Corporate Reporting Assignment Handbook - Retail Sector Analysis

advertisement

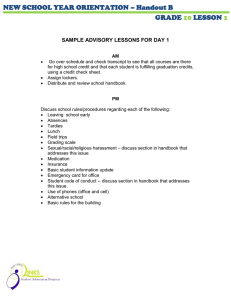

Faculty of Business and Law Business School BA (Hons) Accounting & Finance Level 6 - (30 Credits) Corporate Reporting (Unit code 5R6Z0038) Assignment Handbook 2020/2021 Unit leader: Anna Hardy-Watmough: NBS Room 4.29 a.hardy-watmough@mmu.ac.uk BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Contents Assignment brief ................................................................................................................................. 3 Tutorial week 1: Selecting your company and performance analysis ................................................ 4 Tutorial Week 2: Investor information ............................................................................................... 8 Tutorial Week 3: Impact of Covid-19 and presentation ................................................................... 11 CR Assignment Handbook Page 2 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Assignment brief For the purpose of this assignment, you are a financial journalist working for the online investment magazine ‘InvestIt!’ You have been asked to analyse a selected listed company in the retail sector, and write an article that explains whether you would advise investing in this business. The specific areas for consideration are: • • • • • • Overview of the retail sector in the country in which your chosen company operates in 2019, and an introduction to your chosen company within it. Analysis of the performance of your chosen company for the financial year ended 2019, and in comparison to the sector/ previous year. Analysis of investor information of your chosen company for the financial year ended 2019, including share price movements to 31st December 2019, and comparison to the sector/ previous year. Impact of Covid-19 on your chosen company and the retail sector for 2020. A conclusion as to whether you would currently invest in your chosen company. The article should be 3,000 word maximum in length (+/-10%), and suggested word counts for each area are as follows: o Sector/company introduction – 500 words o Performance analysis – 1,000 words o Investor analysis – 1,000 words o Impact of Covid and investment decision – 500 words • The article should be in a style suitable for publication in a magazine, using proper business English and presented appropriately. • All sources must be suitably referenced. • An executive summary is NOT required. • Marks will NOT be awarded for calculations, but rather the quality of the analysis. • Marks will be split over the parts of the article as follows: Section Introduction Analysis of financial performance Analysis of investor information Impact of Covid-19 and conclusion Presentation CR Assignment Handbook Marks 15 marks 25 marks 25 marks 15 marks 20 marks Page 3 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Tutorial week 1: Selecting your company and performance analysis • • • • • • • Financial Analysis is a key role performed within organisations. It is an important aspect of corporate reporting. The purpose of this assignment is to develop your analysis skills, and give you a wider understanding of business and commercial issues. You can work together to perform research and to generate ideas, but please be aware that your submission is individual. Please contact your tutorial lecturer or unit leader if you have any questions. Due date is Monday 26th October at 9pm. Work submitted within 5 working days of the due date will be marked and capped at 40%, after this time work submitted will be awarded zero (unless a student has approved exceptional factors). Your assignment will be submitted online only, via the CR Moodle site. We will use Easyjet as a sample company to work through the analysis This week we will firstly consider: • • • • • • • • What is analysis? How do we perform analysis? How do we use the financial statements? How do we calculate ratios? What do they tell us? Where can we get sector information? What is not included in financial information? Where else can we look for information? What is analysis? • Analysis is the use of financial statements or other financial information to evaluate the past, current and expected future performance of a company. • We perform analysis both internally and externally. Internally, businesses will compare results to budgets, or prior periods. Externally, business analysts analyse the results of large Plcs and look for reasons for profit/ revenue variances etc. • We see business analysis all the time on the business news, in the press etc. What have you seen/ read recently? CR Assignment Handbook Page 4 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook How do we perform analysis? • Take the financial statements and compare: o To prior year o To competitor o To industry averages • Can also use interim/ other internal financial information if work for a company Important points • • Always use group financial statements (contains everything) Think about format/ presentation (may not be same as in ‘exam world’) How do we calculate ratios, and what do they tell us? • In FR (2nd year). • Various ratios, in different categories. This time will consider performance/ profitability. • Note – you do NOT need to calculate your own ratios (available via databases e.g FAME, or in the financial statements). You may want to calculate if considering the impact of one-offs or for some more unusual figures. Performance (Profitability) Concerned with profits generated a. Gross Profit (expressed as percentage) Gross Profit Revenue How much profit generated at gross level (so just excluding cost of sales). Affected by? b. Operating profit (expressed as percentage) CR Assignment Handbook Page 5 Operating Profit Revenue BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Profit generated after expenses, but before interest and tax taken into account, (not performance related). How does this differ from GP? c. ROCE Operating Profit Capital Employed (Equity + long term debt) Measure of efficiency, how much profit generated by the long-term capital employed in the business. A target ROCE is often included in company key performance indicators (KPIs). Can split broken down into OP% x net asset turnover, if want to compare businesses. Can use other profit measures, e.g. net profit %, but these tell you mostly the same thing. Remember: • • • • Can vary methods used to calculate ratios, these are not absolute. Strip out ‘one-offs’ (exceptionals) to get a better view of sustainable performance. Cash also important – can use cashflow statement and substitute cash for profits to see if company in good cash position. E.g. cannot pay a dividend if no cash to pay it! Calculations are not as important as the analysis at this level. Where can we get sector information? • • • Library databases e.g Business Source Premier, Mintel FT.com Online sources What is not included in financial statements? • • • Annual reports contain lots of non-financial information, as seen above. Financial statements are historic however, and so don’t include current and future information (directors can include in their own reviews). For investor analysis we will need to look at more up-to-date information. The annual report will try to highlight where the company has done well, will not include negative reports e.g. press reports. We will have to look at other sources as well. Where else can we look for information? • What do you think? CR Assignment Handbook Page 6 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Selecting your company • Who are you interested in? • Who do you think you can talk about? • Which companies have been in the news? Industry information • Databases – what information is on there? • FT.com • Start to get a feel for your country/retail industry within Chosen company • Access the financial statements • Calculate/find the common ratios • Use FAME to see what information there is • Can use annual report Performance • How do ratios look? • Why? Sample company • • • Financials – FAME Industry sector information 2019 focus CR Assignment Handbook Page 7 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Tutorial Week 2: Investor information Investor Ratios Q – What are the areas of interest for investors? Solvency Gearing Long term debt Long term debt + Equity How business financed – debt or equity. No perfect method but need to ensure sustainable. Interest Cover Profit before interest Finance Costs How far can cover finance/interest costs with profits. Investor ratios P/E Ratio Share Price Latest EPS Indicates risk and confidence in investment. High = high confidence. Used in the real world by analysts. Dividend yield Dividend per share Market price per share Return on investment in shares, relative to market price. Dividend cover Earnings per share Dividend per share Ability of entity to maintain existing dividends (use in conjunction with yield). If high, likely entity can maintain level of dividends. Share price Share price fluctuations occur for many reasons: • General business events. CR Assignment Handbook Page 8 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook • • • Sector specific events. Company specific events – external and internal. For large fluctuations, look for explanations. See the following for Easyjet, compared to Ryanair (from 1 October- 31 December 2019): Source: London Stock Exchange What would you look at here? News sources You can google your chosen company, choose information from reputable sources (and don’t forget the library resources, as these are reputable and paid for!). For example, googling Easyjet business news on 24th August 2020 gives the following: CR Assignment Handbook Page 9 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Include information you think is relevant to your chosen company. CR Assignment Handbook Page 10 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Tutorial Week 3: Impact of Covid-19 and presentation Covid-19 • • Impact across all business sectors Some suffered, some benefited • What is the impact on Easyjet? • What is the impact on retailers? CR Assignment Handbook Page 11 BA Accounting & Finance Year three (Level 6) Corporate Reporting Assignment Handbook Your article There are various online magazines you can look at. E.g https://www.pqmagazine.com/ or https://ukinvestormagazine.co.uk/ Articles should be well presented and engaging, the style can be more casual than a report, but you must use proper English and write in full sentences. Also, consider graphics to assist with your analysis. All assignments must be submitted by Monday 26th October at 9pm. Submit your assignment on Moodle. If you submit within five working days of the submission deadline, your assignment will be marked but capped at 40%. Any submissions received after this will be awarded zero marks (unless there are approved exceptional factors). CR Assignment Handbook Page 12