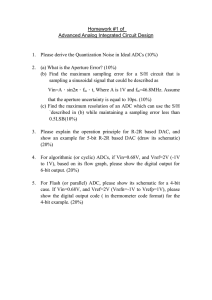

ADCs BioProcess Insider eBooks EVOLVING LINKS IN THE BIOPHARMACEUTICAL PIPELINE Dan Stanton May 2021 Antibody–Drug Conjugates Evolving Links in the Biopharmaceutical Pipeline by Dan Stanton A Slow Start page 4 From Mylotarg to Zynlonta ADCs page 4 Old Pioneers and Their New Technologies page 8 New Players, New Interests Page 11 Big Pharma on Board page 13 References page 14 About the Author page 16 The number of ADCs that have gained regulatory approval has increased over the past four years. Advancements in linker technologies and process development are improving the therapeutic outlooks of these products, catching the attention of investors. Biomanufacturers now are dedicating substantial research and development and clinical trial resources into “next-generation” ADC pipelines. New for 2021, the BioProcess Insider quarterly eBook series reports industry perspectives about and critical analyses of emerging trends in biopharmaceutical development, manufacturing, and commercialization. Upcoming topics include the production capacity and regulatory hurdles to be negotiated by gene-therapy developers and the COVID-19 pandemic’s long-term effects on vaccine supply chains and industry investments. Photo courtesy of Adobe Stock. Copyright ©2021 INFORMA CONNECT. All rights reserved. 2 BioProcess International 19(5)E2 MAY 2021 E-Book YOUR ADC WITH AJINOMOTO BIO-PHARMA SERVICES, YOU HAVE THE POWER TO MAKE. To make your vision a reality. To make your program a success. To make a positive difference in the world. Our ADC service offerings simplify your complex supply chain by consolidating process development/transfer, analytical development, GMP bioconjugation, purification and fill finish services all at a single location. ADC SERVICES: Conjugation & Purification Fill Finish & Lyophilization Process Development Analytical Development Packaging & Labeling AJICAP™ Technology WHAT DO YOU WANT TO MAKE? www.AjiBio-Pharma.com T he number of antibody–drug conjugate (ADC) products that have gained regulatory approval has reached double-digit figures, and ADC developers both old and new are talking about the next generation of drug candidates coming through their pipelines. In April 2021, Zynlonta (loncastuximab tesirine from ADC Therapeutics) became the eleventh ADC product to receive approval from the US Food and Drug Administration (FDA) (Table 1) (1). But with dozens of ADC candidates currently in clinical trials, those 11 products represent the tip of the ADC iceberg (2). To understand how this modality is likely to evolve and to try to define the different generations of ADCs, it is worth investigating their history and regulatory approval patterns. A Slow Start Eleven years passed between the approval of Mylotarg (gemtuzumab ozogamicin, developed by Wyeth and Celltech) and the next ADC approval. When Adcetris (brentuximab vedotin from Seagen, formerly Seattle Genetics) received approval in 2011, it was the sole ADC on the market because Pfizer — which bought Wyeth’s pharmaceutical business in 2009 — had pulled its Mylotarg product from the market the previous year (3). Over the subsequent five years, only one other ADC, Kadcyla (ado-trastuzumab emtansine from Roche) garnered thumbs up from the FDA. But in 2017, the number of ADCs on the market doubled as Pfizer commercialized Besponsa (inotuzumab ozogamicin) and gained Mylotarg reapproval (4). In 2018, one more ADC reached the market. But since 2019, the number of approvals brought about a relative tidal wave: six more ADCs, including the aforementioned Zynlonta product. However, different generations of ADCs cannot be defined only by the dates of their approvals. ADCs comprise a potent small molecule warhead, a targeting antibody, and a linker that attaches them both. Ongoing research and development in each of those three individual elements along with their combinations mean that a “next-generation” label can be nothing more than a successful scientific tweak that further tips the efficacy–toxicity balance toward the former. ADCs are complex, multicomponent molecules, incorporating the drug development difficulties of both an antibody and a highly toxic small molecule, so evolution of the modality is not a linear path, says Shawn Novick, principal consultant at Biophia Consulting and former director of the quality control department at Seagen. “Clearly the drug and the linker make a big difference, and people are still trying to figure those out.” Back to Contents From Mylotarg to Zynlonta ADCs The history of the Mylotarg product is the best case study to evaluate. That ADC was ill-fated because of the instability of its cleavable linker, which included a hydrazone bond that releases the cytotoxic agent calicheamycin prematurely in plasma 4 BioProcess International 19(5)e2 May 2021 E-Book Energizing pharma New empowering GEA Pharma portfolio GEA Pharma Separators aseptic and pure – for highest hygienic demands and utmost variability for your process Join us at for a new era of processing! GEA experts have transformed decades of separation experience into a new, complete selection of plug & produce skids – infinitely adaptable to take all pharma customers to the next level! gea.com/energizing-pharma Table 1: Approved antibody–drug conjugates (ADCs) Drug Gemtuzumab ozogamicin Brentuximab vedotin Trastuzumab emtansine Inotuzumab ozogamicin Moxetumomab pasudotox Polatuzumab vedotin Enfortumab vedotin Trastuzumab deruxtecan Sacituzumab govitecan Maker Pfizer/Wyeth Condition Trade Name Seattle Genetics, Hodgkin’s lymphoma (HL) and systemic, anaplastic, large-cell lymphoma Millennium/Takeda (ALCL) Genentech, Roche HER2-positive metastatic breast cancer (mBC) following treatment with trastuzumab and a maytansinoid Pfizer Relapsed or refractory CD22-positive B-cell precursor acute lymphoblastic leukemia AstraZeneca Relapsed or refractory hairy-cell leukemia (HCL) Adcetris 2017 (originally 2000) 2011 Kadcyla 2013 Besponsa 2017 Lumoxiti 2018 Genentech, Roche Relapsed or refractory diffuse large B-cell lymphoma (DLBCL) Polivy 2019 Astellas/Seattle Genetics AstraZeneca/ Daiichi Sankyo Immunomedics Adult patients with locally advanced or metastatic urothelial cancer who have received a PD-1 or PD-L1 inhibitor and a Pt-containing therapy Adult patients with unresectable or metastatic HER2-positive breast cancer who have received two or more anti-HER2–based regimens Adult patients with metastatic triple-negative breast cancer (mTNBC) who have received at least two previous therapies and for patients with relapsed or refractory metastatic disease Multiple myeloma patients whose disease has progressed despite treatment with an immunomodulatory agent, proteasome inhibitor, and anti-CD38 antibody Relapsed or refractory large B-cell lymphoma (including DLBCL arising from low-grade lymphoma, DLBCL of unspecified origin/etiology, and high-grade B-cell lymphoma) after two or more lines of systemic therapy Padcev 2019 Enhertu 2019 Trodelvy 2020 Blenrep 2020 Zynlonta 2021 Belantamab mafodotin GlaxoSmithKline Loncastuximab tesirine ADC Therapeutics Relapsed acute myelogenous leukemia (AML) Mylotarg Approval Year circulation. That led to the 2010 withdrawal. By tweaking the dose level of the payload, modifying the administration schedule, and targeting a different patient population, however, Pfizer and Wyeth gained FDA reapproval in 2017. That same linker technology is used in Pfizer’s Besponsa ADC. Arguably, the Mylotarg product’s reversal of fortune came from Pfizer’s continued R&D efforts in the ADC space in the five years after pulling its Mylotarg product. Thus, the linker technology does not define the 17-year gap between the Mylotarg and Besponsa products, but rather, it represents the scientific evolution of how a linker interacts with a payload and monoclonal antibody (MAb). Note that Pfizer licensed out its ADC technology to Pyxis Oncology, along with its two preclinical assets known as PYX-201 and PYX-203 (5). The platform includes different payload classes, site-specific conjugation techniques, and an evolved version of the linker technology in both Mylotarg and Besponsa products. The “second-generation” ADCs have different linkers: a noncleavable linker in the Kadcyla product and Seagen’s cathepsin-cleavable technology in Adcetris, Padcev (enfortumab vedotin from Astellas/ Seattle Genetics), and Polivy (polatuzumab vedotin from Genentech/Roche) ADCs (6). Both technologies offer advantages in terms of stability and toxicity over “first-generation” linker technologies but still are subject to their own limitations. But ADCs are not defined by their linkers alone. “The toxicity of a drug and its ability to infiltrate the cell” also are critical to 6 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book HEARD THE BUZZ ? ZZ WE’RE PUTTING THE STING IN YOUR TARGETED THERABEES! A RELIABLE CDMO PARTNER FOR ADC PROCESS DEVELOPMENT & MANUFACTURING › Purpose-built Bioconjugation facility › ADC conjugation expertise › Experienced supplier of ADC payloads › Fast-track offer for first samples › cGMP clinical & commercial manufacturing › Integrated supply chain › Leader in preparative chromatography › Excellent regulatory history LEARN MORE understand, says Novick. She adds that the development of the Adcetris product included much time spent on determining how toxic its antimitotic agent, monomethyl auristatin E (“vedotin”), needed to be. With Immunomedic’s Trodelvy (sacituzumab govitecan) approved nine years after the Adcetris ADC, the low toxicity of its cytotoxic payload SN-38 showed a high efficacy level, which “was surprising to the community” but demonstrated the critical balance among the warhead, the MAb, and the linker (in this case, a new hydrolyzable linker). Conversely, whereas the Troveldy ADC’s success centered on the low toxicity of its small molecule, ADC Therapeutics’s Zynlonta (loncastuximab tesirine) product stood out for the high toxicity of its pyrrolobenzodiazepine (PBD) dimer payload. PBDs are a class of compounds that kill cells by binding their DNA and interfering with replication. In nature, they are made by a group of bacteria known as actinomycetes but were developed by Spirogen, (from which ADC Therapeutics spun out in 2013) for use in medicine. PBDs are a useful alternative to cytotoxic payloads such as calicheamycin because they are not cross-resistant with other chemotherapy agents (7). They also have a unique mode of action that sets them apart from the tubulin binders such as maytansinoids and auristatins, which currently dominate the ADC arena. The different ADCs that have reached the market show that no single element is driving the evolution of the modality. As Penelope Drake, head of R&D for bioconjugates at Catalent tells us: “Each element — target selection, antibody discovery, optimization, conjugation site, linker chemistry, and payload selection — factors heavily into the success or failure of a program.” The combination of those parts is key. Old Pioneers and Their New Technologies Clay Siegall, ADC innovator and chief executive officer of Seagen, offered up his take on the difference in the generations of ADC products already on the market and those that are coming through the pipeline (Figure 1). “The field is now really taking on a life of its own, and a lot of companies now work on ADCs,” he told shareholders in April 2021 (8). “I look at the past ADCs and how they were made with bad linkers and natural-product drugs, and I call that ‘ADCs 1.0.’ Then there were better drugs, synthetic drugs, and much better linkers that are in drugs such as Adcetris, Padcev, and Polivy from Roche, and others. And I call those ‘ADCs 2.0.’” Since the arrival of the Adcetris ADC, Siegall has expanded his company’s proprietary and partnered pipeline (9). His team is investigating a PBD dimer as a highly potent cytotoxic agent, while collaborating with biomanufacturers such as Roche (such as in the case of the Polivy ADC), GlaxoSmithKline, Genmab, and Pfizer. Seagen also has licensed its linker technology to companies, including AbbVie, Astellas, Bayer, Celldex, Genentech, GlaxoSmithKline, Pfizer, and Progenics. 8 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book YOUR GLOBAL DUAL SOURCE FOR BIOLOGICS Capabilities Include: GMP Production Where and When You Need It. Quality. Expertise. Performance. Capacity. These are the four Drug Substance (DS) Manufacture • 150,000 L bioreactor capacity, expanding to 430,000 L after 2024 • Single-use/disposable bioreactors • Scale-out manufacturing paradigm • Fed-batch or continuous cell culture cornerstones WuXi Biologics provides to its clients with every biologic Drug Product (DP) Manufacture produced. We are operating 10 state-of-the-art world-class cGMP DS • Ten automated, isolator-based fill lines facilities and another 10 DP facilities across four countries while expanding globally over the next few years. WuXi Biologics provides high-quality DS and DP where and when you need it. Let’s Get Started. China • Germany • Ireland • Singapore • United States www.wuxibiologics.com • Vial or pre-filled syringe and liquid or lyophilization fill options • Ready-to-Use (RTU) containers and closures available Figure 1: Seagen’s clinical development pipeline (https://www.seagen.com/assets/pdfs/Our-Science/Pipeline/SeagenPipeline.pdf) Siegall continued, rhetorically asking how the ADC industry can move to a third generation of products and implement technologies that continue to improve efficacy in patients and decrease side effects. “We’ve spent many years pioneering new technologies, and I am really jazzed up about those new technologies based on all of their preclinical data in efficacy and in safety, including [from] nonhuman primates.” For now, however, details from Seagen remain behind closed laboratory doors. “What you’ll see from us is another generation of new ADCs that may have different payloads, different linkers, [and] different ways of thinking about how to do these different toxicities or lack thereof. Those are coming. We are working hard on ‘ADCs 3.0.’ So stay tuned.” Big biopharmaceutical developer AbbVie has had a more turbulent relationship with ADCs. In 2016, the company spent US$5.8 billion to acquire Stemcentrx (10), citing its candidate lung cancer ADC Rova-T (rovalpituzumab tesirine) as a major driver. In August 2019, however, Abbvie halted development after the drug demonstrated no survival benefit in clinical trials (11). The 10 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book company still has a program in phase 2 clinical trials with telisotuzumab vedotin (ABBV-399), an ADC targeting c-Met to treat non–small-cell lung cancer. “Approaches in this area historically have focused on smallmolecule kinase inhibitors and anti–c-Met antibodies, both of which have shown only limited efficacy in this patient population, which has not been sufficient for approval,” AbbVie president Mike Severino said during a Q1 2021 conference call (12). “By contrast, our c-Met antibody–drug conjugate is a novel approach that we believe will have broader applicability and will provide enhanced efficacy compared with previous approaches.” But Severino also spoke candidly about a “next-generation” c-Met ADC program set to enter clinical trials later this year. “Our new c-Met ADC, ABBV-400, uses a topoisomerase inhibitor payload, which we believe will provide greater antitumor efficacy against both amplified Met and over-expressed c-Met subtypes, thus providing deeper responses with broader applicability than other anti–c-Met targeting agents.” Similarly, AstraZeneca saw success with partner Daiichi Sankyo with anti–human epidermal growth factor receptor 2 (anti-HER2) ADC Enhertu (fam-trastuzuab deruxtecan). Now the company wants to bolster its position in the breast cancer field further through datopotamab deruxtecan (DS-1062), consisting of a humanized antiTROP2 MAb and a topoisomerase I inhibitor payloa, which is currently in phase 3 clinical trials. “The payload TROP1 versus SN38 is 10 times more potent. We have a highly stable linker. The half-life of DS-1062 is five days, so we can have a convenient three-week schedule,” Cristian Massacesi, senior vice president of AstraZeneca’s late-stage oncology R&D unit said, last month (13). New Players, New Interests In 2019, about 80 ADCs were in clinical development through nearly 600 clinical trials (14). Although current figures are difficult to determine — some market reports claim that nearly 250 unique ADC product candidates are under development (15) — the numbers are increasing, spurred by recent commercial successes. According to a 2020 report from Beacon Intelligence, the past 10 years have brought a linear growth in the number of ADC trials initiated per year, with a compound annual growth rate (CAGR) of new trials of 15.7% (16). “After many years of expectations, it is only recently, thanks to multiple new drug launches, that ADC therapies finally have fulfilled their promise,” explains Kevin Daley, market director of pharmaceuticals at Novasep. “The clinical pipeline continues to strengthen, and the pharmaceutical innovator ‘pioneers’ of ADCs now have been joined by many new entrants, both large pharma and small biotech companies, with technical advances, (such as site-specific conjugation) leading to more effective ADCs.” Catalent’s Drake adds that “much of the new pipeline growth has been driven by small and virtual biotech companies, but mid-sized 11 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book Table 2: Investments and money raised by antibody–drug conjugate (ADC) companies in 2020 and 2021 Money Raised (Millions) Select ADC Information Company Name Funding Type Velos Bio Series B Dyne Therapeutics Araris Biotech IPO Seed $268 CHF 12.7 Remegen IPO $515 Silverback Therapeutics IPO $241 Bolt Biotherapeutics IPO $230 New class of oligonucleotide-based therapies Matched protein–drug conjugates by combining proprietary novel technologies with disease-specific biology ROR1-directed ADC (the company has since been bought by Merck) Antibody–antisense conjugate Linker for attachment of any payload to “off-the-shelf” antibodies without antibody engineering “Uniquely positioned in China with an in-house, fully integrated end-to-end ADC platform” ADCs based on ImmunoTAC platform, which attaches antibodies to small molecules that adjust the immune system Immune-stimulating antibody conjugates (ISACs) Suzhou Medilink Therapeutics Pyxis Oncology Series A $50 “More efficacious and safer ADC drug” March 2021 Series B $152 Licensed technology and assets from Pfizer March 2021 Cybrexa Therapeutics Series B $21 Alphalex peptide–drug conjugate (PDC) March 2021 Adcendo – €51 April 2021 Adcentrx Therapeutics Series A $50 ADCs using uPARAP, a cell-surface receptor involved in collagen degradation cloned and characterized by the scientific founders No details available Mablink Bioscience Seed €4 Uses proprietary PSARlink technology to link cytotoxic molecules to antibodies April 2021 Avidity Biosciences Tubulis IPO Series A $298 €10.7 $137 and large pharma [companies] also have been very active in the space by developing their own ADCs or by looking for opportunities to in-license or acquire ADC programs.” Daley and Drake point to the diverse mix of companies taking up the ADC baton. For example, Byondis (previously Synthon Biopharmaceuticals) and Mersana Therapeutics, are mid-sized clinical stage biotechnology companies yet to commercialize a product, but each one hopes to be the next Seagen if and when assets blossom. Byondis’s trastuzumab duocarmazine (SYD985) is the latest in a wave of ADCs directed by HER2. Mersana’s lead asset upifitamab rilsodotin (UpRi) is in phase 2 clinical studies as a treatment for ovarian cancer and is based on the company’s Dolaflexin platform. That technology uses the proprietary Fleximer polymer, a biodegradable, biocompatible, water-soluble polymer that can carry multiple drug molecules attached through a cleavable linker to a scaffold, which is then conjugated to the antibody through a noncleavable linker. BioAtla, which formed around the same time as those two companies, also falls in this category of new ADC companies. It uses antibodies that can be activated or inactivated under defined physiological conditions in its ADC development, with the conditionally active biologic (CAB)–ADCs platform allowing the preferential targeting of tumor tissues while reducing the toxicity of the warhead. But numerous start-ups also want to take their place in the ADC industry, and it appears that the money is available to support 12 BioProcess International 19(5)e2 May 2021 Date July 2020 July 202 July 2020 September 2020 October 2020 November 2020 December 2020 February 2021 April 2021 Back to Contents E-Book them throughout their growth. Even with the global pandemic in full thrust, ADC Therapeutics raised $267 million in May 2020 (17) through an initial public offering (IPO). But much of the other investments in the past year have focused on early stage, drug conjugate, small- and medium-sized entities (SMEs), including those listed in Table 2. Big Pharma on Board A good sign that a sector is robust is when investments are high and private equities and venture capitals are fluid. Further proof that the ADC sector is becoming a major part of the biopharmaceutical landscape is the entry and renewed interest of Big Pharma. Major players such as Pfizer, AstraZeneca, Roche, and GSK have been — and continue to be — heavily invested in ADCs. And the excitement in the field has brought others on board. In September 2020, Gilead Sciences announced a $21 billion deal to buy Immunomedics (18). Although revenues from the recently approved Trodelvy ADC were a key driver in the deal, management said the acquisition was an opportunity to secure an ADC platform for future products. “A lot of people have been struggling with ADCs for a long time,” said chief medical officer Merdad Parsey. “We’re excited about what we’re seeing on the therapeutic potential here of this platform. The ability to deliver a payload here with this particular linker is promising in triple-negative [breast cancer], so we have to think about what other antibodies and other antigens we could go after to try to expand the utility.” Merck & Co. (known as MSD outside of North America) became another entrant in the ADC space in 2020. First, the company entered into a strategic development collaboration with Seagen in September (19). The deal, which included Merck buying a $1 billion stake in its new partner, involves codevelopment of ladiratuzumab vedotin, an investigational ADC targeting LIV-1 in phase 2 clinical trials for breast cancer and other solid tumors. Weeks later, Merck went all in and bought phase 2 ADC developer VelosBio for $2.75 billion (20). Boehringer Ingelheim’s €1.18 billion ($1.4 billion) acquisition of private Swiss biotech NBE Therapeutics in December (21) brought the Germany-headquartered pharmaceutical developer an ADC technology platform and a lead compound: NBE-002 in phase 1 clinical studies for triple-negative breast cancer and other solid tumors. And that was not the company’s first ADC deal. “Boehringer Ingelheim was active previously in the field with a first-generation ADC technology,” spokesman Reinhard Malin told BPI Insider when the deal was announced. “With the acquisition of NBE Therapeutics, we have reentered the space with an innovative, next-generation technology, which expands our activities in tumorcell–targeting approaches.” In the early 2000s, Boehringer Ingelheim filed several patents (22, 23, for example) for antibodyconjugate technologies. However, no commercialized ADCs resulted from those. 13 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book Commercial pharmaceutical company Exelixis also is viewing ADCs as the natural extension to its heritage of developing novel small-molecules, and it has signed a number of deals in the past 12 months. In September 2020, Exelixis paid NBE Therapeutics $25 million to develop ADCs using NBE Therapeutics’s conjugation and novel anthracycline-based payload platform (24), while simultaneously teaming with Catalent for access to SMARTag site-specific bioconjugation technology. And in March, Exelixis made what it describes as a “modest” payment to Chinese drugmaker WuXi Biologics for exclusive license to a panel of MAbs to a preclinically validated target, intended for the development of ADCs. “We really like the ADC space . . . It’s the ultimate Venn diagram view of chemistry and biology kind of merging together,” chief executive officer Michael Morrissey told investors at the 2021 Barclays Global Healthcare Conference earlier this year (25), before adding that his company intends to go full throttle on the modality. “We’re not going to just dabble and do a little bit here or there and see what happens. If we’re convinced and we have conviction in a technology and our ability to navigate and bring in new science, then we’re going to go in strong with the right level of resources and the right level of both financial and human capital to be able to move the needle there.” Further evidence of the strength of the ADC market is evident in the 2020 sales for select commercialized therapies, including • Adcetris product: $658 million for Seagen, JPY 59.4 billion ($542 million) for Takeda (FY ending 31 March 2021) • Kadcyla product: CHF 1.75 billion ($1.92 billion) for Roche, JPY 10.2 billion ($93 million) for subsidiary Chugai • Padcev product: $222 million for Seagen, JPY 12.8 billion ($117 million) for Astellas (FY ending 31 March 2021) • Polivy product: CHF 169 million ($186 million) for Roche. Thus, with money flowing, deals in the making, and agencies regulating, ADCs finally have established themselves as part of the healthcare landscape that is likely to have a bright and lucrative future. References 1 Stanton D. ADC Therapeutics Joins Conjugate Elite with Zynlonta FDA Back to Contents Approval. BioProcess Insider 27 April 2021; https://bioprocessintl.com/ bioprocess-insider/regulations/adc-therapeutics-joins-conjugate-elite-withzynlonta-fda-approval. 2 Global Antibody–Drug Conjugate (ADC) Clinical Trial Review. Creative Biolabs: Shirley, NY; https://www.creative-biolabs.com/resource/adc/pdf/com/ downloads/Global-Antibody-drug-Conjugate-ADC-Clinical-Trial-Review.pdf. 3 Hall J, Krauskopf L. Pfizer to Buy Wyeth for $68 Billion. Reuters, 25 January 2009; https://www.reuters.com/article/us-wyeth-pfizer/pfizer-to-buywyeth-for-68-billion-idUSTRE50M1AQ20090126. 14 BioProcess International 19(5)e2 May 2021 E-Book 4 FDA Approves Mylotarg for Treatment of Acute Myeloid Leukemia. US Food and Drug Administration, 1 Septemer 2017; https://www.fda.gov/news-events/ press-announcements/fda-approves-mylotarg-treatment-acute-myeloidleukemia. 5 Pyxis Oncology Presents Preclinical Data and Details on Antibody–Drug Conjugate Candidates Supporting Therapeutic Potential. Pyxis Oncology, 27 April 2021; https://www.globenewswire.com/fr/news-release/2021/04/27/2217631/0/ en/Pyxis-Oncology-Presents-Preclinical-Data-and-Details-on-Antibody-DrugConjugate-Candidates-Supporting-Therapeutic-Potential.html. 6 Joubert N, et al. Antibody–Drug Conjugates: The Last Decade. Pharmaceuticals (Basel) 13(9) 2020: 245; https://www.ncbi.nlm.nih.gov/pmc/ articles/PMC7558467/#B10-pharmaceuticals-13-00245. Back to Contents 7 Pyrrolobenzodiazepine (PBD). ADC Review; https://www.adcreview.com/ pyrrolobenzodiazepine-pbd. 8 Seattle Genetics (SGEN) Q1 2021 Earnings Call Transcript. Motley Fool 29 April 2021; https://www.fool.com/earnings/call-transcripts/2021/04/30/seattlegenetics-sgen-q1-2021-earnings-call-transc. 9 Stanton D. Beyond Adcetris: Seattle Genetics Aiming for Big Biopharma Status. BioProcess Insider 30 April 2018; https://bioprocessintl.com/bioprocessinsider/therapeutic-class/beyond-adcetris-seattle-genetics-aiming-for-bigbiopharma-status. 10 AbbVie to Expand Oncology Presence Through Acquisition of Stemcentrx and Its Novel Late-Stage Rova-T Compound for Small Cell Lung Cancer. AbbVie 28 April 2016; https://news.abbvie.com/news/abbvie-to-expand-oncology-presencethrough-acquisition-stemcentrx-and-its-novel-late-stage-rova-t-compound-forsmall-cell-lung-cancer.htm. 11 AbbVie Discontinues Rovalpituzumab Tesirine (Rova-T) Research and Development Program. Cision PR Newswire 29 August 2019; https://www. prnewswire.com/news-releases/abbvie-discontinues-rovalpituzumab-tesirinerova-t-research-and-development-program-300909121.html. 12 AbbVie (ABBV) Q1 2021 Earnings Call Transcript. The Motley Fool 30 April 2021; https://www.fool.com/earnings/call-transcripts/2021/04/30/abbvie-abbvq1-2021-earnings-call-transcript. 13 AstraZeneca PLC’s (AZN) CEO Pascal Soriot on Q1 2021 Results: Earnings Call Transcript. Seeking Alpha, 30 April 2021; https://seekingalpha.com/ article/4423281-astrazeneca-plcs-azn-ceo-pascal-soriot-on-q1-2021-resultsearnings-call-transcript. 14 Coats S, et al. Antibody–Drug Conjugates: Future Directions in Clinical and Translational Strategies to Improve the Therapeutic Index. Clin. Cancer Res. 25(18) 2019: 5441; https://doi.org/10.1158/1078-0432.CCR-19-0272. 15 ADC Contract Manufacturing Market, 4th Edition. Roots Analysis, January 2021; https://www.rootsanalysis.com/reports/view_document/adc-contractmanufacturing-market/218.html. 16 Beacon ADC Landscape Inforgraphic H1 2020; Beacon Targeted Therapies; https://beacon-intelligence.com/adc-h1-2020-landscape-infographic. 17 ADC Therapeutics Announces Closing of Upsized $267 Million Initial Public Offering and Receipt of the $65 Million First Tranche Under Its $115 Million Convertible Credit Facility with Deerfield. Business Wire 19 May 2020; https://www.businesswire.com/news/home/20200519005941/en/ADCTherapeutics-Announces-Closing-of-Upsized-267-Million-Initial-Public-Offeringand-Receipt-of-the-65-Million-First-Tranche-under-Its-115-Million-ConvertibleCredit-Facility-with-Deerfield. 15 BioProcess International 19(5)e2 May 2021 E-Book 18 Vinluan F. Gilead Adds ‘Cornerstone’ Cancer Drug in $21bn Immunomedics Buyout. BioProcess Insider, 14 September 2020; https:// bioprocessintl.com/bioprocess-insider/deal-making/gilead-adds-cornerstonecancer-drug-in-21bn-immunomedics-buyout. 19 Seattle Genetics and Merck Announce Two Strategic Oncology Collaborations. Merck press release, 14 September 2020; https://www.merck. com/news/seattle-genetics-and-merck-announce-two-strategic-oncologycollaborations. 20 Merck to Acquire VelosBio. Merck press release, 5 November 2020; https:// www.merck.com/news/merck-to-acquire-velosbio. 21 Stanton D. Boehringer Ingelheim Re-enters ADC Space with $1.4bn NBE Buy. BioProcess Insider, 11 December 2020; https://bioprocessintl.com/ bioprocess-insider/deal-making/boehringer-ingelheim-re-enters-adc-space-with1-4bn-nbe-buy. 22 Günther A, Baum A, Heider K-H. EP1391213A1: Compositions and Methods for Treating Cancer Using Maytansinoid CD44 Antibody Immunoconjugates and Chemotherapeutic Agents. European Patent Office; https://patents.google.com/ patent/EP1391213A1/en. 23 Garidel P, et al. DE10361599A1: Liquid Formulation of Antibody Conjugates. European Patent Office; https://patents.google.com/patent/DE10361599A1/en. 24 Stanton D. Exelixis: Deals with NBE and Catalent Bring Multipronged ADC Approach. BioProcess Insider, 17 September 2020; https://bioprocessintl.com/ bioprocess-insider/deal-making/exelixis-deals-with-nbe-and-catalent-bringmulti-pronged-adc-approach. 25 Exelixis, Inc. (EXEL) CEO Michael Morrissey on Barclays Global Healthcare Conference (Transcript). Seeking Alpha, 13 March 2019; https://seekingalpha. com/article/4248478-exelixis-inc-exel-ceo-michael-morrissey-on-barclaysglobal-healthcare-conference-transcript. About the Author Dan Stanton is founding editor of BioProcess Insider; dan. stanton@informa.com. 16 BioProcess International 19(5)e2 May 2021 Back to Contents E-Book