion costs? a. b. c. d. 80,600 78,100 83,100 75,600 ANSWER: b EASY Chapter 7 49. Special Production Issues: Lost Units and Accretion What is the cost per equivalent unit for material using weighted average? a. b. c. d. $1.72 $1.62 $1.77 $2.07 ANSWER: 50. $4.62 $4.21 $4.48 $4.34 ANSWER: MEDIUM $31,000 $15,500 $30,850 none of the above ANSWER: d EASY Assume that the cost per EUP for material and conversion are $1.75 and $4.55, respectively. What is the cost assigned to ending Work in Process? a. b. c. d. $100,800 $87,430 $103,180 $71,680 ANSWER: 53. c What is the cost assigned to normal spoilage using weighted average? a. b. c. d. 52. MEDIUM What is the cost per equivalent unit for conversion costs using weighted average? a. b. c. d. 51. a d EASY Using FIFO, what are equivalent units for material? a. b. c. d. 75,000 72,500 84,500 70,000 ANSWER: d EASY 7–13 7–14 54. Chapter 7 Using FIFO, what are equivalent units for conversion costs? a. b. c. d. 72,225 67,225 69,725 78,100 ANSWER: 55. EASY $1.42 $1.66 $1.71 $1.60 ANSWER: c EASY Using FIFO, what is the cost per equivalent unit for conversion costs? a. b. c. d. $4.46 $4.15 $4.30 $3.84 ANSWER: 57. b Using FIFO, what is the cost per equivalent unit for material? a. b. c. d. 56. Special Production Issues: Lost Units and Accretion a EASY Assume that the FIFO EUP cost for material and conversion are $1.50 and $4.75, respectively. Using FIFO what is the total cost assigned to the units transferred out? a. b. c. d. $414,194 $339,094 $445,444 $396,975 ANSWER: a DIFFICULT Chapter 7 Special Production Issues: Lost Units and Accretion 7–15 Use the following information for questions 58–65. T Co. has the following information for July: Units started Beginning Work in Process: (35% complete) Normal spoilage (discrete) Abnormal spoilage Ending Work in Process: (70% complete) Transferred out Beginning Work in Process Costs: Material $15,000 Conversion 10,000 100,000 20,000 3,500 5,000 14,500 97,000 units units units units units units All materials are added at the start of the production process. T Co. inspects goods at 75 percent completion as to conversion. 58. What are equivalent units of production for material, assuming FIFO? a. b. c. d. 100,000 96,500 95,000 120,000 ANSWER: 59. MEDIUM What are equivalent units of production for conversion costs, assuming FIFO? a. b. c. d. 108,900 103,900 108,650 106,525 ANSWER: 60. a d MEDIUM Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. What is the amount of the period cost for July using FIFO? a. b. c. d. $0 $9,375 $10,625 $12,500 ANSWER: c MEDIUM 7–16 61. Chapter 7 Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. Using FIFO, what is the total cost assigned to the transferred-out units (rounded to the nearest dollar)? a. b. c. d. $245,750 $244,438 $237,000 $224,938 ANSWER: 62. DIFFICULT 107,000 116,500 120,000 115,000 ANSWER: c EASY What are equivalent units of production for conversion costs assuming weighted average is used? a. b. c. d. 113,525 114,400 114,775 115,650 ANSWER: 64. b What are equivalent units of production for material assuming weighted average is used? a. b. c. d. 63. Special Production Issues: Lost Units and Accretion a EASY Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. What is the cost assigned to normal spoilage, using weighted average, and where is it assigned? a. b. c. d. Value $7,437.50 $7,437.50 $8,750.00 $8,750.00 ANSWER: b Assigned To Units transferred out and EI Units transferred out Units transferred out and EI Units transferred out EASY Chapter 7 65. Special Production Issues: Lost Units and Accretion Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. Assuming that weighted average is used, what is the cost assigned to ending inventory? a. b. c. d. $29,725.00 $37,162.50 $38,475.00 $36,250.00 ANSWER: 66. EASY its minimum tolerance for defects. its maximum tolerance for defects. a decision to seek world-class status as a manufacturer. its automated quality limits. ANSWER: b EASY World-class companies a. b. c. d. believe that “Six-Sigma” is the best AQL to have. have performed well if their defect percentage is greater than their AQL. continuously attempt to raise their AQL. all of the above. ANSWER: 68. a A company’s AQL represents a. b. c. d. 67. 7–17 c MEDIUM Six Sigma translates into a rate of 3.4 defects per a. b. c. d. million items processed. billion items processed. thousand items processed. hundred items processed. ANSWER: a EASY 7–18 69. Chapter 7 The concept of Six Sigma is directly related to a. b. c. d. Variation elimination no no yes yes ANSWER: 70. d JIT Inventory no yes yes no MEDIUM Performing services with zero errors is viewed as a(an) a. b. c. d. reasonable goal for all service organizations. impossible goal for any service organization. laudable goal for most service organizations. goal equivalent to achieving Six-Sigma performance. ANSWER: 71. Special Production Issues: Lost Units and Accretion c MEDIUM Which of the following would be the most likely cause of an increase in the number of units in a department? a. b. c. d. Bulk packaging Expansion of material Heat processing All of the above ANSWER: b MEDIUM SHORT ANSWER/PROBLEMS 1. How is the cost of reworking defective items accounted for? ANSWER: Reworked units are also known as defective units. These units can be reprocessed and sold or sold as is as irregulars. Rework cost is classified as either a product or period cost. If rework is considered normal and actual costing is used, the cost is added to current Work in Process and is assigned to all units produced. If rework is abnormal, the cost is allocated to a loss account for the period. MEDIUM Chapter 7 2. Special Production Issues: Lost Units and Accretion 7–19 Discuss the accounting treatment of spoilage in a job order costing system. ANSWER: If the spoilage is common to all jobs, is normal, and can be estimated, the net cost is applied to production using a predetermined overhead rate that was set by including the spoilage estimate in estimated overhead. If spoilage pertains to a particular job and is normal, the disposal value of the spoiled goods should be removed from that particular job. If the spoilage is abnormal, the net cost should be charged to a loss account and credited to the particular Work in Process job that created the spoilage. MEDIUM 3. Discuss why units are lost during production. ANSWER: In most production processes, losses are anticipated to a certain degree. Losses may be classified as normal and abnormal depending on management’s expectations. A normal loss is one that is expected, while an abnormal loss is one that exceeds the normal loss. The losses may result in spoiled or defective units. Spoiled units cannot be economically reworked; defective units can be. Losses can occur on a continuous or a discrete basis. Quality control points are established at the end of and/or within the process to inspect goods and remove from further processing those units that are either spoiled or defective. MEDIUM 4. Discuss how spoilage is treated in EUP computations. ANSWER: If spoilage is normal and continuous, the calculations for EUP do not include this spoilage (method of neglect), and the good units simply absorb the cost of such spoilage. If spoilage is normal and discrete, the equivalent units are used in the EUP calculations, and the spoilage cost is assigned to all units that passed through the inspection point during the current period. If the spoilage is abnormal and either discrete or continuous, the equivalent units are used in EUP calculations and costed at the cost per EUP; the total cost is then assigned to a loss account. MEDIUM 7–20 Chapter 7 Special Production Issues: Lost Units and Accretion Use this data for questions 5 and 6. The following information is available for Paas Co. for January 2001. All materials are added at the start of production. Beginning Work in Process: (80% complete) Started Normal spoilage (continuous) Abnormal spoilage Ending Work in Process: (55% complete) Transferred out Beginning Work in Process Costs: Material $ 14,000 Conversion 45,000 Current Costs: Material 50,000 Conversion 175,000 Total Costs $ 284,000 8,000 35,000 6,000 2,500 15,000 19,500 units units units units units units Chapter 7 5. Special Production Issues: Lost Units and Accretion 7–21 Prepare a cost of production report for January using FIFO. ANSWER: BI 8,000 + Started 35,000 = Accountable for 43,000 Paas Co. Cost Report January 31, 2001 BWIP S&C EWIP Norm Abnorm. Acctd. for 8,000 11,500 15,000 6,000 2,500 43,000 Material 0 11,500 15,000 0 2,500 29,000 Material: $50,000/29,000 = $1.72 Conversion Costs: $175,000/23,850 = $7.34 Cost Assignment: Ending Work in Process 15,000 × $1.72 = $ 25,800 8,250 × $7.34 = 60,555 Abnormal Spoilage 2,500 × $9.06 = Cost Transferred Out $284,000 – 86,355 – 22,650 = Total costs accounted for MEDIUM $ 86,355 22,650 174,995 $ 284,000 CC 1,600 11,500 8,250 0 2,500 23,850 7–22 6. Chapter 7 Special Production Issues: Lost Units and Accretion Prepare the cost of production report assuming weighted average. ANSWER: BI 8,000 + Started 35,000 = Accountable for 43,000 Paas Company Cost Report January 31, 2001 TO EWIP Norm Abnorm. Acctd. for 19,500 15,000 6,000 2,500 43,000 Material 19,500 15,000 0 2,500 37,000 Material: $64,000/37,000 = $1.73 Conversion Costs: $220,000/30,250 = $ 7.27 Cost Assignment: Ending Work in Process 15,000 × $1.73 = 8,250 × $7.27 = Abnormal Spoilage 2,500 × $9.00 = $25,950 59,978 Transferred Out $284,000 – 85,928 – 22,500 = Total costs accounted for MEDIUM $ 85,928 22,500 175,572 $ 284,000 CC 19,500 8,250 0 2,500 30,250 Chapter 7 7. Special Production Issues: Lost Units and Accretion 7–23 MJ Company manufactures picture frames of all sizes and shapes and uses a job order costing system. There is always some spoilage in each production run. The following costs relate to the current run: Estimated overhead (exclusive of spoilage) Spoilage (estimated) Sales value of spoiled frames Labor hours $160,000 $ 25,000 $ 11,500 100,000 The actual cost of a spoiled picture frame is $7.00. During the year 170 frames are considered spoiled. Each spoiled frame can be sold for $4. The spoilage is considered a part of all jobs. a. b. c. Labor hours are used to determine the predetermined overhead rate. What is the predetermined overhead rate per direct labor hour? Prepare the journal entry needed to record the spoilage. Prepare the journal entry if the spoilage relates only to Job #12 rather than being a part of all production runs. ANSWER: a. $160,000 + $25,000 – $11,500 = $173,500 $173,500/100,000 = $1.735 per DLH b. Disposal Value of Spoiled Work Manufacturing Overhead Work in Process Inventory 680 510 Disposal Value of Spoiled Work Work in Process Inventory—Job #12 680 c. MEDIUM 1,190 680 7–24 8. Chapter 7 Special Production Issues: Lost Units and Accretion I Eat Yogurt Company produces yogurt in two departments—Mixing and Finishing. In Mixing, all ingredients except fruit are added at the start of production. In Finishing, fruit is added and then the mixture is placed into containers. Adding the fruit to the basic yogurt mixture increases the volume transferred in by the number of gallons of fruit added. Any spoilage that occurs is in the Finishing Department. Spoilage is detected just before the yogurt is placed into containers or at the 98 percent completion point. All spoilage is abnormal. Finishing Department BWIP (100% fruit, 0% container, 30% CC) Gallons transferred in Gallons of fruit added EWIP (100% fruit, 0% container, 60% CC) Gallons transferred out Abnormal spoilage BWIP Costs: Transferred In Fruit CC Current Costs: Transferred In Fruit Containers CC Total Costs $ 5,000 gallons 5,500 1,200 1,700 gallons 9,000 1,000 9,700 10,500 15,000 12,400 54,000 11,000 98,000 $ 210,600 Prepare a cost of production report for September 2001. The company uses weighted average. Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: 7–25 I Eat Yogurt Co. Cost Report September 30, 2001 BWIP Trans. In Fruit Acctble. For 5,000 5,500 1,200 11,700 TO EWIP AS TI 9,000 1,700 1,000 11,700 Fruit 9,000 1,700 1,000 11,700 Container 9,000 0 0 9,000 CC 9,000 1,020 980 11,000 TI $ 9,700 12,400 $22,100 11,700 $1.89 Fruit $10,500 54,000 $64,500 11,700 $5.51 Container $ 0 11,000 $11,000 9,000 $1.22 CC $ 15,000 98,000 $113,000 11,000 $10.27 Costs: BWIP Current EUP Per unit Cost Assignment: EWIP 1,700 × $1.89 = $ 3,213 1,700 × $5.51 = 9,367 1,020 × $10.27 = 10,475 Spoilage 1,000 × $1.89 = $ 1,890 1,000 × $5.51 = 5,510 980 × $10.27 = 10,065 Transferred Out $210,600 – 23,055 – 17,465 = Total accounted for MEDIUM $ 23,055 17,465 170,080 $ 210,600 7–26 9. Chapter 7 Special Production Issues: Lost Units and Accretion In Dept 1 material is added at the beginning, in Dept 2 material is added at the end. Normal losses in Department 1 should not exceed 5 percent of the units started; losses are found at an inspection point located 70 percent of the way through the production process. The normal loss in Department 2 is 3 percent of the units transferred in; losses are determined at an inspection point at the end of the production process. The following production and cost data are available for January 2001. PRODUCTION RECORDS (IN UNITS) Beginning inventory Started or transferred in Ending inventory Spoiled units Transferred out Dept. 1 6,000 150,000 18,000 9,000 ? Dept. 2 3,000 ? 15,000 6,000 111,000 COST RECORD Beginning inventory Preceding department Material Conversion Current period: Preceding department Material Conversion n/a $3,000 2,334 $6,690 0 504 n/a $36,000 208,962 $230,910* 740 52,920 *This is not the amount derived from your calculations. Use this amount so that you do not carry forward any possible cost errors from Department 1. The beginning and ending inventory units in Department 1 are, respectively, 10 percent and 60 percent complete as to conversion. In Department 2, the beginning and ending units are, respectively, 40 percent and 80 percent complete as to conversion. Assume spoilage in Department 1 is continuous and discrete in Department 2. Use FIFO in Department 1 and weighted average in Department 2. Chapter 7 Special Production Issues: Lost Units and Accretion 7–27 ANSWER: Complete + Equiv End + Abn Loss – Equiv Beg EP Department 1 Mat CC 129,000 129,000 18,000 10,800 1,500 1,050 148,500 140,850 (6,000 ) (600) 142,500 140,250 Unit Cost + Norm Loss EP Unit Cost TI TI 111,000 15,000 2,130 3,870 132,000 Department 2 . Mat CC 111,000 111,000 0 12,000 2,130 2,130 3,870 3,870 117,000 129,000 $6,690 + 230,910 = $1.80 132,000 Mat $36,000 = $0.25 142,500 Mat $740 = $0.01 117,000 CC $208,962 = $1.49 140,250 CC $504 + 52,920 = $0.41 129,000 End WIP 18,000 × $0.25 = $ 4 500 10,800 × $1.49 = 16,092 $20,592 End WIP 15,000 × $1.80 = $27,000 12,000 × $0.41 = 4,920 $31,920 ABN Loss 1,500 × $0.25 = 1,050 × $1.49 = ABN Loss 2,130 × $2.22 = $ 375 1,565 $1,940 COGM (Department 1) $ 250,296 – 20,592 – 1,940 = $ 227,764 DIFFICULT $4,729 COGM (Department 2) $291,764 – $31,920 – $4,729 = $255,115 7–28 10. Chapter 7 Special Production Issues: Lost Units and Accretion All material is added at the beginning of the process. Costs Beginning inventory Current period Total costs Material $ 30,000 885,120 $915,120 UNITS Beginning inventory (30% complete—conversion) Started Completed Ending inventory (70% complete—conversion) Normal spoilage Conversion $ 3,600 335,088 $338,688 Total 33,600 1,220,208 $1,253,808 $ 6,000 180,000 152,000 20,000 4,800 units units units units units Required: Find ending WIP inventory, abnormal loss, and COGM. Assume that, for conversion costs, abnormal shrinkage is 60 percent. Chapter 7 Special Production Issues: Lost Units and Accretion 7–29 ANSWER: Units Complete + Equivalents Ending WIP + Abnormal Loss = Equivalent Production—WA = Equivalent Begin WIP = Equivalent Production—FIFO Mat 152,000 20,000 9,200 181,200 (6,000) 175,200 Unit Costs: WA Mat $915,120 = $5.05 181,200 FIFO Mat CC CC $338,688 = $1.97 171,520 Ending WIP Material 20,000 × $5.05 CC 14,000 × $1.97 Abnormal Spoilage Material 9,200 × $5.05 CC 5,520 × $1.97 $101,000 27,580 $128,580 $ 46,460 10,874 $ 57,334 Cost of Good Transferred $1,253,808 – 128,580 – 57,334 = $1,067,894 MEDIUM CC 152,000 14,000 5,520 (9,200 × .6) 171,520 (1,800) 169,720 $885,120 = $5.05 175,200 $335,088 = $1.97 169,720 7–30 11. Chapter 7 Special Production Issues: Lost Units and Accretion Department 1 uses FIFO costing and Department 2 uses weighted average. Units are introduced into the process in Department 1 (this is the only material added in Department 1). Spoilage occurs continuously through the department and normal spoilage should not exceed 10 percent of the units started. Department 2 adds material (packaging) at the 75 percent completion point; this material does not cause an increase in the number of units being processed. A quality control inspection takes place when the goods are 80 percent complete. Spoilage should not exceed 5 percent of the units transferred in from Department 1. The following production cost data are applicable for operations for May 2001: Department 1 Production Data Beginning inventory (65% complete) Units started Units completed Units in ending inventory (40% complete) Department 1 Cost Data Beginning inventory: Material Conversion Current period: Material Conversion Total costs to account for Department 2 Production Data Beginning inventory (90% complete) Units transferred in Units completed Units in ending inventory (20% complete) Department 2 Cost Data Beginning inventory: Transferred in Material Conversion Current period: Transferred in Material` 1,000 25,000 22,000 2,800 $1,550 2,300 $3,850 $38,080 78,645 116,725 $120,575 8,000 22,000 24,000 4,500 $40,800 24,000 4,320 $113,700* 53,775 $ 69,120 Chapter 7 Special Production Issues: Lost Units and Accretion Conversion Total costs to account for 7–31 11,079 178,554 $247,674 *This may not be the same amount determined for Department 1; ignore any difference and use this figure. Required: a. Compute the equivalent units of production in each department. b. Determine the cost per equivalent unit in each department and compute the cost transferred out, the cost in ending inventory, and the cost of spoilage (if necessary). ANSWER: a. 1 Mat CC Mat = $38,080 23,800 = $1.60 $78,645 22,470 Complete + End WIP 22,000 2,800 24,800 22,000 1,120 (2,800 × 4) 23,120 CC = = $3.50 – Beg WIP (1,000 ) 23,800 (650 ) (1,000 × .65) 22,470 End WIP = 2,800 × $1.60 = = 1,120 × $3.50 $ 4,480 3.920 $ 8,400 COGM = $120,575 – 8,400 = $112,175 b. 2 Complete + End WIP + Normal + Abnormal TI Mat CC 24,000 4,500 1,100 400 30,000 24,000 0 1,100 400 25,500 24,000 900 880 320 26,100 End WIP 4,500 × $5.15 900 × $0.59 $23,175 531 $23,706 COGM = $247,674 – 23,706 – 3,469 = $220,499 Mat = $ 77,775 25,500 = $3.05 CC = $ 15,399 26,100 = $0.59 TI = $154,500 30,000 = $5.15 Abn Loss 400 × $3.05 320 × $0.59 400 × $5.15 $1,220 189 2,060 $3,469 7–32 MEDIUM Chapter 7 Special Production Issues: Lost Units and Accretion Chapter 7 12. Special Production Issues: Lost Units and Accretion 7–33 Consider the following data for a cooking department for the month of January: Physical Units Work in process, beginning inventory* Started during current period To account for Good units completed and transferred out during current period: From beginning work in process Started and completed Good units completed Spoiled units Work in process, ending inventory~ Accounted for 11,000 74,000 85,000 11,000 50,000 61,000 8,000 16,000 85,000 *Direct material, 100% complete; conversion costs, 25% complete ~Direct material, 100% complete; conversion costs, 75% complete Inspection occurs when production is 100 percent completed. Normal spoilage is 11 percent of good units completed and transferred out during the current period. The following cost data are available: Work in process, beginning inventory: Direct material Conversion costs Costs added during current period: Direct material Conversion costs Costs to account for $220,000 30,000 $ 250,000 1,480,000 942,000 $2,672,000 Required: Prepare a detailed cost of production report. Use the FIFO method. Distinguish between normal and abnormal spoilage. 7–34 Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: Normal Sp = 11% × 61,000 = 6,710 units FIFO Abnormal Sp = 8,000 – 6,710 = 1,290 units Mat Complete + End + Ab Sp – Ave – Beg FIFO 61,000 16,000 1,290 78,290 (11,000) 67,290 CC 61,000 12,000 1,290 74,290 (2,750 ) 71,540 Mat = $1,480,000 67,290 = $22.00 CC = $942,000 71,540 = 13.17 $35.17 WIP Material 16,000 × $22.00 CC 12,000 × $13.17 Loss = 1,290 × $35.17 COGM = $2,672,000 – 510,040 – 45,369 = $2,116,591 MEDIUM $352,000 158,040 $510,040 45,369 Chapter 7 13. Special Production Issues: Lost Units and Accretion 7–35 In the Lamination Department, varnish is added when the goods are 60 percent complete as to overhead. The units that are spoiled during processing are found upon inspection at the end of production. Spoilage is considered discrete. Production Data for March 2001 Beginning inventory (80% complete as to labor, 70% complete as to overhead) Transferred in during month Ending inventory (40% complete as to labor, 20% complete as to overhead) Normal spoilage (found during final quality inspection) 1,000 units 7,450 units 1,500 units 100 units Abnormal spoilage—found at 30% completion of direct labor and 15% of conversion; the sanding machine was misaligned and scarred the chairs 200 units All other units were transferred to finished goods Cost Data for March 2001 Beginning work in process inventory: Prior department costs Varnish Direct labor Overhead Current period costs: Prior department costs Varnish Direct labor Overhead Total costs to account for $7,510 950 2,194 5,522 $ 16,176 $68,540 7,015 23,000 56,782 155,337 $171,513 Required: Determine the proper disposition of the March costs for the Laminating Department using the weighted average method. 7–36 Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: TI 6,650 1,500 100 200 8,450 Complete + end + normal + abnormal Unit Cost $76,050 = $9 8,450 End WIP DL MOH TI Abnormal Loss DL MOH TI MAT 6,650 0 100 0 6,750 MOH 6,650 300 100 30 7,080 $7,965 = $1.18 $25,194 = $3.40 $62,304 = $8.80 6,750 7,410 7,080 600 × $3.40 300 × $8.80 1,500 × $9.00 = $ 2,040 = 2,640 = 13,500 $18,180 60 × $3.40 30 × $8.80 200 × $9.00 = $ 204 = 264 = 1,800 $ 2,268 COGM = $171,513 – 18,180 – 2,268 = $151,065 MEDIUM DL 6,650 600 100 60 7,410 Chapter 7 14. Special Production Issues: Lost Units and Accretion 7–37 Tons of Shad employs a weighted average process costing system for its products. One product passes through three departments (Molding, Assembly, and Finishing) during production. The following activity took place in the Finishing Department during March 2001: Units in beginning inventory Units transferred in from Assembly Units spoiled Good units transferred out 4,200 42,000 2,100 33,600 The costs per equivalent unit of production for each cost failure area as follows: Cost of prior departments Raw material Conversion Total cost per EUP $5.00 1.00 3.00 $9.00 Raw material is added at the beginning of the Finishing process without changing the number of units being processed. Work in process inventory was 40 percent complete as to conversion on March 31. All spoilage was discovered at final inspection. Of the total units spoiled, 1,680 were within normal limits. Required: a. Calculate the equivalent units of production b. Determine the cost of units transferred out of Finishing c. Determine the cost of ending Work in Process Inventory d. The portion of the total transferred in cost associated with beginning Work in Process Inventory amounted to $18,900. What is the current period cost that was transferred in from Assembly to Finishing? e. Determine the cost associated with abnormal spoilage for the month. 7–38 Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: a. TI 33,600 10,500 1,680 420 46,200 Complete + Equiv WIP + Normal Sp + Abnor Sp b. 33,600 × $9 1,680 × $9 $302,400 15,120 $317,520 c. 10,500 × $5 10,500 × $1 4,200 × $3 $52,500 10,500 12,600 $75,600 Mat 33,600 10,500 1,680 420 46,200 TC = 46,200 × $5 46,200 × $1 39,900 × $3 COGM = $396,900 – 75,600 – 3,780 = $317,520 d. $5 = $18,900 + X 46,200 X = $231,000 – 18,900 = $212,100 e. ABN = 420 × $9 = $3,780 420 × $9 = $3,780 MEDIUM CC 33,600 4,200 1,680 420 39,900 $231,000 46,200 119,700 $396,900 Chapter 7 15. Special Production Issues: Lost Units and Accretion 7–39 Department 2 adds new material to the units received from Department 1 at the end of process. A normal loss occurs early in processing. Production and cost data for Department 2 for the month of September are as follows: Production record (in units): In process, September 1— 75% complete for processing cost Received from Department 1 Completed and transferred to finished goods Lost in processing (normal) In process, September 30— 2/3 complete for process cost Cost Record: Work in process inventory, September 1: Preceding department cost Processing cost Cost from preceding department in September Material cost for September Processing cost for September 4,000 20,000 16,000 2,000 6,000 $ 620 2,000 $2,620 1,800 4,800 10,200 Required: Determine the following for Department 2 under (a) weighted average the method of costing and (b) the FIFO method of costing: (1) unit costs for each cost component, (2) cost of production transferred to finished goods, (3) cost of work in process inventory of September 30. 7–40 Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: Equivalent production Units complete + Equiv. ending WIP = Equiv. prod. average – Equiv. begin. WIP = Equiv. prod. FIFO Unit Cost Average TI = $620 + 1,800 22,000 Mat = $4,800 16,000 CC = $2,000 + 10,200 20,000 End. WIP—WA PD 6,000 × $0.11 = CC 4,000 × $0.61 = TI 16,000 6,000 22,000 (4,000 ) 18,000 Material 16,000 0 16,000 0 16,000 Conv. cost 16,000 4,000 20,000 (3,000 ) 17,000 = $0.11 Unit Cost FIFO TI = $1,800 18,000 = $0.10 = $0.30 Mat = $4,800 16,000 = $0.30 = $0.61 CC = $10,200 17,000 = $0.60 $ 660.00 2,440.00 $3,100.00 End. WIP—FIFO 6,000 × $0.10 = $ 600.00 4,000 × $0.60 = 2,400.00 $3,000.00 Cost of Goods Complete WA $19,420 – 3,100 = MEDIUM $16,320.00 FIFO $19,420 – 3,000 = $16,420.00 Chapter 7 16. Special Production Issues: Lost Units and Accretion 7–41 The formula for a chemical compound requires one pound of Chemical X and one pound of Chemical Y. In the simplest sense, one pound of Chemical X is processed in Department A and transferred to Department B for further processing where one pound of Chemical Y is added when the process is 50 percent complete. When the processing is complete in Department B, the finished compound is transferred to finished goods. The process is continuous, operating 24 hours a day. Normal spoilage occurs in Department A. Five percent of material is lost in the first few seconds of processing. No spoilage occurs in Department B. The following data are available for the month of October 2001: Units in process, October 1 Stage of completion of beginning inventory Units started or transferred in Units transferred out Units in process, October 31 Stage of completion of ending inventory Units of Chemical Y added in Department B Dept. A 8,000 3/4 50,000 46,500 ? 1/3 Dept. B 10,000 3/10 ? ? ? 1/5 44,500 Required: a. Prepare a schedule showing finished equivalents for Chemical X and for conversion cost for Department A using the FIFO method. b. Determine for Department B the number of units of good product completed during October and the number of units in process on October 31. c. Prepare a schedule for Department B showing finished equivalents for preceding department cost, cost of Chemical Y, and conversion cost using the FIFO method. 7–42 Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: a. c. Mat 46,500 9,000 (8,000) 47,500 b. CC 46,500 3,000 (6,000 ) 43,500 PD 44,500 12,000 (10,000 ) 46,500 Mat 44,500 0 0 44,500 CC 44,500 2,400 (3,000 ) 43,900 Since the material in the second department goes in at the 50 percent point and the ending WIP inventory is only at the 20 percent point, units complete is the same as the equivalents of material 44,500, given that units started plus units in beginning WIP are equal to units complete plus ending WIP 10,000 + 46,500 – 44,500 = 12,000 units in ending WIP. MEDIUM